Ayurvedic Throat Care Market Size, Key Players with Trends and Growth

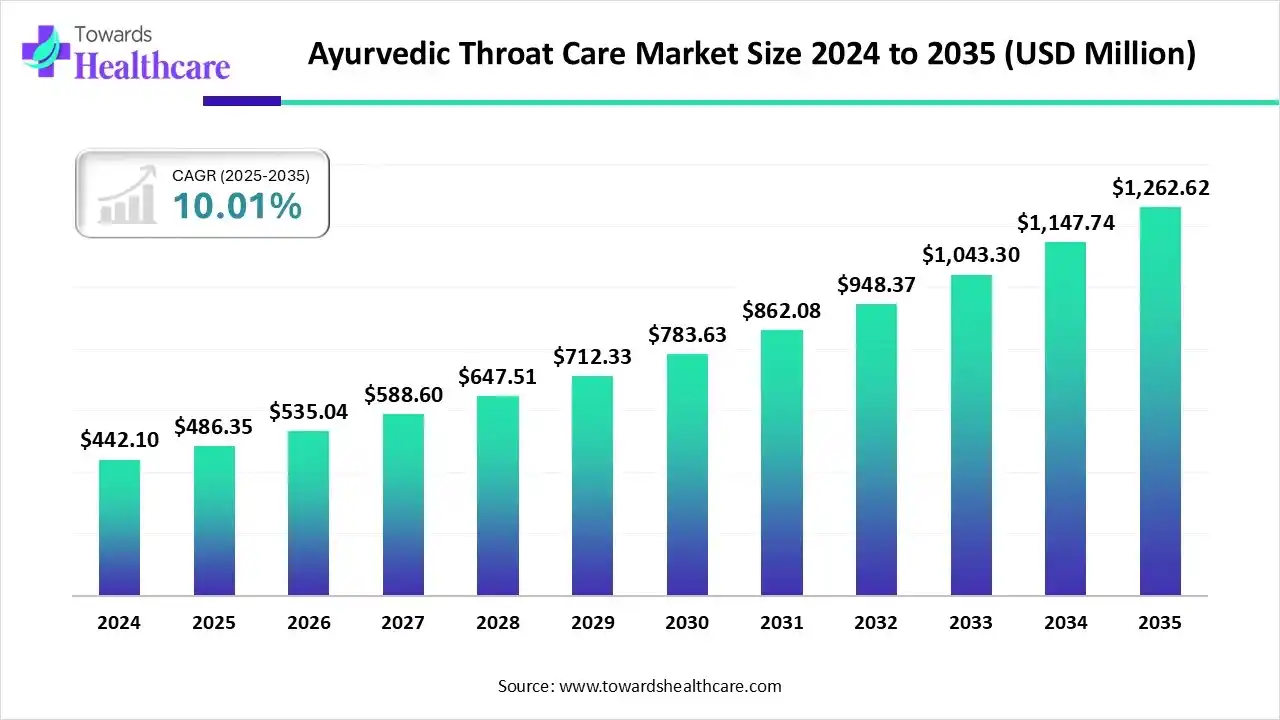

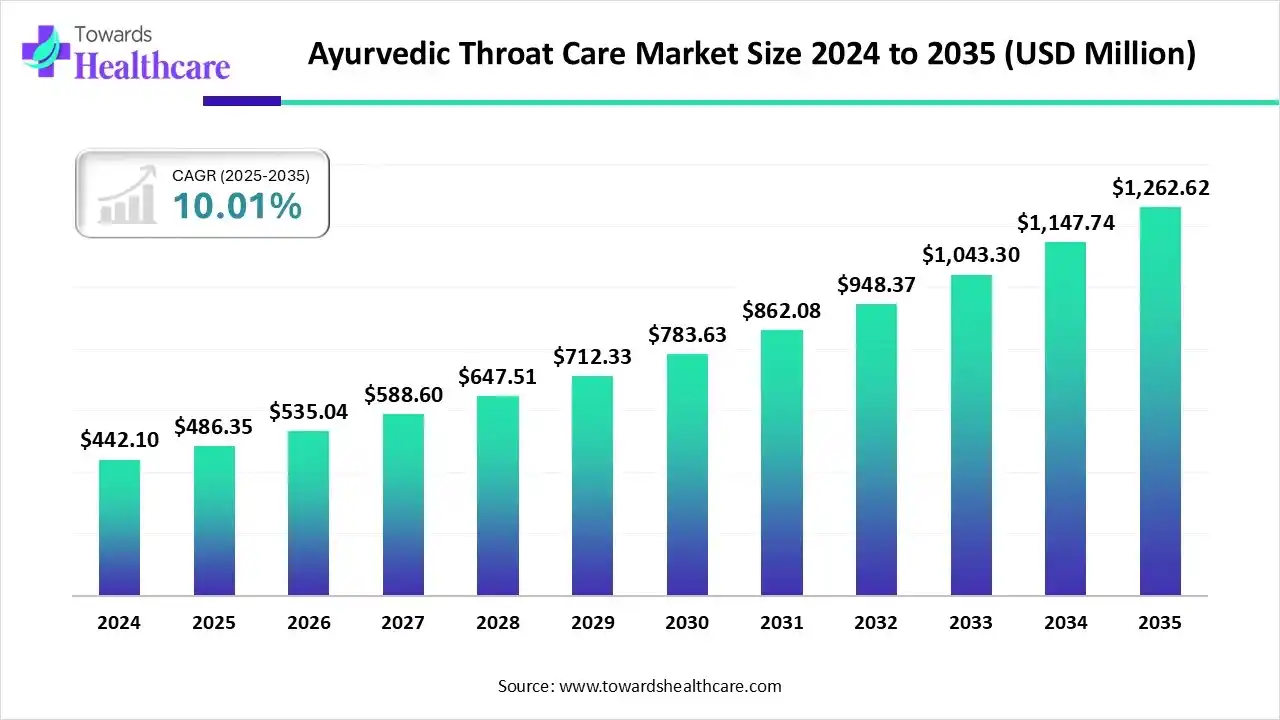

The global ayurvedic throat care market size is calculated at US$ 486.35 million in 2025, grew to US$ 535.04 million in 2026, and is projected to reach around US$ 1262.62 million by 2035. The market is expanding at a CAGR of 10.01% between 2026 and 2035.

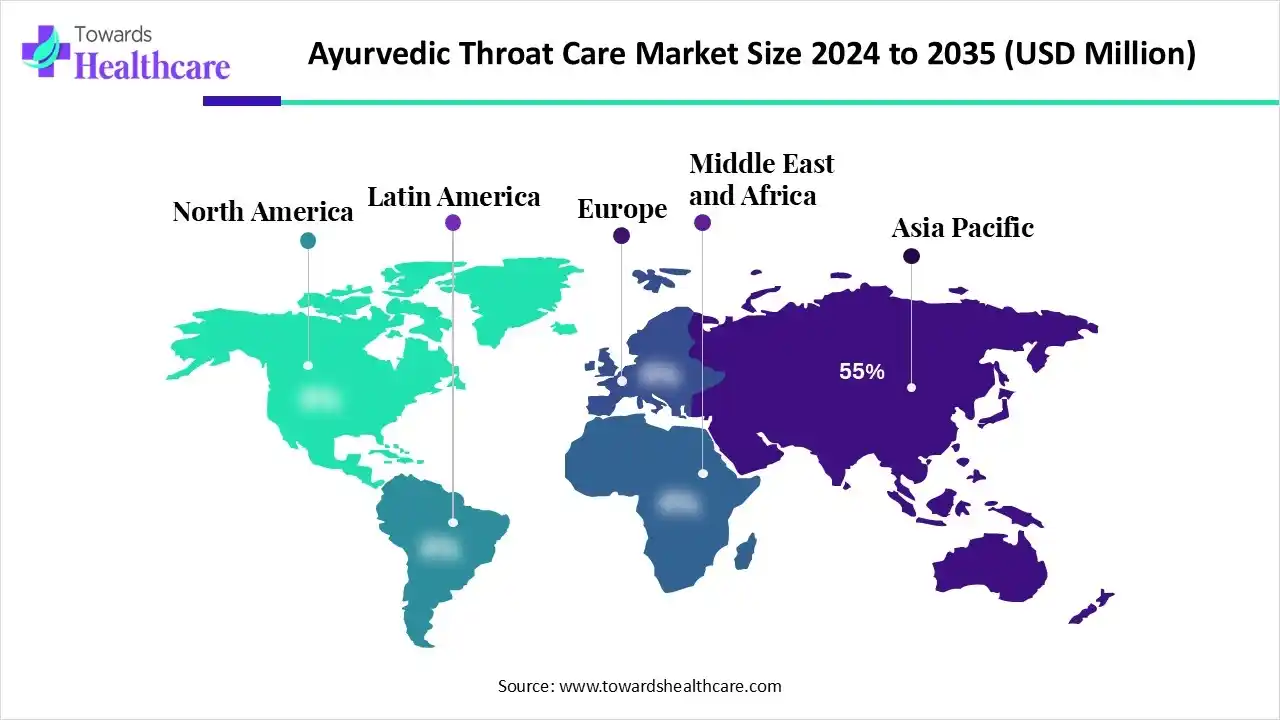

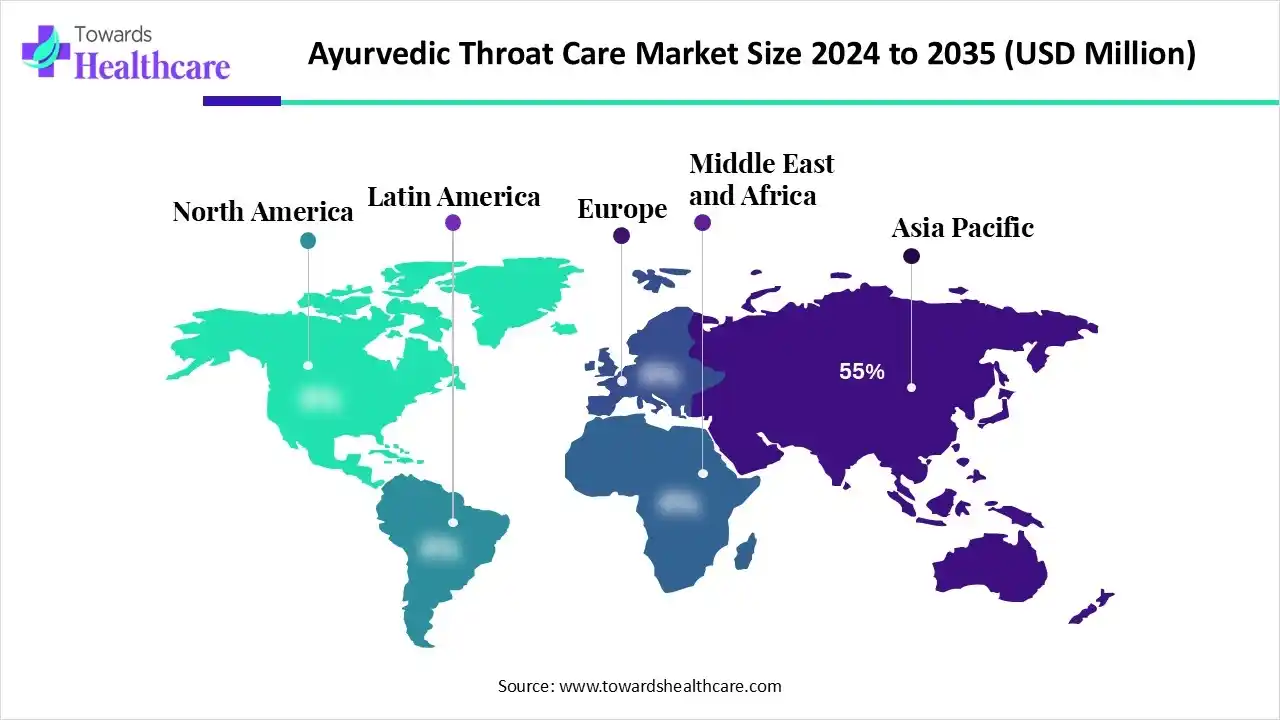

The ayurvedic throat care market is expanding due to the growing prevalence of throat diseases and the holistic health strategy. North America is dominated by e-commerce expansion and rising consumer awareness. Asia Pacific is the fastest-growing as a large and health-conscious consumer base.

Key Takeaways

- Ayurvedic throat care sector pushed the market to USD 486.35 million by 2025.

- Long-term projections show USD 1262.62 million valuation by 2035.

- Growth is expected at a steady CAGR of 10.01% in between 2026 to 2035.

- Asia Pacific dominated the ayurvedic throat care market in 2024, with a 55% share.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By product type, the lozenges/pastilles segment dominated the market with a share of 40% in 2024.

- By product type, the throat sprays/oral sprays segment is expected to grow at the fastest rate during the forecast period.

- By key ingredient/formulation class, the traditional ayurvedic extracts segment dominated the market with a share of 50% in 2024.

- By key ingredient/formulation class, the standardized phyto-extracts/purified fractions segment is expected to grow at the fastest rate during the forecast period.

- By indication/use case, the acute sore throat segment dominated in the ayurvedic throat care market with a share of 60% in 2024.

- By indication/use case, the chronic/recurrent throat conditions segment is expected to grow at the fastest rate during the forecast period.

- By dosage form/delivery and convenience, the Immediate-release formats segment dominated the market with a share of 68% in 2024.

- By dosage form/delivery and convenience, the portable formats segment is expected to grow at the fastest CAGR during the forecast period.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 486.35 Million |

| Projected Market Size in 2035 |

USD 1262.62 Million |

| CAGR (2026 - 2035) |

10.01% |

| Leading Region |

Asia Pacific by 55% |

| Market Segmentation |

By Product Type, By Key Ingredient / Formulation Class, By Indication / Use Case, By Dosage Form / Delivery & Convenience, By Region |

| Top Key Players |

Dabur India Ltd., Patanjali Ayurved Ltd., The Himalaya Drug Company, Zandu (Emami Ltd.), Baidyanath (Patanjali/Baidyanath group), Vicco Laboratories, Hamdard Laboratories (Wakf), Kottakkal Arya Vaidya Sala, Kerala Ayurveda Ltd., Charak Pharma Pvt. Ltd., Jiva Ayurveda, Organic India Pvt. Ltd., Pukka Herbs (Ayurvedic herbal blends), Forest Essentials (premium Ayurvedic personal care), Herbal Hills |

What are postpartum health supplements?

Ayurvedic throat care products are herbal and traditional formulations based on Ayurvedic principles used to prevent or relieve throat ailments (sore throat, throat irritation, cough-associated throat discomfort, tonsillar irritation, hoarseness). The ayurvedic throat care market includes syrups, lozenges/pastilles, throat sprays, herbal kadhas/tea blends, gargles, powders, and topical balms formulated from Ayurvedic ingredients. Scope covers OTC consumer products, pediatric formulations, prescription adjuncts, private-label and branded products, and distribution via pharmacies, modern retail, and e-commerce.

Ayurvedic Throat Care Market Outlook

- Industry Growth Overview: The market is expected to increase rapidly between 2025 and 2034 due to the growing urbanization and pollution contributing to an increasing incidence of throat infections and related complexities, thereby increasing the demand for effective throat care services.

- Global Expansion: This market is driven by consumers who are increasingly aware of the potential adverse effects of synthetic medicines and are seeking safer, plant-based substitutes for common ailments such as sore throats and coughs.

- Startup Ecosystem: Ayurvedic throat care industry startup ecosystem is dynamic. Startups leverage classical ayurvedic formulations and combine them with modern R&D, manufacturing processes (GMP certified), and delivery processes such as sprays, lozenges, and e-commerce platforms.

How AI is Revolutionizing the Ayurvedic Throat Care Market?

AI-driven platforms identify imbalances in doshas and suggest predictive modelling, targeted diet plans, natural remedies, and lifestyle variations. With its progressive data analytics and machine learning, the AI-based system improves the understanding and application of Ayurvedic principles. The combination of AI into Ayurveda shows a transformative strategy to traditional medicine, providing innovative solutions for diagnosis and treatment. AI platforms gather and analyze patient symptoms to suggest probable health imbalances even before diseases fully progress.

Segmentation Insights

Product Type Insights

Which Product is Dominating the Market?

The lozenges/pastilles segment accounted for 40% of the ayurvedic throat care market share in 2024, as lozenges are a suitable and efficient way to offer relief from minor throat and mouth symptoms, and they are broadly available over-the-counter at various pharmacies and grocery stores. Herbal lozenges are small tablets or pills that are characteristically made with a blend of herbs and different natural ingredients.

Throat Sprays / Oral Sprays

The throat sprays/oral sprays segment is expected to grow at the fastest CAGR in the ayurvedic throat care market during the 2025-2034 period, as these sprays contain ingredients such as glycerine or honey, which coat the throat and offer a soothing barrier. Herbal throat spray formula supports calm irritation, allergies, or environmental factors, helping to achieve a smoother, comfortable throat feel.

Kadha / Instant Herbal Tea Powders

The kadha/instant herbal tea powders segment is expected to grow at a significant CAGR during the forecast period, as Kadha is a natural immunity promoter and it is the best remedy in contradiction of fever and sore throat. It enhanced the symptoms of occasional infections. The herbs utilized in Ayurvedic kadha for the immune system vary from those intended to relieve cold and cough symptoms.

Key Ingredient / Formulation Class insights

Which formulation Class is Dominant in the Market in 2024?

The traditional ayurvedic extracts segment accounted for 50% of the ayurvedic throat care market share in 2024, as ayurvedic herbal extracts are products created from herbal components extracted from trees and plants using a diversity of solvents. Ayurvedic products are made from herbal extracts that contain supportive plant components. Ayurvedic extracts have a broad range of applications and are utilized for various purposes.

Standardized Phyto-extracts / Purified Fractions

The standardized phyto-extracts/purified fractions segment is expected to grow at the fastest CAGR in the ayurvedic throat care market during the 2025-2034 period, as phytotherapy important complement to conventional medicine, particularly for general complaints like stomach aches, headaches, joint problems, and mild inflammation. Standardized extracts of whole herbs provide not only the active ingredient, but also contain numerous synergistic compounds.

Essential Oil / Volatile Blends

The essential oil/volatile blends segment is expected to grow significantly during the forecast period, as essential oils in the treatment of respiratory tract diseases play a significant role in bacterial infections and their anti‐inflammatory activities. Essential oils are highly concentrated; inhaling them directly can irritate the respiratory tract. This led to symptoms like coughing, nose and throat irritation, or shortness of breath.

Indication / Use Case Insights

Which indication/Use Case Dominated the Market in 2024?

The acute sore throat segment dominated the ayurvedic throat care market, accounting for 60% of the share in 2024, as ayurvedic treatment for sore throat provides longer relief by balancing the body's natural energies. Ayurvedic remedies for sore throat mainly focus on balancing the doshas, lowering inflammation, and offering soothing relief. Dietary modifications, herbal remedies, and Ayurvedic therapies are options for an acute sore throat.

Chronic / Recurrent Throat Conditions

The chronic/recurrent throat conditions segment is expected to grow fast in the ayurvedic throat care market during the 2025-2034 period, as natural remedies, dietary modifications, and ayurvedic therapies relieve symptoms and also promote advanced health. Ayurvedic remedies for sore throat provide lasting relief by balancing the body's natural energies, such as vata, pitta, and kapha doshas, and improving immunity.

Cough-Associated Throat Irritation

The cough-associated throat irritation segment is expected to grow significantly in the ayurvedic throat care market during the 2025-2034 period, as ayurvedic medicine is able to support managing symptoms of cold and flu when combined with traditional medicine. Ayurveda manages cough and cold by using herbs like ginger, tulsi, black pepper, and honey.

Dosage Form / Delivery & Convenience Insights

Which Dosage Form/Delivery & Convenience Dominated the Market in 2024?

The immediate-release formats segment dominated the ayurvedic throat care market, accounting for 68% of share in 2024, as immediate-release formats for a sore throat, like gargles, lozenges, and warm herbal concoctions, provide the primary benefit of offering rapid, localized relief from irritation and pain. Herbal remedies, dietary alterations, and Ayurvedic therapies not only improve symptoms but also promote long-term throat health.

Portable Formats

The portable formats segment is expected to grow at the fastest CAGR in the ayurvedic throat care market during the 2025-2034 period, as these formats are compact, frivolous, and simple to carry in a purse, pocket, or bag, enabling use anytime, anywhere deprived without disrupting daily routines. Sore throat pastilles and sprays offer lowers in throat pain. Throat sprays for sore throat provide several advantages for those suffering from sore throat pain.

Sustained / Controlled-release lozenges/pastilles

The sustained/controlled-release lozenges/pastilles segment is expected to grow significantly in the ayurvedic throat care market during the 2025-2034 period, as ayurvedic lozenges are herbal remedies which used for centuries to soothe throat discomfort. Ayurvedic sore throat drops connect nature’s drugstore, leveraging herbal extracts renowned for their anti-inflammatory, soothing, antimicrobial, and immune-boosting characteristics.

Regional Insights

Asia Pacific: Increasing Government Approval

Asia Pacific dominated the ayurvedic throat care market in 2024 with a 55% share, as increasing consumer preference for natural remedies and extensive product availability. Governments in the region, specifically in India, actively encourage traditional medicine systems by dedicated ministries such as the Ministry of AYUSH. The increasing prevalence of throat-related conditions, worsened by urbanization and pollution in the region, contributes to the growth of the market.

For Instance,

- In October 2025, the Ministry of Ayush organized a Press Conference to build momentum for its participation in the Emerging Science, Technology, and Innovation Conclave (ESTIC) 2025 at the Central Council for Research in Ayurvedic Sciences (CCRAS) Headquarters located at Janakpuri in New Delhi.

India: Increasing Respiratory Health Concern

In India, growing consumer preference for herbal remedies, growing respiratory health concerns associated with urbanization and air pollution, and the expansion of Ayurveda into normal wellness. Ayurvedic medicines are produced by several companies in India. India is the largest manufacturer of ayurvedic medicinal plants. There are currently about 250,000 registered medical practitioners of the Ayurvedic system, as compared to about 700,000 of modern medicine.

For instance,

- In July 2025, Common flu, seasonal throat infections, and fevers are on the rise in India, making it imperative to practice self-care and community protection. Leading the charge, Cipla Health Ltd., one of India's most trusted fast-moving wellness goods (FMWG) companies, through its thoughtful and medically backed range of products, offers holistic support to navigate the ongoing seasonal challenges that have also seen a resurgence in respiratory illnesses like COVID-19.

North America: Approval of Wellness Practices such as Yoga and Meditation

North America is estimated to host the fastest-growing Ayurvedic throat care market during the forecast period, as the increase in holistic health awareness, preventive healthcare, and the approval of wellness practices such as yoga and meditation have created a favourable environment for the adoption of Ayurvedic guidelines and products. There is an increasing acceptance of consolidative medicine practices in North America, where traditional therapies are utilized alongside predictable treatments, which lends integrity to Ayurvedic healthcare solutions, driving the growth of the market.

U.S.: Rising Interest in Holistic Health

In the U.S., the majority of people prefer efficient and affordable healthcare solutions. Ayurveda is one such option. Around 250,000 Americans utilize Ayurvedic medicine, according to the National Institute of Health. Ayurveda bring into line with the rising interest in holistic health, yoga, preventive care, and meditation in the U.S., which supports driving ayurvedic product adoption.

Europe: Increasing Innovation in Ayurvedic Products

Europe is expected to grow at a significant CAGR in the ayurvedic throat care market during the forecast period, as Europeans progressively seek solution-oriented tools that tackle mental, physical, and emotional well-being. Growing innovation in ayurvedic products, for instance, Indena is currently showcasing its range of nutraceutical ingredients for pain management and beauty from within at Vitafoods Europe 2025, including two novel additions to its portfolio. The company will be showcasing two new botanical ingredients, PureB-Kale and Cronilief P.E.A. Indena Phytosome. All these factors drive the growth of the market.

An increasing awareness of natural products

In the U.K., growing awareness and preference among UK consumers for natural, plant-based, and preventive health services as substitutes to conventional biomedicine. Customers often shift to Ayurvedic preparations for minor conditions such as sore throats because they are supposed to have fewer adverse effects compared to conventional medicines.

Amazon Aura: Herbal Wellness Sweeps South America

Urban consumers across South America increasingly prefer herbal throat remedies as pollution and seasonal infections surge. E-commerce, wellness influencers, and natural certifications fuel awareness, while regional brands embrace clean sourcing and quick delivery to dominate key metropolitan wellness markets.

Rio Remedy: Brazil Embraces Ayurvedic Innovation

Brazilians blend Ayurvedic principles with modern throat syrups and lozenges. Pharmacies and online retailers expand their herbal offerings as local producers boost clean-label output, improve exports, and strengthen regulatory compliance to meet growing trust-driven, health-conscious consumer demand.

Desert Remedy: MEA Turns to Herbal Relief

Across MEA, natural throat soothers gain traction with telehealth, promoting Ayurvedic options. Regional pharmacies stock imported syrups and lozenges as Indian manufacturers collaborate with distributors, emphasizing halal compliance, product safety, and wider accessibility in major urban markets.

Gulf Glow: GCC Chooses Premium Herbal Care

GCC consumers prefer certified herbal lozenges and immunity blends through pharmacies and luxury e-commerce. Halal labeling, rigorous testing, and elegant packaging attract affluent buyers, while corporate wellness initiatives and digital marketing further strengthen Ayurvedic throat care visibility.

Ayurvedic Throat Care Market – Value Chain Analysis

R&D

The R&D process for postpartum health supplements involves ingredient selection, purification and processing, formulation development, product standardization, quality control (QC), safety, and toxicity assessments

Key Players: Himalaya Wellness Company and Dabur India Limited

Clinical Trials

The clinical trial process for Ayurvedic throat care products follows a structured, multi-phase approach, adapted from modern Good Clinical Practice (GCP) strategies but integrated with traditional Ayurvedic principles and regulated by authorities such as the Ministry of AYUSH and the Central Drugs Standard Control Organization (CDSCO).

Key Players: Patanjali Ayurved Limited, and Baidyanath Ayurved Bhawan Pvt. Ltd.

Patient Services

The patient services process for Ayurvedic throat care usually involves a holistic, multi-step strategy that moves from early consultation and diagnosis to treatment and long-term preventive care.

Key Players: Jiva Ayurveda and Travancore Ayurveda

Company Landscape

Dabur India Ltd.

(Known for Honitus cough syrup and lozenges)

Company Overview:

- Dabur India Ltd. is one of India's largest Fast-Moving Consumer Goods (FMCG) companies, with a legacy of over 140 years rooted in Ayurveda and natural healthcare.

- The company operates in key consumer segments including Health Care, Home & Personal Care, and Foods & Beverages.

- It is known for popularizing traditional Ayurvedic remedies into modern, accessible formats.

Corporate Information:

- Headquarters: Ghaziabad, Uttar Pradesh, India

- Year Founded: 1884

- Ownership Type: Public Limited Company (Listed on NSE and BSE)

History and Background:

- Founded by Dr. S.K. Burman as an Ayurvedic practitioner in Calcutta.

- Initially focused on manufacturing and distributing Ayurvedic medicines.

- Evolved into a major FMCG player while retaining its core Ayurvedic heritage.

Key Milestones/Timeline:

- 1884: Foundation of Dabur by Dr. S.K. Burman.

- 1994: Public listing of the company.

- 1998: Business restructured into three divisions (Health Care, Personal Care, and Foods) to drive growth.

- FY 2024-25: Consolidated Revenue from Operations reached ₹12,563 crore.

- FY 2024-25: Maintained market share gains across over 90% of its portfolio.

Business Overview:

- Focused on providing natural and science-based Ayurvedic products globally.

- Portfolio includes over 250 herbal/Ayurvedic products.

- "Honitus" is one of its eight Power Brands.

Business Segments/Divisions:

- Consumer Care Business:

- Health Care (Includes Honitus, Chyawanprash, Pudin Hara)

- Home & Personal Care (Includes Dabur Amla, Dabur Red Paste)

- Food & Beverages Business (Includes Réal fruit juices, Badshah Masala)

- International Business

- Geographic Presence:

- India: Strong rural and urban presence, covering 8.4 million retail outlets as of FY 2024-25.

- International: Significant presence in the Middle East, Africa, South Asia, Europe, and the US.

Key Offerings (Ayurvedic Throat Care Focus):

- Honitus Cough Syrup: Ayurvedic remedy for cough relief.

- Honitus Lozenges: Ayurvedic throat lozenges for soothing a sore throat.

- Honitus Hot Sip: Ayurvedic Kadha (herbal decoction) for cold and cough.

End-Use Industries Served:

- Consumer Health (OTC/Ayurvedic Medicine)

- Personal Care (Hair care, Oral care, Skin care)

- Food & Beverages

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Acquisition of Badshah Masala (effective FY 2023-24) to expand its Food & Beverages segment.

- Partnerships & Collaborations: Ongoing collaborations with research and academic institutions for R&D on Ayurvedic formulations.

- Product Launches/Innovations: Continuous launch of extensions and specialized variants within the Honitus range (e.g., sugar-free variants, specific immunity boosters).

- Capacity Expansions/Investments: Investments in expanding manufacturing capacity and modernizing existing plants to meet growing demand.

- Regulatory Approvals: Adherence to AYUSH regulations in India and international standards (e.g., USFDA, EU) for specific products.

- Distribution channel strategy: Focus on expanding rural reach (1.32 lakh villages covered in FY 2024-25) and strengthening D2C/e-commerce platforms.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Leveraging proprietary extraction and standardization techniques for herbal ingredients (e.g., in Honitus). Focus on achieving high purity and efficacy of Ayurvedic formulations.

- Research & Development Infrastructure: Advanced R&D center for clinical validation, toxicological studies, and new product development in Ayurveda.

- Innovation Focus Areas: Bioavailability enhancement of herbal actives, developing modern dosage forms, and clinical validation of traditional knowledge.

Competitive Positioning:

- Strengths & Differentiators: Strong brand equity and trust in Ayurveda built over 140 years; market leadership in several key categories like Chyawanprash, Honey, and Ayurvedic cough syrups; vast distribution network.

- Market presence & ecosystem role: Dominant player in the Indian FMCG-Ayurveda space, serving as a benchmark for traditional healthcare integration.

SWOT Analysis:

- Strengths: Brand heritage, extensive product portfolio, massive rural reach, strong R&D in Ayurveda.

- Weaknesses: High competition in the FMCG segment; potential regulatory challenges for herbal products in international markets.

- Opportunities: Growing consumer preference for natural/Ayurvedic products globally; digital transformation and D2C channel expansion.

- Threats: Intense competition from domestic and international FMCG giants; risk of counterfeit products; dependence on volatile raw material pricing.

Recent News and Updates:

- Press Releases (May 2025): Reported Q4 FY 2024-25 Consolidated Net Profit of ₹320 Cr and Revenue of ₹2,830 Cr, emphasizing market share gains across 90% of its portfolio despite a challenging demand environment.

- Industry Recognitions/Awards: Consistently ranks among India's most trusted and sustainable companies in various industry reports.

Himalaya Wellness Company

(Known for Koflet cough syrup and lozenges.)

Company Overview:

- Himalaya Wellness Company (formerly The Himalaya Drug Company) is a global leader in herbal health and personal care products.

- It combines traditional Ayurvedic principles with modern science (Phytochemistry, Pharmacology) to create standardized, safe, and effective products.

- A major focus is on research-backed, safe, and gentle Ayurvedic solutions.

Corporate Information:

- Headquarters: Bengaluru, Karnataka, India

- Year Founded: 1930

- Ownership Type: Private/Family-owned (Global presence)

History and Background:

- Founded by Mr. M. Manal in 1930 with a vision to bring Ayurveda to society in a contemporary form.

- Launched Liv . 52 in 1955, a flagship herbal medicine.

- Pioneered scientific research to validate the efficacy of herbal products.

- Renamed to Himalaya Wellness Company to reflect its expanded focus on wellness.

Key Milestones/Timeline:

- 1930: Company foundation.

- 1955: Launch of Liv . 52.

- 1999: Launch of the Personal Care range.

- 2010s: Significant global expansion and diversification into the wellness segment.

- November 2023: Launched a major 360° national campaign for Koflet cough syrup across major Indian states.

Business Overview:

- Focus on developing herbal pharmaceuticals and personal care products.

- Operates in HealthCare, Personal Care, BabyCare, and Animal Health segments.

- Koflet and its variants are a key part of the HealthCare division.

Business Segments/Divisions:

- Pharmaceuticals (Ayurvedic/Herbal Medicines - includes Koflet)

- Personal Care

- Baby Care

- Animal Health

Geographic Presence:

- India: Strong national presence across modern trade, general trade, and pharmacies.

- International: Global presence in over 100 countries, including the Middle East, Asia, Europe, and the US.

Key Offerings (Ayurvedic Throat Care Focus):

- Koflet Cough Syrup: Ayurvedic syrup containing ingredients like Holy Basil and Licorice for dry and productive cough.

- Koflet-EX Linctus: Expectorant and mucolytic variant for wet cough.

- Koflet-H Lozenges: Ayurvedic lozenges for throat irritation.

End-Use Industries Served:

- Pharmaceuticals/OTC Health

- Personal Care & Cosmetics

- Pediatric Care

- Veterinary Health

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Primarily focused on organic growth; M&A activities are less frequent or publicly emphasized compared to organic expansion.

- Partnerships & Collaborations: Collaboration with various research institutions for clinical trials and efficacy testing of herbal products.

- Product Launches/Innovations: Continuous innovation in the BabyCare and Personal Care segments; new variants of cough and throat care products (e.g., Koflet-EX).

- Capacity Expansions/Investments: Continuous investment in modern, high-tech manufacturing facilities that adhere to international quality standards (GMP).

- Regulatory Approvals: Products meet stringent quality and safety standards for markets across the globe.

- Distribution channel strategy: Strong focus on pharmacies (a key channel for Ayurvedic healthcare) and growing its dedicated Himalaya Stores and online channels.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Proprietary "Fingerprinting" technology for standardizing herbal extracts; focus on Phytochemistry to isolate and identify active markers in herbs.

- Research & Development Infrastructure: Dedicated R&D center with over 200 scientists, focusing on clinical research and ensuring batch-to-batch consistency.

- Innovation Focus Areas: Evidence-based herbal medicine, formulation development for enhanced absorption and taste masking, and clinical validation of traditional Ayurvedic formulations.

Competitive Positioning:

- Strengths & Differentiators: Strong emphasis on scientific validation ("Science-based Ayurveda"); high brand recall and global presence; expertise in specific therapeutic areas (e.g., Liver care, cough/cold).

- Market presence & ecosystem role: A key competitor to large FMCG players, setting a high standard for quality and R&D in the Ayurvedic sector, particularly in the pharmacy channel.

SWOT Analysis:

- Strengths: Scientifically backed herbal portfolio, strong R&D focus, significant international footprint, diversified product segments (BabyCare, Personal Care).

- Weaknesses: Private ownership limits public financial transparency; brand is often associated with personal care, which can dilute its pharma/health image.

- Opportunities: Rapid growth in the global herbal supplements market; increasing demand for natural baby care products; expansion in modern/online retail.

- Threats: Intense competition from domestic players like Dabur and Patanjali; regulatory hurdles in new international markets; ensuring consistent raw material quality and supply.

Recent News and Updates:

- Press Releases (November 2023): Execution of a 360° national advertising campaign for Koflet Syrup in India to boost market presence during the cold season.

- Industry Recognitions/Awards: Frequently recognized for product quality, efficacy, and ethical marketing practices in the health and wellness space.

Top Vendors in the Ayurvedic Throat Care Market & Their Offerings

| Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

| Dabur India Ltd. |

Ghaziabad, Uttar Pradesh |

A diverse product portfolio spanning healthcare and personal care |

In 2025, Dabur India launched Dabur Ventures, a new investment platform. It will invest up to ₹500 crore in digital-first businesses. |

| Patanjali Ayurved Ltd. |

Haridwar, Uttarakhand |

A strong brand built on natural and Ayurvedic principles. |

Patanjali Foods Limited in July 2024 decided the acquire Patanjali Ayurved for a sum of Rs. 1100 crore. |

| The Himalaya Drug Company |

Bengaluru |

strong brand reputation |

The Himalaya Drug Company has planned to launch an omnichannel strategy to connect its retail outlets to the e-commerce portal. |

| Baidyanath |

Kolkata |

long history and deep roots in Ayurvedic tradition |

Baidyanath produces the largest range of Ayurveda products with over 700 formulations, sold at over 1,00000 retail outlets. |

| Hamdard Laboratories |

New Delhi, India |

Strong legacy and consumer trust |

Hamdard Sualin Natural Cough & Cold Remedy is an Unani formulation designed to help provide quick relief from cough, cold, and sore throat. |

Top Companies in the Ayurvedic Throat Care Market

- Dabur India Ltd.

- Patanjali Ayurved Ltd.

- The Himalaya Drug Company

- Zandu (Emami Ltd.)

- Baidyanath (Patanjali/Baidyanath group)

- Vicco Laboratories

- Hamdard Laboratories (Wakf)

- Kottakkal Arya Vaidya Sala

- Kerala Ayurveda Ltd.

- Charak Pharma Pvt. Ltd.

- Jiva Ayurveda

- Organic India Pvt. Ltd.

- Pukka Herbs (Ayurvedic herbal blends)

- Forest Essentials (premium Ayurvedic personal care)

- Herbal Hills

Read further to see how top players are redefining the Ayurvedic Throat Care Market at: https://www.towardshealthcare.com/companies/ayurvedic-throat-care-companies

Recent Developments in the Ayurvedic Throat Care Market

- In August 2025, Reliance Retail expanded its presence in the beauty segment by introducing an Ayurvedic personal care brand under its Tira platform, as per news reports. The newly launched brand, Puraveda, represents a fusion of India’s age-old wellness traditions with the precision of modern science.

- In September 2025, the Ministry of Ayush signed an agreement with the World Health Organization (WHO) to co-host the 2nd WHO Global Summit on Traditional Medicine on the theme “Restoring balance for people and planet: The science and practice of well-being".

Segments Covered in the Report

By Product Type

- Lozenges / Pastilles

- Sugar-based lozenges

- Sugar-free / diabetic-friendly lozenges

- Syrups / Oral Drops

- Adult herbal syrups

- Pediatric syrups (child-friendly flavors & dosing)

- Throat Sprays / Oral Sprays

- Herbal antiseptic sprays

- Soothing botanical sprays (e.g., honey + herb blends)

- Kadha / Instant Herbal Tea Powders

- Ready-to-mix kadha sachets

- Loose herbal tea blends for throat care

- Gargles / Mouth Rinses (herbal)

- Topical Balms / Inhalation Blends

By Key Ingredient / Formulation Class

- Traditional Ayurvedic Extracts

- Mulethi (licorice) extracts

- Tulsi (holy basil) extracts

- Turmeric / Curcumin blends

- Essential Oil / Volatile Blends

- Eucalyptus, menthol, clove, peppermint blends

- Honey-based & Natural Syrups

- Raw honey + herbal infusion syrups

- Standardized Phyto-extracts / Purified Fractions

- Standardized glycyrrhizin, curcumin, etc.

- Multi-herbal Proprietary Blends

By Indication / Use Case

- Acute Sore Throat / Pharyngitis

- Cough-Associated Throat Irritation

- Chronic / Recurrent Throat Conditions

- Prophylactic / Immunomodulatory Use

By Dosage Form / Delivery & Convenience

- Immediate-release (lozenges, syrups)

- Sustained / Controlled-release lozenges/pastilles

- Portable formats

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA