January 2026

The pediatric devices market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

Mainly, the worldwide pediatric devices market encompasses a few drivers, like a rise in the number of premature births, coupled with chronic health issues, such as asthma, diabetes, cardiovascular conditions, and epilepsy. These conditions are further fueling demand for advanced medical devices, including respiratory ventilators. Along with this, nowadays, the major demand for neonatal intensive care units (NICUs) is highly impacting the adoption of innovative devices in preterm birth conditions. Hence, the further market is developing new opportunities in diagnostic, remote patient monitoring, therapeutic, and surgical applications. The main purpose of the rising development in the home-based healthcare system is to significantly drive the market expansion.

The pediatric devices market refers to the global industry focused on the development, manufacturing, and commercialization of medical devices specifically designed for infants, children, and adolescents (typically aged 0 to 18 years). These devices are customized in terms of size, usability, safety, and performance to accommodate the anatomical and physiological needs of pediatric patients. Pediatric devices span across diagnostic, monitoring, therapeutic, and surgical applications, and must meet stringent regulatory standards due to the vulnerable patient group.

Primarily, diverse factors are impacting the adoption of AI in this market, such as significant technological breakthroughs, enhanced awareness about pediatric health, and the movement towards the adoption of minimally invasive procedures. In these conditions, AI-driven tools are highly transforming diagnostics, treatment, and patient management by boosting precision, customization, and efficacy. As well as these AI-based tools support in the improvements of diagnostic accuracy by analyzing medical images (like X-rays and MRIs) in earlier disease detection, including pneumonia, brain tumors, and congenital heart defects. With the help of AI algorithms possible to do early detection, estimation of health risks, and allow robust and targeted therapies for children.

Accelerating Preterm Births and Chronic Health Concerns

The pediatric devices market is driven by a rise in many infants born prematurely, necessitating specialized care in neonatal intensive care units (NICUs). This results in a major demand for NICU devices and equipment. Along with this, growing cases of chronic diseases in children, particularly asthma, diabetes, and diverse infectious diseases, are also fueling the adoption of sophisticated medical devices for effective diagnosis and treatment. Nowadays, the development of newer medical devices, like advanced imaging technologies, portable devices for home healthcare, and minimally invasive surgical tools, is supporting in ultimate expansion of the market.

Widespread Expenses in the Development and Arising Design Challenges

Generally, the development of innovative and advanced pediatric medical devices needs an extensive research approach, with clinical trials, and adherence to strict regulatory standards; all these conditions require broad expenditure with time consumption. Moreover, in the pediatric devices market, another evolving limitation is the creation of a specific design to locate the unique physiological and developmental characteristics of children, which change based on age, gender, and weight.

Expansion of Digitalization and Home-Based Healthcare

During the forecast period, the market will have various opportunities, especially the adoption and expansion of integrated AI and digital health technologies into pediatric devices to optimize disease monitoring, personalized treatment, and remote patient care. Besides this, numerous medtech companies are involved in the development of inexpensive and accessible pediatric devices. A growing population is demanding remote patient monitoring and home-based healthcare, which shows an emerging opportunity for the transformation of portable and user-friendly pediatric devices.

In the therapeutic devices segment, the neonatal and pediatric ventilators sub-segment held the major share in 2024. The significant drivers of this segment are the increasing rates of newborns, mainly premature infants, who require respiratory support, fueling the demand for ventilators. As well as a wide range of population is demanding non-invasive ventilation approaches due to their major advantages over invasive ventilation is also impacting the segment growth.

Whereas, in the case of the surgical devices segment, the pediatric robotic surgery tools segment is predicted to grow at a rapid CAGR. Most contributing factors are the growing adoption of robotic surgery, with its numerous advantages offering surgeons, like accelerated accuracy, dexterity, and visualization as compared to conventional laparoscopic or open surgery, especially beneficial for complex procedures in smaller anatomical spaces. Additionally, continuous advancements in robotic technology, such as miniaturization of instruments and the development of new robotic platforms, are boosting the possibilities for pediatric robotic surgery.

By age group, the children (1–12 years) segment dominated the global pediatric devices market in 2024. Due to the occurrence of asthma, diabetes, and congenital heart defects in this age group, they are increasingly leading to the broad adoption of advanced diagnostic and therapeutic devices. Also, currently, heavier investments in healthcare systems and services are assisting in using the novel medical devices effectively in this age group of children.

On the other hand, the neonates (0–28 days) segment will expand rapidly. As this age group comprises the increasing preterm birth rates around the world, are is a need for specialized neonatal care and equipment. Also, they need intensive care and specific medical devices to assist their development, like incubators and respiratory support systems are influencing the overall segment expansion. Apart from this, rising public awareness campaigns and major government steps are actively boosting robust prenatal and neonatal care with enhanced demand for devices and services.

In 2024, the pediatric hospitals segment led the market, due to a rise in premature birth rates and chronic diseases, like asthma, diabetes, and other severe health issues. Moreover, growing novel creations, including diagnostic imaging (including 3D imaging), in vitro diagnostics, and AI-powered tools for disease management, are widely accessible in these hospitals. Alongside, the presence of a number of neonatal intensive care units (NICUs) is also impacting the ultimate market and segment expansion.

And, the home care settings segment is anticipated to expand fastest during 2025-2034. Across the globe, parents and caregivers are highly preferring home-based healthcare for its favourable, decreased risk, cost-effectiveness, and overall optimized quality of life for children. In the upcoming era, tremendous innovations in portable medical devices, remote monitoring systems, and telehealth platforms have made it more accessible and more efficient to enable specialized care in the home setting.

The neonatology segment led the global pediatric devices market in 2024. Ongoing innovations in neonatal care equipment, such as respiratory devices, monitoring systems, and imaging technologies, are fueling the segment's growth. Along with this, increasing awareness about the significance of neonatal care, allied with government initiatives to minimize infant mortality rates, is also being incorporated as a growth factor in the market.

Although the cardiology segment is estimated to grow rapidly in the projected period, the segment will expand because the accelerating prevalence of congenital heart defects among children is generating a need for specialized treatments and devices. In addition, the progression of minimally invasive devices, like bioresorbable stents and advanced catheter systems, is developing approaches as safer and highly efficient for pediatric patients. Furthermore, the expansion of clinical trials aimed at pediatric cardiac interventions is propelling innovation and new treatment paradigms.

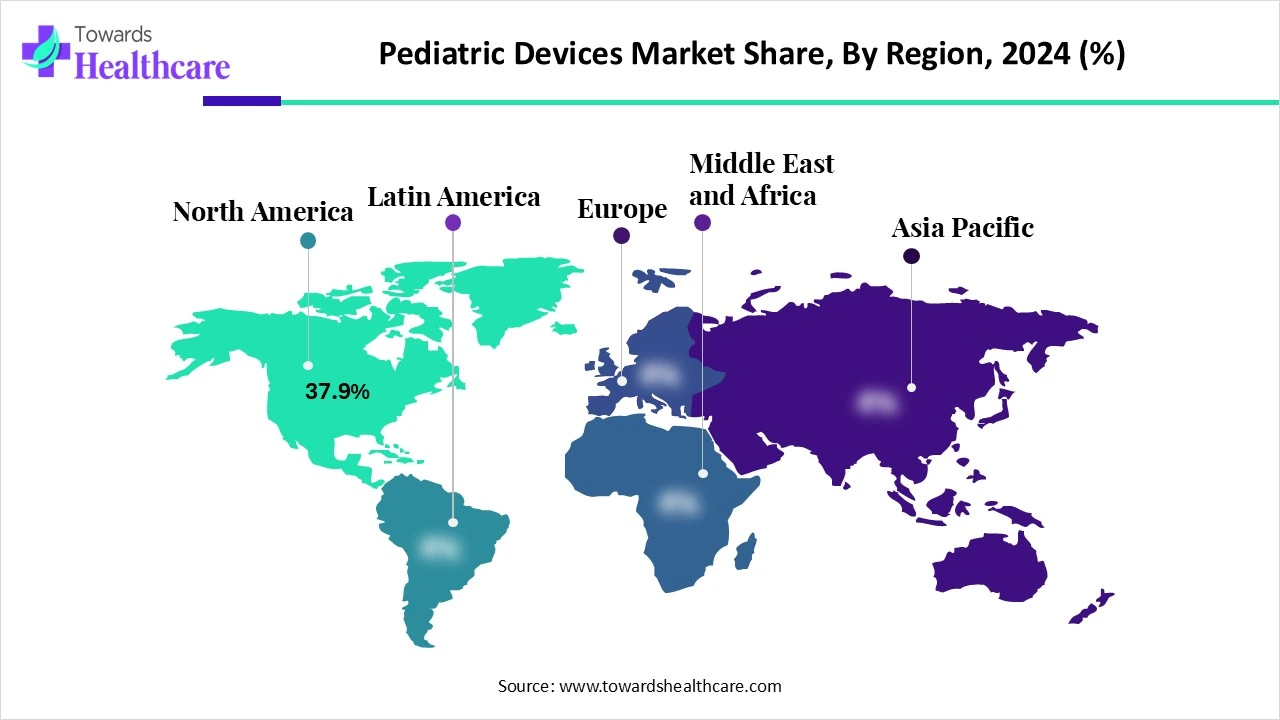

North America was dominant in the market share by 37.9% in 2024, due to a robust and favourable regulatory environment that ensures the safety and efficacy of pediatric medical devices, further nourishing the market expansion. Along with this, in this region, well-developed hospitals, with their comprehensive infrastructure and specialized pediatric units, are a vast end-user segment, fueling the demand for different devices, including infant incubators. Also, the transforming diagnostic measures and infection control are assisting in the adoption of advanced devices.

In the US, the market is fueled by the rising adoption of AI integration in medical devices, with improved diagnostic accuracy and treatment effectiveness, particularly in asthma management. Furthermore, the US is widely involved in the widespread awareness about pediatric healthcare needs and increasing investments in pediatric medical device innovation, both from the public and private sectors.

For instance,

In North America, Canada is another developing region in this market, due to the immense disposable incomes and advancements in healthcare infrastructure, which are resulting in enhanced expenditure on pediatric healthcare. Along with this, Canada possesses trends in in vitro diagnostics, immunohistochemistry, and genetic testing to boost pediatric diagnosis, with AI and immunodiagnostics revolutionizing the sector.

For this market,

In 2025-2034, the Asia Pacific is expected to register rapid growth, with an increasing pediatric population, coupled with enhanced demand for sophisticated medical devices. Additionally, in ASAP, developing countries are advancing healthcare infrastructure, which enables them to be the easiest to adopt and apply advanced medical technologies, including pediatric devices. As well as escalating awareness about the importance of pediatric care and expansion in healthcare expenditure in the region, leading to widespread investment in medical devices.

In China, a huge pool of births rates with rising need for neonatal intensive care unit (NICU), especially for premature and critically facing health issues in infants. Also, the Chinese government is supporting to acceleration of healthcare infrastructure, simplifying the regulatory landscape, and incentivizing manufacturers, as well as the emerging adoption of AI solutions and digital approaches.

For instance,

As Japan is popular for various technological advancements, including novel developments in sectors like diagnostic imaging (MRI, CT), point-of-care ultrasound, and AI-powered analysis, it is involved in the overall market expansion. Additionally, escalating demand for home-use medical equipment, such as respiratory devices, with a rise in the need for convenient and accessible care. Also, the respective government is offering the funding, reforms, and policies for research and development, and the adoption of new technologies in pediatric healthcare.

Currently, Europe is experiencing a significant growth in the pediatric devices market. Inclusion of several factors is the growing innovations in telemedicine, smart incubators with remote monitoring, and minimally invasive surgical instruments, assisting the overall market growth. Other than this, expanded insurance coverage for pediatric medical devices is making treatments widely cost-effective for families, and stepping towards minimally invasive approaches in pediatric surgery is creating demand for smaller, more precise surgical instruments and imaging systems.

In this region, crucial advancements in 3D printing for personalized orthotic devices and the development of specialized devices for respiratory care, diagnostics, and neonatal intensive care are further driving market expansion. As well as this region’s government fostering the major steps in pediatric healthcare, by incorporating many regulations for the use of digital platforms, or screening time among the children's population.

In the UK, combined factors are driving the overall market expansion, particularly growth in the asthma, diabetes, congenital heart defects, and epilepsy pediatric cases, and rapid progress in AI-enabled devices, miniaturization, and minimally invasive technologies are boosting the capabilities and applications of pediatric medical devices.

For this market,

| Companies | Headquarters | Offerings | Revenue (2024) |

| Medtronic plc | Dublin, Ireland | Oxygenators, arterial filters, cannulae, hemoconcentrators | $32.36 billion |

| GE Healthcare | Chicago, Illinois, United States | GE Healthcare Adventure Series, Giraffe Omnibed Carestation, Novii+ Wireless Patch System | $19.7 billion |

| Siemens Healthineers | Erlangen, Germany | MINITOM Kids, Photon-counting CT with Quantum Technology | €22.36 billion |

The latest research focuses on developing innovative devices using 3D printing technology.

Key Players: Abbott Laboratories, GE Healthcare, and Boston Scientific Corporation.

Pediatric devices are tested for safety and effectiveness in children and approved by regulatory agencies like the FDA, EMA, and NMPA.

Key Players: Philips Healthcare, Velocity Clinical Research, Pfizer, and Medpace.

It refers to guiding about the use and benefits of pediatric devices, as well as providing financial assistance.

By Product Type

By Age Group

By End User

By Application Area

By Region

January 2026

December 2025

December 2025

December 2025