Explore the Top Companies in the Medical Drone Delivery Services Market

- Zipline

- Matternet

- Wingcopter

- Swoop Aero

- Amazon Prime Air

- UPS Flight Forward

- Flytrex

- Drone Delivery Canada Corp.

- Airbus SE

- DHL Group

- EHang Holdings Limited

- Skyports

- Vayu Inc. (Vayu Drones)

- Elroy Air

- Manna Drone Delivery

- Draganfly Inc.

- Avy

- Skye Air Mobility

- TechEagle

- Volocopter GmbH

What are Medical Drone Delivery Services?

The global medical drone delivery services market covers services that use unmanned aerial vehicles (drones) to deliver medical supplies, including blood, vaccines, pharmaceuticals, lab samples, organs, and emergency kits, to hospitals, clinics, remote health posts, and other healthcare facilities. These services include route planning, drone operations (including beyond-visual-line-of-sight (BVLOS) flights), payload handling, cold-chain logistics, regulatory & air-traffic integration, landing/dispatch infrastructure, and fleet management.

Growth is driven by the need for faster delivery in remote/underequipped regions, regulatory advances allowing drone medicine delivery, pandemic-accelerated interest in contactless healthcare logistics, and increasing partnerships between drone firms and health systems.

Market Growth

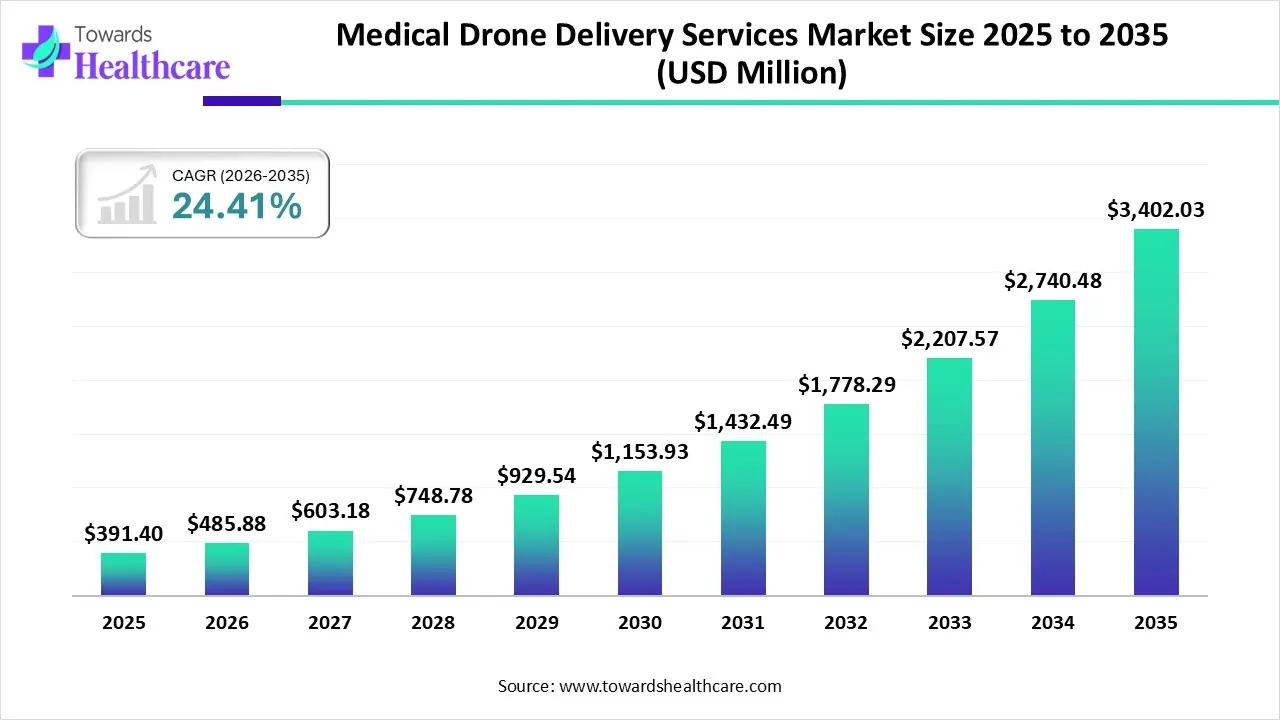

The global medical drone delivery services market size is calculated at US$ 391.4 million in 2025, grew to US$ 485.88 million in 2026, and is projected to reach around US$ 3402.03 Million by 2035. The market is expanding at a CAGR of 24.41% between 2026 and 2035.

Market Outlook

- Industry Growth Overview: The medical drone delivery services market is expected to expand dramatically due to the need for quick and effective logistics, particularly in rural areas. Better batteries and artificial intelligence (AI) navigation are two important technological developments, and expanded operations are made possible by more regulatory support.

- Sustainability Trends: Sustainability trends emphasize green logistics, which lowers carbon emissions by using electric cars and drones that run on solar or hydrogen power. By avoiding traffic and lessening the environmental effect of conventional transportation methods, the use of drones for medical supplies is naturally efficient.

- Startup Ecosystem: With startups like Zipline, Matternet, and Wingcopter spearheading innovation and obtaining substantial funding to expand operations, the medical drone delivery services market has a thriving startup ecosystem. A significant trend supporting a strong, growing industry landscape is the formation of strategic alliances among governments, large businesses (such as Walmart and UPS), and startups.

Company Landscape

1. Zipline International Inc.

Company Overview:

Company Overview: Zipline is a robotics company that designs, manufactures, and operates a comprehensive instant logistics system using autonomous electric fixed-wing and hybrid aerial vehicles (drones) and associated ground infrastructure. Its mission is to provide universal access to urgent and routine necessities, starting with medical supplies.

Corporate Information

- Headquarters: South San Francisco, California, U.S.

- Year Founded: 2014 (Pivoted from Romotive, founded 2011)

- Ownership Type: Privately held (Venture-backed, latest Series F funding in April 2023)

History and Background

History and Background: Founded by Keller Rinaudo Cliffton, Keenan Wyrobek, and William Hetzler, the company pivoted from robotics toys (Romo) in 2014 to focus on drone delivery for medical supplies. Launched its first commercial operations in Rwanda in 2016 to deliver blood and critical medical products to remote hospitals.

Key Milestones/Timeline

- 2016: Launched first commercial drone delivery operations for blood in Rwanda.

- 2019: Expanded to Ghana, serving 2,500 health facilities; became a 'unicorn' with a $1.2 billion valuation.

- 2021: Began commercial operations in the U.S. and announced partnerships to expand into non-medical sectors like retail (Walmart).

- 2023: Announced and began deploying Platform 2 (P2), designed for precise, quiet home delivery; raised $330 million in Series F funding at a $4.2 billion valuation.

- 2024: Continued expansion of P2 services across the U.S. with new partnerships in healthcare and retail.

Business Overview

- Business Segments/Divisions: Instant Logistics System/Delivery-as-a-Service, covering both long-range enterprise/government deliveries and precise last-mile home deliveries.

- Geographic Presence: Active commercial service in the United States, Rwanda, Ghana, Nigeria, Côte d'Ivoire, Kenya, and Japan.

- Key Offerings: On-demand delivery of blood products (whole blood, plasma), vaccines (including COVID-19 and ultra-low temperature cold chain), pharmaceuticals, medical kits, and non-medical items (retail, food, e-commerce, and animal health products).

- End-Use Industries Served: Healthcare/Hospitals, Government Bodies (Health Ministries), NGOs, Pharmaceutical Companies, Retail (Walmart), Restaurants (Sweetgreen, Panera), and E-commerce.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions: No recent major acquisitions found (Focus is on organic growth and strategic partnerships).

- Partnerships & Collaborations:

- 2024/2025: Expanded P2 partnerships with major U.S. health systems (e.g., Cleveland Clinic) and retailers/restaurants for instant home delivery.

- Continues long-term partnerships with the Government of Rwanda and Ghana to operate national medical logistics networks.

- Product Launches/Innovations:

- Platform 2 (P2): Launched in 2023, featuring a quieter, smaller, hybrid aircraft and a "Droid" system for precision, ground-level package lowering (delivery within a 6-foot radius). Designed for urban and suburban last-mile delivery.

- Capacity Expansions/Investments: Raised $330 million in Series F funding in April 2023. Continuously expanding distribution centers and fleet size globally (makes a delivery every ~60 seconds globally as of 2024).

- Regulatory Approvals: Has secured key waivers and certifications (e.g., FAA authorization in the U.S.) to operate beyond visual line of sight (BVLOS) for commercial delivery in multiple countries.

Distribution Channel Strategy

- Distribution channel strategy: Direct to Consumer/Last-Mile Delivery (via P2 for retail/home), and Business-to-Government/Enterprise (via P1 for medical/large-scale logistics systems operated under service contracts with governments and major health systems).

Technological Capabilities/R&D Focus

- Core Technologies/Patents: Proprietary autonomous, fixed-wing aircraft (Platform 1, for long-range) and hybrid vertical take-off and landing (VTOL) system (Platform 2, for precise delivery); full-stack instant logistics system, including cold chain storage and airspace management/deconfliction tools.

- Research & Development Infrastructure: Dedicated R&D in aircraft design, battery technology, computer vision, and autonomous flight safety protocols.

- Innovation Focus Areas: Autonomous flight safety, noise reduction, precision delivery mechanisms (Droid on P2), and expanding payload capacity/delivery range.

Competitive Positioning

- Strengths & Differentiators:

- Operational Scale: The world's largest commercial autonomous delivery system (over 1.8 million commercial deliveries made as of 2024).

- Proven Reliability: Established track record serving national healthcare systems (Rwanda/Ghana) in challenging environments.

- Dual Platform: Offers two distinct, optimized systems (P1 for long-range, P2 for precise last-mile).

- Market presence & ecosystem role: A dominant market leader and pioneer, often setting the global standard for long-range medical drone logistics, with a growing presence in the U.S. last-mile sector.

- SWOT Analysis:

- Strengths: Global operational footprint, proven system reliability, strong government/health system partnerships, substantial recent funding ($330M in 2023).

- Weaknesses: High initial infrastructure cost (distribution centers), regulatory complexity in new markets.

- Opportunities: Rapid expansion of P2 last-mile delivery in the U.S. and Europe, diversifying into new sectors (food, e-commerce).

- Threats: Increased competition from Matternet, Wing, and Amazon; evolving/unpredictable aviation regulations.

Recent News and Updates

- Press Releases: Ongoing announcements in 2024 for the expansion of Platform 2 services with new partners (e.g., new hospital systems and restaurants) across the U.S.

- Industry Recognitions/Awards: Named to CNBC's Disruptor 50 list multiple times (including 2023).

2. Matternet Inc.

Company Overview:

Company Overview: Matternet is a leading developer of the world's first urban drone logistics platform, primarily focusing on enabling healthcare systems and partners to operate reliable, on-demand drone networks within cities and between medical facilities.

Corporate Information

- Headquarters: Mountain View, California, U.S.

- Year Founded: 2011

- Ownership Type: Privately held (Venture-backed)

History and Background

History and Background: Founded by Andreas Raptopoulos, Matternet has been a long-time pioneer in the drone delivery space, focusing heavily on urban environments and the healthcare supply chain. It was one of the first companies to receive commercial regulatory approval for urban drone delivery operations in Switzerland and the U.S.

Key Milestones/Timeline

- 2011: Founded.

- 2017: Launched the world’s first city-to-city drone delivery network over Lugano, Switzerland.

- 2019: Achieved the first-ever FAA Type Certification for a non-military unmanned aircraft system (UAS), the M2 drone. Began commercial medical delivery operations in the U.S. with UPS Flight Forward and WakeMed.

- 2020: Supported the COVID-19 response with delivery flights in Switzerland and the U.S.

- 2023: Continued to expand drone networks with hospital systems, leveraging the M2 drone for on-campus and between-facility transport.

Business Overview

- Business Segments/Divisions: End-to-end Drone Logistics Platform (hardware, software, and services) for urban and suburban environments.

- Geographic Presence: Primarily focused on the United States (with multiple major hospital networks), Switzerland, and Germany.

- Key Offerings: Matternet M2 drone system, Matternet Software Platform (M2 Cloud Platform), and Ground Infrastructure (Stations/Landing Pads and automated workflow). Offers delivery of laboratory samples, blood, pharmaceuticals, and pathology specimens.

- End-Use Industries Served: Healthcare Systems/Hospitals (on-campus and inter-facility transport), Diagnostic Laboratories, and Pharmaceutical Supply Chains.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions: No recent major acquisitions found.

- Partnerships & Collaborations:

- 2024/2025: Continuing and expanding partnerships with U.S. hospital networks and logistic providers (e.g., UPS Flight Forward) for permanent drone delivery networks.

- Working with regulatory bodies globally to standardize drone delivery operations.

- Product Launches/Innovations: Continuous refinement of the Matternet M2 drone and cloud platform for enhanced safety, autonomy, and payload capacity. Focus on integrating drone operations seamlessly into existing hospital logistics software.

- Capacity Expansions/Investments: Ongoing deployment of Matternet Station infrastructure at new U.S. hospital locations.

- Regulatory Approvals: Holds a crucial FAA Type Certificate for its M2 drone (since 2019), allowing for broad commercial operations in the U.S. airspace under specific regulations.

Distribution Channel Strategy

- Distribution channel strategy: Business-to-Business (B2B) Service Provider. Sells or operates its technology platform directly to healthcare systems and logistics partners who integrate it into their supply chain.

Technological Capabilities/R&D Focus

- Core Technologies/Patents: Matternet M2 quadcopter drone (VTOL) and proprietary cloud-based logistics and air traffic management software (Matternet Cloud Platform). Focus on autonomous precision landing and payload exchange at dedicated Matternet Stations.

- Research & Development Infrastructure: R&D focused on advanced air traffic management, autonomous flight systems, and compliance with the most stringent aviation safety standards globally.

- Innovation Focus Areas: Developing highly reliable and safe drone systems for high-density, urban medical logistics; achieving further regulatory milestones (e.g., Expanded BVLOS approvals).

Competitive Positioning

- Strengths & Differentiators:

- Regulatory Leadership: First company to receive FAA Type Certification for a delivery drone (M2).

- Urban Focus: Specializes in short-haul, high-frequency, on-demand transport within densely populated urban and hospital campus settings.

- High Integration: Deeply integrated into U.S. and European healthcare logistics systems.

- Market presence & ecosystem role: A key enabler of drone logistics for major U.S. and European health networks, often the first to achieve necessary certifications for complex urban airspace operations.

- SWOT Analysis:

- Strengths: Strong regulatory advantage (Type Certificate), deep partnerships with major healthcare providers, technology optimized for urban environments.

- Weaknesses: Smaller operational scale in total deliveries compared to Zipline, focus is less on long-range delivery.

- Opportunities: Leveraging Type Certification to scale rapidly across the U.S. healthcare market, expanding inter-facility delivery networks.

- Threats: Competition from Wingcopter and other VTOL providers; challenges of scaling complex urban air traffic management.

Recent News and Updates

- Press Releases: Frequent announcements in 2024 regarding the launch of new drone networks at U.S. healthcare facilities, often replacing courier services for lab samples.

- Industry Recognitions/Awards: Recognized for its regulatory achievements and pioneering work in urban air mobility and healthcare logistics.

Recent Developments in the Market

- In October 2025, Narayana Health chose to use Airbound, an autonomous logistics company that specializes in blended-wing-body aircraft, for drive delivery of medications. The latter was granted a pilot partnership with Narayana Health and seed funding totaling $8.65 million.

- In February 2025. Apollo Hospitals and TechEagle have introduced a new diagnostic drone delivery service. The goal of the service is to expedite and improve the efficiency of medical sample transportation from collection centers to diagnostic labs.

- In February 2025, in Vadodara, a 35-kilometer free drone blood delivery service was introduced. Drones have already assisted eight patients in remote areas since the initiative was started by Indu Blood Bank and Polycab India.

Collaborate with our experts to explore the Medical Drone Delivery Services Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking