Top 5 Innovators Shaping the Future of Lipid Regulators Market

Market Growth

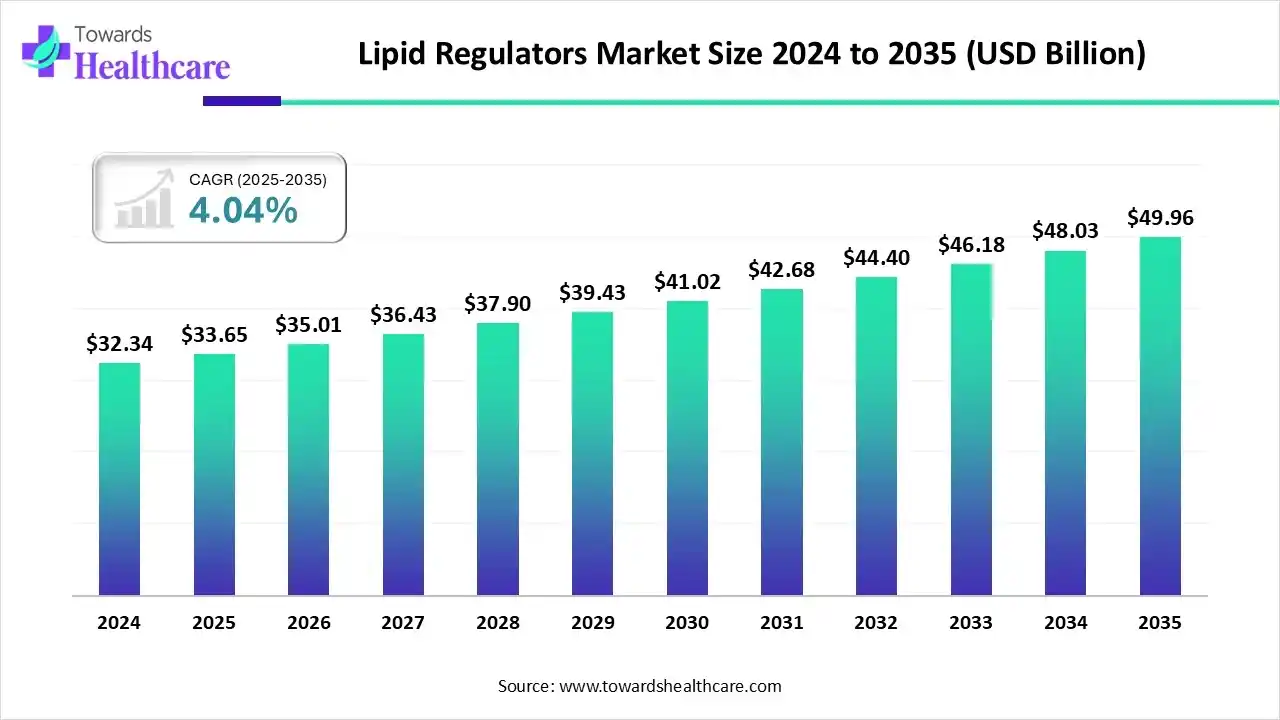

The lipid regulators market size stood at US$ 33.65 billion in 2025, grew to US$ 35.01 billion in 2026, and is forecast to reach US$ 49.96 billion by 2035, expanding at a CAGR of 4.04% from 2026 to 2035.

What are Lipid Regulators?

The lipid regulators market is growing due to the rising prevalence of cardiovascular diseases and increasing demand for effective cholesterol management therapies. The market comprises pharmaceuticals and biologics used to manage blood lipid levels primarily to lower low-density lipoprotein cholesterol (LDL-C), reduce triglycerides, and raise high-density lipoprotein (HDL). It includes drug classes such as statins, ezetimibe, fibrates, bile acid sequestrants, omega-3 fatty acid therapies, PCSK9 inhibitors, siRNA therapies (e.g., inclisiran), combination lipid therapies, and generics.

Products in this market are prescribed for primary and secondary prevention of atherosclerotic cardiovascular disease, familial hypercholesterolemia, and severe hypertriglyceridemia. Market activity is driven by clinical guideline updates, aging populations, cardiovascular disease prevalence, patent expiries, availability of generics and biosimilars, and innovations in RNA-based and monoclonal antibody therapies.

Meet the Top Companies in the Lipid Regulators Market

- Pfizer

- Novartis

- Amgen

- Sanofi

- Regeneron Pharmaceuticals

- Merck & Co.

- AstraZeneca

- Eli Lilly and Company

- Johnson & Johnson (Janssen)

- Bristol-Myers Squibb

- Bayer AG

- AbbVie

- Boehringer Ingelheim

- Takeda Pharmaceutical Company

- Viatris

- Teva Pharmaceutical Industries

- Sandoz (Novartis generics)

- Sun Pharmaceutical Industries

- Cipla

- Dr. Reddy’s Laboratories

5 Major Companies Overview

| Company | Headquarters | Annual Revenue (2024, USD) | Established Year |

|---|---|---|---|

| Pfizer Inc. | New York City, USA | $58.5 Billion | 1849 |

| Novartis AG | Basel, Switzerland | $46.4 Billion | 1996 |

| Amgen Inc. | Thousand Oaks, USA | $28.2 Billion | 1980 |

| Sanofi S.A. | Paris, France | $45.9 Billion | 1973 |

| Regeneron Pharmaceuticals | Tarrytown, USA | $13.1 Billion | 1988 |

Pfizer Inc.

Overview

-

Headquarters: New York City, United States

-

Established: 1849

-

Overview: Pfizer is a global biopharmaceutical leader known for developing innovative medicines and vaccines across therapeutic areas such as cardiovascular, oncology, immunology, and infectious diseases.

-

The company operates in over 120 countries, emphasizing science-driven innovation and public health advancement.

-

Pfizer has a legacy of strategic collaborations and acquisitions to strengthen its R&D capabilities.

Top Products

-

Lipitor (Atorvastatin): One of the world’s most prescribed lipid-lowering drugs.

-

Caduet: Combines amlodipine and atorvastatin for managing high blood pressure and cholesterol.

-

Vyndaqel/Vyndamax: Targets transthyretin amyloid cardiomyopathy (ATTR-CM), improving heart function.

Regional Impact

-

Strong market presence in North America and Europe, with growing expansion in Asia-Pacific.

-

Plays a key role in global public health initiatives and affordable access to medicines.

-

Contributes significantly to cardiovascular disease treatment awareness campaigns worldwide.

SWOT Analysis

-

Strengths: Broad product portfolio; strong R&D and innovation pipeline; global market presence.

-

Weaknesses: High dependency on blockbuster drugs; patent expiration challenges.

-

Opportunities: Growth in biologics, mRNA technology applications, and cardiovascular therapeutics.

-

Threats: Increasing competition from biosimilars and generics; strict regulatory environments.

Recent Development

-

Announced ongoing research on next-generation lipid-regulating therapies leveraging RNA-based platforms.

-

Expanding partnerships for digital health and precision medicine integration.

-

Focused investments in sustainable manufacturing and supply chain optimization.

Novartis AG

Overview

-

Headquarters: Basel, Switzerland

-

Established: 1996 (merger of Ciba-Geigy and Sandoz)

-

Overview: Novartis is a leading global healthcare company focusing on innovative pharmaceuticals and generics.

-

The company drives its mission through advanced science and technology, especially in cardiovascular, oncology, and immunology sectors.

-

Operates in more than 140 countries with a commitment to reimagining medicine.

Top Products

-

Lescol (Fluvastatin): A lipid-lowering statin drug.

-

Sandoz Generic Statins: Providing affordable cholesterol management solutions.

-

Entresto: A breakthrough treatment for heart failure, supporting lipid metabolism indirectly.

Regional Impact

-

Major operations in Europe, the U.S., Japan, and emerging Asia-Pacific markets.

-

Strengthened its footprint in developing countries through generic access programs.

-

Contributed to regional clinical trials in cardiovascular diseases and metabolic disorders.

SWOT Analysis

-

Strengths: Robust R&D ecosystem; strong global brand; diversified product range.

-

Weaknesses: Complex regulatory dependencies; litigation risks in generics.

-

Opportunities: Expansion in digital therapeutics and data-driven clinical innovations.

-

Threats: Price pressures in key markets and competition from biosimilars.

Recent Development

-

Completed spin-off of Sandoz to focus on innovative medicines.

-

Investing in AI-powered R&D to accelerate cardiovascular drug discovery.

-

Launched new initiatives for sustainable healthcare solutions globally.

Amgen Inc.

Overview

-

Headquarters: Thousand Oaks, California, United States

-

Established: 1980

-

Overview: Amgen is a biotechnology pioneer known for advancing therapies in cardiovascular, oncology, and inflammation.

-

It emphasizes human genetics to drive innovation and precision medicine.

-

Operates in over 100 countries with a focus on biologic-based therapeutics.

Top Products

-

Repatha (Evolocumab): PCSK9 inhibitor used to lower LDL cholesterol.

-

Aimovig: Migraine prevention drug with cardiovascular safety profile.

-

Aranesp: Used in anemia management with implications for cardiovascular health.

Regional Impact

-

Strong foothold in North America, Europe, and emerging markets.

-

Expanding collaborations in Asia-Pacific for cardiovascular research and biosimilars.

-

Plays a vital role in lipid regulation awareness through global outreach programs.

SWOT Analysis

-

Strengths: Leadership in biologics; advanced biomanufacturing; genetics-based R&D.

-

Weaknesses: High R&D costs; limited product diversification compared to pharma giants.

-

Opportunities: Growth in cardiovascular and metabolic therapeutics.

-

Threats: Patent cliffs and biosimilar competition.

Recent Development

-

Secured FDA approval for expanded Repatha indications.

-

Investing in next-generation lipid management therapies using precision biologics.

-

Strengthened collaborations with digital health startups for cardiovascular monitoring.

Sanofi S.A.

Overview

-

Headquarters: Paris, France

-

Established: 1973

-

Overview: Sanofi is a global healthcare leader focused on prescription medicines, vaccines, and consumer healthcare.

-

It operates through multiple segments including cardiovascular, diabetes, oncology, and immunology.

-

Sanofi’s mission emphasizes access to healthcare and innovative medicine worldwide.

Top Products

-

Praluent (Alirocumab): PCSK9 inhibitor developed with Regeneron for lowering cholesterol.

-

Lantus: Insulin product that supports overall metabolic health.

-

Plavix: Antiplatelet drug for cardiovascular and lipid-related conditions.

Regional Impact

-

Prominent presence in Europe, North America, and expanding influence in Asia and Africa.

-

Contributes to cardiovascular health initiatives and access programs globally.

-

Drives partnerships with local manufacturers for medicine affordability.

SWOT Analysis

-

Strengths: Broad global reach; strong collaboration pipeline; diverse product portfolio.

-

Weaknesses: Slower growth in some therapeutic areas; dependence on partnerships.

-

Opportunities: Expanding biologics and digital health integration.

-

Threats: Pricing pressures and biosimilar entry in key markets.

Recent Development

-

Advancing research on next-generation PCSK9 inhibitors.

-

Strategic partnerships for AI-driven clinical development.

-

Continued focus on cardiovascular digital monitoring solutions.

Regeneron Pharmaceuticals Inc.

Overview

-

Headquarters: Tarrytown, New York, United States

-

Established: 1988

-

Overview: Regeneron is a science-driven biotechnology company focused on discovering, developing, and commercializing innovative medicines.

-

Known for its strong emphasis on monoclonal antibody technology and genetic research.

-

Collaborates extensively with Sanofi for cardiovascular and immunology drugs.

Top Products

-

Praluent (Alirocumab): Co-developed with Sanofi for hypercholesterolemia.

-

Eylea: Major product with indirect cardiovascular relevance.

-

Evkeeza: A novel therapy for homozygous familial hypercholesterolemia.

Regional Impact

-

Major influence in North America and Europe, with expansion in Asia-Pacific markets.

-

Conducts key global cardiovascular clinical trials.

-

Supports healthcare education and precision medicine programs.

SWOT Analysis

-

Strengths: Cutting-edge R&D; collaboration network; genetic innovation.

-

Weaknesses: Limited product diversity; high R&D expenditure.

-

Opportunities: Expansion in cardiovascular and metabolic disorder therapies.

-

Threats: Competitive biologics landscape; dependence on collaboration revenue.

Recent Development

-

Expanding Evkeeza access programs globally.

-

Advanced work in gene-based lipid metabolism research.

-

Continued collaborations for precision cardiovascular therapies.

Lipid Regulators Market Value Chain Analysis

Clinical Trials

- Ongoing clinical trials for lipid regulators aim to lower cardiovascular risk by managing cholesterol and lipid levels.

- New drugs under evaluation include inclisiran, bempedoic acid, and obicetrapib.

- Research is also being conducted on established therapies such as atorvastatin and rosuvastatin.

Packaging and Serialization

- Packaging and serialization of lipid regulators ensure product safety and authenticity across the supply chain.

- Non-reactive and protective packaging materials are used to maintain drug stability and quality.

- Serialization systems are implemented to enable full traceability and prevent counterfeiting.

- Compliance with international standards such as the U.S. DSCSA and EU FMD is strictly maintained.

Patient Support and Services

- Patient support programs are essential for managing cholesterol-related conditions effectively.

- They help improve medication adherence and overall treatment outcomes.

- Services include guidance from healthcare professionals and access to educational materials.

- Behavioral and lifestyle support are provided to promote long-term health.

- Specialized clinics and patient organizations offer continuous assistance and monitoring.

Recent Developments in the Lipid Regulators Market

- In June 2025, Eli Lilly completed the acquisition of Verve Therapeutics to strengthen its focus on developing one-time gene-editing therapies for familial hypercholesterolemia, particularly targeting the PCSK9 pathway to improve long-term cholesterol control.

- In May 2025, HLS Therapeutics entered a partnership with Esperion to market NEXLETOL and NEXLIZET in Canada, under a deal that included an upfront payment of USD 1 million to expand access to cholesterol-lowering treatments.

Collaborate with our expert team and explore the lipid regulators market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking