February 2026

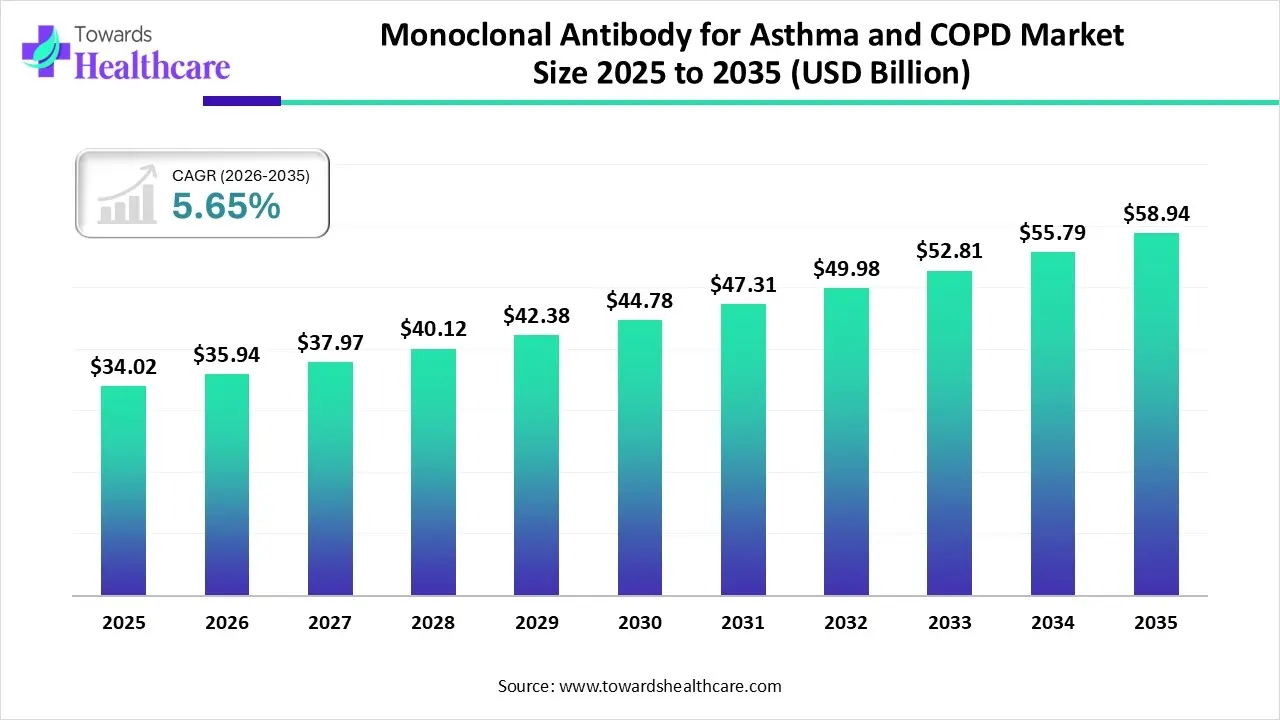

The monoclonal antibody for asthma and COPD market size was valued at US$ 34.02 billion in 2025 and is projected to grow to 35.94 billion in 2026. Forecasts suggest it will reach approximately US$ 58.94 billion by 2035, registering a CAGR of 5.65% during the period.

China and India are bolstering their healthcare services due to the rising asthma and COPD cases annually, especially in the growing geriatric population. This further accelerates advances in the global monoclonal antibody for asthma and COPD market, including bispecific antibodies, inhaled formulations, biosimilar versions, and other targeting therapeutics. As well as governments are leveraging diverse public funding with the coverage of different health policies, and putting wider efforts in the expansion of numerous biopharmaceutical companies.

The monoclonal antibody for asthma and COPD market includes biologic therapies designed to inhibit immune mediators that drive airway inflammation, mucus hypersecretion, and airflow obstruction. These antibodies target cytokines such as IL-5, IL-4, IL-13, IgE, and TSLP to suppress eosinophilic and allergic responses, improving control in severe or steroid-dependent asthma and specific COPD phenotypes.

The market encompasses discovery, clinical development, and commercialization of therapeutic monoclonal antibodies, along with related diagnostic and companion testing solutions. Increasing biologic adoption in respiratory diseases, coupled with advanced drug-delivery routes and expanding reimbursement in biologic therapies, is enhancing uptake across developed and emerging regions, especially as bispecific and next-generation antibody constructs enter late-stage development.

Growing Development of Biologics

There is a rise in the development of a wide range of biologics, where their increasing approvals are also driving the development of various bispecific antibodies with enhanced target-specific action.

Increasing Therapeutic Advancements

To control inflammation, enhance efficacy, and offer rapid action, various dual-target mAbs, biomarker-guided therapies, multi-pathway mAbs, and personalized treatments are being developed, which are actively driving their R&D activities.

Blooming Drug Delivery Solutions

Different types of inhaled and nebulized biologic formulations are being developed to offer targeted specific action through subcutaneous administration and lung delivery to reduce the side effects and enhance patient adherence.

Growing Disease Burden

Due to the growing incidence of asthma and COPD globally, driven by various environmental factors, the demand for their monoclonal antibodies is increasing, which is driving the development of advanced therapies.

| Country | Facilities |

| U.S. |

|

| Canada |

|

| India |

|

| China |

|

| Japan |

|

The widespread adoption of AI algorithms in the market is supporting the discovery and improvements in monoclonal antibodies (mAbs) for asthma and chronic obstructive pulmonary disease (COPD). Moreover, it emphasizes the creation of more efficacious and patient-specific therapies. Alongside, AI and machine learning platforms are employed to develop and optimize new nanobodies for asthma. Especially, a bifunctional nanobody targeting both TSLP and IL-13 (SAR443765) showed excellent results in a Phase I clinical trial for type 2 asthma.

| Key Elements | Scope |

| Market Size in 2025 | USD 34.02 Billion |

| Projected Market Size in 2035 | USD 58.94 Billion |

| CAGR (2025 - 2035) | 5.65% |

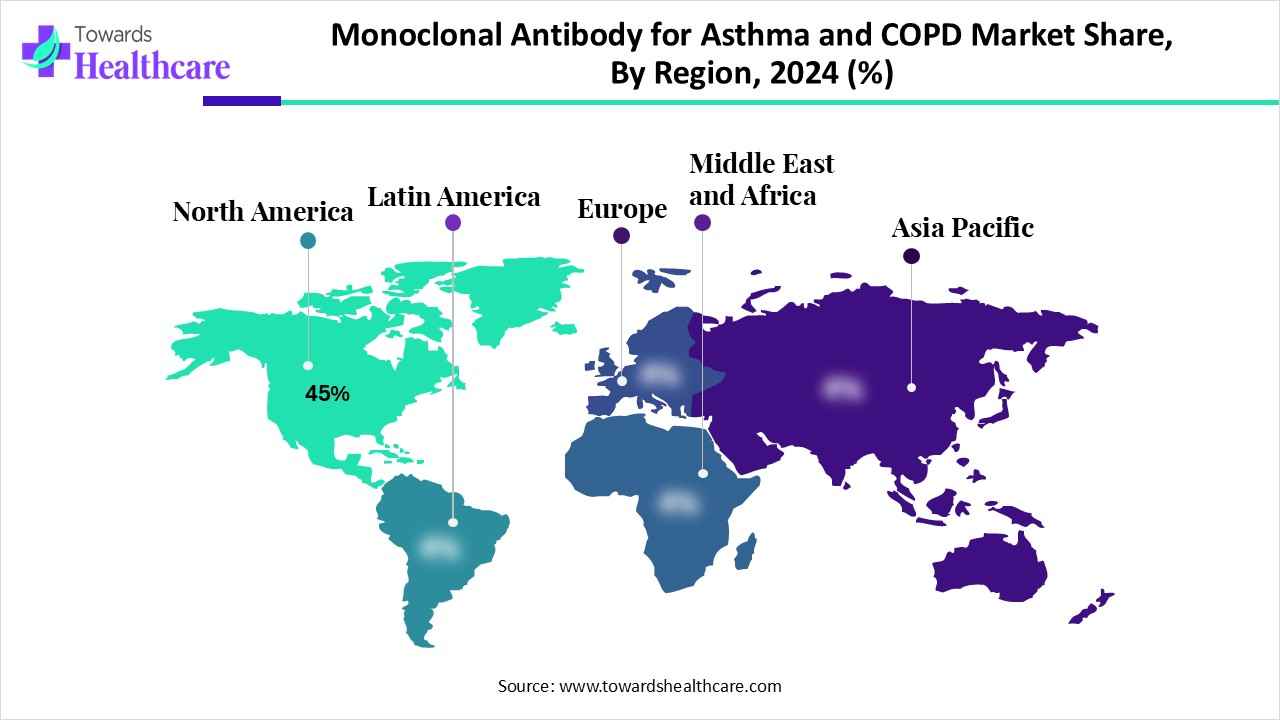

| Leading Region | North America by 45% |

| Market Segmentation | By Disease Indication, By Mechanism of Action, By Molecule Type, By Dosage Form, By End User, By Region |

| Top Key Players | Roche/Genentech, Inc., Amgen Inc., Teva Pharmaceutical Industries Ltd., Chugai Pharmaceutical Co., Ltd., Merck & Co., Inc., Johnson & Johnson (Janssen Biotech), AbbVie Inc., Eli Lilly and Company, Kiniksa Pharmaceuticals Ltd., Biogen Inc., Hanmi Pharmaceutical Co., Ltd., Sino Biopharmaceutical Limited (Innovent Biologics), Samsung Bioepis Co., Ltd., Celltrion Healthcare Co., Ltd., Kyowa Kirin Co., Ltd. |

How did the Asthma Segment Lead the Market in 2024?

By capturing nearly 55% share, the asthma segment dominated the monoclonal antibody for asthma and COPD market in 2024. The segment is mainly driven by a rise in incidences of chronic respiratory diseases, the transformation of personalized medicine for difficult-to-treat patients, and breakthroughs in biotechnology. According to NIH & GINA, there will rise in 100 million patients in the upcoming years, which leads to 260 million people and over 450000 deaths each year around the globe.

Whereas the COPD segment is anticipated to expand rapidly in the coming era. The rising wider air pollution and smoking, the demand for more targeted and efficient treatments for patients with uncontrolled or severe cases is impacting the evolving COPD cases. According to the World Health Organization (WHO), COPD, alongside asthma, results in nearly 4 million deaths annually, with over 1 million premature deaths in people under 70. Whereas the "Global State of COPD Report" from 2024 was released, there were 391 million COPD cases in the world in 2024.

Why did the Cytokine Neutralization Segment Dominate the Market in 2024?

In 2024, the cytokine neutralization segment led with approximately 40% share of the monoclonal antibody for asthma and COPD market. A key driver is the severe challenges of conventional therapies and the increasing understanding of disease heterogeneity. Recently found treatments are blocking specific inflammatory pathways, particularly Type 2 (T2) inflammation, propelled by cytokines like IL-4, IL-5, IL-13, and thymic stromal lymphopoietin (TSLP).

The dual or multi-pathway blockade segment is predicted to expand at a rapid CAGR during 2025-2034. This type of MOA focuses on inhibiting multiple, often related, components of the disease process simultaneously for a more complete therapeutic effect. In 2025, the globe is leveraging combination inhaled therapies, advanced biologics, and novel non-inhaled drugs, like long-acting muscarinic antagonist (LAMA) and a long-acting beta-agonist (LABA), corticosteroid (ICS), to the LAMA/LABA formula.

What Made the Fully Human Monoclonal Antibody Segment Dominant in the Market in 2024?

In 2024, the fully human monoclonal antibody segment held an approximate 45% share of the monoclonal antibody for asthma and COPD market. These types of molecules are used to reduce the risk of the body developing an immune reaction against the therapy itself. The recent developments encompass Dupilumab and Tezepelumab, which are approved for severe asthma and expanded into COPD and other inflammatory conditions, as an interleukin-4 receptor alpha 𝐼𝐿−4𝑅𝛼 antagonist and blocking thymic stromal lymphopoietin (TSLP), respectively.

However, the bispecific antibody segment is anticipated to register the fastest growth. Patients who are not responding to standard treatments, specifically high-dose corticosteroids and even existing mAbs, where bispecific antibodies are utilized as a robust approach in this population. Currently, lunsekimig (Anti-IL-13/TSLP) is targeting interleukin-13 (IL-13) and thymic stromal lymphopoietin (TSLP), which are major drivers of Type 2 inflammation.

How did the Subcutaneous Segment Lead the Market in 2024?

The subcutaneous segment accounted for nearly a 50% share of the monoclonal antibody for asthma and COPD market in 2024. This dosage form is easy to administer, with lowered dosing errors, and also possesses expanded features, including 7 accelerated adherences. Recently marketed biologics in asthma and COPD include pre-filled syringes or auto-injectors, such as dupilumab (Dupixent), mepolizumab (Nucala), benralizumab (Fasenra), and tezepelumab (Tezspire).

Moreover, the inhaled or nebulized formulation segment is anticipated to expand rapidly. The eventual benefits of this dosage form are direct targeting of the airways, potentially increased efficacy with minimal doses, and lowered systemic side effects. The players have developed a nebulized combination of formoterol (LABA) and budesonide (ICS), as well as the establishment of dry powder monoclonal antibodies, mainly abrezekimab for asthma, and nebulized revefenacin (LAMA) for COPD.

Why did the Hospitals & Specialty Clinics Segment Dominate the Market in 2024?

In the monoclonal antibody for asthma and COPD market, the hospitals & specialty clinics segment captured approximately 45% revenue share in 2024. They provide a robust hub for advanced care, research, and clinical trials. Moreover, specialty clinics are offering targeted expertise and focused care for administering monoclonal antibodies in the growing cases of severe asthma and COPD. Rajagiri Hospital (Kochi, India), Dr. Vikas Mittal (New Delhi, India), and "Breathe Easy" clinics are certain examples.

Furthermore, the biopharmaceutical companies segment will expand rapidly. Ongoing advancements in personalized medicine through asthma phenotyping and the development of smart inhalers are boosting the progress of these companies. As well as a rise in R&D investments to discover new biologics and improve existing ones, faster approval pathways for innovative biologic therapies, and expanded collaborations are bolstering the company's transformation.

North America’s monoclonal antibody for asthma and COPD market accounted for an approximate 45% share in 2024. Primarily involved drivers are the boosting of environmental pollution, high counts of smoking (though declining, it remains a risk factor), and a geriatric population. Also, this region is exploring its strong healthcare systems, such as tertiary hospitals and specialized clinics, which offer the diagnosis, treatment, and distribution of advanced biologic therapies.

For instance,

Emerging Patient Population and Targeted Therapies are Supporting the U.S. Market

The US monoclonal antibody for asthma and COPD market is experiencing major growth, due to the acceleration of asthma and COPD patients, which is further fueling demand for new drugs that target specific inflammatory pathways (like Th2 inflammation). As per NIH, there were 24.9 million asthma cases in 2021, and it is estimated that the U.S. will experience by 29.14% between 2020 and 2030, accelerating from 5.37 million to 6.94 million cases annually.

Availability of Various Therapies & Government Support is Impacting the Canadian Market

Canada has widespread accessibility to Dupixent, Fasenra, Nucala, Cinqair, and Tezspire drugs, which are ultimately influencing the growth of the monoclonal antibody for asthma and COPD market. However Canadian government is boosting initiatives, public funding, and health technology assessments, like those promoted by the Canadian Agency for Drugs and Technologies in Health (CADTH), impacting drug access and pricing, and patient access.

In the future, the Asia Pacific is anticipated to witness the fastest growth in the monoclonal antibody for asthma and COPD market. Many developing countries in ASAP are fostering their healthcare spending to improve infrastructure and overall accessibility to specialty care, with advanced therapies, like mAbs. Alongside, they are stepping into innovations in technologies used in the biotechnology and genetic engineering areas, resulting in the progression of more efficacious and targeted monoclonal antibodies.

A Surge in Biosimilar Development and R&D Activities is Bolstering the Indian Market

India is one of the largest countries having a major aging population, which is highly susceptible to diverse respiratory concerns, like severe asthma and COPD. This expansion is fostering the progress and approval of cost-effective biosimilar versions of mAbs through the emergence of significant companies, like Aurobindo Pharma. Besides this, India is increasingly putting efforts into robust research and development activities for leveraging novel mAbs with expanded applications over the existing ones. In 2024, India had 33 million patients with asthma and 55 million patients with chronic obstructive pulmonary disease.

Encouraging Healthcare Policies are Impacting the Chinese Market

The monoclonal antibody for asthma and COPD market in China is exploring several supportive healthcare policies, including insurance coverage. This mainly encompasses expensive mAbs and biosimilars in the national medical insurance list. Moreover, China’s regulatory landscape is boosting its approval process to bring new drugs and biosimilars to the market rapidly.

Europe is expected to grow significantly in the monoclonal antibody for asthma and COPD market during the forecast period, due to the presence of a well-developed healthcare infrastructure. At the same time, the growing incidences of asthma and COPD are also increasing their demand. The increasing government support, growing demand for biologics, and increasing innovations are also promoting the market growth.

UK Market Trends

The UK consists of a well-developed healthcare system, which is increasing the adoption of monoclonal antibodies for asthma and COPD, to tackle their growing incidences. Moreover, the presence of reimbursement policies is also increasing their accessibility, where the growing advancements in the mABs are also driving their early adoption.

South America is expected to grow significantly in the monoclonal antibody for asthma and COPD market during the forecast period, due to the growing incidence of respiratory diseases. The expanding healthcare and increasing health awareness are also increasing the use of monoclonal antibodies for asthma and COPD. Additionally, growing adoption of advanced therapies are also enhancing the market growth.

Brazil Market Trends

The expanding healthcare in Brazil is increasing the adoption of various monoclonal antibodies for the treatment of asthma and COPD. Their growing incidences are also encouraging the development of new mAb treatment options. At the same time, growing early diagnosis of respiratory diseases and R&D activities are driving the development of advanced therapies.

Foremost, it finds a target, like a specific antigen, a protein, a cell, or another molecule, then it screens for desired properties. Finally, various process development steps, such as upstream processing, cell line development, etc, are involved.

Key Players: Novartis, Pfizer, Johnson & Johnson, etc.

mAbs are usually ready-to-use liquid solutions or a lyophilized (freeze-dried) powder form, which are derived from the selection and combination of excipients with the purified mAb with ensured stability, safety, and effectiveness throughout their shelf life and during administration.

Key Players: F. Hoffmann-La Roche (Genentech), AbbVie Inc., Merck & Co., Inc., etc.

The monoclonal antibody for asthma and COPD market is promoting different financial assistance and access programs, clinical support & education, infusion and delivery support, and emotional and practical support.

Key Players: Aurigene, Biogen, Eli Lilly and Company, etc.

By Disease Indication

By Mechanism of Action

By Molecule Type

By Dosage Form

By End User

By Region

February 2026

February 2026

February 2026

February 2026