March 2026

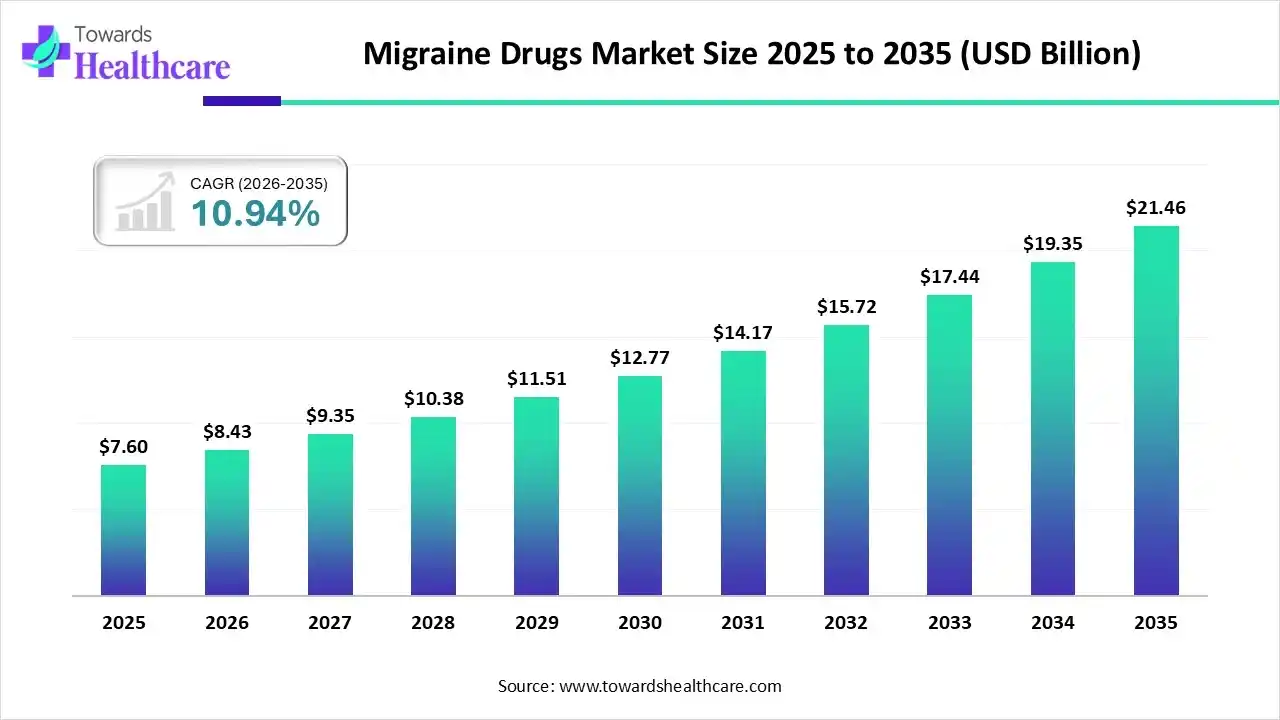

The global migraine drugs market size was estimated at USD 7.6 billion in 2025 and is predicted to increase from USD 8.43 billion in 2026 to approximately USD 21.46 billion by 2035, expanding at a CAGR of 10.94% from 2026 to 2035.

The increasing incidence of migraine is increasing the demand for their drugs, where their development is being supported by AI technologies. The companies are launching new products, which are also promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 8.43 Billion |

| Projected Market Size in 2035 | USD 21.46 Billion |

| CAGR (2026 - 2035) | 10.94% |

| Leading Region | North America |

| Market Segmentation | By Treatment, By Therapeutic Class, By Route of Administration, By Age Group, By Availability, By Region |

| Top Key Players | AbbVie, Pfizer, Eli Lilly and Company, Amgen, Teva Pharma, Lundbeck, Axsome, Novartis, GSK, Biohaven |

The migraine drugs market is driven by growing demand for CGRP-class therapies and targeted biologics. The migraine drugs encompass the medications used to prevent, manage, and treat migraine headaches. These drugs help in reducing the pain, abnormal vascular or neural activity, and neuroinflammation associated with migraine.

The AI technologies are being utilized throughout the migraine drug discovery till their development. It is also used in predicting the drug efficacy and safety, as well as for the optimization of their formulations. The development of combination therapies and personalized medications also utilizes AI technologies. It is also used in the optimization of clinical trials and tracking treatment adherence.

The companies are developing new therapies, precision medicine, and combination therapies, as per the growing demand of patients with enhanced safety and efficacy.

Different types of telemedicine platforms and mobile apps are being developed in order to track the patient treatment process, ensuring their adherence to the treatment.

The growing awareness is increasing the demand for preventive treatment, which is encouraging the development of new therapies with low dosing frequency.

Why Did the Preventive Segment Dominate in the Migraine Drugs Market in 2025?

The preventive segment held the largest share in the market in 2025, due to the growing number of migraine cases. These treatments help in eliminating chronic migraines, enhancing the quality of life, which increased their use. Advanced therapies were also used for preventive treatment, where growth in awareness also increased their demand.

Acute

The acute segment is expected to show lucrative growth during the predicted time, driven by its rapid pain relief. The companies are also launching and developing new products to offer faster and sustained pain relief for migraine patients. The growing self-care is also increasing its use.

How CGRP Monoclonal Antibodies Segment Dominated the Migraine Drugs Market in 2025?

The CGRP monoclonal antibodies segment led the market in 2025, due to their targeted action. They provided enhanced safety and efficacy, which increased their use in episodic and chronic migraine treatments. Moreover, their reduced dosage frequencies also increased their acceptance rates.

CGRP Small Molecule Antagonists

The CGRP small molecule antagonist segment is expected to show the highest growth during the predicted time, due to its preventive as well as acute treatment options. They also offered a rapid onset of action, where their oral administration also increased their acceptance rates. These factors are driving their innovations.

Which Route of Administration Type Segment Held the Dominating Share of the Migraine Drugs Market in 2025?

The injectable segment held the dominating share in the market in 2025, due to its enhanced efficacy and bioavailability. Moreover, they also provided long-term relief from migraine. Additionally, they were also preferred during the emergency conditions, where the growing development of biologics also increased their use.

Oral

The oral segment is expected to show lucrative growth during the upcoming years, due to its easy use. This is increasing the adherence rates to the treatment, where its wide range of availability is also increasing their use. The growing development of CGRP small molecule antagonists is also increasing their use.

What Made Adult the Dominant Segment in the Migraine Drugs Market in 2025?

The adult segment led the market in 2025, due to growth in migraine cases, driven by work-related stress and hormonal changes. This increased the use of a wide range of drugs. At the same time, growth in their early diagnosis also increased the demand for effective treatment options, promoting their development.

Geriatric

The geriatric segment is expected to show lucrative growth during the upcoming years, due to growing incidences of migraine. This, in turn, is increasing the demand for target-specific drugs with low side effects. Additionally, the companies are developing new therapies to enhance their quality of life.

Why the Prescription Drugs Segment Dominated the Migraine Drugs Market?

The prescription drugs segment held the largest share in the market in 2025, due to their enhanced efficacy. This increased their use for the treatment of chronic migraine and as a preventive treatment option. Moreover, the presence of reimbursement policies and the development of new therapies also increased their acceptance rates.

Over-the-Counter (OTC) Drugs

The over-the-counter (OTC) drugs segment is expected to show the highest growth during the upcoming years, driven by their wide range of availability. Their affordability is also increasing their use, where the growing shift towards self-care is also increasing their demand. Furthermore, growing awareness and online delivery platforms are also increasing their use.

North America dominated the migraine drugs market in 2025, due to the presence of the advanced healthcare sector, which increased access to these drugs. The growing awareness and migraine cases also increased the demand for these drugs. Moreover, the early adoption of advanced therapies and growth in R&D activities also contributed to the market growth.

U.S. Market Trends

The U.S. consists of well-developed hospitals and clinics, which increased the availability and access to migraine drugs. The growing awareness is increasing the early diagnosis as well as the adoption of various advanced therapies, which are being effectively utilized to overcome the growing burden of migraine.

Asia Pacific is expected to host the fastest-growing migraine drugs market during the forecast period, due to growing incidences of migraine. The expanding healthcare is also increasing the adoption of advanced treatment options, where the growing awareness is increasing their early diagnosis. The expanding industries and startups are also increasing their development, promoting market growth.

China Market Trends

The growing educational campaign in China is increasing the awareness and diagnosis of migraine cases. This, in turn, is increasing the use of various migraine drugs, where the expanding pharmaceutical industries are driving their innovations and production rates. The growing disposable income is also increasing their advancements.

Europe is expected to grow significantly in the migraine drugs market during the forecast period, due to growing health awareness, which is increasing the early diagnosis of patients suffering from migraine. The growing demand for preventive treatment options is also increasing the demand for migraine drugs. Additionally, the presence of advanced healthcare is also increasing access to these drugs, enhancing the market growth.

UK Market Trends

The presence of advanced healthcare in the UK is increasing the adoption rates of migraine drugs, where the growing incidence of migraine is also increasing the demand for their preventive care options. The growing patent expirations and increasing R&D activities are also leading to new innovations.

| Companies | Headquarters | Migraine Drugs |

| AbbVie | North Chicago, U.S. | Ubrelvy and Qulipta |

| Pfizer | New York, U.S. | Nurtec ODT and Zavzpret |

| Eli Lilly and Company | Indianapolis, U.S. | Reyvow and Emgality |

| Amgen | Thousand Oaks, U.S. | Aimovig |

| Teva Pharma | Tel Aviv, Israel | Ajovy |

| Lundbeck | Valby, Denmark | Vyepti |

| Axsome | New York, U.S. | Symbravo |

| Novartis | Basel, Switzerland | Aimovig |

| GSK | London, UK | Imigran or Imitrex |

| Biohaven | New Haven, U.S. | Nurtec ODT |

By Treatment

By Therapeutic Class

By Route of Administration

By Age Group

By Availability

By Region

March 2026

March 2026

March 2026

March 2026