Explore Leading Companies in the Ayurvedic Throat Care Market

- Dabur India Ltd.

- Patanjali Ayurved Ltd.

- The Himalaya Drug Company

- Zandu (Emami Ltd.)

- Baidyanath (Patanjali/Baidyanath group)

- Vicco Laboratories

- Hamdard Laboratories (Wakf)

- Kottakkal Arya Vaidya Sala

- Kerala Ayurveda Ltd.

- Charak Pharma Pvt. Ltd.

- Jiva Ayurveda

- Organic India Pvt. Ltd.

- Pukka Herbs (Ayurvedic herbal blends)

- Forest Essentials (premium Ayurvedic personal care)

- Herbal Hills

Market Growth

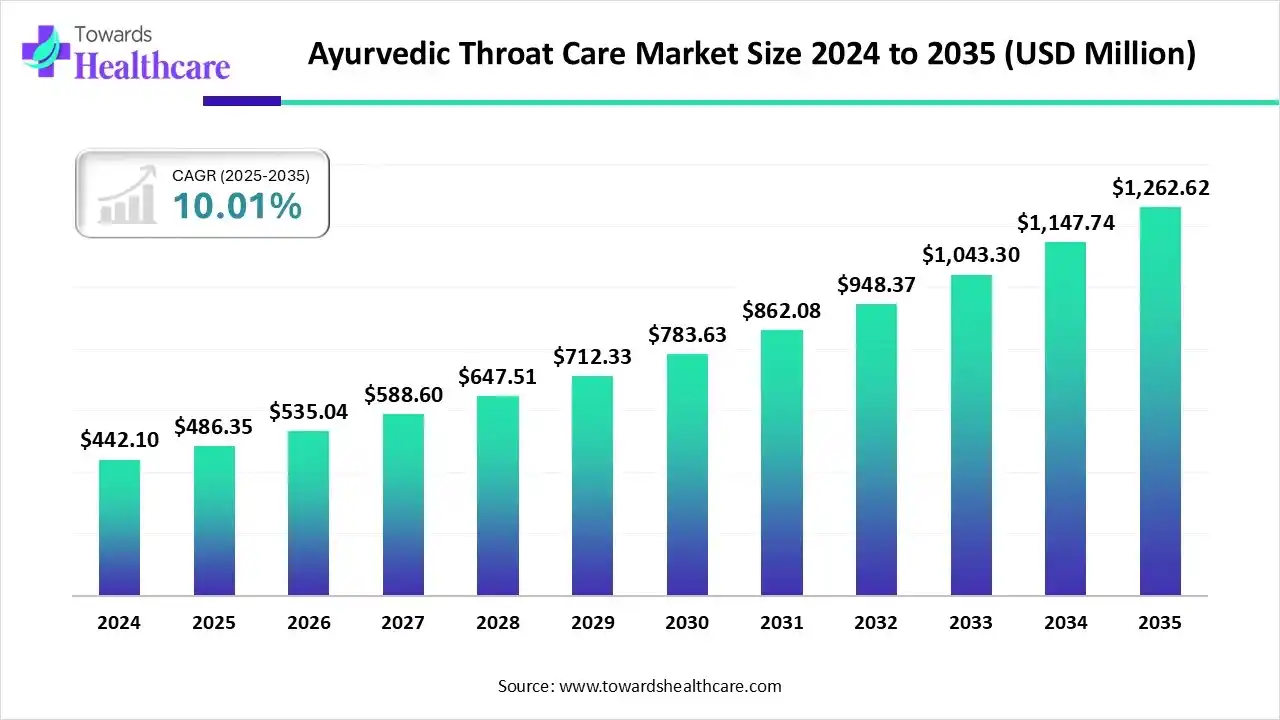

The global ayurvedic throat care market size is calculated at US$ 486.35 million in 2025, grew to US$ 535.04 million in 2026, and is projected to reach around US$ 1262.62 million by 2035. The market is expanding at a CAGR of 10.01% between 2026 and 2035.

Ayurvedic Throat Care Market Outlook

- Industry Growth Overview: The market is expected to increase rapidly between 2025 and 2034 due to the growing urbanization and pollution contributing to an increasing incidence of throat infections and related complexities, thereby increasing the demand for effective throat care services.

- Global Expansion: This market is driven by consumers who are increasingly aware of the potential adverse effects of synthetic medicines and are seeking safer, plant-based substitutes for common ailments such as sore throats and coughs.

- Startup Ecosystem: Ayurvedic throat care industry startup ecosystem is dynamic. Startups leverage classical ayurvedic formulations and combine them with modern R&D, manufacturing processes (GMP certified), and delivery processes such as sprays, lozenges, and e-commerce platforms.

Company Landscape

Dabur India Ltd.

(Known for Honitus cough syrup and lozenges)

Company Overview:

- Dabur India Ltd. is one of India's largest Fast-Moving Consumer Goods (FMCG) companies, with a legacy of over 140 years rooted in Ayurveda and natural healthcare.

- The company operates in key consumer segments including Health Care, Home & Personal Care, and Foods & Beverages.

- It is known for popularizing traditional Ayurvedic remedies into modern, accessible formats.

Corporate Information:

- Headquarters: Ghaziabad, Uttar Pradesh, India

- Year Founded: 1884

- Ownership Type: Public Limited Company (Listed on NSE and BSE)

History and Background:

- Founded by Dr. S.K. Burman as an Ayurvedic practitioner in Calcutta.

- Initially focused on manufacturing and distributing Ayurvedic medicines.

- Evolved into a major FMCG player while retaining its core Ayurvedic heritage.

Key Milestones/Timeline:

- 1884: Foundation of Dabur by Dr. S.K. Burman.

- 1994: Public listing of the company.

- 1998: Business restructured into three divisions (Health Care, Personal Care, and Foods) to drive growth.

- FY 2024-25: Consolidated Revenue from Operations reached ₹12,563 crore.

- FY 2024-25: Maintained market share gains across over 90% of its portfolio.

Business Overview:

- Focused on providing natural and science-based Ayurvedic products globally.

- Portfolio includes over 250 herbal/Ayurvedic products.

- "Honitus" is one of its eight Power Brands.

Business Segments/Divisions:

- Consumer Care Business:

- Health Care (Includes Honitus, Chyawanprash, Pudin Hara)

- Home & Personal Care (Includes Dabur Amla, Dabur Red Paste)

- Food & Beverages Business (Includes Réal fruit juices, Badshah Masala)

- International Business

- Geographic Presence:

- India: Strong rural and urban presence, covering 8.4 million retail outlets as of FY 2024-25.

- International: Significant presence in the Middle East, Africa, South Asia, Europe, and the US.

Key Offerings (Ayurvedic Throat Care Focus):

- Honitus Cough Syrup: Ayurvedic remedy for cough relief.

- Honitus Lozenges: Ayurvedic throat lozenges for soothing a sore throat.

- Honitus Hot Sip: Ayurvedic Kadha (herbal decoction) for cold and cough.

End-Use Industries Served:

- Consumer Health (OTC/Ayurvedic Medicine)

- Personal Care (Hair care, Oral care, Skin care)

- Food & Beverages

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Acquisition of Badshah Masala (effective FY 2023-24) to expand its Food & Beverages segment.

- Partnerships & Collaborations: Ongoing collaborations with research and academic institutions for R&D on Ayurvedic formulations.

- Product Launches/Innovations: Continuous launch of extensions and specialized variants within the Honitus range (e.g., sugar-free variants, specific immunity boosters).

- Capacity Expansions/Investments: Investments in expanding manufacturing capacity and modernizing existing plants to meet growing demand.

- Regulatory Approvals: Adherence to AYUSH regulations in India and international standards (e.g., USFDA, EU) for specific products.

- Distribution channel strategy: Focus on expanding rural reach (1.32 lakh villages covered in FY 2024-25) and strengthening D2C/e-commerce platforms.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Leveraging proprietary extraction and standardization techniques for herbal ingredients (e.g., in Honitus). Focus on achieving high purity and efficacy of Ayurvedic formulations.

- Research & Development Infrastructure: Advanced R&D center for clinical validation, toxicological studies, and new product development in Ayurveda.

- Innovation Focus Areas: Bioavailability enhancement of herbal actives, developing modern dosage forms, and clinical validation of traditional knowledge.

Competitive Positioning:

- Strengths & Differentiators: Strong brand equity and trust in Ayurveda built over 140 years; market leadership in several key categories like Chyawanprash, Honey, and Ayurvedic cough syrups; vast distribution network.

- Market presence & ecosystem role: Dominant player in the Indian FMCG-Ayurveda space, serving as a benchmark for traditional healthcare integration.

SWOT Analysis:

- Strengths: Brand heritage, extensive product portfolio, massive rural reach, strong R&D in Ayurveda.

- Weaknesses: High competition in the FMCG segment; potential regulatory challenges for herbal products in international markets.

- Opportunities: Growing consumer preference for natural/Ayurvedic products globally; digital transformation and D2C channel expansion.

- Threats: Intense competition from domestic and international FMCG giants; risk of counterfeit products; dependence on volatile raw material pricing.

Recent News and Updates:

- Press Releases (May 2025): Reported Q4 FY 2024-25 Consolidated Net Profit of ₹320 Cr and Revenue of ₹2,830 Cr, emphasizing market share gains across 90% of its portfolio despite a challenging demand environment.

- Industry Recognitions/Awards: Consistently ranks among India's most trusted and sustainable companies in various industry reports.

Himalaya Wellness Company

(Known for Koflet cough syrup and lozenges.)

Company Overview:

- Himalaya Wellness Company (formerly The Himalaya Drug Company) is a global leader in herbal health and personal care products.

- It combines traditional Ayurvedic principles with modern science (Phytochemistry, Pharmacology) to create standardized, safe, and effective products.

- A major focus is on research-backed, safe, and gentle Ayurvedic solutions.

Corporate Information:

- Headquarters: Bengaluru, Karnataka, India

- Year Founded: 1930

- Ownership Type: Private/Family-owned (Global presence)

History and Background:

- Founded by Mr. M. Manal in 1930 with a vision to bring Ayurveda to society in a contemporary form.

- Launched Liv . 52 in 1955, a flagship herbal medicine.

- Pioneered scientific research to validate the efficacy of herbal products.

- Renamed to Himalaya Wellness Company to reflect its expanded focus on wellness.

Key Milestones/Timeline:

- 1930: Company foundation.

- 1955: Launch of Liv . 52.

- 1999: Launch of the Personal Care range.

- 2010s: Significant global expansion and diversification into the wellness segment.

- November 2023: Launched a major 360° national campaign for Koflet cough syrup across major Indian states.

Business Overview:

- Focus on developing herbal pharmaceuticals and personal care products.

- Operates in HealthCare, Personal Care, BabyCare, and Animal Health segments.

- Koflet and its variants are a key part of the HealthCare division.

Business Segments/Divisions:

- Pharmaceuticals (Ayurvedic/Herbal Medicines - includes Koflet)

- Personal Care

- Baby Care

- Animal Health

Geographic Presence:

- India: Strong national presence across modern trade, general trade, and pharmacies.

- International: Global presence in over 100 countries, including the Middle East, Asia, Europe, and the US.

Key Offerings (Ayurvedic Throat Care Focus):

- Koflet Cough Syrup: Ayurvedic syrup containing ingredients like Holy Basil and Licorice for dry and productive cough.

- Koflet-EX Linctus: Expectorant and mucolytic variant for wet cough.

- Koflet-H Lozenges: Ayurvedic lozenges for throat irritation.

End-Use Industries Served:

- Pharmaceuticals/OTC Health

- Personal Care & Cosmetics

- Pediatric Care

- Veterinary Health

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Primarily focused on organic growth; M&A activities are less frequent or publicly emphasized compared to organic expansion.

- Partnerships & Collaborations: Collaboration with various research institutions for clinical trials and efficacy testing of herbal products.

- Product Launches/Innovations: Continuous innovation in the BabyCare and Personal Care segments; new variants of cough and throat care products (e.g., Koflet-EX).

- Capacity Expansions/Investments: Continuous investment in modern, high-tech manufacturing facilities that adhere to international quality standards (GMP).

- Regulatory Approvals: Products meet stringent quality and safety standards for markets across the globe.

- Distribution channel strategy: Strong focus on pharmacies (a key channel for Ayurvedic healthcare) and growing its dedicated Himalaya Stores and online channels.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Proprietary "Fingerprinting" technology for standardizing herbal extracts; focus on Phytochemistry to isolate and identify active markers in herbs.

- Research & Development Infrastructure: Dedicated R&D center with over 200 scientists, focusing on clinical research and ensuring batch-to-batch consistency.

- Innovation Focus Areas: Evidence-based herbal medicine, formulation development for enhanced absorption and taste masking, and clinical validation of traditional Ayurvedic formulations.

Competitive Positioning:

- Strengths & Differentiators: Strong emphasis on scientific validation ("Science-based Ayurveda"); high brand recall and global presence; expertise in specific therapeutic areas (e.g., Liver care, cough/cold).

- Market presence & ecosystem role: A key competitor to large FMCG players, setting a high standard for quality and R&D in the Ayurvedic sector, particularly in the pharmacy channel.

SWOT Analysis:

- Strengths: Scientifically backed herbal portfolio, strong R&D focus, significant international footprint, diversified product segments (BabyCare, Personal Care).

- Weaknesses: Private ownership limits public financial transparency; brand is often associated with personal care, which can dilute its pharma/health image.

- Opportunities: Rapid growth in the global herbal supplements market; increasing demand for natural baby care products; expansion in modern/online retail.

- Threats: Intense competition from domestic players like Dabur and Patanjali; regulatory hurdles in new international markets; ensuring consistent raw material quality and supply.

Recent News and Updates:

- Press Releases (November 2023): Execution of a 360° national advertising campaign for Koflet Syrup in India to boost market presence during the cold season.

- Industry Recognitions/Awards: Frequently recognized for product quality, efficacy, and ethical marketing practices in the health and wellness space.

Ayurvedic Throat Care Market – Value Chain Analysis

R&D

The R&D process for postpartum health supplements involves ingredient selection, purification and processing, formulation development, product standardization, quality control (QC), safety, and toxicity assessments

Key Players: Himalaya Wellness Company and Dabur India Limited

Clinical Trials

The clinical trial process for Ayurvedic throat care products follows a structured, multi-phase approach, adapted from modern Good Clinical Practice (GCP) strategies but integrated with traditional Ayurvedic principles and regulated by authorities such as the Ministry of AYUSH and the Central Drugs Standard Control Organization (CDSCO).

Key Players: Patanjali Ayurved Limited, and Baidyanath Ayurved Bhawan Pvt. Ltd.

Patient Services

The patient services process for Ayurvedic throat care usually involves a holistic, multi-step strategy that moves from early consultation and diagnosis to treatment and long-term preventive care.

Key Players: Jiva Ayurveda and Travancore Ayurveda

Recent Developments in the Ayurvedic Throat Care Market

- In August 2025, Reliance Retail expanded its presence in the beauty segment by introducing an Ayurvedic personal care brand under its Tira platform, as per news reports. The newly launched brand, Puraveda, represents a fusion of India’s age-old wellness traditions with the precision of modern science.

- In September 2025, the Ministry of Ayush signed an agreement with the World Health Organization (WHO) to co-host the 2nd WHO Global Summit on Traditional Medicine on the theme “Restoring balance for people and planet: The science and practice of well-being".

Partner with our experts to explore the Ayurvedic Throat Care Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking