March 2026

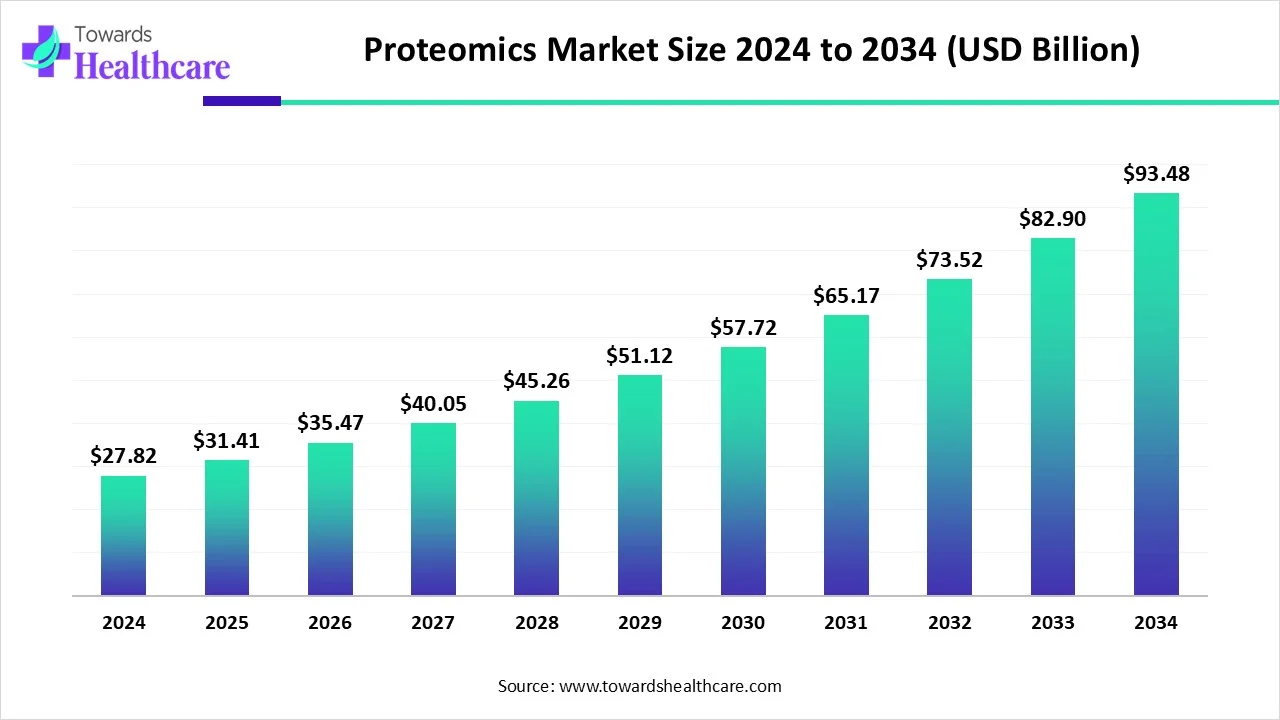

The global proteomics market size is calculated at USD 31.42 billion in 2025, grew to USD 35.49 billion in 2026, and is projected to reach around USD 106.09 billion by 2035. The market is expanding at a CAGR of 12.94% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 35.49 Billion |

| Projected Market Size in 2035 | USD 106.09 Billion |

| CAGR (2026 - 2035) | 12.94% |

| Leading Region | North America share by 46% |

| Market Segmentation | By Product & Services, By Technology, By Application, By Region |

| Top Key Players | Agilent Technologies, Alamar Biosciences, Applied Biomics, Inc., Bertis, Inc., BOC Sciences, Bruker Corporation, Creative Proteomics, Opentrons, PreOmics, Proteome Sciences, Proteomics International Laboratories, Quantum-Si, Inc., Thermo Fisher Scientific |

Proteomics is the large-scale study of the proteome, or proteins. It provides a detailed understanding of the structure or function of the organism better than genomics. The different types of techniques include one-dimensional (1D) and two-dimensional (2D) gel electrophoresis, gel-free high-throughput screening technologies, and stable isotope labeling with amino acids in cell culture. Proteomics is used to investigate the rates of protein production, the movement of proteins between subcellular compartments, and the involvement of proteins in metabolic pathways.

Several factors govern the market, including the rising prevalence of chronic disorders and growing research and development activities. Several government organizations launch initiatives and provide funding for various research activities related to proteomics. The growing demand for precision therapeutics boosts the market. The increasing collaboration among academic researchers and industry leaders promotes advanced research. The advent of advanced technologies drives the latest innovations in proteomics.

Artificial intelligence (AI) can revolutionize proteomics by enhancing data processing, pattern recognition, and prediction in proteomics. Integrating AI in proteomics expedites the drug discovery process and fosters deeper understanding. AI identifies functional domains within proteins, aiding in understanding their roles in biological processes. It also predicts protein-protein interactions to study human biology. It can be used to incorporate proteomics data with genomics and metabolomics, uncovering systems-level insights into cellular mechanisms. AI and machine learning (ML) algorithms analyze vast amounts of data and identify potential biomarkers for cancer diagnosis and prognosis.

Growing Drug Discovery Research

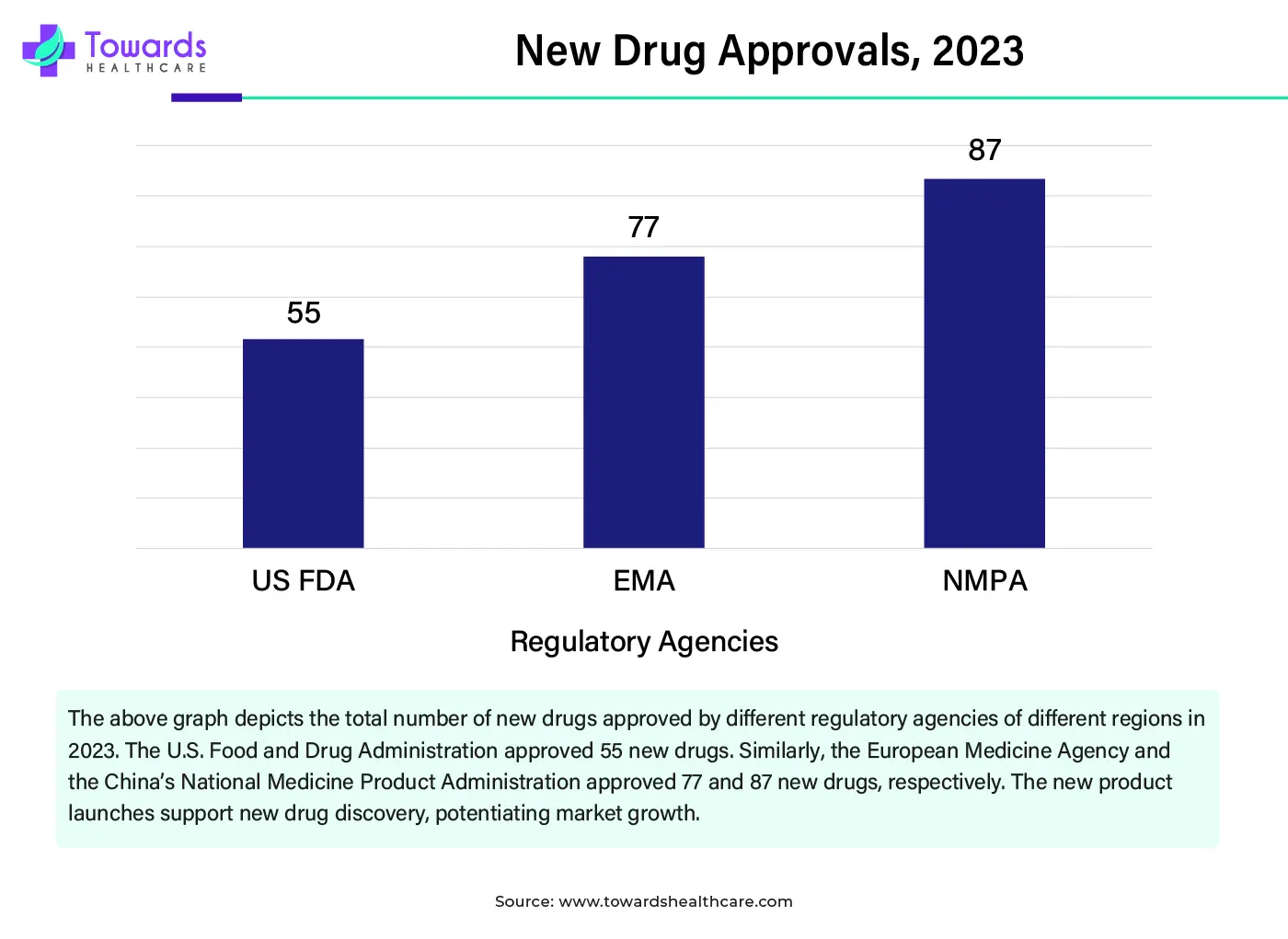

Proteomics is widely used to evaluate the structure and function of various proteins in the body. The rising prevalence of chronic disorders necessitates researchers to develop novel drugs. Novel drugs are discovered based on the protein structure, facilitating the binding of drugs to the desired protein site. Thereafter, the drugs amplify the protein action and help reduce disease progression, thereby treating the condition. The growing demand for personalized medicines also potentiates new drug discovery research. The availability of a suitable regulatory framework and new product approvals favor drug discovery.

Difficulty in Quantifying Low Abundance Proteins

The major challenge of the proteomics market is the difficulty in quantifying low-abundance proteins. Low-abundance proteins are those detected in small amounts. Conventional methods are not sensitive enough to detect such low amounts of protein. Hence, novel sensitive methods need to be developed for low-abundance proteins.

Personalized Medicines

The future of the market is promising, driven by the growing need for personalized medicines. The rapidly changing demographics and increasing geriatric population facilitate the development of personalized medicines for various chronic disorders. Several government organizations have launched initiatives to encourage precision medicine research and development. The U.S. government has launched the “Precision Medicine Initiative” to understand a person’s genetics, environment, and lifestyle. The initiative was launched to generate the scientific evidence needed to move the concept of precision medicine into clinical practice. (Source - NIH)

By Products & Services

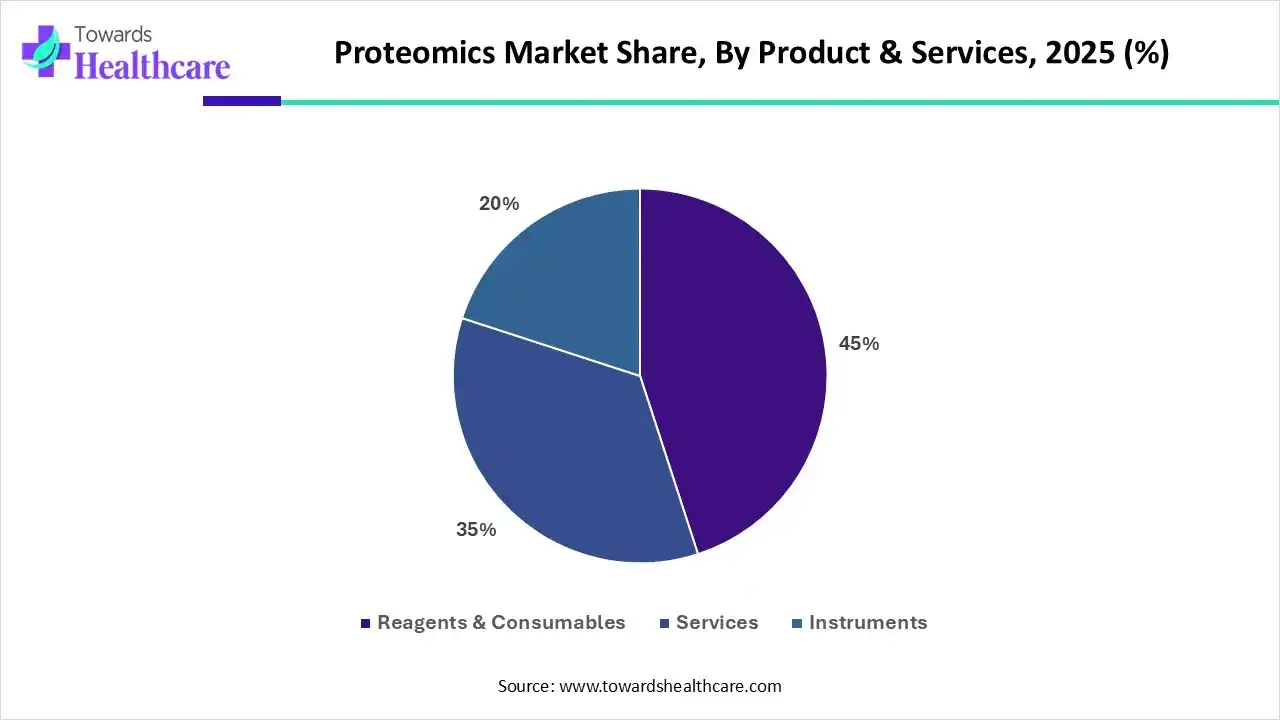

Why the Reagents & Consumables Segment Dominated in 2025?

By products & services, the reagents & consumables segment held a dominant presence in the proteomics market by 45% in 2025. Reagents & consumables are essential components for proteomics research and clinical applications. Some common examples of consumables include protein extraction and purifying kits, buffers for electrophoresis, and protein ladders. They are used to refill the experimental requirements and perform multiple tests simultaneously. Their affordability and easy availability of a wide range of reagents based on research needs.

By products & services, the services segment is expected to grow at the fastest rate in the market during the forecast period. Services provide relevant expertise and access to cutting-edge technologies, which are otherwise unaffordable by research institutions. The lack of a sufficient number of skilled professionals and unaffordability to purchase expensive equipment boost the segment’s growth. The increasing collaboration and mergers & acquisitions also promote the segment’s growth.

Why the Spectrometry Segment Held the Largest Share in 2025?

By technology, the spectrometry segment held the largest share of the proteomics market in 2025. Spectrometry enables the measurement of the molecular weight of proteins and helps to identify their structure. It is the most widely used technique due to its affordability and easy application. The availability of automated spectrometry instruments streamlines the proteomics operation, enhancing efficiency and reducing time. It offers high sensitivity and accuracy, and its versatility in various applications.

By technology, the next-generation sequencing (NGS) segment is expected to grow with the highest CAGR in the market during the studied years. Next-generation sequencing (NGS) is a technology used to determine the sequences of nucleotides. It provides a detailed understanding of the underlying heterogeneity of complex biological systems. Technological advancements enable protein measurements, contributing to the elucidation of amino acid sequences in complex tissues. It offers superior benefits compared to other analytic techniques, making it a suitable choice among researchers.

| Segment | Share 2025 (%) |

| Drug Discovery | 45% |

| Clinical Diagnostics | 40% |

| Others | 15% |

How did the Drug Discovery Segment Led in 2025?

By application, the drug discovery segment led the global proteomics market by 45% in 2025. The growing new drug discovery research, owing to increasing investments and favorable regulatory policies, contributes to the segment’s growth. As of May 15, 2025, the U.S. FDA approved a total of 12 novel drugs. (Source - U.S. FOOD & Drug) The growing need for precision medicines also necessitates the development of novel drugs. The increasing number of clinical trials to assess the safety and efficacy of new drugs also increases the demand for proteomics for disease diagnosis and screening.

By application, the clinical diagnostics segment is projected to expand rapidly in the market in the coming years. The rising prevalence of genetic and rare disorders potentiates the need for proteomics in the clinical diagnostics sector. Numerous government bodies launch initiatives and create awareness for the screening and diagnosis of chronic disorders. Proteomics approaches are widely used to explore the biological basis of disease and identify new targetable proteins.

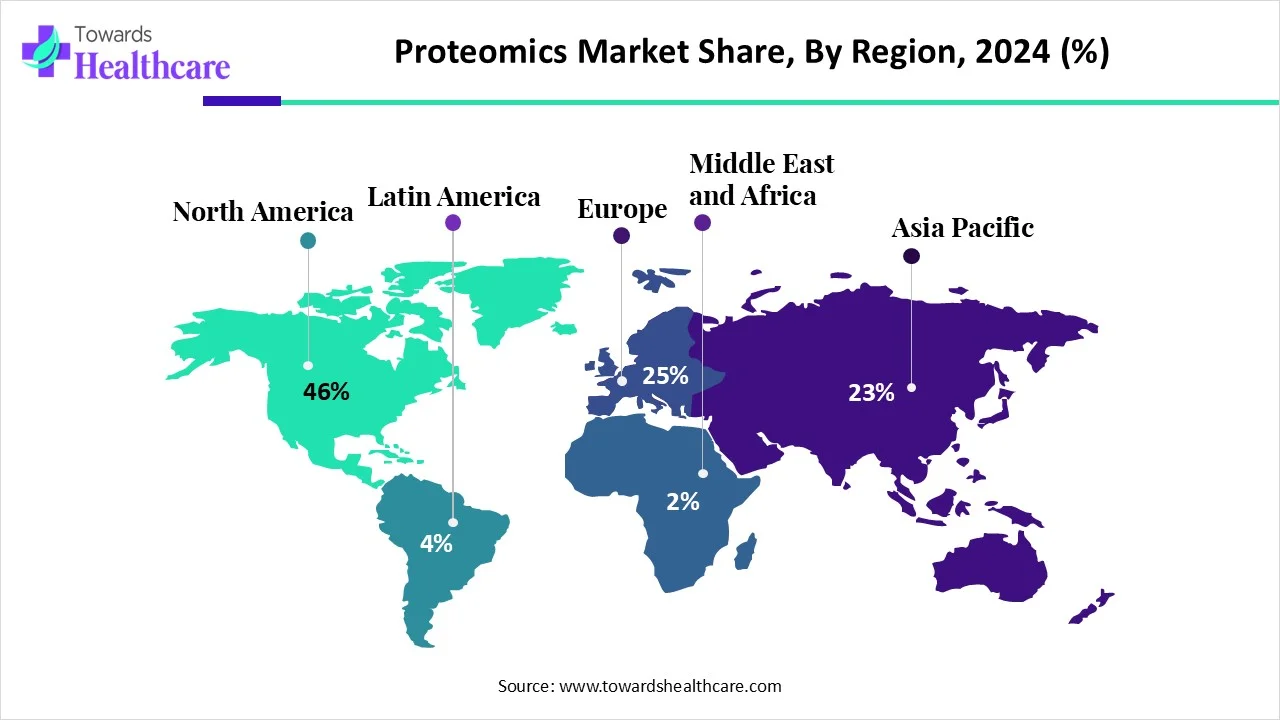

North America dominated the global market share by 46% in 2024. Technological advancements and the availability of state-of-the-art research and development facilities are the major growth factors of the market in North America. The presence of key players and favorable government policies augments the market. The increasing investments by government and private organizations promote proteomics research. Most of the North American countries have a robust healthcare infrastructure. This potentiates the use of advanced solutions for effective diagnosis and treatment related to proteomics.

Key players, such as Agilent Technologies, Thermo Fisher Scientific, and PerkinElmer, hold the major share of the market in the U.S. The National Cancer Institute’s Clinical Proteomic Tumor Analysis Consortium (CPTAC) leverages its investment in cancer proteogenomics and accelerates precision oncology. It is a national effort to accelerate the understanding of molecular mechanisms of cancer. (Source - NIH)

The federal government’s “The Canadian National Proteomics Network (CNPN)” provides a co-operative mechanism for building the proteomics research infrastructure in Canada and to better understand proteomics in the Canadian life-sciences community. (Source - CNPN) The Canadian Precision Health Initiative by Genome Canada received a total funding of $200 million, including $81 million from the federal government. (Source - GENOME)

Asia-Pacific is expected to grow at the fastest rate in the proteomics market during the forecast period. The rising prevalence of chronic disorders and the increasing geriatric population potentiates the demand for proteomics. The rapidly expanding proteomics sector, due to government initiatives and increasing investments, boosts the market. Several government and private institutions organize conferences and workshops to train professionals for proteomics experiments. The increasing number of biotech startups also contributes to market growth.

According to a 2023 article published in the Journal of the American Medical Directors Association, the national prevalence of any chronic disease in China was 81.1%, representing 179.9 million Chinese older adults, out of the total 224,640 Chinese residents aged 60 years and above. The Chinese government has launched a 30-year, multibillion RMB Proteomics Initiative, expected to be one of the largest and best-funded research initiatives to date.

The Longitudinal Ageing Survey in India (LASI) reported that 21% of the elderly population in India suffers from at least one chronic condition, with urban areas showing a higher prevalence (29%), compared to rural areas (17%). India has around 3,500 biotechnology companies, which are expected to reach 10,000 by 2025.

Europe is expected to grow at a notable rate in the proteomics market in the foreseeable future. The rising adoption of advanced technologies and growing research and development activities foster market growth. Favorable government support and regulatory policies govern the market. The European Proteomics Association (EPA) supports proteomics research and educates and trains in all areas of proteomics throughout Europe. The increasing collaborations and mergers & acquisitions contribute to market growth.

The German Biotechnology Report 2024 mentioned that, in 2023, a total of €203 million was raised by biotech start-ups in the early stages in 18 investment rounds. The total turnover of the biotech sector in 2023 was €12.7 billion. The figures were generated from 784 companies headquartered in Germany and 212 German subsidiaries.

The UK Biobank launched a proteomics project in January 2025 to analyze proteins in initial samples from 250,000 UK Biobank volunteers and about 50,000 second samples taken at follow-up assessments. The UK government announced £20 million for the UK Biobank to complete the world’s most significant protein study. The funding will enable the analysis of proteins from 500,000 people.

Latin America is considered to be a significantly growing area in the proteomics market, due to the growing research and development activities and the burgeoning proteomics sector. The increasing demand for identifying novel drug targets and personalized medicines fosters market growth. The rising collaborations, public-private partnerships, and mergers & acquisitions facilitate companies to access advanced technologies and expand their geographical presence. Favorable government support through initiatives and funding propels the market.

In 2025, four major pharmaceutical firms, Boehringer Ingelheim, Carnot, Bayer, and AstraZeneca, announced plans to invest more than 13 billion pesos in drug development and manufacturing. This strategic move is part of the “Plan México” initiative that aims to reduce reliance on international supply chains and enhance the nation’s self-sufficiency in pharmaceuticals.

The Brazilian Society of Proteomics (BrProt) advances proteomics research in Brazil through conferences, networking, and scientific exchange. The Brazilian government has launched initiatives to support research and local manufacturing of pharmaceuticals. Brazilian pharmaceutical company, EMS, invested over R$1 billion in local peptide production and launched its first GLP-1 pen in August 2025.

James Atwood, General Manager of Robotics at Opentrons, commented on the launch of its Opentrons Flex Proteomics Workstation that protein analysis is essential for labs working on biomarker research and potential drug targets. The automated workstation enables labs to process more samples per day without adding staffing. (Source - businesswire)

By Product & Services

By Technology

By Application

By Region

March 2026

March 2026

March 2026

March 2026