February 2026

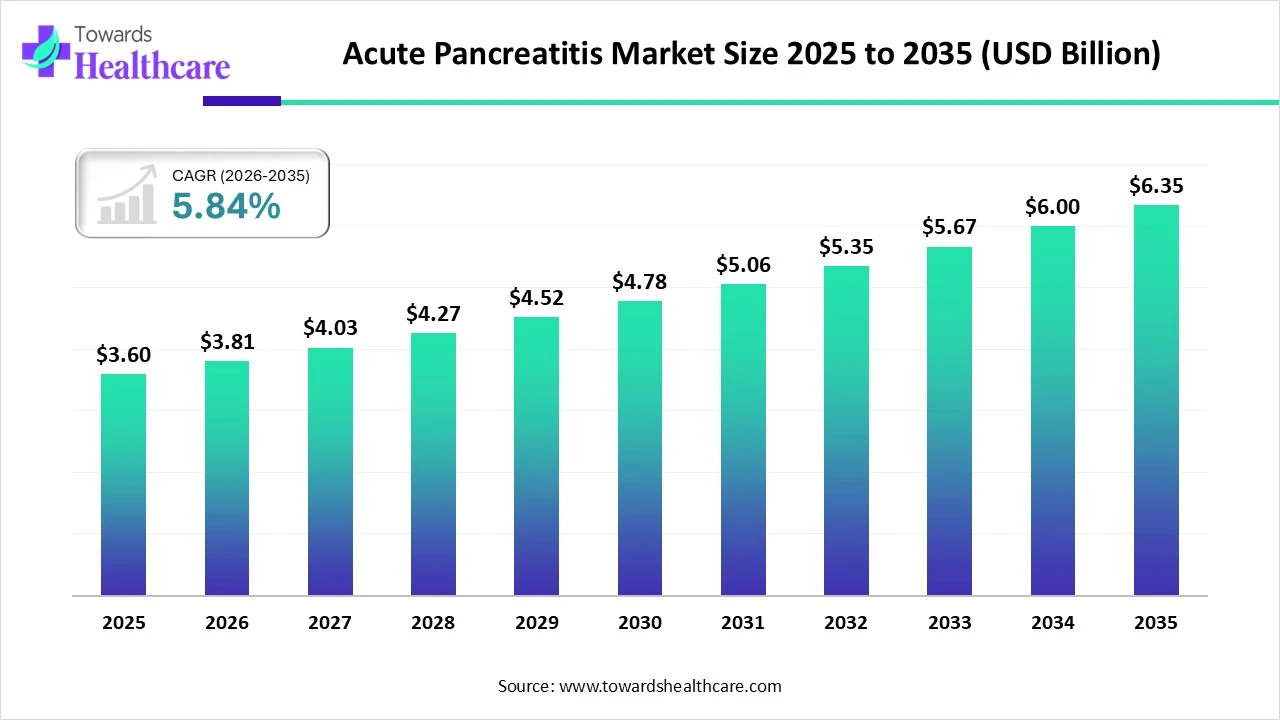

The global acute pancreatitis market size is calculated at US$ 3.6 in 2025, grew to US$ 3.81 billion in 2026, and is projected to reach around US$ 6.35 billion by 2035. The market is expanding at a CAGR of 5.84% between 2026 and 2035.

The acute pancreatitis market is fueled by continuous improvements in medical research, especially in the areas of therapeutic approaches and diagnostic imaging. Early diagnosis of the condition has improved with the advent of new diagnostic techniques like CT scans and endoscopic ultrasound.

| Key Elements | Scope |

| Market Size in 2025 | USD 3.6 billion |

| Projected Market Size in 2035 | USD 6.35 billion |

| CAGR (2026 - 2035) | 5.84% |

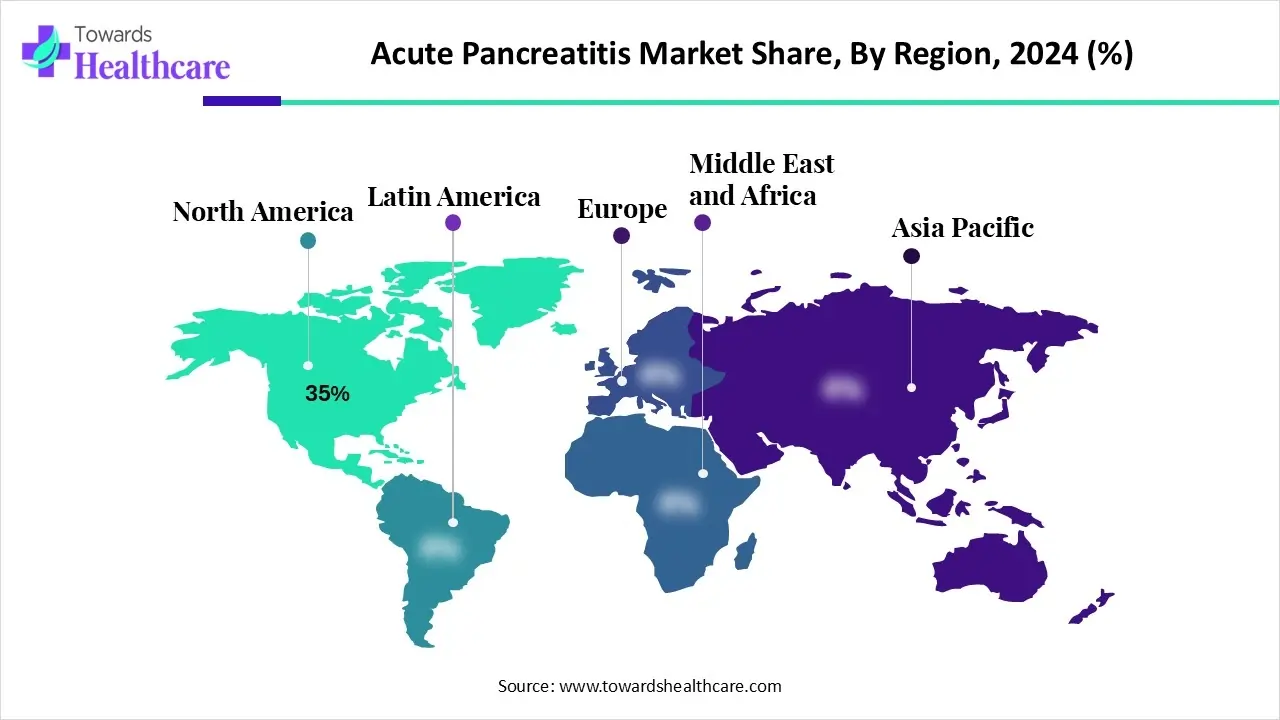

| Leading Region | North America by 35% |

| Market Segmentation | By Treatment Type, By Severity Type, By End-User, By Route of Administration (Treatments), By Distribution Channel, By Region |

| Top Key Players | Pfizer, Merck & Co., Baxter International, Abbott Laboratories, B. Braun SE, CalciMedica Inc., Dynavax Technologies, Fresenius SE & Co., GlaxoSmithKline, Olympus Corporation, SCM Lifescience, Boston Scientific Corporation, AnGes, Mitsubishi Tanabe Pharma, Medtronic, Ixaka Ltd (formerly Rexgenero), Mercator MedSystems, Hemostemix Inc., Caladrius Biosciences, Reven Pharmaceuticals |

The global acute pancreatitis market comprises diagnostics, therapeutics, supportive care solutions, hospital services, and medical technologies used in the management of acute pancreatitis. The market covers pharmaceutical treatments (analgesics, antibiotics, IV fluids, enzyme inhibitors), nutritional support, endoscopic and surgical interventions, imaging diagnostics (CT, MRI, ultrasound), monitoring tools, and hospital-based critical care services.

Growth is driven by the rising prevalence of gallstones, increasing alcohol consumption, higher incidence of hypertriglyceridemia-induced pancreatitis, improved diagnostic imaging, and demand for minimally invasive procedures (ERCP, EUS). Hospitals dominate patient management, while advancements in biologics and anti-inflammatory therapies represent emerging growth areas.

AI is drastically changing how pancreatitis is treated. By leveraging sophisticated inputs such as CT scans and biomarker panels, ML and DL models are enabling earlier and more precise diagnosis of pancreatic inflammation. AI in prognostics enables real-time, personalized risk assessment, assisting physicians in anticipating issues, directing intensive care unit triage, and customizing monitoring plans. AI-driven techniques are improving treatment personalization and speeding up drug discovery in the therapeutics field, particularly when combined with network pharmacology and TCM concepts.

Why Supportive Care Dominated the Acute Pancreatitis Market in 2024?

The supportive care segment held the largest revenue of approximately 45% of the market in 2024 because a combination of supportive care techniques, such as intravenous fluid administration, pain management, enteral feeding, and surgical or endoscopic procedures for complications like infected necrotic tissue or gallstones, is used to treat acute pancreatitis.

Endoscopic Interventions

The endoscopic interventions segment is estimated to grow at the highest rate of approximately 8-10% in the acute pancreatitis market during the forecast period because, in the current management of pancreatic fluid collections, endoscopic procedures are crucial. Endoscopic methods are used to treat local complications of pancreatitis, usually in a step-up fashion. Less invasive methods are preferred initially, and, depending on the patient's clinical response and the evolution of the collection, more invasive procedures may be used later.

Pharmacotherapy

The pharmacotherapy segment is expected to grow at a significant rate during the forecast period. The traditional treatment for acute pancreatitis involves supportive measures like fluid resuscitation, nutritional support, pain management, and antibiotics when necessary. However, pre-clinical and clinical studies have indicated promising prospects for novel pharmacologic therapy.

Which Severity Type Segment Dominated the Market in 2024?

Mild Acute Pancreatitis

The mild acute pancreatitis segment held the largest revenue of approximately 55% of the acute pancreatitis market in 2024 because about 80% of patients have mild acute pancreatitis, which is distinguished by the lack of organ failure and any systemic or local complications. Usually, patients recover quickly from this condition. People with mild pancreatitis have a 3% mortality rate, while those with pancreatic necrosis have a 20% mortality rate.

Severe Acute Pancreatitis Cases

The severe acute pancreatitis cases segment is estimated to grow at the highest rate of approximately 7% in the acute pancreatitis market during the forecast period. While the majority of cases are mild, 15% to 20% develop severe acute pancreatitis (SAP), which can result in serious complications and a mortality rate of 13% to 35%. In patients with severe acute pancreatitis, urinastatin, either alone or in combination with other therapeutic agents, is associated with significant improvements in clinical outcomes and reduced mortality.

Moderately Severe Acute Pancreatitis

The moderately severe acute pancreatitis segment is expected to grow rapidly during the forecast period, as this form of pancreatitis affects 20% to 25% of patients; it often necessitates a longer hospital stay and can lead to local complications such as fluid collections or necrosis. This 20–25% figure represents the prevalence of moderately severe cases among all acute pancreatitis patients, although the overall prevalence of the condition varies worldwide.

How the Hospitals Dominated the Acute Pancreatitis Market in 2024?

The hospitals segment accounted for approximately 65% of the market in 2024, as acute pancreatitis is a potentially fatal condition that requires immediate, specialized care, including intravenous fluids, pain management, nutritional support, and ongoing monitoring for complications such as organ failure. For this reason, hospitals are essential.

Ambulatory Surgical Centers

The ambulatory surgical centers segment is estimated to grow at the highest rate of approximately 8% in the acute pancreatitis market during the forecast period. The use of ambulatory surgical centers (ASCs) to treat cases of mild acute pancreatitis is being investigated. This strategy aims to achieve safe outpatient care, fewer needless hospital stays, better patient outcomes, and lower healthcare system expenses.

Diagnostic Imaging Centers

The diagnostic imaging centers segment is expected to grow at a significant rate during the forecast period because in order to diagnose acute pancreatitis, determine its cause (such as gallstones), assess its severity, find complications (such as necrosis or fluid collections), and direct treatment, diagnostic imaging centers employ methods such as ultrasound, CT scans, and MRIs. This facilitates efficient management.

Why Intravenous Dominated the Acute Pancreatitis Market in 2024?

The intravenous segment held the largest revenue of approximately 50%of the acute pancreatitis market in 2024. Intravenous (IV) fluid therapy is regarded by many authors as the mainstay of SAP treatment, particularly in the first 24 hours following the onset of the illness. According to the American College of Gastroenterology (ACG), unless there are cardiovascular and/or renal comorbidities, all patients with AP should receive aggressive intravenous hydration (250–500 ml/hour) during the first 12–24 hours.

Enteral Feeding

The enteral feeding segment is estimated to grow at the highest rate of approximately 9% in the acute pancreatitis market during the forecast period because enteral feeding has been used for nearly 20 years to treat acute pancreatitis. According to recent meta-analyses, enteral nutrition, rather than parenteral feeding, significantly reduces mortality in patients with severe acute pancreatitis. Enteral feeding should begin within the first 24 hours of hospital admission to preserve gut barrier function and prevent early bacterial translocation.

Oral

The oral segment is expected to grow at a significant rate during the forecast period. One EN strategy in AP is oral feeding. It reduces intubation complications and eases the discomfort of intubation, making it more acceptable than tube feeding. The length of stay (LOS) and recovery of AP patients are impacted by the timing of oral refeeding.

Why Hospitals Pharmacies Became Dominant in the Market in 2024?

The hospital pharmacies segment held the largest revenue of approximately 55% of the acute pancreatitis market in 2024. Through identifying drug-induced causes, providing appropriate supportive care, managing pain with opioids, and helping with critical care therapies like nutrition, hospital pharmacists play a critical role in the management of acute pancreatitis.

Online Pharmacies

The online pharmacies segment is estimated to grow at the highest rate of approximately 10-12% in the acute pancreatitis market during the forecast period. Online pharmacies have many advantages, including easy access to critical supportive care drugs for managing acute pancreatitis and avoiding complications, such as analgesics, intravenous fluids, and nutritional support.

Specialty Clinics/Direct Supply

The specialty clinics/direct supply segment is expected to grow at a significant rate during the forecast period. Professional, multidisciplinary care is offered by specialty clinics, guaranteeing early diagnosis, specialized treatments, and easy access to necessary services like cutting-edge procedures and nutritional support. Patients with acute pancreatitis recover better and experience fewer complications thanks to this coordinated approach.

North America dominated the acute pancreatitis market in 2024 due to well-established healthcare infrastructure, rising obesity and gallstone cases, rising rates of acute pancreatitis, and a growing number of research studies, all of which are driving market expansion.

In the U.S., gallstones and alcohol use are responsible for roughly 35% to 40% and 17% to 25% of cases of acute pancreatitis, respectively. Acute pancreatitis is the most common cause of gastrointestinal disease-related hospitalizations in the U.S., with an estimated 200,000 to 275,000 admissions per year. Despite being widespread, the condition's clinical severity varies. About 80 percent of patients are released within a few days after presenting with mild illness. The overall death rate is between 1% and 2%, but it rises significantly when systemic organ failure or pancreatic necrosis are present.

Asia Pacific is estimated to host the fastest-growing acute pancreatitis market during the forecast period due to rising pancreatitis cases, continued research to create treatments, and government initiatives to increase public awareness are some of the factors driving the market's. Additionally, cases of pancreatitis linked to alcohol use also contribute to the region's market expansion.

Globally, hypertriglyceridemic acute pancreatitis (HTG-AP) has become a major cause of acute pancreatitis, with a particularly high incidence in China. The epidemiological patterns, pathophysiology, genetic predispositions, and treatment approaches for HTG-AP have been the main topics of recent Chinese research. According to epidemiological data from China, HTG-AP is responsible for roughly 10–30% of all cases of acute pancreatitis, with incidence rates as high as 35.9% reported in some areas.

Europe is expected to grow at a significant CAGR in the acute pancreatitis market during the forecast period because they have developed cutting-edge medical systems that offer the best diagnostic and therapeutic options. Germany, the United Kingdom, and France continue to hold their position as the world's top healthcare providers. The market is expanding as more people undergo minimally invasive procedures, patients have easier access to antibiotics and painkillers, and healthcare facilities prioritize their patients.

According to recent data from Guts UK, the number of acute pancreatitis cases in the UK is rising, reaching up to 56 cases per 100,000 people per year. Genomics England and the UK's MHRA have launched a study to investigate whether genetic factors contribute to the development of acute pancreatitis following the use of GLP-1 weight-loss drugs such as Wegovy and Mounjaro, in response to safety concerns.

South America is expected to grow significantly in the acute pancreatitis market during the forecast period, led by Brazil. Rising alcohol consumption and gallstones, major risk factors, drive this expansion. Improvements in healthcare access and diagnostic capabilities are the latest significant factors.

Brazil spearheads South America's expansion. Growth is fueled by an aging population and high rates of heavy alcohol intake. Increased healthcare spending and greater awareness of gastrointestinal health enhance detection and treatment adoption.

The Middle East and Africa are expected to grow at a lucrative CAGR in the acute pancreatitis market during the forecast period. Market expansion is supported by rising healthcare expenditure. Enhanced hospital infrastructure and growing patient awareness about the disease drive demand for advanced diagnosis and therapy.

GCC nations are heavily investing in sophisticated healthcare facilities. This push, combined with the rising prevalence of lifestyle disorders like obesity, is propelling the acute pancreatitis market forward, emphasizing advanced treatment modalities.

R&D focuses on finding novel therapeutic agents, imaging methods (such as sophisticated AI analysis of CT/MRI scans), and biomarkers, from laboratory studies to clinical hypotheses.

Key Companies: Siemens Healthineers, Olympus Corporation, Cook Group Incorporated, Neusoft Medical System, Bioseutica B.V., Lamassu Pharma, LLC, GNT Pharma Co., etc.

It involves proving the safety and effectiveness of novel diagnostics and treatments through human trials, which can be difficult because of the high placebo response in pain. This is followed by gaining FDA or comparable agency market authorization.

Key Companies: Arctx Medical, AcelRx Pharmaceuticals, LipimetiX Development, Angion Biomedica, SCM Lifescience, Panafina, Inc., etc.

It includes lifestyle counseling, long-term management to avoid recurrence, supportive care (IV fluids, pain management, nutrition), and putting patients in touch with advocacy organizations such as the National Pancreas Foundation.

Key Companies: Abbott Laboratories, Baxter International Inc., Fresenius SE & Co. KGaA, Medtronic, Boston Scientific, etc.

Company Overview

Company Overview

| Company | Offerings in Acute Pancreatitis | Contribution to Market | Focus Area |

| Pfizer | Pain management medications (analgesics), antibiotics, and sterile injectables. | Provides essential supportive care drugs fundamental to standard treatment protocols in hospitals. | Supportive Care |

| Abbott Laboratories | IV fluids, nutritional products (enteral/parenteral), diagnostic tools/assays. | Supplies critical supportive nutrition and aids in diagnostics to assess severity and manage complications. | Diagnostics & Nutrition |

| B. Braun SE | IV solutions, infusion pumps, pain therapy systems, and surgical products. | Offers comprehensive solutions for fluid management and precise drug delivery within the acute care setting. | Fluid & Pain Mgmt |

| CalciMedica Inc. | Auxora (CRAC channel inhibitor drug candidate). | Developing a novel therapeutic to target the root cause of organ failure in severe cases through clinical trials. | Novel Therapeutics |

| Dynavax Technologies | Adjuvants for vaccine development (no direct AP product). | No direct offerings for acute pancreatitis treatment or diagnostics; they specialize in adjuvant systems for vaccines. | (Not Applicable) |

By Treatment Type

By Severity Type

By End-User

By Route of Administration (Treatments)

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026