Learn About the Liver Disease Therapeutics Market Companies with Growth

- Gilead Sciences

- AbbVie

- Merck & Co.

- Roche/Genentech

- Bristol-Myers Squibb (BMS)

- Novartis

- Johnson & Johnson (Janssen)

- Pfizer

- Sanofi

- Takeda Pharmaceutical

- Intercept Pharmaceuticals

- Madrigal Pharmaceuticals

- Alnylam Pharmaceuticals

- Arrowhead Pharmaceuticals

- Medivation / Astellas

- Eli Lilly

- Novo Nordisk

- Galmed Pharmaceuticals / Other biotech (representative)

- Vertex Pharmaceuticals

Rising Liver Diseases: Making the Market Grow Exponentially

The liver disease therapeutics market is driven by global burdens of viral hepatitis and metabolic-associated liver disease, advances in antiviral cures and novel antifibrotic/ metabolic candidates, growing diagnostics and patient awareness, and rising investment into NASH and HCC therapeutics. The market comprises pharmaceuticals, biologics, advanced cell and gene therapies, and supportive care products used to prevent, treat, manage, or slow the progression of liver diseases. Key indications include viral hepatitis (HBV, HCV), non-alcoholic fatty liver disease (NAFLD) and its progressive form, non-alcoholic steatohepatitis (NASH), cirrhosis, hepatocellular carcinoma (HCC), and autoimmune and cholestatic liver diseases.

Every year, liver disease kills more than two million people worldwide. The prevalence of metabolic-associated steatotic liver disease (MASLD) is expected to rise dramatically by 2030 in many areas, contributing to the growing burden of MASLD in 2024. Deaths from viral hepatitis (HBV/HCV) are also a serious concern; by 2030, the WHO wants to reduce mortality by 65%.

Market Growth

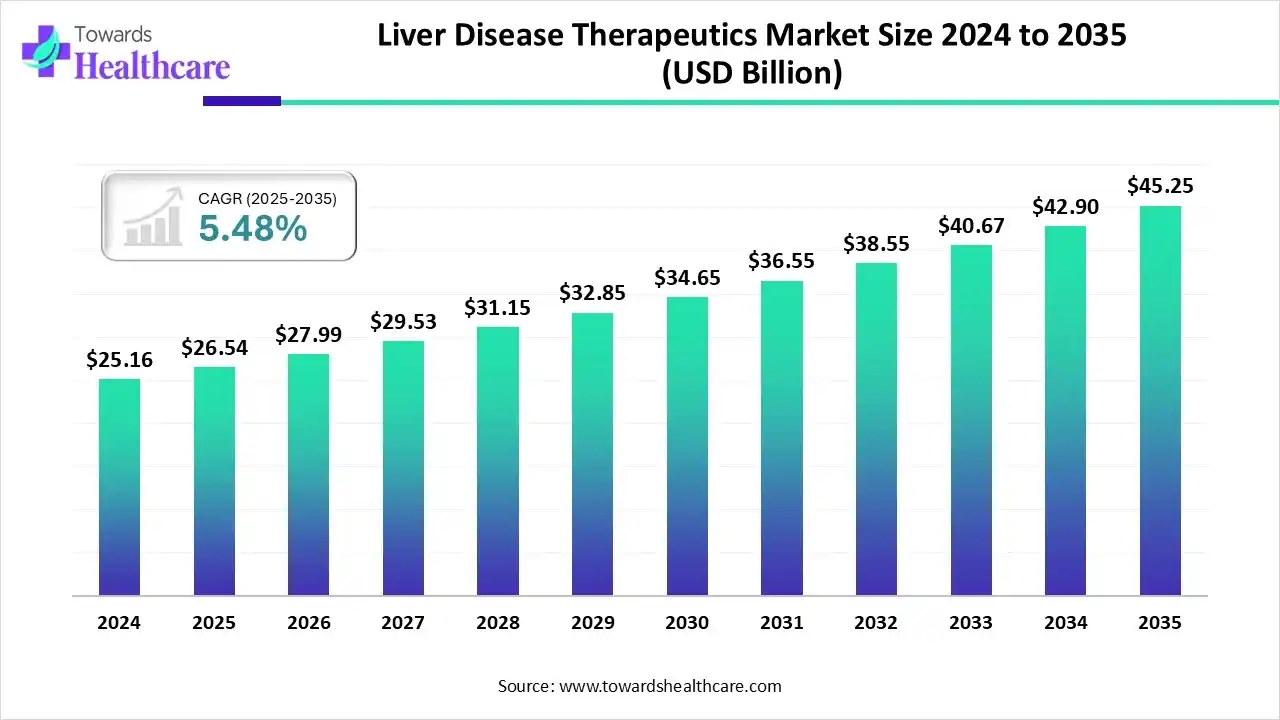

The global liver disease therapeutics market size is calculated at US$ 26.54 billion in 2025, grew to US$ 27.99 billion in 2026, and is projected to reach around US$ 45.25 billion by 2035. The market is expanding at a CAGR of 5.48% between 2026 and 2035.

Liver Disease Therapeutics Market Companies Outlook

- Major Investors: The liver disease therapeutics market is dominated by large biopharmaceutical firms such as Bristol-Myers Squibb, AbbVie, Gilead Sciences, and Merck & Co. Significant investment in treatments for metabolic liver disease has been highlighted by recent M&A activity, with major agreements from Novo Nordisk, GSK, and Roche concentrating on cutting-edge treatments like FGF21 agonists.

- Startup Ecosystem: Precision medicine and targeted therapies are the focus of a thriving startup ecosystem that includes businesses like Akero Therapeutics and Madrigal Pharmaceuticals. Venture capital investments are on the rise, especially for early-stage businesses creating RNA-based therapies, AI-powered diagnostics, and anti-fibrotic drugs for diseases like NASH.

Meet the Innovators and their Company Profile

Gilead Sciences

Company Overview:

- A research-based biopharmaceutical company focused on discovering, developing, and commercializing innovative medicines in areas of unmet medical need.

- Pioneered transformative treatments for HIV, viral hepatitis (HCV, HBV, HDV), and is expanding into oncology and inflammation.

- Its HCV portfolio, featuring pan-genotypic, short-duration regimens, has been a major market driver in liver disease therapeutics.

Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: Foster City, California, United States

- Year Founded: 1987

- Ownership Type: Public (NASDAQ: GILD)

History and Background:

- Established a foundation in antiviral drugs, notably with HIV treatments like Viread (tenofovir disoproxil fumarate).

- Achieved market dominance in HCV with the introduction of Direct-Acting Antivirals (DAAs) like Sovaldi (sofosbuvir) and Harvoni (ledipasvir/sofosbuvir), which revolutionized treatment with high cure rates.

Key Milestones/Timeline:

- 2013: FDA approval of Sovaldi (sofosbuvir), initiating the DAA era for HCV.

- 2014: FDA approval of Harvoni (ledipasvir/sofosbuvir), the first single-pill regimen for most HCV patients.

- 2016: FDA approval of Epclusa (sofosbuvir/velpatasvir), the first pangenotypic HCV treatment.

- 2024: Continues to advance its Hepatitis B (HBV) and Hepatitis D (HDV) pipeline programs.

Business Overview:

- Mission: To create a healthier world by advancing and applying science globally.

- Focus Areas: Antivirals (HIV, Viral Hepatitis), Oncology, Inflammatory/Fibrotic Diseases.

- 2024 Revenue: Remains one of the top biopharma companies globally, with significant revenue from its Virology and Oncology segments.

Business Segments/Divisions:

- Virology: Focuses on HIV, Hepatitis B, C, and D.

- Oncology: Developing treatments for various cancers, including liver cancer (Hepatocellular Carcinoma - HCC).

- Cell Therapy: Focused on CAR T-cell therapies (through Kite Pharma subsidiary).

Geographic Presence:

- Global operations, with products sold in over 100 countries.

- Major revenue sources in the United States and Europe.

Key Offerings:

- Hepatitis C (HCV): Epclusa, Harvoni, Vosevi, Sovaldi.

- Hepatitis B (HBV): Vemlidy, Viread.

- Hepatitis D (HDV): Hepcludex (bulevirtide) in certain regions (acquired through the acquisition of MYR Pharmaceuticals).

- Oncology: Expanding portfolio, including treatments relevant to liver cancer.

End-Use Industries Served:

- Hospitals and Clinics

- Retail and Specialty Pharmacies

- Government Programs (e.g., in HIV/HCV elimination efforts)

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions:

- 2020-2024: Focus on strengthening the oncology pipeline (e.g., Immunomedics acquisition).

- 2020: Acquisition of MYR Pharmaceuticals to secure Hepcludex (bulevirtide) for HDV.

- Partnerships & Collaborations:

- Ongoing collaborations for research into HBV functional cure and MASH/NASH treatments.

- Partnerships for global access programs for HIV and viral hepatitis drugs in developing countries.

- Product Launches/Innovations:

- Continuous development of next-generation antivirals and long-acting treatments.

- Advancing pipeline candidates for MASH/NASH.

Capacity Expansions/Investments:

Significant R&D investment of over $5 billion in 2024 (estimated) across its therapeutic areas.

Regulatory Approvals:

- Seeking broader indications and new formulations for existing core products.

- Advancing its oncology pipeline with new regulatory filings.

Distribution channel strategy:

- Leveraging specialty pharmacies and hospital distribution networks due to the high-cost, specialized nature of its therapies (especially HCV and oncology).

- Strong focus on patient access programs to mitigate cost barriers.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Strong patent portfolio in antivirals, particularly in nucleotide/nucleoside analogs (e.g., tenofovir, sofosbuvir derivatives).

- Research & Development Infrastructure: Global R&D centers dedicated to small molecule and biologic drug discovery, virology, and translational medicine.

Innovation Focus Areas:

- Functional cure for Chronic Hepatitis B (HBV).

- Novel therapies for MASH/NASH and advanced liver fibrosis.

- Expanding the oncology portfolio into solid tumors, including HCC.

Competitive Positioning:

- Strengths & Differentiators:

- Market Leadership in HCV: Unparalleled history and high-efficacy treatments in hepatitis C.

- Deep Virology Expertise: Strong foundation in complex antiviral drug development (HIV, HBV, HDV).

- Robust Financials: High cash flow supporting extensive R&D and strategic M&A.

- Market presence & ecosystem role:

- Dominant player in the global infectious disease market.

- Key role in global public health initiatives for viral hepatitis and HIV eradication.

SWOT Analysis:

- Strengths: Dominant position in HCV; strong HIV/Antiviral franchise; deep R&D capabilities.

- Weaknesses: Declining HCV revenue post-peak due to high cure rates and market maturity; patent expiry challenges for some core assets.

- Opportunities: MASH/NASH pipeline development; HBV functional cure; Oncology expansion (including HCC).

- Threats: Increased competition in MASH/NASH; pricing pressure on mature products; successful generic entry for some antivirals.

Recent News and Updates (2024-2025):

- Press Releases:

-

- Mid-2025: Announced positive Phase 2 data for a key MASH/NASH pipeline asset, demonstrating significant anti-fibrotic activity.

- Early 2024: Reported significant progress in its clinical trial programs for functional cure of chronic Hepatitis B (HBV).

- Industry Recognitions/Awards: Consistently recognized for its global health contribution in infectious diseases.

AbbVie Inc.

Company Overview:

- A global, research-based biopharmaceutical company committed to developing innovative advanced therapies.

- Major therapeutic areas include immunology, oncology, neuroscience, eye care, and virology (historically strong in Hepatitis C).

- Its HCV treatment, Mavyret, remains a key pan-genotypic option in the market.

Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: North Chicago, Illinois, United States

- Year Founded: 2013 (Spun off from Abbott Laboratories)

- Ownership Type: Public (NYSE: ABBV)

History and Background:

- Formed as the research-based pharmaceutical company when Abbott Laboratories split into two publicly traded companies in 2013.

- Inherited a strong R&D foundation and focused on building a specialized portfolio.

- Became a major force in the HCV market with the development and launch of Viekira Pak and later the highly effective, pan-genotypic regimen, Mavyret.

Key Milestones/Timeline:

- 2013: Spin-off from Abbott Laboratories.

- 2014: FDA approval of Viekira Pak for HCV.

- 2017: FDA approval of Mavyret (glecaprevir/pibrentasvir), a pan-genotypic, 8-week treatment for most HCV patients.

- 2024-2025: Strategic focus on growing Immunology and Oncology, while maintaining a strong virology presence.

Business Overview:

- Mission: To discover and deliver innovative medicines that solve serious health issues today and address the medical challenges of tomorrow.

- Focus Areas: Immunology, Oncology, Neuroscience, Aesthetics (Allergan Aesthetics), and Virology.

- 2024 Revenue: Reported total annual revenue of approximately $56.33 billion (2024 estimate/report).

Business Segments/Divisions:

- Immunology: (e.g., Humira, Skyrizi, Rinvoq).

- Oncology: (e.g., Imbruvica, Venclexta).

- Neuroscience.

- Allergan Aesthetics.

- Virology: Includes the HCV franchise.

Geographic Presence:

- Operates in over 175 countries worldwide.

- Significant sales and R&D activities across North America, Europe, and Asia.

Key Offerings:

- Hepatitis C (HCV): Mavyret (glecaprevir/pibrentasvir) - a leading short-course, pan-genotypic treatment.

- Infectious Diseases: EMBLAVEO (aztreonam and avibactam) for complicated intra-abdominal infections (February 2025 US approval).

- Oncology: Products used in blood cancers, which can be relevant for patients with liver disease complications.

End-Use Industries Served:

- Hospitals and Specialty Clinics

- Ambulatory Surgical Centers

- Specialty and Retail Pharmacies

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

2024: Acquisition of Landos Biopharma (March 2024) and Cerevel Therapeutics (August 2024) to expand the pipeline in immunology and neuroscience, respectively.

Partnerships & Collaborations:

- Active partnerships for global access to its HCV medicines.

- Collaborations in early-stage research in oncology and immunology, including with Tentarix Biotherapeutics (February 2024).

Product Launches/Innovations:

- Continued focus on immunology and oncology pipeline candidates.

- EMBLAVEO approval (Feb 2025) for cIAI, reflecting its infectious disease strength.

Capacity Expansions/Investments:

- R&D investment of $10.8 billion in 2024.

- Strategic investments in manufacturing and supply chain to support blockbuster products.

Regulatory Approvals:

- February 2025: U.S. FDA approval of EMBLAVEO for complicated intra-abdominal infections (cIAI).

- Advancing late-stage pipeline programs, particularly in immunology and oncology.

Distribution channel strategy:

Utilizes a mix of specialized distribution channels for its HCV and oncology products, ensuring precise patient reach and adherence support.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Strong intellectual property surrounding its DAA combinations (Mavyret) and various biologic therapies (e.g., anti-IL-23, JAK inhibitors).

- Research & Development Infrastructure: Focused R&D in small molecules, biologics, and immunology, with a pipeline of nearly 90 compounds/indications.

Innovation Focus Areas:

- Next-generation immunology and oncology therapies.

- Early-stage development in MASH/MASLD, including a dual agonist of GLP-1 and glucagon receptors.

- Virology pipeline maintenance and exploration of new infectious disease areas.

Competitive Positioning:

- Strengths & Differentiators:

- HCV Cure Rate: Mavyret provides a leading, highly effective, short-duration (8-week) treatment option.

- Diversified Portfolio: Strong foundation outside of virology (Immunology and Oncology) provides revenue stability.

- R&D Investment: Substantial annual R&D spend fuels a robust pipeline.

- Market presence & ecosystem role:

- A top-tier global biopharmaceutical company with a major presence in chronic disease management.

- Critical competitor in the viral hepatitis segment, driving access and affordability.

SWOT Analysis:

- Strengths: Strong cash flow; high-efficacy, short-course HCV treatment (Mavyret); diversified, growing portfolio (Immunology, Oncology).

- Weaknesses: High reliance on core immunology product (Humira biosimilar erosion challenge); less focused on emerging HBV/HDV cure segments compared to Gilead.

- Opportunities: Success in MASH/MASLD pipeline; oncology expansion; leveraging acquired assets (e.g., Cerevel, Landos).

- Threats: Intense competition in HCV from Gilead; biosimilar market entry impacting legacy products; clinical trial attrition in new focus areas.

Recent News and Updates (2024-2025):

- Press Releases:

- February 2025: Announced FDA approval of EMBLAVEO for complicated intra-abdominal infections.

- July 2025: Submitted for U.S. FDA Approval of Combination Treatment of VENCLEXTA and Acalabrutinib for Previously Untreated CLL.

- Industry Recognitions/Awards: Named a top workplace for various metrics, including diversity and inclusion, in 2024.

Liver Disease Therapeutics Market Value Chain Analysis

R&D

The standard, stringent drug development pipeline, which usually takes more than ten years and consists of five primary stages regulated by organizations like the FDA, is followed in the research and development (R&D) steps for liver disease therapeutics.

- Key Players include Gilead Sciences, AbbVie, Novo Nordisk, AstraZeneca, Pfizer, and Roche.

Clinical Trials and Regulatory Approvals

Preclinical studies and an IND application are necessary for the development of a treatment for liver disease. Phases 1 (safety), 2 (efficacy/side effects), and 3 (large-scale confirmation) are the stages of clinical trials. A New Drug Application (NDA) and regulatory review (FDA Drug Review) follow from this. Phase 4 measures long-term safety after the product is put on the market.

- Key players include Gilead Sciences, AbbVie, Novo Nordisk, AstraZeneca, Pfizer, and Roche.

Patient Support and Services

Liver disease patient support and services include medical, financial, and emotional resources offered by government agencies, non-profits, and healthcare systems to assist in managing the illness and navigating available treatments.

-

- Key players include Gilead Sciences, AbbVie, Novo Nordisk, AstraZeneca, Pfizer, and Roche.

Recent Developments in the Liver Disease Therapeutics Market

- In July 2025, to prevent, test for, treat, and cure Hepatitis C (HCV) in people with substance use disorder (SUD) and/or serious mental illness (SMI), the U.S. Department of Health and Human Services (HHS) announced a $100 million pilot funding opportunity.

- In June 2025, to further the development of AHB-137, a treatment for chronic hepatitis B, AusperBio raised $50 million. According to the company, the money will be used to invest in its expanding pipeline, expand manufacturing partnerships, and initiate Phase 2 clinical trials outside mainland China.

- In May 2025, a S$9 million investment round closed to support HistoIndex's next phase of growth. The company is well-known for its innovative biophotonic Second Harmonic Generation (SHG) technology and is a trailblazing leader in Artificial Intelligence (AI) digital pathology for the treatment of fibrotic diseases.

- In April 2025, Ideaspring Capital is leading a $1.25 million Pre-Series A funding round for Chennai-based molecular diagnostics startup Tvaster Genkalp. Episcreen™ Liver, a ground-breaking methylation-based liquid biopsy test intended for the early detection of liver cancer, will be commercialized and expanded throughout India with the help of the recently raised funds.

Collaborate with our experts to explore the Liver Disease Therapeutics Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking