January 2026

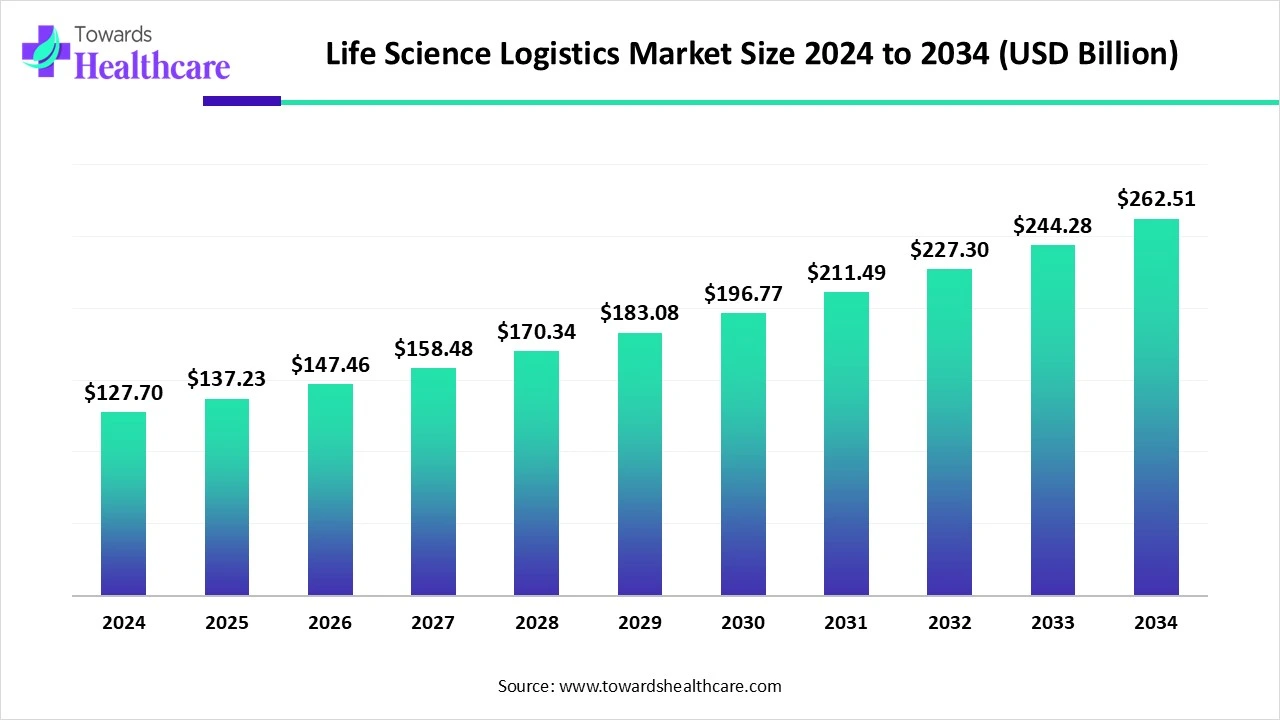

The global life science logistics market size is calculated at US$ 127.7 in 2024, grew to US$ 137.23 billion in 2025, and is projected to reach around US$ 262.51 billion by 2034. The market is expanding at a CAGR of 7.46% between 2025 and 2034.

In 2025, the global life science logistics market will be developing with the emergence of various needs for pharmaceuticals, biologics like vaccines, and insulins are driving demand for efficient and reliable logistic services. Also, some kinds of biologics or biosimilars require temperature-controlled solutions, such as cold chain supply management and specialized transportation, especially for those items that are highly temperature sensitive.

In the coming era, these life science logistics companies will have massive investments in many types of companies particularly in biopharmaceutical and clinical trials. Also, the market will widely adopt advanced technologies in this service, especially AI, ML, and other solutions.

| Metric | Details |

| Market Size in 2025 | USD 137.23 Billion |

| Projected Market Size in 2034 | USD 262.51 Billion |

| CAGR (2025 - 2034) | 7.46% |

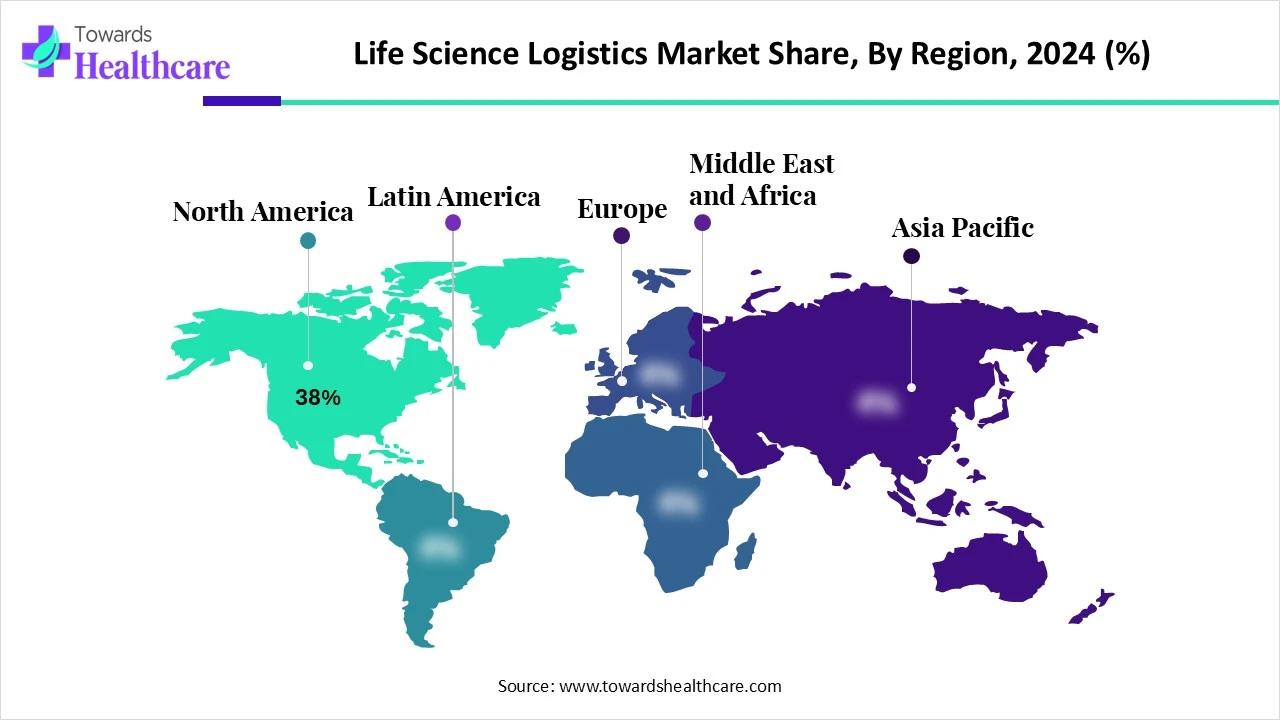

| Leading Region | North America share by 38% |

| Market Segmentation | By Service Type, By Mode of Transport, By Application, By End User, By Region |

| Top Key Players | DHL Supply Chain, UPS Healthcare, Kuehne+Nagel, FedEx Express, DB Schenker Life Science Logistics, CEVA Logistics (CMA CGM Group), Agility Logistics, Marken (UPS subsidiary), Cryoport, Inc., World Courier (AmerisourceBergen), Biocair, GEODIS, Catalent Pharma Solutions, Movianto (Walden Group), Yusen Logistics, Zuellig Pharma, Panalpina (merged with DSV), Fiege Pharma, Softbox Systems (Cold Chain Technologies), Envirotainer |

The life science logistics market refers to the specialized supply chain and transportation services tailored for life science products, including pharmaceuticals, biologics, clinical trial materials, vaccines, diagnostics, and medical devices. This market encompasses temperature-controlled logistics (cold chain), warehousing, regulatory-compliant transportation, inventory management, and value-added services such as labeling, packaging, and returns management. Currently, this market is widely investing in cold chain infrastructure, strategic partnerships among leading players, and the adoption of digital technologies for enhanced traceability.

The market possesses a major role of AI in the same growth, due to emerging factors, like rising demand for precision medicine, and the need for quick drug development. And the expansion in the complex supply chains. As well as AI-driven measures are highly revolutionizing sectors, including demand forecasting, route improvements, inventory management, and cold chain logistics.

In different processes, AI supports in enhancing effectiveness, affordability, and accelerating patient care. Alongside, AI-based autonomous vehicles are employed for last-mile delivery of medications and medical supplies, potentially minimizing delivery times and transportation expenses.

Escalating Demand for Pharmaceuticals & Biologics, and Advanced Therapies

The life science logistics market is driven by boosting demand for various kinds of pharmaceuticals and biologics, which frequently need expert logistics services, with temperature-controlled transportation and storage. Furthermore, novel advanced therapies, particularly cell and gene therapies, are being greatly explored, necessitating more strict and complex logistics solutions. Along with this, these therapies are highly sensitive with short shelf life, which requires significant management and transportation is fueling the overall market growth.

Risk of Product Damage and Infrastructure Challenges

For temperature-sensitive products, it is a major challenge to control the required temperature, as changes in these conditions, even a small one, may result in product damage, and ultimately, it becomes unusable. Another barrier is moving around the infrastrure, in which inaccurate transportation networks, cold chain storage facilities, and standardized warehousing may generate a crucial hurdle in effective logistic solutions.

Expansion in Cold Chain Handling, Digitalization, and Collaborations

During 2025-2034, the life science logistics market will register numerous opportunities in optimizing and developing cold chain infrastructure and its capabilities, with enhanced adoption of digital approaches, like AI and automation. These opportunities will help in streamlining the processes, evolving routes, and boosting real-time visibility. Besides this, a progressing market will require strategic collaborations and partnerships will be necessary for executing specialized expertise and accelerating into new markets.

By service type, the transportation segment was dominant in the global life science logistics market in 2024. The is propelled by novel advanced technologies, such as AI-driven route improvements, blockchain for optimized traceability, and real-time monitoring systems, which accelerate effectiveness and decrease risks in the supply chain. As well as a growing need for specialized cold chain solutions for storage and transportation in temperature-sensitive products, especially vaccines and biologics is driving the overall segment growth.

However, the inventory & order management segment is estimated to grow rapidly, with increasing need for visibility, security, and efficiency in supply chains, including specialized products, such as biologics and medical devices. Furthermore, progression in e-commerce for healthcare, like the expanding trend of online pharmacies and direct-to-consumer pharmaceutical sales, requires strong logistics solutions, including efficient inventory management and order fulfillment.

In 2024, the road segment registered dominance in the market due to a growing demand for efficient and reliable transportation of pharmaceuticals and medical products. Additionally, this kind of transport is important in the distribution of temperature-sensitive drugs like biologics, vaccines, and specific types of insulin, which require specialized cold chain logistics. Also, this is an affordable and flexible solution for transporting a broad range of pharmaceutical products, with the inclusion of both temperature-sensitive and non-temperature-sensitive items.

And, the air segment will show the fastest expansion in the studied years. The major involvement of need is for faster and precise transportation of pharmaceuticals, particularly biologics and vaccines. Other significant growth factors driving this segment are the time-sensitive nature of these products, the boost of global healthcare needs, and breakthroughs in temperature-controlled transportation and real-time tracking technologies.

The pharmaceuticals segment dominated the global life science logistics market in 2024. Contributing factors are a rise in demand for novel medications, like vaccines and biologics, which require stringent temperature control during storage and transportation are majorly impacting the segment expansion. As well as a significant expansion of biopharmaceutical industries, resulting in enhanced demand for specialized logistics solutions for managing complex products like monoclonal antibodies and cell/gene therapies.

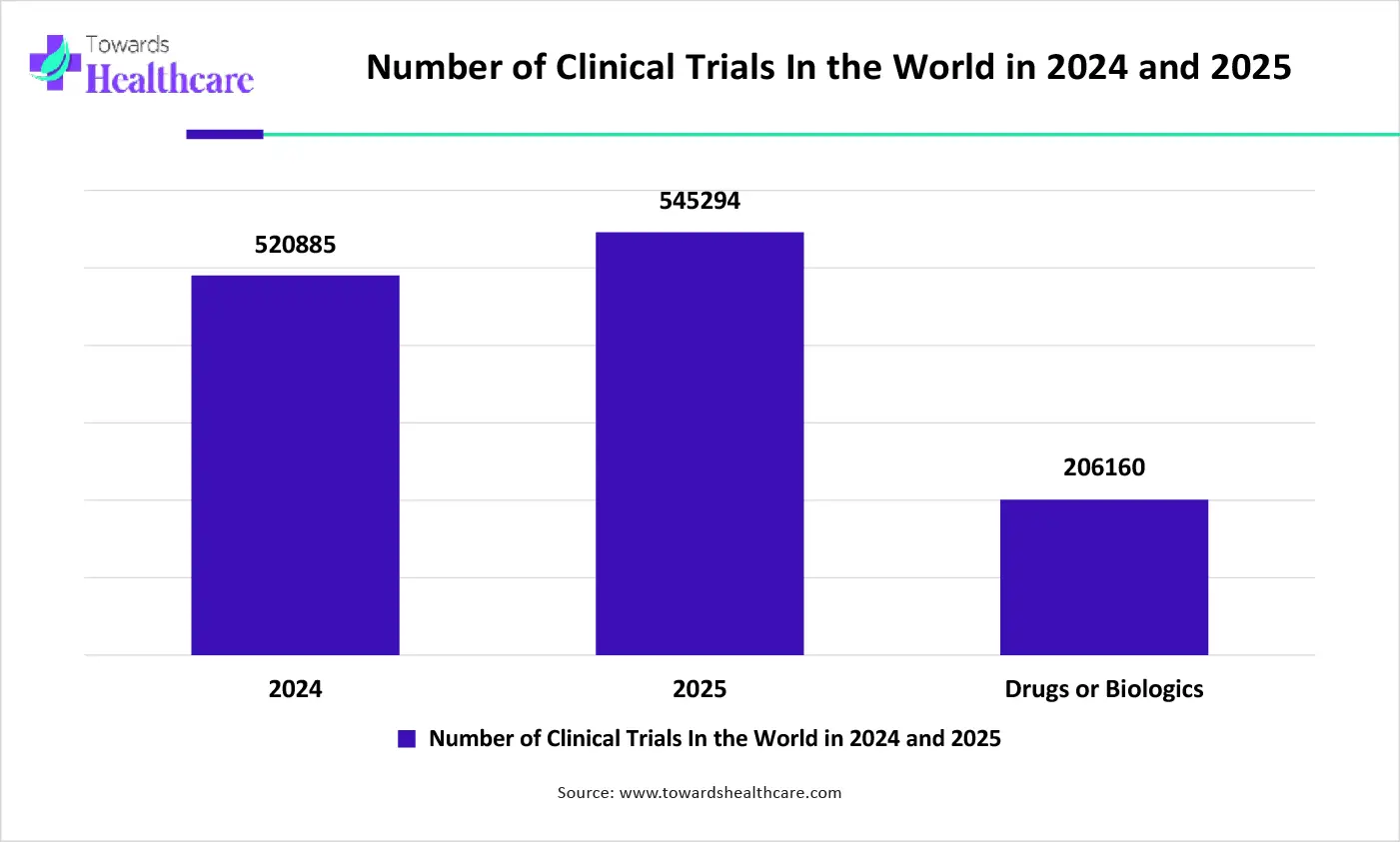

Although the clinical trials segment is anticipated to grow at a rapid CAGR during 2025-2034. The segment is driven by accelerating numbers of clinical trials, increasing R&D investments and funding, as well as the rising complexity of worldwide trials. Along with this, the segment is experiencing the immense adoption of decentralized trials, advancements in technology, especially AI and blockchain, and the need for specialized logistics for cell and gene therapies. Besides this, many biopharmaceutical industries are widely outsourcing their clinical trial logistics to major providers is also influencing the overall segment and market growth.

The pharmaceutical & biotechnology companies segment held the biggest revenue share of the market in 2024. Mainly, the segment is impelled by major enhancements in the international trade in pharmaceuticals, which requires strong and reliable logistic measures to ensure timely and safe delivery of products around the globe. Also, the developing trend towards tailored medicine and therapies, along with significant demand for a variety of biologics like cell and gene therapies, is enormously fueling the expansion of this segment or these companies.

The contract manufacturing organizations (CMOs) segment will grow at a rapid CAGR, with increasingly contributing factors, such as growing demand for biologics and biosimilars, advancements in biopharmaceutical manufacturing technologies, and the expansion of personalized medicine and gene therapies. CMOs offer major manufacturing services to pharmaceutical and biotech companies, especially for complex biologics and sterile injectable drug formulations.

North America experienced a dominating nature in the respective market share by 38% in 2024, due to a strong regulatory framework (FDA, DEA), a robust pharma/biotech base, which is boosting the need for advanced and reliable logistic supply chain solutions. In addition, the enhanced focus on personalized medicine, including cell and gene therapies, requires specialized handling and transportation, leading to the growth of the market.

For this market,

The US is experiencing a crucial expansion in this market, due to widespread progression in clinical trials for evolving novel therapies, with adoption of advanced measures, like AI-driven route optimization. As well as important advancements in cold chain management with raised effectiveness and transparency are assisting in this region’s market growth.

For instance,

Canada’s government is regulating its rules, like Good Distribution Practices (GDP), for maintaining stringent QC and confirming product integrity throughout the supply chain in different pharmaceutical companies is fueling the need for specialized logistics services. Also, this region encompasses an expansion of e-commerce, and the rising demand for online solutions to healthcare items is majorly impacting the logistics sector with widespread adoption of new delivery models and expectations in many companies.

In 2025-2034, the Asia Pacific will show the fastest growth, with various countries incorporating factors, including a surge in biologics R&D and clinical trials (India, China, Singapore), and investment in life science parks and cold chain infrastructure. Besides this, ASAP is a crucial hub for developing pharmaceutical and biotechnology companies, as many countries in ASAP are facing a vital burden of chronic disease prevalence and other newly emerging health concerns.

For this market,

Primarily, in India, increasing cases of chronic diseases and the expansion of the healthcare domain are increasingly influencing demand for pharmaceutical and biologics, which ultimately impacts on development of efficient and trustworthy logistic solutions. Nowadays, India is highly focused on the emergence of novel and advanced cell and gene therapies, which require specialized handling and storage conditions, establishing a higher need for temperature-controlled logistics in the life science sector.

China is immensely adopting e-commerce solutions, like online pharmacies and direct-to-patient (DTP) delivery, which is widely impelling the pharmaceutical and healthcare areas. Besides this, significant innovations in cold chain technology, such as specialized packaging, real-time monitoring systems, and temperature-controlled containers, with emerging sophisticated techniques, including AI, big data, and machine learning, are also optimizing logistic operations with improved supply chain profiles.

For instance,

Europe is experiencing a significant growth in the life science logistics market, because of the raised emphasis on globalization of the pharmaceutical industry and the rise of e-commerce, with major growth in the geriatric population, which is fueling the same development of companies. Moreover, this region is highly adopting expansion in biologics and other temperature-sensitive pharmaceuticals is propelling the need for effective cold chain solutions, including specialized packaging, temperature monitoring, and transportation.

The possession of advanced technologies, such as AI, blockchain, and IoT, in a broad growing life science companies is boosting efficiency, transparency, and traceability in the supply chain, resulting in optimization of logistic measures.

For this market,

Germany, emphasizing rising environmental issues, is fostering the industries towards eco-friendly practices, including sustainable packaging and the use of electric vehicles. Besides this, this region’s government is supporting and funding R&D in life sciences, which further boosts the expansion and the need for logistics solutions. Also, Germany is a central site in Europe, which makes it a pool for international trade and distribution of pharmaceuticals and other life science products.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

By Service Type

By Mode of Transport

By Application

By End User

By Region

January 2026

December 2025

November 2025

October 2025