January 2026

The worldwide life science CDMO market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

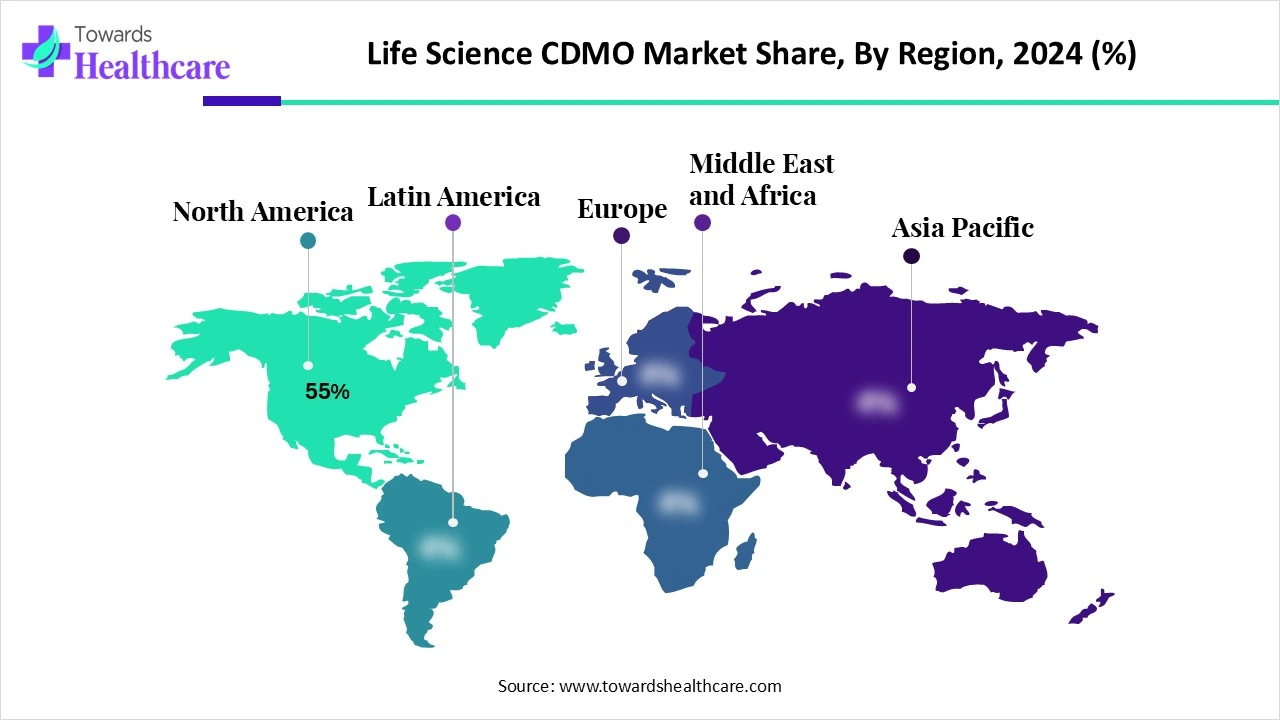

The life science CDMO market is expanding due to the increasing demand for outsourcing in the biotechnology and pharmaceutical industries. North America is dominated in the market by an increasing pipeline of personalized medicine, biologics, and challenging therapies such as cell and gene therapies. Asia Pacific is fastest fastest-growing due to the strong R&D infrastructure and increasing healthcare investment.

The life science CDMO market refers to third-party service providers that offer contract-based drug development, formulation, and manufacturing services to pharmaceutical, biotechnology, and life science companies. These services span the full lifecycle of a drug, from preclinical development and clinical trial material manufacturing to commercial-scale production of APIs (Active Pharmaceutical Ingredients), biologics, and finished dosage forms. CDMOs enable clients to reduce time-to-market, minimize capital expenditure, and gain access to specialized technologies (e.g., cell & gene therapy, biologics, HPAPI, ADCs).

Integration of AI in the life science CDMO drives the growth of the market as AI-driven technology allows automation of manufacturing lines, visual monitoring, quality control and processing, and preventative maintenance of equipment and devices in life science. CDMOs progressively leverage AI sales enablement to strengthen consumer relationships, modernise pipelines, and grasp business opportunities. AI-driven algorithms analyze huge datasets with high speed, detecting patterns and insights that would take humans significantly longer to uncover. This transformation to rapid drug discovery, enhanced formulations, and streamlined manufacturing processes will eventually reduce time-to-market for novel products. AI-driven technology personalizes customer experiences by analysing individual requirements and preferences. This enables CDMOs to progress targeted products and offer tailored data, authorising consumers to make informed decisions about their health condition.

Why Increasing Demand for Healthcare Outsourcing?

The rising demand for healthcare outsourcing has made it a strategic imperative for the healthcare industry. Collaborating with specialized partners can enhance efficiency, minimize errors, and support business expansion. Outsourcing helps reduce hiring, training, and management costs for in-house administrative staff, thus lowering operational expenses. It also simplifies compliance with regulations and ensures precise billing, especially when working with skilled outsourcing providers. These professionals are often highly trained in specific fields, such as virtual medical assistants and healthcare revenue cycle management (RCM) services. As enterprises increasingly seek long-term, strategic alliances rather than just operational support, they become more willing to outsource complex business processes. This trend fuels the growth of the life sciences Contract Development and Manufacturing Organization (CDMO) market.

High Challenges of Life Science CDMO

CDMOs face various challenges in achieving lucrative growth, meeting rigorous government support requirements, managing expenses, and delivering safe and effective products to market rapidly. This limits the growth of the life science CDMO market.

Rapid Adoption of Advanced Healthcare Services

The healthcare outsourcing landscape will experience a significant transformation driven by advances in telehealth, automation, and predictive analytics, which are reshaping how healthcare services are delivered and managed. By staying ahead of these developments and proactively tackling related challenges and risks, healthcare organizations can realize the full benefits of outsourcing and maintain their competitiveness in the dynamic healthcare environment. Additionally, many medical device companies are redesigning their insourced operation models to optimize processes throughout the entire product lifecycle, spanning design, advanced manufacturing, supply chain, and post-production services, creating novel opportunities for growth in the life science CDMO market.

By service type, the API development & manufacturing segment led the life science CDMO market, due to active pharmaceutical ingredients are the support of the pharmaceutical industry. From allowing efficient technology to driving research and innovation, APIs play a significant role in shaping worldwide healthcare. CDMO helps multifaceted activities, including active pharmaceutical ingredient (API) development, regulatory compliance, formulation development, process development, clinical trial management, upscaling, and commercial production.

On the other hand, the biologics CDMO services segment is projected to experience the fastest CAGR from 2025 to 2035, as biologics CDMOs play a significant role by providing solutions to streamline manufacturing and development. Early partnership with a CDMO is significant for reducing challenges, improving scalability, and ensuring product success. The CDMO plays a significant role in supporting invention and driving development in the manufacturing of biologics by providing specialized expertise in all stages of manufacturing. From initial process development to end product release, CDMOs streamline workflows, reducing challenges and ensuring consistent quality.

By phase, the commercial manufacturing segment dominated the life science CDMO market in 2024, as CDMOs frequently have commercial manufacturing services, allowing pharmaceutical companies to benefit from economies of scale and cost-effective production. Collaborating with CDMOs lets pharmaceutical companies share challenges related to drug development and manufacturing, as CDMOs often have more expanded portfolios and experience with different projects. It provides numerous advantages, including increased production efficacy, lower costs, and improved product consistency.

The preclinical development services segment is projected to grow at the highest CAGR from 2025 to 2035, as an efficient CDMO preclinical advancement services provide particular expertise, support services, and resources through the drug development procedure by transporting a wealth of information and experience in different aspects of drug development that supports their clients make more up-to-date decisions, evade common pitfalls, and overcome any challenges that may arise. It has access to advanced facilities, devices, and technologies that may not be readily available in-house for biotechnology and pharmaceutical companies.

By customer type, the large pharma companies segment led the life science CDMO market in 2024, due to its structured and advanced operational procedures. Having industrialised and sophisticated these processes over many years, greater pharmaceutical firms ensure that decisions are made based on verified protocols and clear chains of command. They often have massive resources at their disposal, including advanced technology, R&D abilities, and access to large-scale funding. These organizations are also international players with a worldwide footprint, which offer employees the opportunity to work in different regions.

The small & mid-size biotech firms’ segment is projected to experience the fastest CAGR from 2025 to 2035, as these firms perform early-stage research and development. These firms partner with large pharma companies, which benefit from de-risked technologies. They are more nimble than larger companies because there aren’t as many employees involved in decision-making. This makes it simple to make changes and follow up on them fast.

By molecule type, the small molecules segment dominated in the life science CDMO market in 2024, as small-molecule drugs provide numerous advantages, such as high oral bioavailability, which allows for suitable self-administration, most often in oral solid dose (OSD) form. This encourages patient acquiescence, making them appropriate for the long-term treatment of chronic conditions. Small molecules have different types of biological functions or applications, helping as drugs in medicine, cell signalling molecules, pesticides in agriculture, and many other roles.

On the other hand, the biologics segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as it is used to manage various types of diseases and is often applied to treat immune-related diseases like ankylosing spondylitis, psoriasis, rheumatoid arthritis, and Crohn’s Disease. In immune system-related diseases, biologics act by disturbing signals and pathways in the immune system in such a way as to lessen the damage exacted by these conditions.

North America dominated the life science CDMO market share by 55% in 2024, as the presence of large biopharmaceutical companies, such as Pfizer, Johnson and Johnson, and Amgen, with the expertise and resources to help clinical trials, get regulatory approval, and manufacture and market the products that output from these revolutions, which drives the demand for CDMO services. North America spends twice as much as comparable countries do on health care services, which allows a consistent drug development process that needs CDMO support, contributing to the growth of the market.

The US provides strict regulatory oversight by the Food and Drug Administration (FDA), which imposes GMP standards. In addition to government adherence, the FDA, CDMOs, and sponsors work together to come up with services that are continuously in the best interest of the patients. Working with a US-based CDMO that produces products domestically mitigates risks associated with geopolitical tensions, global shipping disruptions, and trade restrictions. This drives the growth of the market.

Canada is the best place to launch niche pharmaceutical strategies for rolling out novel therapies that could then be extended worldwide, such as cell and gene therapies and innovative biologics. It growing demand to particularly for CDMOs. The presence of major CDMOs such as Evonik, Apotex, and Lonza drives the growth of the market.

Asia Pacific is estimated to be the fastest-growing life science CDMO market during the forecast period, as it has low operational costs as a highly attractive destination for worldwide biotech and pharma companies for outsourcing. Governments of Asia Pacific invested hugely in infrastructure to support the rising outsourcing. For instance, the monthly minimum wage in Vietnam in 2022 ranged from about $140 to $202 US dollars, depending on the region, while the minimum wage in the Philippines comes out to a mere $9.98 per day, which drives the growth of the market.

In China, the biopharmaceutical sector has been rising rapidly because of growing healthcare needs, regulatory support, and investments in research and development (R&D). The Chinese government has realised regulatory reorganisations to encourage the development and manufacture of pharmaceuticals in the country. The pharmaceutical industry chain is increasingly specialized, refined, and customized. Contract Development and Manufacturing Organizations (CDMOs), which present the pharmaceutical contract outsourcing service division, have emerged and rapidly become a vital part of the worldwide pharmaceutical industry, driving the growth of the market.

Indian CDMOs are increasing their capabilities in these evolving fields to meet the rising demand from biopharma specialists. These abilities include a wide range of services for R&D and manufacturing of multifaceted compounds, cell therapies, biologics, and targeted medicines. CDMOs in India play a significant role in growing innovation and helping the advancement of novel therapies and treatments. In April 2023, Biocon Biologics and Serum Institute of India restructured an agreement centering on vaccines and various biological products. Serum Institute increased its total investment in Biocon Biologics to $300 million. The revised pact will grant Serum approximately a 4.9 % equity stake in Biocon Biologics, which contributes to the growth of the market.

For Instance,

Europe is notably growing in the life science CDMO market as European CDMOs are more focused than ever on transparency and long-term collaboration, providing huge alignment on quality standards and compliance with EU guidelines. This emphasis on quality positions European CDMOs as able partners in safeguarding supply stability and regulatory adherence in a challenging worldwide environment, which drives the growth of the market.

For Instance,

In Germany, CDMOs are increasing their advanced role as technology innovators. Many healthcare companies progressively incorporate smaller start-ups and technology leaders. Germany's growing focus on sustainability, innovation, and digital innovation is further driving the growth of the market.

For Instance,

The UK has played a significant role in the research and development of cell and gene therapies and various types of biologics innovations, as a leader in these treatments, which is boosting the demand for CDMO. Growing healthcare funding from the government is accelerating CDMO services, contributing to the growth of the market.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In May 2025, Greg Behar, Recipharm’s CEO, stated, “Recipharm and PLG announced a strategic partnership. This partnership brings together Recipharm’s development and manufacturing expertise, with PLG’s 2,000 regulatory experts, operating across 150 countries. By incorporating scientific, regulatory, operational, and commercial strategy from the outset, we support our consumers' move faster, evade costly delays, and build confidence that their product submissions will meet and exceed agency requirements, for critical medicines worldwide.” (Source - Johnson & Johnson)

By Service Type

By Phase

By Customer Type

By Molecule Type

By Region

January 2026

December 2025

November 2025

November 2025