February 2026

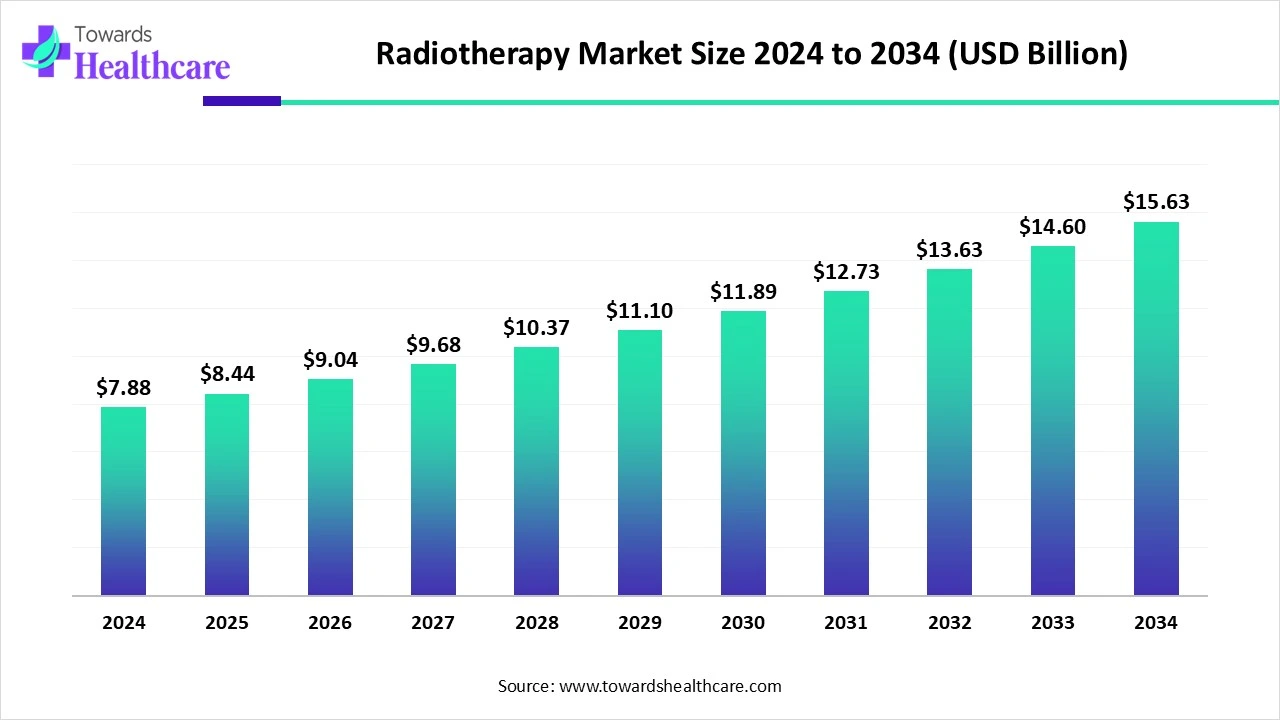

The global radiotherapy market size is calculated at USD 7.88 billion in 2024, grow to USD 8.44 billion in 2025, and is projected to reach around USD 15.63 billion by 2034. The market is projected to expand at a CAGR of 7.09% between 2025 and 2034.

The radiotherapy market is witnessing steady growth driven by the rising incidence of cancer worldwide and advancements in radiation technologies like proton therapy and image-guided radiotherapy. These innovations improve treatment accuracy while minimizing damage to healthy tissues. Increased healthcare spending, growing awareness, and expanding access to cancer care in emerging regions are further fueling market expansion. Additionally, the integration of AI and personalized treatment approaches is enhancing clinical outcomes, making radiotherapy a vital component in modern oncology care.

| Metric | Detail |

| Market Size in 2025 | USD 8.44 Billion |

| Projected Market Size in 2034 | USD 15.63 Billion |

| CAGR (2025 - 2034) | 7.09% |

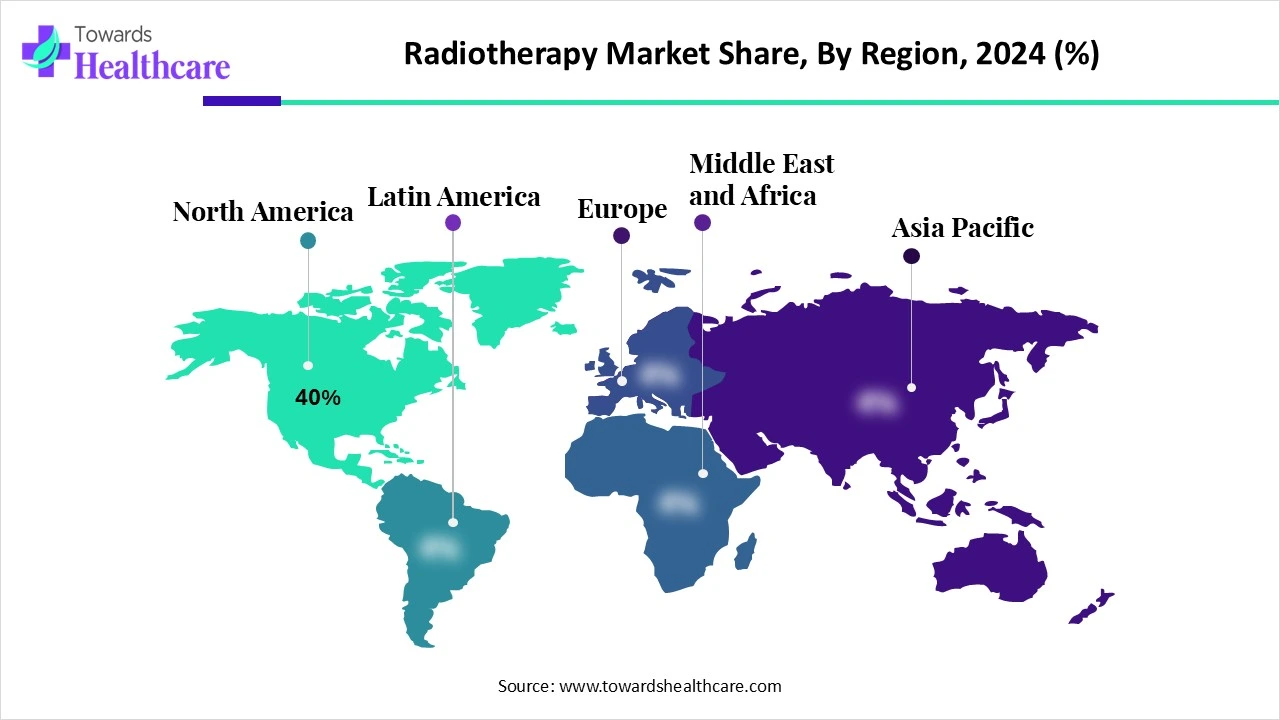

| Leading Region | North America share by 40% |

| Market Segmentation | By Type of Therapy, By Component, By Application, By End User, By Technology, By Region |

| Top Key Players | Varian Medical Systems (Siemens Healthineers), Elekta AB, Accuray Incorporated, ViewRay Inc., IBA (Ion Beam Applications), Mevion Medical Systems, Hitachi Ltd., RefleXion Medical, GE HealthCare, Brainlab AG, Nordion (BWX Technologies), Canon Medical Systems Corporation, Panacea Medical Technologies Pvt. Ltd., Isoray Inc., C-RAD AB, Becton, Dickinson and Company (BD), Philips Healthcare, RaySearch Laboratories, Advanced Oncotherapy PLC, ZAP Surgical Systems Inc. |

The Radiotherapy Market encompasses the medical technologies, equipment, software, and services used to deliver ionizing radiation for the treatment of cancer and certain benign conditions. Radiotherapy aims to destroy or damage cancer cells while minimizing exposure to surrounding healthy tissues. This market includes external beam radiation therapy (EBRT), internal radiation therapy (brachytherapy), and systemic radiotherapy (radiopharmaceuticals). It also involves treatment planning systems, simulation, quality assurance tools, and dosimetry, forming an integral part of comprehensive oncology care. The market is driven by the rising cancer prevalence, technological advancements in radiation therapy, increased healthcare investment, and growing demand for non-invasive treatments that offer improved precision and fewer side effects.

AI is significantly transforming the market by enhancing precision, efficiency, and treatment planning. It enables faster and more accurate tumor detection, automates contouring and dose calculations, and personalizes therapy based on patient-specific data. These advancements reduce treatment time, minimize human error, and improve clinical outcomes. Additionally, AI supports adaptive radiotherapy by analyzing real-time data and adjusting treatment accordingly, making it a vital tool in advancing cancer care and expanding access to high-quality radiotherapy services.

For Instance,

Increasing Global Burden of Cancer

The growing number of cancer cases worldwide is significantly contributing to the expansion of the radiotherapy market. With more patients requiring timely and efficient treatment, radiotherapy has become a critical option due to its ability to precisely target tumors. This increasing reliance on therapies is prompting healthcare providers to invest in modern radiotherapy technologies, leading to greater adoption across hospitals and cancer centers and ultimately fueling market growth.

High Cost of Equipment and Treatment

The expensive nature of radiotherapy equipment and procedures poses a challenge to market expansion, particularly in regions with limited healthcare budgets. The need for specialized facilities, ongoing maintenance, and skilled professionals adds to the overall cost; upgrade these technologies. As a result, access to advanced radiotherapy remains limited in several parts of the world, affecting treatment availability and slowing the growth of the global radiotherapy market.

Integration of Artificial Intelligence and Machine Learning in the Treatment and Planning

Incorporating AI and machine learning into radiotherapy offers a promising future by transforming how treatments are planned and delivered. These technologies enable faster decision-making, optimize dose accuracy, and adapt therapy to patient-specific needs in real time. BY enhancing the precision and effectiveness of radiation delivery, they help improve clinical outcomes while reducing the workload on medical staff. This shift towards intelligent, data-driven solutions is set to advance the quality and accessibility of radiotherapy services globally.

The external beam radiation therapy segment led the radiotherapy market in 2024 due to its non-invasive approach and ability to accurately target tumors while minimizing damage to surrounding healthy tissue. It is widely used for targeting common cancers like breast, prostate, and lung, offering effective results with fewer side effects. The continuous advancements in techniques such as image-guided and intensity-modulated radiation therapy have further improved precision and outcomes, making EBRT the preferred choice among healthcare providers and patients alike.

The proton beam therapy segment is expected to witness the fastest growth in the radiotherapy market due to its advanced ability to deliver focused radiation with minimal exposure to nearby healthy tissue. This makes it especially useful for pediatric cases and hard-to-treat tumors located near vital organs. Growing awareness of its clinical benefits, coupled with increasing investment in proton therapy infrastructure and broader insurance coverage, is encouraging its adoption and driving its rapid expansion in cancer treatment worldwide.

The radiotherapy devices segment dominated the market in 2024 due to the growing demand for advanced treatment systems capable of delivering high-precision radiation. Devices such as linear accelerators and CT-based systems have become central to modern cancer care, with their ability to adapt treatment to patient-specific needs. Ongoing technological improvements, rising cancer cases, and the increasing availability of sophisticated machines in hospitals and cancer centers have further boosted the adoption of these devices across healthcare settings.

The software & services segment is expected to grow rapidly in the radiotherapy market due to rising demand for advanced treatment planning, real-time imaging, and AI-based solutions. These tools enhance precision, automate workflows, and support personalized care. Additionally, increased adoption of digital health systems and cloud platforms is driving the need for efficient, scalable radiotherapy software.

The treatment planning sub-segment is growing rapidly due to increasing demand for accurate, patient-specific radiotherapy. Enhanced imaging technologies and AI integration allow for better tumor targeting and optimized dose distribution. These systems improve treatment outcomes, reduce side effects, and streamline clinical workflows, making them essential in delivering precise and effective cancer care.

The prostate cancer segment led the market in 2024 due to the rising number of diagnosed cases and its strong response to radiation-based treatment. Radiotherapy is commonly used as a primary or adjuvant surgical option for prostate cancer, offering high success rates with minimal invasiveness. Innovation in targeted radiation delivery and growing awareness of early screening have further boosted its use, making it the most dominant application in cancer radiotherapy.

The lung cancer segment is expected to grow rapidly in the radiotherapy market due to the rising number of cases linked to smoking, pollution, and aging populations. Advanced techniques like SBRT and image-guided radiation allow for the precision treatment of tumors in delicate lung tissue. These innovations, along with increased early detection and improved access to care, are driving higher adoption of radiotherapy for lung cancer during the forecast period.

In 2024, the hospitals segment held the largest share in the radiotherapy market due to the widespread availability of comprehensive cancer care services. Hospitals offer integrated treatment options, from diagnosis to therapy, under one roof, making them a preferred choice for patients. Additionally, continuous investments in upgrading radiotherapy infrastructure and expanding oncology departments have strengthened hospitals' role as primary centers for delivering high-quality radiation therapy.

The radiotherapy centers segment is expected to grow at the fastest pace due to its focus on delivering specialized cancer care with advanced, targeted technologies. These centers often operate independently or as part of cancer networks, offering quicker access to treatment and shorter wait times. Their streamlined operations, lower treatment costs compared to hospitals, and growing adoption of modern radiotherapy solutions make them an increasingly attractive choice for both patients and healthcare providers.

The conventional radiotherapy segment dominated the radiotherapy market in 2024 because of its long-standing use in clinical practice and broader accessibility in both developed and developing regions. These systems are easier to operate, require less technical infrastructure, and are widely available in general hospitals. Their reliability in treating common cancers and relatively lower cost compared to advanced techniques have helped maintain strong demand, especially in areas with limited access to cutting-edge radiotherapy solutions.

The adaptive radiotherapy segment is expected to grow at the fastest pace due to its ability to modify treatment based on changes in patients' anatomy or tumor size during the therapy course. This dynamic approach enhancement precision and reduces side effects. With the growing use of advanced imaging and AI tools, clinicians can deliver more personalized, accurate care, making adaptive radiotherapy increasingly valuable in managing complex and evolving cancer cases.

North America dominated the market share by 40% in 2024, due to its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and strong presence of key industry players. Widespread availability of trained professionals, early cancer diagnosis, and growing investments in oncology research further supported the region’s lead. Additionally, favorable reimbursement policies and increased awareness about radiotherapy’s benefits contributed to its high usage, solidifying North America's position at the forefront of the global radiotherapy market.

The U.S. market is expanding due to a significant rise in cancer cases has increased the demand for effective treatment options. Advancements in radiotherapy technologies, such as AI-enhanced imaging and precision targeting, have improved treatment outcomes. Additionally, increased healthcare spending and favorable reimbursement policies have made advanced radiotherapy more accessible to patients, further driving market growth.

The market in Canada is expanding due to the rising number of cancer cases and growing demand for advanced treatment options. Technological innovations such as image-guided and adaptive radiotherapy are improving treatment accuracy and patient outcomes. Government support, increased healthcare funding, and enhanced access to oncology services are also driving growth. Additionally, public awareness of early cancer diagnosis is encouraging the timely use of radiotherapy across the country.

Asia-Pacific is expected to grow at the fastest CAGR in the market due to a rising cancer burden, a growing elderly population, and increasing demand for advanced cancer care. Expanding healthcare infrastructure, government support, and rising investments in oncology are accelerating the adoption of modern radiotherapy technologies. Additionally, improved access to early diagnosis and a growing focus on precision treatment are further driving market growth across the region.

China's market is expanding rapidly due to the country facing a high cancer burden, with over 4.8 million new cases annually, prompting increased demand for effective treatments. Government initiatives like "Healthy China 2030" emphasize early detection and advanced therapies, leading to significant investments in healthcare infrastructure. Additionally, the integration of cutting-edge technologies such as AI-enhanced imaging and adaptive radiotherapy is enhancing treatment precision and outcomes, further propelling market growth.

India's market is expanding due to a rising cancer burden, with over 1.4 million new cases annually. Government initiatives like Ayushman Bharat and the establishment of specialized centers, such as the proposed proton therapy facility at KMIO in Bengaluru, enhance access to advanced treatments. Technological advancements, including AI-driven radiotherapy and precision techniques, further drive growth. Additionally, increased healthcare investments and public-private partnerships are strengthening oncology infrastructure nationwide.

In 2024, Europe is advancing its market through strategic investments in cutting-edge technologies like intensity-modulated radiotherapy (IMRT), stereotactic body radiotherapy (SBRT), and proton therapy. This progression is driven by a rising cancer incidence and supportive government initiatives aimed at enhancing oncology care. Countries such as Germany, France, and the UK are leading with substantial healthcare funding and infrastructure development, ensuring broader access to advanced radiotherapy treatments across the region.

The UK market is expanding due to rising cancer cases and increased government investment in cancer care infrastructure. Initiatives like the £70 million funding for upgrading radiotherapy equipment aim to improve access and reduce treatment delays. Additionally, advancements in precision technologies and AI-driven solutions are enhancing treatment outcomes. These efforts, combined with a growing focus on early diagnosis, are fueling the market's growth across the country.

Germany's market is expanding due to a combination of factors. The country faces a high cancer burden, with over 500,000 new diagnoses annually, prompting increased demand for effective treatments. Government initiatives, such as funding from the German Cancer Aid, support the integration of advanced technologies and AI-based planning systems. Additionally, Germany's strong economy and emphasis on high-tech healthcare delivery facilitate robust market growth in medical radiation therapy devices.

Aster DM Healthcare has become the first in India to introduce Intra-Operative Electron Radiation Therapy (IOeRT) at its Aster Whitefield Hospital in Bengaluru. This advanced technique delivers radiation during surgery, improving precision and reducing recovery time. Alisha Moopen, Deputy MD, stated that IOeRT marks a major step in precision oncology, offering more targeted and less invasive cancer care while enhancing patient comfort and setting new benchmarks in treatment. (Source - Aster Hospitals)

By Type of Therapy

By Component

By Application

By End User

By Technology

By Region

February 2026

February 2026

February 2026

January 2026