Which Companies are Leading in the AI in Pharma Market

- Exscientia

- Insilico Medicine

- BenevolentAI

- Atomwise

- BioAge Labs

- XtalPi

- Recursion Pharmaceuticals

- Valo Health

- Deep Genomics

- Absci Corporation

- IBM Watson Health

- NVIDIA Corporation

- Microsoft Azure AI

- Google DeepMind

- Schrödinger, Inc.

- Cloud Pharmaceuticals

- Cyclica (Recursion)

- Ardigen S.A.

- Owkin Inc.

- Turbine.ai

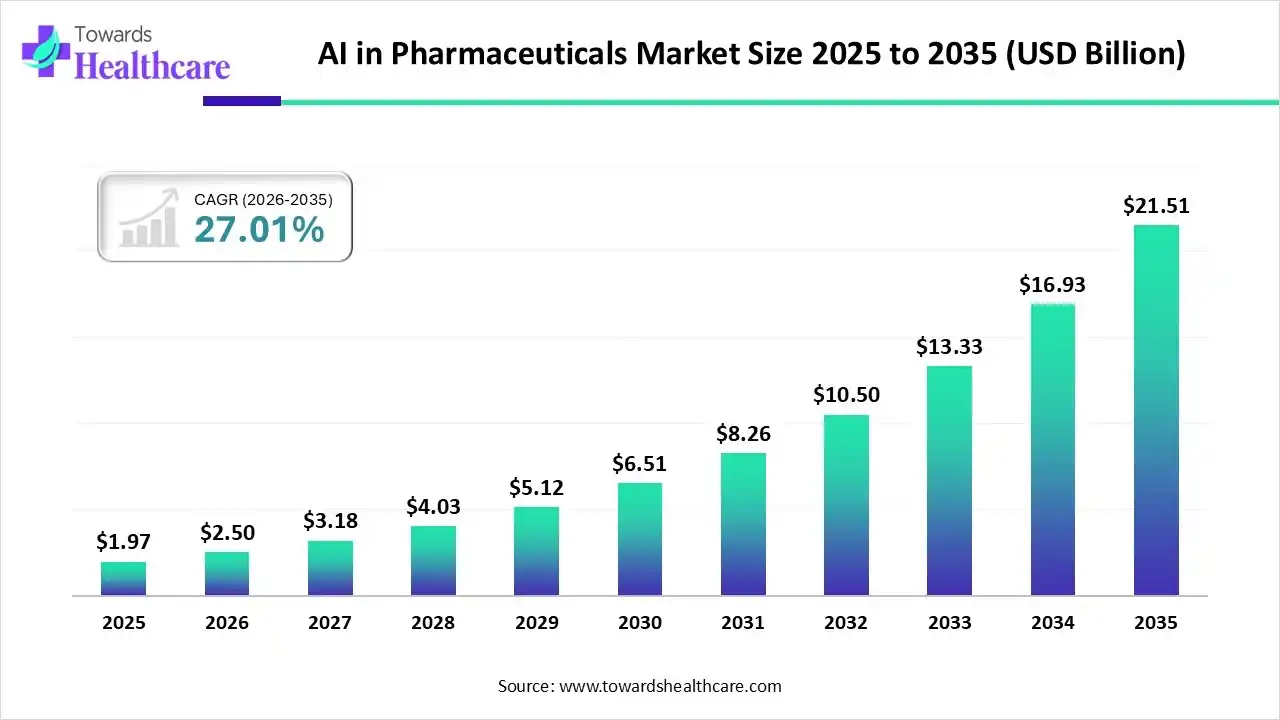

Market Growth

The global AI in pharmaceuticals market size is calculated at US$ 1.97 billion in 2025, grew to US$ 2.5 billion in 2026, and is projected to reach around US$ 21.51 billion by 2035. The market is expanding at a CAGR of 27.01% between 2026 and 2035.

What is the Role of AI in Pharmaceuticals?

The AI in pharmaceuticals market refers to the application of artificial intelligence (AI), machine learning (ML), and deep learning (DL) across various stages of the pharmaceutical value chain, from drug discovery and clinical trials to manufacturing, supply chain management, and commercialization. AI helps accelerate target identification, reduce R&D costs, improve clinical trial design, optimize drug formulation, and enhance patient outcomes. The growing availability of biomedical data, regulatory support for AI-enabled innovation, and partnerships between pharma and AI startups are key factors driving market growth.

AI in Pharmaceuticals Market Outlook

- Global Expansion: Due to significant investment and R&D efforts, North America currently holds a dominant market share in the rapidly growing global market. The demand for customized treatments and rising healthcare spending, however, are driving the fastest-growing market in Asia-Pacific. With government initiatives and strong regulatory frameworks for AI in healthcare, Europe is also experiencing strong growth.

- Major Investors: Venture capital firms and large pharmaceutical companies are examples of key investors. AI companies are being actively funded and partnered with by corporate investors such as Pfizer, AstraZeneca, and Novartis. AI startups like Insilico Medicine and Recursion Pharmaceuticals are receiving significant funding for innovation from well-known venture capital firms like Andreessen Horowitz and Sequoia Capital.

- Startup Ecosystem: In an effort to transform drug development and drastically cut costs and time, traditional pharmaceutical companies are increasingly looking to artificial intelligence startups. All 10 of the world's top pharmaceutical companies have collaborated with AI-driven drug discovery startups since 2023.

Company Landscape

Novartis

Company Overview: Global pharmaceutical company focused on innovative medicines, generic and biosimilar pharmaceuticals (Sandoz spin-off completed in 2023), and eye care. AI plays a central role in its "unbossed" strategy, aiming to transform drug discovery, clinical development, manufacturing, and commercialization.

Corporate Information

- Headquarters: Basel, Switzerland

- Year Founded: 1996 (formed through the merger of Ciba-Geigy and Sandoz)

- Ownership Type: Public (SIX: NOVN, NYSE: NVS)

History and Background

History and Background: Novartis traces its roots back to the 18th century. The 1996 merger created a global life science leader. It has been an early and aggressive adopter of digital technologies, particularly AI and Machine Learning, to revitalize its R&D productivity and operational efficiency.

Key Milestones/Timeline:

- 1996: Formation of Novartis.

- 2017: Announced a strategic partnership with Amazon Web Services (AWS) for AI in drug discovery.

- 2019: Established a five-year strategic alliance with Microsoft to transform R&D with AI and data science.

- 2023: Completed the spin-off of its Generics and Biosimilars division, Sandoz, to focus purely on innovative medicines and advanced therapies, heavily leveraging AI.

- 2024/2025: Continued use of AI for clinical trial optimization and biomarker discovery.

Business Overview

- Business Segments/Divisions:

- Innovative Medicines: Comprises Pharmaceuticals (incl. Oncology) and Cell & Gene Therapies. AI is integrated across all functions.

- Sandoz: Spun off in 2023, now a separate entity.

- Geographic Presence: Global operations with a strong presence in North America (largest market), Europe, and Asia.

- Key Offerings: Innovative drugs and advanced therapies in areas like Oncology, Cardiovascular, Immunology, and Neuroscience. AI-driven platforms support all drug offerings.

- End-Use Industries Served: Healthcare Providers, Patients, Pharmaceutical Manufacturing, and Research Institutions.

Key Developments and Strategic Initiatives

Mergers & Acquisitions: Focus is generally on smaller, targeted AI/tech partnerships rather than large AI company acquisitions, preferring to build in-house capabilities and strategic alliances.

Partnerships & Collaborations:

- Microsoft: Multi-year collaboration to apply AI across R&D.

- Amazon Web Services (AWS): Partnership for cloud-based AI solutions in drug discovery.

- Molecular Partners: Partnership leveraging AI for multi-target drug design.

- Product Launches/Innovations: AI-assisted launch of new therapeutic candidates in clinical trials across multiple therapeutic areas.

- Capacity Expansions/Investments: Significant investment in its internal NIBR (Novartis Institutes for BioMedical Research) and IT infrastructure to support AI/ML initiatives.

- Regulatory Approvals: AI-informed clinical trial design for drugs across its portfolio, leading to faster regulatory submissions.

- Distribution channel strategy: Utilizing digital and AI tools to optimize supply chain and logistics, and leveraging digital engagement for commercial activities.

Technological Capabilities/R&D Focus

- Core Technologies/Patents: Proprietary AI platforms for predictive modeling, target identification, clinical trial site selection, and biomarker discovery. Holds numerous AI and data-related patents.

- Research & Development Infrastructure: Global network of NIBR sites fully integrated with a centralized data and AI platform.

- Innovation Focus Areas: Generative AI for drug design, optimization of clinical trial protocol/recruitment, predictive maintenance in manufacturing, and precision medicine.

Competitive Positioning

- Strengths & Differentiators:

- Early Mover in AI Integration: One of the first major pharma companies to commit to a widespread, strategic AI transformation.

- Massive Data Scale: Access to vast proprietary clinical and R&D data for training algorithms.

- Strong Partnerships: Deep alliances with tech giants like Microsoft and AWS.

- Market presence & ecosystem role: A dominant global pharma player (top 10 by market cap) driving AI adoption and setting benchmarks for R&D efficiency in the industry.

- SWOT Analysis:

- Strengths: Deep therapeutic expertise, global scale, strong AI partnerships, large data sets.

- Weaknesses: Integration complexity of legacy IT systems, high cost of AI talent/infrastructure.

- Opportunities: Accelerate pipeline development, drive precision medicine, improve operational efficiency.

- Threats: Competition from pure-play AI biotech, data privacy regulations, speed of technological change.

Recent News and Updates

- Press Releases:

- Q4 2024: Announced continued success in using AI to halve the time needed for clinical trial feasibility assessments.

- 2025: Reports highlighting the advanced use of AI to accelerate the discovery of new drug candidates in oncology.

- Industry Recognitions/Awards: Consistently recognized as a leader in digital transformation and AI integration within the life sciences sector by multiple industry reports.

Roche (F. Hoffmann-La Roche Ltd.)

Company Overview: Global pioneer in pharmaceuticals and diagnostics. Roche is highly committed to personalized healthcare, using data and AI to integrate therapeutic and diagnostic offerings. Its AI strategy is critical for pathology, diagnostics, and targeted oncology drug discovery.

Corporate Information

- Headquarters: Basel, Switzerland

- Year Founded: 1896

- Ownership Type: Public (SIX: ROG, OTCQX: RHHBY)

History and Background

History and Background: Over 125 years of history, with major contributions in vitamins and pharmaceuticals. The acquisition of Genentech in 2009 solidified its leadership in biotechnology. The unique integration of the Pharmaceuticals and Diagnostics divisions positions it to leverage vast amounts of real-world patient and diagnostic data, which is key for its AI strategy in personalized healthcare.

Key Milestones/Timeline:

- 2018: Partnership with GE Healthcare to develop AI-powered digital pathology solutions.

- 2020: Strategic partnership with Novartis to accelerate the discovery and development of oncology therapeutics using AI. (This is a simplified mention; the actual collaboration focuses on specific targets/technologies.)

- 2024: Expanded partnership with PathAI for AI-powered companion diagnostics.

- 2025: Continuous integration of AI into the VENTANA portfolio for digital pathology and diagnostics.

Business Overview

- Business Segments/Divisions:

- Pharmaceuticals: Focuses on Oncology, Immunology, Infectious Diseases, Ophthalmology, and Neuroscience. (Genentech is a fully-owned subsidiary).

- Diagnostics: Offers a comprehensive portfolio of diagnostic tests and systems, including digital pathology, leveraging AI heavily.

- Geographic Presence: Operates globally, with a strong presence in North America (via Genentech) and Europe.

- Key Offerings: Innovative oncology medicines, advanced diagnostic systems, personalized healthcare solutions. AI-driven tools underpin its digital pathology and diagnostic offerings.

- End-Use Industries Served: Hospitals, Laboratories (Clinical and Research), Healthcare Providers, and Patients.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions:

- Acquisition of Foundation Medicine: Gained access to genomic profiling data, crucial for AI-driven precision oncology.

- Acquisition of Flatiron Health: Gained access to high-quality electronic health record (EHR) data, vital for AI/RWD initiatives.

- Partnerships & Collaborations:

- PathAI: Expanded exclusive partnership (early 2024) to develop AI-powered digital pathology algorithms for companion diagnostics.

- Bristol Myers Squibb, GE Healthcare: Partnerships for AI applications in clinical development and digital solutions.

- Product Launches/Innovations:

- Launched AI-enabled applications within its Navify Digital Pathology platform.

- Continued development of AI-powered diagnostic assays.

- Capacity Expansions/Investments: Major investments in its DiCo (Digital Collaborative) data platform and cloud infrastructure to integrate Pharma and Diagnostics data.

- Regulatory Approvals: Received FDA approvals/clearances for multiple AI-powered diagnostic and pathology devices and algorithms (e.g., in its VENTANA product line, including the VENTANA TROP2 (EPR20043) RxDx Assay, which received FDA Breakthrough Device Designation in 2024).

- Distribution channel strategy: Leverages its Diagnostics division's global network to deploy AI-enabled lab and pathology solutions directly into hospitals and clinical labs.

- Technological Capabilities/R&D Focus

- Core Technologies/Patents: Leader in digital pathology and deep learning algorithms for image analysis. Focuses on AI for Real-World Data (RWD) analysis, biomarker discovery, and clinical decision support. Holds numerous patents in AI for diagnostics.

- Research & Development Infrastructure: Integration of Genentech's advanced R&D with the Diagnostics division's data capabilities; centralized data platforms (DiCo).

- Innovation Focus Areas: Personalized Healthcare (PHC) driven by AI, digital pathology, predictive models for disease progression, and early-stage drug target validation using multi-omics data.

Competitive Positioning

- Strengths & Differentiators:

-

- Integrated Model: Unique combination of Pharmaceuticals and Diagnostics, providing end-to-end patient data (from diagnosis to treatment).

- Data Assets: Massive repository of proprietary clinical, diagnostic, and RWD from Flatiron and Foundation Medicine.

- Oncology Leadership: Deep expertise and market leadership in oncology, a primary focus area for AI in pharma.

- Market presence & ecosystem role: A top-tier global pharmaceutical and diagnostics company (top 5 by market cap) actively leveraging its unique data ecosystem to lead in personalized healthcare.

SWOT Analysis:

-

- Strengths: PHC leadership, integrated Pharma/Diagnostics data, strong position in oncology/diagnostics, strategic acquisitions (Flatiron, Foundation Medicine).

- Weaknesses: Regulatory hurdles for integrated AI-driven drug/diagnostic products, complexity of merging the two large divisions' data.

- Opportunities: Dominate the AI-powered companion diagnostics market, accelerate drug repurposing, create fully personalized treatment pathways.

- Threats: Competition from tech giants entering diagnostics, cybersecurity risks, and high integration costs.

Recent News and Updates

- Press Releases:

- Early 2024: Announced the expansion of the PathAI partnership for exclusive AI-powered companion diagnostics development.

- 2024: Completed the acquisition of Carmot Therapeutics to expand its portfolio in obesity and diabetes, a deal that will leverage AI for clinical development.

- 2025: Entered a major agreement with Zealand Pharma for co-development of obesity treatments, integrating AI for portfolio and trial management.

- Industry Recognitions/Awards: Frequently recognized for excellence in diagnostics innovation and leadership in personalized healthcare, driven by data science and AI.

Recent Developments in the AI in Pharmaceuticals Market

- In October 2025, in order to expand its AI-driven preclinical drug development platform, which helps researchers predict drug success and expedite the lab-to-clinic journey, Dublin-based biotech Meta-Flux has raised €1.8M ($2M) in seed funding.

- In September 2025, the pharmaceutical company Eli Lilly announced the launch of a machine learning and artificial intelligence platform that will give biotech firms access to drug discovery models trained on years' worth of its research data.

Partner with our experts to explore the AI in Pharmaceuticals Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking