November 2025

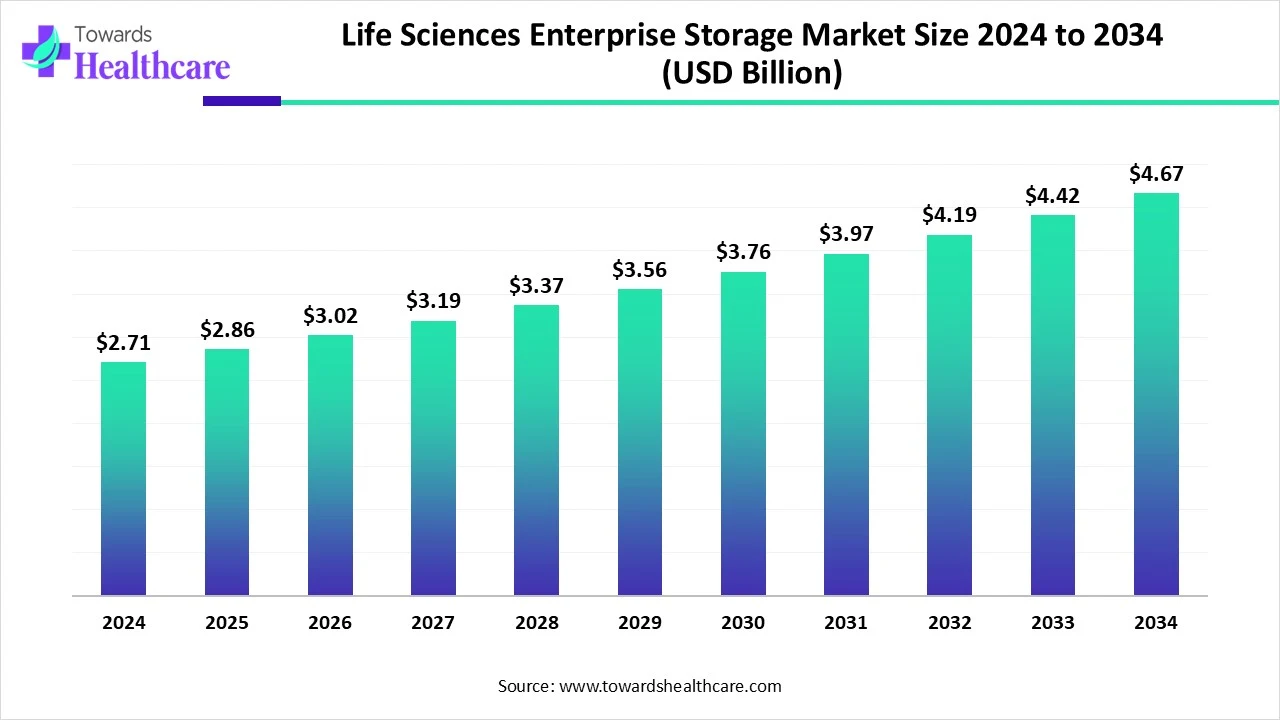

The global life sciences enterprise storage market size is calculated at US$ 2.71 billion in 2024, grew to US$ 2.86 billion in 2025, and is projected to reach around US$ 4.67 billion by 2034. The market is expanding at a CAGR of 5.65% between 2025 and 2034.

The global life sciences enterprise storage market possesses many reasons for its development, including progressing digital platforms, as well as raised focus on the development of personalized medicine. Along with this, enhanced demand for data security with robust infrastructure is fueling the adoption of enterprise storage solutions. The market will give rise to various opportunities in the future, such as increased adoption in clinical trials, drug discovery, medical imaging, and patient monitoring, where huge amounts of data are generated and boosting demand for more effective, robust, and secure storage solutions.

| Metric | Details |

| Market Size in 2025 | USD 2.86 Billion |

| Projected Market Size in 2034 | USD 4.67 Billion |

| CAGR (2025 - 2034) | 5.65% |

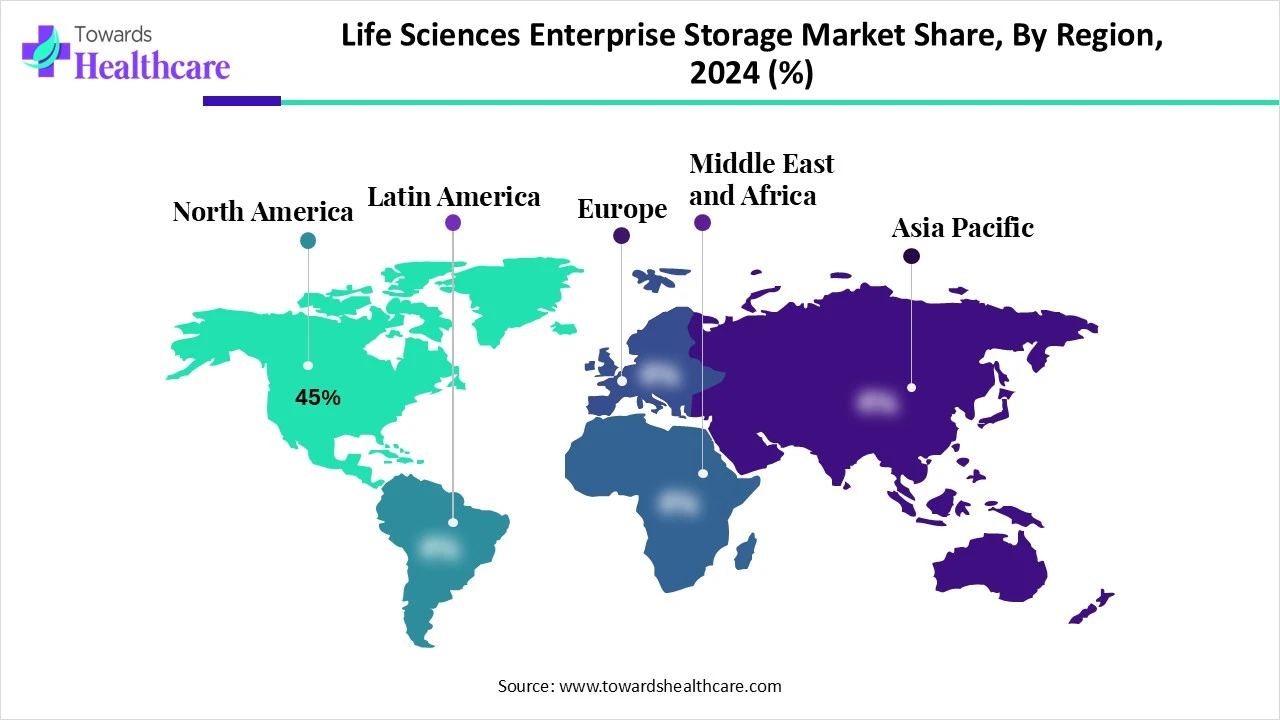

| Leading Region | North America share by 45% |

| Market Segmentation | By Storage Type, By Deployment Mode, By Application, By End User, By Region |

| Top Key Players | Dell Technologies (EMC Storage), NetApp Inc., Hewlett-Packard Enterprise (HPE), IBM Corporation (Storage & Cloud Infrastructure), Amazon Web Services (AWS Life Sciences Cloud Storage), Microsoft Azure for Genomics & Life Sciences, Google Cloud Platform (GCP) for Biomedical Data Storage, Pure Storage Inc., Hitachi Vantara, Seagate Technology, Western Digital Corporation, Oracle Corporation (Life Sciences Cloud Infrastructure), Qumulo, Inc., DataDirect Networks (DDN), Huawei Technologies Co., Ltd. (Life Sciences HPC storage), Cohesity Inc., Informatica LLC (data integration + storage orchestration), Snowflake Inc. (biopharma data cloud storage and analytics), VAST Data (exascale data platforms for genomics), Spectra Logic Corporation |

The life sciences enterprise storage market consists of high-capacity, secure, and scalable data storage solutions designed to handle the massive volumes of complex biological, clinical, and research data generated in the pharmaceutical, biotechnology, genomic, and medical device industries. These systems ensure data integrity, compliance (HIPAA, GxP, GDPR), scalability, and real-time accessibility, supporting advanced workloads such as genomics, multiomics, drug discovery, imaging, and clinical trials. The market is growing rapidly due to data-intensive R&D, adoption of AI/ML tools, and the need for high-performance computing (HPC) in life sciences.

In the respective market, AI has a crucial role as it assists in data management, expanding research activities, and boosting operational effectiveness. Majorly impacting growth factors such as a rise in biological data, the need for rapid drug discovery, and the demand for precision medicine are boosting the adoption of AI in the market. In the research process, AI algorithms help in the analysis of difficult datasets, detection of patterns, and estimation of results are much quicker than conventional methods, which ultimately enables drug discovery, disease diagnosis, and tailored medicine.

Expanded Digitalization and Demand for Personalized Medicine

The life sciences enterprise storage market is driven by the accelerating digitization of healthcare and research data around the world, with enhanced demand for customized therapies and analysis of vast genomic datasets. These huge datasets need a strong and scalable storage infrastructure, as well as expansion of remote patient monitoring and telehealth services, with a raised need for storage and management services. Along with this, rising awareness about the significance of data security and backup solutions is supporting companies to invest in major storage infrastructure.

Expensive Storage Solutions and Data Management Difficulties

In case of the implementation and maintenance of advanced storage solutions in the life science area are highly expensive, which may raise their adoption, especially for smaller-scale organizations. As well as, vast volume and diverse data created in life sciences research (genomics, proteomics, clinical trials, etc.) need robust, sophisticated data management and analysis techniques.

Widespread Adoption in Many Areas

The life sciences enterprise storage market has been experiencing various opportunities in clinical trials, drug discovery, medical imaging, and patient monitoring. In clinical trials, the management of patient records, test results, and research data is a major opportunity in the market. As well as in drug discovery research, storage and analysis of genomic data, chemical compounds, and biological assays are widely escalating the adoption of different solutions. By using X-rays, MRIs, and CT scans, generating huge volume datasets is demanding for specialized storage and processing capabilities.

The network-attached storage (NAS) segment held a major revenue share of the market in 2024. Due to the major provision of a centralized location for data storage, making it compatible for researchers and teams to allow and share information, boosting the segment growth. Besides this, enhanced adoption of remote work arrangements in life sciences industries and collaborations on projects from different sites, resulting in optimized productivity, are driving the segment expansion.

By storage type, the cloud-based storage segment will grow rapidly, with its significant benefits, including increased data volumes, need for scalability and flexibility, and the affordable of cloud solutions as compared to conventional storage solutions. Along with this, escalating integration of technologies, such as artificial intelligence (AI) and machine learning (ML) in data management, is fueling the expansion of this segment.

In 2024, the hybrid storage systems segment led the market, due to its balance of performance and cost-effectiveness, creating new life sciences applications. Also, increasing demand for sustainable products, technological advancements, and the accelerating volume of data generated in the life sciences area.

By deployment mode, the fully cloud-based solutions segment will register rapid growth, with its high scalability, flexibility, and affordability. Moreover, the segment is driven by the generation of huge datasets, including genomics, clinical trials, and research experiments, which require scalable and effective storage solutions like cloud-based systems. Whereas, many organizations are adopting hybrid or multi-cloud strategies, combining the benefits of on-premises and cloud storage to enhance data management and security.

By application, the genomics & next-generation sequencing (NGS) segment dominated the life sciences enterprise storage market. The segment is propelled by the expansion of the development of personalized medicine, breakthroughs in genomic technologies, and the boosted use of NGS in research and clinical diagnostics. Although growing cases of chronic and genetic diseases, including cancer, require complete genomic analysis for diagnosis, prognosis, and treatment planning, accelerating the demand for NGS.

Whereas, the regulatory & compliance storage segment is predicted to grow rapidly, due to strict guidelines by HIPAA, GDPR, and others need for maintaining secure, auditable, and accessible data storage methods. Along with this, rising demand for data integrity and security in the life sciences industry is fueling demand for strong storage methods that are necessary for the conservation of sensitive patient data, and to avoid data breaches, is boosting the overall segment growth.

The pharmaceutical & biotechnology companies segment was dominant in the market due to the development of large datasets from different sources, such as genomic sequencing, molecular modeling, and clinical trial data. Furthermore, these companies are highly involved in complex drug discovery and development, which demands sophisticated storage systems to manage the huge datasets.

However, the hospitals & diagnostic laboratories segment will expand rapidly. This is coupled with the rising digitalization of healthcare data from electronic health records (EHRs), imaging systems (like radiology and pathology), and genomic sequencing, developments in diagnostic techniques, including Next-Generation Sequencing (NGS) and digital pathology, and the accelerating incidence of chronic diseases.

North America was dominant in the market share by 45% in 2024, due to several contributing factors, like rising data generation from genomics, personalized treatments, and advanced imaging. As well as high concentration of genomics research, AI-driven biotech, and data regulation frameworks are boosting the ultimate market growth. Furthermore, enhanced requirements for measurable and secure storage systems, with raised adoption of big data analytics, and the demand for compliance with regulations like HIPAA are fueling the market growth.

In North America, the US is experiencing major growth, with the emergence of techniques such as SSDs and NVMe devices, which are providing rapid data transfer rates. Besides this, the US is putting efforts into precision medicine development, and the expansion of gene and cell therapies is allied with extensive data analysis and storage capabilities.

For this market,

Currently, Canada is widely investing in data center infrastructure, including co-location facilities and green data centers, to meet enhanced demand for storage. These developing infrastructure creates new opportunities for intelligent storage management systems that can improve energy consumption and data management. As well as continuous digital transformation around different areas, such as healthcare and life sciences, is fueling Canada’s market expansion.

In the upcoming era, the life sciences enterprise storage market in Asia Pacific will experience the fastest growth, owing to expanding biotech hubs in India, China, South Korea, and APAC-wide cloud adoption. Along with ASAP is promising a surge in the adoption of digital technologies in healthcare and research, resulting in a massive increase in data volume. Also, the region is emphasizing personalized medicine, and the focus on data security and compliance is predicted to drive further investments in this area.

Primarily, the Chinese government is broadly investing in R&D in life sciences, especially in data-driven sectors. This is highly boosting the demand for enterprise storage systems. Whereas novel developments in genomics, AI, and big data have led to an explosion in data generation, which is further propelling the need for advanced storage systems.

Immensely developing Japan has been committed to research and development in life sciences, with increased research activities in novel drug development driving demand for enterprise storage solutions. As well as Japan’s government stepping towards supporting policies and initiatives for automation and advanced manufacturing in Japan, it is also propelling the market growth.

For instance,

Europe is facing notable growth in the market, with the contribution of many factors, including encouraging government initiatives and regulations are fueling further investments in healthcare infrastructure and tailored medicine. Along with this, the life sciences enterprise storage market in Europe is impelled by rising R&D expenditure, especially in the pharmaceutical and biotech industries, which is fueling expansion in datasets, further accelerating demand for specialized storage systems.

The respective market is propelled by the escalated adoption of Electronic Health Records (EHRs), along with innovations in storage techniques, like hybrid flash arrays, which are enhancing data retrieval speeds and allowing better management of big data workloads. Also, the emergence of regulations, including GDPR, accelerates the need for secure and adaptable storage conditions, especially for delicate patient data is boosting overall market growth.

The UK’s government has started programs, such as Genomics England and the UK Biobank are propelling demand for storage solutions. Moreover, advancements in technologies like NVM Express (NVMe) have allowed storage solutions to provide quick data transfer rates, and hybrid storage solutions are appealing UK’s population. As well as the application of analytics and machine learning in life science R&D is fueling the UK’s market expansion, with a need for effective storage and data handling.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In May 2025, Salesforce, a major AI CRM, announced a network of certified life sciences partners to expand customer migration to Life Sciences Cloud, its HIPAA-ready, pre-validated, GxP-compliant platform. Frank Defesche, Senior Vice President and General Manager, Salesforce Life Sciences, stated that this will boost the togetherness of apps, data, life sciences-specific workflows, and AI, all in comprehensive trust and compliance. (Source - Businesswire)

By Storage Type

By Deployment Mode

By Application

By End User

By Region

November 2025

October 2025

October 2025

October 2025