December 2025

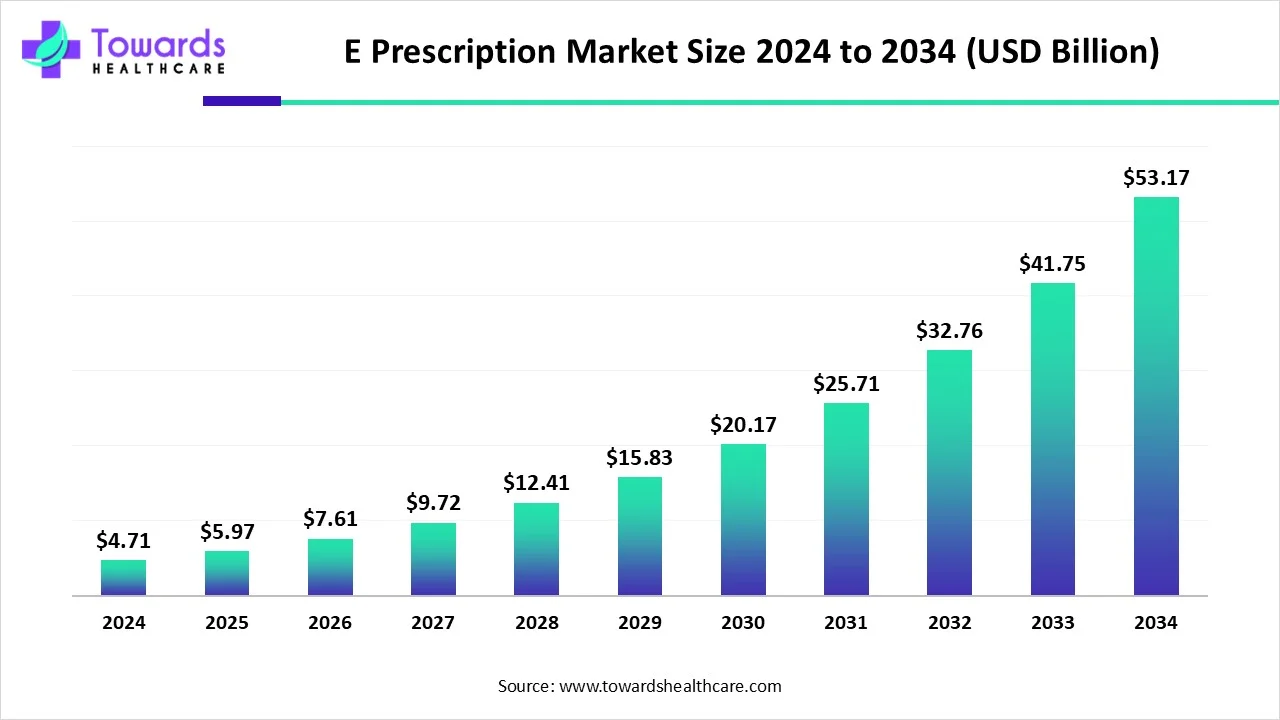

The global E-prescription market size is calculated at USD 4.71 billion in 2024, grew to USD 5.97 billion in 2025, and is projected to reach around USD 53.17 billion by 2034. The market is expanding at a CAGR of 26.84% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 4.71 Billion |

| Projected Market Size in 2034 | USD 53.17 Billion |

| CAGR (2025 - 2034) | 26.84% |

| Leading Region | North America |

| Market Segmentation | By Product, By Delivery Mode, By End-Use, By Usage Methods, By Substances, By Specialties, By Region |

| Top Key Players |

AdvancedMD, DoseSpot, DrFirst, FredIT, iCoreConnect, Inc., MDToolbox, PharmacyX, PracticeSuite, Practice Fusion, RXNT, Surescripts, Veradigm |

E-prescription or electronic prescription is a system that generates and transmits prescription orders from healthcare providers to patients and pharmacies. It eliminates the need for handwritten prescriptions, thereby reducing medication errors. It can also improve healthcare quality and patient safety by assessing drug interactions and preventing allergies. The e-prescription system helps healthcare providers limit the risk of unauthorized dispensing and misuse of medications.

The growing number of patient visits to hospitals or clinics due to the rising prevalence of chronic disorders boosts the market. Healthcare providers aim to reduce errors due to the increasing number of patients in a healthcare setting. Several government organizations support the adoption of electronic systems to enhance patient care. The COVID-19 post-pandemic era has increased the demand for paperless systems, preventing the spread of infections. The rising need for telemedicine services and precision medicine favors market growth.

Artificial intelligence (AI) plays a vital role in suggesting appropriate medications to patients based on their conditions and medication history. It can also suggest the potential risk of adverse effects by analyzing previous records. AI can introduce automation, reducing the number of quality and safety alerts for patients and pharmacists. It can also save a lot of time for pharmacists and providers, ensuring process efficiencies. AI enhances the accuracy and efficiency of prescriptions. AI-enabled natural language processing (NLP) techniques allow pharmacists to interpret diverse formats of prescriptions. Additionally, an AI-assisted blockchain-enabled smart and secure e-prescription management framework overcomes the challenges of the centralized e-prescription systems.

Environmental Sustainability

The growing need for environmental sustainability encourages healthcare organizations to adopt a paperless system. The world produces around 420 million tons of paper annually, increasing the risk of deforestation. The paper-making process releases certain harmful chemicals into the environment and generates a huge amount of waste. It is estimated that paper accounts for around 26% of the total waste in landfills. Moreover, it is believed that paper distribution and transportation result in carbon-emitting fossil fuels. Numerous government organizations take stringent measures to reduce the environmental burden and promote sustainability. By adopting e-prescription systems, healthcare organizations contribute to environmental sustainability and eliminate the need to maintain physical patient medical records.

High Cost

The major challenge of the e-prescription market is the high cost of system installation. The e-prescription system is purchased on a subscription basis, which limits its adoption. The average cost of this system ranges from $500 to $800 per year per prescriber. Several healthcare organizations, especially in low- and middle-income countries, cannot afford such annual subscriptions. Apart from the installation, the maintenance costs also restrict market growth.

Adoption of Advanced Technologies

The future of the market is promising, driven by the rising adoption of advanced technologies in healthcare organizations. The increasing investments and collaborations are major factors leading to the adoption of advanced technologies, streamlining workflows, and reducing errors. Digitized healthcare processes, such as telemedicine and electronic medical records, increase medication adherence and help reduce the likelihood of patients deferring treatment. The advent of cloud-based technologies enables providers to store and share a vast amount of patient data. These processes allow hospitals and other healthcare organizations to strengthen their market position. Numerous government organizations launch initiatives to promote the adoption of digitized healthcare solutions. In the U.S., around 75% of hospitals use electronic health records.

E-Prescription Market Size, By Product (USD Billion)

| Year | Solutions | Services |

| 2024 | 3.10 | 1.61 |

| 2025 | 3.91 | 2.06 |

| 2026 | 4.85 | 2.72 |

| 2027 | 6.21 | 3.40 |

| 2028 | 7.84 | 4.36 |

| 2029 | 10.12 | 5.35 |

| 2030 | 13.01 | 6.60 |

| 2031 | 16.79 | 8.09 |

| 2032 | 21.59 | 9.97 |

| 2033 | 27.02 | 13.01 |

| 2034 | 34.17 | 16.59 |

By product, the solutions segment held a dominant presence in the market in 2024. This segment dominated because several software companies launch user-friendly systems for hospitals and other healthcare organizations. Incorporating e-prescription solutions enables providers to maintain the privacy of patient medical records. The increasing investments by the government and private organizations boost the segment’s growth. Solutions are more affordable and help providers send their data across multiple platforms.

By product, the services segment is expected to grow at the fastest rate in the market during the forecast period. E-prescription services provide advanced and customized solutions to healthcare providers. Services eliminate the need for extra staff to operate and maintain the software. They also do not need other suitable infrastructure to install the system in a healthcare organization. The lack of expertise to operate complex software also augments the segment’s growth.

By delivery mode, the web/cloud-based segment led the global market in 2024. This is because the advent of advanced technologies, such as cloud systems, enables providers to store and share vast amounts of patient data. Advancements in connectivity technology and the growing adoption of the internet promote the segment’s growth. Providers can access patient data from anywhere and at any time through smartphones, laptops, or desktop computers. Cloud-based system helps to increase the scalability.

By delivery mode, the on-premise segment is anticipated to grow with the highest CAGR in the e-prescription market during the studied years. The increasing investments and the presence of suitable infrastructure promote the adoption of advanced on-premise e-prescription systems. Healthcare providers and other healthcare staff can have complete control over the system. On-premise systems also offer high data security to protect sensitive information. They can be more customized to meet the growing needs of a healthcare organization.

By end-use, the hospitals segment held the largest share of the market in 2024. The increasing number of hospital admissions encourages hospitals to adopt e-prescription systems. Patients mostly prefer hospitals for their treatment due to the presence of skilled professionals and favorable reimbursement policies. The availability of suitable IT infrastructure and capital investment leads to increased adoption of advanced IT systems.

By end-use, the pharmacy segment is projected to expand rapidly in the market in the coming years. Pharmacy stores use e-prescription to receive updates and notifications from hospitals. Doctors can directly send the prescription to the pharmacy stores through their computers. E-prescription allows for more efficient processing of prescriptions and may eliminate steps in the dispensing process, saving pharmacists’ time and efforts. Additionally, e-prescriptions can bypass the entire order entry process, eliminating a step in dispensing and reducing manual errors.

By usage methods, the handheld segment held the major share of the market in 2024. The rising demand for portable systems, such as smartphones and tablets, fosters the segment’s growth. E-prescription systems can be operated from handheld devices, allowing providers to write and transmit prescriptions from anywhere. They enable faster prescription writing and delivery, allowing patients to access their medications more quickly in cases of refills or emergencies.

By usage methods, the computer-based devices segment is anticipated to show lucrative growth during the forecast period. Computer-based devices, such as desktop computers and laptops, are more user-friendly. They offer enhanced safety and accuracy. E-prescription systems provide more features on a computer-based system than on a portable system.

By substances, the controlled substances segment registered its dominance over the global market in 2024. Some examples of controlled substances include opioids, stimulants, depressants, hallucinogens, and anabolic steroids. E-prescription systems can directly transmit prescriptions to pharmacists. Controlled substances cannot be prescribed without a proper prescription to avoid the misuse of drugs. E-prescription reduces fraud and prevents prescription forgery. AI is integrating into such systems to protect against prescriber identity.

By substances, the non-controlled substances segment is predicted to witness the fastest growth in the e-prescription market over the forecast period. Non-controlled substances are medications that do not have significant abuse or dependence potential. The rising prevalence of chronic disorders potentiates the segment’s growth. Approximately 1 in 3 people globally are affected by chronic disorders, necessitating the administration of non-controlled substances for their treatment.

By specialties, the sports medicine segment dominated the global market in 2024. The increasing prevalence of sports injuries and the rising demand for sports participation propel the segment’s growth. The U.S. reports more than 3.5 million injuries annually from about 30 million children and teens participating in some form of organized sports. Providers can prescribe sports medicines quickly using reusable protocols and ready combinations.

By specialties, the cardiology segment is estimated to show the fastest growth in the e-prescription market over the forecast period. The rising prevalence of cardiovascular disorders promotes the use of e-prescription systems. Cardiovascular disorders, such as heart failure and hypertension, require regular filling of monthly medications. E-prescription systems can maintain patient records and reduce medication errors. They help to improve medication adherence and streamline the prescription process.

| Year | North America | Europe | Asia-Pacific | Latin America | Middle East & Africa |

| 2024 | 1.82 | 1.15 | 0.99 | 0.39 | 0.36 |

| 2025 | 2.35 | 1.50 | 1.24 | 0.43 | 0.46 |

| 2026 | 2.94 | 2.01 | 1.47 | 0.50 | 0.66 |

| 2027 | 3.97 | 2.50 | 1.90 | 0.55 | 0.68 |

| 2028 | 4.94 | 3.29 | 2.40 | 0.60 | 0.96 |

| 2029 | 6.16 | 4.34 | 2.64 | 0.88 | 1.44 |

| 2030 | 7.93 | 5.59 | 3.49 | 1.02 | 1.59 |

| 2031 | 10.46 | 6.78 | 4.75 | 1.30 | 1.60 |

| 2032 | 12.84 | 8.18 | 6.13 | 1.91 | 2.50 |

| 2033 | 15.81 | 10.77 | 7.21 | 2.97 | 3.26 |

| 2034 | 20.30 | 12.78 | 9.03 | 4.14 | 4.52 |

North America dominated the global e-prescription market in 2024. The presence of key players and technological advancements drives the market. Key players are responsible for launching and distributing advanced tools and software in North America. Advanced healthcare infrastructure and the increasing adoption of digitized healthcare solutions promote the market. Favorable government organizations support the development and adoption of e-prescription systems in healthcare organizations.

According to the Office of the National Coordinator for Health IT, 92% of healthcare professionals e-prescribe medications. The Centers for Medicare and Medicaid Services regulate e-prescribing standards and transactions. Numerous funding programs like the HITECH Act, the SUPPORT Act, ONC Health IT Programs, and NIST provide funding for the adoption of e-prescription systems.

The increasing number of prescriptions encourages healthcare professionals to adopt e-prescription systems. Approximately 750 million prescriptions are dispensed in Canada annually. Around 75% of Canadians wish to send prescription renewal requests electronically.

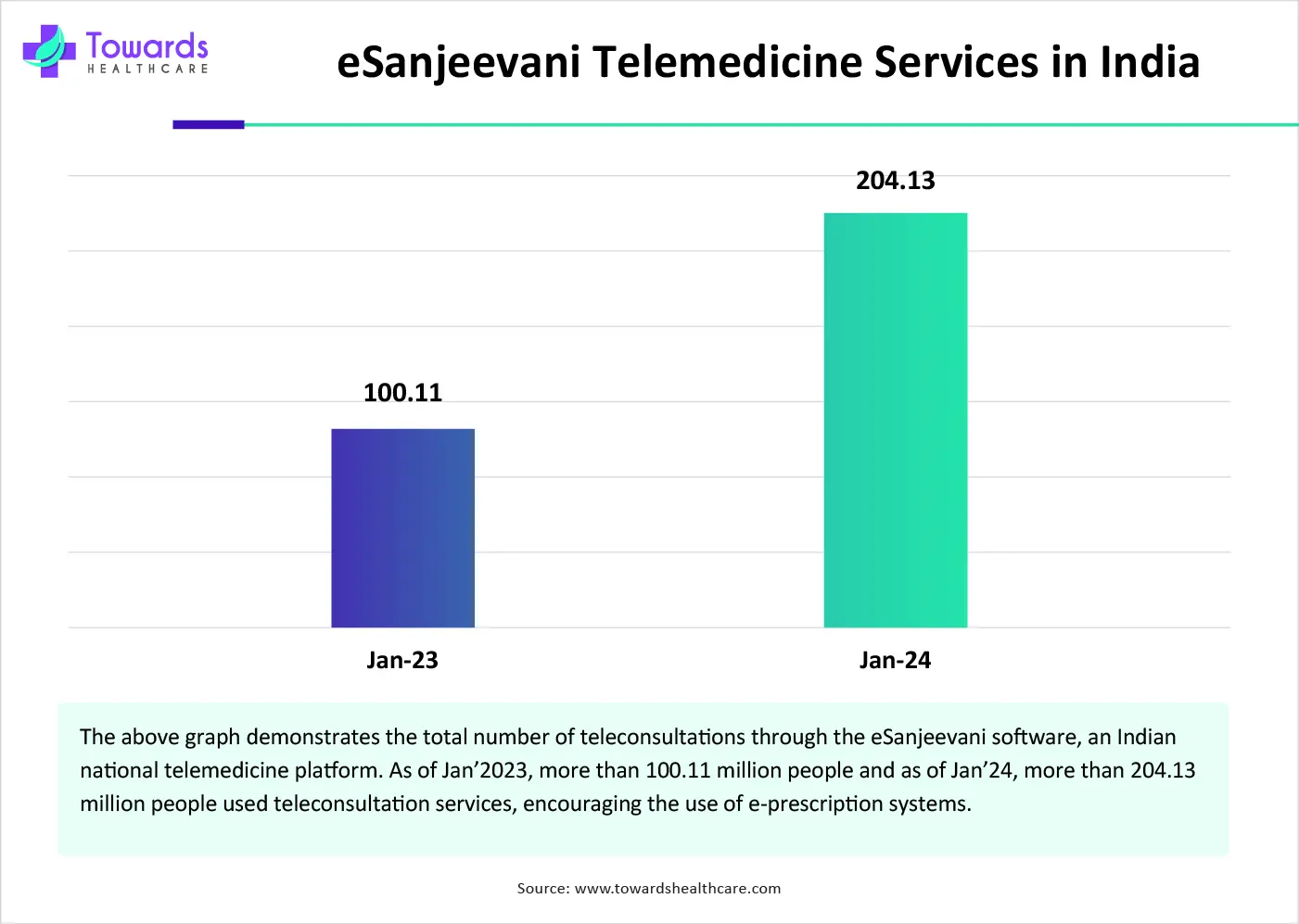

Asia-Pacific is projected to host the fastest-growing e-prescription market in the coming years. The rising adoption of advanced technologies and the burgeoning healthcare sector are the major growth factors of the market. The increasing number of hospitals and the rising need for reduced medication errors promote the installation of e-prescription systems. Several government and private organizations conduct seminars and workshops to create awareness about e-prescription systems. Favorable government policies also support market growth.

The Chinese government announced plans to construct an online prescription system in response to increasing fraudulent insurance claims worth over 100 million yuan ($14 million). Around 26 Chinese provinces have already launched their own online platforms connecting hospitals and pharmacists.

As of January 2024, approximately 189 million e-prescriptions were issued by more than 80,000 prescribers. The Australian government’s “Electronic Prescribing Initiative” aims to make the Pharmaceutical Benefits Scheme (PBS) more efficient and is part of a broader digital health and medicines safety framework, improving healthcare delivery for patients and clinicians.

Europe is considered to be a significantly growing area in the e-prescription market over the coming years. The increasing investments by government and private organizations, and collaborations, foster market growth. The European governments actively support the implementation of e-prescriptions across member states to improve healthcare access and efficiency. The growing awareness about advanced healthcare IT solutions also contributes to market growth. The rising need for advanced healthcare accuracy and precision medicines favors the market.

Since November 2023, six NHS England hospital trusts have begun using the e-prescription service. This includes sending outpatient prescriptions electronically to community pharmacies. In 2023, the number of digital requests rose by more than 45%, amounting to 3.1 million repeat prescriptions a month.

Josh Weiner, CEO of DoseSpot, commented that digital connectivity gives patients transparency and choice with the medications they have never had before. The system has insurance information, providing patients with true price transparency and pharmacy choice. He also said that the company is adhering to strict standards for controlled and uncontrolled substances.

By Product

By Delivery Mode

By End-Use

By Usage Methods

By Substances

By Specialties

By Region

December 2025

November 2025

November 2025

February 2026