January 2026

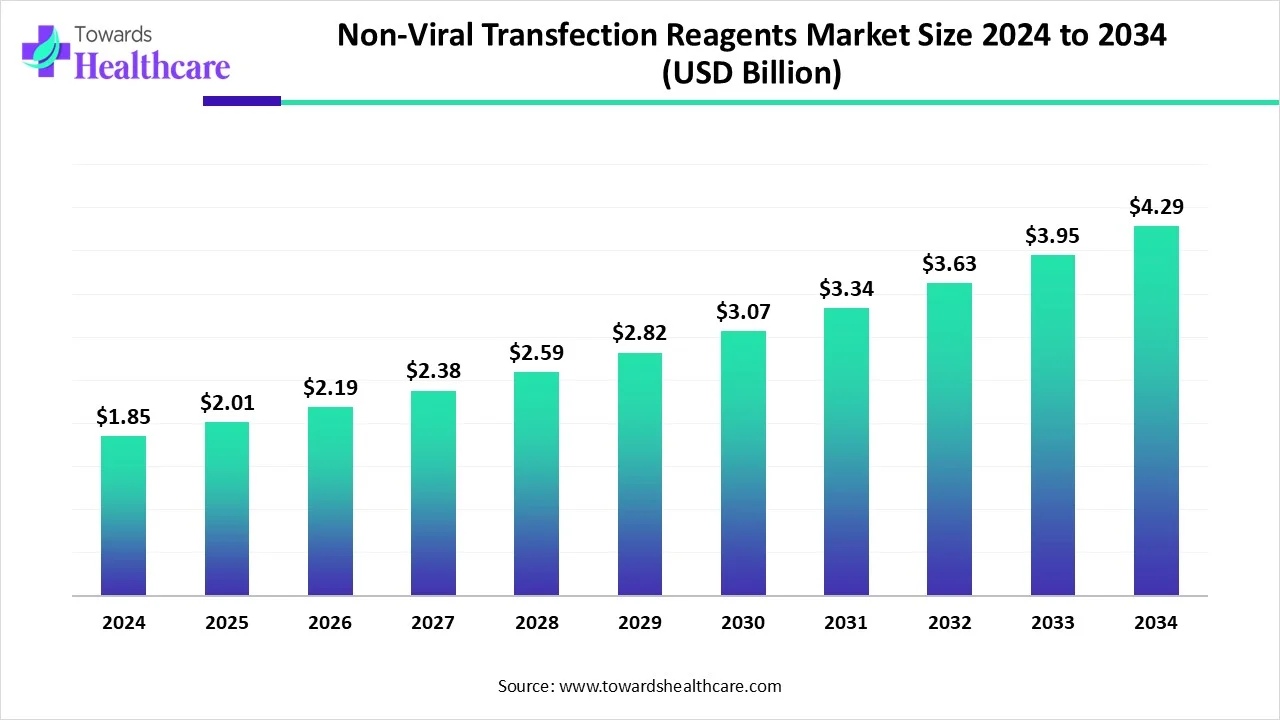

The global non-viral transfection reagents market size is calculated at US$ 1.85 in 2024, grew to US$ 2.01 billion in 2025, and is projected to reach around US$ 4.29 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 2.01 Billion |

| Projected Market Size in 2034 | USD 4.29 Billion |

| CAGR (2025 - 2034) | 8.73% |

| Leading Region | North America |

| Market Segmentation | By Application, By Methodology, By Product Type, By End Use, By Region |

| Top Key Players | Thermo Fisher Scientific, BioRad Laboratories, Sigma-Aldrich, Santa Cruz Biotechnology, New England Biolabs, Roche, Qiagen, GenScript, MilliporeSigma, TransIT, Lonza, Mirus Bio, Polyplustransfection, Promega Corporation, Cell Biolabs |

The non-viral transfection reagents market is growing rapidly because these reagents are widely developed and applied in healthcare practice due to their low immunogenicity, simple synthesis, better biocompatibility and modification, and low cost of production. Non-viral reagents improve the absorption of cargos, extend the time of circulation, progress therapeutic effects, and offer targeted delivery. Transfection is an advanced and powerful process applied to insert foreign nucleic acids into eukaryotic cells.

Increasing non-viral transfection for gene therapy or vaccines and carriers for drug delivery has been extensively researched owing to their facile use, targeting ability, and good biocompatibility. The investigation of non-viral vectors like polymer, liposomes, mesoporous silica nanoparticles, gold nanoparticles, and carbon nanotubes in healthcare research is increasing rapidly. Non-viral vectors can prevent the premature degradation of nucleic acids, proteins, or drugs, prolong therapeutic effect, and decrease side effects, which increases the demand for non-viral transfection reagents.

Integration of AI in non-viral transfection reagents is driving the growth of the market. AI-driven technology increases non-viral gene delivery approaches due to their excellent biosafety profile. Also, AI increases the transfection efficiency, specificity, and safety, leading to an increased number of nonviral vectors in gene therapy clinical trials. AI is applied in genomic data analysis to personalize medicines based on each patient's genetics. AI applications not only increase the accuracy and speed of biotechnological endeavours but also drive innovation and cost reduction. AI-based systems are optimizing clinical manufacturing by reducing challenges and enhancing the consistency of the product.

Non-viral Methods Provide Enhanced Safety and Increased Flexibility

Non-viral methods provide enhanced safety and increased flexibility for various recipient and target cell types, as well as different diseases. Compared to viral vectors, non-viral vectors present several benefits, such as being easier to manage, accommodating larger capacities, possessing a favorable toxicity profile, and being able to be repeatedly administered since they lack immunogenic properties. Their notably lower pathogenicity, cost-effectiveness, and ease of production give non-viral vectors a significant safety advantage over viral methods. The primary benefit of using non-viral vectors is their biosafety, which contributes to the growth of the non-viral transfection reagents market.

Low Efficiency Issues

The growth of non-viral transfection reagents market limited by the major challenge od the use of non-viral gene vectors for neuronal transfection due to it have low efficiency as compared to viral vectors, because of non-viral vectors cannot replicate in the cells, therefore they must rely on different mechanisms to deliver their cargo, which limits the growth of the non-viral transfection reagents market.

Recent Advancements in Nanoparticle-based Non-Viral Delivery

Rapid advancement in nonviral delivery vectors, including application of polymer, lipid, peptides, and inorganic nanoparticle-driven delivery systems, creates an opportunity in the non-viral transfection reagent market. Nanoparticle-driven non-viral delivery systems are evolving as potential solutions to address the limitations along with viral vectors, such as the complex production processes, limited capabilities of packaging, and potential cell damage while reducing immunogenicity. It enhances targeted DNA delivery and modulation of therapeutic efficacy, which contributes to the growth of the market.

By procedure, the gene editing segment dominated the non-viral transfection reagents market in 2024, as non-viral genome editing is the best solution to implement personalized chronic disease therapy, as it enables direct modification of genes. It is a cost-effective process and easy to handle. Non-viral gene editing techniques are used for modifying a patient’s DNA instead of using viruses to deliver the gene-editing tools.

The gene therapy segment is expected to be the fastest growing in the non-viral transfection reagents market due to its demonstrated reduced pathogenicity, affordable, and simplicity of production. Non-viral vectors in gene therapy have an important safety advantage over traditional approaches. It also provides several advantages such as broad raw materials, flexible chemical composition, simply modulated topology, high DNA loading, and safety. Non-viral vectors mainly contain exosomes, LNP, cationic polymers, polymer hydrogels, and inorganic nanoparticles.

By methodology, the electroporation segment is dominant in the non-viral transfection reagents market in 2024, as it has emerged as a reliable manual technique for delivering plasmid DNA. This therapy is delivered intramuscularly, intradermally, or intratumorally. Electroporation offers many advantages as comparison to other transfection techniques, with the benefits being its applicability for stable and transient transfection of all cell types and its potential to transfect a huge number of cells in a short time.

The calcium phosphate transfection segment is expected to be the fastest growing due to the calcium phosphate transfection is a broadly applicable method for introducing foreign DNA plasmids into cells. DNA-calcium phosphate transfection is internalized by the cells, and DNA is proficiently expressed in almost all types of cells. The affordability and simplicity of this method enable to applicability in primary neuronal cultures, despite challenges of neurotoxicity.

By product type, the nucleic acid delivery segment dominated the non-viral transfection reagents market in 2024, as non-viral nucleic acid delivery is a substitute for viral vector-mediated gene delivery. This type of delivery of DNA or mRNA is generally more rapid as compared viral-mediated delivery, provides a larger payload, and has nearly no risk of incorporation. This delivery of DNA or RNA is preferable to non-viral DNA delivery in those medical applications that do not need lasting expression for chronic conditions.

The cationic polymers segment is expected to be the fastest growing in the market during the predicted time, as this type of polymer, such as poly L-lysine (PLL) and polyethylenimine (PEI) and their complexes, is experimentally established as a non-viral vector with huge transfection efficacy. It bears many properties, suitable for bound with penetrating cell and DNA. Cationic polymers are a predictable, safe, biodegradable, and harmless alternative to viral gene therapy, which relies on the incorporation of biopolymers in the synthetic polymer-driven carriers on target genes or various biomolecules' swallow effect.

By end use, the biotechnology companies segment was dominant in the non-viral transfection reagents market in 2024, as non-viral transfection reagents have very low immunogenicity, biodegradability, simple synthesis, cost-effective production, and are not restricted by the size of the molecules to be introduced. It has more prolonged and higher gene expression afforded by minivectors or minicircles decreases the number of treatments needed in biotech companies.

The pharmaceutical companies segment is expected to be the fastest growing in the market during the forecast period, as non-viral transfection methods in the pharmaceutical field are attractive because they allow a flexible size of DNA to be transported, are cost-effective, simple to prepare, and generate little or no in vivo immune response. Non-viral vectors transport a broad range of genetic cargo, including mRNA, plasmid DNA, and small interfering RNA (siRNA). Non-viral vectors have the potential to facilitate the manufacturing of therapies at a larger scale in pharma companies.

North America dominated the non-viral transfection reagents market as the North American government provides the facilities, advanced research infrastructure, and logistics to support scientists who have advanced knowledge in biotech and other significant areas of bioscience. Growing scientific advances in various sectors which a growing demand for non-viral transfection reagents. As the biotech industry rapidly grows, many North American cities are evolving into biotech hubs, goal of becoming the next epicentres of novel innovation, which contributes to the growth of the market growth.

In the United States, the presence of robust infrastructure, advanced research institutions, and a favourable government environment drives the growth of the market. Also, increasing Government funding remains a main driver of biotech research. For instance, the National Institutes of Health (NIH) invested over $47 billion in 2023. For major biotech startups, securing NIH grants provides important funding. The United States also holds its position as the leader of medical sciences, which increases the demand for non-viral transfection reagents.

Canada’s life sciences sector is rapidly increasing its strength and economic vibrancy. Supported by a world-class research and science ecosystem, this makes the country a global leader in healthcare innovation and drug discovery. Canada is home to more than 2,000 life sciences firms, retaining as many as 220,000 people in the country. Most of their activity majorly focuses on research and development at public and private labs, which creates several forms of IP used in modern health sciences, driving the market growth.

The Asia Pacific region is projected to experience the fastest growth in the non-viral transfection reagents market during the forecast period, because of growing collaborations in the biotech firms, government agencies, and academic institutions within the region. The evolving role of personalized medicine in different cell and gene therapies, and its role in health economics, contributes to the growth of the non-viral transfection reagents market.

The biopharmaceutical sector in China is progressively shifting its focus to nearby regions to improve induced supply chain pressures. China focused on developing novel drug types, including CAR-T and monoclonal cell products, which are driving the growth of the market. Chinese biotech companies are gradually establishing global footprints. In China, the rapid incidence of solid tumours has increased an urgent requirement for advanced therapies, encouraging the push for novel treatment strategies.

India's biotech sector, driven by government support and innovation, provides global leadership in bio-pharma and vaccines. The manufacturing sector in India is progressively shifting to an automated and process-driven manufacturing, which is expected to increase efficiency and boost strategy. Indian manufacturing is innovating because of automation, AI, and IoT adoption, which presents opportunities for higher efficiency and productivity of biotech services which causing growth of the market.

For Instance,

Europe is expected to grow significantly in the non-viral transfection reagents market during the forecast period, as Europe has a growing bio talent, science, and ambition to lead in advanced food, biotech, and life sciences industries, also the European government is increasing spending in healthcare services, driving the market growth. The life sciences sector is one of Europe’s most significant strategic assets, delivering ground-breaking medicines and vaccines that are essential to the long-term health and security of EU citizens, which increases the demand for non-viral transfection reagents. Europe increases investment in research and manufacturing, and aims to be a priority location for clinical trials and innovative medicines, which drives the growth of the market.

Germany is growing the accessibility of significant cell and gene therapies to patients, a major driver of the market. Germany has strong biotech innovation, including world-class fundamental research in various future-oriented fields. Modern scientific research, combined with a highly skilled workforce, has created a boundless environment for innovation. The life sciences sectors in Germany are driven by a strong and stable medical market, support for research and development, and a wealth of organizations and institutes, which cause the growth of the market.

In March 2025, Igor Fisch, Ph.D., NewBiologix CEO and Co-founder, stated, “Our committed bioinformaticians and scientists have tirelessly developed the NBX-HEK293 cell line, which not only fulfills but also surpasses industry standards. This advancement marks a crucial step in achieving our aim of introducing a stable HEK293 cell line that produces rAAV particles for gene therapies.” (Source: Businesswire)

By Application

By Methodology

By Product Type

By End Use

By Region

January 2026

November 2025

November 2025

February 2026