February 2026

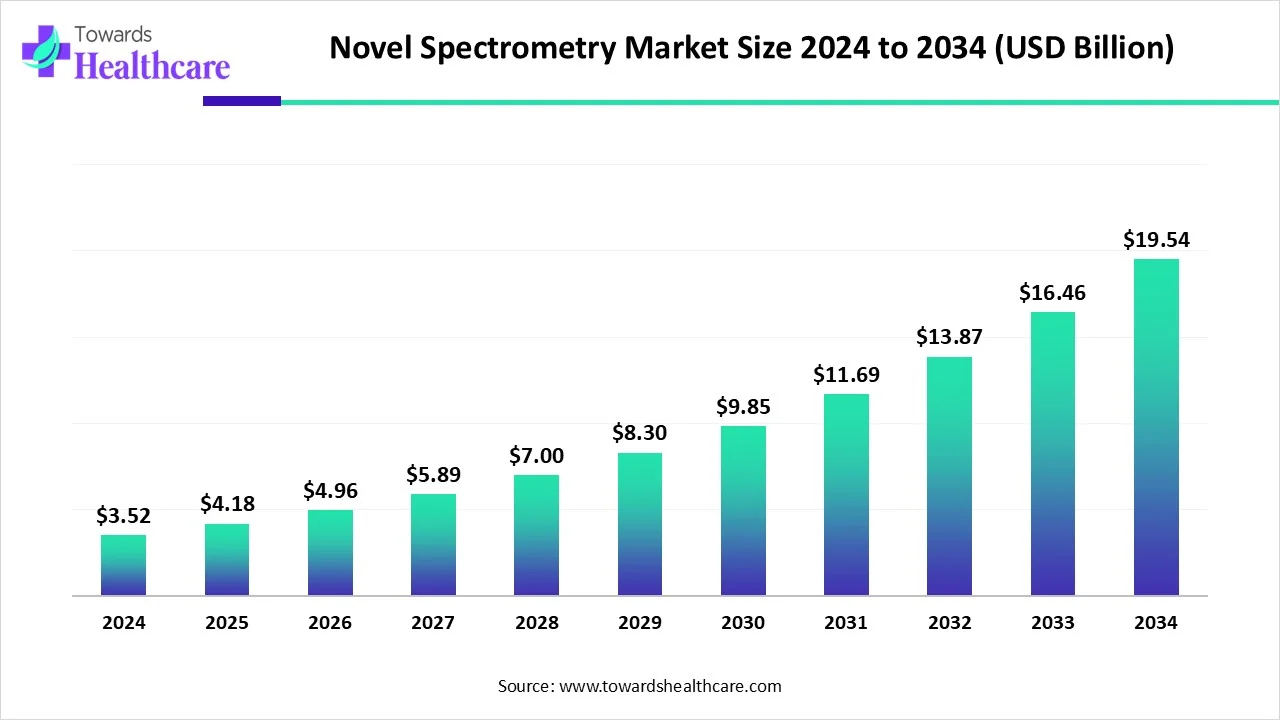

The global novel spectrometry market size is calculated at USD 4.18 billion in 2025, grew to USD 4.97 billion in 2026, and is projected to reach around USD 23.35 billion by 2035. The market is expanding at a CAGR of 18.77% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 4.97 Billion |

| Projected Market Size in 2035 | USD 23.35 Billion |

| CAGR (2026 - 2035) | 18.77% |

| Leading Region | North America share by 41% |

| Market Segmentation | By Spectrometry Type, By Application, By End-Use, By Region |

| Top Key Players | Agilent Technologies, Avantes, Bruker Corporation, Metrohm AG, MOBILion Systems, Inc., PerkinElmer AES, Rigaku Group, SCIEX, Shimadzu Corporation, Thermo Fisher Scientific, Waters Corporation |

Novel spectrometry is an advanced version of the spectrometer, which studies the interaction between matter and electromagnetic radiation. A wide range of different spectroscopic techniques is applied in various domains, from environmental analysis and biomedical sciences to space exploration endeavors. In biomedical sciences, spectrometry is widely used in diagnostic and therapeutic applications. The major advantage of this technology is a rapid, non-destructive approach, necessitating little or no sample preparation.

Numerous factors that govern the market growth include the rising prevalence of chronic disorders and technological advancements. Ongoing research efforts are made to develop novel spectrometry tools and techniques based on diverse requirements. Several government and private organizations provide funding for developing and deploying novel spectrometry in healthcare organizations. Technological advancements drive the latest innovations in spectrometry.

Artificial intelligence (AI) introduces automation in novel spectrometry tools, reducing human errors. It assists researchers in every task of the research process, from sample preparation to analysis. AI can help researchers prepare multiple samples and detect them simultaneously. It enhances the efficiency and accuracy of spectrometry techniques, increasing reproducibility. AI and machine learning (ML) algorithms improve and automate data processing for classification and visualization of spectrochemical data measured from biological and medical samples. AI systems can compare measured spectra to computer-generated spectra.

Growing Drug Discovery Research

The major growth factor of the market is the growing drug discovery research. The increasing demand for novel drugs leads to an increasing research and development activities and new product launches. Drug discovery research requires advanced spectrometry techniques to identify, characterize, quantify, and purify compounds. Spectroscopic techniques are also used to identify potential drug targets, i.e., proteins associated with disease progression. The increasing investments in drug discovery research enable researchers to develop more innovative drugs. It is reported that pharma R&D spending surged 1.5% in 2024. Drugmakers around the world pumped nearly $288 billion into R&D in 2024.

Lack of Trained Professionals

The major challenge of the novel spectrometry market is the lack of trained professionals. Numerous underdeveloped and developing countries lack skilled professionals to operate complex novel spectrometry for diverse applications, limiting its widespread use.

Increasing Number of Startups

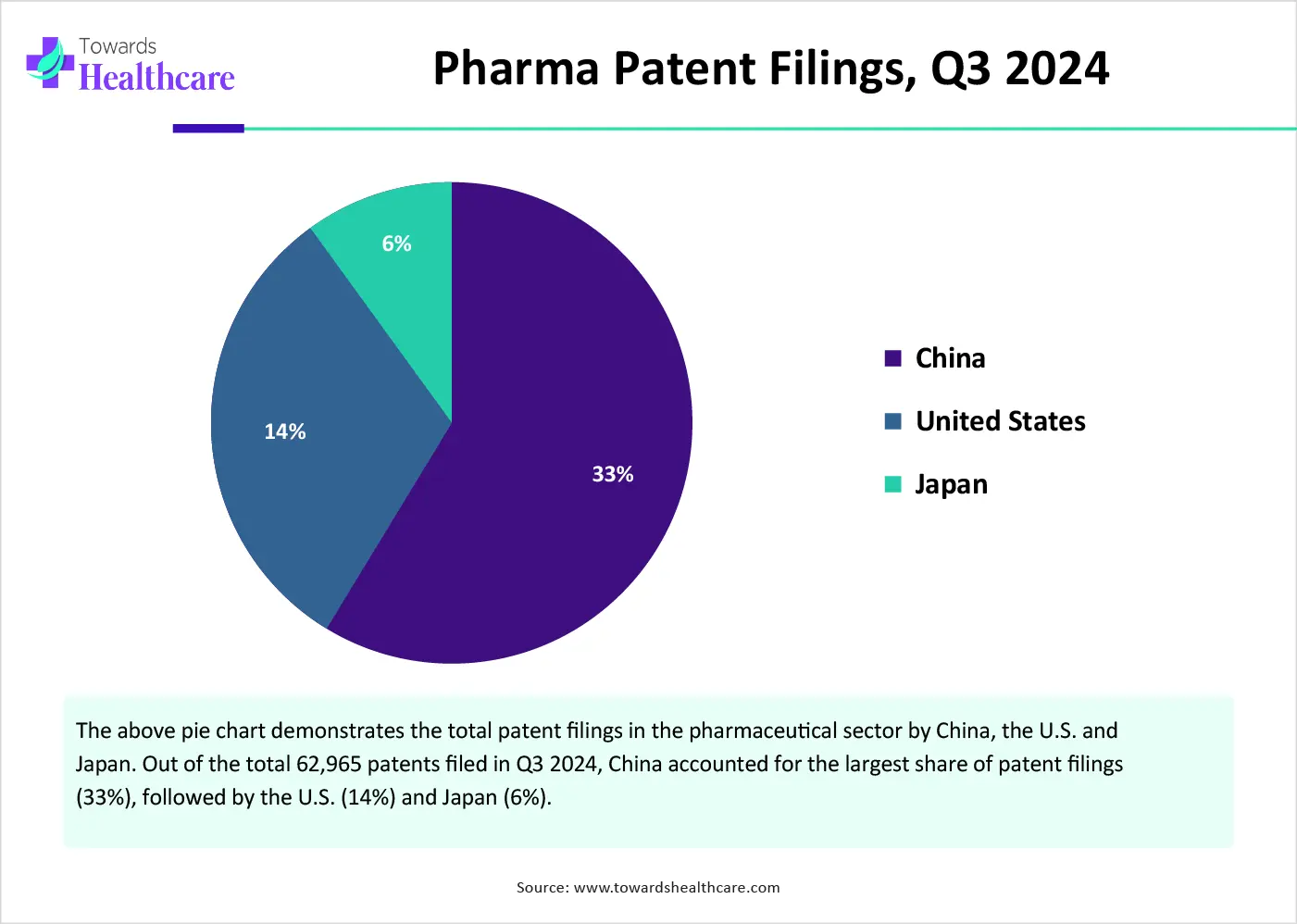

The future of the market is promising, driven by the increasing number of pharmaceutical and biotechnology startups. Pharma and biotech startups offer innovative and advanced solutions, offering a pathway for pharmaceutical companies to access cutting-edge technologies. The increasing venture capital investments and the rising collaborations among startups and large companies foster the market. This facilitates startups to adopt advanced spectrometry tools. These startups provide customized solutions and a collaborative spirit, fostering a dynamic environment for driving innovation. The increasing number of startups also leads to growing research and development activities and the rising patent applications and publications, necessitating the use of spectrometry for various applications.

Why Did the Optical Spectrometry Segment Dominate in 2024?

By spectrometry type, the optical spectrometry segment held a dominant presence in the novel spectrometry market in 2024. Optical spectrometry is used to measure the absorption of a sample in the near UV throughout the visible spectrum. Continuous innovations in lasers and photonics chips improve optical spectrometry’s functionality, thereby increasing its demand. Researchers are also working on a variety of super-resolution imaging techniques for studying single-molecule locations in 3D-biospecimens. Such advancements enhance the efficiency of optical spectrometry, making it a suitable choice.

Mass Spectrometry Segment

By spectrometry type, the mass spectrometry segment is expected to grow at the fastest CAGR in the market during the forecast period. Mass spectrometry (MS) is a widely used tool to measure the exact molecular weight of one or more samples. The growing research and development activities in proteomics, metabolomics, and lipidomics potentiate the use of MS. MS is continually advanced, driven by new technology and methodological innovations. Integrating AI and ML in MS data analysis offers advanced tools for data interpretation and pattern recognition.

How Analytical Testing & Diagnostics Segment Dominated in 2024?

By application, the analytical testing & diagnostics segment held the largest revenue share of the novel spectrometry market in 2024. The rising prevalence of chronic disorders increases the need for analytical testing and diagnostics. Favorable government policies for screening and early diagnosis of various chronic disorders boost the segment’s growth. Spectrometry techniques are useful in proteomics, steroid hormone analysis, and therapeutic drug monitoring, empowering the development of safe and effective clinical diagnostics and precision medicines. Moreover, capillary electrophoresis-mass spectrometry has become a powerful tool for analyzing metabolites in complex biological samples for disease diagnosis.

Quality Control & Assurance

By application, the quality control & assurance segment is expected to grow with the highest CAGR in the market during the studied years. Spectrometry tools, like MS, are widely used for biopharma quality control. In pilot plants, they enable the detection of slight changes in biotherapeutics due to their increased sensitivity and specificity. They can detect even minute changes in product composition and identify impurities within the product. Additionally, spectrometry techniques are used to assess the compatibility of two or more drugs in vitro to avoid drug-drug interactions within the body.

What are the Factors Promoting the Healthcare & Pharmaceuticals Segment’s Growth?

By end-use, the healthcare & pharmaceuticals segment led the global novel spectrometry market in 2024. Spectrometry tools and techniques are widely used in the healthcare and pharmaceutical sectors. The growing research and development activities, such as drug discovery and development, and quality control, increase the demand for spectrometry. The increasing number of startups and the rising demand for early disease diagnosis also augment the segment’s growth.

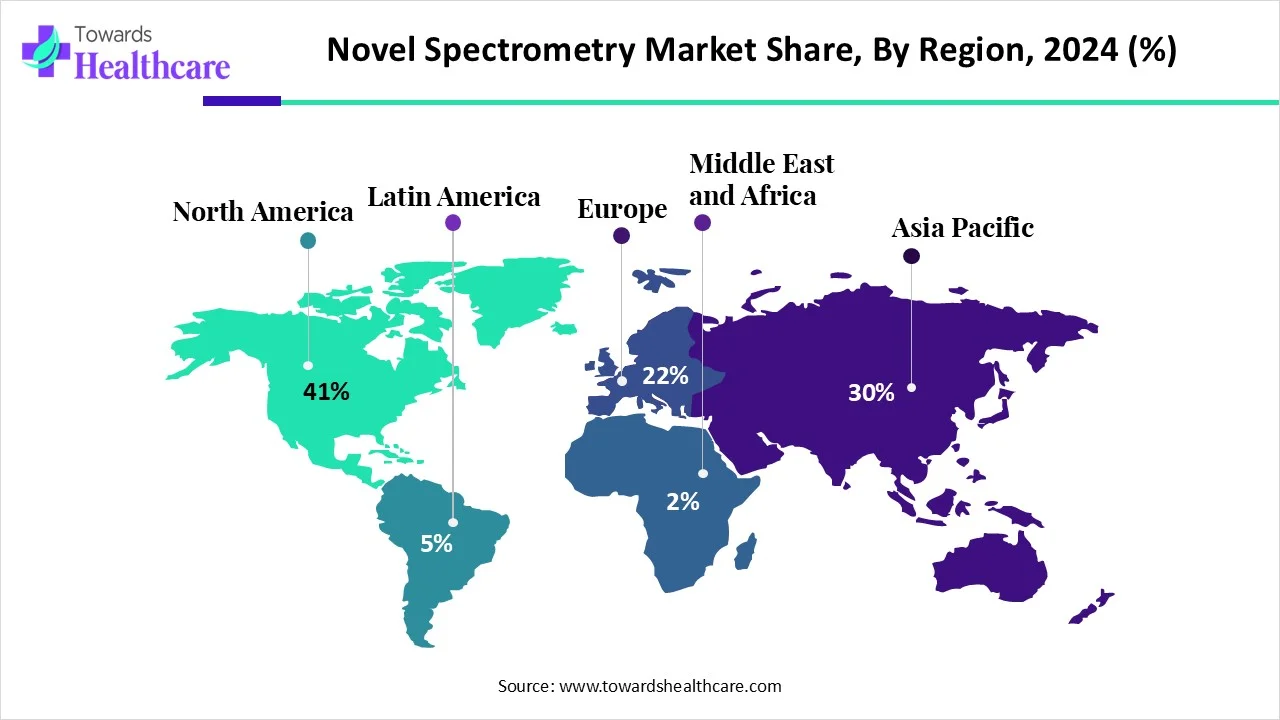

North America dominated the global market share by 41% in 2024. The rising adoption of advanced technologies and the presence of state-of-the-art research and development facilities are the major growth factors of the market in North America. Favorable government policies and regulatory frameworks favor the use of spectrometry. The presence of a robust healthcare infrastructure favors the use of spectrometry techniques in the healthcare and clinical sectors. The increasing collaboration and mergers & acquisitions foster the market.

U.S. Market Trends

The presence of key players, such as Bruker Corporation and Thermo Fisher Scientific, holds the major revenue share of the market in the U.S. The U.S. accounted for the second-largest exporter of spectrometers and spectrophotometers, with a trade value of $104 billion and exports of 177,726 units.

Canada Market Trends

The Government of Canada announced an investment of $49 million to support the adoption of cutting-edge technologies and approaches to accelerate drug discovery and develop new drugs for the effective treatment of Canadians. The funding was made through the Strategic Innovation Fund for the creation of the Conscience Open Science Drug Discovery Network.

Asia-Pacific is expected to grow at the fastest CAGR in the novel spectrometry market during the forecast period. The growing research and development activities and the burgeoning pharmaceutical sector augment market growth. The increasing venture capital investments also contribute to market growth. Several government and private organizations conduct conferences and workshops to train professionals and create awareness about novel spectrometric methods and their applications. Countries like Singapore, China, and Malaysia are among the top 10 global exporters of spectrometers.

China Market Trends

China’s pharmaceutical industry ranks second globally in new drug development. Foreign companies invest in China due to its vast market potential and its crucial role in helping them maintain a competitive edge globally. At the China Development Forum 2025, held in March 2025, AstraZeneca announced a landmark agreement to invest $2.5 billion in Beijing over the next five years, including the establishment of a global strategic R&D center.

Japan Market Trends

The Japanese government has launched several initiatives to boost the pharmaceutical sector in the country. These initiatives include the Pharmaceutical Industry Vision 2021, revisions to Price Maintenance Premium in 2023 and 2024, and the Integrated Innovation Strategy 2023. The government also launched a roadmap to double private investments in drug discovery startups by 2028 and enhance the clinical trial system in the country.

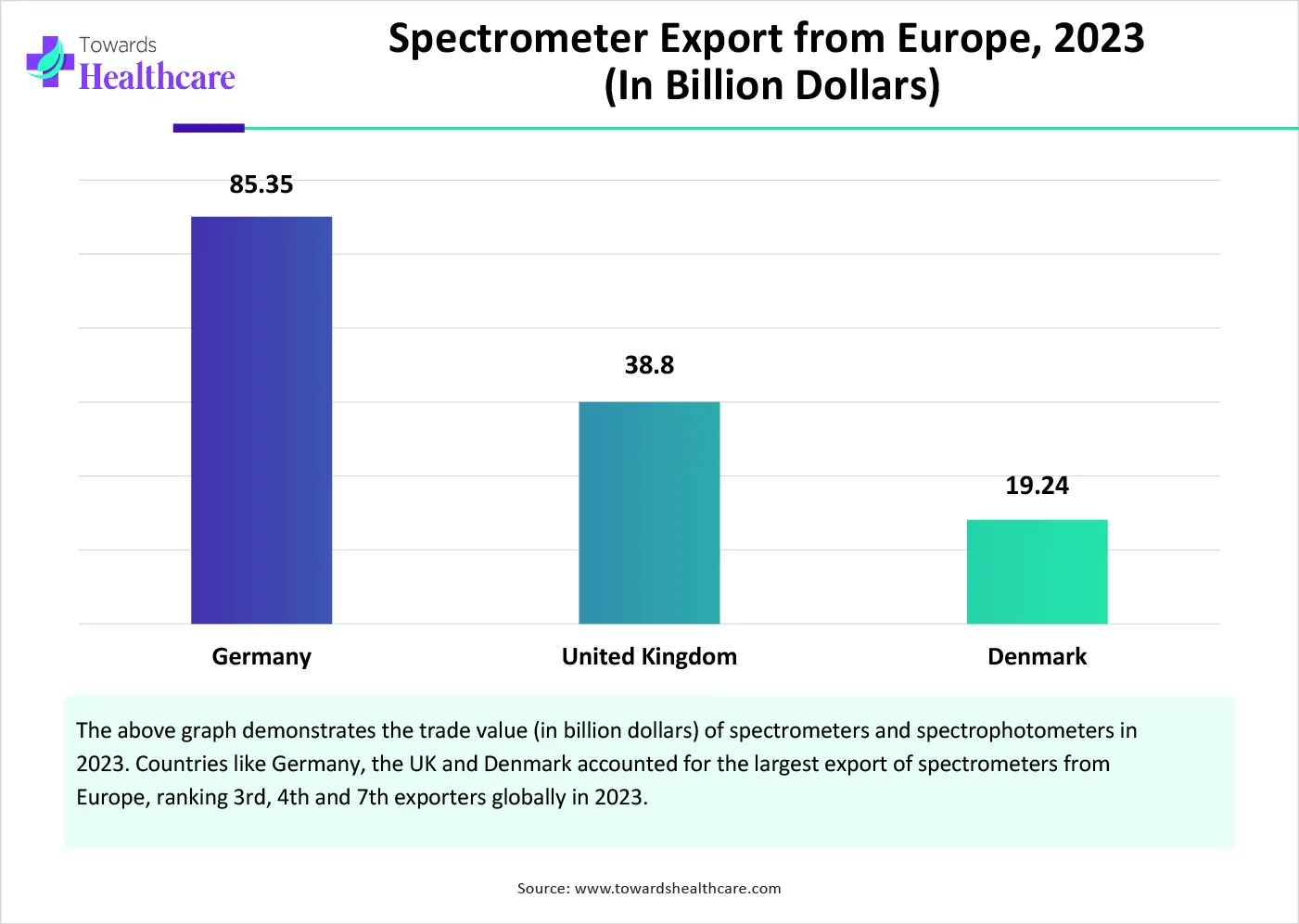

Europe is expected to grow at a notable rate in the novel spectrometry market in the foreseeable future. The rising prevalence of chronic disorders due to the increasing geriatric population facilitates researchers to develop novel drugs, potentiating the need for spectrometry. Government organizations provide funding for new drug discovery research and adopt advanced technologies in healthcare organizations. Favorable trade policies also govern the market. The European Union accounted for the world’s largest export of spectrometers and spectrophotometers in 2023, worth USD 137 billion, resulting in 100,225 units.

Germany Market Trends

Germany is considered Europe’s largest pharmaceutical market, with a global market share of 16% in pharmaceutical R&D. Germany exports around €90 million of pharma products. The German government also launched the Pharma Strategy 4.0 paper to accelerate clinical trials, promote digitization in the healthcare sector, and promote innovation and research projects.

UK Market Trends

In April 2025, the UK Prime Minister and the Wellcome Trust announced an investment of up to £600 million to accelerate the discovery of novel life-saving drugs and improve patient care, making Britain a leader in medical research. (Source - Gov.in) Additionally, the UK Secretary of State for Science, Innovation and Technology announced £388 million in funding to support five new infrastructure projects. Sheffield Hallam University received £50 million as part of this project to advance the UK’s capabilities in mass spectrometry. (Source - Sheffield Hallam University)

South America is expected to grow significantly in the novel spectrometry market during the forecast period, due to growing adoption of advanced analytical technologies, driven by expanding industries. The growing development of portable systems and increasing food safety regulations are also increasing their adoption rates, where the expanding healthcare infrastructure is also increasing their use, promoting the market growth.

Brazil Novel Spectrometry Market Trends

The expanding healthcare sector across Brazil is increasing the demand for novel spectroscopy for various analytical applications. The growing R&D activities across the industries and institutes are also increasing their use. Moreover, growing clinical diagnostics are also increasing their demand for various disease detection.

MEA is expected to grow significantly in the novel spectrometry market during the forecast period, due to expanding industries. At the same time, the growing healthcare investments are also increasing the innovation, driving the demand for novel spectrometry. The growing diagnostic labs and food safety concerns are also increasing their use, enhancing the market growth.

Saudi Arabia Novel Spectrometry Market Trends

The growth in the healthcare investment, supporting the growing R&D activities across the industries and institutions of Saudi Arabia are also increasing the use of novel spectrometry. The growing government initiatives are also encouraging their use, where companies are collaborating to enhance the application of novel spectrometry.

R&D

Clinical Trials and Regulatory Approvals

Packaging and Serialization

Distribution to Hospitals, Pharmacies

Patient Support and Services

Jose-Castro-Perez, Vice President, Product Management, SCIEX, commented on the launch of the Echo MS+ System that the system comprises acoustic ejection technology coupled with mass spectrometry. It offers contactless sample ejection and uses a nanoliter range of samples. He also said that his team coordinates with customers earlier in the development process and considers their needs for lab workflows.

By Spectrometry Type

By Application

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026