October 2025

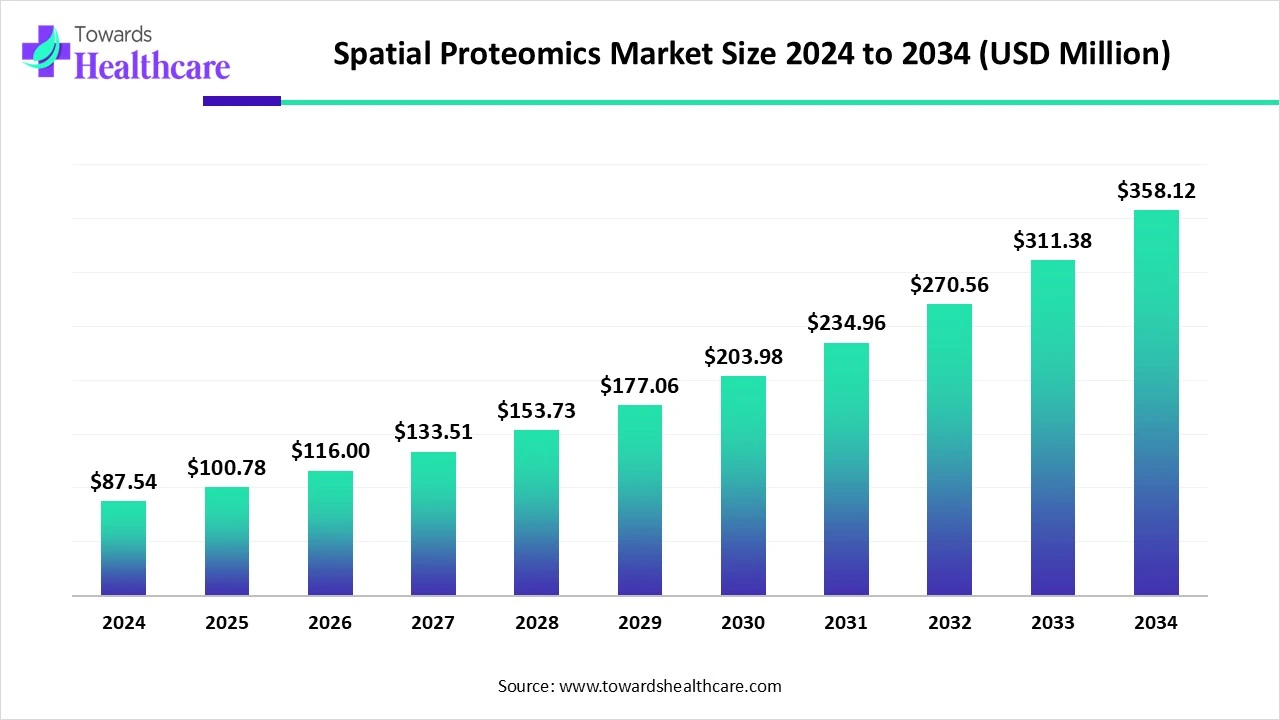

The global spatial proteomics market size is calculated at US$ 87.54 million in 2024, grew to US$ 100.78 million in 2025, and is projected to reach around US$ 358.12 million by 2034. The market is expanding at a CAGR of 15.14% between 2025 and 2034.

Because of the quick developments in mass spectrometry, imaging technologies, and bioinformatics tools, the market for spatial proteomics is quite inventive. Analysing proteins in their original tissue context with high resolution and specificity has been transformed by methods like Digital Spatial Profiling (DSP), Multiplexed Ion Beam Imaging (MIBI), and Imaging Mass Cytometry (IMC). The industry is among the most dynamic and rapidly changing sectors because of these cutting-edge technologies, which allow researchers to obtain a greater understanding of biological activities and disease causes. With more and more applications in areas including immunology, neurology, infectious diseases, and cancer, the market is expanding significantly.

| Metric | Details |

| Market Size in 2025 | USD 100.78 Million |

| Projected Market Size in 2034 | USD 358.12 Million |

| CAGR (2025 - 2034) | 15.14% |

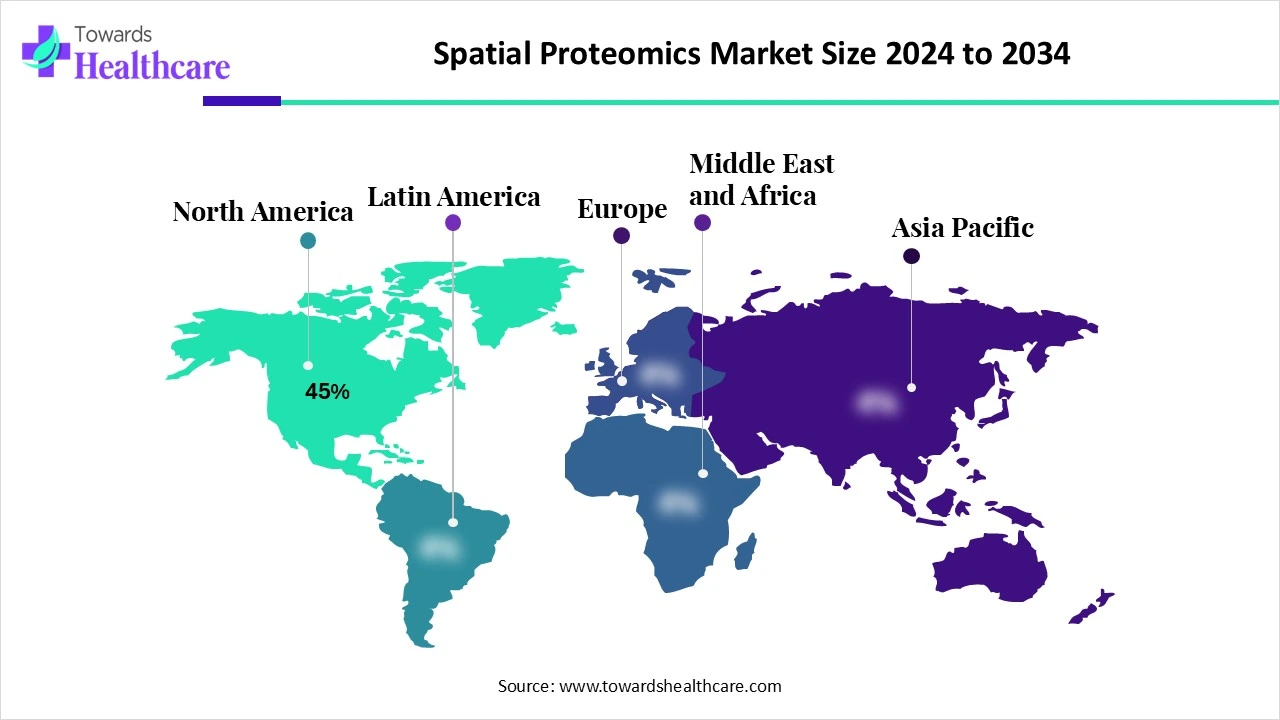

| Leading Region | North America Share by 45% |

| Market Segmentation | By Technology, By Sample Type, By Application, By End User, By Region |

| Top Key Players | Nikon Instruments Inc., Thermo Fisher Scientific Inc., Bruker Corporation, Fluidigm Corporation (Standard BioTools), NanoString Technologies, Inc., Akoya Biosciences, Inc., 10x Genomics, Inc., Leica Microsystems (Danaher Corporation), Abcam plc, Cell Signaling Technology, Inc., Roche Diagnostics, Meso Scale Diagnostics, LLC., Bio-Techne Corporation, Indica Labs, Inc., Biognosys AG, Lunaphore Technologies SA, Vectra (part of Akoya Biosciences), Ionpath Inc., Canopy Biosciences (a Bruker company), CytoMol Biosciences |

The spatial proteomics market refers to the ecosystem of technologies, platforms, and services designed to analyze and map the spatial distribution of proteins within tissues, cells, or organ systems, maintaining their native architecture. Unlike conventional proteomics, which often loses spatial context due to sample homogenization, spatial proteomics allows researchers to study protein expression, localization, interactions, and post-translational modifications in a high-resolution, tissue-specific context. This market has emerged as a powerful approach in oncology, neurology, immunology, and drug discovery, driven by advancements in imaging, mass spectrometry, multiplexed immunohistochemistry, and spatial transcriptomics integration.

Large-scale proteome dataset collecting, insightful extraction, and improved clinical decision-making have all been made possible by artificial intelligence. From data preparation to downstream analysis, artificial intelligence (AI) approaches are particularly useful for managing high-dimensional data. These developments are essential for improving precision medicine, prognosis prediction, and illness diagnostics, which in turn allow for a better comprehension of tumour microenvironments and cellular interactions.

For Instance,

Platforms for Spatial Proteomics

Researchers may now use new technologies to detect proteins or RNA, which bridges the gap between gene expression and high-resolution tissue imaging. Aortic plaques in the human heart, immune infiltration within tumour microenvironments, and even neurobiology, including brain injury models and Alzheimer's disease, can all be studied by scientists and pathologists with the use of automated platforms and improved analysis made possible by machine learning.

Limited Sensitivity is a Challenge

Sensitivity is one of the problems with single-cell and spatial proteomics. Proteins' intrinsic "stickiness," which causes nonspecific adsorption to reaction vessels, limits sensitivity. Consequently, the many sample preparation stages result in sample losses.

Emergence of Single-Cell Proteomics

Localisation and expression of proteins vary among populations of genetically identical isotypic cells. Hence, all areas of biomedical research can benefit from single-cell proteomic analyses. In the upcoming years, single-cell spatial proteomics will have a ton of room for innovation. The promise of personalised precision biomedicine may even be realised for decades to come because of single-cell spatial proteomics, which offers a wealth of novel mechanistic insights into human cell biology and disease processes, while the severity of illness is still therapeutically actionable and reversible.

By technology, the imaging-based spatial proteomics segment held the largest share of the spatial proteomics market in 2024. A potent method for visualising and measuring proteins in their cellular and tissue context is imaging-based spatial proteomics, which blends microscopy with protein analysis methods. Insights into cellular heterogeneity and disease causes can be gained by using this technology to investigate protein expression patterns, protein-protein interactions, and cellular organisation with great spatial resolution.

In the imaging-based spatial proteomics segment, the multiplexed immunofluorescence (mIF) sub-segment dominated the spatial proteomics market in 2024. Because multiplex immunofluorescence (mIF) may give extensive spatial and molecular information, it is being used more and more in translational research. mIF provides multi-marker, highly quantitative data that might potentially scale to hyperplex levels.

By technology, the spatial transcriptomics couple with proteomics segment is estimated to grow at the highest rate during 2025-2034. Researchers have significantly increased the precision of differential gene expression analysis across tissue areas by combining spatial transcriptomics with protein markers. We can now map the spatial organisation of tissues, including cell kinds, activities, and cell-to-cell connections, like never before, thanks to this fascinating technology.

By sample type, the tissue samples segment was dominant in the spatial proteomics market in 2024. To examine cellular activity in both healthy and pathological conditions, spatial molecular profiling of complex tissues is crucial. Human tissues and organs are incredibly intricate structures made up of several cell types arranged in well-specified spatial patterns. Numerous methods have been created to describe the biomolecules' spatial distribution in human tissues. The two that are most frequently employed are immunohistochemistry and immunofluorescence.

In the tissue samples segment, the FFPE (Formalin-Fixed Paraffin-Embedded) sub-segment held the major share of the spatial proteomics market in 2024. In spatial proteomics, formalin-fixed paraffin-embedded (FFPE) tissues are a crucial component. Since spatial proteomics is expanding so quickly, FFPE tissues may be a more convenient substitute for frozen tissues, which are more often employed. Large-scale investigations are made easier by the vast collections of FFPE samples in pathology archives and biobanks, which help identify the genetic changes, biomarkers, and molecular markers linked to various diseases.

By sample type, the organoids segment is anticipated to witness the highest CAGR during the upcoming timeframe. Stem cell-derived organoids have grown in importance as a tool for disease modelling and human development research. From in vitro human development models to customised cancer treatments, the recent advancement of human three-dimensional organoid cultures has created new possibilities. The traditional understanding of human development and disease is expanding thanks to these novel in vitro systems.

By application, the cancer research segment led the spatial proteomics market in 2024. Spatial proteomics is a potent approach that may identify proteins or cell types linked to aggressive cancer, which can act as new biomarkers, and distinguish changed cancer pathways. In a similar vein, spatial transcriptomics has been effective in locating biomarkers linked to aggressive behaviours and early-onset malignancies, opening the door to new targeted treatments.

By application, the drug discovery & development segment is estimated to be the fastest-growing during the forecast period. Platforms for spatial biology might speed up the translational process of finding new drugs. By locating possible drug targets and comprehending how medications impact protein interactions and localisation inside cells, spatial proteomics can help with drug discovery. Drugs' effects on protein expression and interactions within tissues can be investigated using spatial proteomics. By using this knowledge, new therapeutic targets can be found, and medication safety and efficacy can be increased.

By end-user, the academic & research institutes segment captured the largest share of the spatial proteomics market in 2024. The area of spatial proteomics, which examines the positions and interactions of proteins in cells and tissues, is one that is expanding quickly in educational and scientific settings. Westlake University, the Max Planck Institute of Biochemistry, and the Helmholtz Zentrum München are among the eminent organisations actively engaged in spatial proteomics research and development. These institutions are helping to develop spatial proteomics methods, data processing, and applications in a number of scientific fields, including infectious illnesses, cancer, and neurology.

By end-user, the pharmaceutical & biotechnology companies segment is anticipated to showcase the fastest growth during the forecast period. Due to its capacity to offer comprehensive insights into protein localisation and interactions within tissues, spatial proteomics is rapidly gaining popularity in the biotechnology and pharmaceutical sectors, supporting the development of new drugs. With businesses utilising spatial proteomics technology to comprehend illness causes and provide tailored treatments, the industry is expanding significantly.

North America dominated the spatial proteomics market in 2024. Several reasons, such as the presence of leading pharmaceutical and biotechnology businesses, significant expenditures in life sciences research, and cutting-edge university research institutes, have contributed to the region's dominant market position. Additionally, several of the top biotechnology and pharmaceutical firms in North America employ spatial proteomics to improve therapeutic development, precision medicine, and drug discovery.

The utilisation of living organisms to produce commodities and services that benefit society has been made possible by the U.S. National Science Foundation's biotechnology investments for decades, which have also expedited scientific discovery. Researchers have won a Nobel Prize in chemistry for their work designing completely new proteins and predicting the structure of proteins based on their amino acid sequence, thanks to NSF financing.

In April 2024, in its pledges, the government budget emphasised investment, research, and regulatory performance, which was well received by the Canadian biotechnology industry. A timely and significant acknowledgement of the strategic significance of securing life science innovation into the general growth of the Canadian economy was provided by the government budget. In order to attract pension fund investment resources into Canada's innovative industries, $200 million has been reinvested in the Venture Resources Catalyst Initiative.

Asia Pacific is estimated to host the fastest-growing spatial proteomics market during the forecast period. This is explained by rising demand for cutting-edge technology, growing research capacities, and increased investments in healthcare infrastructure. Additionally, the expansion of research and academic institutions throughout Asia-Pacific adds to the market's dynamic growth in the area.

The announcement of plans by Chinese scientists might place them at the forefront of global efforts to classify and describe every protein in the human body. The Pilot Hub of Encyclopedical ProteomIX (PHOENIX) is a national laboratory that has been planned for several years and for which the Chinese government also intends to invest 1.2 billion yuan.

With this scientific foundation, proteomics activities and efforts in India developed around the turn of the century. Protein study has long been a specialty of Indian biological research. Central research agencies within the Government of India provide a significant amount of funding for scientific research in India. The Scientific and Industrial Research Council (CSIR) is one of them.

Europe is expected to grow significantly in the spatial proteomics market during the forecast period. Supported by strong scientific, academic, and medical infrastructures. Spatial proteomics technologies are in high demand in the region due to the presence of multiple globally recognised research institutes, government-backed funding, and a growing interest in personalised medicine and drug development. Leading nations, including Germany, France, Switzerland, and the United Kingdom, are at the forefront of the development and use of spatial proteomics technologies. In proteomics and systems biology, where organisations like the European Bioinformatics Institute (EBI) and the Max Planck Institute are at the vanguard, the European market benefits from robust academic and scientific relationships.

Germany has a booming biotech sector. Close collaboration among biotech businesses, research institutes, technology parks, and their local communities remains a key success element. These entities are efficiently coordinated by Germany's biotech cluster organisations. Germany's status as one of the world's top biotechnology R&D ecosystems is supported by the thousands of research projects that firms engage in each year with industry and research institute partners.

In December 2024, the founder and CEO of Syncell, Jung-Chi Liao, expressed his gratitude and honour at Microscoop technology's recognition for its innovative proteomics technique, which has led to new understandings of biological processes. As more researchers become aware of Microscoop's possibilities, spatial proteomics will enable biological study on an ever-larger scale.

By Technology

By Sample Type

By Application

By End User

By Region

October 2025

November 2025

November 2025

November 2025