Digital Manufacturing in Life Sciences Market Size, Key Players with Insights and Trends

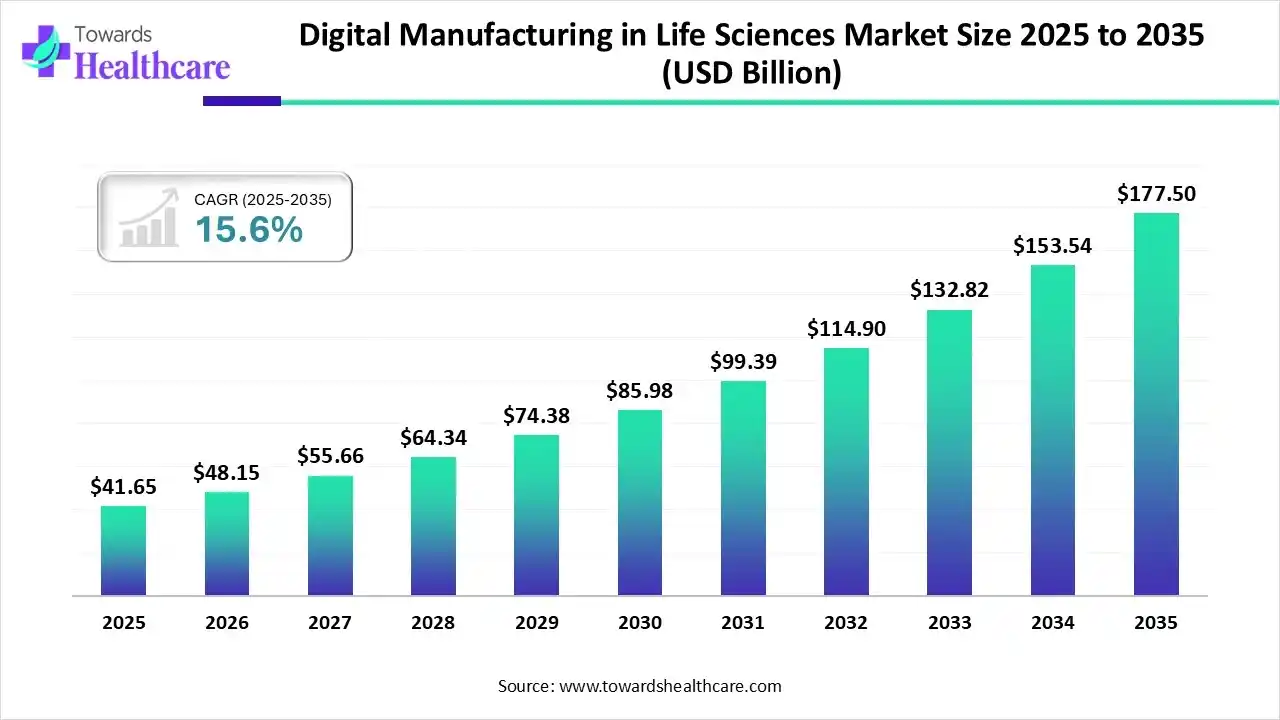

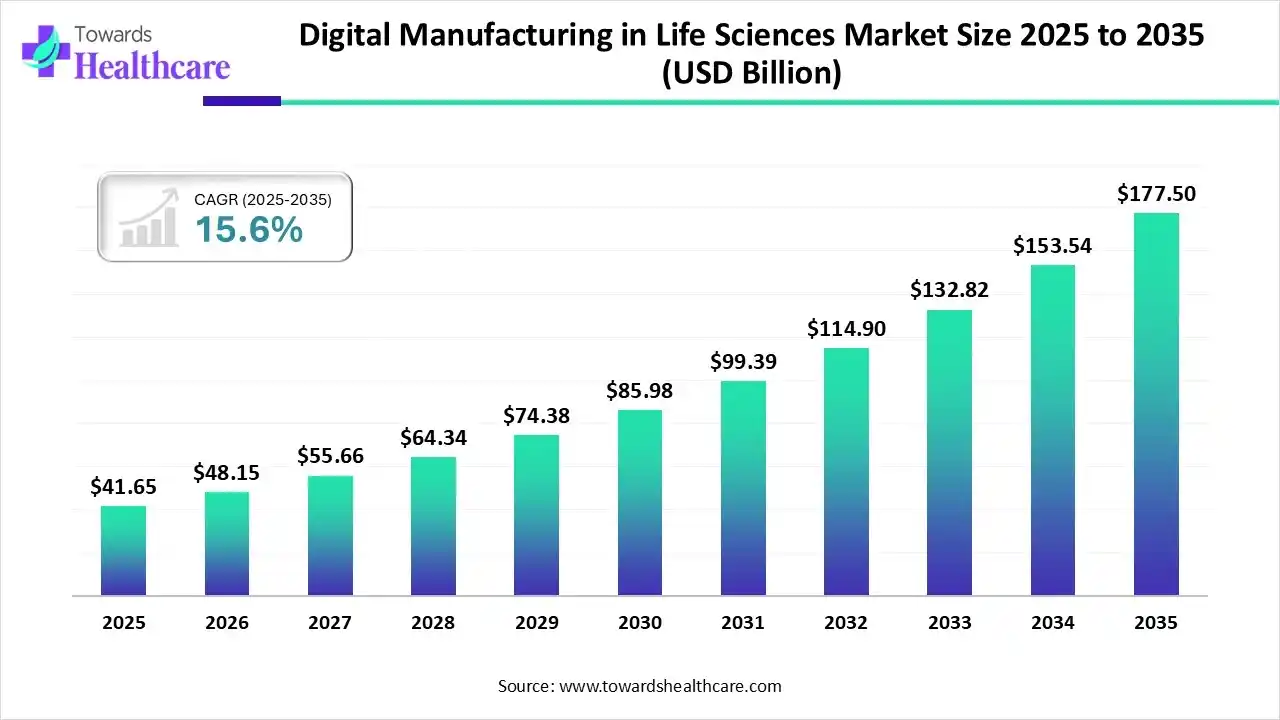

The global digital manufacturing in life sciences market size is calculated at US$ 41.65 billion in 2025, grew to US$ 48.15 billion in 2026, and is projected to reach around US$ 177.5 billion by 2035. The market is expected to expand at a CAGR of 15.6% between 2026 and 2035.

The digital manufacturing in life sciences market is expanding rapidly as more and more biotechnology, pharmaceutical, and medical device companies adopt digital transformation to improve productivity, quality, and compliance. The design, manufacturing, and monitoring of products in the life sciences is being revolutionized by the integration of digital tools like artificial intelligence (AI), robotics, the Industrial Internet of Things (IIoT), and advanced analytics.

Key Takeaways

- Digital manufacturing in life sciences sector pushed the market to USD 41.65 billion by 2025.

- Long-term projections show USD 177.5 billion valuation by 2035.

- Growth is expected at a steady CAGR of 15.6% in between 2026 to 2035.

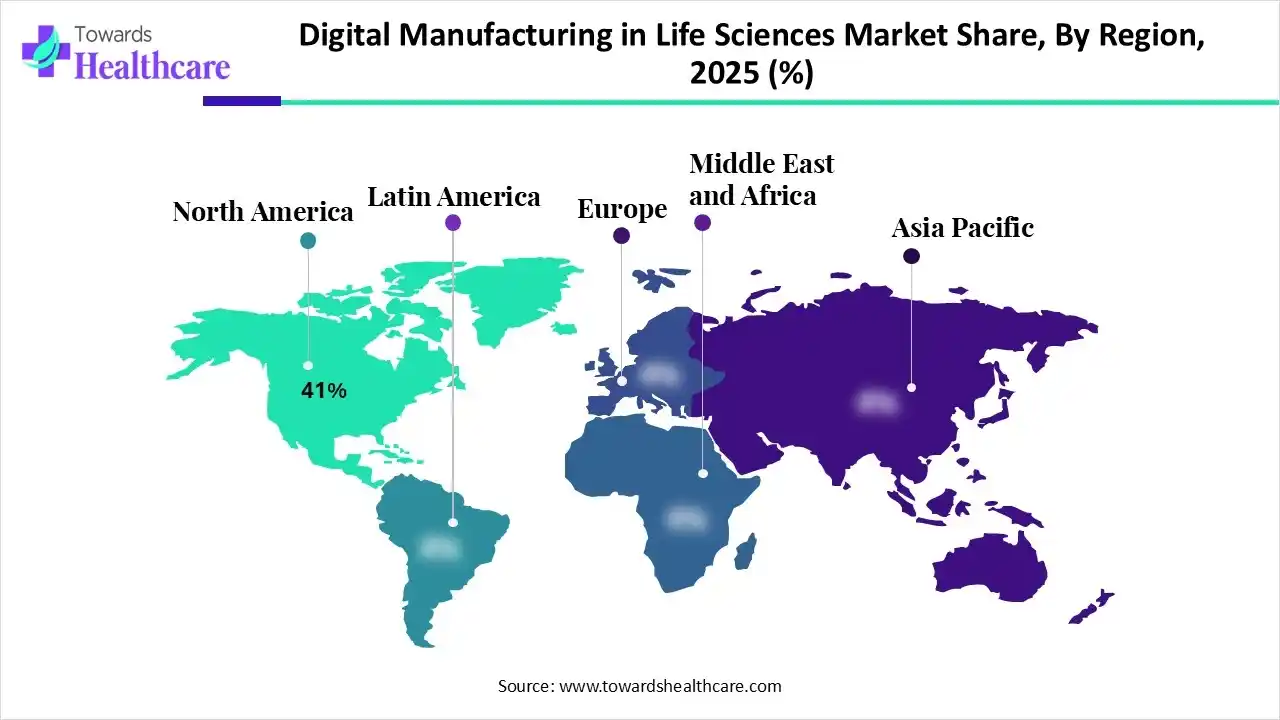

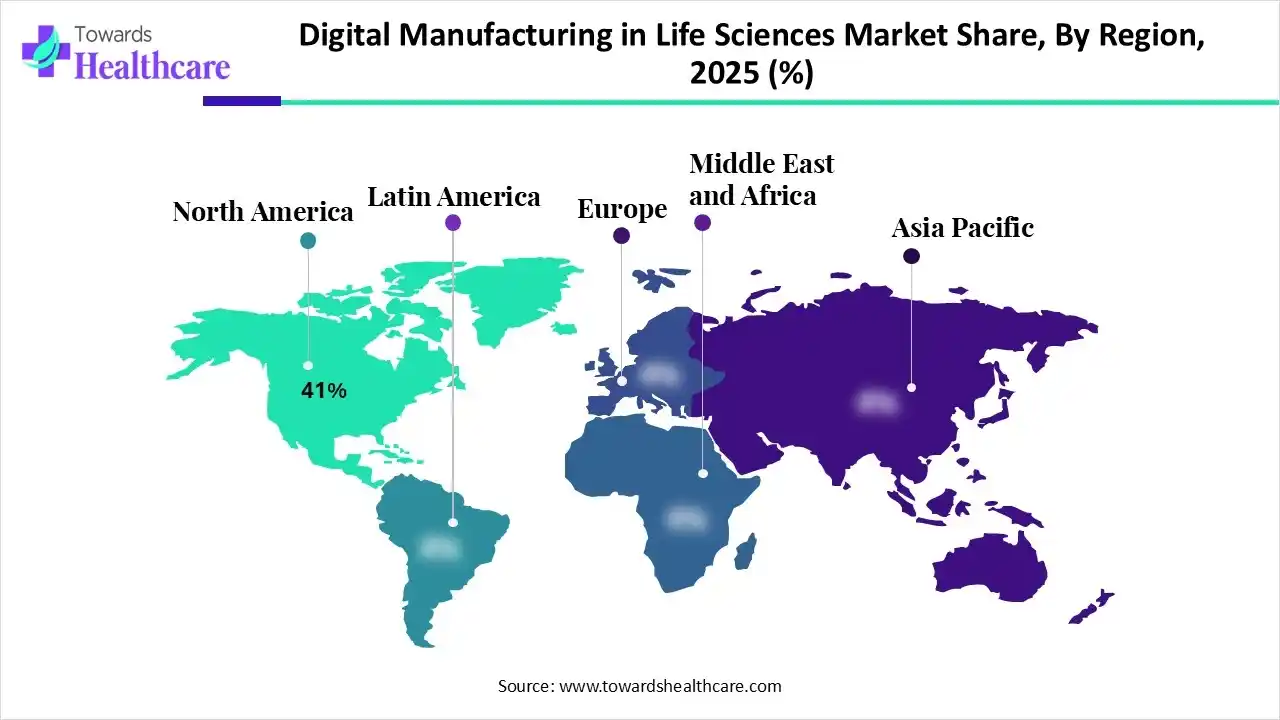

- North America led the digital manufacturing in life sciences market with a revenue of approximately 41% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By solution, the manufacturing execution systems (MES) & process automation segment led the market with a revenue of approximately 30% in 2024.

- By solution, the AI, ML, and digital twin platforms segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment mode, the on-premises segment led the market with a revenue of approximately 50% in 2024.

- By deployment mode, the public cloud/SaaS segment is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the large pharmaceutical companies segment led the digital manufacturing in life sciences market with a revenue of approximately 44% in 2024.

- By end-user, the biotechnology startups segment is expected to grow at the fastest CAGR during the forecast period.

Key Indicators and Highlights

| Key Elements |

Scope |

| Market Size in 2025 |

USD 41.65 Billion |

| Projected Market Size in 2035 |

USD 177.5 Billion |

| CAGR (2026 - 2035) |

15.6% |

| Leading Region |

North America by 41% |

| Market Segmentation |

By Solution, By Application, By Deployment Mode, By End User, By Region |

| Top Key Players |

Siemens AG, Dassault Systèmes, Rockwell Automation, Honeywell International, GE Vernova/GE Digital , ABB Ltd., AspenTech , Schneider Electric , AVEVA Group , SAP SE , Veeva Systems, IBM Corporation, Emerson Electric Co., POMSnet (Werum IT Solutions), Thermo Fisher Scientific, Lonza Group AG, Catalent, Inc., Samsung Biologics, Cytiva (Danaher), Amazon Web Services (AWS) Healthcare & Life Science |

What does Digital Manufacturing in Life Science Mean?

Digital manufacturing in life sciences integrates advanced technologies such as automation, artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), digital twins, and cloud computing into pharmaceutical and biotechnology production processes. It aims to streamline operations across R&D, process development, and large-scale manufacturing while ensuring compliance with Good Manufacturing Practices (GMP). Through predictive analytics, real-time monitoring, and process optimization, digital manufacturing improves productivity, product quality, and time-to-market. It is pivotal for biologics, cell & gene therapies, vaccines, and personalized medicines, enabling smart, flexible, and data-driven manufacturing ecosystems.

Market Outlook

- Industry Growth Overview: The digital manufacturing in life sciences market sciences is growing rapidly due to the widespread use of automation and artificial intelligence in production. Growing R&D expenditures, as well as the pressing need for quicker, more effective drug discovery and development procedures, are driving this expansion.

- Global Expansion: North America is still the market leader, but the Asia-Pacific area is expanding at the fastest rate because of the quick industrial digitalization and encouraging government policies in nations like China and India. These areas are updating their operations to satisfy demand from around the world.

- Startup Ecosystem: Numerous health-tech and life sciences startups are emerging worldwide, making the startup ecosystem of digital manufacturing in life sciences market a shining example of innovation. A dynamic environment for future innovations is being created by government support and private investment, which are encouraging advancements in AI-driven solutions and personalized medicine.

Segmental Insights

Solution Insights

Which Solution Segment Dominated the Market in 2024?

The manufacturing execution systems (MES) & process automation segment led the digital manufacturing in life sciences market, accounting for approximately 30% of revenue in 2024. Achieving long-term competitive advantages in the life science sector requires MES. They make it possible for plants to be more productive and efficient, as well as for production processes to be more flexible and agile. Furthermore, from experiment delivery to analysis, automated technology is augmenting, or even performing, a wide range of tasks in the life sciences.

AI, ML, and Digital Twin Platforms

The AI, ML, and digital twin platforms segment is anticipated to witness the highest growth in the digital manufacturing in life sciences market during the forecast period. Top companies are adopting generative AI, a potent subset of AI particularly well-suited to this industry because it can analyze extensive datasets on pharmaceutical manufacturing processes and quality control. Machine learning in manufacturing employs sophisticated algorithms to examine large volumes of production data, thereby improving efficiency and precision. Moreover, digital twins can rapidly optimize manufacturing processes, leading to more robust, sustainable global supply chains.

Process Analytical Technology (PAT) & Real-Time Monitoring

The process analytical technology (PAT) & real-time monitoring segment is growing significantly in the digital manufacturing in life sciences market during the studied period. By enabling real-time process monitoring, automation, and faster problem-solving, PAT in CPV guarantees product quality. By giving control and understanding through ongoing data collection, this results in stable product quality, optimized manufacturing, and shortened production times. Real-time process monitoring is managed by the PAT tool. This optimizes quality assurance while reducing the costs and time required to produce high-quality pharmaceuticals.

Deployment Mode Insights

How the On-Premises Segment Became Dominant in the Market in 2024?

The on-premises segment led the digital manufacturing in life sciences market, accounting for approximately 50% of revenue in 2024. From improved security to cost predictability, on-premises software provides a host of strategic benefits. They give businesses complete control over their systems and data. These solutions offer adaptable choices to meet particular operational and regulatory requirements.

Public Cloud/Saas

The public cloud/SaaS segment is anticipated to witness the highest growth in the digital manufacturing in life sciences market during the forecast period. Businesses in the life sciences can close this data, infrastructure, and intelligence (DII) gap with the aid of SaaS and cloud computing solutions. SaaS and cloud solutions offer a strong option for life sciences organizations to overcome the challenges of updating legacy systems and modernizing their infrastructure in a timely, resource-efficient manner.

Hybrid Cloud Solutions

The hybrid cloud solutions segment is growing significantly in the market during the studied period. Hybrid cloud and integration services have become essential tools for managing the challenges of operational efficiency and regulatory compliance in the regulated life sciences industry. These technologies enable businesses to improve data security, scalability, and flexibility, which promotes innovation while meeting strict compliance standards.

End-User Insights

Which End-User Dominated the Market in 2024?

The large pharmaceutical companies segment led the digital manufacturing in life sciences market, accounting for approximately 44% of revenue in 2024. Pharmaceutical companies like Pfizer, Johnson & Johnson, and Novartis are spearheading digital transformation to improve production efficiency and uphold compliance, which is crucial for guaranteeing patient safety, product quality, and business success.

Biotechnology Startups

The biotechnology startups segment is expected to grow at the fastest CAGR during the forecast period. Biotechnology is currently and will continue to be impacted by technological advancements. Modern biotech tools are being used by forward-thinking businesses to boost productivity and expansion. Cloud computing, machine learning, artificial intelligence, and other next-generation computing tools are among the developments anticipated to significantly affect biotechnology manufacturing processes now and in the future.

Contract Development & Manufacturing Organizations (CDMOs)

The contract development & manufacturing organizations (CDMOs) segment is growing significantly in the digital manufacturing in life sciences market during the studied period. In addition to managing various facets of the product development process, CDMOs help businesses meet legal and commercial scalability requirements. They manage far more than just outsourced manufacturing; they can also be involved in product development and collaboration that takes place prior to production.

Regional Insights

What Made North America Dominant in the Market in 2024?

North America dominated the digital manufacturing in life sciences market share by 41%, accounting for approximately 41% of revenue in 2024, propelled by the substantial presence of top biotechnology, pharmaceutical, and medical device firms, as well as by sophisticated digital infrastructure and substantial R&D expenditures. To guarantee product quality and compliance, the region's well-established regulatory framework promotes innovation and the use of Industry 4.0 technologies.

Funding Life Science: Securing the U.S. Future

In addition to human health and knowledge of the natural world, the U.S. life science research mission is essential to food production and agriculture, technological advancements, socioeconomic development, national defense, and global leadership. According to a 2025 Research!America survey, 92% of respondents favor the government actively advancing medical science, in part by providing funding for chronic and infectious diseases.

Presence of Top Life Science Companies is Driving the Asia Pacific

Asia Pacific is estimated to host the fastest-growing digital manufacturing in life sciences market during the forecast period. Among the top nations with the most life sciences companies are China and Japan. Major life science firms are also investing and forming partnerships in developing countries such as Singapore, Japan, and India to broaden their business portfolios and introduce new technologies into the pharmaceutical industries there.

Japan's Bio-Strategy: Innovation for 2030

To become the world's leading bioeconomy by 2030, Japan developed a "Bio-Strategy" in 2019. Based on current domestic and global trends, the "Bioeconomy Strategy" was updated in 2024 to reflect the direction of science, technology, and innovation policies aimed at growing the bioeconomy market by 2030. In addition, a substantial budget of roughly 1 trillion yen has been set aside under the Bio-Stegy to support technology development and demonstration in 2024.

Rise in Digital Health is Driving Europe

Europe is expected to grow at a significant CAGR in the digital manufacturing in life sciences market during the forecast period, backed by a thriving biopharmaceutical industry, reputable research institutions, and substantial government funding. Leading nations in the adoption of cutting-edge technologies for cell biology, proteomics, and genomics research include Germany, the United Kingdom, and France. Europe's focus on digital health and sustainability enhances its standing in the dynamic global life science tools market.

UK: Europe's Leading Life Sciences Hub

With strong government support and a promising future, the healthcare and life sciences sectors are among the eight strategic growth sectors in the UK's Modern Industrial Strategy. The UK is Europe's top location for life sciences investment, offering a thriving industry with world-class research, a well-connected ecosystem, highly qualified personnel, and a close partnership with the National Health Service (NHS) for foreign investors. For ambitious life sciences companies, the UK is the perfect location because it successfully links investors with clients, partners, and cutting-edge innovation in a competitive business environment.

Digital Dawn in South America’s Life Sciences

South America is expected to grow significantly in the digital manufacturing in life sciences market during the forecast period. South America’s life science manufacturers adopt digital manufacturing platforms to modernize production, improve traceability, and support biologics scale-up. Regional public and private investments in AI and infrastructure accelerated in 2024 and 2025, fueling transformative projects and cross-border research partnerships.

Brazilian Biotech Momentum

Brazil pushes AI and pharma manufacturing investment with a 23 billion reais AI plan announced in 2024 and targeted public support for industrial modernization. Local firms and multinationals accelerate digitalization and smart factory pilots across major regional life science hubs

Middle East and Africa Uplift

The Middle East and Africa are expected to grow at a lucrative CAGR in the digital manufacturing in life sciences market during the forecast period. MEA life sciences embrace digital manufacturing to expand capacity, diagnostics, and clinical research. Governments increased R&D funding and infrastructure investments in 2024 while private players deploy AI-enabled quality systems, automation, and cloud-based production tools to enhance competitiveness.

Gulf Smart Factory Surge

GCC states scale digital manufacturing in life sciences through national innovation programs, biotech manufacturing projects, and industrial incentives. Saudi and UAE funds and biotech investment vehicles in 2024 and 2025 accelerated capacity building and technology partnerships across regional facilities.

Company Landscape

Siemens AG

Company Overview

Siemens AG: A global industrial technology company that provides automation, digitalization, and digital manufacturing solutions across industries, including life sciences.

Corporate Information

- Headquarters: Munich, Germany

- Year Founded: 1847 (as Siemens & Halske)

- Ownership Type: Public company (listed on German and other exchanges)

History and Background

- Originally an electrical telegraph and engineering business; over time, diversified into transport, energy, automation, and digital industries.

- Digital Industries division (covering automation, software, industrial IoT) has grown significantly in recent years.

- In 2022 launched the Siemens Xcelerator platform – a digital business platform for industrial software, hardware, and services.

Key Milestones/Timeline

- June 2023: Aiming to raise the software business’s sales share to ~20 %.

- November 4, 2025: Announced expanded strategic partnership with Capgemini to build AI-native digital manufacturing solutions for life sciences and other industries.

- April 2, 2025: Announced acquisition of Dotmatics (US R&D software company) for ~$5.1 billion to bolster life-sciences software/PLM capabilities.

Business Overview

- Business Segments/Divisions

- Digital Industries (software, automation, industrial IoT)

- Smart Infrastructure, Mobility, Energy, Healthcare & Life Sciences (via subsidiaries)

- Dedicated segment addressing Life Sciences & Health Technology through tailored solutions

Geographic Presence

- Global operations across Europe, North America, Asia-Pacific, Latin America, the Middle East & Africa

- Strong presence in manufacturing hubs globally

Key Offerings

- Digital manufacturing software (PLM, MES, digital twin, simulation)

- Automation hardware & systems (controllers, drives, sensors) for manufacturing lines

- Industry-specific solutions for life sciences (pharma/biotech manufacturing, med-tech)

End-Use Industries Served

- Life sciences & pharmaceuticals (manufacturing, critical environments)

- Medtech / medical devices

- Automotive, aerospace, heavy equipment

- Electronics, consumer goods

Key Developments and Strategic Initiatives

- Mergers & Acquisitions

- Acquisition of Dotmatics (Apr 2025) to expand life-sciences software footprint

- Earlier acquisition of engineering software firm Altair for ~$10.6 billion

- Partnerships & Collaborations

- Partnership with Capgemini (Nov 2025) on AI-native manufacturing solutions in life sciences

- Collaborations with NVIDIA, Microsoft, AWS for industrial AI and digital twin capabilities

- Product Launches/Innovations

- Siemens Xcelerator platform (industrial digital platform)

- Digital manufacturing solutions integrating simulation, 3D visualization, analytics, and collaboration tools

- Capacity Expansions/Investments

- Investment in expanding digital software and services offerings globally; specific capacities in manufacturing lines for life sciences noted in case studies

- Regulatory Approvals

- Compliant with global manufacturing standards and data security regulations; life sciences solutions support compliance in pharma manufacturing

- Distribution Channel Strategy

- Global partner ecosystem (system integrators, software resellers, automation equipment suppliers)

- Direct sales of software & hardware plus services, consulting, and support

- Platform approach via Siemens Xcelerator, enabling subscription/SaaS models

- Technological Capabilities / R&D Focus

- Core Technologies/Patents

- Digital twin, industrial IoT, simulation, PLM, MES, automation hardware & software stack

- Proprietary tools, including Siemens NX, Tecnomatix, Opcenter

- Research & Development Infrastructure

- Global R&D centers; investment in industrial digitalization and life-sciences manufacturing transformation Continuous

- innovation in digital twin, AI/ML for manufacturing, simulation, and advanced automation

- Innovation Focus Areas

- AI-native manufacturing tools for life sciences (e.g., generative AI in MES workflows)

- Digital twin for pharma/biotech production lines and critical environments

- End-to-end integration of product/process design and manufacturing for speed, flexibility, and quality

Competitive Positioning

- Strengths & Differentiators

- Global scale, deep technology stack across hardware, software, and services

- Strong in digital manufacturing across industries, now applying to life sciences

- Platform offering (Siemens Xcelerator) allows integrated solutions

- Strategic acquisitions (e.g., Dotmatics) strengthen life-sciences-oriented software

- Recognized leader in industrial digitalization

- Market Presence & Ecosystem Role

-

- Key enabler of “Pharma 4.0” / life-sciences manufacturing digital transformation

- Works with pharma/biotech and med-tech companies to implement digital manufacturing and automation solutions

SWOT Analysis

- Strengths: Comprehensive offering, global scale, strong brand, cross-industry experience

- Weaknesses: Complex offerings may slow time-to-value; integration across business units can be challenging

- Opportunities: Growth in life-sciences manufacturing digitalization, pharma/biotech automation, digital twin, and AI adoption

- Threats: Competition from specialized software/automation vendors; regulatory/environmental shifts; economic disruptions

Recent News and Updates

- Press Releases

- Siemens & Capgemini collaboration announcement (Nov 2025) on AI-native solutions for manufacturing, including life sciences

- Acquisition of Dotmatics (Apr 2025) to bolster life-sciences portfolio

- Industry Recognitions/Awards

- Siemens Digital Industries Software recognized for market vision and product capabilities

Thermo Fisher Scientific Inc.

Company Overview

Thermo Fisher Scientific: A leading global provider of laboratory instruments, analytical equipment, reagents, consumables, software, and services to the life-sciences, biopharma, diagnostics, and manufacturing sectors—including digital manufacturing support for life-sciences production.

Corporate Information

- Headquarters: Waltham, Massachusetts, U.S.

- Year Founded: 1956 (via merger of Thermo Electron and Fisher Scientific in 2006)

- Ownership Type: Public company listed on U.S. exchanges

History and Background

- Thermo Electron founded in 1956; Fisher Scientific founded earlier; merged in 2006 to form Thermo Fisher Scientific

- Expanded via acquisitions into analytical instruments, life-sciences consumables, services, software, and manufacturing support for biotech/pharma

Key Milestones/Timeline

- 2013: Acquisition of Life Technologies Corporation

- 2016: Acquisition of Affymetrix and FEI Company

- 2018: Acquisition of BD Advanced Bioprocessing

- 2021: Acquisition of PPD (clinical research services)

- 2025: Announced a $2 billion investment (over four years) in U.S.-based biotech manufacturing capacity and R&D investment

- 2025 (Oct): Plan to acquire Clario (clinical services/data management) for ~$9.4 billion as part of digital health and manufacturing expansion

Business Overview

- Business Segments/Divisions

- Life Sciences Solutions (instruments, consumables, software)

- Analytical Instruments

- Specialty Diagnostics

- Laboratory Products & Services

- Manufacturing & Bioprocessing solutions for pharma/biotech

Geographic Presence

- Global footprint across the Americas, Europe, Asia-Pacific, Middle East & Africa

- Manufacturing and operational sites in major biotech hubs

Key Offerings

- Instruments: chromatography, mass spectrometry, spectroscopy, sequencers

- Consumables: reagents, labware, kits

- Software & services: lab management, digital automation, manufacturing technologies

- Bioprocessing & manufacturing solutions for pharma/biotech

- Digital manufacturing/automation support for life sciences production

End-Use Industries Served

- Pharmaceuticals & Biotech (R&D, manufacturing)

- Diagnostics & Clinical labs

- Academic & Government research labs

- Industrial & applied markets

- Contract manufacturing/biotech manufacturing support

Key Developments and Strategic Initiatives

- Mergers & Acquisitions

-

- Acquisitions of Life Technologies, Affymetrix, FEI, BD Advanced Bioprocessing, and PPD

- 2025: Plan to acquire Clario for ~$9.4 billion to strengthen digital health/data/clinical trial services

- Partnerships & Collaborations

- Collaborates with major pharma & biotech companies for digital manufacturing and data solutions

- Product Launches/Innovations

- Expanded digital instrument and lab workflow tools

- 2025: $2 billion investment in manufacturing capacity and R&D aimed at scaling biotech production

- Capacity Expansions/Investments

$2 billion U.S. investment over four years, including $1.5 billion for manufacturing and $500 million for R&D

Regulatory Approvals

- Operates under strict compliance for manufacturing support in regulated life sciences environments

- Distribution Channel Strategy

- Direct global sales of instruments, consumables, and services

- Partner network and authorized distributors

- Digital/online platforms for software and support

- Technological Capabilities / R&D Focus

Core Technologies/Patents

- Analytical instrumentation, high-throughput lab systems, automation, and manufacturing technologies

- Software for lab informatics, digital manufacturing, and data management

Research & Development Infrastructure

Global R&D centers focusing on biotechnology manufacturing and digital technologies

Innovation Focus Areas

- Bioprocessing/manufacturing for biotech

- Digital manufacturing/automation in life sciences production

- Data management and software for lab and biopharma workflows

Competitive Positioning

- Strengths & Differentiators

-

- Market leader in life sciences instruments and consumables

- Extensive manufacturing support for biopharma/biotech

- Strong acquisition strategy enhancing digital capabilities

- Trusted brand with global presence in regulated industries

- Market Presence & Ecosystem Role

-

- Key supplier to pharmaceutical and biotech manufacturing ecosystems

- Enabler of digital manufacturing in life sciences, integrating hardware and software

- Operates across lab instrumentation, manufacturing, and automation ecosystems

SWOT Analysis

- Strengths: Scale, broad portfolio, manufacturing support, global reach

- Weaknesses: High capital intensity, margin pressure, competition from digital-native players

- Opportunities: Growth in biotech manufacturing, digitalization of life-sciences production, and outsourcing trends

- Threats: Digital disruption, regulatory challenges, macroeconomic headwinds

Recent News and Updates

- Press Releases

- 2025: $2 billion investment in U.S. manufacturing and R&D

- Oct 2025: Planned acquisition of Clario for $9.4 billion to expand digital health capabilities

- Industry Recognitions/Awards

- Consistently ranked among the top global life-sciences firms and Fortune 500 companies

- Reported revenue of approximately $42.879 billion in 2024

Top Vendors in the Market & Their Offerings

| Company |

Offerings |

Contributions in Digital Manufacturing in Life Sciences Market |

| Dassault Systèmes |

Provides the 3DEXPERIENCE platform, integrating PLM, simulation, and digital twin solutions. |

Enables virtual design and process optimization for biotech and pharma manufacturing, improving R&D-to-production efficiency. |

| Rockwell Automation |

Offers FactoryTalk, automation hardware, and life sciences MES systems. |

Enhances smart manufacturing with integrated control, data, and analytics for pharma production. |

| Honeywell International |

Delivers automation, process control, and digital MES platforms. |

Supports compliant, data-driven pharmaceutical operations with advanced analytics. |

| GE Vernova/GE Digital |

Provides digital twin, Predix software, and manufacturing analytics. |

Optimizes production and asset performance in life sciences plants. |

| ABB Ltd. |

Offers automation, robotics, and control systems for life sciences. |

Improves precision, scalability, and sustainability in manufacturing environments. |

| AspenTech |

Develops AI-driven process optimization software and digital twins. |

Enhances efficiency, predictive maintenance, and compliance in pharma manufacturing. |

Top Companies in the Market

- Siemens AG

- Dassault Systèmes

- Rockwell Automation

- Honeywell International

- GE Vernova/GE Digital

- ABB Ltd.

- AspenTech

- Schneider Electric

- AVEVA Group

- SAP SE

- Veeva Systems

- IBM Corporation

- Emerson Electric Co.

- POMSnet (Werum IT Solutions)

- Thermo Fisher Scientific

- Lonza Group AG

- Catalent, Inc.

- Samsung Biologics

- Cytiva (Danaher)

- Amazon Web Services (AWS) Healthcare & Life Science

Recent Developments in the Market

- In April 2025, through its Digital Membership consortium, CPI has partnered with leading global digital pharmaceutical companies such as AstraZeneca, Atos, AWS, Capgemini, GSK, and Siemens to introduce a groundbreaking Digital Architecture that will transform the pharmaceutical manufacturing process.

- In January 2025, through digital transformation and sophisticated automation, Honeywell unveiled the TrackWise® Life Sciences Platform, a solution specifically created to transform how life sciences organizations approach integrated manufacturing and quality management.

Segments Covered in the Report

By Solution

- Manufacturing Execution Systems (MES) & Process Automation

- Process Analytical Technology (PAT) & Real-Time Monitoring

- Industrial IoT & Edge Connectivity

- AI, ML, and Digital Twin Platforms

- Quality Management Systems (QMS) & eBatch Records

- Cloud Data Platforms & Analytics Hubs

By Application

- Biopharmaceutical Manufacturing

- Small Molecule Drug Manufacturing

- Cell & Gene Therapy

- Vaccine Production

- Diagnostics & Research Labs

By Deployment Mode

- On-premises

- Hybrid Cloud Solutions

- Public Cloud/SaaS

By End User

- Large Pharmaceutical Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Biotechnology Startups

- Vaccine Manufacturers

- Academic/Translational GMP Facilities

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA