December 2025

The global genomics life science analytics market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The global genomics life science analytics market has been experiencing major growth in the rising innovations across the globe. Majorly, accelerating chronic disease cases, which require more efficient drugs, are fueling demand for life science analytics tools. Also, around the world, companies are emphasizing on development of tailored treatments based on individual genetic profiles.

As well as for prospective the life science analytics are emerging innovations in diagnostics, bioinformatics, in which vast data is derived from different omics. Furthermore, technological advancements like next-generation sequencing, CRISPR, and gene editing are expanding the applications of life science analytics.

The genomics life science analytics market refers to the market encompassing software, tools, and services t hat analyze large-scale genomic data generated from sequencing technologies and related life science research. These analytics solutions enable researchers, biotechnologists, pharmaceutical companies, and healthcare providers to interpret complex genomic information to drive discoveries in personalized medicine, drug development, disease research, and genetic diagnostics. The market includes platforms for data management, bioinformatics analysis, visualization, and interpretation of genomic datasets. Recent updates included are standardization of genomic data formats (e.g., FASTQ, BAM/CRAM, VCF) to allow data sharing and interoperability between various bioinformatics tools.

AI plays a major role in the market by expanding drug discovery processes, allowing precision medicine, and accelerating disease risk estimation. At the same time, several growth factors are impacting the market growth by adoption of AI, including rising volume of genomic data, technological advancements, along with a few concerns like data privacy. Along with this, organizations are leveraging AI to anticipate gene functions, find mutations, and personalize treatment plans.

Progressing Demand and Developments in Personalized Medicine and Drug Discovery

The genomics life science analytics market is primarily driven by increasing demand for personalized medicine. Personalized medicines are tailored based on individual patients' genetic profiles and other data. In life science, analytics assists in integrating and examining vast datasets to accelerate precision medicine developments. However, another major driver of the market is drug discovery and development, where life science analytics are used to improve clinical trial design, identification of potential drug candidates, and enhance the overall development process.

Raising Barriers to Data Privacy and Cost Issues

Basically, in the genomics life science analytics market, the arising challenges are regarding data privacy and security, in which these analytics are involved in managing huge datasets of sensitive patient and research data. Along with this, expenditure on advancements in analytics software, infrastructure, and expertise for implementation is creating a hindrance for numerous organizations.

Emerging Applications in Predictive Analytics and Other Areas

Along with the development of precision medicine and drug discovery, many other opportunities are emerging, such as the rising importance of diagnostics like genomic sequencing and analysis, which allows prior and more precise disease detection for cancer and other complex conditions. Furthermore, ML algorithms are providing analysis of large datasets of genomic and clinical data, which leads to the prediction of disease progression, patient results, and treatment responses. Also, NLP (Natural Language Processing) is employed to extract significant data from irregular data sources like scientific literature and electronic health records, boosting research and optimising decision-making.

By product type, the software solutions segment dominated the market with a nearly 65% share in 2024. The segment is fueled by growing adoption of big data analytics, breakthroughs in cloud-based solutions, and increasing need for enhanced patient care and tailored therapeutics. As well as, the growth of this segment is occurring by accelerating the complexity of genomic research, which demands robust data processing and analytics tools.

By product type, the cloud-based analytics software segment is predicted to show the fastest expansion during 2025-2034. Advantages of this segment include its scalability and flexibility to meet the fluctuating demands of life research, enabling researchers with the resources whenever they require them, along with its investments in infrastructure, which is generating an inexpensive option for organizations are driving the expansion of the overall segment.

The drug discovery & development segment was dominant in the global genomics life science analytics market with approx.40% share in 2024. Majorly contributing factors are growing cases of chronic diseases, rising need for rapid and more effective drug development with reduced expenses in the process. Also, innovations in genomics, AI, which are highly in demand for customized medicine, are propelling the segment growth.

By application, the clinical diagnostics & personalized medicine segment is estimated to grow rapidly over the projected period. The expansion of the segment is driven by reducing spending on sequencing, advancements of novel technologies such as NGS, CRISPR, gene editing, and liquid biopsy, along with growing focus on preventive care to accelerate outcomes. Besides this, across the world, governments are widely investing in genomic research, and personalized medicine initiatives are also fueling demand for life science analytics and ultimate market growth.

By technology, the next-generation sequencing (NGS) analytics segment led with a revenue share of nearly 70% in 2024. As NGS is offering high-throughput, scalability, and pace, transforming genomics by allowing researchers to assess biological systems at the highest point is fueling demand for segment growth. Whereas, NGS has been widely adopted in clinical diagnostics, such as cancer diagnosis, prenatal testing, and infectious disease tracking, resulting in broader market penetration.

However, the omics integration (proteomics & metabolomics) segment is anticipated to grow at a rapid CAGR during 2025-2034. Majorly impacting factors are rising volume and difficulty of biological data, technological advancements, and growth in precision treatments. Besides this, growing requirement for extracting significant insights from a variety of omics datasets (genomics, proteomics, transcriptomics, etc.) to accelerate drug discovery, improve diagnostics, and personalize healthcare.

By deployment mode, the on-premises segment held a major revenue share of approximately 60% of the market in 2024. The segment has experienced growth fueled by several factors, including optimized data security control, regulatory compliance, and the need for more control over delicate information, especially in large-scale pharmaceutical and biotech companies.

Whereas, the cloud-based deployment segment is predicted to register the fastest growth in the upcoming years. The segment is propelled by growing demand for measurable, affordable, and approachable data solutions, as well as accelerating genomic data, the need for well-developed and advanced analytics, and with desire for enhanced collaboration and rapid research timelines.

With a ~45% share of the market in 2024, the pharmaceutical & biotechnology companies segment dominated the global genomics life science analytics market. Companies are assisting in accelerating drug discovery processes by using life analytics in the genomic sector, which ultimately minimizes the development timelines and expenses. Other factors like regulatory compliance, AI integration with genomics, adoption of cloud-based approaches, and growing demand for personalized medicines are escalating the segment growth.

Moreover, the hospitals & diagnostic laboratories segment is predicted to grow at a rapid CAGR during 2025-2034. The segment growth is fueled by growing value-based care, emphasizing efficient results and cost-effective diagnosis, with the developing incidence of chronic and genetic disorders. Besides this, segments have benefits like integration of genomic data into clinical decision-making, including diagnostics, treatment, and disease monitoring.

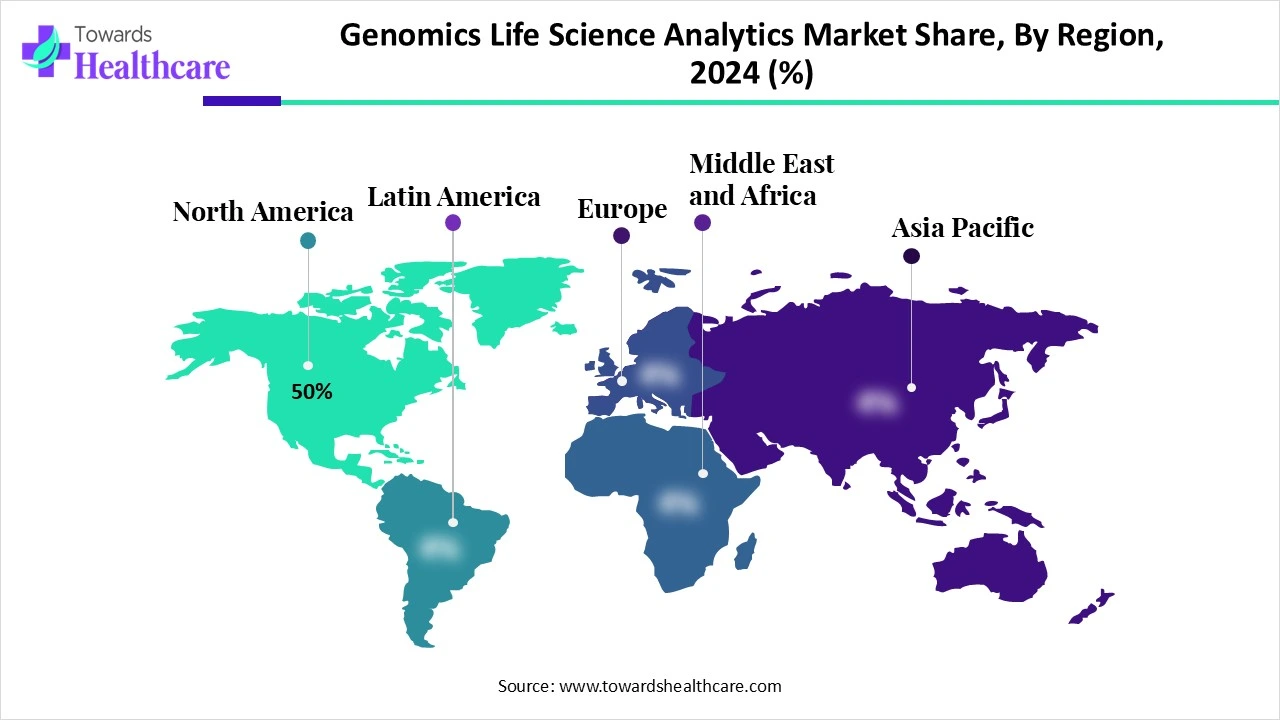

North America led with nearly 50% revenue share of the global genomics life science analytics market in 2024. The region has adopted technological advancements in genomics to treat growing chronic cases in geriatric populations. As well as they are also widely accelerating research and development activities in genomic sectors to fulfill the rising demand for biologics, vaccines, and personalized medicine. Accelerating focus on AI and machine learning applications in life science analytics is expanding the market in this region.

Major investments in R&D, especially in genomics and customized medicine, are fueling the demand for novel analytics solutions in the US. As well as developing transformations in life science industries in the US, from drug discovery to clinical trials stages are generating huge datasets that require advanced analytics to analyze and process them.

For instance,

The regulatory environment of Canada is encouraging for genomic research and innovations, with agencies like Health Canada enabling guidance and approvals for genomic-based diagnostic tests and therapies. Also, the region has strengthened public health infrastructure in genomics, such as sequencing capacity and data hubs, which are propelling the demand for advanced life science analytics and the overall market growth.

Asia Pacific is predicted to grow at the fastest CAGR in the studied years. Primarily, in ASAP, including China and India, has raised its focus on healthcare spending, which is driving demand for genomic and life science analytics. Along with this, the region is widely showing interest in precision medicine development, and the governments as well as private companies, are broadly investing in R&D activities like translation research are demanding sophisticated tools are support market expansion.

China is experiencing major growth in the geriatric population, connected with diverse and complex chronic diseases that require advanced diagnostics for early disease detection and enhanced patient outcomes. Also, the growing advancements in technologies used in genetic conditions and research like NGS, CRISPR, and gene editing, along with accelerated collaborations with a variety of companies, are driving the region's market growth.

For this market,

India, with major expansion in the market, is encompassing advancements in bioinformatics, customized medicine, along with growing instances of chronic diseases are driving the market growth. As well as the Indian government is stepping towards initiatives, affordable sequencing technologies, and increasing demand for data-driven insights in drug discovery and development are fueling demand for life science analytics.

Europe is experiencing significant growth in the genomics life science analytics market. Furthermore, it has enhanced focus on the use of genomic data and its analysis, which is vital for tailored treatments based on individual genetic profiles. Besides this, Europe is enormously adopting AI, machine learning, and cloud-based solutions to boost the assessment of complex genomic data, allowing quick drug discovery.

The respective market is driven by the rising adoption of electronic health records, clinical trials, and genomics research generates large amounts of data, developing a demand for sophisticated analytics tools. Also, Germany is fostering a robust base of technological innovation, especially in domains like next-generation sequencing (NGS), high-throughput screening, and data analytics.

The UK has prestigious universities and research institutions, including the Wellcome Foundation, UCL, and the Francis Crick Institute, fueling cutting-edge research in genomics, oncology, and neuroscience. Along with this, the government of the UK is accelerating financial support, which deals with the Life Sciences Sector Deal, with rising collaboration between government, industry, and academia propelling the market expansion.

For instance,

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

By Product Type

By Application

By Technology

By Deployment Mode

By End Use

By Region

December 2025

November 2025

November 2025

October 2025