December 2025

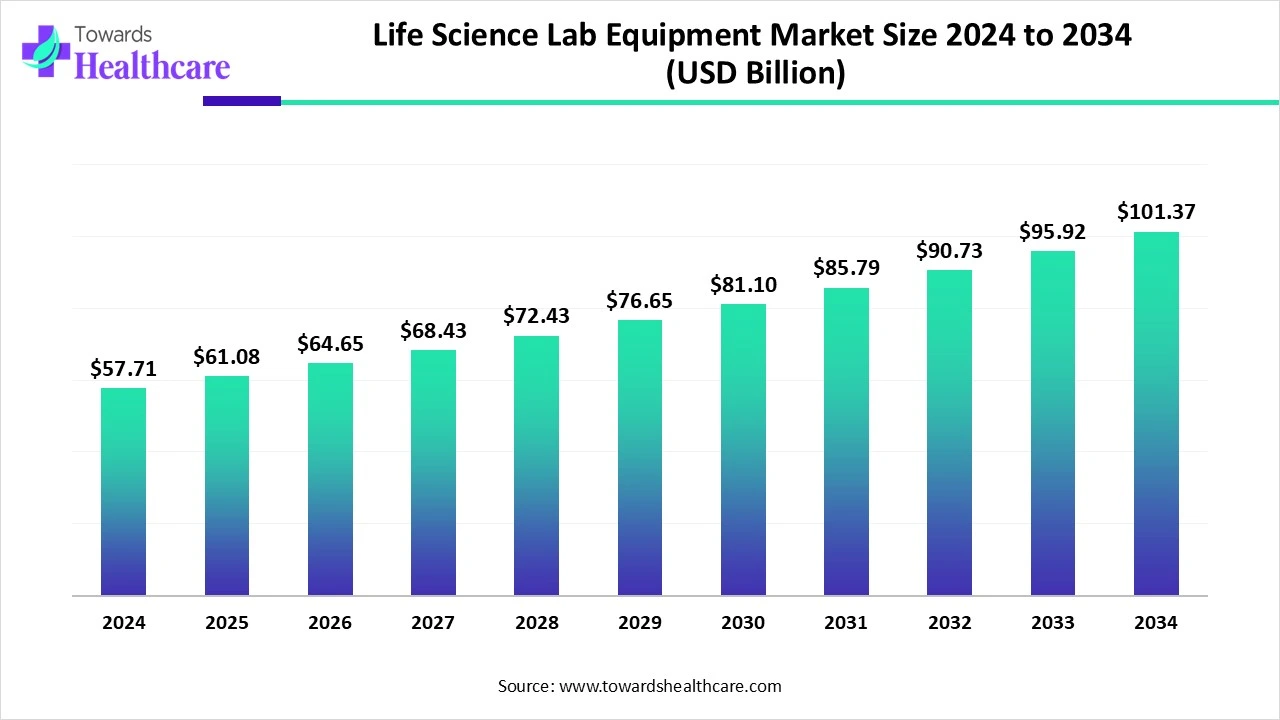

The global life science lab equipment market size is calculated at USD 57.71 billion in 2024, grow to USD 61.08 billion in 2025, and is projected to reach around USD 101.37 billion by 2034. The market is expanding at a CAGR of 5.84% between 2025 and 2034.

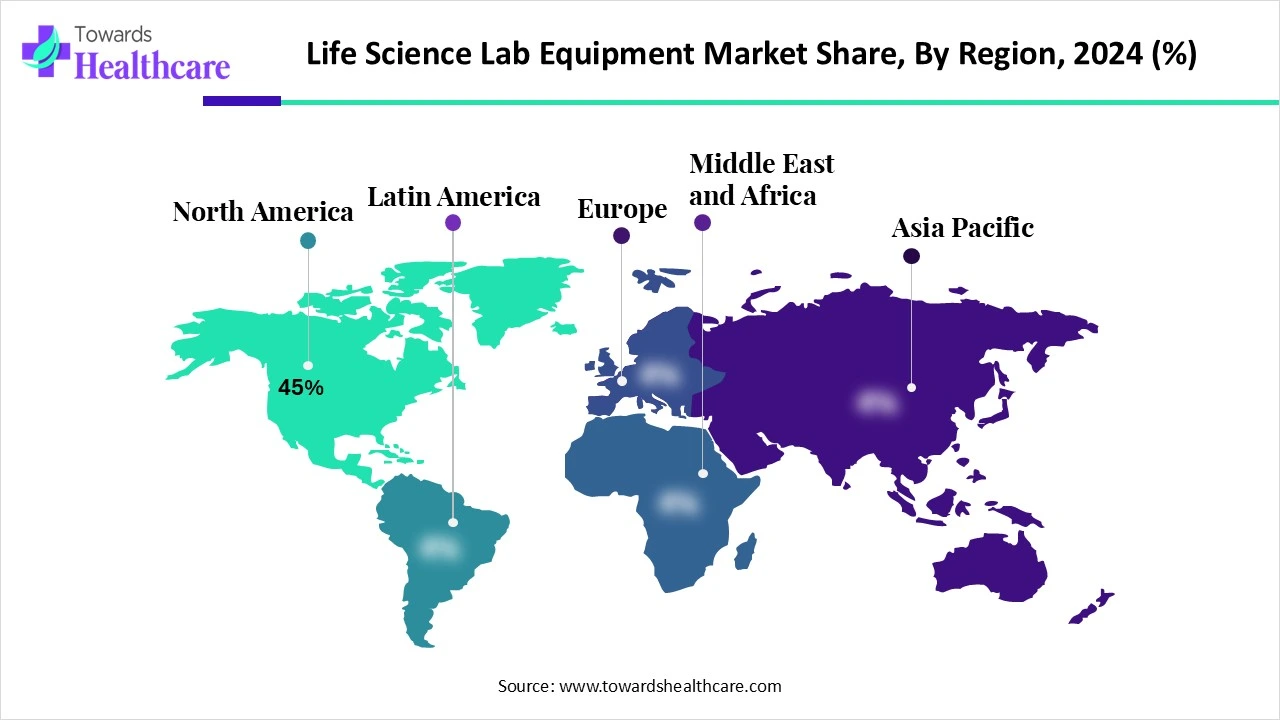

The global life science lab equipment market is expanding steadily as technological innovation rising biotechnology and pharmaceutical R&D, and increasing demand for precision medicine drive investment in advanced lab instruments. Automation, next-generation sequencing, and AI-enabled diagnostics are gaining traction, particularly in North America, which currently dominates the market. Meanwhile, the AsiaPacific region is projected to experience the fastest growth due to expanding healthcare infrastructure and growing research capabilities

| Metric | Details |

| Market Size in 2025 | USD 61.08 Billion |

| Projected Market Size in 2034 | USD 101.37 Billion |

| CAGR (2025 - 2034) | 5.84% |

| Leading Region | North America share by 45% |

| Market Segmentation | By Equipment Type, By Application, By End User, By Automation Level, By Region |

| Top Key Players | Thermo Fisher Scientific, Agilent Technologies, Danaher Corporation, Merck KGaA (MilliporeSigma), GE Healthcare Life Sciences, PerkinElmer (Revvity), Waters Corporation, Illumina, Qiagen, Bio-Rad Laboratories, Eppendorf, Shimadzu Corporation, Tecan Group, Hamilton Company, Leica Microsystems, Olympus Corporation, Bruker Corporation, Sartorius AG, BD Biosciences, Perlast |

The Life Science Lab Equipment Market consists of a wide array of instruments and automation systems used in research, diagnostics, biotech, and pharma laboratories. This includes chromatography systems, spectrometers, PCR platforms, sequencing instruments, flow cytometers, microscopes, lab automation robots, and consumable systems. These tools enable workflows in genomics, proteomics, cell biology, drug discovery, diagnostics, and academic research. Growth is powered by increasing R&D investment, genomics and cell therapy expansion, and adoption of automation and digital lab infrastructure. Innovation is driving the growth of the life science lab equipment market by introducing advanced technologies such as automation, AI, and smart devices. These innovations enhanced research accuracy, streamlined workflows, and enabled faster, more efficient scientific discoveries.

For Instance,

AI is significantly transforming the life science lab equipment market by enhancing automation, data analysis, and decision-making. It enables faster processing of large datasets, improves the accuracy of experimental results, and streamlines lab workflows. AI-powered systems also support predictive maintenance of equipment, reducing downtime and operational costs. As laboratories increasingly adopt AI-driven technologies, efficiency, productivity, and innovation in research are expected to rise, fueling further demand for intelligent lab equipment across the life sciences sector.

Rising R&D Investment

Increased R&D spending is fueling growth in the life science lab equipment market by encouraging the development of new therapies, diagnostics, and scientific techniques. As research becomes more complex and data-intensive, laboratories require modern, high-performance tools to support experimentation and analysis. This surge in research activity across academic, pharmaceutical, and biotech sectors directly boosts the need for innovative lab equipment, making R&D investment a major factor driving market expansion.

For Instance,

High Cost of Advanced Lab Equipment

The steep pricing of modern lab equipment limits its accessibility for many organizations, particularly smaller research centres and institutions in low-resource settings. Beyond the initial purchase, ongoing costs like calibration, servicing, and staff training add to the financial burden. This discouraged widespread adoption of innovative technologies, hindering progress in research and diagnostics. As a result, the high cost remains a significant obstacle to market growth, especially in cost-sensitive or emerging regions.

Adoption of Automation and Robotics

Automation and robotics are emerging as a key growth opportunity in the life science lab equipment market, as they enable labs to conduct complex experiments with greater speed and consistency. These technologies minimize manual interventions, lower operational costs, and improve workflow scalability. With increasing research demands and the need for faster results, especially in genomics and drug development, automated lab systems are gaining traction, positioning them as a vital component of the future laboratory landscape.

In 2023, the benchtop instruments segment led the life science lab equipment market in revenue market in revenue due to its practicality and widespread usage in routine laboratory tasks. These compact, versatile systems, such as benchtop centrifuges, spectrophotometers, and automated liquid handling units, are essential in both academic and clinical settings. Their affordability, space efficiency, and ease of use drive high adoption. In particular, benchtop automation tools enable consistent, high-throughput operations, making them indispensable in modern laboratories.

The automation & robotics segment is projected to experience the fastest growth in the life science lab equipment market as labs seek to boost efficiency, reduce human error, and handle larger workloads. These systems streamline complex procedures, enhance reproducibility, and support 24/7 operations without fatigue. With increasing pressure for faster results in drug development and diagnostics, along with rising labor costs and talent shortages, automated lab solutions are becoming essential tools for modern research environments.

In 2024, the pharmaceutical & biotechnology R&D segment generated the highest revenue in the life science lab equipment market due to continuous advancements in drug development and biologics research. These sectors rely heavily on high-performance lab tools for complex analysis, clinical trials, and molecular studies. The growing focus on targeted therapies, personalized medicine, and biosimilars production further increased the demand for innovative lab technologies, making this market the top contributor.

The biomanufacturing & QA/QC segment is projected to grow at the fastest CAGR in the life science lab equipment market due to the rising production of biologics, vaccines, and cell-based therapies. The shift towards advanced bioprocessing techniques, including continuous manufacturing and single-use technologies, is fueling equipment demand. Increasing global focus on scalable, cost-effective therapeutics production and the expansion of biopharma facilities are further accelerating the adoption of specialized lab equipment in bio-manufacturing applications.

In 2024, the academic & research institutions segment secured the largest share of the market, driven by increased focus on scientific discovery and innovation. These institutions regularly conduct studies in genetics, cell biology, and drug development, requiring advanced lab tools. Steady government and private funding further boosted the adoption of modern lab technologies in academic settings, contributing to the major market growth.

The CROs & CDMOs segment is projected to witness the fastest growth in the life science lab equipment market during the forecast period due to the rising trend of outsourcing drug development and manufacturing services. These organizations require cutting-edge equipment to meet client demands for speed, precision, and regulatory compliance. As more pharmaceutical and biotech companies aim to reduce costs and accelerate timelines, the reliance on CROs and CDMOs is increasing, driving strong demand for advanced laboratory technologies.

In 2024, the manual/benchtop segment accounted for the largest revenue share in the life science lab equipment market due to its widespread adoption across academic, clinical, and industrial labs. These instruments are valued for their dependability, ease of use, and cost-effectiveness. Many research facilities utilize benchtop analyzers such as centrifuges, spectrophotometers, and liquid handlers as primary tools for routine workflows. Their accessibility and adaptability made them the dominant revenue contributors in that year.

The fully automated & integrated segment is projected to grow fastest in the life science lab equipment market due to increasing demand for streamlined, error-free workflows and high-throughput capabilities. Laboratories are shifting towards end-to-end systems that handle sample processing, analysis, and data management with minimal human intervention. These solutions enhance reproducibility, scalability, and operational efficiency, especially in drug discovery, clinical diagnostics, and large-scale biomanufacturing settings, driving steep adoption and accelerating market growth in the coming years.

North America led the life science lab equipmentmarket share by 45% in 2024, in revenue due to its advanced research ecosystem and strong presence of top biotech and pharmaceutical companies. The region's well-established academic institutions, frequent technological upgrades, and supportive regulatory environment encouraged widespread adoption of innovative lab instruments. Additionally, high healthcare spending and strategic collaborations between industry and research organizations contributed to sustained market dominance throughout the year.

The U.S. market is expanding due to strong investment in biotechnology and pharmaceutical research, accelerating demand for sophisticated instruments in drug discovery, diagnostics, and genomics. Major players and public institutions receive sustained federal funding, including large NIH grants, fueling equipment procurement. Additionally, rapid adoption of automation, AI, and microfluidic technologies, along with increasing focus on precision medicine and large-scale biomanufacturing, further drives market growth.

Canada’s market is expanding thanks to strong government funding, increasing healthcare expenditure, and significant investments in R&D infrastructure. The Canada Foundation for Innovation and federal initiatives have supported advanced equipment at research institutions, boosting molecular diagnostics and biomanufacturing capacity. Growing demand from biotech firms and clinical labs, alongside collaborations with global pharmaceutical companies, further drives equipment adoption across the country.

AsiaPacific is projected to register the fastest CAGR in the market during the forecast period, supported by strong healthcare infrastructure investments, expanding pharmaceutical and biotech industries, and rising R&D expenditures in countries like China and India. Governments are enhancing lab capacity, while emerging economies are upgrading diagnostics, genomics, and biotech facilities. These trends, combined with rapidly growing demand for analytical testing and regulatory alignment with global standards, are accelerating equipment adoption and fueling robust regional growth.

China’s market is expanding rapidly due to significant government support for biotech and R&D initiatives, as outlined in the national 14th Five-Year Plan. Rising healthcare expenditure and investments in research infrastructure are boosting demand for advanced lab tools across the pharmaceutical, diagnostics, and genomics sectors. Additionally, large-scale construction of laboratory space in cities like Beijing and Shanghai, alongside innovation hubs like Wuxi and strong private-public collaboration, is accelerating market growth.

India’s market is expanding rapidly due to increasing government funding, supportive policies like the PLI and BioRIDE schemes, and strong biotechnology investment. Heavy R&D spending in genomics, diagnostics, and precision medicine, along with expanding pharmaceutical manufacturing and CRO/CDMO operations, has boosted demand for advanced instruments. Policy reforms easing procurement and the growth of medtech hubs and innovation parks further spur adoption across academic, clinical, and industrial labs.

In 2024, Europe’s approach to the market was marked by steady expansion and strategic investment. Laboratories in Germany, the UK, and France embraced automation and robotics to optimize research efficiency and data handling. Strong government support, including EU R&D funding, drove the adoption of high-end analytical instruments and compliance with stringent regulatory requirements. Sustainability initiatives and clinical demand further accelerated demand for cutting-edge molecular and clinical lab systems. These factors combined to position Europe as the world’s second-largest regional market.

The UK market is expanding due to strong government backing, including initiatives like the £520 million Life Sciences Innovative Manufacturing Fund. The country’s well-integrated ecosystem linking the NHS, academic institutions, and industry supports cutting-edge research in diagnostics, genomics, and biomanufacturing. High foreign investment, streamlined regulatory pathways, and a focus on innovation are accelerating the adoption of advanced lab technologies, positioning the UK as a key hub for life science advancements in Europe.

Germany’s market is growing steadily due to strong government and institutional investment in R&D, particularly through organizations like the Max Planck and Fraunhofer Institutes. High healthcare demand and a focus on chronic disease research are driving the need for advanced diagnostics and laboratory technologies. Additionally, Germany’s emphasis on automation, precision medicine, and biotech innovation is accelerating the adoption of modern lab equipment across both academic and industrial sectors.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In August 2024, Calibre Scientific acquired ACEFE, S.A.U. (ACEFESA), a Spanish distributor known for its lab consumables and equipment used in biotechnology, molecular biology, pharmaceuticals, and veterinary sectors. This marks Calibre Scientific’s fifth acquisition in Spain, aiming to expand its footprint across the Iberian Peninsula. ACEFESA, recognized for its strong filtration systems and wide range of over 200 SKUs, enhances Calibre's offerings. CEO Ben Travis stated that this move strengthens their commitment to the region and broadens their solutions for scientific and industrial clients. (Source - Pharmaceutical Manufacturer)

By Equipment Type

By Application

By End User

By Automation Level

By Region

December 2025

November 2025

December 2025

October 2025