December 2025

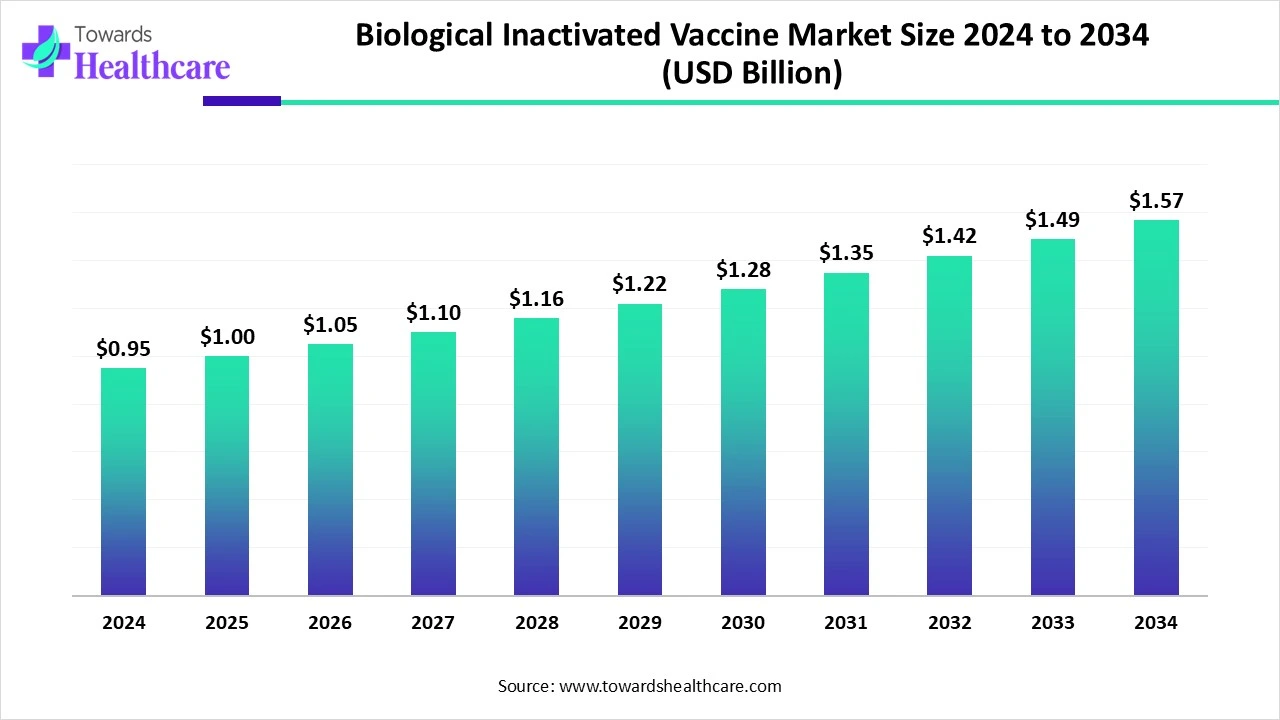

The global biological inactivated vaccine market size is calculated at USD 0.95 billion in 2024, grew to USD 1.00 billion in 2025, and is projected to reach around USD 1.57 billion by 2034. The market is expanding at a CAGR of 5.14% between 2025 and 2034.

The biological inactivated vaccine market is primarily driven by the rising prevalence of infectious disorders. The growing need to prevent infectious disorders and the increasing emphasis by government organizations are boosting the market. This leads to the development of new product launches. Numerous immunization programs promote the demand for inactivated vaccines. The future looks promising, with the new development and delivery techniques.

| Metric | Details |

| Market Size in 2025 | USD 1.00 Billion |

| Projected Market Size in 2034 | USD 1.57 Billion |

| CAGR (2025 - 2034) | 5.14% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Vaccine Type, By Application/Disease Type, By End-User, By Route of Administration, By Distribution Channel, By Technology/Production Process, By Region |

| Top Key Players | GlaxoSmithKline (GSK), Sanofi Pasteur, Pfizer Inc., Bharat Biotech International Ltd., Serum Institute of India Pvt. Ltd., Sinovac Biotech Ltd., Johnson & Johnson (Janssen Pharmaceuticals), Baxter International Inc., Valneva SE, Boehringer Ingelheim GmbH, Novavax, Inc., Merck & Co., Inc., Cangene Corporation (now part of Emergent BioSolutions), Shenzhen Kangtai Biological Products Co., Ltd., Sinopharm Group Co., Ltd., Biological E Limited, Jiangsu Changjiang Bio-Pharmaceutical Co., Ltd., LG Chem, Ltd., Mylan N.V., Serum Institute of India Pvt Ltd. |

The biological inactivated vaccine market refers to the global market for vaccines that contain pathogens (viruses or bacteria) that have been killed or inactivated so do not cause disease. These vaccines stimulate the immune system to produce a protective response without risking infection. Inactivated vaccines are widely used to prevent infectious diseases, including influenza, polio, hepatitis A, and rabies, among others. They are considered safe and effective, particularly for immunocompromised individuals.

Numerous factors influence market growth, including the rising prevalence of infectious disorders and growing research and development activities. Favorable government support for immunization boosts the market. The increasing investments and collaborations lead to the development of novel vaccines. The growing number of clinical trials and the burgeoning biotech sector contribute to market growth. Technological advancements drive the latest innovations in the production of inactivated vaccines.

Artificial intelligence (AI) can revolutionize the development of biological inactivated vaccines by introducing automation, enhancing the efficiency and accuracy of the development process. AI assists researchers in designing novel vaccines, focusing on antigen selection, epitope prediction, adjuvant identification, and optimization strategies. AI and machine learning (ML) algorithms analyze vast amounts of data and predict antigenic epitopes and assess immunogenicity. They facilitate the development of safe and more efficacious vaccines. Integrating AI and ML in single-cell omics and synthetic biology enhances vaccine design precision and scalability.

Immunization Programs are Driving the Market

The major growth factor of the biological inactivated vaccine market is favorable immunization programs by government organizations. The growing infectious disorders among people of all age groups necessitate the delivery of vaccines. The WHO launched the “Immunization Agenda 2030” to create awareness and assist every country in achieving a world where everyone fully benefits from vaccines for good health and well-being. (Source - WHO) The WHO has reported that immunization prevents 3.5 million to 5 million deaths annually from diseases such as diphtheria, tetanus, pertussis (whooping cough), influenza, and measles.

Lesser Efficacy

Inactivated vaccines do not contain live pathogens; thus, they have a reduced ability to produce a robust immune response. They are comparatively less efficacious than live attenuated virus vaccines. This facilitates the development of novel vaccine types, such as DNA and mRNA vaccines, restricting the use of inactivated vaccines.

What is the Future of the Biological Inactivated Vaccine Market?

The market future is promising, driven by new development techniques that create different types of vaccines. Researchers focus on developing novel methods for the preparation of inactivated vaccines. They aim to generate vaccines on a larger scale and at a faster speed. Novel techniques are developed to inactivate or kill microbes. Additionally, novel drug delivery systems are prepared to deliver vaccines other than injections. Some common novel delivery techniques include inhaled vaccines and patch application. Influenza vaccines have been made in a nasal spray. At the same time, a patch delivers a vaccine through the matrix of extremely tiny vaccines.

By vaccine type, the viral vaccines segment held a dominant presence in the market in 2024. This is due to the growing risk of viral infections and the simplicity of viral vaccines. Inactivated viral vaccines elicit immune responses without requiring adjuvants. They provide long-lasting responses compared to bacterial vaccines. Novel vectors are used to deliver inactivated virus in humans. The stability and safety of inactivated viral vaccines also make them a suitable option.

The influenza vaccine sub-segment held the largest revenue share. The rising incidence of seasonal influenza necessitates the delivery of influenza vaccines to humans of all ages. Influenza vaccines can reduce the risk of hospitalization and protect people from infection with the virus.

The rabies vaccine sub-segment is expected to grow rapidly. Rabies is a fatal disorder that affects the brain and nervous system, leading to seizures, hallucinations, and paralysis. The rabies vaccine can prevent this deadly viral disease caused by an animal bite.

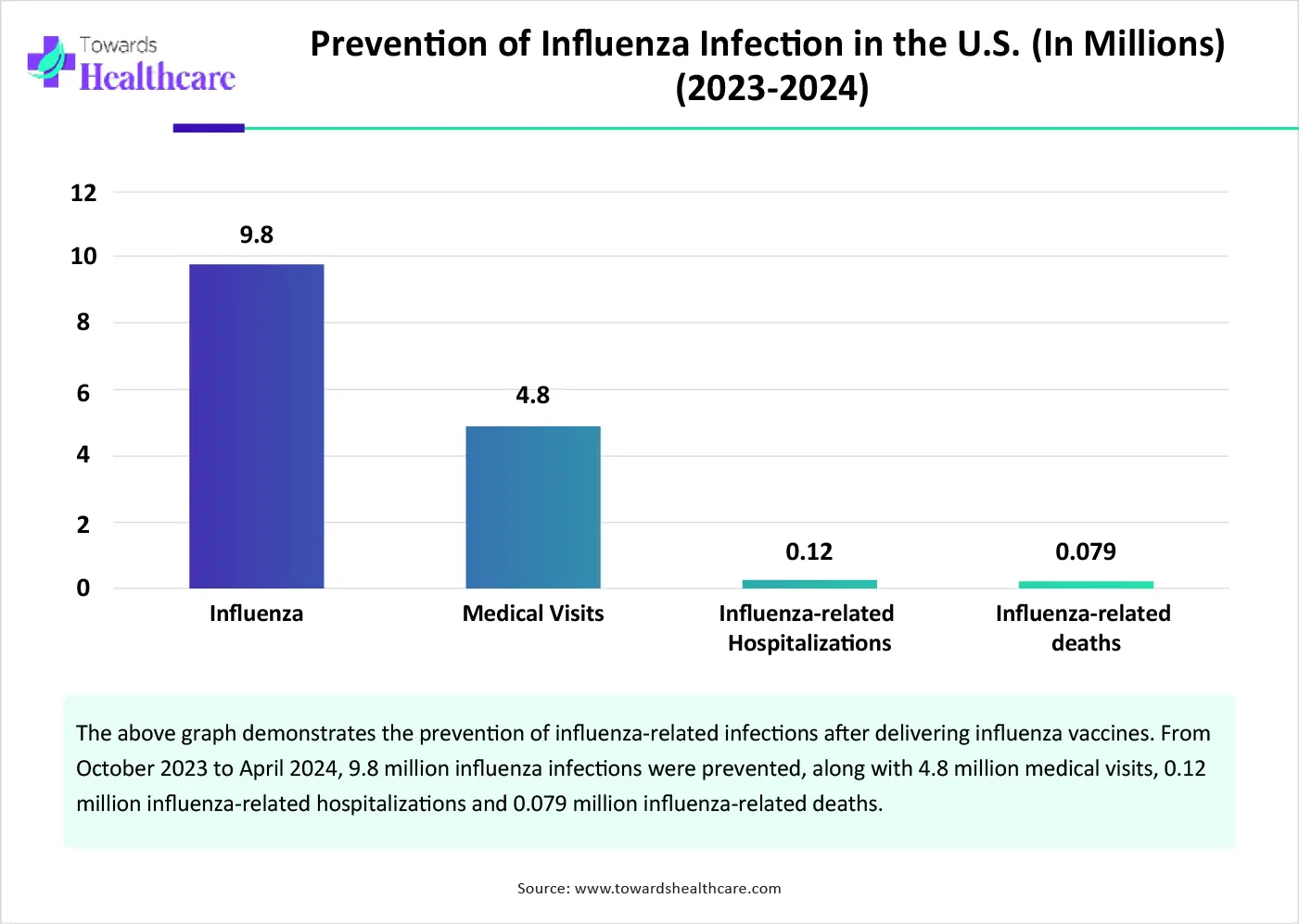

By application/disease type, the influenza segment contributed the biggest revenue share of the market in 2024. This segment dominated because of the growing influenza infection and the need to prevent infection. The WHO reported that influenza incidence is higher in Central America and the Caribbean, Tropical South America, and South East Asia. The influenza prevalence was more than 30% in parts of Western Africa, Tropical South America, and Southern Asia. (Source - WHO) The Centers for Disease Control and Prevention (CDC) estimated that 9.8 million influenza-related illnesses were prevented through influenza vaccines from October 2023 to April 2024.

By application/disease type, the polio segment is expected to grow at the fastest CAGR in the market during the forecast period. Numerous countries launch initiatives and campaigns to create awareness among the general public to receive polio vaccines and prevent polio infections. This has benefited several countries, resulting in 99-100% eradication of polio infections. However, as of 16th July 2025, Afghanistan, Angola, Cameroon, Chad, Papua New Guinea, Somalia, and Yemen reported polio cases. (Source - Polio Eradication)

By end-user, the hospitals segment registered its dominance over the global market in 2024. This is due to the presence of favorable infrastructure and the increasing number of hospitalizations. Hospitals possess skilled professionals to deliver vaccines through several drug delivery systems. They are part of numerous clinical trials, enabling patients to access novel vaccines before market approval. The increasing pediatric population and growing awareness of vaccinations among children augment the segment’s growth.

By end-user, the research institutes segment is expected to expand rapidly in the market in the coming years. The growing research and development activities in research institutions lead to the development of novel vaccines. The research activities of such institutions are supported by funding from the government and private organizations. They have appropriate technology to develop and store vaccines.

By route of administration, the intramuscular segment accounted for the highest revenue share of the market in 2024. Intramuscular is the most preferred choice of vaccine delivery due to its ability of high immunogenicity and fewer adverse reactions. It also does not cause severe infections at the injection site. It has a faster onset of action and high bioavailability as it is directly delivered to the general circulation. It is usually administered through different body areas, such as the upper arms, thighs, or buttocks.

By route of administration, the intradermal segment is expected to witness the fastest growth in the market over the forecast period. The intradermal route is primarily used for the administration of the rabies and BCG vaccines. The demand for the intradermal route is increasing because skin contains large numbers of antigen-presenting cells. Thus, vaccines delivered through the intradermal route are more efficient, thereby increasing the availability of vaccine doses.

By distribution channel, the hospital pharmacy segment held a major revenue share of the market in 2024. The segmental growth is attributed to the favorable infrastructure and suitable capital investment. This enables hospital pharmacies to adopt appropriate equipment for vaccine storage. Hospital pharmacies have trained professionals to evaluate a patient’s prescription and provide vaccines. People prefer hospital pharmacies as they have a wide range of vaccines for different diseases.

By distribution channel, the online pharmacy segment is expected to grow with the highest CAGR in the market during the studied years. The burgeoning e-commerce sector and the increasing adoption of smartphones boost the segment’s growth. The growing digital healthcare adoption also facilitates the use of online pharmacies. Online pharmacies offer numerous benefits, such as free home delivery, special discounts, and virtual consultations with healthcare professionals. This enables patients to order vaccines from the comfort of their homes.

By technology/production, the egg-based inactivated vaccines segment held the maximum revenue share of the market in 2024. Egg-based manufacturing of inactivated vaccines is the most preferred choice for the large-scale production of vaccines. Most of the influenza vaccines available in the market are developed through the egg-based method. It is a well-established and well-characterized process with more than 30 years of commercial-scale application. Additionally, egg-based inactivated vaccines are more cost-effective than cell-based vaccines.

By technology/production, the cell culture-based inactivated vaccines segment is expected to show the fastest growth over the forecast period. Advancements in cell culture techniques have led to the development of cell culture-based vaccines. Cell culture-based manufacturing is an advanced technique and can be used to manufacture large quantities of vaccines. The growing emphasis on veganism and vegetarianism also encourages researchers to develop vaccines through this method. They provide long-term benefits compared to egg-based vaccines.

Asia-Pacific held a major revenue share of the market in 2024 and is expected to grow at the fastest CAGR in the market during the forecast period. The increasing population and suitable immunization programs boost the market. Government organizations create awareness of vaccination and prevention of infectious diseases through immunization programs and campaigns. The rising prevalence of infectious disorders, especially in low- and middle-income countries, propels the market.

As of 2023, more than 90% of the Chinese population had completed two doses of inactivated COVID-19 vaccines in Mainland China. China exported $1.03 billion of vaccines, blood, antisera, toxins, and cultures in 2024. Most of these products were exported to the U.S., Belgium, and the UK between 2023 and 2024. (Source - OEC)

India is emerging as a global hub for vaccine manufacturing and distribution. India accounts for 60% of the global vaccine production, making it the largest vaccine producer. It is also one of the biggest suppliers of low-cost vaccines in the world. It delivered over 298 million COVID-19 vaccines to around 100 countries from 2020 to 2023. (Source - Azadi ka Amrut Mahotsav)

North America is expected to grow at a considerable CAGR in the biological inactivated vaccine market in the upcoming period. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the major growth factors of the market in North America. The increasing research activities lead to the development of novel vaccines and the rising number of clinical trials. The presence of a robust healthcare infrastructure facilitates the distribution of innovative vaccines.

Key players, such as Pfizer, Inc., GlaxoSmithKline, and Johnson & Johnson, are the major contributors to the market in the U.S. Out of the total 1,366 clinical trials, 386 clinical studies are registered from the U.S. related to inactivated vaccines on the clinicaltrials.gov website as of July 2025. (Source - Clinical Trials)

The Government of Canada’s Public Health Agency launched the National Immunization Strategy to reduce vaccine-preventable diseases and increase the number of Canadians vaccinated over the next five years. The federal government invested $20 million in Sanofi’s new state-of-the-art vaccine manufacturing facility in Toronto, Ontario, to expand the production of life-saving vaccines. (Source - Prime Minister of Canada)

Josephine Cheng, Senior Modality Expert, APAC Process Solutions, Life Science business of Merck, commented that traditional vaccine types, such as inactivated viruses and recombinant protein/subunit, will remain an important part of the landscape due to a strong history of investment, efficacy, and regulatory success. She also said that vaccine manufacturers are actively planning for expansion and next-generation vaccine facilities. (Source - Biospectrum Asia)

By Vaccine Type

By Application/Disease Type

By End-User

By Route of Administration

By Distribution Channel

By Technology/Production Process

By Region

December 2025

December 2025

December 2025

December 2025