January 2026

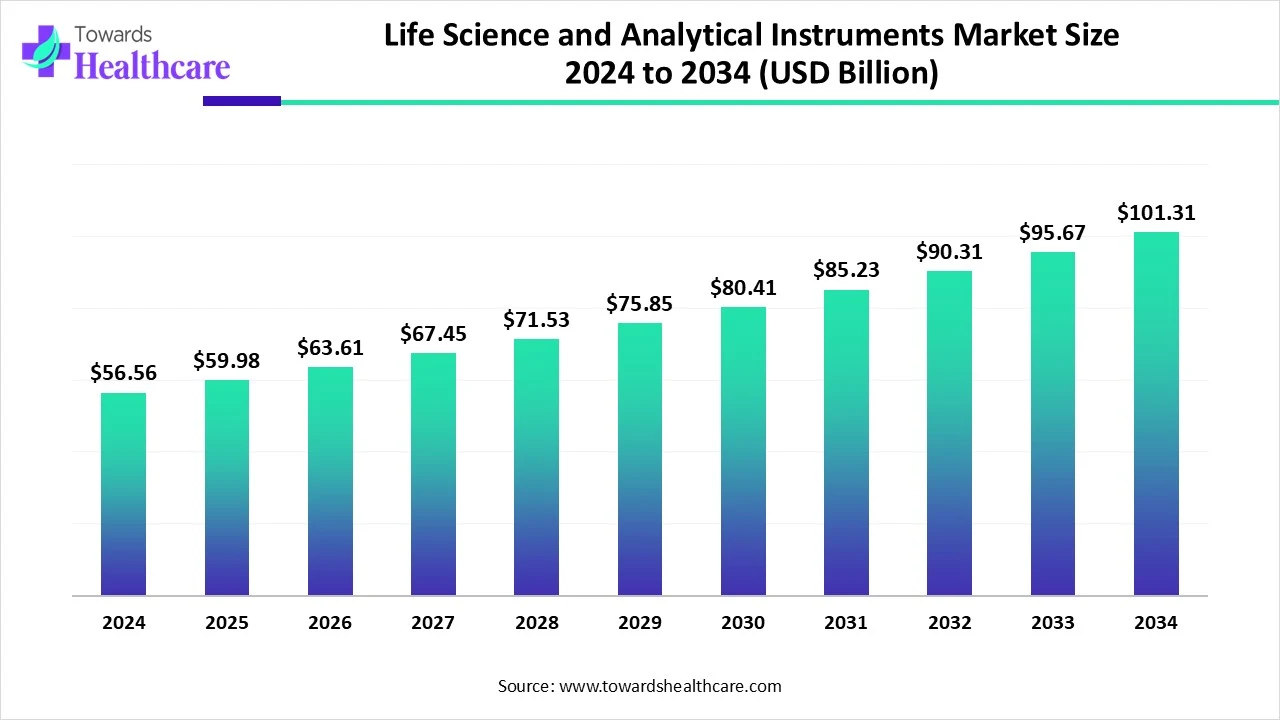

The global life science & analytical instruments market size is calculated at US$ 56.56 billion in 2024, grew to US$ 59.98 billion in 2025, and is projected to reach around US$ 101.31 billion by 2034. The market is expanding at a CAGR of 6.04% between 2025 and 2034.

The increasing prevalence of genetic disorders and target diseases, along with increased public and private funding for life science research and rising R&D spending by pharmaceutical and biotechnological companies, are all contributing to the growth of the global market for life science and analytical instruments. The use of various methods has significantly increased, including immunoassays, chromatography, spectroscopy, flow cytometry, polymerase chain reaction, next-generation sequencing, and clinical chemistry analyzers. Due to the growing need for this equipment, the global market for life sciences and analytical instruments is growing.

| Metric | Details |

| Market Size in 2025 | USD 59.98 Billion |

| Projected Market Size in 2034 | USD 101.31 Billion |

| CAGR (2025 - 2034) | 6.04% |

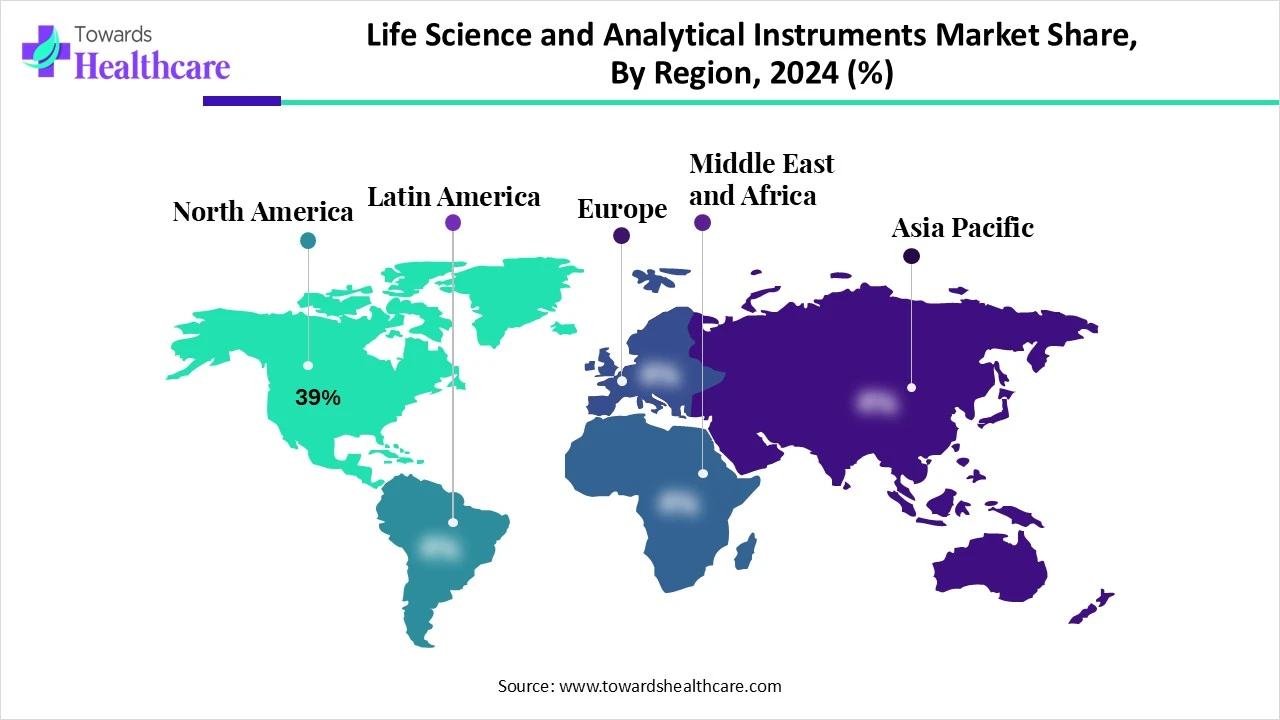

| Leading Region | North America share by 39% |

| Market Segmentation | By Product Type, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Danaher Corporation (including Sciex, Beckman Coulter, Leica), Shimadzu Corporation, PerkinElmer, Inc. (Revvity), Waters Corporation, Bruker Corporation, Bio-Rad Laboratories, Inc., Illumina, Inc., QIAGEN N.V., Roche Diagnostics, Eppendorf SE, Merck KGaA (MilliporeSigma), GE HealthCare (Cytiva), Oxford Instruments plc, JEOL Ltd., HORIBA Ltd., Hitachi High-Tech Corporation, Analytik Jena AG, BD Biosciences (Becton, Dickinson and Company) |

The life science & analytical instruments market comprises a wide range of instruments and systems used in biological research, drug discovery, clinical diagnostics, forensics, food testing, environmental analysis, and industrial quality control. These instruments help in analyzing the physical, chemical, molecular, and biological properties of materials. The market is driven by rising R&D spending in pharma-biotech, technological advancements in omics and imaging, and increasing demand for precision medicine, regulatory testing, and academic research.

By integrating AI into lab equipment and informatics platforms, researchers have made notable advancements in life science laboratories. Using artificial intelligence (AI) to leverage laboratory automation improvements guarantees accuracy and precision while managing microtiter-size sample quantities during upstream procedures. Sample preparation for bioanalysis is made easier by this automation, which reduces human error. AI-driven automation is being used more and more in downstream processes to electronically record and retain lab study methods and data.

Rising Government Initiatives

Growing R&D in the biotechnology and life science sectors, as well as more government investment in life science research, are some of the key factors driving the market for life science instruments. Stricter government regulations to ensure the safety of pharmaceuticals and heightened consumer awareness of food quality also promote market expansion.

Lack of Expertise & High Cost

Numerous barriers may keep the market for analytical equipment from expanding, even if it is already growing. One major barrier that may be out of reach for labs and smaller businesses with more limited funding is the high cost of devices. Furthermore, using and maintaining certain analytical instruments can be challenging and require specialized expertise and skills.

Emergence of Miniaturized Instruments and Portability

One significant trend in the market for analytical and life science instruments is the growing creation and application of portable and tiny equipment. These small devices offer the advantage of enabling real-time, on-site analysis, which is particularly beneficial for field research, point-of-care diagnostics, and environmental monitoring. Due to advancements in lab-on-a-chip and microfluidics technology, smaller yet equally effective analytical instruments are now possible. This trend is being driven by the growing need for faster and more accessible analytical solutions, particularly in remote or resource-constrained locations. The proliferation of portable tools is expected to boost market penetration, especially in developing countries.

By product type, the spectroscopy instruments segment dominated the life science & analytical instruments market in 2024. At the atomic and molecular level, spectroscopy makes delicate observations possible. Spectroscopy equipment is therefore commonly used in research, pharmaceutical, and industrial fields, including manufacturing, drug development, material science, and chemical analysis of forensic, industrial, and environmental materials. Spectrophotometers are essential tools for qualitative and quantitative analysis in both fundamental and practical research.

By product type, the lab automation & robotics segment is estimated to grow at the highest CAGR during 2025-2034. Scientific research, analysis, and diagnosis are being revolutionized by laboratory robots and automation. Through the integration of cutting-edge technologies, including robots, artificial intelligence, and complex software systems, medical research labs are attaining previously unheard-of levels of accuracy, productivity, and repeatability. For clinical laboratories to streamline processes and maximize resources, automation and robotics integration are essential.

By application, the pharmaceutical & biotechnology research segment held the major share of the life science & analytical instruments market in 2024. Both biotechnology and pharmaceutical research are highly essential in providing advanced, novel, and latest therapeutics. While biotechnology research focuses on innovation in cellular biologics, and gene-based products & services, pharmaceutical research is more focused on developing, optimizing drugs. But both the research sectors require highly advanced life science & analytical instruments such as spectrometers, microscopes, thermocyclers, etc.

By application, the bioprocess monitoring segment is anticipated to be the fastest-growing during the forecast period. Monitoring and controlling bioprocesses is a complicated endeavor that requires quick, dependable techniques that can be adjusted for ongoing investigation. Advances in several biotechnology domains need the use of suitable equipment for production control and bioprocess research. There is new, more sensitive equipment available, and in some situations, it may be operated and monitored online.

By end-user, the pharmaceutical & biotechnology companies segment dominated the life science & analytical instruments market in 2024. Advanced laboratory equipment is crucial to pharmaceutical discovery, research, and manufacturing. In order to guarantee the quality, safety, and effectiveness of pharmaceutical goods, these tools are essential. Additionally, laboratories must be furnished with a variety of equipment and instruments, ranging from benchtop devices to larger standalone and integrated systems, in order for biotechnological research and development to thrive.

By end-user, the industrial laboratories segment is expected to grow at the highest rate during the upcoming timeframe. Selecting the right equipment is crucial for conducting accurate testing, analysis, and research in modern industrial laboratories. Every element, from sophisticated analysis tools to safety gear, improves dependability and efficiency. To support a range of procedures, analysis, and experiments, industrial laboratories depend on a variety of equipment. Several key considerations should be taken into account when selecting laboratory equipment. These consist of budgetary restrictions, scalability, brand reputation, application-specific requirements, and regulatory compliance.

North America dominated the life science & analytical instruments market share by 39% in 2024. The region's established pharmaceutical sector and healthcare system are responsible for this sizable portion, since they have generated a substantial demand for analytical apparatus for both clinical and research applications. The demand for these tools has also been spurred by extensive R&D projects for the development of vaccines and treatments for various illnesses, as well as an increase in public-private financing in cancer research.

The utilization of living organisms to produce commodities and services that benefit society has been made possible by the U.S. National Science Foundation's biotechnology investments for decades, which have also expedited scientific discovery. Biodegradable plastics and life-saving vaccinations are just two examples of how innovations based on the discovery, use, and modification of living things are expanding the U.S. economy and revolutionizing industries as diverse as manufacturing, clean energy, agriculture, and medicine.

The goal of PHAC is to enhance the health of all Canadians and communities, with science at its heart. The Agency is a scientific-based institution that leads the way in public health science in Canada. From 2021 to 2022 and 2024 to 2027, it invested an average of over $400 million annually in science activities. Along with our scientific research, this also involves investments in applied public health research, science communication initiatives, and attempts to identify and comprehend health concerns.

Asia Pacific is estimated to host the fastest-growing life science & analytical instruments market during the forecast period. China, Japan, South Korea, India, and other nations are making more and more investments in biomedical infrastructure and healthcare. As a result, there is now a greater need in the area for sophisticated life science research instruments and analytical equipment. As its pharmaceutical sector grows to meet the extensive healthcare demands of its people, China continues to be the key development engine in Asia Pacific.

The Chinese government has been offering policy and regulatory clarifications since late 2023 in an effort to attract international investments and facilitate their operations in China related to the health sciences sector. In order to support China's attempts to promote cross-border technology transfer for local production of new medications and medical devices, the NMPA has set up a series of accelerated approval processes.

One of the world's leading marketplaces for life sciences (LS) is India, with the fastest rate of growth. The nation's rapidly growing population, expanding life expectancy, robust industrial foundation, and inclusive government policies are all contributing factors to the LS sector's potential for multi-fold expansion by 2030. The factors driving LS expansion in India include rising government funding in the healthcare sector, cost advantages in terms of reasonably priced labor and real estate, and the availability of a sizable skilled workforce.

Europe is expected to grow significantly in the life science & analytical instruments market during the forecast period. Included major contributions from Germany, France, the United Kingdom, and other countries. The region's robust biotechnology and pharmaceutical industries, together with its strong emphasis on research and innovation, are driving the need for advanced analytical instruments. Additionally, the stringent regulatory requirements for environmental monitoring and food safety are facilitating the usage of analytical equipment in this area.

With a strong biotechnology, pharmaceutical, and medical technology sector, Germany is a prominent player in the worldwide life sciences industry. Germany is a hub for innovation, with 3,842 companies in the sector, thanks to creative research and strong public-private collaborations. The biotechnology sector is particularly robust, with pharmaceutical and diagnostic companies accounting for a significant portion of the market. Additionally, Germany boasts a thriving medical technology sector with a focus on cutting-edge diagnostics and digital health solutions.

A major step towards enhancing global competitiveness, the new UK strategy introduces the upcoming Life Sciences Sector Plan. The UK government's new 10-year Industrial Strategy aims to boost both domestic talent and economic growth. There are plans to issue more plans that concentrate on key areas of growth, such as the bio sciences.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In January 2024, the CEO of Opentrons, Jonathan Brennan-Badal, says that because every academic discipline has unique needs, companies have an opportunity to develop and offer a vast array of products and services that are required. Thanks to Opentrons' open-source robotics platform's many uses and versatility, as well as important partner technologies that satisfy various needs, global laboratories may create and automate with efficiency. (Source - Businesswire)

By Product Type

By Application

By End User

By Region

January 2026

January 2026

December 2025

December 2025