January 2026

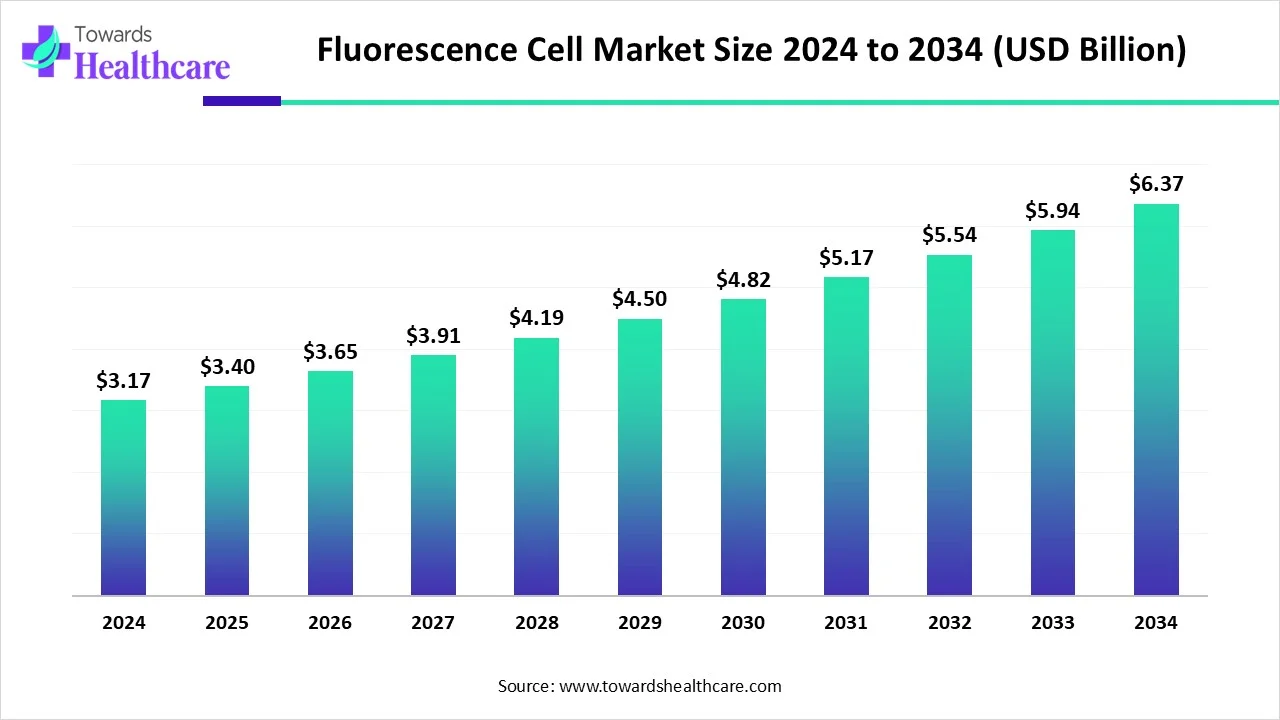

The global fluorescence cell market size is calculated at USD 3.17 billion in 2024, grew to USD 3.4 billion in 2025, and is projected to reach around USD 6.37 billion by 2034. The market is expanding at a CAGR of 7.29% between 2025 and 2034.

The fluorescence cell market is primarily driven by the growing research and development activities. Fluorescent cells are essential for cell imaging, diagnostics, therapeutic monitoring, and genomics. The R&D activities are supported by government initiatives and incentives. The growing demand for personalized medicines leads to the development of novel drugs. The future looks promising, with the advances in cell labelling technologies and the integration of AI/ML in research workflows.

Fluorescence is a phenomenon that involves emitting light by cells that are illuminated with a specific wavelength of light. The color of the light emitted depends on the chemical composition of the cells. The pigments present in fluorescent cells contain fluorescent proteins that potassium ions can activate to track their movement, aggregation, and dispersion. Fluorescent cells have a wide range of applications in various sectors, including analytical chemistry, spectroscopy, lasers, biochemistry, forensics, and medicine.

The major growth factors of the market include growing research and development activities in various fields, including novel drug discovery, diagnostics, and genomics. Fluorescent cells are also used to study disease progression. The increasing investments, collaborations, and mergers & acquisitions promote market growth. The growing need for constant therapeutic monitoring, especially during clinical trials, potentiates the use of fluorescent cells.

Artificial intelligence (AI) can transform the market by automating research workflows and assisting in complex experiments. AI can suggest to researchers the type of fluorophores or dyes used to label cells based on their chemical structure. It can help researchers in developing novel fluorescent dyes for specific cells to enhance their selectivity and specificity. It can automate the fluorescent labeling methods, enhancing efficiency and reducing manual errors. AI can predict the nature of cells and their functionality before incorporating them into imaging or spectroscopic instruments.

New Drug Discovery Research

The major growth factor for the fluorescence cell market is the growing new drug discovery research. The rising prevalence of chronic disorders, such as cancer, infectious disorders, and genetic disorders, necessitates researchers to develop novel drugs for such disorders. Major pharmaceutical giants invest heavily in drug discovery research. Deloitte, an audit and consulting company, reported that the average drug development cost was around $4.3 billion in 2023. The average return on investment from innovation in R&D for the world’s 20 largest pharmaceutical companies increased to 4.1% in 2023. (Source - Deloitte) Fluorescent cells are essential in new drug discovery to visualize the effects of drugs on cells and understand the mechanism of novel drugs.

Lack of Skilled Professionals

The preparation of fluorescent cells using dyes requires skilled professionals for such procedures. Training is also required to operate complex fluorescence equipment and analyze results obtained from research. The lack of skilled professionals, especially in underdeveloped and developing countries, poses a significant challenge to the market.

What is the Future of the Fluorescence Cell Market?

The future of the market is promising, driven by the integration of fluorescent cells in novel biotech technologies, such as CRISPR-Cas9 and regenerative medicines. Integrating fluorescent cells in the CRISPR-Cas9 gene editing technique enables researchers to track gene expression and protein localization in real-time. This helps them to study and analyze complex biological processes. The technique also aids in modeling disease progression and screening for potential drugs. Additionally, fluorescent cells in regenerative medicine present ample opportunities to track the differentiation of regenerative medicine into specific cell types. This provides a detailed idea about the mechanism of regenerative medicines within the body.

By product type, the fluorescence microscopes segment held a dominant presence in the market in 2024. The segmental growth is attributed to the ease of use of microscopes and the capability of revealing the presence of a single molecule. Fluorescence microscopes are used to identify cells and sub-microscopic cellular components with high specificity. They are comparatively cost-effective, increasing the affordability of numerous institutions and companies in developing countries. Technological advancements in imaging quality boost the segment’s growth.

By product type, the fluorescence activated cell sorting (FACS) segment is expected to grow at the fastest CAGR in the market during the forecast period. FACS is a type of flow cytometry used to isolate cells based on their fluorescent and light scattering properties. It is highly specific to isolate cell populations based on size and surface markers. It is widely preferred due to its diverse applications in immunology, cancer biology, and stem cell research. It is also used to sort non-viable cells from viable cells.

By technology, the super-resolution microscopy segment led the global market in 2024. This segment dominated due to high resolution, faster diagnosis, and enhanced sensitivity of super-resolution microscopy. Super-resolution microscopy makes imaging at the nanoscale more accessible and also results in more quantitative results. This technique allows researchers to determine molecule numbers with given techniques, structure size, and track molecules. Continuous advancements in analyzing super-resolution data, including data-driven and machine learning algorithms, augment the segment’s growth.

By technology, the fluorescence lifetime imaging microscopy (FLIM) segment is expected to grow with the highest CAGR in the market during the studied years. FLIM measures fluorescence lifetime, which refers to how long a fluorophore remains in its excited state. It is widely used to explore cellular microenvironments with environmentally sensitive fluorescent probes, characterize various types of tissues, and analyze metabolism and mitochondrial dysfunction in living cells.

By application, the clinical diagnostics segment held the largest revenue share of the market in 2024. This is due to the rising prevalence of chronic disorders and the growing demand for screening and early diagnosis of disorders. Fluorescent cells play a vital role in detecting the presence of specific biomarkers involved in disease progression. They are used in clinical diagnostics due to their high specificity, selectivity, and speed. The increasing demand for non-invasive diagnostic testing also potentiates the use of fluorescence cells.

By application, the pharmaceutical research segment is expected to expand rapidly in the market in the coming years. Fluorescent cells are in high demand for various research purposes, such as new drug discovery, biotechnology, synthetic biology, and analytical chemistry. Researchers can also analyze disease progression using fluorescent cells, enabling them to identify specific targets. The increasing investments in pharmaceutical research and technological advancements also foster the segment’s growth.

By end-user, the pharmaceutical & biotechnology companies segment contributed the biggest revenue share of the market in 2024. This segment dominated because pharma & biotech companies have favorable research infrastructure and suitable capital investment. Major pharma & biotech companies invest heavily in research and manufacturing of products. The two Swiss pharma companies, Novartis and Roche, had the highest R&D spend with $145 billion in 2023, representing an increase of 4.5%. (Source - Deloitte) The increasing collaboration among key players allows them to access cutting-edge technologies, leading to better outcomes.

By end-user, the contract research organizations (CROs) segment is expected to witness the fastest growth in the market over the forecast period. CROs have skilled professionals and specialized equipment to conduct advanced research activities. The increasing number of pharma & biotech startups potentiates the demand for CRO services, as they lack specific equipment and infrastructure. Skilled professionals provide relevant expertise to startups. Large companies also prefer CROs, enabling them to focus on multiple projects simultaneously and product sales.

North America dominated the global market in 2024. The presence of key players, availability of state-of-the-art research and development facilities, and the growing demand for personalized medicines are the major growth factors of the market in North America. Healthcare organizations have a robust infrastructure, encouraging them to adopt cutting-edge technologies. Favorable government support and increasing collaboration among academic researchers and key players boost the market.

Key players, such as Bio-Rad Laboratories, Thermo Fisher Scientific, and Sigma-Aldrich, are the major contributors to the market over the world. The U.S. government supports the development of personalized medicines through the “Precision Medicine Initiative”. The National Human Genome Research Institute (NHGRI) provides funding for genomics and personalized medicines.

The Canadian Institutes of Health Research (CIHR) launched the “Personalized Medicine Signature Initiative” to enhance health outcomes through patient stratification approaches by integrating evidence-based medicines and precision diagnostics into clinical practice. (Source - Canadian Institutes of Health Research)

Asia-Pacific is expected to host the fastest-growing fluorescence cell market in the coming years. The rapidly expanding pharma & biotech sector and the increasing number of startups bolster the demand for fluorescence cells and other related techniques. Several government and private institutions conduct seminars, conferences, and workshops to train individuals regarding complex experiments and create awareness of advanced techniques. The increasing investments by government and private organizations also augment market growth.

The National Health Commission and other regulatory bodies formed an action plan to eradicate dementia by 2030, covering all aspects from prevention and early diagnosis to treatment and rehabilitation. (Source - My news). There are more than 4,000 healthcare startups in China.

India is the second-largest private equity-venture capital destination in Asia-Pacific. Healthcare funding demonstrated an 80% increase in deal volumes by large medtech companies and pharma CDMOs. IIT Bombay organized a “National Workshop on Fluorescence and Raman Spectroscopy” in November 2024 to teach the most complex, modern instrumentations in the area of Fluorescence and Raman spectroscopy. (Source - Fluorescence India)

Europe is expected to grow at a significant CAGR in the fluorescence cell market during the forecast period. Government organizations launch initiatives to encourage the general public to screen and receive early diagnosis of diseases. They also provide funding for research activities. The growing research and development activities and the rising adoption of advanced technologies propel the market. The presence of key players provides cutting-edge technologies to companies and institutions in Europe. Sartorius AG, Sysmex Europe, and Carl Zeiss AB majorly contribute to market growth in Europe.

In August 2024, ImCheck Therapeutics announced that it received EUR 20.18 million as part of the France 2030 Plan to deliver 20 innovative biomedicines by the end of the decade. The funding also enables ImCheck Therapeutics to accelerate the progress of two breakthrough programs in cancer and infectious diseases. (Source - Biospace)

Jan-Willem van Bree, Chief Technical Officer at CytoSMART Technologies, commented that automated imaging at regular time intervals can increase the temporal resolution of the fluorescent data, leading to more relevant data about cellular processes. Researchers can determine if a certain process has occurred and the process speed. (Source - Labmate)

By Product Type

By Technology

By Application

By End-User

By Region

January 2026

January 2026

January 2026

January 2026