Learn How Small Molecule API Market Companies are Reshaping Pharmaceuticals Industry

- Lonza Group

- Catalent Inc.

- Cambrex Corporation

- Bachem

- Siegfried Group

- Divi’s Laboratories

- Aurobindo Pharma

- Dr. Reddy’s Laboratories

- Sun Pharmaceutical Industries

- Granules India

- Jubilant LifeSciences

- Teva Pharmaceuticals

- Pfizer

- Merck KGaA

- Novartis

- Sandoz

- WuXi AppTec

- Piramal Pharma Solutions

- Hikal Ltd.

- Famar

- Fareva

- EuroAPI

- Lupin

- Glenmark

- Cipla

What are Small Molecule APIs?

The small molecule API market comprises production, trade, and supply of low-molecular-weight chemical compounds that are the active ingredients in most conventional pharmaceuticals. It includes innovator APIs (patent-protected) and generic/merchant APIs (off-patent), produced in dedicated API manufacturing facilities or by CDMOs. The market covers synthetic chemistry, process R&D, scale-up, regulatory compliance (cGMP), and specialty services such as controlled-substance handling, high-potency APIs (HPAPIs), and sterile small-molecule injectables. Global demand is driven by rising chronic disease burden, outsourcing to CDMOs, reshoring investments, and growth in novel small-molecule therapeutic launches.

Market Growth

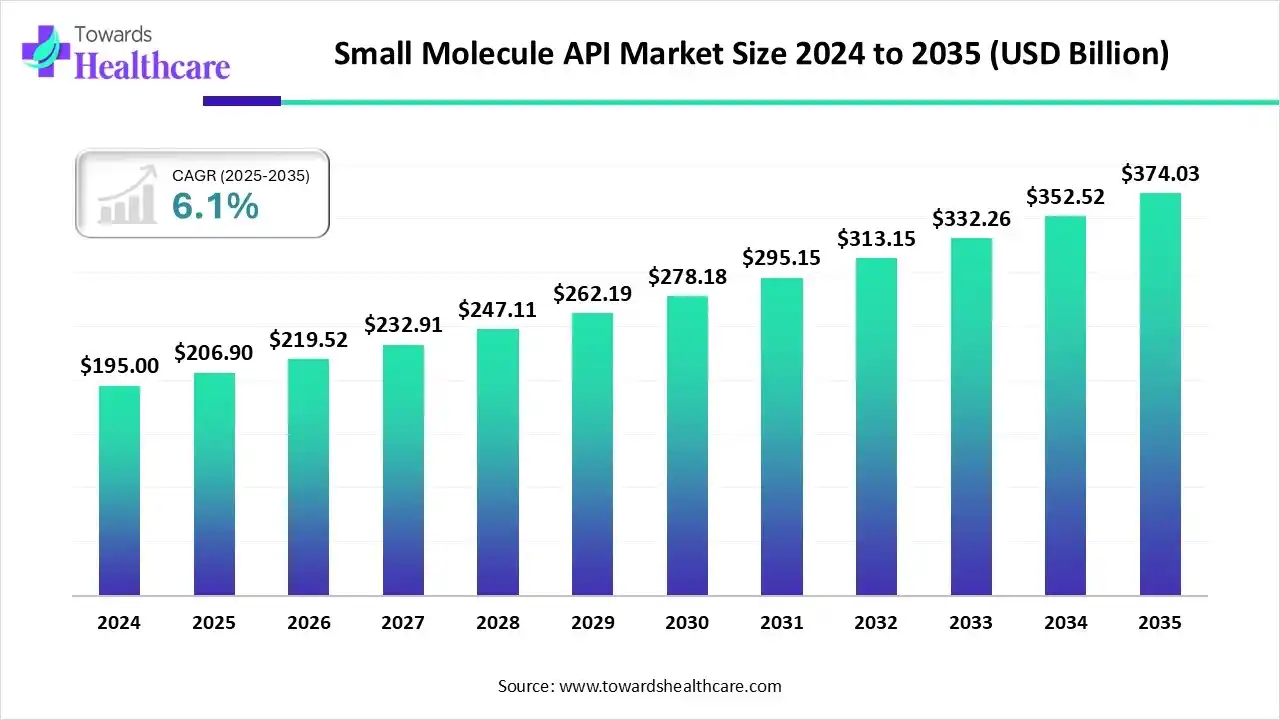

The global small molecule API market size is calculated at US$ 206.9 billion in 2025, grew to US$ 219.52 billion in 2026, and is projected to reach around US$ 374.03 billion by 2035. The market is expanding at a CAGR of 6.1% between 2026 and 2035.

Small Molecule API Market Outlook

- Industry Growth Overview: The market is steadily growing due to rising rates of chronic illnesses and the need for generic medications.

- Major Investors: Large pharmaceutical companies like Pfizer, Merck, and Novartis, as well as contract manufacturers like Lonza and Cambrex, have made significant investments in the market. These expenditures are concentrated on advanced manufacturing technologies and capacity expansion.

- Startup Ecosystem: The small molecule API market's startup ecosystem is vibrant, with new businesses concentrating on innovation, especially in green chemistry and AI-driven drug discovery. Strategic partnerships with large corporations help these smaller firms scale up.

Company Landscape

Merck KGaA (Life Science Business/MilliporeSigma)

Corporate Information:

- Headquarters: Darmstadt, Germany (Merck KGaA); Burlington, Massachusetts, U.S. (MilliporeSigma, the Life Science business)

- Year Founded: 1668 (Merck KGaA)

- Ownership Type: Publicly Traded (Frankfurt Stock Exchange), with the Merck family holding a majority stake (approx. 70%) through E. Merck KG.

History and Background:

- The oldest chemical and pharmaceutical company in the world.

- Its U.S. and Canadian pharmaceutical business (Merck & Co., Inc.) was seized during WWI and is a separate entity.

- The Life Science business, which includes API supply and custom manufacturing, was significantly boosted by the acquisition of Millipore in 2010 and Sigma-Aldrich in 2015, forming MilliporeSigma (known as Merck Life Science outside the U.S. and Canada).

Key Milestones/Timeline:

- 1668: Founding of Merck.

- 2010: Acquisition of Millipore Corporation, significantly expanding its bioprocessing and lab materials portfolio.

- 2015: Acquisition of Sigma-Aldrich for $17 billion, creating a global leader in the life science industry (MilliporeSigma).

- 2024-2025: Continued strategic focus on capacity expansion, particularly in its Life Science services, including small molecule API and Highly Potent API (HPAPI) manufacturing.

Business Overview

Business Segments/Divisions:

-

- Life Science: The primary segment for small molecule API, which includes Process Solutions (bioprocessing and API manufacturing services, including CDMO) and Science & Lab Solutions (lab consumables and chemicals).

- Healthcare: Focuses on specialty pharmaceuticals (e.g., Oncology, Neurology).

- Electronics: Focuses on specialty materials for high-tech industries.

Geographic Presence:

Global presence with major manufacturing and R&D sites across North America, Europe (Germany, Switzerland, UK), and Asia-Pacific (China, India, Japan).

Key Offerings:

- Custom/Contract API Manufacturing (CDMO): Process development, optimization, and large-scale cGMP manufacturing of customer's proprietary small molecule APIs, including complex and HPAPIs.

- Catalog APIs/Chemicals: A vast catalog of raw materials, solvents, and non-GMP/GMP intermediates for drug synthesis (under brands like EMPROVE®).

- High Potency API (HPAPI) Services: Specialized containment facilities and expertise for manufacturing oncology and other highly potent APIs.

End-Use Industries Served:

- Pharmaceutical and Biotechnology Companies (Innovator and Generics).

- Contract Development and Manufacturing Organizations (CDMOs).

- Academic and Government Research Institutions.

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions:

The company's current structure is largely due to the 2015 acquisition of Sigma-Aldrich, which is foundational to the current Life Science portfolio.

- Partnerships & Collaborations:

Focus on long-term CDMO partnerships with pharmaceutical clients, leveraging its end-to-end capabilities from clinical to commercial scale.

- Capacity Expansions/Investments:

Continued high investment in the Life Science sector. Example: Ongoing investments (over $300 million announced in recent years) to expand HPAPI and small molecule manufacturing capacity in Europe and North America to meet growing global demand.

- Regulatory Approvals:

- Maintains numerous global certifications (FDA, EMA, etc.) across its cGMP manufacturing facilities for API production.

- Technological Capabilities/R&D Focus

- Core Technologies/Patents:

- Advanced continuous manufacturing and flow chemistry techniques for API synthesis to enhance efficiency and safety.

- Specialized purification and isolation technologies.

Research & Development Infrastructure:

Extensive R&D facilities focused on process chemistry, analytical development, and formulation sciences within the Life Science business.

- Innovation Focus Areas:

- Sustainability in chemical manufacturing (Green Chemistry).

- Advanced synthesis (e.g., biocatalysis, photocatalysis) for complex small molecules.

- Digitalization and automation of API production processes.

- Competitive Positioning

Strengths & Differentiators:

- Scale and Scope: Offers a highly integrated portfolio from lab research materials to commercial API manufacturing.

- Quality and Reliability: Reputation for high regulatory standards (EMPROVE® program) and secure supply chain.

- HPAPI Expertise: A leader in the complex and fast-growing High Potency API manufacturing space.

Market Presence & Ecosystem Role:

Dominant supplier in the research chemicals and lab materials sector, providing a direct pipeline into CDMO services. One of the top global CDMOs for small molecule and biopharma services.

SWOT Analysis (Life Science Segment):

- Strengths: Global manufacturing footprint, comprehensive product portfolio, strong brand reputation (MilliporeSigma/Merck).

- Weaknesses: High reliance on industrial and academic R&D spending, which can be cyclical.

- Opportunities: Growth in HPAPI/oncology drugs, increasing outsourcing trend, expansion of continuous manufacturing.

- Threats: Intense competition from Asian generic API manufacturers, regulatory complexity.

Recent News and Updates

- Press Releases (H2 2024 - H2 2025):

- Focus on financial performance updates, showing resilience and organic growth in the Life Science sector, particularly in Process Solutions (API/CDMO).

- Announcements regarding accelerated capacity projects for both small molecule and biologics production across various global sites.

Industry Recognitions/Awards:

Frequently recognized for supply chain excellence, quality, and sustainability initiatives in the pharmaceutical manufacturing sector.

Pfizer Inc. (Pfizer CentreOne)

Corporate Information:

- Headquarters: New York, New York, U.S.

- Year Founded: 1849

- Ownership Type: Publicly Traded (NYSE: PFE)

History and Background:

- One of the largest pharmaceutical companies globally, with a long history of both small molecule and vaccine/biologics innovation.

- Small molecule API production initially supported its internal portfolio. Pfizer CentreOne was established as a dedicated Contract Development and Manufacturing Organization (CDMO) embedded within Pfizer, leveraging internal manufacturing capacity and expertise to serve external customers.

Key Milestones/Timeline:

- 1849: Founding of Pfizer.

- Mid-20th Century: Became a major producer of small molecule active ingredients (e.g., citric acid, penicillin, tetracycline).

- 2015: Re-branding and centralization of its CDMO services under the Pfizer CentreOne name, formalizing its offering of APIs and finished dosage forms to external partners.

- 2024-2025: Continued development of new small molecule drug candidates in its pipeline (e.g., in oncology and internal medicine).

Business Overview

- Business Segments/Divisions:

- Biopharma: The primary segment encompassing all commercial and pipeline medicines and vaccines. Small molecule API production is critical for a large portion of this portfolio.

- Pfizer CentreOne: This is the dedicated CDMO arm that manufactures and supplies small molecule APIs, including specialty compounds like corticosteroids, hormonal steroids, prostaglandins, and select antibiotics, to other pharmaceutical companies, alongside its internal supply.

Geographic Presence:

Extensive global manufacturing network, including major API facilities in the U.S., Europe (e.g., Ireland, Italy), and Asia.

Key Offerings:

- Internal API Supply: Manufacturing APIs for its blockbuster and pipeline small molecule drugs (e.g., Ibrance, Xeljanz).

- Pfizer CentreOne APIs & Intermediates: Specialized small molecule APIs and custom synthesis, focusing on complex, high-value molecules that leverage Pfizer's proprietary containment and fermentation capabilities.

- Sterile Injectables: While primarily a small molecule focus, its CDMO arm also offers sterile injectable finished dosage forms.

End-Use Industries Served:

- Internal Pfizer Biopharma needs.

- External Pharmaceutical and Biotechnology Companies seeking high-quality, complex, or specialty APIs and reliable supply.

Key Developments and Strategic Initiatives

Mergers & Acquisitions:

Focus in 2024/2025 is primarily on integrating major past acquisitions (e.g., Seagen) to bolster its pipeline, which drives demand for small molecule APIs, particularly HPAPIs for oncology.

Partnerships & Collaborations:

- Strategic CDMO relationships through Pfizer CentreOne, acting as an internal "contractor" to external companies who value the quality and regulatory assurance of a major pharma producer.

- R&D collaborations for new therapeutic modalities (small molecules, biologics, gene therapy).

Product Launches/Innovations:

The small molecule API business is driven by the internal launch of new small molecule drugs from Pfizer's pipeline (e.g., new oncology or internal medicine drugs) which requires large-scale API production.

Capacity Expansions/Investments:

Ongoing investments in its global manufacturing network to ensure supply chain resilience and to support its growing pipeline, especially in specialized areas like HPAPI production.

Technological Capabilities/R&D Focus

Core Technologies/Patents:

- World-class expertise in complex organic synthesis and process chemistry, particularly in the manufacturing of steroids and potent compounds.

- Large-scale fermentation capabilities for certain APIs and intermediates.

Research & Development Infrastructure:

Massive global R&D infrastructure supporting medicinal chemistry and process development for thousands of small molecule compounds in its history.

Innovation Focus Areas:

- Optimizing API manufacturing for cost-efficiency and sustainability (Green Chemistry).

- Developing new synthetic routes for challenging small molecule targets.

- Competitive Positioning

Strengths & Differentiators:

- Unmatched Quality/Regulatory Trust: Highest level of cGMP compliance expected of a major innovator pharma company.

- Specialty Focus: Leader in complex APIs (e.g., steroids, hormones) through Pfizer CentreOne.

- Reliability: Backed by a pharmaceutical giant's resources and global supply chain.

Market Presence & Ecosystem Role:

Dominant player in the finished dose market, and a significant, high-quality, and specialized supplier in the API and CDMO segment, acting as a "secure source" for specialty APIs.

SWOT Analysis (Pfizer CentreOne):

- Strengths: Superior quality standards, technical expertise in complex chemistry, reliable large-scale capacity, strong financial backing.

- Weaknesses: May be less cost-competitive for generic, simple APIs compared to specialized CDMOs or Asian suppliers; primary focus remains on internal portfolio.

- Opportunities: Leveraging excess capacity and expertise post-patent expiries for CDMO growth; High Potency API demand surge.

- Threats: Manufacturing consolidation in the CDMO space, intellectual property risks with external partnerships.

Recent News and Updates

- Press Releases (H2 2024 - H2 2025):

- Announcements related to advancements in the small molecule pipeline (e.g., oncology, inflammatory disease programs).

- Q3/Q4 2025 earnings reports showing continued investment in manufacturing and R&D for small molecule drugs and vaccines.

Industry Recognitions/Awards:

Often receives awards for its overall supply chain performance and manufacturing excellence within the pharma industry.

Small Molecule API Market Value Chain Analysis

R&D

Through improved molecular design for therapeutic efficacy, new synthesis pathways, and sophisticated chemistry, research and development propel innovation in small molecule APIs.

Key Companies: Pfizer, Novartis, AstraZeneca, Merck & Co., Johnson & Johnson, Bristol Myers Squibb, and Sanofi drive R&D innovation.

Clinical Trials and Regulatory Approvals

Before APIs are used in the manufacturing of commercial pharmaceuticals, extensive clinical testing and rigorous regulatory reviews guarantee safety, efficacy, and compliance.

Key Companies: Roche, GlaxoSmithKline, Eli Lilly, Bayer, Amgen, AbbVie, Takeda, etc

Formulation and Final Dosage Preparation

To satisfy therapeutic and commercial requirements, APIs are transformed into final dosage forms via quality control, stability optimization, and precise formulation.

Key Companies: Catalent, Lonza, Thermo Fisher Scientific, Siegfried Holding AG, Piramal Pharma Solutions, Cambrex Corporation, Recipharm AB, etc.

Recent Developments in the Small Molecule API Market

- In May 2025, to expedite the creation of small molecule APIs, Lonza introduced Design2Optimize, a model-based platform. As a CDMO, Lonza hopes to improve manufacturing readiness and process reliability while assisting drug developers in accelerating the transition from candidate selection to first-in-human trials.

- In February 2025, an improved analytical testing laboratory devoted to High Potency Active Pharmaceutical Ingredients (HPAPIs) was launched by SK Pharmteco, a global contract development and manufacturing organization (CDMO), marking the expansion of a core competency.

Partner with our experts to explore the Small Molecule API Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking