December 2025

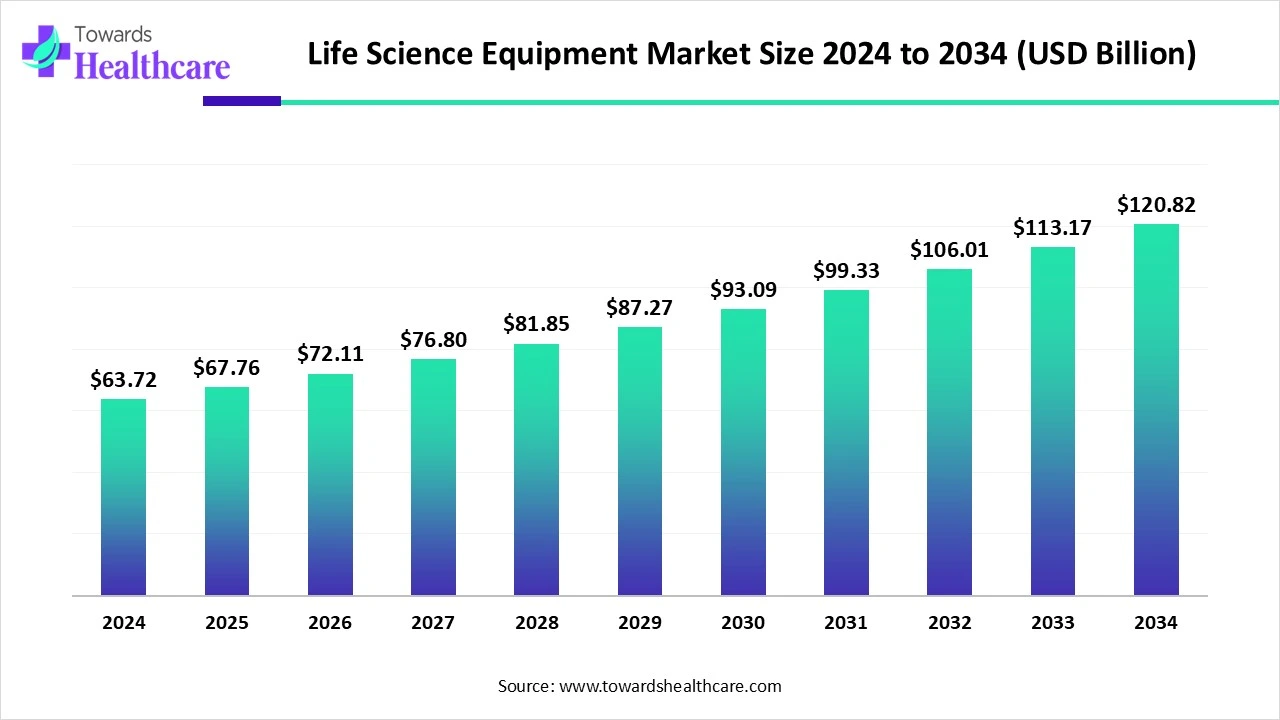

The global life science equipment market size is calculated at USD 63.72 billion in 2024, grew to USD 67.76 billion in 2025, and is projected to reach around USD 120.82 billion by 2034. The market is expanding at a CAGR of 6.34% between 2025 and 2034.

The life science equipment market is primarily driven by the growing research and development activities. The increasing adoption of equipment in synthetic biology, pharmaceutical, biotechnology, and clinical sectors facilitates market growth. Key players collaborate to develop novel equipment and strengthen their market position. The future looks promising with laboratory automation, robotics, and the integration of artificial intelligence (AI) and the Internet of Things (IoT).

| Metric | Details |

| Market Size in 2025 | USD 67.76 Billion |

| Projected Market Size in 2034 | USD 120.82 Billion |

| CAGR (2025 - 2034) | 6.34% |

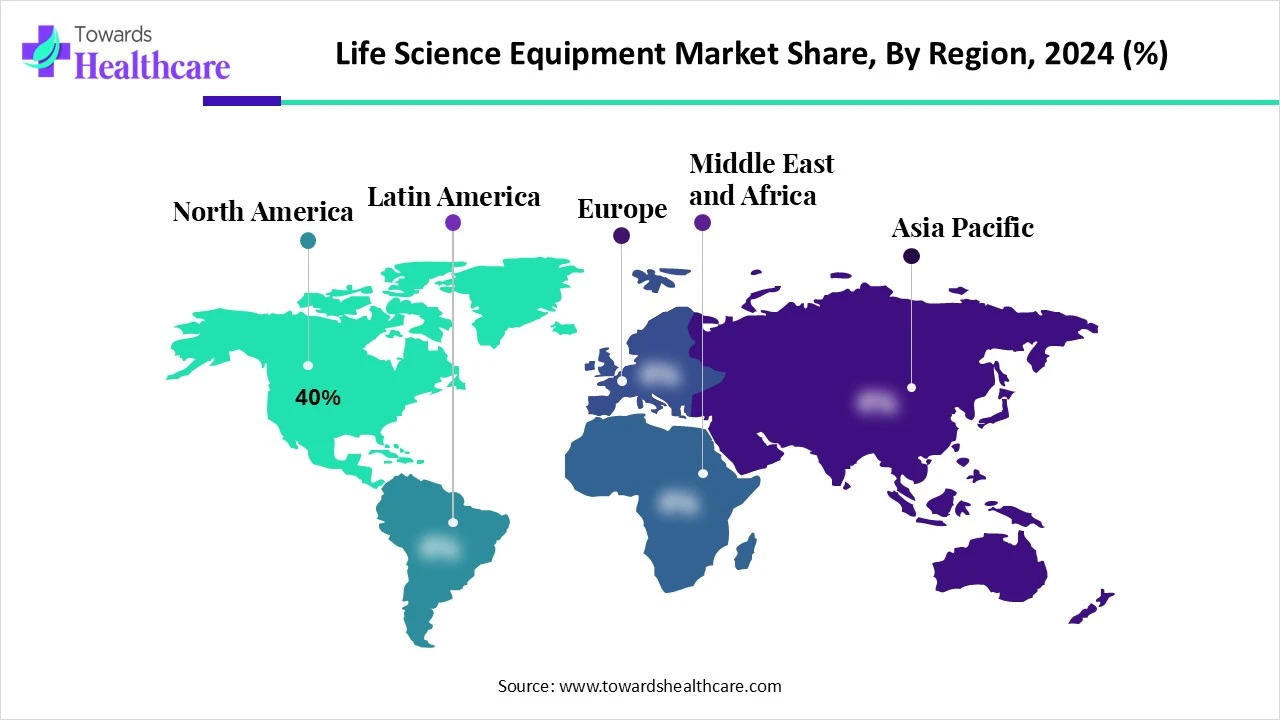

| Leading Region | North America share by 40% |

| Market Segmentation | By Equipment Type, By Application, By Technology, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation, PerkinElmer Inc., Bio-Rad Laboratories, Merck KGaA (MilliporeSigma), Bruker Corporation, Waters Corporation, Eppendorf AG, Sartorius AG, QIAGEN N.V., Beckman Coulter (Danaher), GE Healthcare Life Sciences (Cytiva), Becton, Dickinson and Company (BD), Shimadzu Corporation, Hamilton Company, Corning Incorporated, Hitachi High-Tech Corporation, Oxford Instruments, Tecan Group Ltd. |

The market refers to a wide range of precision instruments and devices used in biological and medical research, diagnostics, pharmaceutical manufacturing, and clinical applications. These tools are essential for activities such as molecular biology, cell culture, genomics, proteomics, drug discovery, and quality control. They perform numerous functions, from sample preparation to data analysis. They accelerate life science research with innovative technology by integrating novel chemistry.

Demand is driven by the rising prevalence of chronic diseases, increasing R&D investments by biotech and pharmaceutical firms, and the growth of personalized and regenerative medicine. Technological advancements such as automation, high-throughput systems, and integration with AI and IoT are further transforming this market. Government organizations support the development and deployment of innovative life science equipment through funding.

Integrating AI into various life science equipment revolutionizes its functionality and enhances its efficiency and accuracy. AI-enabled sensors are embedded in equipment to enable real-time monitoring of experiments for researchers. Smart lab equipment allows researchers to monitor, control, and optimize laboratory conditions, enabling them to make proactive decisions. AI- and IoT-based predictive maintenance identifies the potential defects in equipment, enabling researchers to take necessary actions. AI and machine learning (ML) algorithms in life science equipment reduce manual errors and improve research outcomes, thereby maximizing productivity.

Growing Research Activities

The major growth factor of the life science equipment market is the growing research activities in the life sciences sector. The increasing drug discovery activity owing to the rising prevalence of chronic disorders necessitates the use of equipment. Ongoing research efforts in the field of agriculture and food science also potentiate the demand for life science equipment. Research activities are conducted to derive innovative solutions, thereby simplifying people’s lifestyles. Pharmaceutical and biotechnology companies invest billions of dollars every year in R&D to bring new products to market.

High Cost

Several innovative life science equipment are expensive, limiting the affordability of numerous academic institutions, laboratories, and companies in low- and middle-income countries. The average cost of new life science equipment generally ranges from $2,000 to $250,000. The cost depends on the manufacturer, type of equipment, and its capabilities.

What is the Future of the Life Science Equipment Market?

The market future is promising, driven by laboratory automation and 3D printing technology. As research becomes more complex and data-driven, the need for highly efficient and automated systems in laboratories is increasing. Some researchers adopt partial automation, while some adopt total lab automation. Automated equipment reduces human error, saves time, decreases labor costs, and enhances throughput. Additionally, 3D printing has revolutionized the manufacturing of life science equipment, leading to the development of customized tools. The 3D printing technique generates less waste and cost-effective tools, making scientific research more accessible and efficient.

By equipment type, the microscopes segment held a dominant presence in the market in 2024. This is due to growing microbiology research and advances in microscopes. Microscopes are widely used for various applications, from small-scale to large-scale. They are cost-effective and available in versatile options. Advances in microscopes are made to enhance the resolution and detail of objects to be studied. They enable groundbreaking research and improved diagnostics.

By equipment type, the PCR equipment segment is expected to grow at the fastest CAGR in the market during the forecast period. The growing genomics and proteomics research potentiates the demand for PCR equipment. PCR equipment enables in vitro DNA amplification, detecting pathogenic microorganisms, and accurate genotyping. It is used in the pharmaceutical, biotech, and forensic sectors. It offers high specificity, sensitivity, and versatility. The rising demand for point-of-care diagnostics and molecular testing boosts the segment’s growth.

By application, the drug discovery & development segment held the largest revenue share of the market in 2024. The segmental growth is attributed to the growing demand for personalized medicines and targeted treatments. Researchers focus on developing novel drugs and biologics for the prevention, diagnosis, and treatment of chronic disorders. New drugs are developed with enhanced efficacy and reduced side effects. Large biopharma companies invest heavily in drug discovery R&D. Merck has set a goal to launch 20 transforming drugs by 2029, and AstraZeneca is pursuing a $80 billion total revenue target by 2030.

By application, the biomanufacturing segment is expected to grow with the highest CAGR in the market during the studied years. The increasing launch of new biologics facilitates the biomanufacturing of biologics. Biomanufacturing focuses on reducing waste and aligning with global sustainability goals, making it an attractive alternative to conventional manufacturing processes. Some common life equipment used for biomanufacturing includes bioreactors, single-use equipment, autoclaves, and filtration systems. They play a vital role in cell culture, filtration, and maintaining sterility.

By technology, the spectroscopy-based instruments segment contributed the biggest revenue share of the market in 2024. This segment dominated because of its widespread applications from environmental analysis and biomedical sciences to space exploration endeavors. Spectroscopy-based instruments include infrared, mass spectrometry, and nuclear magnetic resonance. They are a rapid and non-destructive approach that necessitates little or no sample preparation, saving time for researchers. Advanced instruments enable even slight variations in datasets, enhancing efficiency.

By technology, the PCR and qPCR technologies segment is expected to expand rapidly in the market in the coming years. PCR and qPCR technologies are molecular biology techniques used for diagnosing and developing therapeutic modalities. The qPCR technique enables rapid diagnosis of chronic and infectious disorders. The increasing development of point-of-care diagnostics favors the segment’s growth. PCR and qPCR techniques are simple and highly accurate, with high sensitivity.

By end-user, the pharmaceutical & biotechnology companies segment led the global market in 2024. This segment dominated due to favorable infrastructure and suitable capital investments. These companies conduct advanced research activities to expand their product pipeline, enabling them to strengthen their market position. They also have skilled professionals to operate the equipment. The increasing number of pharmaceutical and biotech startups, along with rising venture capital investments, propels the segment’s growth.

By end-user, the hospitals & diagnostic laboratories segment is expected to witness the fastest growth in the market over the forecast period. Life science equipment has immense potential in the clinical field for prevention, diagnosis, treatment, and rehabilitation. Hospitals and diagnostic laboratories adopt specialized equipment to provide personalized care to patients. The different types of medical equipment are clinical chemistry analyzer, blood bank analyzer, chromatography systems, and microplate reader.

North America dominated the global market in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the major growth factors of the market in North America. Government organizations provide funding to support research activities. The rising adoption of advanced technologies leads to the development of innovative life science equipment.

Key players, such as Thermo Fisher Scientific, Agilent Technologies, and Becton, Dickinson and Company, are the major contributors to the market in the U.S. The approval of novel drugs by the Food and Drug Administration (FDA), increasing R&D investments by the government, and venture capital investments support market growth. The annual venture capital funding in the life sciences sector increased by 10% year-over-year in Q3 2024.

The Canadian government actively supports life science research and biomanufacturing to ensure Canada’s future pandemic readiness. The Ontario government announced an investment of $5.5 million to help 11 life sciences companies develop and bring to market medical innovations and healthcare solutions, accounting for $500,000 to each company. (Source - OCI)

Asia-Pacific is expected to host the fastest-growing life science equipment market in the coming years. The growing research and development activities and the burgeoning pharmaceutical and biotech sectors drive the market. Several government and private institutions conduct seminars, conferences, and workshops to encourage the development of novel equipment and stay updated with the latest advancements. The increasing number of startups and venture capital investments boosts the market growth.

The China Association for Science and Technology (CAS) Consortium of Life Sciences Societies organized a “China Life Science Conference and China Life Science Expo” to showcase groundbreaking advancements and innovative achievements in molecular diagnostics, single-cell analysis, and other fields. (Source - Biospectrum Asia)

India and China are among the top three exporters of lab equipment globally. India leads with the highest export, accounting for 24,955 shipments. Between October 2023 and September 2024, India exported 177 shipments of lab equipment, mainly to Nigeria, the U.S., and Tanzania. (Source - Volza)

Europe is expected to grow at a notable CAGR in the life science equipment market in the foreseeable future. Favorable government support and increasing R&D investments promote the use of life science equipment in Europe. European nations have a robust research and healthcare infrastructure, necessitating the use of life science equipment. The increasing collaborations among key players, academic-industry partnerships, and mergers & acquisitions augment market growth.

The Germany Trade & Invest report stated that the life sciences sector contributes 2.9% of the country’s GDP. It is the largest exporter of medical products globally, and is home to nearly 3,800 companies. The shift towards personalized medicines, AI-driven drug discovery, and digital health technologies facilitates the growth of the life sciences sector in Germany.

The Imperial Biomedical Research Center received funding of £1 million from the National Institute for Health and Care Research (NIHR) for cutting-edge equipment that will support vital translational research across the BRC partnership. The new equipment will help researchers improve patient outcomes by increasing access to clinical trials and innovative treatments. (Source - Imperial Biomedical Research)

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

Tim Golnik, Vice President of Product at Elemental Machines, commented on the launch of a novel product that enhances monitoring and communication in shared laboratory spaces, including clean rooms, that the product launch represents the company’s commitment to delivering solutions tailored to customers’ unique needs. The company ensures that it stays ahead in a constantly shifting landscape by continuously innovating new monitoring solutions that are aligned with evolving challenges. (Source - Businesswire)

By Equipment Type

By Application

By Technology

By End-User

By Region

December 2025

November 2025

December 2025

October 2025