December 2025

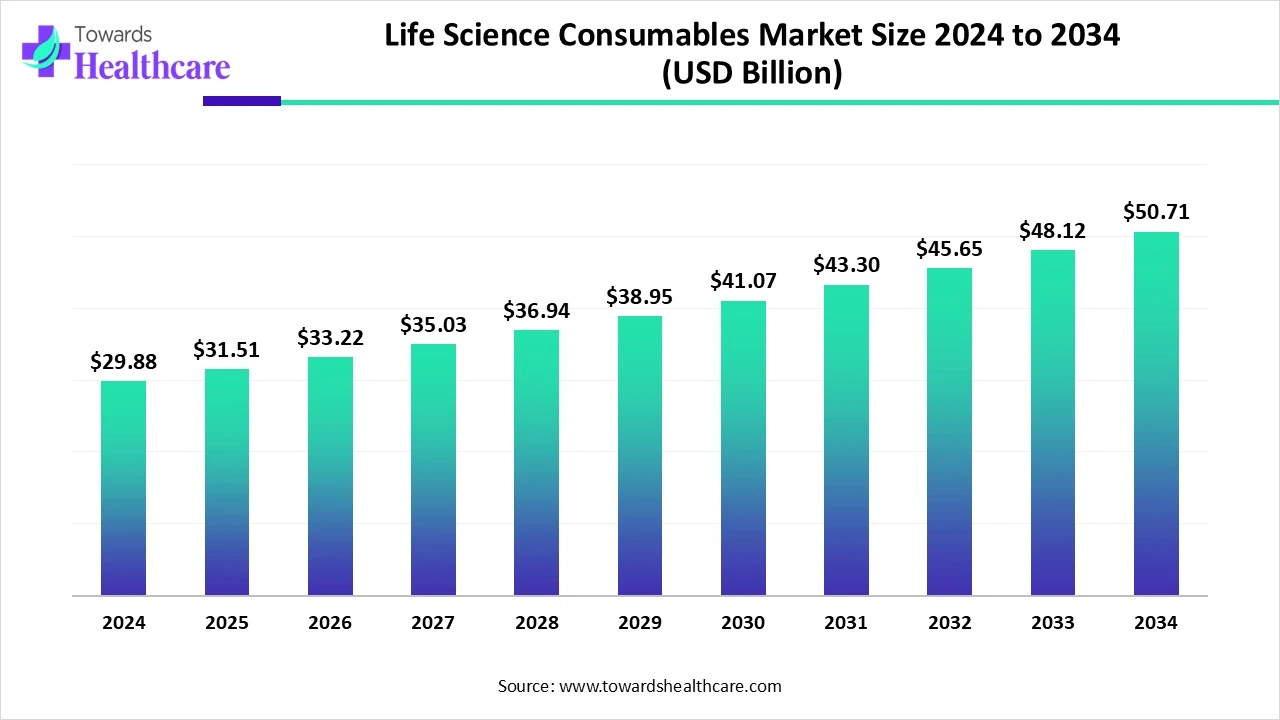

The global life science consumables market size is calculated at US$ 29.88 billion in 2024, grew to US$ 31.51 billion in 2025, and is projected to reach around US$ 50.71 billion by 2034. The market is expanding at a CAGR of 5.44% between 2025 and 2034.

A vast array of essential laboratory supplies, such as pipette tips, cell culture plates, centrifuge tubes, and specialised disposable laboratory products, are included in life science consumables, which have emerged as the foundation of scientific enquiry. Breakthrough medical discoveries, the growing complexity of research procedures, and the growing research capacities of the worldwide scientific community are all organically tied to the market's growth. Global health issues, personalised medicine, and emerging technologies have all increased demand for high-quality and dependable research consumables.

| Metric | Details |

| Market Size in 2025 | USD 31.51 Billion |

| Projected Market Size in 2034 | USD 50.71 Billion |

| CAGR (2025 - 2034) | 5.44% |

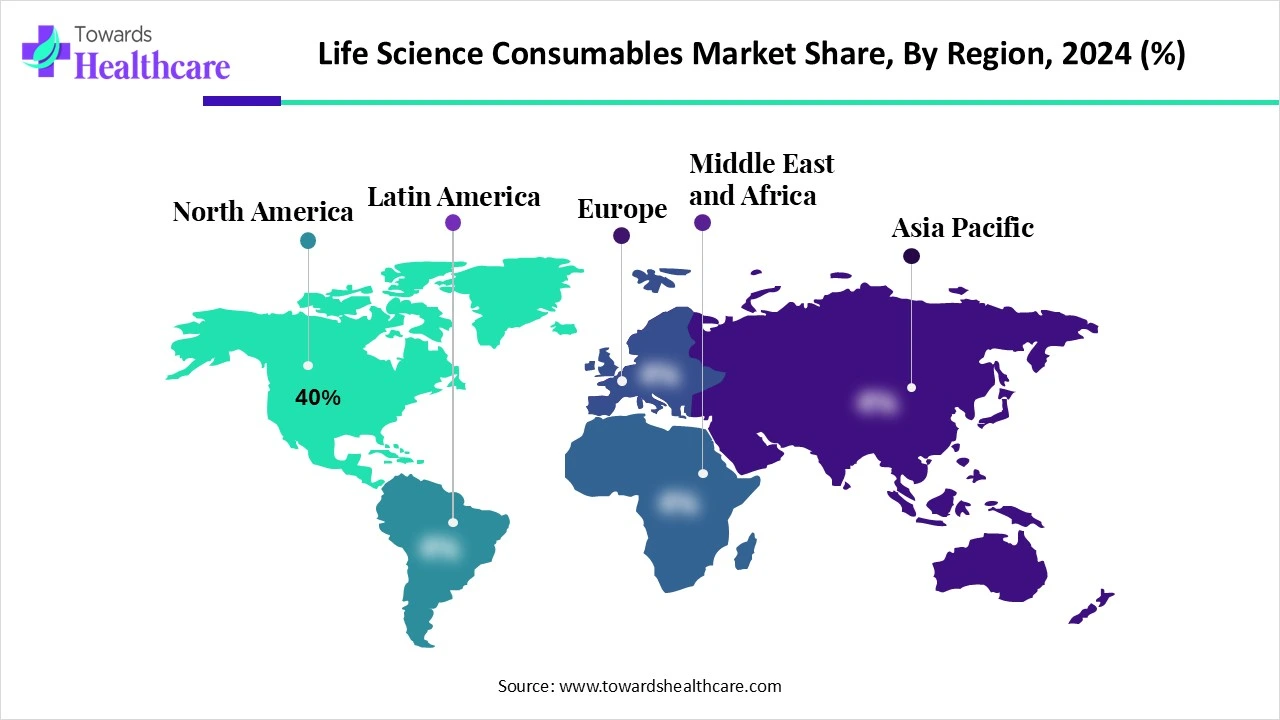

| Leading Region | North America share by 40% |

| Market Segmentation | By Product Type, By Application, By Technology, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Danaher Corporation (Cytiva, Beckman Coulter), Bio-Rad Laboratories, Inc., Agilent Technologies, QIAGEN N.V., PerkinElmer, Inc., Becton, Dickinson and Company (BD), Promega Corporation, Roche Diagnostics, Eppendorf AG, Corning Inc., Lonza Group Ltd., Illumina, Inc., Takara Bio Inc., Sartorius AG, New England Biolabs (NEB), Avantor, Inc., Sigma-Aldrich (Now part of Merck), Abcam plc |

The life science consumables market comprises a wide range of products that are used once or for a limited number of times in laboratory experiments, diagnostics, and biopharmaceutical production. These include reagents, kits, assays, media, labware, and plasticware that are essential for molecular biology, cell biology, proteomics, genomics, and microbiology workflows. Life science consumables are critical for enabling research reproducibility, reducing contamination, and ensuring reliable analytical results. Growth is driven by increased R&D in pharmaceuticals and biotech, rising adoption of molecular diagnostics, and expansion of cell & gene therapy research.

The convergence of synthetic biology, artificial intelligence, and microfluidics portends a future where reagent creation is not just accelerated but also personalised. In order to increase the efficacy of treatment or the accuracy of diagnosis, think about utilising reagents that are tailored according to an individual's genetic makeup. Researchers may be able to digitally filter in silico reagent libraries before lab validation thanks to AI, which would drastically save costs. PCR kit enzymes can be optimised by machine learning approaches to improve amplification efficiency and thermostability. The use of AI-based image analysis has the potential to improve customer satisfaction and product consistency by automatically detecting contaminants in fluorescence probe batches.

Rising R&D

Numerous factors are contributing to the growth of the life science consumables market. One important factor is the increase in research and development (R&D) efforts, particularly in the fields of genetics, biotechnology, and pharmaceuticals. Because of the growing investment in biopharmaceutical production and the increased prevalence of chronic diseases like cancer and diabetes, there is a greater demand for cell-based treatments. According to the National Institutes of Health (NIH), funding for cancer research alone has surpassed $7 billion annually, which has raised demand for equipment and materials for cell culture.

Regulatory Challenges

Authorities such as the FDA in the US and the EMA in Europe govern consumables used in life science. It can be difficult and time-consuming to comply with these regulations, which can impede the development of new products. This raises the price of tests and kits even more, particularly consumables needed for biologics research.

What Factors are Promoting the Life Science Consumables Market?

The industry is anticipated to increase due to a number of factors. Manufacturers are investigating biodegradable and recyclable consumables as a result of the growing emphasis on eco-friendly materials, which is changing the way products are developed. This change satisfies legal requirements and supports business social responsibility objectives. Custom laboratory supplies made to meet particular research requirements are becoming more and more in demand. Manufacturers are concentrating on adaptable systems that handle a range of applications, improving user experience, and satisfying a variety of research needs. Additionally, businesses are now lowering the risks associated with international shipping by investing in local sourcing and diverse supply chains to guarantee a consistent supply of laboratory consumables.

By product type, the reagents & chemicals segment led the life science consumables market in 2024. Chemicals or chemicals utilised in biological and biomedical research applications are referred to as life science reagents. These chemicals are essential to many laboratory processes that allow researchers to examine, work with, and evaluate biological systems. Reagents used in life sciences are frequently produced with particular properties appropriate for their intended uses and are frequently of high purity.

By product type, the kits & assays segment is estimated to grow at the highest rate during the upcoming period. Proteins, enzymes, and nucleic acids are examples of biological or biochemical substances that are identified and measured using assay kits, which are pre-packaged sets of materials and reagents. Clinical diagnostics, drug development, and life science research commonly employ these kits to standardise and expedite the assaying procedure. One of the many different kinds of test kits that may be broadly categorised into several groups is biological assay kits, which focus on the identification and examination of biological substances and processes.

In the kits & assays segment, the cell-based assay kits sub-segment is expected to grow at the fastest CAGR during the forecast period. Cell-based tests look at biological processes, including apoptosis and cell division. They can also measure the activity of pathways within the cell by looking at the output of the route that affects the behaviour of the cell (or its organelles) or a marker linked to that pathway. Outside of illness research, cellular tests can be utilised for routine evaluations of cell health and viability. Such experiments can also enable studies of cell development, metabolism, and function. There are several different cellular tests that focus on different detection methods.

By application, the molecular biology segment dominated the life science consumables market in 2024. All biological processes are driven by molecular machinery and pathways, which scientists can study thanks to molecular biology and functional genomic reagents and resources. From protein expression, detection, and quantification to gene editing, DNA and RNA, oligos, and qPCR, businesses provide top-notch reagents that are easily accessible for researchers and other customers to make discoveries in both healthy and diseased tissues.

By application, the cell biology segment is anticipated to grow at the highest CAGR during the upcoming period. The following categories apply to the raw materials used in the production of cell therapies: growth factors, kits, reagents, buffers, cell culture medium, and extracellular matrix. Media are thought to be responsible for 15–25% of the manufacturing costs of cell therapy. Therefore, media optimisation is a crucial component for the creation of commercially viable cell therapies. Over eighty stakeholders in this field supply over 450 consumable goods for cell treatment. Numerous collaborations were also formed in this area.

By technology, the cell culture technology segment held the largest revenue share of the life science consumables market in 2024. The term "cell culture consumables" describes a variety of specialised tools and supplies used in laboratories that are necessary for the cultivation, upkeep, and testing of cells in a controlled setting. For researchers in disciplines including drug development, biotechnology, cell biology, and regenerative medicine, these consumables are essential.

By technology, the next-generation sequencing (NGS) segment is estimated to be the fastest-growing during the predicted time. Next-Generation Sequencing is a modern sequencing technology that allows scientists to effectively sequence DNA by reading several short DNA segments at once. The entire genome can be sequenced in a single day thanks to this technique. The 3 billion base pairs that comprise the entire human genome are also analysed multiple times to improve the accuracy of the data generated. Because NGS may be crucial for both diagnosis and research, it employs a variety of consumables.

By end-user, the pharmaceutical & biotechnology companies segment dominated the life science consumables market in 2024. Because more clinical and genetic data will be available to support the development of novel treatments, this field is expected to have a strong growth outlook. The development of new treatments and tests, the success of better diagnostics, and the expansion of the therapeutic pipeline are other important factors that are positively impacting the growth of the market for life science consumables based on pharmaceutical and biotechnology companies

By end-user, the clinical & diagnostics labs segment is estimated to grow at the highest CAGR during 2025-2034. Healthcare facilities known as clinical laboratories offer a variety of laboratory services to help physicians diagnose, treat, and manage patients. The scientists working in these labs are qualified to conduct and evaluate tests on biological specimen samples taken from patients.

North America dominated the life science consumables market share by 40% in 2024. This growth is fueled by a number of causes, including the growing need for accuracy in pharmaceutical manufacture, diagnostics, and medical research. Rapid growth in the biotechnology and pharmaceutical sectors is driving advancements in consumables for life science. The development of environmentally friendly filter materials is also influenced by the push towards sustainable manufacturing. High-end technology adoption is fueled by regulatory requirements from the FDA and other organisations that emphasise strict control. As a result, businesses are making significant investments in R&D to create novel solutions.

Some of the top life science centres in the world are located in the United States. These locations, which range from Boston to San Francisco, draw top talent and capital for the life sciences industry. Boston is a hub for life science professionals, home to the most life science companies and more than 30 colleges and universities. Leading research institutes have contributed to San Diego's widespread recognition as a centre for biomedical research.

Being a major centre for the life sciences worldwide, Canada draws top biosciences, pharmaceutical, and medical technology firms. The market in Canada is expanding thanks to a robust R&D environment, highly qualified people, top-notch academic institutions, extensive research networks, and chances for cooperation in research and skill development.

Asia Pacific is estimated to host the fastest-growing life science consumables market during the forecast period. The entry of foreign market participants into Asian markets, including China, India, and others, is one of the primary factors driving the industry. Additionally, Asian countries are attracting a lot of interest from global market players as a hub for clinical research on novel tests and treatments due to their inexpensive manufacturing and operating expenses.

Around 14 million square feet of research and development (R&D) space is being built in China's top two cities, Beijing and Shanghai, which are leading the world in the construction of life sciences facilities, according to a CBRE report. The building industry is expanding in mainland China's cities due to an ageing population and an increase in health issues. More than 35 million square feet of such research facilities were constructed worldwide last year, with 7.4 million of those buildings located in Beijing and 6.4 million in Shanghai, making up more than a third of the total, according to the data from the real estate consultant. (Source - My News)

A strong focus on innovative research, development projects, and technical advancements has propelled India's life sciences industry's remarkable and steady growth trajectory over time. Numerous businesses have contributed significantly to the sector's growth, which is why this remarkable transformation has been so successful.

Europe is expected to grow significantly in the life science consumables market during the forecast period. Europe's governments and corporate institutions are making significant investments in life sciences research. The demand for premium instruments and reagents is being driven by this infusion of capital. Significant financial assistance is being given for research and innovation in the life sciences industry by programmes like the European Union's Horizon Europe programme. There is a growing trend of cooperation across research organisations, academic institutions, and industrial participants.

Germany is one of the largest and fastest-growing markets for healthcare and life sciences in Europe, and its fourth-largest national economy in the world offers great stability for the life sciences. Germany's leading manufacturers and suppliers power a life science industry that provides patients around the world with an extensive range of medications, medical technology, and medical equipment.

The UK is at the forefront of patient care and medical advancements due to its highly competitive and world-class healthcare and life sciences environment, which generates innovative technologies, medicines, and health systems. The UK model sets the norm because of the tight collaboration between the NHS, industry, academia, government, and other health funders. The UK is a major life sciences hub worldwide, tops Europe in life sciences financing, and comes in third globally in life sciences inward investment.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In February 2025, according to Dr Ovidiu Novac, Senior Scientist and Project Manager (DILI assay kit), CN Bio, toxicological testing is perhaps the most crucial stage in developing a new drug, yet our preclinical methods are currently insufficient, putting drug researchers at risk of costly, late-stage failures. We made the decision to further develop our DILI assay into a simple, all-in-one kit, which was previously available via our CRS, in response to the increasing demand for preclinical toxicological testing that is relevant to humans. The introduction of Human 24 has made it easier for PhysioMimix customers to replicate our industry-leading DILI test in their own lab, which will result in deeper mechanistic understanding of drug-induced hepatoxicity and more confidence in drug candidate advancement into the clinic. (Source - News Medical Life Science)

By Product Type

By Application

By Technology

By End User

By Region

December 2025

November 2025

October 2025

October 2025