November 2025

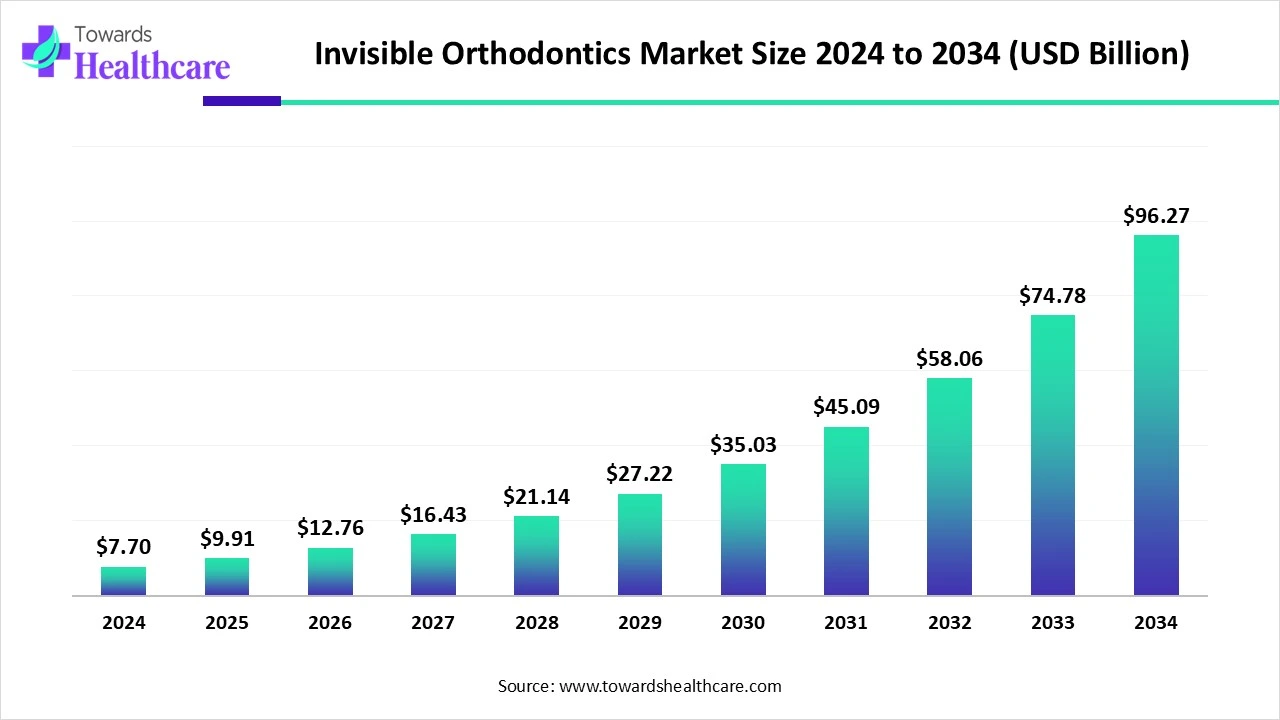

The global invisible orthodontics market size is calculated at USD 7.7 billion in 2024, grows to USD 9.91 billion in 2025, and is projected to reach around USD 96.27 billion by 2034. The market is expanding at a CAGR of 28.54% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 9.91 Billion |

| Projected Market Size in 2034 | USD 96.27 billion |

| CAGR (2025 - 2034) | 28.54% |

| Leading Region | North America |

| Market Segmentation | By Product, By Dentist Type, By Age, By End-use, By Region |

| Top Key Players | Angel Aligner, SmarTee, Dentsply Sirona, Institut Straumann AG, SCHEU DENTAL GmbH, Ormco Corporation (Envista), Henry Schein, Inc., SmileDirectClub, Align Technology, Inc., TP Orthodontics, Inc., K Line Europe GmbH, 3M, ClearPath Healthcare Services Pvt Ltd, DB Orthodontics, Inc., G&H Orthodontics, Orthodontics SDC |

Invisible orthodontics is a modern dental treatment method that involves the use of clear, transparent aligners or braces designed to correct misaligned teeth and bite issues in a discreet and aesthetically pleasing manner, offering an alternative to traditional metal braces. The market is expanding due to rising demand for aesthetically appealing and less noticeable dental treatments, especially among adults. Technological advancements like 3D printing, digital scanning, and improved aligner materials have made treatments more effective and comfortable. Increased awareness bout oral health, combined with a growing focus on personal appearance, is encouraging more people to opt for invisible aligners. Additionally, the influence of social media and the availability of direct-to-consumer options are further driving market expansion.

For Instance,

AI has the potential to significantly impact the market by improving treatment planning, personalization, and efficiency. Through advanced algorithms, AI can analyze patient data, such as dental scans and X-rays, to create highly customized aligner treatments with better precision and faster results. AI-powered tools can also predict treatment outcomes and optimize aligner designs, reducing the need for manual adjustments. Additionally, AI can streamline the workflow for dental professionals, improving patient experience and reducing treatment time, ultimately driving market growth.

Aesthetic Concerns

Aesthetic concerns play a key role in driving the invisible orthodontics market, as many individuals, particularly adults, seek discreet alternatives to traditional metal braces. Metal braces can be seen as unattractive, making people hesitant to pursue treatment. Invisible orthodontics, like clear aligners, offer more aesthetically pleasing solutions, allowing users to straighten their teeth without the noticeable appearance of traditional braces. As personal appearances become more important in both social and professional settings, the demand for these subtle orthodontic options continues to rise, boosting the market growth. A study revealed that 34% of participants preferred clear aligners, with 37% of females and 30% of males selecting them as their top choice. According to orthodontic practitioners, patient preferences are shifting, with many now focusing more on the aesthetic advantages of invisible orthodontics. Dentists and orthodontists often highlight these benefits when discussing treatment options with their patients.

High-Cost Treatment

Clear aligners and other advanced technologies often come with higher production and treatment costs compared to traditional braces. As a result, these treatments may be out of reach for many people, particularly those in lower-income brackets. Furthermore, the need for regular consultations and follow-up care increases the overall expense. This makes invisible orthodontics less accessible to a wider audience, especially in price-sensitive markets, which hinders the expansion of the market.

Rising Adoption in Emerging Markets

The Growing adoption of invisible orthodontics in emerging markets presents a major opportunity for market expansion. As countries like India, China, and Brazil experience rising disposable incomes and a growing middle class, more people are willing to invest in advanced dental treatments for aesthetic and health reasons. Increased awareness about oral health and the influence of social media are also driving demand for clear aligners in these regions. Additionally, improvements in healthcare infrastructure and greater access to dental care are making such treatment more available. This shift opens up a new revenue stream for manufacturers and service providers, helping to fuel the overall growth of the invisible orthodontics market.

By product, the clear aligners segment held a dominant presence in the market in 2024, due to its rising popularity as a comfortable, removable, and nearly invisible alternative to traditional braces. These aligners offer convenience and aesthetic appeal, making them especially attractive to adults and teens seeking discreet orthodontic solutions. Advancements in digital scanning, 3D printing, and AI-driven treatment planning have further enhanced their effectiveness and accessibility, and increased marketing by key players has contributed to the growth of the invisible orthodontics market.

By product, the ceramic braces segment is predicted to grow at a significant rate in the market during the studied years due to its aesthetic appeal compared to traditional metal braces. These braces are less noticeable, making them an ideal choice for adults and teenagers who prioritize appearance during orthodontic treatment. Technological advancement in ceramic materials and bonding methods have enhanced their comfort, strength, and effectiveness. Moreover, the growing popularity of cosmetic dentistry and the increasing awareness of dental aesthetics are encouraging more individuals to opt for ceramic braces, boosting their demand in the global market.

By dentist type, the orthodontics segment was dominant in the market in 2024 because of its specialized skills and expertise in orthodontics in managing complex dental alignment issues. Orthodontists are specifically trained to use clear aligners and other advanced orthodontic tools, allowing them to create highly personalized and effective treatment plans. Their access to modern technologies such as 3D imaging and digital treatment simulations ensures greater precision and improved outcomes. As more patients seek discreet and customized solutions for teeth straightening, they tend to prefer orthodontists over general dentists, contributing to the invisible orthodontics market.

By dentist type, the general dentists segment is expected to grow at a lucrative rate in the coming years due to increased adoption of clear aligner treatments within general dental practices. As demand for invisible orthodontics rises, more general dentists are being trained and supported by manufacturers to offer these services. This expands access to orthodontic care beyond specialists, making it more convenient for patients to receive treatment from their regular dentist.

By age, the adult segment led the market in 2024, due to increasing demand for discreet and convenient orthodontic solutions. Adults are more inclined to choose clear aligners for their aesthetic appeal, as they offer a subtle way to improve dental alignment without the visibility of metal braces. The removable nature of aligners also fits well with adult and oral hygiene. Additionally, many adults view orthodontic treatment as an investment in both their appearance and long-term oral health.

By age, the teens segment is expected to grow at the fastest CAGR in the market during the forecast period. Teenagers are increasingly focused on aesthetics and prefer clear aligners for their discreet appearances over traditional braces. Additionally, the removable nature of aligners offers comfort and convenience, allowing teens to maintain oral hygiene and eat freely. The prevalence of dental issues like crowded teeth and overbites further fuels demand. Technological advancements in aligner designs also enhance treatment effectiveness, making them more appealing to younger patients.

By end-use, the stand-alone practices segment accounted largest share in the invisible orthodontics market in 2024. These practices are led by orthodontics specialists with expertise in designing tailored treatment plans that deliver optimal results, particularly for patients opting for clear aligners and other invisible orthodontics options. Additionally, stand-alone practices offer a high level of personalized care, which fosters strong relationships between patients and providers, enhancing overall satisfaction. With their focused services in orthodontics, these practices are well-equipped to meet the growing demand for aesthetic dental solutions, dominating the invisible orthodontics market.

By end-use, the hospitals segment is estimated to grow at a significant CAGR over the forecast period. Hospitals are increasingly adopting invisible orthodontic treatments, such as clear aligners and ceramic braces, to offer comprehensive dental care. This trend is driven by the growing prevalence of dental issues like malocclusion and the demand for aesthetic dental solutions. Additionally, advancements in orthodontic technology and the integration of orthodontic services within hospital settings are enhancing treatment accessibility and patient outcomes, contributing to the market growth.

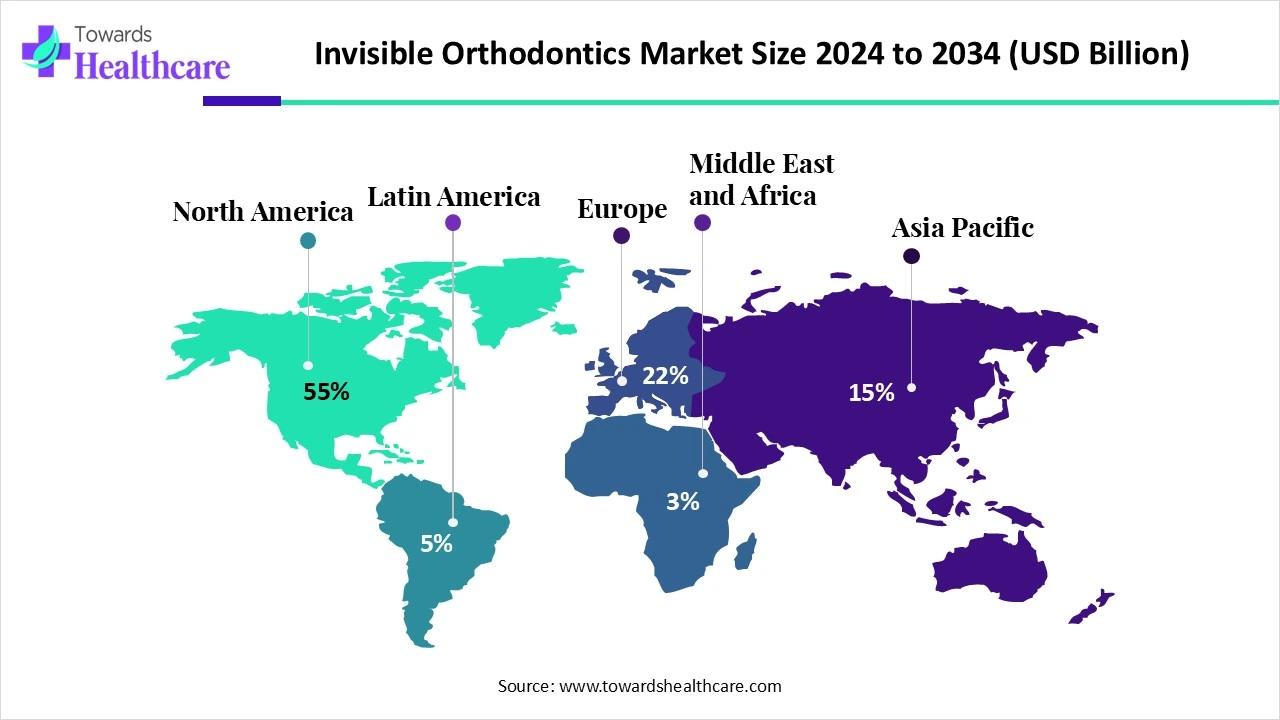

North America dominated the invisible orthodontics market in 2024, accounting for over 54% of global revenue. This dominance is driven by high consumer demand for discrete orthodontic treatments like clear aligners, as more people seek aesthetic solutions that fit their lifestyles. The region also benefits from advanced healthcare infrastructure and a high concentration of skilled orthodontic professionals. Technological advancements, such as AI-driven treatment planning and 3D imaging, have further enhanced treatment precision. Additionally, increased insurance coverage for orthodontic treatments has made these services more accessible to a wider population.

The U.S market is growing due to rising demand for aesthetic treatments that are discreet and comfortable, such as clear aligners. Technological advancements in 3D scanning and digital treatment planning have enhanced precision and effectiveness. Increased consumer awareness, the convenience of removable aligners, and the rise of direct-to-consumer brands like SmileDirectClub have also contributed to the growth. Social media influencers and rising disposable incomes further drive interest in orthodontic treatments. These factors collectively make invisible orthodontics a popular choice for those seeking a more flexible, aesthetically pleasing solution.

The Canadian market is expanding due to a growing focus on self-care and cosmetic dentistry. More people, particularly adults, are opting for clear aligners and other invisible options as they offer a more aesthetically pleasing and comfortable alternative to traditional braces. Additionally, the increasing acceptance of orthodontic treatments among adults and the rise of direct-to-consumer brands have made invisible orthodontics more accessible. Moreover, rising disposable incomes and better awareness of oral health are fueling demand for these advanced orthodontic solutions.

Asia-Pacific is anticipated to grow at a significant rate in the market during the forecast period, due to factors like the high prevalence of malocclusion, particularly in countries like India and China. Technological advancements in 3D imaging, AI, and intraoral scanning have made treatments more precise and comfortable. Additionally, rising disposable incomes and the increasing popularity of dental tourism in countries like Thailand and India are contributing to market expansion. Public health initiatives promoting oral care and awareness also play a crucial role in driving demand for orthodontic solutions.

The expansion of China's market is driven by the increasing adoption of advanced dental care solutions and a growing middle class. Rising urbanization and the increasing focus on personal appearance are pushing demand for aesthetic treatments like clear aligners. Moreover, the growing awareness of orthodontic options through digital platforms and social media has contributed to wider acceptance. The rising number of dental professionals offering invisible orthodontics and the introduction of cost-effective solutions are also key factors fueling market growth in China.

India’s market is growing due to increasing awareness about oral health and cosmetic dentistry. The rise in disposable income, particularly among urban populations, allows more people to afford premium treatments like clear aligners. The growing influence of social media and celebrities has also made aesthetic dental treatments more desirable. Additionally, a shift towards preventive care, with people seeking orthodontic solutions at an earlier age, and the increasing availability of advanced orthodontic solutions in smaller cities, are contributing to the market’s expansion.

Europe is anticipated to grow at a notable rate in the market during the forecast period, due to the rising demand for aesthetic dental treatments, particularly among adults. As more people prioritize self-image and seek discreet options, clear aligners are becoming increasingly popular. Additionally, growing awareness about the benefits of early orthodontic intervention and increasing disposable incomes in many European countries are contributing to market growth. The expansion of online orthodontic platforms and improved insurance coverage for orthodontic treatments are also factors enhancing accessibility and driving demand in the region.

The UK's market is expanding due to advancements in technology, such as 3D imaging and AI-based systems, improving the precision and comfort of clear aligners. Growing aesthetic preferences, especially among adults and teenagers, have driven demand for discreet treatments. Increased awareness through online platforms and educational content has also played a role in influencing consumer choices. Furthermore, the expansion of dental clinics, the availability of products online, and dental insurance coverage are making invisible orthodontics more accessible and affordable for a wider population.

Germany's market is expanding due to technological advancements such as 3D printing and AI-driven treatment planning, improving the efficiency and comfort of clear aligners. There is also a growing demand for aesthetic dental solutions, particularly among adults and teenagers, who prefer discreet treatments. The expansion of dental clinics and the availability of products online have made these treatments more accessible. Additionally, the introduction of dental insurance coverage and the market’s expected high growth rate further contribute to the sector’s expansion in Germany.

In April 2024, Align Technology, a global leader in medical devices known for its Invisalign® clear aligners, iTero™ intraoral scanners, and exocad™ CAD/CAM software, introduced the "Better Way" advertising campaign. The campaign features the tagline “Invis is for Kids” and aims to raise awareness of the Invisalign® Palatal Expander System. Kamal Bhandal, Align Technology’s Vice President of Global Brand and Consumer Experience, stated, “As part of our ‘Invis is for Kids’ strategy to improve the orthodontic experience for children, we are excited to launch this campaign to showcase how the system is a game-changer in expanding a child’s narrow palate."

By Product

By Dentist Type

By Age

By End-use

By Region

November 2025

November 2025

November 2025

November 2025