January 2026

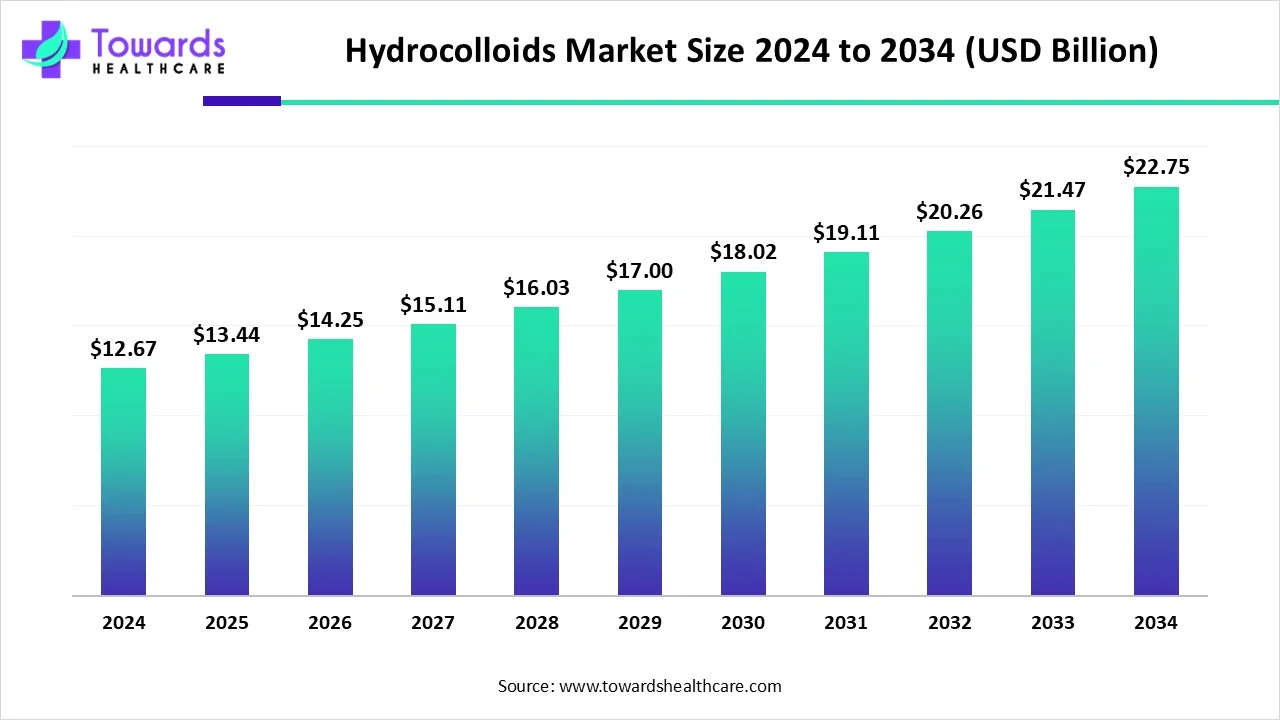

The global hydrocolloids market size is calculated at US$ 13.44 billion in 2025, grew to US$14.25 billion in 2026, and is projected to reach around US$ 24.16 billion by 2035. The market is expanding at a CAGR of 6.04% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 13.44 Billion |

| Projected Market Size in 2035 | USD 24.16 Billion |

| CAGR (2026 - 2035) | 6.04% |

| Leading Region | Europe |

| Market Segmentation | By Product, By Function, By Application, By Region |

| Top Key Players |

DuPont, Palsgaard, Nexira, Ingredion,Incorporated, Kerry, BASF, Ashland, CP Kelco U.S. Inc., Glanbia Nutritionals, Darling Ingredients, Inc., Tate & Lyle Plc, Cargill, Incorporated, Fuerst Day Lawson, Koninklijke DSM N.V., The Archer Daniels Midland Company (ADM) |

A broad class of proteins and polysaccharides with a strong gelling ability is referred to as hydrocolloids. Many of these come from nature, with the majority coming from the plant kingdom. Hydrocolloids, however, may also come from bacteria, algae, and animals. Hydrocolloids are mostly employed as gelling and thickening agents.

Hydrocolloids have been investigated more and more in the creation of nanocarriers for targeted and regulated drug administration, perhaps because of their superior biological qualities, low toxicity, and biocompatibility. In addition to improving encapsulation effectiveness and pharmacokinetic features of therapeutic molecules, nanocarriers can stop medication degradation. Guar gum, carrageenan, xanthan gum, gum arabic, pectin, and other hydrocolloids have demonstrated the ability to shield medications against environmental stresses in the pharmaceutical industry.

Research efforts must be maintained in order to spur more breakthroughs and developments as the area of hydrocolloid biotechnology develops and grows. Current issues and constraints, such as legal restrictions and the expansion of sustainable manufacturing methods, can be addressed with the support of further study. Research in hydrocolloid biotechnology is also increasingly utilizing machine learning and artificial intelligence (AI). Research and development procedures can become more successful and economical by using AI to forecast the characteristics of novel hydrocolloids based on their chemical compositions and structures.

Rising Usage in Dermatology

It is commonly known that hydrocolloid dressings (HDs) are useful in treating a variety of wound types, including acute and chronic wounds. Hydrocolloid dressings can be used to treat a variety of wounds, such as superficial wounds, surgical wounds, graft donor sites, and several forms of burns. The use of hydrocolloids as tiny patches for the treatment of various disorders, such as acne, has gained attention despite their widespread usage in the wound healing field.

Strict Regulations

It has been noted that there are no precise, universal rules governing how different components should be used in final goods. Each region has its own set of rules and regulations. As a result, producing materials unique to a certain place has become more expensive. In addition, there are strict regulations governing the quantity of hydrocolloids that can be utilized in food products.

Rising Demand in Pharmaceuticals & Cosmetics

Because of its special qualities, which include outstanding moisture retention, controlled release, and biocompatibility, hydrocolloids are quickly becoming more and more well-known in important industries like cosmetics and medicines. These characteristics are essential for increasing the hydrocolloids market share in these important industries. These polymers are widely used in the pharmaceutical sector as excipients in the manufacturing of tablets, in the formulation of wound care products, and in drug delivery procedures. Furthermore, hydrocolloids are a better choice for both oral dosage forms and transdermal patches due to their capacity to create hydrogels and regulate drug release in patients. Additionally, because of its hydrating and skin-soothing qualities, hydrocolloids are preferred in the cosmetics industry for use in skincare products, particularly in moisturizing and anti-aging formulas.

By product, the gelatine segment held the major share of the hydrocolloids market in 2024. Gelatin is necessary for several additional uses, even though it is mostly utilized for hard and soft capsules. It serves as a matrix in vitamin coating and a binder in tablets. Haemostatic sponges, vaccinations, and plasma expanders are all made from low-endotoxin gelatins. Gelatin is particularly flexible because of its sticky behavior, thermo-reversible gelation qualities, and film-forming capacity. Due to its exceptional qualities, gelatin is also utilized in a variety of additional medical applications, such as thickening liquid dosage forms, forming skin-compatible zinc paste binders, and serving as an excipient for granulates, tablets, or sugar coatings.

By product, the xanthan gum segment is expected to grow at a significant rate in the hydrocolloids market during the forecast period. The applications for xanthan gum are many in both the culinary and medicinal sectors. Xanthan gum is a possible pharmaceutical excipient that has been employed in the formulation of several drug delivery systems, including topical, buccal, oral, and others. As a suspending agent, emulsion stabilizer, and foam enhancer in semi-solid, liquid, and topical formulations, it finds extensive usage in pharmaceutical applications.

By function, the thickening segment dominated the hydrocolloids market in 2024. To improve the consistency and flow characteristics of a variety of pharmaceutical formulations, such as tablets, suspensions, and ointments, hydrocolloids are frequently utilized as thickening agents. They function by absorbing water and creating a gel-like structure, which raises the product's viscosity and enhances its overall texture.

By function, the gelling segment is estimated to be significantly growing in the hydrocolloids market during the forecast period. Hydrocolloids are frequently utilized as gelling agents in pharmaceutical formulations, offering a number of advantages such as enhanced drug delivery, smoothness, and stability. These are polymers, either natural or manmade, that can gel when combined with water to produce a semi-solid consistency. The ability to gel is essential for a number of uses, such as oral formulations and topical therapies.

By application, the pharmaceutical segment held a significant share of the hydrocolloids market in 2024. Hydrocolloids are used in the pharmaceutical industry for a number of purposes, such as binders, excipients, and controlled-release agents in medication formulations. By doing this, the solubility of active substances inside delivery systems is increased, and an equal distribution of the required viscosity is maintained. Hydrocolloid adhesives have special edible qualities, such as being wet and non-toxic. This effectively adheres to the skin, enhancing the drug's delivery potential by forming a barrier that prevents further degradation by the environment.

By application, the personal care & cosmetics segment is estimated to achieve a significant growth rate in the hydrocolloids market during the predicted time frame. Natural texturizers have become more and more popular in recent years due to the widespread consumer interest in natural cosmetics. Originally promoted in organic cosmetics, these substances were first employed as food additives. They have now found their way into mass-market items, and the trend appears to be continuing. They are frequently multipurpose, used to thicken or gel, and crucial to the formula's stability.

Europe dominated the hydrocolloids market in 2024, known for its strict regulatory frameworks and robust R&D capabilities. The largest economies in the region Germany, the United Kingdom, Italy, and France all make distinct contributions to the growth of the market. Due to customer preferences for healthier food alternatives, the European industry is especially driven by the growing demand for natural and clean-label components. Manufacturers of hydrocolloids are constantly being presented with new prospects by the region's thriving pharmaceutical sector and emphasis on creative uses.

In the European gelatin market, Germany is a major player with a sizeable market share. Out of 112 countries, Germany was the third-largest exporter of gelatin in 2023, with $256 million in exports. Gelatin ranked 559th out of 1,215 foreign goods shipped from Germany in that same year. Germany's gelatin exports to France ($26.3M), Japan ($22.7M), Italy ($21.7M), Switzerland ($18.7M), and the US ($17.1M) were the top destinations in 2023.

In order to export gelatin to the UK, exporters need to make sure their facilities are listed with the UK Department for Environment, Food & Rural Affairs, audited by qualified authorities, and HACCP-certified. Products need special health certifications before they can be consumed by humans. The United Kingdom ranked 13th out of 112 countries in the world for gelatin exports in 2023, with $62.7 million in exports. Out of 1,216 products shipped from the UK in that same year, gelatin ranked 479th. The top countries to which the United Kingdom exported gelatin in 2023 were France ($34.2M), the US ($19.2M), Canada ($1.7M), Ireland ($1.44M), and Italy ($1.32M).

Asia Pacific held the second-largest share of the hydrocolloids market in 2024. Driven by the growing demand from pharmaceutical applications and the quickening pace of industrialization. The region's largest economies—China, India, Japan, and South Korea—all make substantial contributions to the expansion of the market. Opportunities for producers of hydrocolloids have increased significantly as a result of the burgeoning food processing industry and rising consumer awareness of wellness and health goods. Due to its strong industrial capacities, especially in China and Japan, the area is now a major producer and consumer of food hydrocolloids by far.

Before a facility may export gelatin to China, it must be inspected and approved by APHIS. With $245 million in exports in 2024, gelatin ranked 721st out of 1,211 Chinese products. South Korea ($19.6M), Japan ($18M), Vietnam ($16M), India ($24.9M), and the United States ($32.4M) were China's top export destinations for gelatin in 2024.

Japan was among the leading exporters of gelatin. Germany ($256M), China ($295M), and Brazil ($377M) were the top exporters of gelatin in 2023. Japan ($139M), Germany ($315M), and the United States ($376M) were the leading importers. Compared to 2022, Japan's sales of commodity group 3503 increased by 9.55%. With 1,159 shipments totaling 20,109 tons, NITTA GELATIN INC. is the biggest exporter of gelatin.

North America is expected to grow significantly in the hydrocolloids market during the forecast period. Supported by a strong worldwide supply chain and significant R&D expenditures, hydrocolloids are extensively accessible to satisfy the growing demand from consumers for natural and useful substances. Major industry players, including DuPont, Cargill, CP Kelco, and DSM, propel market expansion quickly through strategic expenditures in R&D and international expansion strategies.

Market access for collagen and gelatin goods exported by the United States to the European Union (EU) and the United Kingdom (UK) is contingent upon meeting establishment listing criteria. Gelatin was the 779th most exported product in the United States in 2024, with $85.1 million in exports (out of 1,227). The Dominican Republic ($4.27M), Canada ($32.8M), Mexico ($25.2M), Germany ($6.17M), and India ($4.61M) were the top destinations for U.S. gelatin exports in 2024.

Health Canada regulates the approval of hydrocolloids as emulsifying, gelling, stabilizing, or thickening agents. The Government of Canada invested $89.5 million over five years to establish the Canadian Drug Agency (CDA), in addition to the existing federal funding of $34.2 million annually to support the Canadian Agency for Drugs and Technologies in Health (CADTH).

The Middle East & Africa are expected to grow at a notable CAGR in the hydrocolloids market in the foreseeable future. The increased food processing activities and the rising development of drug delivery systems are the major growth factors of the market. Favorable government initiatives to support pharmaceutical research and funding also contribute to market growth. The burgeoning pharmaceutical sector and the growing number of pharma startups augment the market.

Saudi Arabia has the largest pharmaceutical market in the Middle East & Africa. There are over 40 registered pharmaceutical factories, covering 36% of the Saudi market’s pharmaceutical needs. (Source: Saudipedia)

The federal government launched the “Saudi Vision 2030”, a roadmap for the healthcare sector’s pharmaceutical and biotech components. (Source: WAM Saudi)

The pharmaceutical sector in the UAE is undergoing a remarkable transformation, driven by robust government support and strategic investments. The Abu Dhabi Industrial Strategy was developed to support the growth and competitiveness of the Pharmaceutical sector, with an investment of AED 10 billion.

In January 2025, through innovation and decades of experience, the ECE portfolio demonstrates our dedication to improving biomedical solutions. Biotechnological approaches will be used in the future to create animal-free substitutes with improved qualities that are even more sustainable and resource-efficient than traditional techniques. We are prepared to increase our biotechnological knowledge and product line thanks to the pharmaceutical experience of the GELITA Pharma Institute and our Biotech R&D Hub in Frankfurt, according to Martin Junginger, category manager, worldwide marketing & innovation management.

By Product

By Function

By Application

By Region

January 2026

January 2026

January 2026

January 2026