February 2026

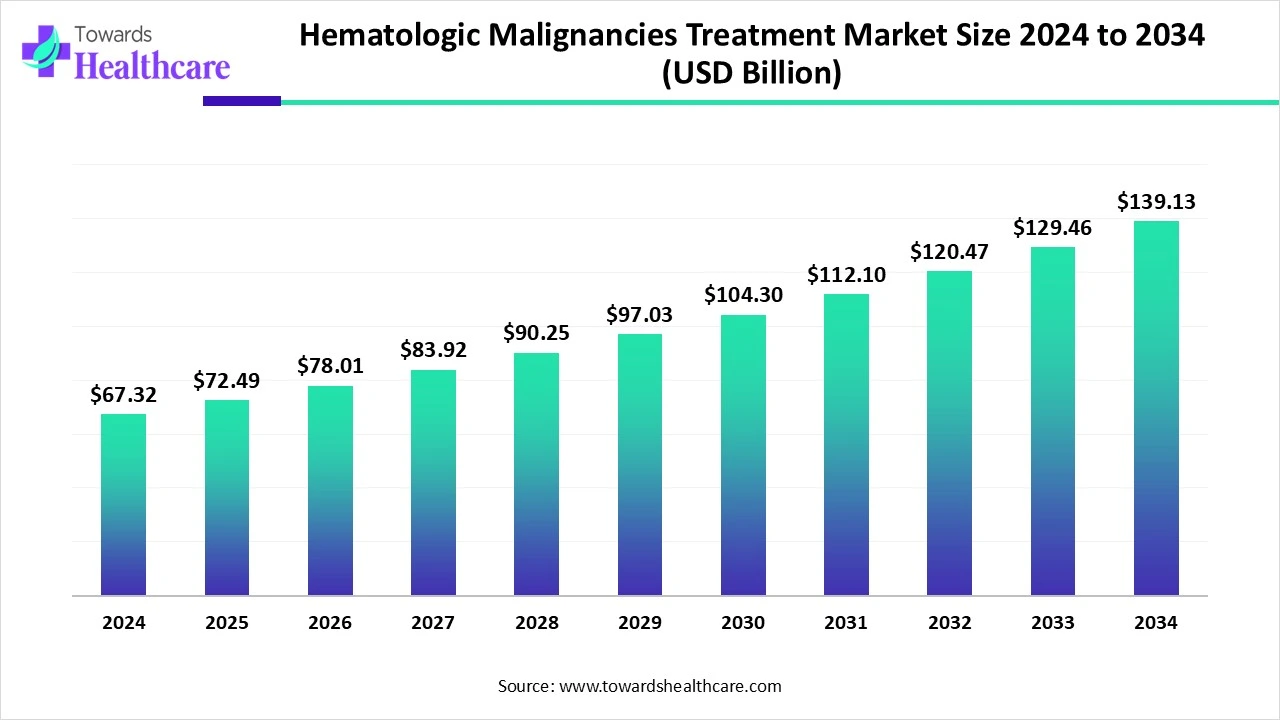

The global hematologic malignancies treatment market size marked US$ 67.32 billion in 2024 and is forecast to experience consistent growth, reaching US$ 72.49 billion in 2025 and US$ 139.13 billion by 2034 at a CAGR of 7.61%.

The hematologic malignancies treatment market is experiencing significant growth due to the rising incidence of blood cancers such as leukemia, lymphoma, and multiple myeloma, along with increasing awareness and early diagnosis. Advances in targeted therapies, immunotherapies like CAR-T cell therapy, and stem cell transplants are driving innovation in treatment options. Growing investments in oncology research, supportive government initiatives, and the expansion of healthcare infrastructure globally are further boosting market expansion. Additionally, the development of personalized medicine and precision oncology is enhancing treatment effectiveness.

| Metric | Details |

| Market Size in 2025 | USD 72.49 Billion |

| Projected Market Size in 2034 | USD 139.13 Billion |

| CAGR (2025 - 2034) | 7.61% |

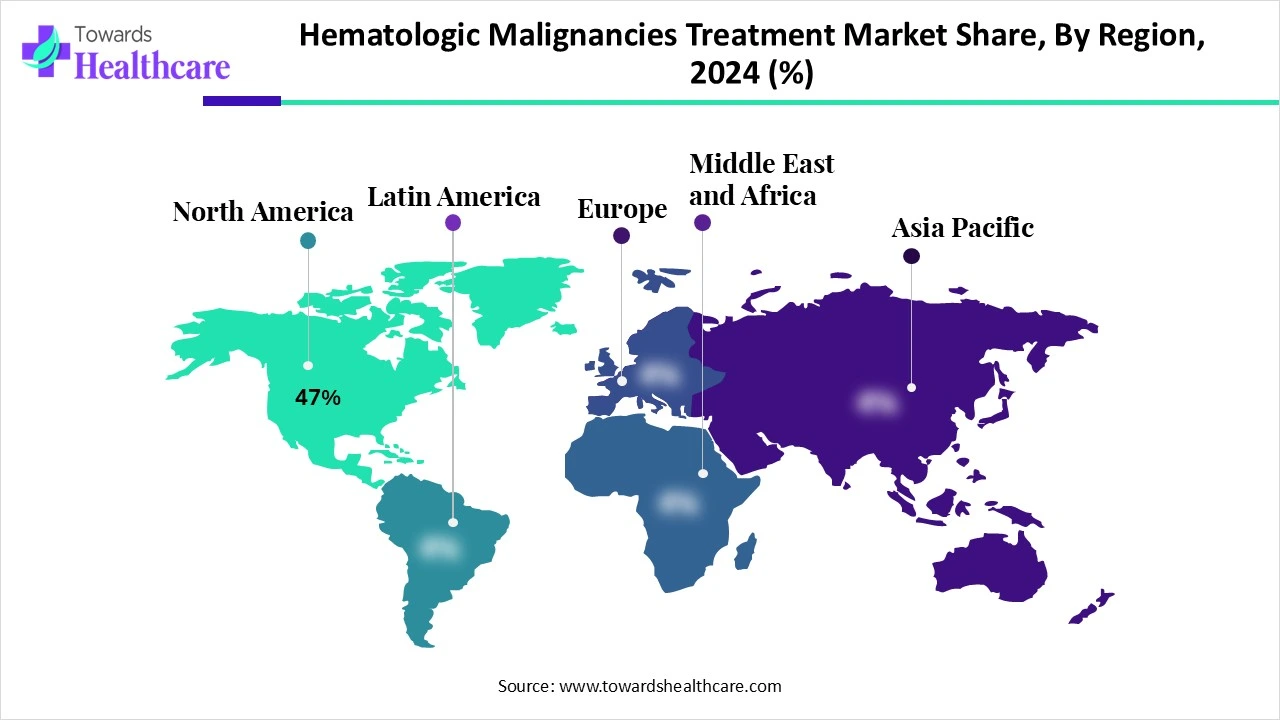

| Leading Region | North America Share 47% |

| Market Segmentation | By Disease Type, By Therapy Type, By Drug Class, By Treatment Line, By End User, By Region |

| Top Key Players | Roche Holding AG, AbbVie Inc., Johnson & Johnson, Novartis AG, Bristol Myers Squibb, Amgen Inc., Gilead Sciences / Kite Pharma, BeiGene Ltd., AstraZeneca, Pfizer Inc., Takeda Pharmaceuticals, Sanofi, Merck & Co., Bluebird Bio, Autolus Therapeutics, MorphoSys AG, Servier Pharmaceuticals, F. Hoffmann-La Roche, ADC Therapeutics, Genmab A/S |

The hematologic malignancies treatment market refers to the industry encompassing therapies used to treat blood cancers, including leukemia, lymphoma, and multiple myeloma. These malignancies arise from abnormal growth and function of blood-forming cells in the bone marrow, lymphatic system, or blood. The treatment landscape is rapidly evolving, fuelled by the integration of targeted therapies, immunotherapies (CAR-T, bispecifics), stem cell transplants, and next-generation small molecules. Advances in genomic profiling, companion diagnostics, and personalized medicine are driving improved outcomes, especially in relapsed/refractory (R/R) settings.

Hematologic malignancies treatment refers to the medical approaches used to manage cancers affecting the blood, bone marrow, and lymphatic system, such as leukemia, lymphoma, and multiple myeloma. These treatments include chemotherapy to kill cancer cells, targeted therapy aimed at specific molecular changes, and immunotherapy to boost the immune response. Radiation therapy is used to destroy localized cancer cells, while stem cell transplants help replace damaged bone marrow. CAR-T cell therapy, a newer immunotherapy, modifies T cells to attack cancer. Treatment choice depends on the cancer type, genetic factors, stage, and patient health, aiming to eliminate cancer and improve survival outcomes.

AI integration can significantly improve the hematologic malignancies treatment market by enhancing diagnostic accuracy, predicting disease progression, and personalizing treatment plans. Through advanced data analysis and machine learning, AI can identify patterns in genetic, clinical, and imaging data, enabling early and precise diagnosis of blood cancers such as leukemia and lymphoma. AI algorithms can help oncologists select the most effective treatment strategies based on individual patient profiles, improving outcomes and reducing trial-and-error approaches. Additionally, AI streamlines drug discovery by analyzing complex biological data, accelerating the development of new targeted therapies. It also supports clinical decision-making and operational efficiency in hospitals.

Rising Incidence of Hematologic Cancers

The rising incidence of hematologic cancers significantly drives the growth of the hematologic malignancies treatment market by increasing the demand for effective therapies and advanced treatment options. As more people are diagnosed with conditions such as leukemia, lymphoma, and multiple myeloma, healthcare providers and systems are compelled to invest in improved diagnostic tools, innovative drugs, and personalized treatment strategies. This growing patient population creates a larger market for pharmaceutical companies and encourages research and development of novel therapies, including immunotherapy and targeted treatments. Additionally, the higher prevalence leads to increased awareness and screening efforts, further supporting early detection and timely intervention, which fuels the continuous expansion and evolution of the hematologic malignancies treatment landscape.

Limited Accessibility in Rural and Developing Areas & Adverse Side Effects of Therapies

Lack of healthcare infrastructure, specialists, and diagnostic facilities in remote regions hampers timely diagnosis and treatment. Advanced therapies such as CAR-T cell therapy, targeted drugs, and stem cell transplants are often expensive, limiting access, especially in low- and middle-income regions. Many hematologic cancer treatments cause serious side effects, which can lead to treatment discontinuation or complications. Stringent regulatory approval processes and long timelines for drug approval can delay the launch of new therapies. In many regions, low awareness about symptoms and screening options delays diagnosis and reduces treatment adoption.

Therapy Advancement & Launch of Advanced Treatment

Advanced Therapeutic Modalities such as CAR T cell therapies, bispecific T cell engagers (BiTEs), antibody drug conjugates (ADCs), and gene editing approaches are expanding treatment options and driving innovation in blood cancers. Combination Regimens that integrate immunotherapies, targeted agents, nanocarrier-based delivery systems, and traditional therapies are showing promise in overcoming resistance and improving patient outcomes.

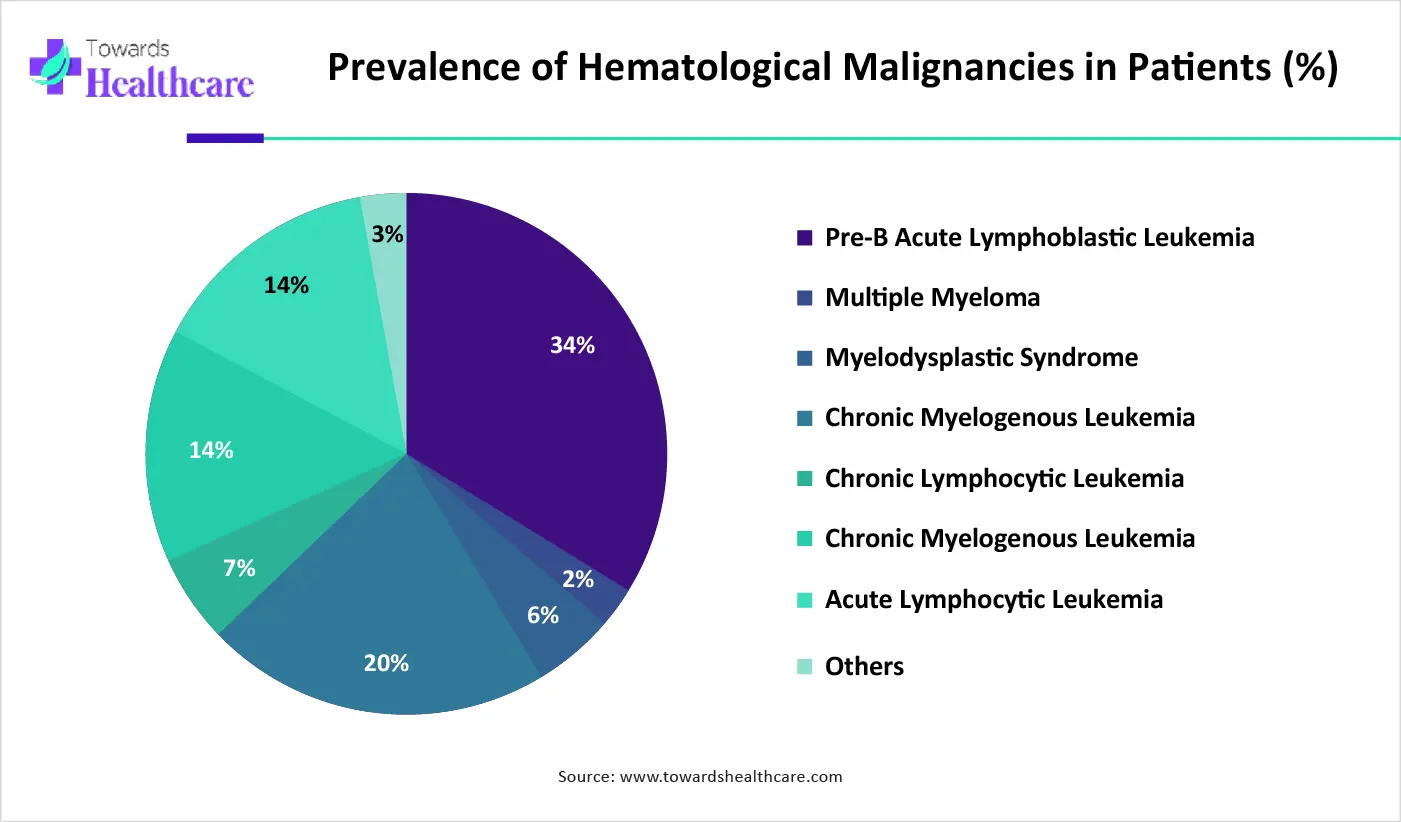

The leukemia segment holds dominance in the hematologic malignancy treatment market due to its high incidence and increasing awareness, leading to early diagnosis and treatment. Advances in targeted therapies, such as tyrosine kinase inhibitors and immunotherapies, have significantly improved survival rates, driving treatment demand. Additionally, the availability of robust clinical pipelines and FDA approvals for novel drugs has expanded therapeutic options. Strong support from healthcare policies and funding for leukemia-specific research further contributes to this segment’s growth. The rising prevalence among both pediatric and adult populations, along with improved diagnostic technologies, reinforces leukemia’s position as the leading segment in the market.

The lymphoma segment is the fastest‑growing in hematologic malignancy treatment due to surging incidence, especially of non‑Hodgkin lymphoma, and expanding awareness and early diagnosis. Innovative immunotherapies, including CAR‑T, bispecific antibodies, checkpoint inhibitors, and antibody‑drug conjugates, are rapidly advancing, driving demand. A strong pipeline of targeted therapies, regulatory fast‑tracking, and precision medicine adoption accelerates approvals and treatment uptake. Rising investment in R&D, improved healthcare access in emerging regions, and expanded use of biosimilars enhance affordability and access, all fueling market momentum.

The targeted therapy segment dominates the hematologic malignancies treatment market due to its precision in attacking specific molecular targets associated with cancer cells, minimizing damage to healthy cells. These therapies, such as monoclonal antibodies, tyrosine kinase inhibitors, and CAR-T cell therapies, offer higher efficacy and reduced side effects compared to traditional treatments. The growing understanding of genetic mutations and biomarkers has enabled the development of personalized medicine, enhancing treatment outcomes. Additionally, the rising number of FDA approvals and ongoing clinical trials for novel targeted drugs further reinforce its leading position, supported by increased healthcare investments and patient demand for advanced therapies.

The immunotherapy segment is the fastest-growing in the hematologic malignancies treatment market due to its groundbreaking ability to harness the body’s immune system to target and destroy cancer cells. Therapies like CAR-T cells, immune checkpoint inhibitors, and bispecific antibodies have shown remarkable success, particularly in refractory and relapsed cases. Increased regulatory approvals, rising clinical trial activity, and strong investment in immuno-oncology research are accelerating adoption. Additionally, patient preference for innovative and less toxic therapies supports the rapid expansion of this segment.

The tyrosine kinase inhibitor (TKI) segment holds a dominant position in the hematologic malignancy treatment market due to its proven efficacy in treating cancers like chronic myeloid leukemia (CML) and acute lymphoblastic leukemia (ALL). TKIs specifically block the activity of abnormal tyrosine kinases that drive cancer cell proliferation, offering targeted and less toxic treatment options. Their oral administration enhances patient compliance, and long-term disease control has been achieved in many cases. Continuous innovations, expanded indications, and favorable clinical outcomes have strengthened their clinical adoption. Regulatory approvals of next-generation TKIs further reinforce their dominance in hematologic malignancy treatment protocols.

The Bruton tyrosine kinase (BTK) inhibitors segment is witnessing the fastest growth in the hematologic malignancy treatment market due to their strong effectiveness in treating B-cell malignancies such as chronic lymphocytic leukemia and mantle cell lymphoma. These inhibitors offer targeted action with fewer side effects, improving patient outcomes and quality of life. Growing clinical evidence, expanding indications, and the development of next-generation BTK inhibitors with improved safety profiles are accelerating adoption. Increased regulatory approvals and ongoing trials further support rapid market expansion.

First-line therapy holds dominance in the hematologic malignancy treatment market due to its critical role in initiating cancer management and improving long-term survival outcomes. It is typically the first course of treatment offered after diagnosis and often includes highly effective regimens such as chemotherapy, targeted therapy, or immunotherapy, depending on the cancer subtype. Physicians and healthcare systems prioritize first-line treatments to achieve rapid disease control, reduce tumor burden, and prevent progression. Additionally, the availability of approved drugs, strong clinical guidelines, and increasing awareness among patients further reinforce the demand for first-line therapy, making it the leading treatment phase in this market.

The relapsed or refractory (R/R) therapy segment is the fastest-growing in the hematologic malignancy treatment market due to the rising number of patients who either do not respond to initial treatments or experience disease recurrence. Advances in molecular diagnostics have enabled early identification of resistant cases, prompting the use of innovative therapies such as CAR-T cell therapy, bispecific antibodies, and next-generation targeted agents. Regulatory bodies are increasingly approving novel treatments specifically for R/R cases, driving rapid market adoption. Additionally, unmet clinical needs, growing clinical trial activity, and increased healthcare spending on advanced therapeutics further fuel the segment's accelerated growth.

Hospitals and cancer institutes are the dominant end-user segment in the hematologic malignancy treatment market due to their comprehensive infrastructure, specialized medical staff, and access to advanced diagnostic and therapeutic technologies. These facilities are equipped to administer complex treatments such as chemotherapy, immunotherapy, and stem cell transplants, often required in managing hematologic cancers. Moreover, hospitals and cancer centers are key locations for clinical trials and newly approved therapies, enhancing patient access to cutting-edge care. Their multidisciplinary approach, continuous patient monitoring, and supportive care services further position them as the primary choice for hematologic malignancy treatment.

The home care settings segment is the fastest-growing end-user segment in the hematologic malignancies treatment market due to the rising demand for patient-centric and cost-effective care. Advancements in oral targeted therapies and subcutaneous injections have made at-home administration safer and more feasible. Patients prefer home care for its comfort, convenience, and reduced hospital visits, especially during long-term treatment or palliative care. Additionally, the growing elderly population, improvements in home healthcare infrastructure, and increased adoption of telemedicine and remote monitoring technologies are driving this shift. Supportive insurance policies and healthcare provider initiatives are further encouraging treatment in home care environments.

North America holds a dominant position in the hematologic malignancies treatment market share by 47% in 2024, due to several critical factors. The region benefits from a well-established healthcare infrastructure, advanced diagnostic facilities, and a high level of awareness among patients and healthcare professionals. The strong presence of leading pharmaceutical and biotechnology companies drives continuous research and development of innovative therapies, including CAR-T cell therapy and targeted drugs.

Supportive government initiatives, favourable reimbursement policies, and high healthcare spending contribute to increased treatment accessibility. The rising prevalence of hematologic cancers and the availability of cutting-edge treatment options further boost market growth. Moreover, the region's robust regulatory framework ensures timely approval and availability of new drugs, reinforcing its leadership in this market.

The U.S. market continues to lead due to a steady stream of FDA approvals and novel therapies. In July 2025, Regeneron’s bispecific antibody linvoseltamab (Lynozyfic) was approved for adults with relapsed/refractory multiple myeloma who’ve had at least four prior treatments, adding a new class of T-cell engager to the arsenal. Earlier in 2025, the FDA granted full approval to acalabrutinib (Calquence) for previously untreated mantle cell lymphoma, elevating it from earlier conditional use in relapsed settings. Also that quarter, brentuximab vedotin gained approval (in combination with lenalidomide and rituximab) for relapsed/refractory large B‑cell lymphoma in patients ineligible for stem cell transplant or CAR‑T therapy.

Anito‑cel, a novel BCMA CAR‑T construct achieving 97% overall response and 68% stringent complete response rates in heavily pretreated RRMM patients, with minimal high‑grade cytokine release or neurotoxicity. Complementing CAR‑T expansion, combination regimens are reshaping treatment in lymphoma. POLARGO, a Phase III trial, demonstrated that a regimen combining polatuzumab vedotin with rituximab, gemcitabine, and oxaliplatin reduced death risk by 40% in relapsed/refractory diffuse large B‑cell lymphoma (DLBCL) patients ineligible for transplant, offering better bridging to CAR‑T therapy.

In Canada, recent Health Canada approvals and home‑grown clinical initiatives have strengthened the hematologic malignancies treatment landscape. In January 2025, Breyanzi (lisocabtagene maraleucel), a CD19-directed CAR‑T therapy, received approval for second‑line treatment of relapsed or refractory diffuse large B‑cell lymphoma (DLBCL) and related subtypes, providing an earlier personalized option for eligible patients; reimbursement recommendations have already been issued in Ontario and Quebec. For multiple myeloma, Elrexfio (elranatamab), a BCMA‑CD3 bispecific antibody, received Health Canada conditional market approval in February 2024 for patients with relapsed/refractory disease after at least three prior therapies.

Canada also has five authorized CAR‑T therapies (Breyanzi, Carvykti, Kymriah, Tecartus, Yescarta), with Health Canada conducting safety reviews regarding the possible risk of secondary T‑cell malignancy, underscoring the growing maturity and caution in deployment. In addition, Canada‑led clinical innovation is underway: BioCanRx supports the development of novel CAR‑T constructs, including CD22‑targeted and MesoCAR platforms, with the aim of starting Canadian phase I trials by 2026. This bolsters in‑country manufacturing, lowers treatment costs, and enhances research sovereignty.

Asia‑Pacific is the fastest-growing region in the hematologic malignancies treatment market, driven by several converging factors. The region’s large and aging population, especially in China, India, and Japan, results in a high incidence of blood cancers, increasing demand for advanced therapies. Improved healthcare infrastructure, greater expenditure, and rising public awareness are expanding access to diagnosis and treatment across urban centers. Regulatory reforms speeding up approvals, plus growing global–local collaboration, have accelerated access to innovative therapies like CAR‑T and targeted agents.

China’s National Medical Products Administration (NMPA) approved two locally produced CD19-directed CAR‑T cell therapies, Axicabtagene ciloleucel (FKC876) and Relmacabtagene autoleucel, for relapsed/refractory large B‑cell lymphoma, signaling the emergence of domestic cell therapy manufacturing and broadening regional treatment options. Meanwhile, Japan and India are becoming hubs for CAR‑T adoption and trials, with India’s Central Drugs Standard Control Organization approving Actalycabtagene autoleucel (NexCAR19) for relapsed/refractory B‑cell lymphomas and leukemia.

Additionally, China leads the world in CAR‑T clinical trial activity, fuelled by streamlined approvals, domestic biotechs, and strong government support for R&D and capital deployment. These elements, patient base, regulatory acceleration, domestic innovation, and international partnerships, are propelling rapid regional growth and expanding access to cutting-edge hematologic cancer therapies.

India has recently advanced its treatment infrastructure with native cell‐and‐gene therapies. In October 2023, NexCAR19 (talicabtagene autoleucel) became the nation’s first indigenously developed CAR‑T therapy, approved by CDSCO for relapsed/refractory B‑cell leukemia and lymphoma; phase I/II trials showed a ~73 % response rate and it’s priced at roughly Rs. 30–40 lakh (~USD 30 000–48 000) dramatically lower than global equivalents.

India made history in the treatment of cancer in April 2024 when NexCAR19, the country's first domestically produced CAR-T cell therapy, was introduced. This was made possible by a groundbreaking partnership between ImmunoACT, Tata Memorial Centre, and IT Bombay. This innovative technology provides a next-generation, extremely effective blood treatment for cancer, giving thousands of people hope. NexCAR19 is a significant step toward oncology care self-reliance because it is accessible and reasonably priced, lowering reliance on costly foreign treatments and enhancing India's standing in cutting-edge biotechnology research and cancer treatment.

Europe is experiencing notable growth in the hematologic malignancies treatment market, driven by several key factors. First, the region boasts robust universal healthcare systems in countries like the U.K., Germany, and France, which ensure broad patient access to advanced therapies through public reimbursement mechanisms. The European Medicines Agency (EMA) and national regulators such as MHRA have streamlined approval pathways, enabling early access to breakthrough treatments, including Glofitamab (Columvi) for relapsed/refractory diffuse large B‑cell lymphoma, approved in the EU in July 2023.

In 2024, EMA’s CHMP recommended an expanded indication for Carvykti (ciltacabtagene autoleucel), allowing its use after just one prior therapy in multiple myeloma, advancing earlier line CAR‑T cell deployment across Europe. Additionally, the UK became the first globally to offer GSK’s "Trojan horse" antibody-drug conjugate, Blenrep (belantamab mafodotin), through its NHS system for multiple myeloma patients who have failed frontline therapy, marking a major achievement in patient access to next-gen ADCs. Europe also benefits from cutting-edge diagnostic adoption (e.g., next-generation sequencing collaborations in Germany) and strong public–private research networks supporting molecular profiling and precision oncology.

In Spain, a breakthrough academic achievement occurred when the hospital-exempt CAR-T construct ARI‑0001 (CART19‑BE‑01) received regulatory sanction under a national hospital exemption. This in-house CD19-directed therapy offers efficacy comparable to commercial products at roughly one-third the cost, enhancing affordability and research autonomy. Meanwhile, in the UK, early adoption of tezclistamab (Tecvayli), a bispecific T-cell engager targeting BCMA, was supported by EMA approval in mid-2022 for relapsed multiple myeloma, followed by NICE appraisal and NHS reimbursement, increasing patient access to novel bispecific immunotherapy. Countries like Italy, Sweden, and Belgium are participating in cross‑country clinical networks and precision diagnostics initiatives such as German-Dutch sequencing collaborations, facilitating molecular profiling and earlier detection of hematologic malignancies and enabling evidence‑driven therapy selection.

In May 2025, General Partner Jasper Bos of Forbion, who will be joining the CellCentric Board, stated that CellCentric has created a novel and effective treatment for Inobrodib is a first-in-class oral p300/CBP inhibitor used to treat multiple myeloma. This novel agent has shown encouraging efficacy and a controllable safety profile in preliminary clinical studies. The general partner is excited to back CellCentric because it pushes inobrodib into registration research with the goal of changing several treatments for myeloma at different phases of the illness.

By Disease Type

By Therapy Type

By Drug Class

By Treatment Line

By End User

By Region

February 2026

January 2026

January 2026

January 2026