February 2026

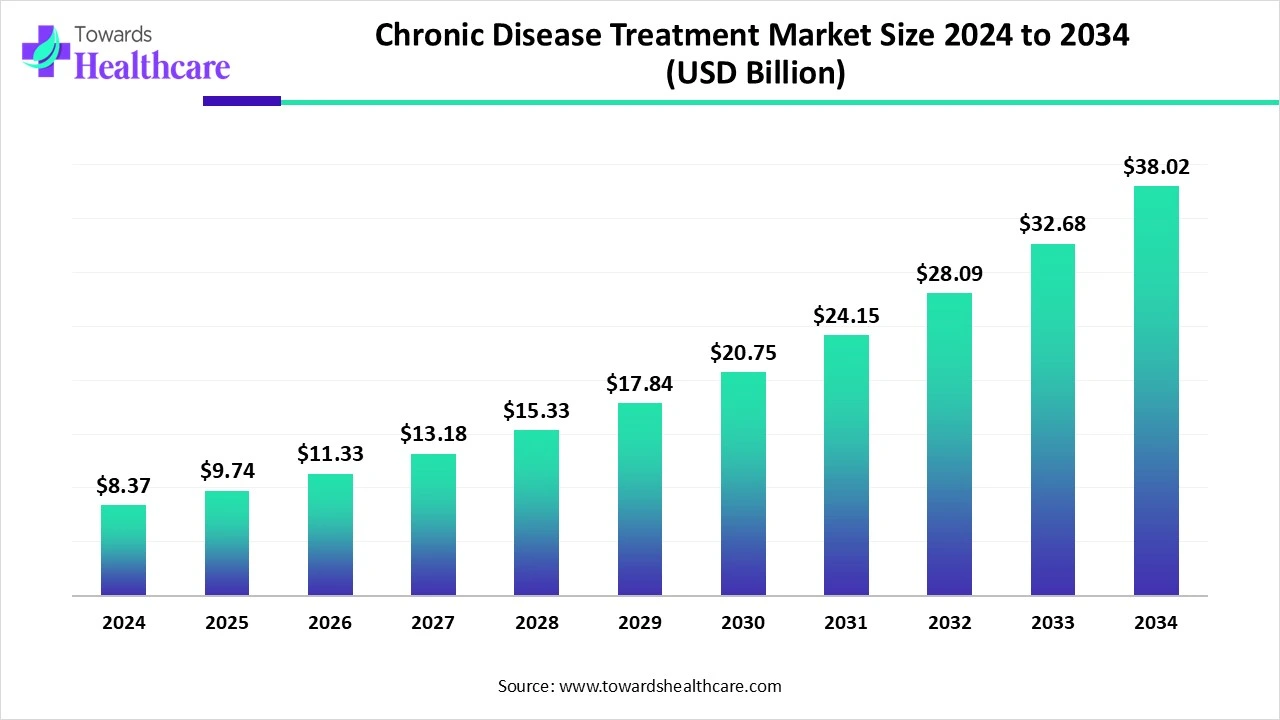

The global chronic disease treatment market size is calculated at USD 8.37 billion in 2024, grew to USD 9.74 billion in 2025, and is projected to reach around USD 38.02 billion by 2034. The market is expanding at a CAGR of 16.34% between 2025 and 2034.

The chronic disease treatment market is primarily driven by the rising prevalence of chronic disorders. The growing research and development activities facilitate the development of novel therapeutics for the treatment of chronic diseases. Prominent market players collaborate to develop novel therapeutics and expand their services globally. The future looks promising, with technological advancements that will enable the prevention, diagnosis, treatment, and cure of chronic diseases.

| Metric | Details |

| Market Size in 2025 | USD 9.74 Billion |

| Projected Market Size in 2034 | USD 38.02 Billion |

| CAGR (2025 - 2034) | 16.34% |

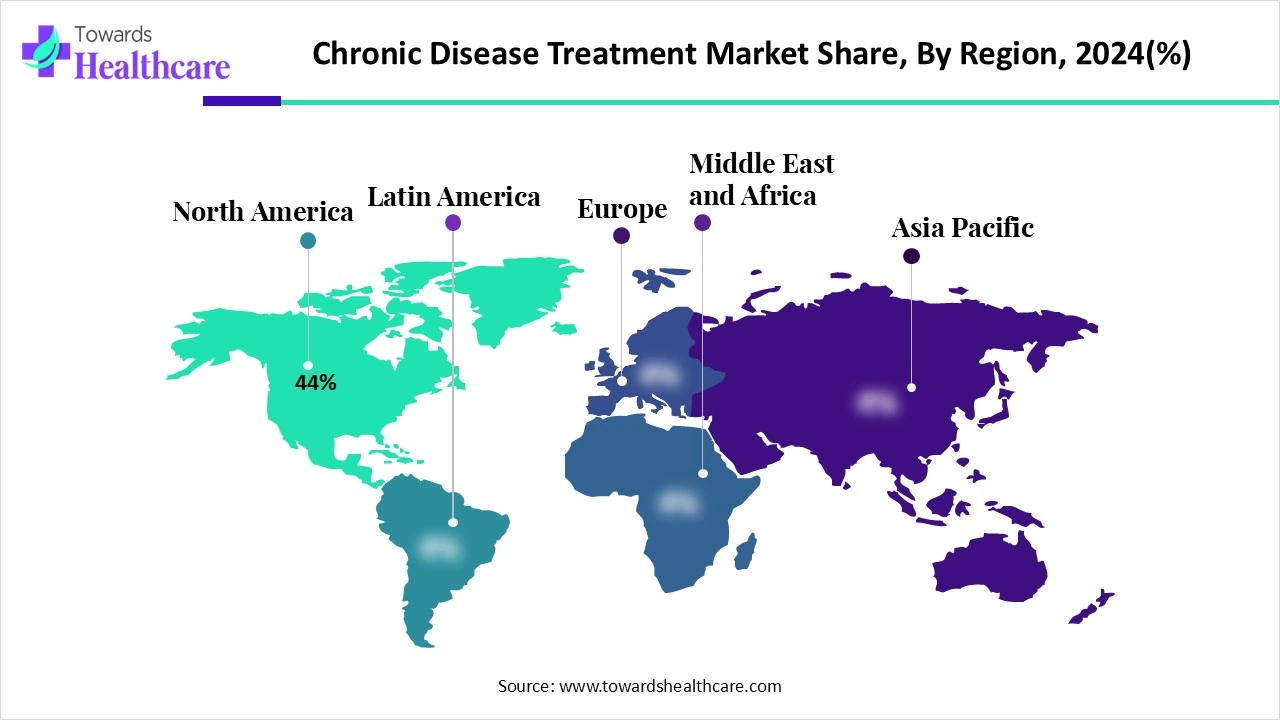

| Leading Region | North America share by 44% |

| Market Segmentation | By Disease Type, By Treatment Type, By Drug Class, By Care Delivery Model, By End-User, By Region |

| Top Key Players | Pfizer Inc., Novartis AG, Sanofi, Johnson & Johnson, Merck & Co., Inc., AstraZeneca plc, Eli Lilly and Company, Boehringer Ingelheim, GlaxoSmithKline plc, Roche Holding AG |

The chronic disease treatment market comprises a wide range of therapeutics, medical devices, and integrated care solutions aimed at managing long-term, persistent health conditions such as cardiovascular diseases, diabetes, respiratory disorders, cancer, and neurological diseases. These conditions require ongoing clinical management, often over the patient’s lifetime, and represent the largest healthcare burden globally. Treatment approaches include pharmaceuticals, biologics, digital health tools, and lifestyle interventions, with growing emphasis on personalized and value-based care.

Numerous factors influence market growth, including the rising prevalence of chronic disorders and growing research activities. People are becoming aware of early diagnosis and effective treatment of chronic diseases. Several government organizations launch initiatives to promote advanced treatment and increase access to it. Moreover, the increasing investments and collaborations among key players augment market growth. Technological advancements drive the latest innovations in chronic disease treatment.

Artificial intelligence (AI) is revolutionizing the market by improving disease diagnosis and screening, enabling healthcare professionals to provide effective therapeutics. It can enhance the efficiency and effectiveness of managing chronic diseases. Integrating advanced algorithms and data analysis facilitates personalized treatment and enhances patient monitoring. AI can suggest potential therapeutic regimens based on a patient’s conditions. AI-based sensors enable healthcare professionals to monitor patients continuously and adjust treatments accordingly. Thus, AI improves the treatment accuracy and improves the overall patient experience.

Growing Research Activities

The major growth factor of the chronic disease treatment market is the growing research and development activities. Research activities enable researchers to study the disease progression and develop novel therapeutics. Advancements in genomics, proteomics, and molecular biology favor the development of advanced therapeutics. Medical devices play an evolving role in managing chronic diseases by enabling remote monitoring and personalized treatment, improving patient outcomes. Government organizations launch initiatives to improve patients’ lives and take necessary measures.

Lack of Skilled Professionals

The shortage of skilled professionals is a major issue in many countries, especially in underdeveloped and developing countries. The increasing population and the rising prevalence of chronic disorders make it difficult for healthcare professionals to focus on every patient and provide advanced care.

What is the Future of the Chronic Disease Treatment Market?

The future of the market is promising, driven by the increasing adoption of digital health tools. Digital therapeutics (DTx) have emerged as promising tools for the prevention and management of chronic diseases. Recent advancements in information technology have enabled healthcare professionals to use digital medical interventions through software algorithms or applications. The growing demand for personalized treatment also potentiates the use of DTx. The development of more customized digital therapeutic projects based on the application status of patients with chronic diseases presents future opportunities for market players.

By disease type, the cardiovascular diseases (CVDs) segment held a dominant market share in 2024. This segment dominated due to the increasing prevalence of cardiovascular diseases and the growing need for early detection. The WHO reported that an estimated 1.28 billion people aged 30-79 years have hypertension globally. (Source - WHO) The rising geriatric population is a major risk factor for cardiovascular diseases. Technological advancements lead to the development of innovative medical devices. The advent of cell and gene therapy has also revolutionized cardiovascular disease treatment.

By disease type, the diabetes segment is expected to grow at the fastest CAGR in the market during the forecast period. Diabetes is a severe, chronic disease that can lead to serious health complications if not managed properly. The primary causes of diabetes are the geriatric population, obesity, family history of diabetes, stress disorders, and other lifestyle-related disorders.

The type 2 diabetes sub-segment is expected to grow rapidly, owing to the rising prevalence of type 2 diabetes. It is reported that approximately 589 million people have type 2 diabetes globally. (Source - International diabetes federation) The growing research activities enable researchers to identify novel drug targets and design new drugs and delivery systems.

By treatment type, the pharmaceuticals segment led the global market in 2024. This is due to the easy availability of pharmaceuticals and their cost-effectiveness. Pharmaceuticals are the primary choice of therapeutics as they provide superior benefits. The availability of generic alternatives allows patients from low- and middle-income groups to afford pharmaceuticals. Pharmaceuticals are usually preferred due to their proven efficacy against a wide range of chronic disorders. They can deliver a precise dose and manipulate dose delivery through sustained-release and immediate-release oral drugs.

By treatment type, the digital therapeutics & remote monitoring segment is expected to grow with the highest CAGR in the market during the studied years. The advent of wearable devices and AI-based sensors facilitates remote monitoring and the development of digital therapeutics. They are often used along with conventional medications to deliver medical treatments directly to patients. They have been proven to reduce disease burdens, deliver better clinical outcomes, and enable healthcare professionals to make informed decisions.

By drug class, the hypoglycemics/insulin therapy segment held the largest revenue share of the market in 2024. This segment dominated because of the increasing diabetes prevalence and the availability of novel drug delivery devices. Researchers have developed needle-free devices to deliver insulin, increasing medication adherence and patient comfort. This also reduces the risk of needle-stick infections. A novel class of hypoglycemics has been developed with enhanced efficacy and reduced side effects.

By drug class, the immunomodulators segment is expected to expand rapidly in the market in the coming years. Immunomodulators are therapeutics that can modify the immune response of an allergic reaction. They are widely used in chronic diseases, such as Crohn’s disease, myositis, and multiple sclerosis. The increasing number of organ transplants potentiates the need for immunomodulators. According to the Health Resources & Services Administration, more than 48,000 organ transplants were performed in the U.S. in 2024. (Source - Organ donor)

By care delivery model, the integrated care & population health management segment contributed the biggest revenue share in the market in 2024. Integrated care (IC) and population health management (PHM) are gaining traction among policymakers and practitioners due to their ability to improve public health and well-being. PHM improves physical and mental health outcomes, reduces health differences, and enables patients to live longer. The increasing collaboration among healthcare professionals, patients, and other social communities boosts the segment’s growth.

By care delivery model, the home-based care segment is expected to witness the fastest growth in the market over the forecast period. The increasing geriatric population and the rising adoption of telehealth augment the segment’s growth. The United Nations anticipates that there will be 2.2 billion aged 65 years and above by the 2070s. (Source - United Nations) Telemedicine enables healthcare professionals to continuously monitor a patient. Home-based care eliminates the need for patients to visit a healthcare organization.

By end-user, the hospitals & specialty clinics segment held a major revenue share of the market in 2024. The segmental growth is attributed to the presence of multidisciplinary professionals and favorable infrastructure. Suitable capital investment enables hospitals and specialty clinics to adopt advanced tools for effective treatment. Patients mostly prefer to visit a hospital or specialty clinics due to favorable reimbursement policies. Skilled professionals and advanced tools can perform surgeries and closely monitor a patient.

By end-user, the home healthcare providers segment is expected to show the fastest growth over the forecast period. Home healthcare providers visit a patient’s home and provide effective treatment. The different types of home healthcare services include doctor care, nursing care, physical/occupational/speech care, medical social services, and basic assistance care. The growing need for rehabilitation procedures and advancements in medical devices enables home healthcare providers to deliver advanced care.

North America dominated the global chronic disease treatment market share by 44% in 2024. The rising prevalence of chronic disorders, the presence of a robust healthcare infrastructure, and payer-driven chronic care models are the major growth factors of the market in North America. The increasing collaboration among key players, healthcare professionals, and other social communities facilitates patients in living a better lifestyle. The increasing healthcare expenditure also leads to market growth.

The Centers for Disease Control and Prevention (CDC) estimated that there are approximately 129 million people in the U.S. with at least one chronic disease. (Source - Centers for Disease Control) The U.S. government has launched several programs, including the “Chronic Disease Self-Management Education Program,” to enhance patient self-management of chronic diseases, improving their lifestyle

Hypertension is the most common chronic condition among Canadians, affecting 7.5 million people living with hypertension. (Source - Hyper tension)The Government of Canada announced an investment of over $6.6 million through the Enhanced Surveillance for Chronic Disease Program (ESCDP) to seven organizations that address public health evidence gaps related to chronic diseases. (Source - Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the chronic disease treatment market during the forecast period. The increasing geriatric population and growing research and development activities augment the market. Rapid urbanization and sedentary lifestyles also increase the risk of developing chronic disorders in people from Asia-Pacific countries. The increasing awareness among people for screening and early diagnosis of chronic disorders contributes to market growth.

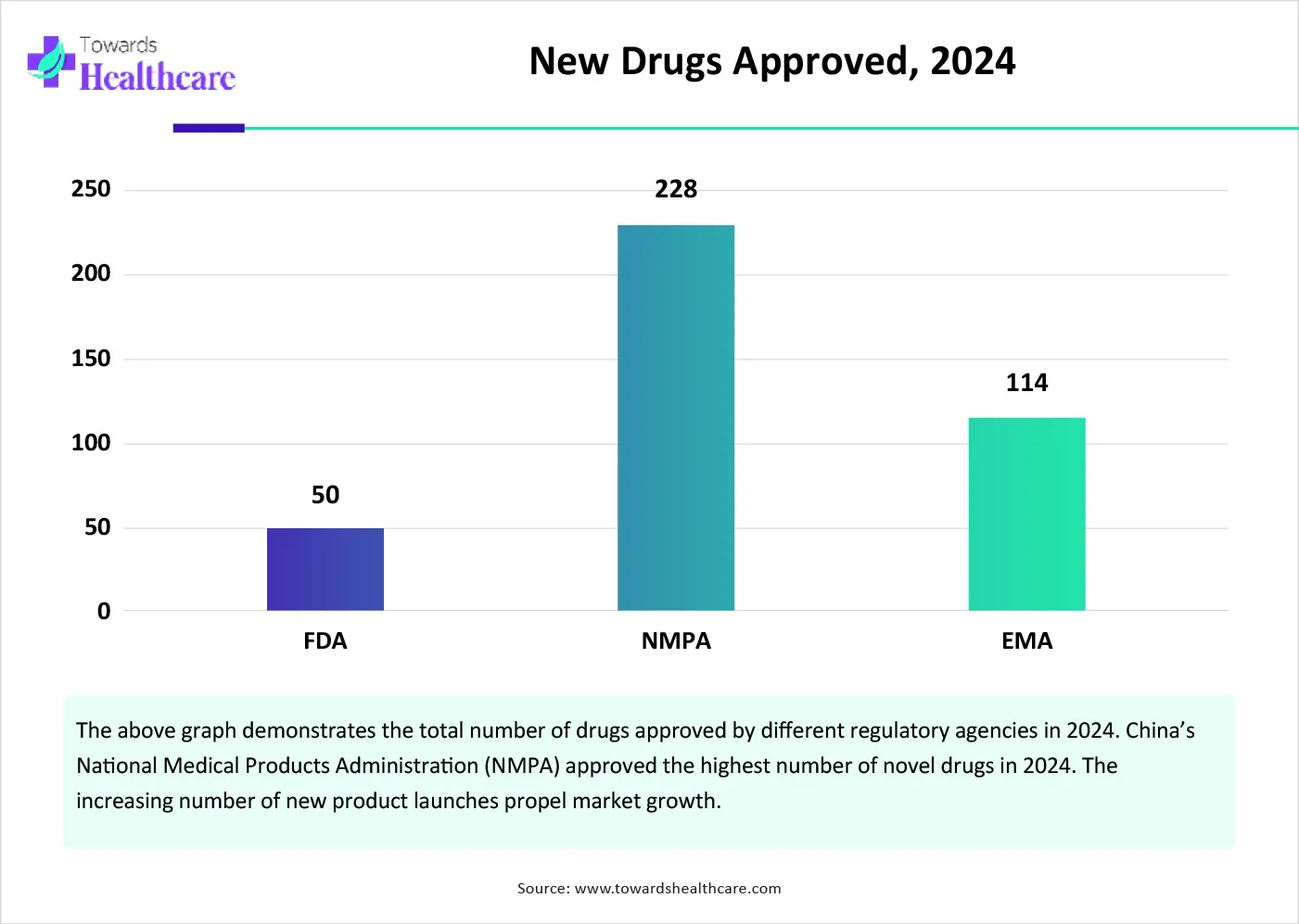

The increasing demand for traditional Chinese medicine (TCM) as a therapeutic for chronic diseases bolsters market growth. The NMPA approved a total of 12 novel TCMs in 2024. China reported that nearly 297 million people were 60 years and above in 2023, representing 21.1% of the total population. China recorded an increase of 7,881 integrated medical and elderly care institutions as of 2023. (Source - English)

According to the Longitudinal Ageing Survey of India (LASI), 21% of the elderly population aged 60 years and above suffered from at least one chronic condition. It is anticipated that the elderly population will reach 158.7 million by 2025. The federal government announced the “75/25” initiative to put 75 million people with diabetes and hypertension on Standard Care by 2025. (Source - Azadi ka Amrut Mahotsav)

Europe is expected to grow at a considerable CAGR in the chronic disease treatment market in the upcoming period. Government organizations launch initiatives and provide funding for early diagnosis and treatment of chronic disorders. They also collaborate with global regulatory bodies like the WHO and UNESCO. The rising adoption of advanced technologies and increasing investments foster the market.

Germany accounts for the highest export of pharmaceuticals globally, accounting for $115 billion of exports in 2023. The top importers were the U.S. and Switzerland. (Source - OEC) The total healthcare expenditure in Germany was approximately €494.65 billion in 2023. Germany allocates 12.8% of its GDP to healthcare.

According to a recent survey, 40% of women and 35% of men in the UK had a health condition as of 2024. (Source - Forth with life)In 2023, the UK exported around $24.4 billion of pharmaceutical products, primarily to the U.S., Germany, and Ireland. (Source - OEC)

Ulrike Bauer, Chief Business Officer of Ypsomed Delivery Systems, commented on collaborating with SideKick Health that it enables the company to empower patients with knowledge, real-time insights, and smarter therapy management, improving long-term health outcomes. He also said that by connecting the company’s smart injection devices, real-time data can be collected to track therapy, allowing pharma companies to improve obesity treatment. (Source - PR newswire)

By Disease Type

By Treatment Type

By Drug Class

By Care Delivery Model

By End-User

By Region

February 2026

February 2026

February 2026

January 2026