February 2026

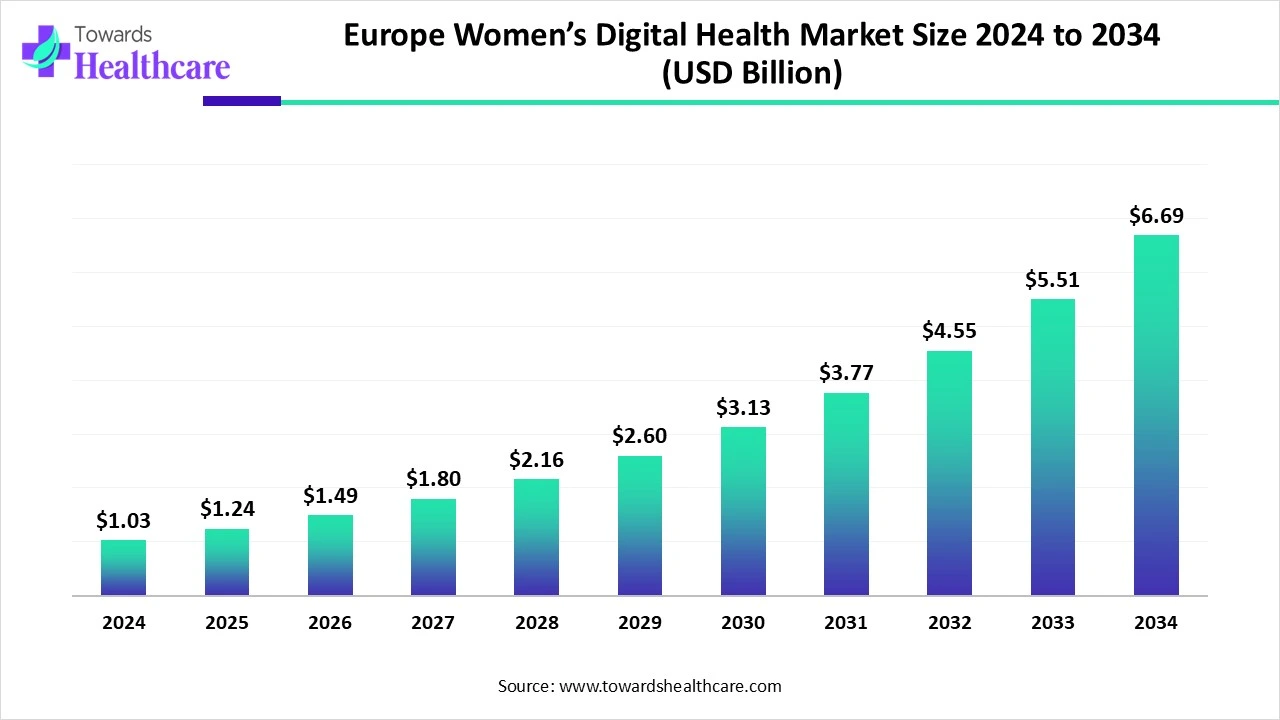

The Europe women’s digital health market size is estimated at USD 1.03 billion in 2024, is projected to grow to USD 1.24 billion in 2025, and is expected to reach around USD 6.69 billion by 2034. The market is expanding at a CAGR of 20.24% between 2025 and 2034.

The Europe women’s digital health market is rapidly expanding because of increasing awareness of female-specific health challenges, increasing adoption of smart technology such as smartphones and wearable devices increasing focus on personalized care. Increasing government and private spending on digital technology in Europe is driving the growth of the market.

| Metric | Details |

| Market Size in 2025 | USD 1.24 Billion |

| Projected Market Size in 2034 | USD 6.69 Billion |

| CAGR (2025 - 2034) | 20.24% |

| Market Segmentation | By Product Type, By Application, By End Use, By Technology, By Region |

| Top Key Players | Ava Women, Clue by BioWink, Elvie, Natural Cycles, HeraMED |

The European women’s digital health market refers to the market for digital health technologies, platforms, devices, and services specifically designed to address women’s health needs across Europe. This includes mobile apps, wearable devices, telehealth solutions, AI-driven diagnostics, and software focused on areas such as reproductive health, pregnancy, menopause, breast health, mental health, and chronic disease management in women. Applications of various digital services in home-based medical termination of pregnancy provide a sense of privacy, enabling women to undergo a sensitive medical intervention in a discreet and calm environment.

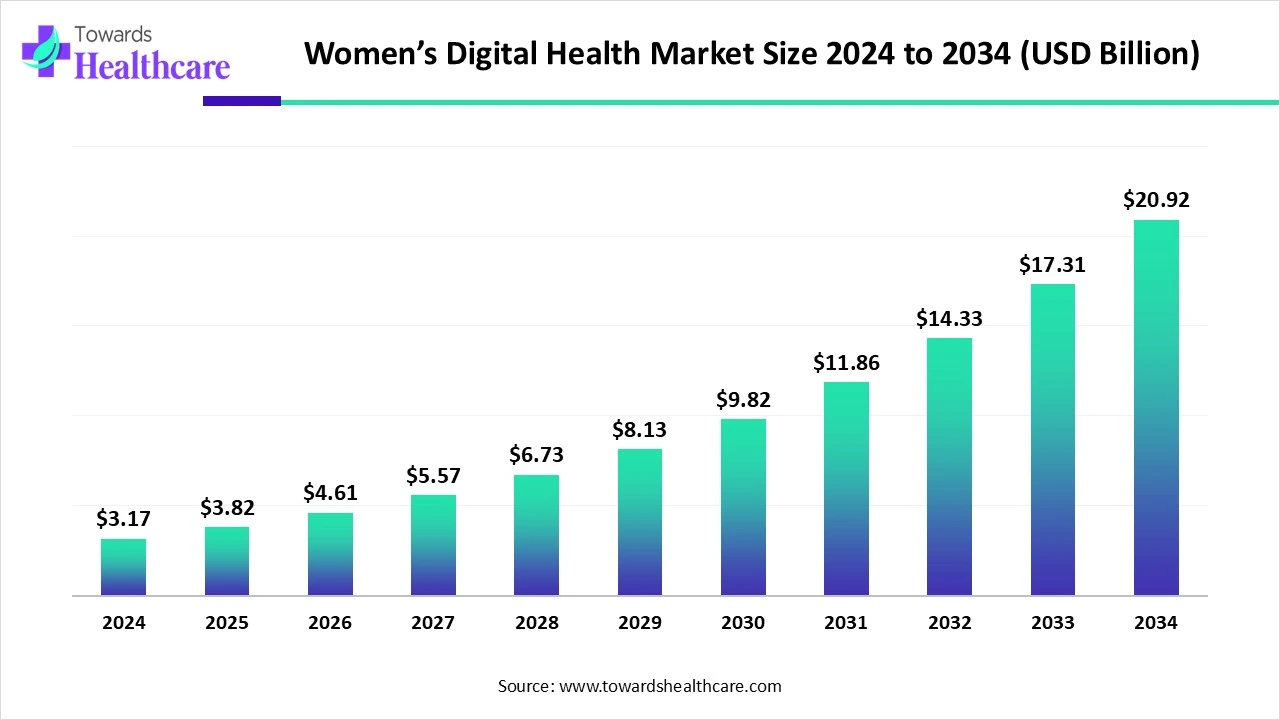

The global women’s digital health market is growing fast-valued at USD 3.17 billion in 2024, rising to USD 3.82 billion in 2025, and projected to reach around USD 20.92 billion by 2034, with a strong annual growth rate of 20.54% between 2025 and 2034.

AI integration in European women’s digital health is driving the growth of the market as it includes AI-driven chatbots, behavioral pattern recognition, and digital counselling, offering constant support, early detection, and personalized recommendations for women suffering postpartum challenges or chronic mental health situations. These inventions are revolutionising women’s health by allowing more advanced care, enhancing diagnostics, and addressing long-standing health challenges. As AI and digital tools continue to shape the future of women’s health, the potential to address complex challenges such as gender disparities in healthcare is becoming a reality. AI-driven technology saves time in disease diagnosis and screening, growing the chances of early treatment and enhancing life expectancy and quality of life.

Increasing Health Issues in Women

Women have historically faced challenges in accessing timely and specialized healthcare due to long wait times, limited provider options, and logistical hurdles. These issues are compounded as women often balance careers, caregiving, and personal health. However, telemedicine and virtual care are transforming this landscape by providing more accessible, efficient, and personalized healthcare solutions. Virtual care grants on-demand access to essential treatments. Currently, 75% of companies emphasize women’s health benefits to attract and retain top talent. These platforms are broadening their offerings to include more affordable, accessible, and comprehensive care in areas like contraceptive services, UTI and yeast infection treatments, menopause management, PCOS, and endometriosis support, driving growth in Europe’s women’s digital health market.

Digital Health Challenges

Inconsistencies across privacy policies and privacy-related app features, flawed data deletion mechanisms, and more were identified. The researchers also observed that apps frequently linked user data to web searches or browsing, risking users' anonymity. This issue restricts the growth of Europe's women’s digital health market.

Advances in Digital Wearables Technology

Wearables are showing a broader range of uses, including menstrual cycle tracking, fertility monitoring, and personalized health insights. Manufacturers are increasingly designing devices with women in mind. Oura and Whoop have expanded their menstrual tracking features and introduced personalized options for women trying to conceive or postpartum. Wearables are also being developed to assist women through menopause, with some devices detecting heart disease and complications during critical periods like pregnancy. This trend opens up opportunities in the European women’s digital health market.

By product type, the mobile health (mHealth) applications segment dominated in the Europe women’s digital health market in 2024 with a 55% share, as smartphone healthcare applications have a significant role to play in women's health with their advanced roles, wide ranging from enhancing health behaviours to carring out personalised tests. It lowers maternal stress, depression, improves pregnancy-associated knowledge, and lowers perceived barriers to being active. Also, a decrease in anxiety, hopelessness, and an enhancement in bonding with babies.

The wearable devices segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as wearable technology facilitates empowerment in women’s health going forward. Many wearable medical tools have entered the market designed to track menstrual cycles. It also plays a significant role in the early detection of potential health challenges, encourages the well management of chronic conditions, and advances healthcare accessibility and engagement.

By application, the reproductive health & fertility segment is dominant in the Europe women’s digital health market in 2024, with a 40% share, as digitalization in reproductive health & fertility health overcomes geographic or social and behavioral challenges to accessing services and facilitates self-use of services or products. It has been used to provision medication, facilitate and abortion the distribution of abortifacient pills backed up by remote care and support. Enhancing access to medical-care solutions, improving maternal health, providing significant health information, and allowing women to have more autonomy.

The mental health & wellness segment is expected to fastest-growing over the forecast period 2025 to 2035, as digital technological innovation has brought numerous benefits to mental health and wellness, by enabling workplace wellbeing and employees' mental health. Increasing adoption of technology in the healthcare sector reflects the idea that modern devices influence workplace wellbeing. Digital interferences are gradually finding their place in mental healthcare systems, and digital clinics will become more commonplace.

By end user, the individual consumers segment is dominant in the Europe women’s digital health market in 2024 with a 65% share, by application of digital platforms provide women with greater access to markets, knowledge, and more flexible working arrangements. There is strong and rising empirical evidence suggesting that advanced levels of gender equality are related to positive results in terms of income, economic growth, and competitiveness. Digital skills play a significant role in encouraging gender equality. By offering women and marginalized groups access to digital education and opportunities

The healthcare providers & clinics segment is expected to fastest-growing over the forecast period 2025 to 2035, as digital health technologies bridge the gap among patients and healthcare providers, specifically in underserved areas or remote locations. Digital health solutions provide convenience and efficiency. Patients access their healthcare records, schedule appointments, and accept personalised prompts through online platforms or mobile apps.

By technology, the mobile apps segment is dominant in the Europe women’s digital health market in 2024, with a 60% share, as these apps make women more aware of their health by regularly tracking their bodily functions. Thus, it supports women having better control of their health conditions. These apps are applied as diagnostic tools for women's health. As these track functions in a proper manner, they act as a health-tracking device that is used to record important data. Hence, they can identify and diagnose medical issues.

The artificial intelligence & machine learning segment is expected to fastest-growing over the forecast period 2025 to 2035, as AI-driven technology continues to sharpen the precision of women's imaging tests by identifying and tracking not only breast cancer, but also fibroids, endometriosis, and cervical precancers, in other conditions. These tools offer immediate data on local helplines, legal rights, and self-defence techniques, allowing women to have at their fingertips.

By regional analysis, Western European countries hold a 60% share as countries have the largest rates of cardiovascular disease, like ischaemic heart disease and stroke, corresponding with increasing obesity. The UK remains to have the highest teenage pregnancy rates in Western Europe, 10% of abortions among under-19s are performed for young women who have had one or more earlier abortions. Women in Western Europe usually live longer, with life expectancies reaching 80 years in major countries, which drives the growth of the market.

In June 2025, Andrew Dudum, founder and CEO of Hims & Hers, stated, “By leveraging ZAVA's established European presence, advanced technology, and deep consumer understanding, we're dignified to fundamentally renovate access to care for millions in Europe. Whether in rural towns, cities, or remote communities across Europe, people battling extensive, often silent chronic conditions such as obesity, depression, and more will have access to the personalized, high-quality care they deserve. (Source - Businesswire)

By Product Type

By Application

By End Use

By Technology

By Region

February 2026

February 2026

February 2026

February 2026