February 2026

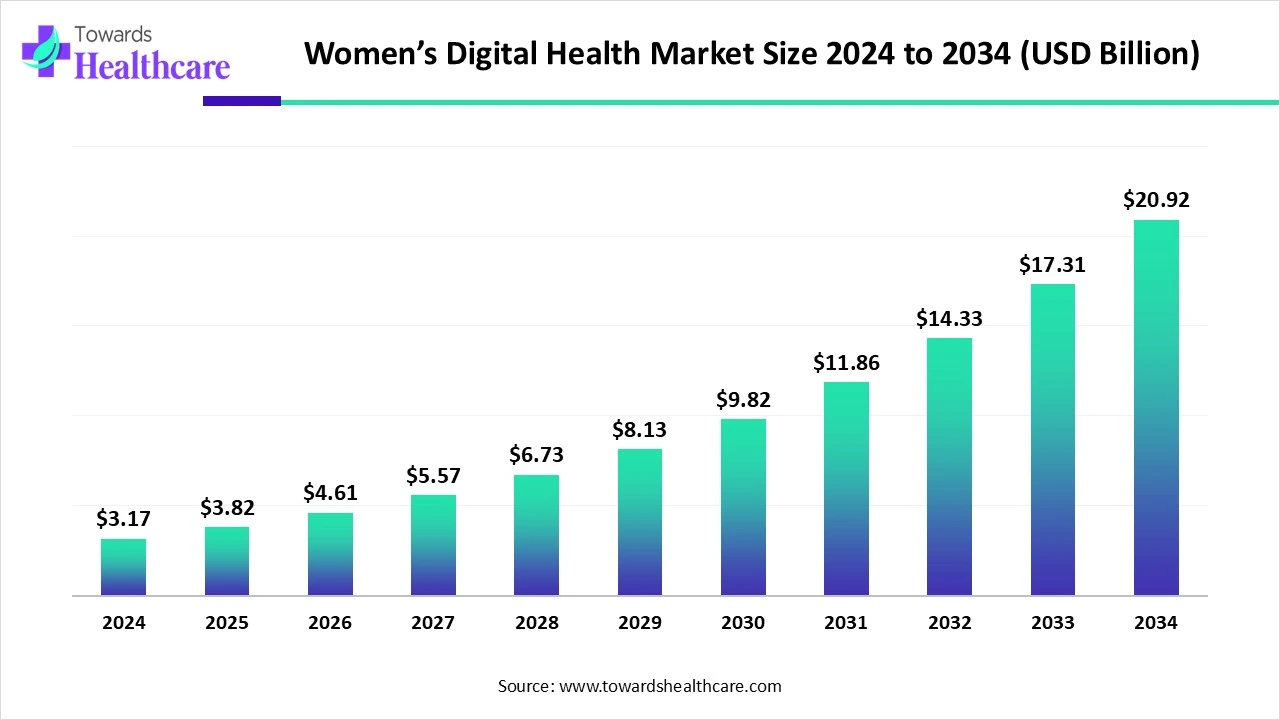

The global women’s digital health market size is calculated at USD 3.17 in 2024, grew to USD 3.82 billion in 2025, and is projected to reach around USD 20.92 billion by 2034. The market is expanding at a CAGR of 20.54% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 3.17 Billion |

| Projected Market Size in 2034 | USD 20.92 Billion |

| CAGR (2025 - 2034) | 20.54% |

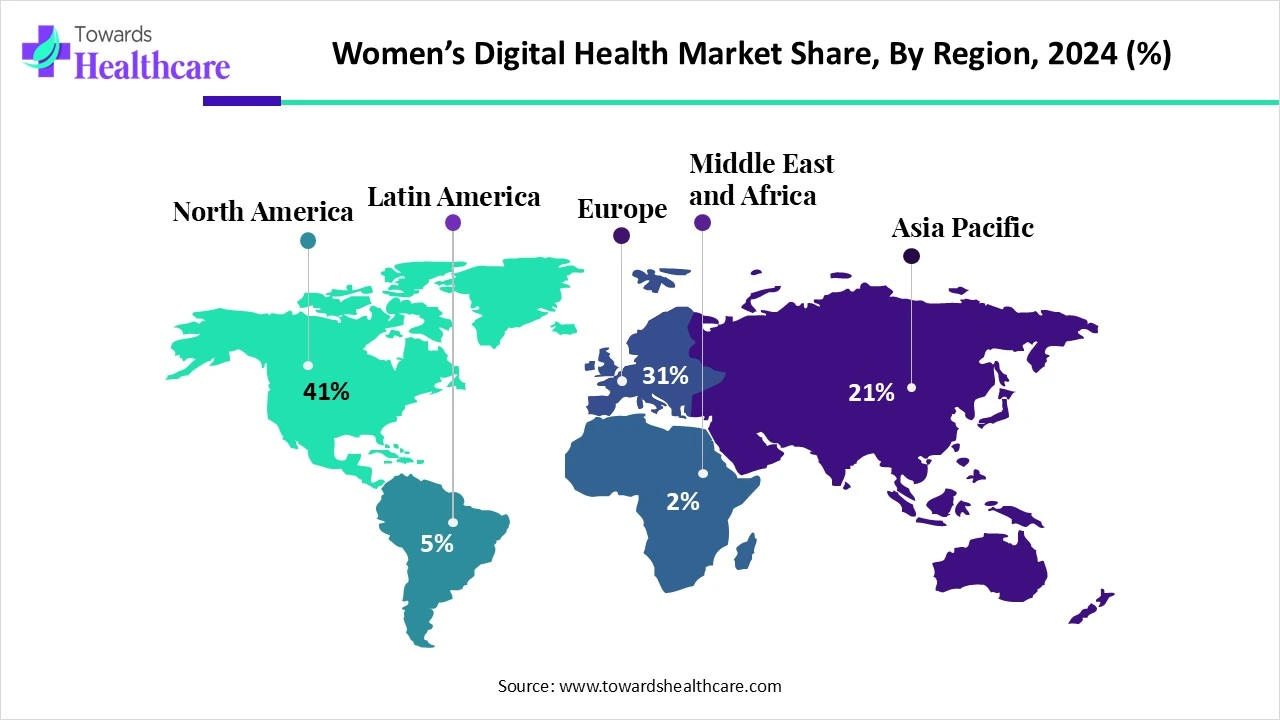

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By Region |

| Top Key Players | HeraMED, iSono Health, Clue by BioWink, Chiaro Technology Ltd., Natural Cycles, Ava Science, Inc., NURX Inc., Prima-Temp, Inc., Glow, Lucina Health, MobileODT Ltd., Braster SA, Athena Feminine Technologies, Plackal Tech |

According to a recent WHO/Europe report, digital health technology can advance equity and enhance the health of women. The advantages are mostly linked to increasing maternal health, giving women more control, boosting access to health care providers, and supplying vital health information. Digital technology gives women the liberty they need to obtain critical information, handle personal health issues on their own terms, and build social networks. This empowerment then spreads to every aspect of life outside of health, giving women the ability to make critical decisions.

The advancement of women's health may be greatly aided by AI technology as it develops further because of its potential to enhance patient access to preventative treatment, simplify workflows, improve detection, and resolve backlogs. It is obvious that AI may enhance clinical decision support, operational effectiveness, and cancer detection. More customization and inclusion will be made possible by AI as technology develops, guaranteeing that more women can take advantage of these developments.

Rising Awareness Among Women

The market for digital health solutions for women is driven by awareness of women's health. Some of the main factors influencing awareness are increased educational campaigns, increased media coverage, and initiatives by nonprofit organizations to highlight issues pertaining to women's health, such as those pertaining to maternal care, reproductive health, and chronic illnesses like osteoporosis and breast cancer. The global campaign to raise awareness of breast cancer, which is widely acknowledged via occasions like Breast Cancer Awareness Month, which is celebrated in October each year, is perhaps the most pertinent example.

Data Security

Consumers' severe worries about data security would likely limit the market's growth and the widespread adoption of mobile health. The market's growth may soon be further hampered by traditional approaches that are deeply embedded in the minds of customers and healthcare professionals. Data breaches are a major cause of declining customer numbers, which harms a brand's reputation.

Rising Investments

One of the most prominent developments in the market for women's health devices is the implementation of several investment projects, which are anticipated to play a major role in the market's expansion over the course of the forecast period. There are several benefits to the amazing speed at which investment projects are moving. One advantage of these efforts is the expansion of the number of simple and affordable solutions available, which promotes broader use of these medical devices.

By type, the mobile apps segment held the largest share of the women’s digital health market in 2024. Health applications, devices, and services can improve accessibility, provide personalized treatment plans, reduce healthcare expenditures, and improve care quality. Digital healthcare apps strive to create the greatest app for women's health by recognizing that the way treatment is delivered may inadvertently discriminate against some groups, in contrast to present healthcare systems and services.

By type, the wearable devices segment is estimated to witness the fastest growth in the women’s digital health market during the forecast period. Features like fertility tracking, non-invasive glucose monitoring, and more comprehensive data integration that takes into account mental, emotional, and physical health are all part of the future of wearable technology for women. Additionally, businesses are starting to investigate wearables that use predictive AI to make real-time lifestyle recommendations to enhance health results. Collaboration between wearable tech businesses and health organizations is essential to achieving the full potential of wearable technology for women.

By application, the reproductive health segment led the women’s digital health market in 2024. Every segment of society's female population is impacted by obstacles to sexual and reproductive healthcare. During the recent United Nations General Assembly, entrepreneurs, funders, and politicians discussed how to use digital solutions to promote health fairness. The American Heart Association's New York City headquarters hosted the 2023 UN General Assembly (UNGA) event, "Roundtable on Accelerating Equitable Digital Innovations for Women's Reproductive Health."

By application, the pregnancy & nursing care segment is expected to grow at the fastest CAGR in the women’s digital health market during the forecast period. Pregnancy care, diagnosis, and monitoring have all greatly improved because of digital health technology. The growing use of social media, internet platforms, and mobile apps by pregnant women has significant potential to improve the standard of maternal healthcare services. As these technologies develop further, they have the potential to revolutionize prenatal care by providing more patient-centered, effective, and accessible solutions, eventually influencing the way maternal healthcare is delivered in the future.

North America dominated the women’s digital health market share by 41% in 2024. Rapid technology expansion and the existence of sophisticated digital health infrastructure are expected to present significant development prospects for the area. Throughout the forecast period, the growing median age of the population is also anticipated to have a significant impact on the growth of the women's digital health market. Over the next years, the US and Canada are expected to be the two largest markets in this sector. Demand in this area is also influenced by growing knowledge of menstrual health and the expanding usage of contraception.

With almost 161,000 women enrolled at 40 clinical locations, the WHI is one of the biggest women's health initiatives ever started in the US. The WHI hormone studies provided crucial information that reduced direct medical expenses in the US by around $35.2 billion. Worldwide, women's health and medical practice have altered as a result of the Women's Health Initiative (WHI) and its findings. Particularly when it comes to the use of hormone treatment during menopause, information from the WHI assists women and their healthcare professionals in making better decisions.

As an illustration of its support for human rights, the Canadian government maintains that all people have the right to get safe and pertinent SRH services. Femtech Canada is a nationwide network dedicated to providing vital tools and recognition to Canadian femtech businesses. To address a worldwide market projected to reach over $4.8 trillion by 2025, Femtech Canada is the only organization in the nation devoted to promoting women's health innovation, commercialization, and investment.

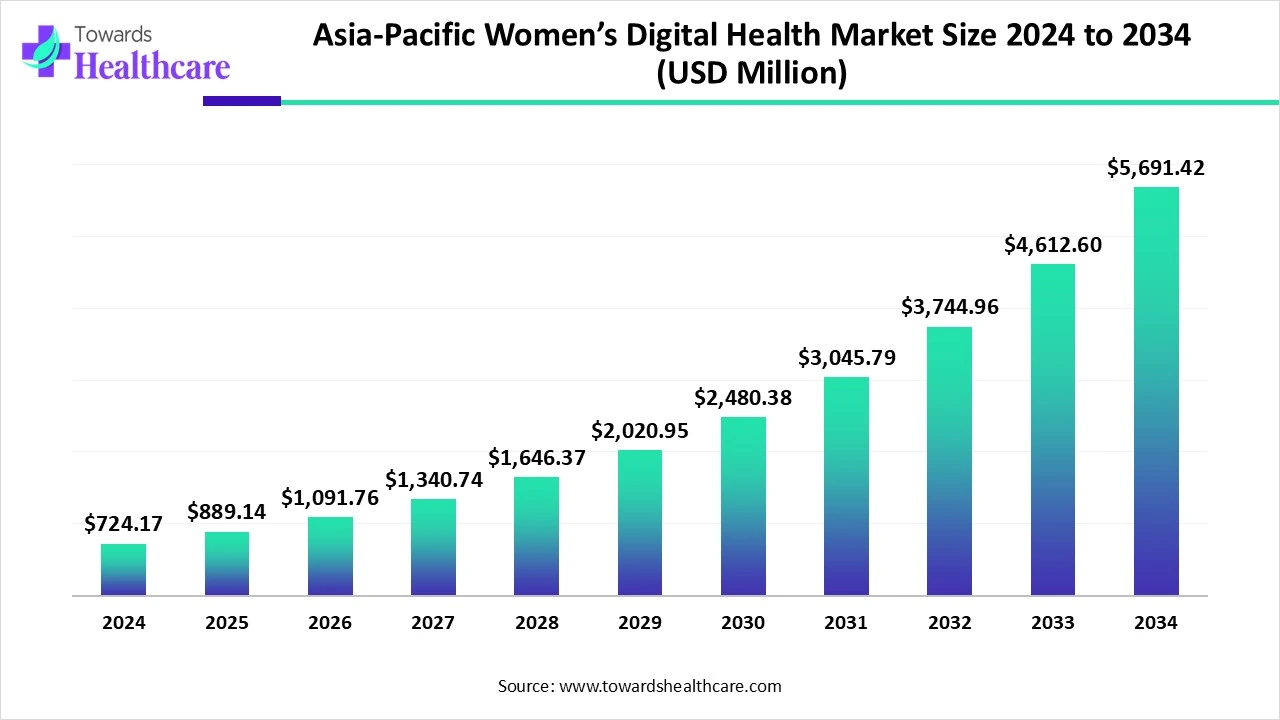

The Asia-Pacific women's digital health market is growing rapidly. In 2024, it was valued at about USD 724.17 million and increased to USD 889.14 million in 2025. Looking ahead, it's expected to reach approximately USD 5,691.42 million by 2034, growing at an impressive annual rate of 22.74% from 2025 to 2034.

Asia Pacific is estimated to host the fastest-growing women’s digital health market during the forecast period. The Asia Pacific market is expanding thanks to rising internet connectivity and smartphone adoption. A growing number of women are utilizing customized digital health services as a result of increased internet and smartphone usage. The demand for digital services is rising as a result of growing concerns about women's health and preventative actions. More women are learning about various health issues and using internet tools to find solutions. The industry is growing due to the need for convenience-driven services and self-care. Women may take control of their health thanks to digital tools like remote monitoring, virtual consultations, and customized tracking gadgets. Thus, in the upcoming years, the Asia Pacific market will benefit from the aforementioned variables taken together.

In practically every sphere of life, women in China participate, have rights, and have duties. They currently hold senior positions in almost every occupational field and make up half of those pursuing higher education. Digital platforms are increasingly being used by Chinese adolescents to acquire sexuality education. Through live-streamed interactive seminars, UNFPA has provided over 10,000 adolescents in rural regions with health and wellness information and expertise in partnership with the commercial sector and civil society partners.

The objective of Women's Health India (WHI 2025) is to offer a forum for the discussion of evidence-based tactics and partnerships that might lessen the effects of illnesses on women. To improve maternal healthcare outcomes and set the path for a healthy future for Indian women, the conference brings together top politicians, medical professionals, academics, experts, and activists to exchange ideas, best practices, and creative solutions.

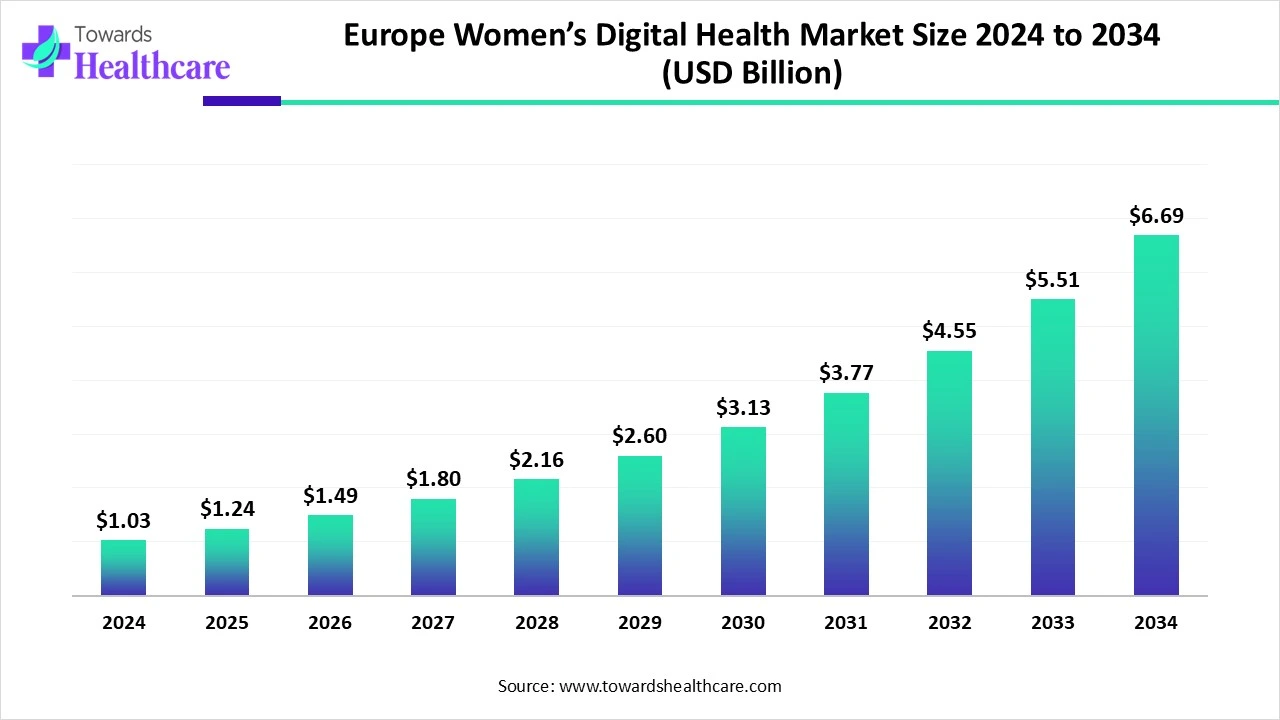

The Europe women’s digital health market is growing rapidly. In 2024, it's valued at about USD 1.03 billion and is expected to reach USD 1.24 billion in 2025. Looking ahead, the market could grow to around USD 6.69 billion by 2034, expanding at an impressive annual growth rate of 20.24% from 2025 to 2034.

Europe is expected to grow significantly in the women’s digital health market during the forecast period. In Europe, the use of women's health apps is still growing because of features like remote monitoring and self-assessment that have effectively improved patient autonomy. Global business and learning possibilities in the digital health industry are provided by trade initiatives like "Digital Health," which were started by the Department for International Trade. Additionally, as smartphones become more widely used, there are more mobile applications available, which propels the market for women's health apps.

The German Federal Ministry of Health recently announced its Digitization Strategy for Health and Care, which calls for improving hospital scores on DigitalRadar as one of its primary digital health initiatives. In collaboration with HIMSS and other research and consulting partners, the ministry created the DigitalRadar model of digital maturity. In at least two DigitalRadar benchmark areas, 50% of all hospitals receiving funding from the Hospital Future Fund are expected to have advanced their digital maturity by the end of 2025.

In the UK, a new Women's Health Strategy was introduced. This is the first Women's Health Strategy for England established by the government. Investing £127 million to expand and assist the maternal NHS staff and to boost neonatal care capacity over the next year are two examples of the steps the government has taken to start addressing the problems and inequalities that women experience. In addition, £95 million has been invested in hiring 100 specialist obstetricians and 1,200 more midwives. Funding the Start for Life initiative and family hubs with £302 million.

In October 2024, Melinda French Gates, the organization's founder, declared she would be allocating an extra $1 billion over the following two years to promote women's empowerment across the world. We're launching a $250 million worldwide open call called Action for Women's Health as part of that promise. "We hope that this open call will spur future change, resulting in more funding, partnerships, innovation, and models to scale," stated Haven Ley, chief officer of Pivotal.

By Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026