January 2026

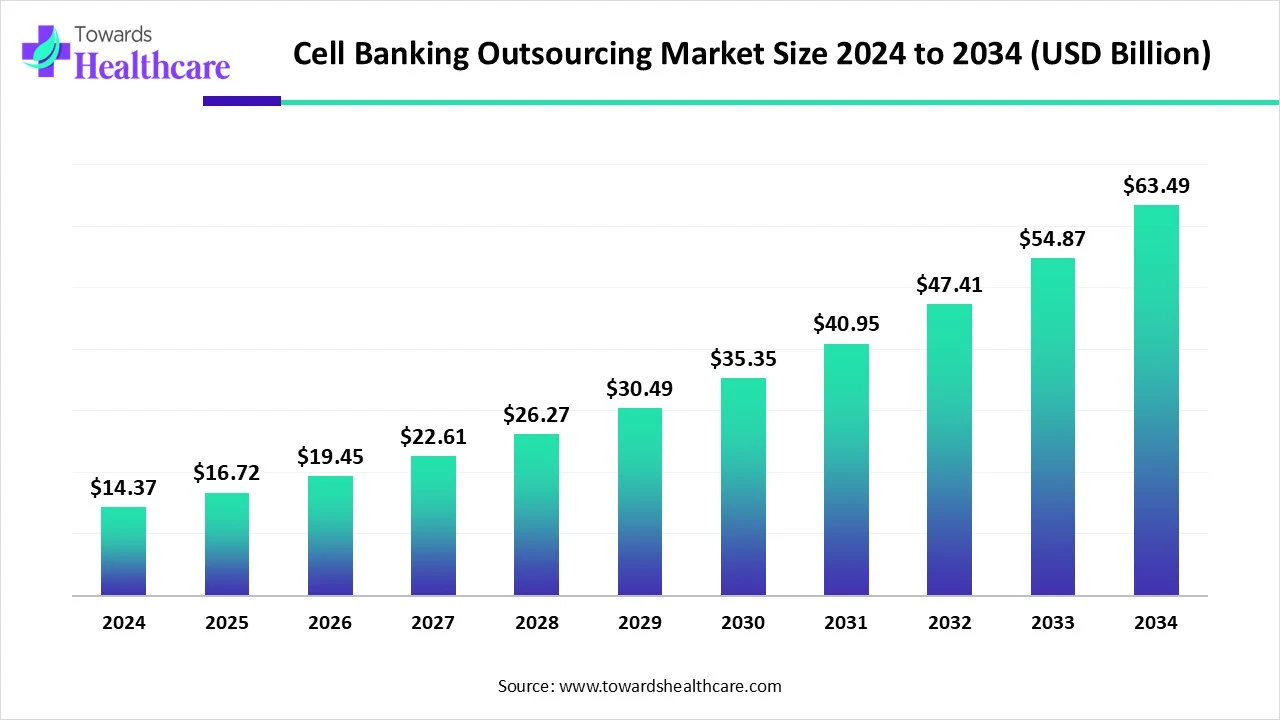

The global cell banking outsourcing market size is calculated at US$ 14.37 billion in 2024, grew to US$ 16.72 billion in 2025, and is projected to reach around US$ 63.49 billion by 2034. The market is projected to expand at a CAGR of 16.37% between 2025 and 2034.

The cell banking outsourcing market is expanding due to the increasing demand for cell-based biologics, therapies, and regenerative medicine. Outsourcing allows pharmaceutical companies to lower operational costs and access advanced technologies. North America is dominant in the market due to technological advancements in cryopreservation, quality control, and automation. Asia Pacific is fastest fastest-growing due to increasing healthcare investment and supportive government support.

| Metric | Details |

| Market Size in 2025 | USD 16.72 Billion |

| Projected Market Size in 2034 | USD 63.49 Billion |

| CAGR (2025 - 2034) | 16.37% |

| Leading Region | North America |

| Market Segmentation | By Bank Type, By Cell Type, By Phase, By Application, By End Use, By Service Type, By Region |

| Top Key Players | AGC Biologics, Aldevron, BioReliance (Merck KGaA), BioOutsource (Sartorius), Cell and Gene Therapy Catapult, Charles River Laboratories, Eurofins Scientifi, Fujifilm Diosynth Biotechnologies, Lonza Group, Novartis Contract Manufacturing, Paragon Bioservices (Catalent), Porton Advanced, QTP Labs, Rentschler Biopharma, Samsung Biologics, Sino Biological, Syngene International, Thermo Fisher Scientific (Patheon), Vibalogics, WuXi Advanced Therapies (WuXi AppTec) |

The Cell Banking Outsourcing Market refers to the external contracting of services related to the creation, characterization, storage, and maintenance of cell banks used in research, biopharmaceutical production, and cell therapy development. Cell banking involves creating Master Cell Banks (MCBs) and Working Cell Banks (WCBs) from cell lines, stem cells, or patient-derived cells for future use in GMP manufacturing, clinical trials, or research. Outsourcing providers offer expertise, regulatory-compliant facilities, quality control, cryopreservation, biosafety testing, and logistical support. The demand for outsourcing arises due to the high cost, regulatory complexity, and technical sophistication involved in establishing and maintaining GMP-compliant cell banking infrastructure.

Integration of AI in cell banking outsourcing drives the growth of the market as AI-driven technology transforms healthcare outsourcing, improving efficiency in healthcare billing and coding for greater revenue cycle management. AI technology has huge potential to modernize the cell banking landscape by reducing errors, improving customer experience, and streamlining operations, enhancing diagnostic accuracy, efficiency, and transfusion safety. The AI intervention allows healthcare professionals to perform well by improving patient safety, lowering diagnostic errors, and enhancing workflow efficiency. By leveraging classy algorithms and machine learning methods, cell banks are recently able to optimize donor-recipient compatibility, modernize the donation process, and improve patient results.

For Instance,

What are the Benefits of Outsourcing Cell Banking?

Outsourcing cell banking provides clients with the flexibility to respond to changing healthcare sector and scientific advancements, helping them achieve long-term success in a fast-evolving environment. It not only cuts costs but also boosts operational efficiency. This shift can streamline research efforts, enabling organizations to focus resources on innovation and discovery. Ensuring compliance and quality remains critical in cell banking. As biotech innovations progress, regulations and standards for biological sample storage also evolve, fueling the growth of the cell biobanking outsourcing market.

Challenges of Outsourcing Cell Banking

Outsourcing in healthcare presents risks like potential data breaches, cultural differences, and quality issues. Institutions must remain vigilant to ensure their outsourcing partners comply with rigorous quality and security standards, which, in turn, constrain the growth of the cell biobanking outsourcing market.

Emerging New Technology of Cell Banking Outsourcing

The role of cell banking in biotech is expected to grow further with new technologies and methods. Outsourcing will remain a vital strategy for companies aiming to improve their capabilities and stay competitive. Biotech companies that outsource their cell banking can benefit from increased flexibility, scalability, and access to advanced technology, which fosters innovation and growth. This trend presents opportunities for the expansion of the cell biobanking outsourcing market.

By bank type, the master cell bank (MCB) segment led the cell banking outsourcing market, due to it serves as a significant source of cells for cell-based therapies, vaccines, biologic drugs, and various final products. Its primary function is to stock cells, the capability of which has been determined by employing different assays. MCB is generally produced from an R&D cell bank, which marks the end of cell line advancement. Master cell banks are considered the mother of all cell banks, offering the raw materials for sub-types like working cell banks or final production cell banks.

On the other hand, the research cell bank (RCB) segment is projected to experience the fastest CAGR from 2025 to 2035, as it is a storehouse of well-characterized cell lines applied as reference materials in healthcare research, drug manufacturing, and functional assays to confirm reproducibility and comparability of experiments. Investigators freeze and store cells at a particular passage level, conserving their properties and reducing differences among the experiments. This consistency improves the reproducibility of results, which is a significant feature of scientific validity.

By cell type, the mammalian cells segment dominated the cell banking outsourcing market in 2024, because this cell is an important tool for clinical, research, and biopharmaceutical applications. Cells isolated from animal tissues are expanded in culture to research the biology of cells and disease, or applied for the manufacture of antibodies, vaccines, and proteins. It performs post-translational modifications, like phosphorylation, glycosylation, and sulfation, which are significant for the proper function of major proteins. Mammalian cells can secrete properly folded proteins in the culture medium, which simplifies downstream purification procedures.

The stem cells segment is projected to grow at the highest CAGR from 2025 to 2035, as stem cells are a superior type of cells that have main properties such as they make more cells like themselves, and they are self-renewing. Stem cells work by encouraging the body's natural healing processes, leading to further efficient and lasting treatments as compared to outdated treatments. Many patients experience a rapid recovery compared to surgical treatments, enabling them to return to daily activities sooner.

By phase, the clinical segment led the cell banking outsourcing market in 2024, due to outsourcing cell banking supports researchers to assess the drug's capability to attain the desired results in a larger patient population. These include cell line characterization, cell bank manufacturing, cryopreservation, and quality control for different clinical applications such as disease modeling, personalized medicine, and cell-driven treatments.

The commercial segment is projected to experience the fastest CAGR from 2025 to 2035, as outsourcing cell banks offers a consistent source of cells for use in lab research, clinical testing, drug discovery, and other applications. The cell banking procedure involves counting the number of cells present in every sample, calculating their growth rate over time, harvesting them when necessary, and then freezing them for long-term storage.

By application, the biologics manufacturing segment dominated in the Cell Banking Outsourcing Market in 2024, as cell banks are a significant source in the production of effective and safe biopharmaceuticals. They offer a vital source of cells, which are used to create medicines and other cellular products. The main aim of cell banking is to confirm that cells remain viable over time and preserve their genetic stability through long-term storage.

On the other hand, the cell & gene therapy segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as cell banking important component for the production of many cell and gene therapy products. Which is critically important to ensure regularity of the population, maintain cell integrity, and accessibility of adequate material to help the whole lifecycle of the project.

By end user, the biopharmaceutical companies segment dominated in the cell banking outsourcing market, as biologics companies that choose to outsource their cell banking forward to huge scalability, flexibility, and access to modern-edge technology. This allows them to respond swiftly to developing opportunities and challenges, increasing innovation and growth in their related fields.

On the other hand, the cell therapy companies segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as it ensures a reliable, consistent, and eagerly available supply of cells for research, development, and manufacturing. This leads to enhanced reproducibility, faster drug development, and affordable cost.

By service type, the cryopreservation & storage segment dominated in the cell banking outsourcing market as cell cryopreservation protects product quality and efficacy, lowers shipping challenges, and also protects the product against unpredictable shipping delays. It helps lower costs and material waste due to the shelf life of products or insufficient planning. This process extends the shelf life and consistency of the product, conserving cell functionality and viability until the cells are required.

The cell line characterization & biosafety testing segment is projected to experience the fastest CAGR from 2025 to 2035, as characterizing cell lines confirms which are well-defined and suitable for the designed study, lowering challenges related to misidentification. It prevents the requirement for rework caused by unacceptable data. It also meets strict guidelines for drug development and toxicology research.

North America dominated the market in 2024, as this region's pharmaceutical area is a hub of healthcare innovation. The medical field is driven by a strong investment in research and development. The presence of major pharmaceutical companies such as Pfizer, Johnson and Johnson, Amgen, and Gilead, these companies' increasing demand for biobanking cells for biologics, cell-based research, and clinical trials, which drives the growth of the market.

For Instance,

The United States increased its healthcare R&D, with $806 billion in gross domestic expenses on R&D in 2021, which led to huge productivity, more employment, and growing competitiveness. In 2024, the US digital health segment recorded a modest yet significant 4% YoY surge in VC funding, reaching $17.2 billion, which drives the growth of the market.

In Canada, growing cases of cancer, recent development in cell therapy technologies, a favourable government environment, rising investments, and partnerships, which are increasing demand for cell-based therapy so it driving the market growth.

Asia Pacific is estimated to be the fastest-growing market during the forecast period, as the huge growth of the healthcare industry in Asia Pacific is mainly due to the emergence of advanced health tools, which are the use of technology to advance the practice of medicine. In Asia-Pacific, increasing healthcare spending, accounting for more than 20% of worldwide spending by 2030, which drive the market growth.

China’s biopharmaceutical sector has grown rapidly, becoming the largest healthcare hub globally, because of significant investments in research and development, technology, and infrastructure. Increasing government support is mainly for driving innovation, attracting foreign investment, and enhancing the global competitiveness of Chinese healthcare organizations, which drives the growth of the market.

India is growing the number of cell-based clinical trials with minimal operational expenses, recent regulatory reforms, and numerous logistic advantages, making India an attractive destination for conducting clinical trials, which increases the demand for cell biobanking. India's increasing spending in stem cell research is driven by its economic growth and vision to acquire worldwide leadership in biotherapeutics, which drives the market growth.

Europe is expected to grow significantly in the market during the forecast period, as it is a global-leading centre for modern research and innovation. With the emergence of science and technology, the European Union provides an ideal environment to develop healthcare research, including cell-based research. Europe has a huge opportunity to support its clinical research ecosystem and regain global competitiveness in life sciences and healthcare, which contributes to the growth of the market.

For instance,

In Germany, early adoption of personalized medicine is due to it has strength to enable patients to receive drugs particular to their disease, and to growing the efficiency of the medical care system, which increases autologous/allogenic cell banking, which drives the growth of the cell banking outsourcing market.

The UK government tried to enhanced the country’s capability to grow cell and gene therapies, with a $10m grant in March 2023 for the NHS Blood and Transplant (NHSBT) to create a facility to develop and manufacture novel gene and cell therapies known as the Clinical Biotechnology Centre (CBC), increases the demand for biobanking cell, which drives the growth of the market.

In April 2025, Mr. Laurent Junique, CEO and Founder, TDCX, Stated, Business cycles are moving more rapidly than ever. Strategic outsourcing is likewise developing at a quick pace. Companies at the forefront of leveraging strategic outsourcing see it as a significant driver for innovation, flexibility, and global expansion, and our acquisition of Open Access BPO strengthens our ability to seize these opportunities. (Source - DCX)

By Bank Type

By Cell Type

By Phase

By Application

By End Use

By Service Type

By Region

January 2026

January 2026

January 2026

January 2026