Key Players Behind Bone & Joint Health Supplements Market Rise

Market Growth

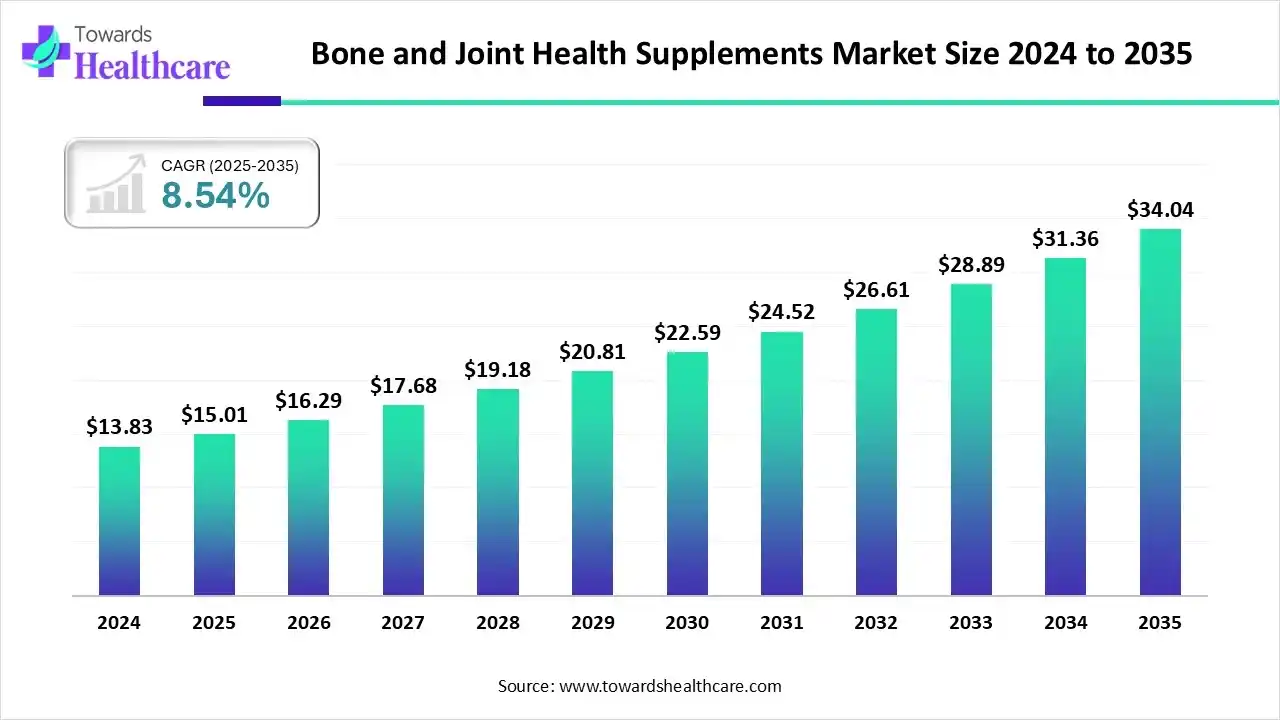

The global bone & joint health supplements market size is calculated at US$ 15.01 billion in 2025, grew to US$ 16.29 billion in 2026, and is projected to reach around US$ 34.04 billion by 2035. The market is expanding at a CAGR of 8.54% between 2026 and 2035.

What are Bone & Joint Health Supplements?

The bone & joint health supplements market is driven by rising demand, a growing geriatric population, and greater awareness of health supplements in developing countries. While age, physical activity, and genetics all have a big impact on bone and joint health, nutrition is an important and frequently overlooked factor that affects how strong and functional bones and joints are over the long term. These days, there are a lot of supplements that can help reduce joint stiffness and pain.

Common Supplements and Their Benefits

1. Calcium

Calcium is the main mineral responsible for keeping your bones strong and dense. It helps prevent bone thinning and reduces the risk of fractures as you age. If your diet doesn’t include enough dairy or calcium-rich foods, your body starts taking calcium from your bones, making them weak over time. Women with low body weight or hormonal changes (like PCOS) should pay special attention to calcium intake since it directly affects bone strength.

2. Vitamin D

Vitamin D works hand-in-hand with calcium. It helps your body absorb calcium from food or supplements. Without enough vitamin D, even if you take calcium, your bones may still weaken because the calcium won’t reach them properly. Sunlight is the best natural source, but if you don’t get enough sun exposure, a vitamin D supplement can help keep your bones strong and healthy.

3. Vitamin K2

Vitamin K2 ensures that calcium goes to your bones instead of building up in soft tissues or arteries. It activates specific proteins that bind calcium inside your bones, improving bone density and strength. Taking K2 along with calcium and vitamin D helps your body use these nutrients more effectively and safely.

4. Magnesium

Magnesium plays a key role in forming and maintaining bone structure. It also supports muscle relaxation, nerve health, and energy production. A lack of magnesium can lead to muscle cramps, fatigue, or poor bone quality. Adding foods like nuts, seeds, and leafy greens or taking a supplement can help your body absorb and balance calcium better.

5. Omega-3 (Fish Oil)

Omega-3 fatty acids have powerful anti-inflammatory properties that can ease joint stiffness and swelling. If you experience mild joint pain, especially after exercise, omega-3 can help reduce discomfort and improve joint flexibility. It also supports the cushioning between your joints, keeping them lubricated and healthy.

6. Glucosamine and Chondroitin

These two are natural compounds found in healthy cartilage the tissue that cushions joints. As we age or put more pressure on our joints through exercise, cartilage can wear down. Glucosamine and chondroitin help protect and rebuild this cartilage, reducing pain or stiffness in areas like knees or hips. They’re not magic pills, but many people feel gradual improvement with consistent use.

7. Collagen or Turmeric (Curcumin)

Collagen is the protein that forms the structure of your bones, joints, and skin. Taking collagen supplements can support flexibility and improve recovery after workouts. Turmeric, on the other hand, contains curcumin — a natural anti-inflammatory that helps reduce joint pain, swelling, and post-workout discomfort. Both work well for maintaining joint comfort and mobility.

Benefits of Taking Bone & Joint Supplements

1. Builds Stronger Bones

These supplements strengthen your bones from within and help prevent bone-related conditions like osteoporosis. They’re especially helpful for women who have low body weight or hormonal imbalances that can affect bone health.

2. Keeps Joints Flexible

By maintaining healthy cartilage and reducing inflammation, supplements like omega-3, glucosamine, and collagen make your joints more flexible. This helps you move comfortably without stiffness.

3. Reduces Pain and Inflammation

Many ingredients especially omega-3, turmeric, and glucosamine naturally lower joint pain and swelling. They can be helpful for people who feel sore after workouts or long hours of sitting.

4. Aids Recovery After Exercise

Supplements that support joints and bones help your body recover faster after workouts. They reduce soreness, prevent overuse injuries, and keep your bones and muscles healthy as you build strength.

5. Supports Long-Term Bone Health

For women, especially those with PCOS or hormonal imbalances, these supplements support long-term bone strength. They help balance calcium levels and reduce the risk of bone loss later in life.

Leading Giants Shaping the Future of Bone & Joint Health Supplements Market:

- Herbalife International of America, Inc.

- GNC Holdings, LLC

- Nature's Bounty

- Amway

- Garden of Life

- Thorne

- Solgar Inc.

- Pure Encapsulations, LLC.

- Glanbia plc

- NOW Foods

Company Landscape

| Company | Headquarters | Established Year | Annual Revenue |

| Herbalife International of America, Inc. | Los Angeles, USA | 1980 | USD 4.99 Billion |

| GNC Holdings, LLC | Pittsburgh, USA | 1935 | USD 1.78 BillionUSD 2 Billion (est.) |

| Nature’s Bounty | United States | 1971 | USD 2 Billion (est.) |

| Amway | Ada, USA | 1959 | USD 7.4 Billion |

| Garden of Life | Florida, USA | 2000 | USD 500 Million+ |

| Thorne | New York City, USA | 1984 | USD 228 Million |

| Solgar Inc. | New Jersey, USA | 1947 | USD 200–500 Million |

| Pure Encapsulations, LLC | Massachusetts, USA | 1991 | USD 100–500 Million |

| NOW Foods | Illinois, USA | 1968 | USD 600 Million+ |

| Glanbia plc | Kilkenny, Ireland | 1997 | USD 5.6 Billion |

Herbalife International of America, Inc.

Overview

-

Headquarters: Los Angeles, California, USA

-

Established: 1980

-

Herbalife is a global nutrition company specializing in weight management, dietary supplements, sports nutrition, and wellness products distributed through independent representatives in over 90 countries.

Top Products

-

Formula 1 Nutritional Shake Mix

-

Herbal Tea Concentrate

-

Herbalife24 Sports Nutrition Range

Regional Impact

-

Operates in more than 90 countries with a strong presence in North and Latin America, Asia-Pacific, and Europe.

-

Supports local entrepreneurship through its global distributor network.

-

Promotes regional wellness initiatives and community nutrition programs.

SWOT Analysis

Strengths:

-

Global brand recognition and strong product diversity.

-

Effective direct-selling network across international markets.

-

Continuous innovation in nutrition and wellness solutions.

Weaknesses:

-

Dependence on a multi-level marketing (MLM) model subject to scrutiny.

-

Exposure to market volatility and foreign exchange fluctuations.

-

Limited control over independent distributor practices.

Opportunities:

-

Growing demand for sports nutrition and wellness products.

-

Expansion in emerging markets and digital channels.

-

Collaboration with sports and fitness organizations.

Threats:

-

Regulatory risks affecting MLM operations.

-

Competition from retail and online wellness brands.

-

Consumer preference shifting toward clean-label, transparent products.

Recent Developments

-

Opened a global Nutrition Innovation Center of Excellence.

-

Reported annual revenue of approximately USD 4.99 billion in 2024.

-

Recognized for sustainability and value-driven wellness initiatives.

GNC Holdings, LLC

Overview

-

Headquarters: Pittsburgh, Pennsylvania, USA

-

Established: 1935

-

GNC manufactures and retails health and wellness products, including vitamins, minerals, herbs, sports nutrition, and weight management solutions.

Top Products

-

Mega Men Multivitamin Series

-

AMP Wheybolic Protein

-

Pro Performance Creatine and Pre-Workout Supplements

Regional Impact

-

Strong presence in North America with expanding global franchises.

-

Operates both retail and e-commerce channels.

-

Growing international footprint across Asia and the Middle East.

SWOT Analysis

Strengths:

-

Established retail network and strong brand recognition.

-

Extensive product range covering major wellness segments.

-

Trusted partnerships with global manufacturers and franchisees.

Weaknesses:

-

Reduced physical store traffic and sales decline in recent years.

-

Intense competition from online supplement retailers.

-

Limited differentiation in some product categories.

Opportunities:

-

Growth of e-commerce and direct-to-consumer sales models.

-

Expansion into functional foods and personalized wellness solutions.

-

Increasing interest in preventive health and immunity products.

Threats:

-

Stringent regulatory oversight on health claims.

-

Price wars from new digital wellness entrants.

-

Changing consumer preferences for transparency and clean labels.

Recent Developments

-

Introduced drone delivery pilot programs in select regions.

-

Enhanced focus on digital transformation and online engagement.

-

Streamlined operations to improve profitability and brand agility.

Nature’s Bounty

Overview

-

Headquarters: United States

-

Established: 1971

-

Nature’s Bounty produces vitamins, minerals, and herbal supplements aimed at promoting everyday health and well-being.

Top Products

-

Nature’s Bounty Vitamin D3 and Fish Oil Capsules

-

Hair, Skin & Nails Gummies

-

Probiotic 10 Digestive Health Formula

Regional Impact

-

Strong retail and e-commerce presence across North America.

-

Expanding distribution in Europe and Asia-Pacific.

-

Plays a key role in popularizing affordable wellness supplements.

SWOT Analysis

Strengths:

-

Recognized and trusted consumer supplement brand.

-

Wide range of products targeting diverse demographics.

-

Established manufacturing and distribution network.

Weaknesses:

-

Limited digital brand differentiation.

-

Competitive pricing environment in retail supplements.

-

Dependence on mature Western markets.

Opportunities:

-

Rising global awareness of preventive health.

-

Product innovation in plant-based and immunity supplements.

-

Growth in e-commerce and subscription-based sales.

Threats:

-

Increasing regulatory scrutiny of supplement claims.

-

Volatility in ingredient sourcing and production costs.

-

Competition from smaller, niche wellness startups.

Recent Developments

-

Focused on expanding product lines for immune and gut health.

-

Strengthened online presence through digital marketing investments.

-

Continued to grow its parent company’s global wellness portfolio.

Amway

Overview

-

Headquarters: Ada, Michigan, USA

-

Established: 1959

-

Amway is one of the world’s largest direct-selling companies, offering nutrition, beauty, and home care products.

Top Products

-

Nutrilite Vitamins and Dietary Supplements

-

Artistry Skincare and Beauty Line

-

XS Energy Drinks and Nutrition Products

Regional Impact

-

Operates in over 100 countries with more than one million distributors.

-

Major influence in Asia-Pacific and Latin America.

-

Drives economic empowerment through direct-selling entrepreneurship.

SWOT Analysis

Strengths:

-

Global presence and brand trust built over decades.

-

Diversified product range across health, beauty, and home care.

-

Robust independent distributor network.

Weaknesses:

-

Declining revenues due to global economic challenges.

-

High dependency on MLM model regulations.

-

Limited presence in mainstream retail channels.

Opportunities:

-

Expansion into personalized nutrition and wellness technologies.

-

Strengthening online and mobile sales platforms.

-

Rising consumer interest in health and immunity.

Threats:

-

Changing consumer attitudes toward MLM businesses.

-

Fluctuating foreign exchange rates impacting earnings.

-

Increased competition from digital wellness brands.

Recent Developments

-

Reported USD 7.4 billion in annual revenue in 2024.

-

Nutrition segment continues to lead growth.

-

Transitioned to new leadership focused on digital and wellness innovation.

Garden of Life

Overview

-

Headquarters: Palm Beach Gardens, Florida, USA

-

Established: 2000

-

Garden of Life focuses on organic, whole-food nutritional supplements designed for clean living and wellness.

Top Products

-

Raw Organic Protein Powders

-

MyKind Organics Vitamin Line

-

Dr. Formulated Probiotics Series

Regional Impact

-

Strong retail presence across the United States.

-

Growing footprint in Europe and Asia for organic supplements.

-

Influences clean-label and sustainable nutrition trends.

SWOT Analysis

Strengths:

-

Certified organic and non-GMO product portfolio.

-

Strong consumer loyalty in the natural supplement space.

-

Transparent ingredient sourcing and sustainable production.

Weaknesses:

-

Premium pricing limits affordability for some consumers.

-

Smaller market share compared to multinational supplement brands.

-

Reliance on organic ingredient supply chains.

Opportunities:

-

Expanding demand for plant-based and vegan nutrition.

-

Innovation in sustainable packaging and ethical sourcing.

-

Growth in online and health-focused retail platforms.

Threats:

-

High production costs for certified organic ingredients.

-

Intense competition in the clean nutrition segment.

-

Potential supply disruptions from raw material shortages.

Recent Developments

-

Reported annual revenue exceeding USD 500 million.

-

Introduced new plant-based protein and probiotic formulations.

-

Strengthened brand sustainability initiatives.

Thorne

Overview

-

Headquarters: New York City, USA

-

Established: 1984

-

Thorne offers science-backed supplements, personalized wellness programs, and health testing solutions.

Top Products

-

Thorne Basic Nutrients Multivitamin Range

-

Collagen Plus and Amino Complex

-

At-Home Health Tests for Biomarkers and Fitness

Regional Impact

-

Expanding U.S. consumer base with global practitioner partnerships.

-

Growing influence in precision nutrition and clinical wellness.

-

Trusted partner for sports teams and healthcare professionals.

SWOT Analysis

Strengths:

-

Strong reputation for research-based, clean formulations.

-

Premium positioning in personalized health and diagnostics.

-

Integrated approach combining supplements and testing.

Weaknesses:

-

Higher price point limits accessibility.

-

Smaller scale compared to mass-market supplement brands.

-

Requires greater consumer education for complex offerings.

Opportunities:

-

Expansion into digital health and wearable integrations.

-

Global demand for personalized wellness solutions.

-

Collaboration with healthcare providers and biotech firms.

Threats:

-

Competitive landscape in personalized wellness technology.

-

Regulatory complexities in supplements and diagnostics.

-

Rising costs of research and production.

Recent Developments

-

Reported revenue of USD 228 million in 2022.

-

Expanded manufacturing facilities to support new product lines.

-

Acquired by L Catterton to accelerate global growth.

Solgar Inc.

Overview

-

Headquarters: Leonia, New Jersey, USA

-

Established: 1947

-

Solgar is a premium supplement brand offering vitamins, minerals, and botanicals with a focus on purity and quality.

Top Products

-

Solgar Vitamin C and Multinutrient Formulas

-

Solgar Calcium Magnesium Citrate

-

Botanical Extracts and Specialty Blends

Regional Impact

-

Distributed globally through pharmacies, health stores, and practitioners.

-

Recognized as a premium brand in wellness and preventive care.

-

Strong presence in North America and Europe.

SWOT Analysis

Strengths:

-

Long-standing reputation for premium quality supplements.

-

Commitment to natural and science-based formulations.

-

Strong professional and retail network.

Weaknesses:

-

Higher cost relative to mainstream brands.

-

Limited marketing in digital channels.

-

Slower innovation pace compared to emerging brands.

Opportunities:

-

Growth in premium health-conscious consumer segments.

-

Expansion in digital and direct-to-consumer platforms.

-

Development of clean-label, vegan-friendly formulations.

Threats:

-

Competition from new boutique wellness brands.

-

Global regulatory and supply chain uncertainties.

-

Market shift toward subscription-based supplement models.

Recent Developments

-

Reported estimated annual revenue between USD 200–500 million.

-

Focused on modernizing product packaging and branding.

-

Expanded plant-based and non-GMO supplement ranges.

Pure Encapsulations, LLC.

Overview

-

Headquarters: Sudbury, Massachusetts, USA

-

Established: 1991

-

Pure Encapsulations specializes in hypoallergenic, professional-grade nutritional supplements designed for healthcare practitioners.

Top Products

-

Pure Encapsulations Magnesium Glycinate

-

Nutrient 950 Multivitamin Series

-

Digestive Enzymes Ultra

Regional Impact

-

Widely used by healthcare professionals across the U.S. and Europe.

-

Expanding into practitioner wellness and personalized nutrition programs.

-

Trusted brand for purity, efficacy, and scientific formulation.

SWOT Analysis

Strengths:

-

High-quality, allergen-free formulations.

-

Strong credibility among healthcare practitioners.

-

Transparent ingredient sourcing and testing standards.

Weaknesses:

-

Niche focus limits mainstream consumer reach.

-

Higher price point compared to mass-market alternatives.

-

Limited direct-to-consumer engagement.

Opportunities:

-

Growth of personalized health and clinical nutrition sectors.

-

Expansion of practitioner partnerships and telehealth channels.

-

Rising demand for clean, medical-grade supplements.

Threats:

-

Increased competition from premium supplement brands.

-

Tightening regulations on professional-grade supplements.

-

Supply chain and ingredient cost challenges.

Recent Developments

-

Reported estimated revenue between USD 100–500 million.

-

Introduced advanced probiotic and immune-support product lines.

-

Strengthened digital support for healthcare providers.

NOW Foods

Overview

-

Headquarters: Bloomingdale, Illinois, USA

-

Established: 1968

-

NOW Foods produces natural health products, supplements, and essential oils focused on affordability and quality.

Top Products

-

NOW Vitamin D3 Softgels

-

Whey Protein Isolate and Amino Acids

-

Essential Oils and Natural Personal Care Products

Regional Impact

-

Global distribution across retail, health food, and online stores.

-

Known for providing affordable natural wellness products.

-

Influences value-based health supplement markets worldwide.

SWOT Analysis

Strengths:

-

Wide product range catering to multiple health segments.

-

Strong reputation for affordability and quality.

-

Family-owned stability and ethical business practices.

Weaknesses:

-

Lower margins compared to premium brands.

-

Limited marketing presence in the luxury wellness segment.

-

Product saturation in certain categories.

Opportunities:

-

Rising global demand for natural and sustainable wellness options.

-

Expansion in emerging economies with value-focused consumers.

-

Diversification into eco-friendly and functional food products.

Threats:

-

Intense competition from both low-cost and premium brands.

-

Price pressures and sourcing challenges.

-

Regulatory risks in international markets.

Recent Developments

-

Expanded global manufacturing capacity.

-

Introduced new organic food and personal care product lines.

-

Continued investment in sustainability and supply chain transparency.

Glanbia plc

Overview

-

Headquarters: Kilkenny, Ireland

-

Established: 1997

-

Glanbia is a global nutrition group engaged in performance nutrition, ingredients, and dairy-based solutions.

Top Products

-

Optimum Nutrition Gold Standard Whey

-

SlimFast Meal Replacement Range

-

BSN Sports Nutrition Supplements

Regional Impact

-

Operates in over 30 countries with strong distribution in North America and Europe.

-

Leading supplier of nutrition and performance ingredients worldwide.

-

Major contributor to global sports nutrition growth.

SWOT Analysis

Strengths:

-

Diversified portfolio across nutrition and dairy ingredients.

-

Strong global brands with loyal consumer bases.

-

Vertical integration in ingredient manufacturing.

Weaknesses:

-

Exposure to dairy commodity price fluctuations.

-

Dependence on fitness and sports nutrition markets.

-

Limited direct retail presence compared to competitors.

Opportunities:

-

Growth in functional and lifestyle nutrition markets.

-

Expansion into plant-based and alternative protein sectors.

-

Strategic acquisitions and partnerships for innovation.

Threats:

-

Intense competition in sports nutrition.

-

Regulatory and environmental pressures on dairy sourcing.

-

Economic slowdown impacting consumer spending.

Recent Developments

-

Focused on sustainability and plant-based innovation.

-

Streamlined portfolio through divestment of non-core assets.

-

Achieved strong growth in its performance nutrition segment.

Market Value Chain Analysis

R&D

Scientific research, product development, and regulatory compliance are all systematically integrated in the R&D process for supplements that promote bone and joint health. From the original concept to commercialization, it usually requires a number of crucial steps.

Clinical Trials and Regulatory Approvals

Because bone and joint health supplements are controlled as food items rather than medications, clinical trials studies are often not required for market access in the U.S. and EU. But in order to validate some health claims on labels and win over customers, studies are essential.

Patient Support and Services

In order to guarantee successful disease treatment, patient support measures for bone and joint supplements include education, usage instructions, adherence reminders, collaboration with healthcare providers, financial aid, and emotional support.

Recent Developments in the Market

- In April 2025, at the National Bone Health & Osteoporosis Foundation (BHOF) Interdisciplinary Symposium, Juvent, a pioneer in clinically proven bone and musculoskeletal health solutions, unveiled HydroxyBMD3, a ground-breaking new supplement system.

- In January 2025, in order to determine if a probiotic and prebiotic combination (BondiaÒ or SBD111) created by Solarea Bio can aid in managing bone health in women 60 years of age and older, Hinda and Arthur Marcus Institute for Aging Research researchers at Hebrew SeniorLife initiated a sizable clinical food study.

Partner with our experts to explore the bone & joint health supplements market at: sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking