December 2025

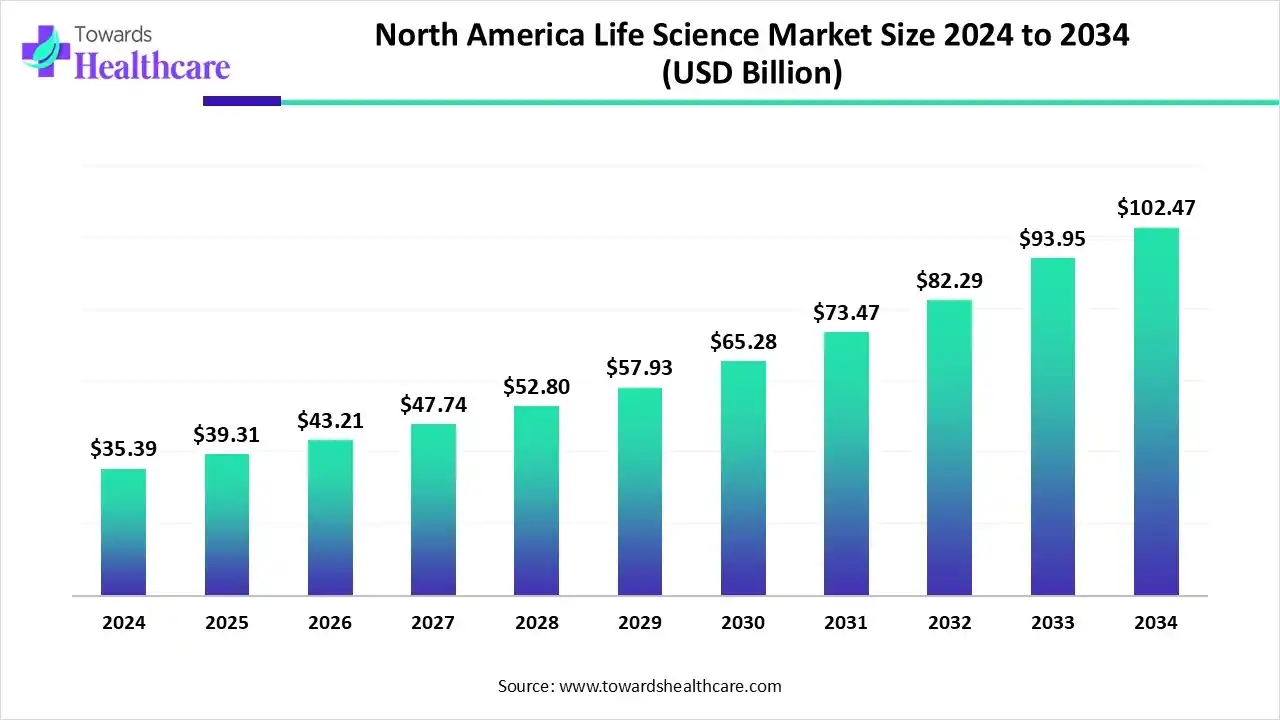

The North America life science market size is calculated at US$ 39.70 billion in 2025, grew to US$ 44.49 billion in 2026, and is projected to reach around US$ 124.18 billion by 2035. The market is expanding at a CAGR of 12.08% between 2026 and 2035.

The growing diseases are driving the R&D activities in North America, which is enhancing the life sciences sector, enhancing the development of advanced therapies, genomics, and personalized medicines. At the same time, the growing funding and investments are increasing the adoption of advanced technologies like AI, which are being used to accelerate drug development, clinical trials, and to develop new models. Additionally, the companies are also developing, investing, and launching new drug products as well as platforms, which are promoting the market growth.

| Table | Scope |

| Market Size in 2026 | USD 44.49 Billion |

| Projected Market Size in 2035 | USD 124.18 Billion |

| CAGR (2026 - 2035) | 12.08% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Country |

| Top Key Players | Gilead Sciences, Moderna, Inc., Biogen Inc., Regeneron Pharmaceuticals, Bristol Myers Squibb (BMS), Eli Lilly and Company, Roche (North American operations), Novartis (regional presence), Thermo Fisher Scientific, Danaher Corporation (Cytiva, Beckman Coulter), Illumina, Inc., Agilent Technologies, Charles River Laboratories, Lonza (North American facilities), Catalent, Inc. |

The North America life science market is driven by high investments in research and development, strong government support, and technological advancements. The North American Life Science encompasses the research, development, manufacturing, and commercialization of biopharmaceuticals, biotechnology products, diagnostics, laboratory tools, and advanced therapeutics across the United States and Canada, including instruments, reagents, consumables, software, and services used in drug discovery, clinical diagnostics, genomics, proteomics, molecular biology, and personalized medicine.

Growth is driven by robust healthcare and R&D spending, advanced biomanufacturing infrastructure, adoption of next-generation sequencing, AI-driven analytics, and supportive regulatory frameworks. The region benefits from a dense network of pharmaceutical and biotechnology companies, leading academic institutes, and established CRO/CDMO infrastructure, and the challenges include high innovation costs, competitive saturation, and complex reimbursement, but opportunities exist in precision medicine, advanced diagnostics, AI-based platforms, and cell and gene therapy adoption.

The use of AI in the life sciences is increasing, as it provides various platforms enhancing drug discovery and development, clinical trials, diagnostics, etc. It is also being used in the development of personalized medicines with the use of multi-omics or genomics data. Additionally, AI virtual cell models are also being developed to test biological hypotheses without traditional lab experiments.

For instance,

Growing investments: Due to growing demand for personalized treatment and growing diseases, there is a rise in investment and funding in the life sciences sector of North America. The companies are focusing on developing new platforms to enhance drug development as well as to develop novel diagnostic techniques. Moreover, to support these advancements, the companies are also introducing new initiatives.

For instance,

| Company | Diagnostics | Application | Source |

| Olympus Corporation | VISERA S OTV-S500 imaging platform | Ear, nose, and throat (ENT) and urology imaging | Olympus Announces U.S. Launch of Newest Imaging Platform for ENT and Urological Applications: 2025: News: Olympus |

| FronteraCare | Diagnostics Network | Bypass long waitlists and quickly understand the child's needs | FronteraCare Launches Diagnostics Network to Cut Wait Times and Provide Clear Answers to Families | News | bakersfield.com |

| SAGA Diagnostics | Pathlight test | Detection of residual disease and its recurrence | SAGA Diagnostics® Announces U.S. Commercial Launch of Pathlight™ at ASCO 2025, Setting a New Standard for Ultra-sensitive and Early MRD Detection |

By product type, the instruments segment held the dominating share of approximately 50% in the market in 2024, driven by growing R&D activities. At the same time, the growth in R&D investment also increased the use of advanced instruments in the industries. Similarly, the growth in clinical trials also contributed to the same. Moreover, growing technological advancements have also increased their demand.

By product type, the software & services segment is expected to show the highest growth during the forecast period. The growing use of genomics is increasing its use for the analysis and interpretation of vast amounts of data. Moreover, they are being used in decentralized clinical trials. Additionally, their affordability, scalability, and regulatory compliance are increasing their use.

By technology type, the genomics segment led the market with approximately a 45% share in 2024, due to growing demand for personalized medicines. At the same time, the growing cancer research has also increased its use for the detection of mutations. Furthermore, they were also used to identify the drug targets and biomarkers.

By technology type, the AI & digital platforms in the life sciences segment are expected to show the fastest growth rate during the forecast period. Their use is increasing as these platforms help in accelerating drug discovery and development. They also streamline the analysis, clinical trials, as well as promote real-time monitoring.

By application type, the drug discovery & development segment held the largest share of approximately 42% in the market in 2024, due to growth in drug and therapy development. The growing chronic diseases also promoted their development. Moreover, the growth in the use of genomics and AI platforms has also accelerated their R&D.

By application type, the personalized medicine segment is expected to show the highest growth during the forecast period. The growing demand for targeted therapies is increasing the development of personalized medicines. Additionally, the growing awareness is increasing the use due to its reduced side effects. They are also being used in the treatment of rare diseases and cancer.

By end user, the pharmaceutical & biotechnology companies segment led the global market with approximately 44% share in 2024, driven by the growing R&D. These companies also contributed to the increased development of precision medicine and biologics. Additionally, they also utilized advanced technologies, which accelerated the development of personalized medicines.

By end user, the hospitals & clinical research laboratories segment is expected to show the fastest growth rate during the forecast period. These laboratories are developing various diagnostic techniques along with precision and personalized medicine. Moreover, the growing diseases is increasing the use of these diagnostic platforms, where the use of advanced technologies has increased their accuracy.

The North America life science market is expanding due to the presence of a robust R&D ecosystem. The life science companies are also investing in the development of innovative therapies like cell and gene therapies. Moreover, the growing R&D supported by the investments and funding from companies and the government also promoted their development. Additionally, they are also focusing on next-generation sequencing and genomics, which contributed to the market growth.

The U.S. held the major share in the North America life science market with 88% in 2024, due to growth in the R&D investments. This, in turn, increased drug discovery and development and technological developments. The growing startup ecosystems also contribute to the increased development of personalized medicine and diagnostics. Additionally, there is a growth in the adoption of AI technologies, which has accelerated the clinical trials and enhanced the market growth.

In September 2025, a new biopharmaceutical manufacturing facility was opened by FUJIFILM Biotechnologies in Holly Springs, as a part of a multi-billion-dollar investment in the life sciences sector in the state. The facility is considered to be the largest cell culture biopharmaceutical CDMO facility in North America.

The global life sciences market is valued at US$ 88.2 billion in 2024, rising to US$ 98.63 billion in 2025, and is expected to reach approximately US$ 269.56 billion by 2034. This growth reflects a compound annual growth rate (CAGR) of 11.82% from 2025 to 2034.

To develop novel treatments for chronic diseases and cancer using technologies such as gene editing and AI is the focus of the North America life science R&D.

Key Players: AbbVie Inc., Eli Lilly and Company, Johnson & Johnson, Merck & Co., Gilead Sciences, Amgen Inc.

The clinical trial and regulatory approval of North America life sciences involve a multiphase process, ensuring the quality, safety, and efficacy of the new drugs and medical devices.

Key Players: AbbVie Inc., Eli Lilly and Company, Johnson & Johnson, Merck & Co., Gilead Sciences, Pfizer Inc., Amgen Inc., Moderna, Inc.

The patient support and services of North America life science companies include management of treatment costs through financial assistance, educational resources to enhance health literacy, and help people access medication.

Key Players: AbbVie Inc., Eli Lilly and Company, Johnson & Johnson, Merck & Co., Gilead Sciences, Pfizer Inc., Amgen Inc., Moderna, Inc.

By Product Type

By Technology

By Application

By End User

By Country

December 2025

November 2025

October 2025

November 2025