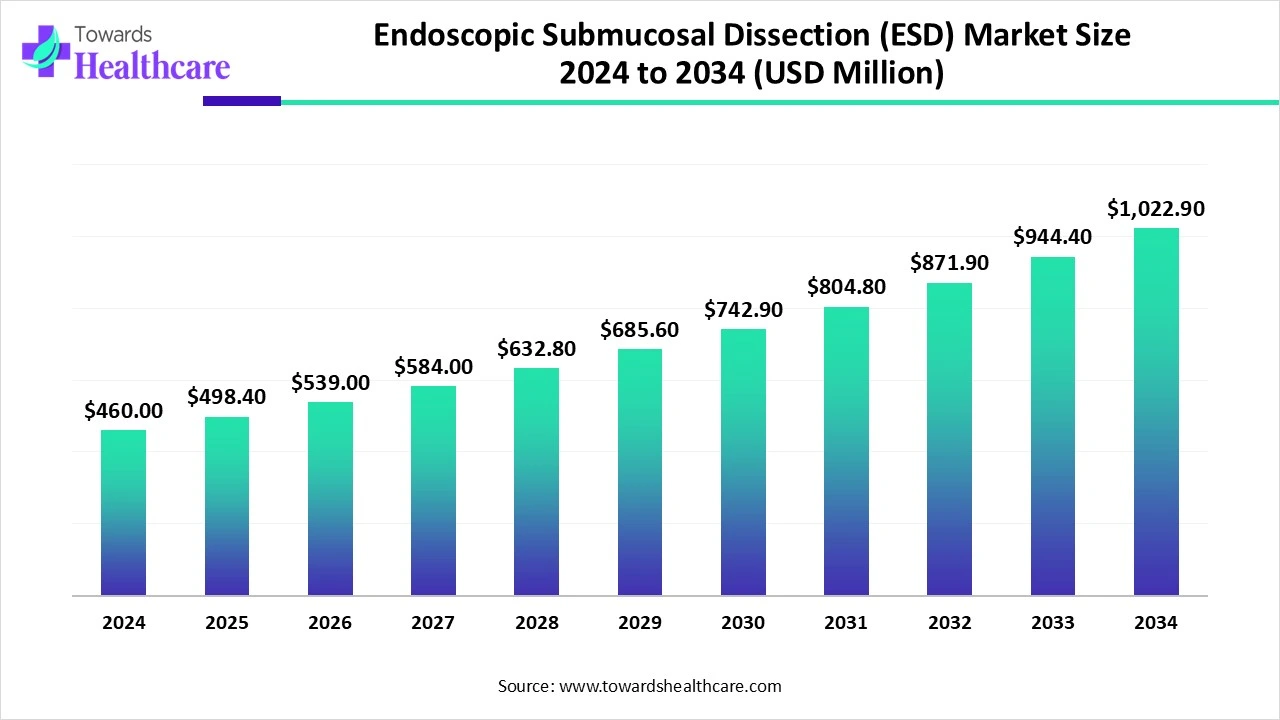

The global endoscopic submucosal dissection (ESD) market size touched US$ 460 million in 2024, with expectations of climbing to US$ 498.41 million in 2025 and hitting US$ 1022.86 million by 2034, driven by a CAGR of 8.35% over the forecast period.

The endoscopic submucosal dissection (ESD) market is experiencing robust growth, driven by the increasing prevalence of gastrointestinal disorders. Prominent players collaborate to access advanced technologies and develop innovative medical devices. This is supported by sufficient funding from the government and private organizations. The integration of artificial intelligence (AI) introduces automation in endoscopic procedures, driving precision. The future looks promising, with the advancements in endoscopic devices.

| Table | Scope |

| Market Size in 2025 | USD 498.41 Million |

| Projected Market Size in 2034 | USD 1022.86 Million |

| CAGR (2025 - 2034) | 8.35% |

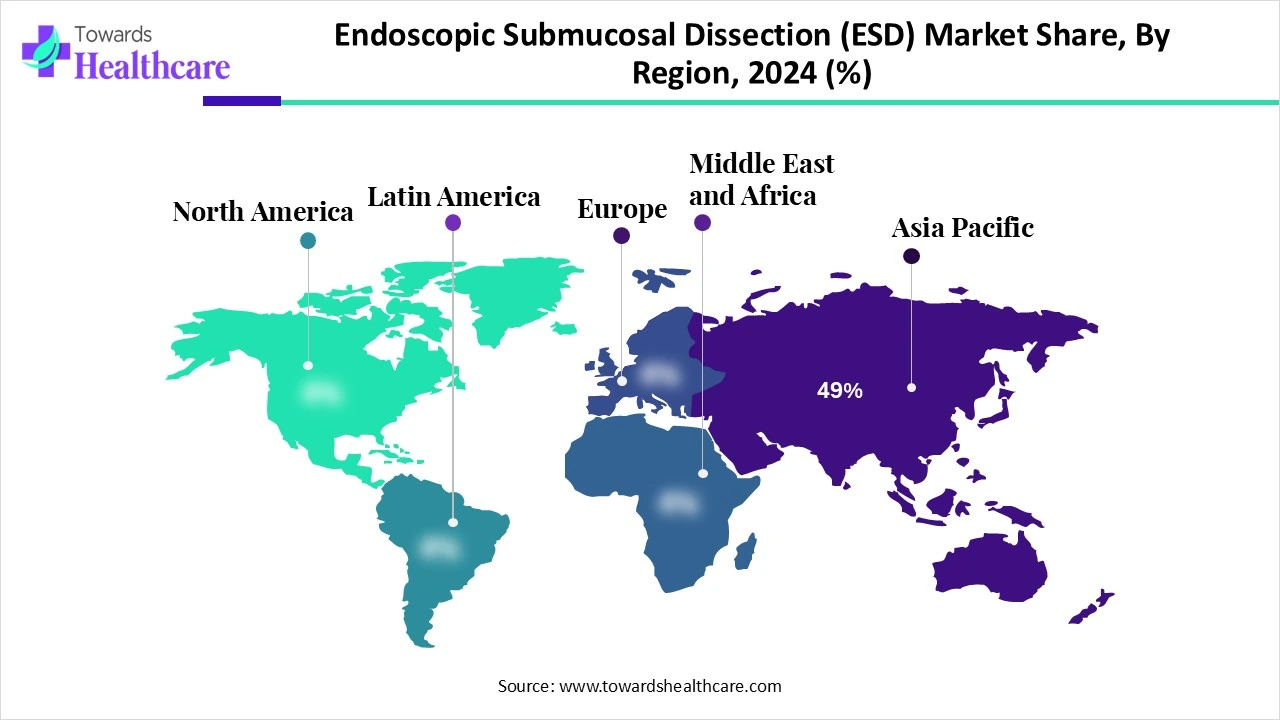

| Leading Region | Asia-Pacific Share 49% |

| Market Segmentation | By Product Type, By Indication, By End-User, By Technology, By Region |

| Top Key Players | Olympus Corporation, FUJIFILM Holdings Corporation, HOYA Corporation (Pentax Medical), Boston Scientific Corporation, Erbe Elektromedizin GmbH, Medtronic plc, ConMed Corporation, Cook Medical, Karl Storz SE & Co. KG, Taewoong Medical Co., Ltd., MTW Endoskopie W. Haag KG, Zeon Medical Inc., Micro-Tech Endoscopy, Creo Medical, Ovesco Endoscopy AG, Aohua Endoscopy, Sumitomo Bakelite Co., Ltd., Endo Tools Therapeutics, CapsoVision, Inc., Asia Meditech |

The endoscopic submucosal dissection (ESD) market refers to an advanced endoscopic technique primarily used for en bloc resection of superficial neoplasms in the gastrointestinal (GI) tract, particularly in the esophagus, stomach, and colon. Unlike Endoscopic Mucosal Resection (EMR), which is typically limited to smaller lesions, ESD enables the complete removal of larger, more complex lesions by dissecting the submucosal layer beneath the lesion. The procedure requires specialized instruments such as ESD knives, injection agents, hemostatic devices, and high-definition endoscopes. ESD is especially significant for early-stage GI cancers as it provides higher curative resection rates and better pathological assessment while preserving organ function.

AI introduces automation in the endoscopic submucosal dissection (ESD) market, enhancing efficiency, accuracy, and precision. An AI-enabled phase recognition system can help identify quality indicators for treatment techniques. It uncovers unmet medical needs that necessitate the creation of new treatment methods and devices. AI and machine learning (ML) algorithms can analyze vast amounts of data and detect potential outcomes of ESD. They can also enable healthcare professionals to train young professionals. This allows them to tackle emergencies and provide treatment to patients across diverse geographical locations.

Prevalence of GI Cancer

The major growth factor for the endoscopic submucosal dissection (ESD) market is the rising prevalence of GI cancer. The different types of gastrointestinal cancers include colorectal cancer, stomach cancer, esophageal cancer, and pancreatic cancer. Prolonged gastroesophageal reflux disease (GERD), inherited genetic factors, stomach infection, gastritis, and polyps are potential risk factors for developing stomach cancer. The American Cancer Society (ACS) estimated that there were 152,810 new cases of colorectal cancer in 2024. Of these, 106,590 were colon cancer and 46,220 were rectal cancer. Colorectal cancer was also the second-leading cause of death in the U.S.

Lack of Expertise

Numerous underdeveloped and developing countries have a lack of skilled professionals to perform complex ESD procedures. Certain nations have limited training opportunities for endoscopists. This limits them from performing advanced procedures, restricting market growth.

Robot-Assisted Dissection

The future of the endoscopic submucosal dissection (ESD) market is promising, driven by the use of robot-assisted surgery. The growing demand for minimally invasive surgery promotes the use of robots. Robotic devices provide simple, effective, and safe multidirectional traction for ESD at challenging locations. Thus, they reduce the difficulty of the procedure caused by manual dissection. Robotic devices help to accelerate the overall time of surgery, reducing patient discomfort. Moreover, these devices reduce manual errors and enhance the efficiency of surgery.

By product type, the ESD knives segment held a dominant presence in the endoscopic submucosal dissection (ESD) market in 2024. This is due to the ability of ESD knives to perform the dual function of marking and dissection. ESD knives simplify the operation, enabling fast and precise dissection of the target tissue. They enable surgeons to differentiate between different types of tissues, allowing them to provide targeted treatment. There are generally two types of knives: a non-injectable needle-type knife (I-knife) and an insulated-tip knife (O-knife).

The insulated-tip (IT) knives sub-segment held the largest revenue share. IT knives were developed to resolve issues during endoscopic mucosal resection (EMR) and EHRSE techniques for the removal of early gastric cancer tumors. Key players also offer electrosurgical IT knives that help minimize invasiveness during cutting and maximize cutting capabilities.

By product type, the hemostasis devices segment is expected to grow at the fastest CAGR in the endoscopic submucosal dissection (ESD) market during the forecast period. Hemostasis devices are essential components of ESD procedures to prevent bleeding complications. This is due to peri-lesional mucosal cuts and submucosal dissection. Some common devices used for hemostasis during ESD include coagulation probes, clips, argon plasma coagulation, and forceps. They save a lot of time for surgeons in managing bleeding risks.

The hemostatic clips sub-segment is expected to grow rapidly. Clips are widely preferred as they provide mechanical hemostasis, reducing the chances of inflammation and tissue damage. They are cost-effective and easy to use. The use of hemostatic clips is considered in cases of severe hemorrhage.

By indication, the gastric cancer/gastric lesions segment contributed the biggest revenue share of the endoscopic submucosal dissection (ESD) market in 2024. This is due to the rising prevalence of gastric cancer and GERD. According to a recent cross-sectional study in Bahrain, the prevalence of GERD was 41.5% among 385 adults. ESD is used as a standard treatment modality in the early stages of gastric cancer. It has also proven to be safe and effective, and replaced surgery as the first-line option for the treatment of the early stages of gastric cancer.

By indication, the colorectal cancer/polyps segment is anticipated to grow with the highest CAGR in the market during the studied years. Colorectal cancer (CRC) is the most common type of GI cancer and is the leading cause of death globally. It is caused due to a combination of genetic, environmental, and lifestyle factors. Researchers have found ESD to be feasible, efficacious, and oncologically safe in patients with CRC. ESD is also used as a primary treatment modality for selected patients.

By end-user, the hospitals segment accounted for the highest revenue share of the endoscopic submucosal dissection (ESD) market in 2024. This segment dominated because hospitals have a favorable infrastructure to perform a wide range of operations. Patients benefit from suitable reimbursement policies. Hospitals have physicians from multiple departments, providing multidisciplinary expertise to patients. Additionally, professionals from hospitals can handle emergencies and complexities in a patient’s health.

By end-user, the ambulatory surgical centers segment is expected to show the fastest growth in the coming years. Ambulatory surgical centers (ASCs) eliminate the need for patients to stay overnight. They perform minimally invasive surgeries and possess specialized equipment. ASCs offer cost-effective services and convenience for routine outpatient procedures. This is because patients do not need to pay for overnight charges.

By technology, the conventional ESD segment led the global endoscopic submucosal dissection (ESD) market in 2024. The conventional ESD procedure offers numerous benefits, such as simple operations and cost-effectiveness. It does not require specialized equipment and reduces procedural time. It is performed in three phases: delimitation, incision, and dissection. It also offers promising enhancements in procedural efficiency and safety.

By technology, the robotic-assisted ESD segment is expected to witness the fastest growth in the market over the forecast period. Robotic-assisted ESD is a more advanced procedure that involves robots to perform dissection and endoscopic procedures. Robots enable minimally invasive surgeries, leading to faster recovery times for patients. They reduce manual errors, improve visualization, and enhance precision.

Asia-Pacific dominated the global endoscopic submucosal dissection (ESD) market share by 49% in 2024. The burgeoning healthcare infrastructure, the increasing awareness of early cancer detection, and favorable regulatory support are the major growth factors of the market in the Asia-Pacific region. ESD was first developed in East Asia and then adopted in many parts of the world. Government organizations launch initiatives to encourage people and create awareness of early cancer detection and effective treatment.

The Japanese government has launched several national screening programs for gastric, colorectal, lung, breast, and cervical cancers. The Japan Cancer Society (JCS), in collaboration with the National Cancer Center (NCC), promotes cancer screening and raises public awareness of cancer prevention. They receive approximately 10% of funding from the Japanese government. Key players, such as FUJIFILM Holdings Corporation, Olympus Corporation, and HOYA Corporation, are the major contributors to the market in Japan.

China reports 4.8 million new cancer cases and around 2.57 million cancer-related deaths annually. The Chinese government has launched an eight-year action plan (2023-2030) for cancer prevention and treatment, aiming to achieve an overall five-year survival rate of 46.6% among cancer patients by 2030.

North America is expected to grow at the fastest CAGR in the endoscopic submucosal dissection (ESD) market during the forecast period. The rising prevalence of GI cancer and favorable regulatory policies bolster market growth. ESD is being increasingly adopted in North American countries owing to its benefits. The increasing funding by government and private organizations and collaborations among key players lead to the development of innovative ESD devices. Healthcare organizations in North American countries have skilled professionals to perform complex ESD procedures.

The American Cancer Society estimated that stomach cancer accounts for about 1.5% of all new cancers in the U.S. About 30,300 new stomach cancer cases are projected in the U.S. in 2025, of which 17,720 are men and 12,580 are women. Companies like Micro-Tech Endoscopy, Boston Scientific Corporation, and ConMed Corporation are the major producers of ESD devices in the U.S.

According to the Canadian Cancer Society (CCS), colorectal cancer is the 4th most common type of cancer in Canada. It is estimated that 25,200 new colorectal cancer cases were reported in 2024, representing 10% of all new cancer cases. CCS also estimated that about 1 in 16 Canadian men will develop colorectal cancer during their lifetime.

Europe is expected to grow at a notable CAGR in the endoscopic submucosal dissection (ESD) market in the foreseeable future. The rising adoption of advanced technologies and the rapidly expanding healthcare sector promote market growth. The European Society of Gastrointestinal Endoscopy (ESGE) recommends ESD for various applications, including superficial esophageal squamous cell cancers (SCCs) and gastric superficial neoplastic lesions. The increasing awareness and training programs for healthcare professionals in European regions potentiate market growth.

In 2024, the total healthcare expenditure in the UK was approximately £317 million, including government and non-government expenses. The expenditure grew by 6.5% in nominal terms between 2023 and 2024. The UK accounts for a total of around 6,600 new stomach cancer cases annually.

Nicholas Drysdale, Chief Financial Officer at EndoQuest Robotics, commented that the company is positioned to deliver meaningful long-term returns for its investors by building on strong momentum and a rapidly expanding technology portfolio with high-impact clinical applications. He also said that the company is committed to capital discipline and focused execution across its U.S. and Korea campuses.

By Product Type

By Indication

By End-User

By Technology

By Region