January 2026

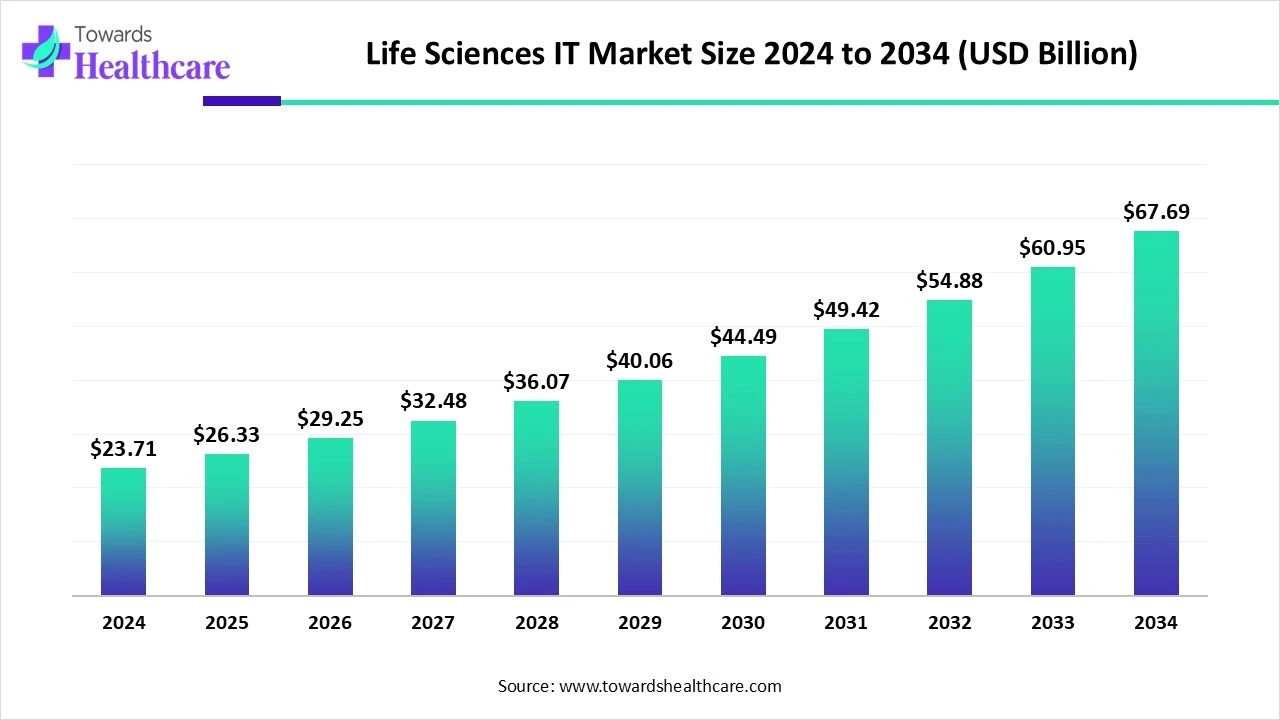

The global life sciences IT market size is calculated at USD 23.71 billion in 2024, grow to USD 26.33 billion in 2025, and is projected to reach around USD 67.69 billion by 2034. The market is expanding at a CAGR of 11.06% between 2025 and 2034.

The Life Sciences IT market is witnessing strong growth driven by the rising adoption of digital tools in drug discovery, clinical research, and healthcare data management. Technologies like AI, cloud computing, and big data analytics in healthcare are enhancing efficiency, accuracy, and decision-making across the sector. Additionally, growing demand for personalized medicine and real-time regulatory compliance is encouraging life sciences companies to invest in advanced IT solutions.

| Metric | Details |

| Market Size in 2025 | USD 26.33 Billion |

| Projected Market Size in 2034 | USD 67.69 Billion |

| CAGR (2025 - 2034) | 11.06% |

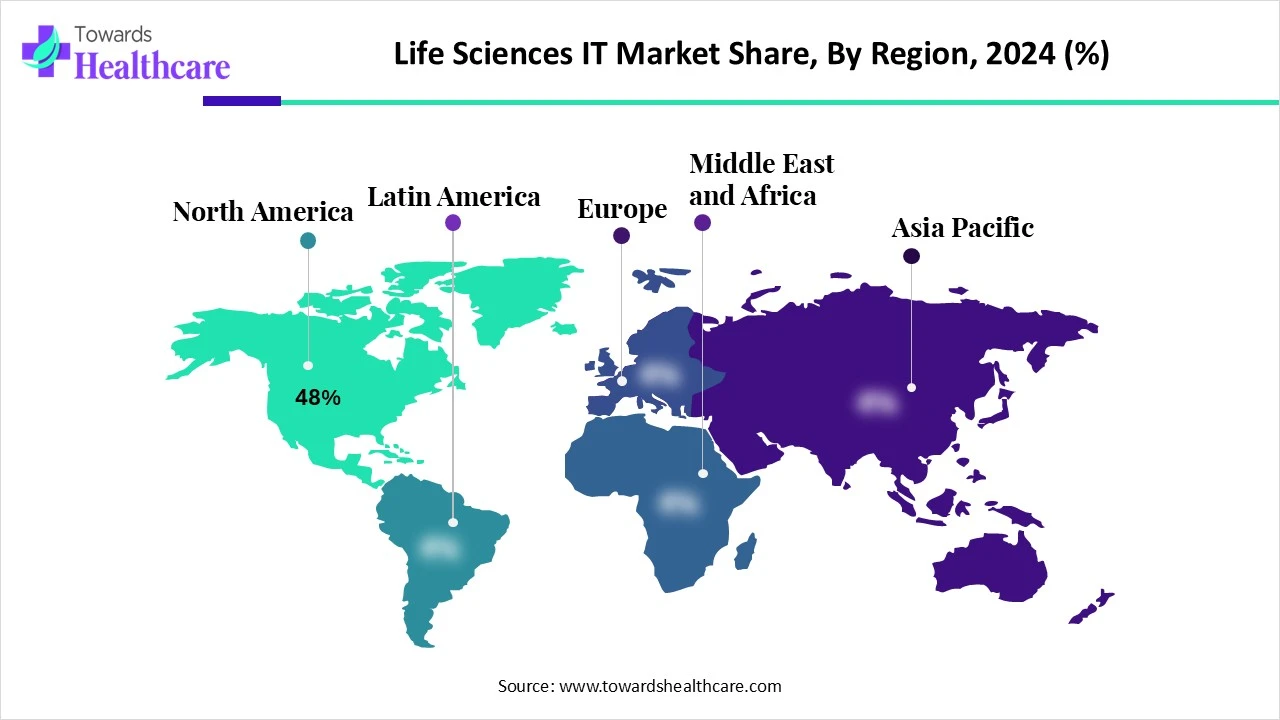

| Leading Region | North America share by 48% |

| Market Segmentation | By Component, By Application, By Deployment Mode, By End User, By Region |

| Top Key Players | Oracle Life Sciences, Veeva Systems, IQVIA, Medidata (Dassault Systèmes), SAP SE, Thermo Fisher Scientific, PerkinElmer / Revvity, LabWare, IDBS (Danaher), Cognizant, Accenture, Wipro, TCS Life Sciences, Infosys Life Sciences, Waters Corporation, Agilent Technologies, Clario, Biovia (Dassault Systèmes), Dotmatics (Insightful Science) |

The Life Sciences IT Market encompasses digital and informatics solutions that support research, development, manufacturing, and commercial activities within the pharmaceutical, biotechnology, and medical device sectors. It includes software, platforms, services, and infrastructure tailored for data management, regulatory compliance, clinical trials, lab operations, drug discovery, pharmacovigilance, and commercialization. Technological advancements are reshaping the life sciences IT market by enabling smarter, faster, and more efficient processes across research and development. Tools like predictive analytics, blockchain, and automation are reducing operational bottlenecks and ensuring data accuracy. Innovation is also driving the development of tailored IT solutions for complex clinical trials and regulatory workflows, supporting better collaboration, transparency, and scalability in pharma and biotech operations. This is fueling broader adoption of digital transformation in the sector.

AI is transforming the market by enabling faster data analysis, improving decision-making, and optimizing drug discovery and clinical trials. It helps identify patterns in complex biomedical data, accelerates personalized medicine, and enhances predictive modeling for patient outcomes. AI also supports automation in regulatory compliance and research workflows, making processes more efficient and cost-effective across pharmaceutical, biotech, and healthcare organizations.

Rising Adoption of Digital Health Solutions

The increasing use of digital health tools is fueling demand for advanced IT solutions in the life sciences sector. These technologies, including mobile health apps and remote monitoring systems, produce large volumes of patient data that need efficient handling. To manage, analyze, and secure this information, companies are turning to innovative IT platforms. This shift not only supports faster clinical decisions but also streamlines operations, enhances research capabilities, and ensures better regulatory alignment.

For Instance,

High Implementation and Maintenance Costs

The substantial financial investment required for deploying modern IT solutions poses a major hurdle in the life sciences sector. Beyond initial setup, companies faces recurring costs related to system upgrades, data security, infrastructure management, and compliance. These ongoing expenses can be especially challenging for startup or smaller research institutions, discouraging rapid digital adoption. As a result, budget constrint slow down the integration of advanced technologies impacting operational efficiency and limiting market growth potential.

Expansion of AI and Machine Learning

This expansion of AI and machine learning presents a major future opportunity in the science IT market by enhancing drug discovery, diagnostics, and clinical trial design. These technologies can analyze vast datasets faster and more accurately than traditional methods, enabling quicker identification of biomarkers and treatment responses. As healthcare becomes increasingly data-driven AI tool support precision medicine, automate workflow and improved decision making driving demand for advanced IT infrastructure across pharmaceutical, biotech, and research organizations.

The service segment led the market due to companies increasingly depending on expert providers to manage complex technologies and evolving compliance needs. With the rapid adoption of cloud, AI, and data analytics, organizations require continuous support for system upgrades, troubleshooting, and user training Services providers offer tailored solutions that help reduce internal workload, ensure data accuracy, and maintains system efficiency making services a vital components in sustaining digital transformation across the life sciences sector.

The IaaS and PaaS segments are projected to witness strong growth in the life sciences IT market as they offer agile and on-demand computing environments. These models enable research institutions and biopharma firms to handle complex workloads, support data-heavy applications, and scale resources as needed without managing physical infrastructure. Their ability to reduce IT overhead, speed up the development cycle, and enhance collaboration makes them an attractive choice for companies pursuing digital transformation in life sciences.

The drug discovery information segment led the life sciences IT market in 2024 as companies prioritized advanced digital tools to streamline early-stage research. Growing complexity in molecular targets and the need for large-scale data analysis drove demand for platforms that support simulation, compound modelling, and predictive analytics. This segment gained momentum as pharmaceutical firms aimed to improve success rate and reduces time to market, making IT-enabled drug discovery a critical area of investment and innovation.

The real-world data analytics and commercial intelligence segment is set to grow rapidly as life sciences companies focus on improving market strategies and patient outcomes through deeper insights. The surge in data from diverse sources like mobile health apps, claims databases, and real-time monitoring tools enables companies to evaluate drug performance, optimize pricing, and enhance patient engagement. This growing reliance on actionable insights for both clinical and commercial decisions is driving the market's accelerated expansion.

The on-premise segment dominated the market in 2024 as many organizations prioritize full control over their IT environments. Concerns around data confidentiality, intellectual property protection, and adherence to region-specific regulatory standards made the on-premise solution a preferred choice, especially for large pharmaceutical firms. This system offered enhanced customization, minimized dependency on external networks, and ensured uninterrupted access to critical factors for managing complex research operations and safeguarding proprietary information.

The cloud-based (private & hybrid) segment is anticipated to expand rapidly in the life sciences industry as companies aim for greater operational agility and innovation. These deployment modes support efficient handling of large datasets, simplify integration of advanced tools like machine learning and enable faster deployment of applications. With growing emphasis on remote research, data interoperability, and cost control, private and hybrid cloud solution offer a secure yet flexible infrastructure tailored to the evolving needs of the life science sector.

The pharmaceutical company segment dominated the life science IT market in 2024 as these forms increasingly adopted advanced technologies to streamline R&D, monitor clinical trial progress, and ensure regulatory readiness. With the surge in data-intensive processes like genomics, drug screening, and digital pharmacovigilance, pharma companies turned to robust IT infrastructure for improved efficiency and data integrity. Their large-scale operations and global reach also drove greater investments in scalable, secure, and integrated digital solutions.

The CRO segment is projected to grow at the highest CAGR in the life sciences IT market as sponsors increasingly depend on these organizations for cost-effective and technology-driven research support. With growing pressure to accelerate drug development and navigate complex regulations, CROs are investing in advanced IT tools to streamline data collection, enable real-time monitoring, and improve trial accuracy. Their expanding role in end-to-end clinical services is fueling demand for scalable foe efficient digital infrastructure.

North America dominated the life science IT market share by 48% in 2024 due to its strong presence of leading pharmaceutical and biotech companies, advanced healthcare infrastructure, and high adoption of digital technologies. The region’s favorable regulatory environment and significant investment in R&D further supported IT integration across clinical research and drug development. Additionally, the growing use of AI, big data, and cloud-based platforms by U.S. and Canadian firms contributed to North America's leadership in the life sciences IT landscape.

The U.S. market is expanding due to several key factors. These include a well-established digital infrastructure, early adoption of AI, machine learning, and cloud technologies, and strong collaborations between tech firms and life sciences companies. The presence of top-tier academic and research institutions drives continuous innovation. Additionally, supportive regulatory frameworks, a skilled workforce, and a focus on personalized medicine and data-driven research further accelerate IT adoption in the life sciences sector.

Canada’s market is expanding thanks to strong government backing such as the Can$2.2 billion Biomanufacturing and Life Sciences Strategy and Strategic Innovation Fund and generous R&D tax credits like SR&ED. Coupled with world-class research institutions, robust AI and genomics expertise, and growing VC/private investment, this innovation ecosystem attracts global firms and fuels increased demand for digital and IT solutions in drug discovery, clinical trials, and data analytics.

Asia-Pacific is poised for the fastest growth in the market due to rapid digital transformation in healthcare, rising focus on precision medicine, and increasing adoption of AI and cloud technologies. Government support for e-health initiatives, expansion of clinical research hubs, and a growing base of tech-savvy healthcare professionals further fuel this growth. Additionally, cost-effective talent and infrastructure make the region attractive for outsourcing and collaborative R&D, accelerating IT integration across life sciences operations.

China’s market is expanding rapidly due to increasing emphasis on healthcare innovation, digital hospital infrastructure, and integration of smart technologies. Government-backed programs like Healthy China 2030 are promoting AI-driven diagnostics, cloud-based systems, and real-time health data use. The rising demand for efficient patient care, a growing biotech sector, and partnerships between tech giants and healthcare providers are further accelerating the digital transformation of China's life sciences ecosystem.

India’s market is growing due to rising digitalization in healthcare, government-backed initiatives like the Ayushman Bharat Digital Mission, and increasing adoption of technologies such as AI, cloud computing, and telemedicine. The country's strong IT expertise, expanding clinical trial landscape, and growing biotech ecosystem support the demand for advanced digital platforms. Additionally, greater focus on personalized medicine and healthcare accessibility is accelerating IT integration across life sciences operations.

In 2024, Europe advanced its landscape by emphasizing data standardization, cross-border collaboration, and digital skill development. Initiatives like the European Health Data Space aimed to streamline health data sharing for research and innovation, while projects such as ELIXIR promoted a unified bioinformatics infrastructure. Countries across the region focused on integrating AI, improving digital health literacy, and upgrading clinical trial capabilities, positioning Europe as a leader in secure, interoperable, and patient-centric digital transformation in life sciences.

The UK market is expanding due to strong government support, investment in health data infrastructure, and a push for faster clinical trial processes. The integration of digital tools across the NHS, growing collaborations between biotech firms and academic institutions, and the development of innovation hubs in cities like Cambridge and Oxford are accelerating digital adoption, boosting research efficiency, and driving demand for advanced IT solutions in life sciences.

Germany’s market is growing due to increased digitalization in healthcare, rising demand for advanced research tools, and strong collaboration between tech firms and pharmaceutical companies. Ongoing initiatives to modernize hospital infrastructure and promote electronic health records are accelerating IT adoption. Additionally, the country’s focus on AI integration in drug development and streamlined regulatory processes is driving innovation and expanding the role of IT across life sciences research and operations.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

The Life Sciences Cloud (ALSC) platform offers pharmaceutical companies a simplified dashboard to monitor the entire manufacturing process, providing real-time insights for improved operational efficiency. It ensures end-to-end supply chain traceability from raw materials to end users, while supporting global compliance standards, including the upcoming DSCSA regulation. The platform is scalable, user-friendly, and allows integration of customer engagement tools to verify product authenticity and enhance relationships. ACG Inspection CEO Udit Singh emphasized their focus on innovations like ALSC, driven by AI and analytics, to improve efficiency, sustainability, and quality across the pharmaceutical value chain. (Source - Pharmaceutical Manufacturer)

By Component

By Application

By Deployment Mode

By End User

By Region

January 2026

January 2026

January 2026

January 2026