February 2026

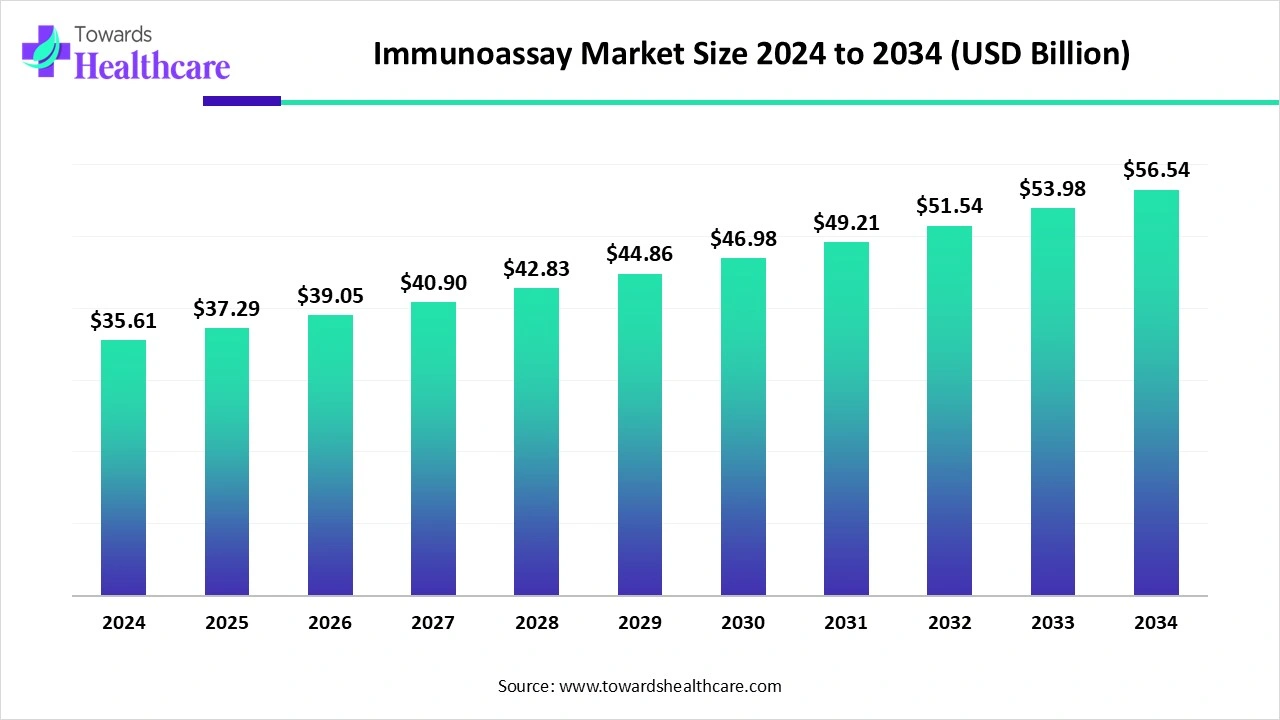

The global immunoassay market size is calculated at US$ 35.61 billion in 2024, grew to US$ 37.29 billion in 2025, and is projected to reach around US$ 56.54 billion by 2034. The market is expanding at a CAGR of 4.72% between 2025 and 2034.

The widespread developments in the immunoassay approaches, like Chemiluminescence Immunoassays (CLIA), quantum dots, and multiplexed immunoassays, are assisting in the global immunoassay market expansion. Along with this, the emergence of automation, like digital microfluidic (DMF) platforms, is also impacting the greater demand for immunoassays. The globe is enhancing focus on stability, specificity, sensitivity, and point-of-care testing (POCT) of these innovative assays. Other developments include paper-based ELISA (p-ELISA) with cost-effectiveness and portability in diverse hospitals and laboratories.

| Table | Scope |

| Market Size in 2025 | USD 37.29 Billion |

| Projected Market Size in 2034 | USD 56.54 Billion |

| CAGR (2025 - 2034) | 4.72% |

| Leading Region | North America |

| Market Segmentation | By Product, By Type, By Purchased Mode, By Technology, By generation, By Application, By End-User, By Region |

| Top Key Players | Abbott Laboratories, Bio-Rad Laboratories, Inc., Becton, Dickinson, and Company, F. Hoffmann-La Roche AG, Thermo Fisher Scientific, Inc., Siemens Healthinners, Danaher Corporation (Beckman Coulter), Quidel Corporation, Ortho Clinical Diagnostics, Sysmex Corporation |

A biochemical test that is used in the detection and quantification of specific analytes in a biological sample is known as an immunoassay. Primarily, it works on the principle of the specific binding of an antibody to its respective antigen, or vice versa. The immunoassay market is currently stepping into miniaturized immunoassays that are adaptable for wearable medical devices and home-based testing, with their enhanced accessibility. Along with this, the globe is shifting towards the transformation of multiplex immunoassays that enable the simultaneous determination of multiple analytes from a single sample, with accelerated effectiveness and offering entire patient data.

Highly developed healthcare infrastructure, technological advances, and ongoing R&D investments are increasingly fueling innovations in the respective market.

An AI-enabled world is focusing on the application of its numerous algorithms in the development of ultrasensitive immunoassays that can identify extremely low levels of biomarkers, further coupled with early diagnosis of diseases, particularly cancer, Alzheimer's, and Parkinson's. Furthermore, this helps in the robust monitoring of disease progression and treatment response. Other evolutions consisting of AI-driven lateral flow immunoassays (LFIA) for point-of-care applications and digital immunoassay platforms with convolutional neural networks (CNNs) for faster, multiplexed detection.

Modernization and Ongoing Advances

As the globe is emphasizing breakthroughs in the healthcare system, which also encompasses the execution of advanced immunoassay technologies, it is acting as a major driver. The global immunoassay market is further fueled by continuous advancements in technologies and laboratory automation. This mainly includes the progression of cutting-edge immunoassay technologies, especially chemiluminescence (CLEIA), surface plasmon resonance (SPR), and rapid tests, which boost precision, speed, and throughput in diagnostics. Whereas, the widespread adoption and demand for efficient automated, automated, high-throughput immunoassay analyzers and integrated systems that are linked to hospital information systems, to expand operational efficiency and aid clinical decision assistance.

Lack of Well-trained Personnel and Regulatory Limitations

These advancing technologies need well-trained professionals to operate immunoassay equipment and interpret the results is evolving into a hindrance to the overall market growth. Also, stringent regulatory frameworks from the FDA and European MDR are required throughout validation and testing, which accelerates spending and delays product launches.

Applications of Nanotechnology and Others

The global immunoassay market will demonstrate several prominent applications in the future, including the broader use of nanotechnology. Eventually, this approach will develop quantum dots that strongly boost immunoassay sensitivity and specificity by facilitating unique optical properties for identification. However, another significant opportunity is the adoption of Metal-Organic Frameworks (MOFs) to enhance the stability, sensitivity, and selectivity of immunoassay platforms through their porous structure and tunable surface characteristics. Multiplexed immunoassays are further coupled with data from omics technologies, primarily proteomics, to inform personalized treatment strategies.

In 2024, the kit and reagent segment accounted for the biggest revenue share of the market. A rise in demand for earlier disease detection, customized treatment, and ready-to-use kits that provide standardized protocols is driving the segment expansion. Whereas, nowadays, the growing developments in higher-quality, more specific reagents, like recombinant rabbit monoclonal antibodies and well-verified antibody pairs, are also expanding the need and demand for kits and reagents among hospitals and laboratories. Also, the emergence of nanozymes instead of natural enzymes and metal nanoparticle amplification for increased sensitivity in low-level detection is fueling further growth.

Although the software and services segment is anticipated to expand rapidly in the immunoassay market in the coming era. A surge in innovations, like label-free systems, high-throughput platforms, and multiplex assays, is generating opportunities for new software solutions to assist their escalated capabilities. Incorporation of various services, such as consulting, calibration, maintenance, and validation of immunoassay instruments, is also influencing the segmental growth. Global novel approaches comprise curve-fitting software, such as Belysa, digital microfluidic (DMF) platforms for automating processes, and cloud-based services for data analysis and management, complementing advanced techniques, specifically Simoa for ultra-sensitive detection, are propelling the global expansion.

By technology, the ELISA segment led with the dominating share of the immunoassay market. Ongoing heavy investments in R&D for the detection of novel biomarkers, the development of innovative vaccines, and the creation of targeted therapies are widely demanding ELISA as a vital tool in these processes. Alongside, a greater application of digital ELISA is assisting in the identification of femtogram-level analytes by gaining single molecules on beads and assessing them in microwells. Moreover, the worldwide emphasis on the development of paper-based ELISA (p-ELISA) that delivers a simple, affordable, and portable alternative to the conventional lab-based tests is further favourable for point-of-care diagnostics

In 2024, the infectious disease segment captured a major share of the immunoassay market. An accelerating case of chronic and infectious diseases, particularly HIV, hepatitis, tuberculosis, and respiratory illnesses, is a crucial driver in the demand for effective immunoassays. As well as a rise in government-led health programs and public awareness campaigns, foster diagnostic testing, with expanded awareness and uptake of immunoassays for disease management. Also, an emerging need for robust diagnostic tools to track disease progression, lower transmission, and optimize patient outcomes, mainly in public health programs and for vulnerable populations, including elderly people, is impacting the market development.

The hospital & clinical segment accounted for the largest share of the immunoassay market in 2024. A combination of factors, like a huge burden of an aging population associated with chronic issues, and the increasing demand for early diagnosis and preventive care, is fueling the segment growth. Whereas, well-developed hospital & clinical facilities are utilizing quick, sensitive, and specific detection and quantification of diverse analytes in biological fluids, particularly hormones, proteins, drugs, and disease markers.

On the other hand, the blood banks segment is predicted to register the fastest growth in the immunoassay market during 2025-2034. These facilities are widely incorporating (ELISAs), which are significant for screening donated blood for transfusion-transmissible infections (TTIs), like HIV, Hepatitis B, and Hepatitis C. The promising focus on blood safety during transfusion, and the use of innovative bispecific antibodies and recombinant proteins in blood banks, are boosting the overall adoption of various immunoassays. According to e-Raktkosh, in India, 4205 registered blood banks are promoting the Blood Transfusion Services (BTS) Programme, which has accelerated the wide range of applications of advanced immunoassays.

The immunoassay market in North America captured a dominant share in 2024. This region is aiming at the widespread need for personalized medicine, precision diagnostics, with enhanced R&D investments. Besides this, the presence of key players like Thermo Fisher Scientific, Abbott Laboratories, etc., is focusing on early cancer detection, automated laboratories, and launches of high-sensitivity tests for cardiovascular conditions and Alzheimer's. Also, the regional market is putting efforts into infectious disease testing, cancer biomarker detection, chronic disease diagnosis, and therapeutic drug monitoring.

In July 2025, Spear Bio, a biotechnology company pioneering homogeneous ultrasensitive immunoassay technology, partnered with Bio-Techne Corporation, a global leading provider of innovative reagents, instruments, to boost global access to Spear Bio’s innovative SPEAR UltraDetect immunoassays.

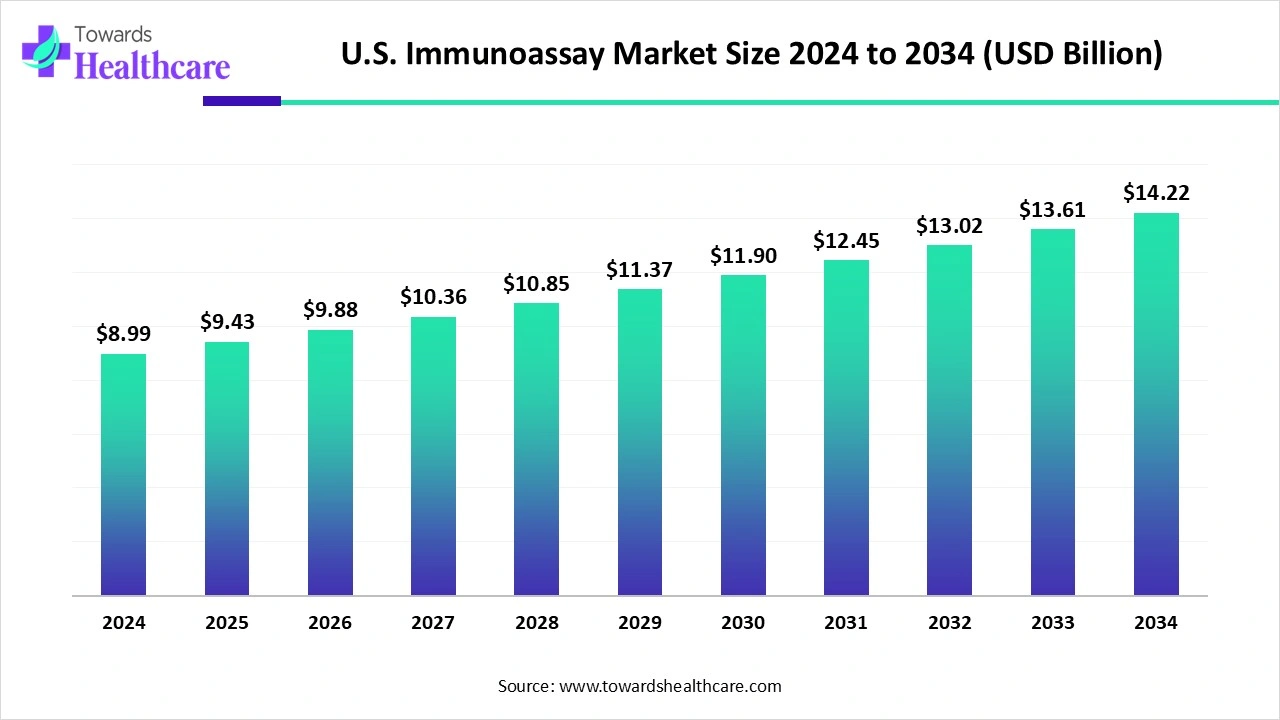

The U.S. immunoassay market is valued at US$ 8.99 billion in 2024, expected to grow to US$ 9.43 billion in 2025, and could reach about US$ 14.22 billion by 2034. This reflects a steady growth rate, with the market expanding at a CAGR of 4.93% from 2025 to 2034.

Canada’s market supports to development of robust kits and reagents used in these assays. And, also stepping into the emergence of innovative automated analyzers, such as the DxC 500i, optimized proficiency testing programs from companies like Bio-Rad, and research into new applications, like an estimation of bladder cancer therapeutic response and early Alzheimer's disease detection.

In the upcoming years, the Asia Pacific will register rapid expansion in the immunoassay market. ASAP is widely involved in the greater use of advanced immunoassays in the growing chronic disease cases, with major innovations in biomarkers with increased sensitivity, and nanozymes by replacing natural enzymes for more robust and sensitive immunosensors. China is emphasizing improvements in high-end antigen and antibody raw materials to narrow the gap with international products. Additionally, ASAP’s researchers are developing syringe-hosted load-and-read devices that apply pressure-based detection for point-of-care testing (POCT).

The global market leverages the selection of appropriate, specific antibodies and antigens, optimization of the assay format, creation of a "sandwich" with a labeled secondary antibody, then validation of the assay, and, at the end, performing a quality control process, such as spike recovery, to ensure accuracy and minimize interference.

Key Players: Abbott, Thermo Fisher Scientific, and Bio-Rad Laboratories, etc.

The immunoassay market involves manufacturing the device (e.g., a lateral flow assay) with its components, such as the sample and conjugate pads, furthermore, the primary, secondary, and tertiary packaging, and ultimately labelling with a unique, trackable identifier (like a QR Code or DataMatrix code).

Key Players: OPTEL, VISIOTT, Antares Vision Group, Systech, ACG, etc.

By collecting blood or saliva samples and testing to measure specific proteins, hormones, or antibodies, assisting in disease management from diagnosis to follow-up care across different issues, mainly infections, autoimmune disorders, cardiovascular issues, and cancers.

Key Players: Vision Diagnostic Centre, IQVIA Labs, bioMérieux, Meridian Bioscience, etc.

In July 2025, TrilliumBiO, a leader in biomarker discovery and precision diagnostics, announced a strategic alliance with T-NeuroDx, a pioneering diagnostics company, to advance the progression of blood-based biomarker diagnostics for Alzheimer's disease. Laura Vivian, CEO of TrilliumBiO, replied that this will leverage more accessible, non-invasive diagnostics for patients and providers.

By Product

By Technology

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026