February 2026

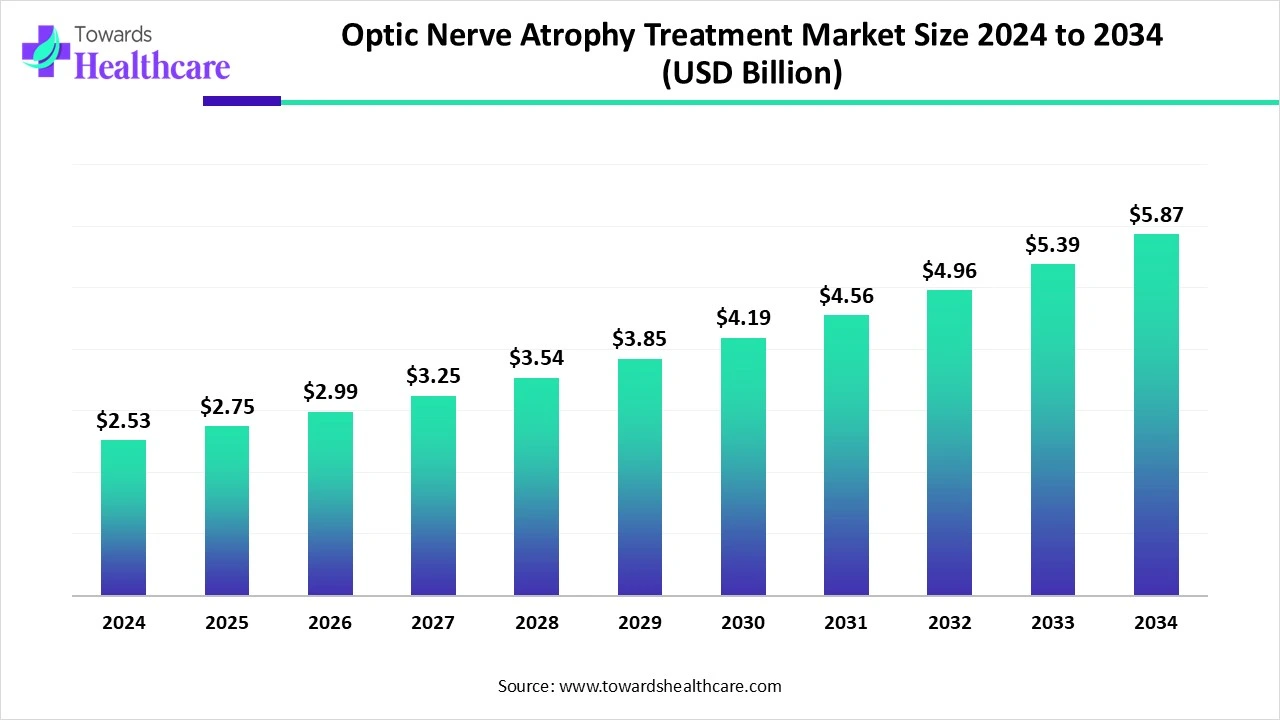

The global optic nerve atrophy treatment market size is calculated at US$ 2.53 in 2024, grew to US$ 2.75 billion in 2025, and is projected to reach around US$ 5.87 billion by 2034. The market is projected to expand at a CAGR of 8.85% between 2025 and 2034.

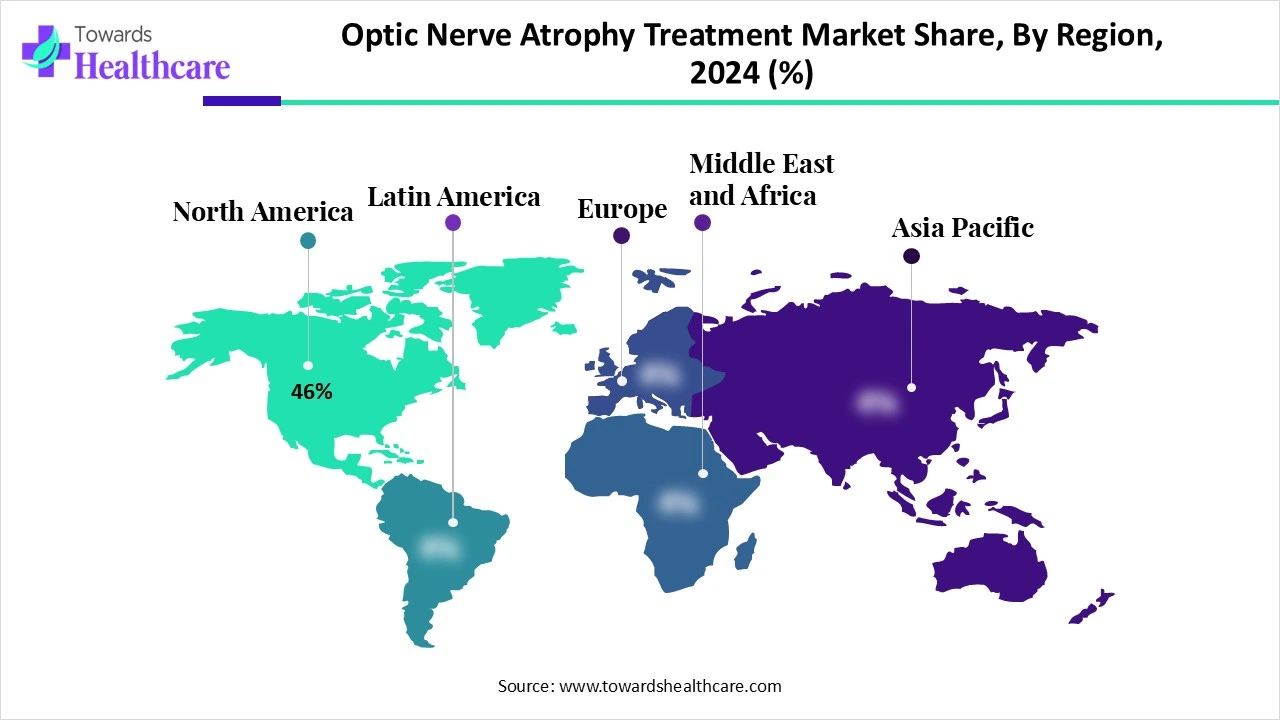

The optic nerve atrophy treatment market is expanding due to the increasing incidence of optic neuropathies in older people and growing investment in neuroprotective stem and cell therapies. North America is dominant in the market due to increasing disease prevalence and presence of advanced healthcare, while Asia Pacific is fastest fastest-growing region due to strong R&D investment and increasing government support.

| Metric | Details |

| Market Size in 2025 | USD 2.75 Billion |

| Projected Market Size in 2034 | USD 5.87 Billion |

| CAGR (2025 - 2034) | 8.85% |

| Leading Region | North America share by 46% |

| Market Segmentation | By Therapy Type, By Disease Type, By Drug Type, By Route of Administration, By End User, By Region |

| Top Key Players | GenSight Biologics, Santhera Pharmaceuticals, Stealth BioTherapeutics, REGENXBIO Inc., Allergan (AbbVie), Novartis AG, Glaukos Corporation, Santen Pharmaceutical Co., Ltd., Bausch + Lomb, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Nanoscope Therapeutics, Stealth BioTherapeutics (Elamipretide), Kubota Vision Inc., EyePoint Pharmaceuticals, Spark Therapeutics (Roche), Quark Pharmaceuticals, Neurotech Pharmaceuticals, NEI/NIH (National Eye Institute) |

The optic nerve atrophy (ONA) treatment market includes therapeutic approaches aimed at managing and potentially restoring visual function in individuals suffering from degeneration or damage to the optic nerve, which results in partial or complete vision loss. While no approved curative treatments currently exist, the market consists of supportive care, neuroprotective agents, regenerative therapies, gene therapies, and assistive technologies. Growth is driven by the rising burden of glaucoma, ischemic injuries, genetic disorders, and optic neuritis, as well as increasing investments in neuro-ophthalmology research and gene therapy innovations.

AI Integration in the optic nerve atrophy (ONA) treatment is driving the growth of the market as AI-driven procedures are the trend for optic nerve fiber reconstruction, and some novel techniques, such as generative AI, support addressing the recent challenges in optic nerve fiber reconstruction. Current advances in artificial intelligence have provided ophthalmologists with fast, precise, and automatic means for treating and diagnosing ocular diseases. AI-driven technology is transforming eye care by improving diagnostic accuracy, allowing early disease detection, and simplifying personalized management plans. AI-driven technology in eye care is promising, with incessant research efforts dedicated to purifying diagnostic algorithms and broadening the scope of AI applications in the field.

What is the Incidence of Optic Atrophy?

Most neuro-ophthalmic diagnoses involve optic nerve conditions. It is more common among young women. Optic neuritis (ON), an acute inflammation of the optic nerve, causes eye pain and temporary vision loss, making it a leading cause of vision problems. This condition involves inflammation that impairs the nerve's ability to transmit visual signals from the retina to the brain, leading to sudden and often severe vision loss. Consequently, this drives growth in the optic nerve atrophy treatment market.

For Instance,

High Cost Challenges

The cost of treating optic nerve atrophy, especially stem cell therapy, generally ranges from $4,000 to $8,500 in India. Prices can vary based on factors such as the type of stem cell treatment, the specific cells used, the number of stem cells needed, pre-treatment investigations, and other medical considerations. These variations impact the growth of the optic nerve atrophy treatment market.

How Does Stem Cell Treatment Help with Optic Atrophy?

Recent advancements in optic atrophy treatment include stem cell therapy, which offers hope to those who once believed their vision loss was irreversible. This therapy can reverse and improve various visual symptoms linked to different optic nerve and retinal disorders. Additionally, gene therapy provides the potential to target neurodegeneration during ONI at a more detailed level, aiding in the survival and regeneration of RGCs and axons. It has been studied for replacing faulty genes in disorders affecting the optic nerve and for modifying genes that control pathways of optic nerve growth and repair. While gene replacement therapy has demonstrated a good safety profile in clinical studies, its long-term therapeutic effects remain limited, opening new opportunities for growth in the optic nerve atrophy treatment market.

By therapy type, the supportive and symptomatic therapy segment dominated in the optic nerve atrophy treatment market in 2024 with a 61% share, as it is the most efficient treatment that regenerates the cells of injured optic nerves. The mesenchymal stem cells are frequently derived from the patient’s bone marrow and inserted by the retrobulbar route. Optic nerve atrophy is caused by inflammation or other existing medical conditions of a patient, and then medication therapy is applied to lower the inflammation near the optic nerve. For patients who have severely lost vision, rehabilitation and vision aid therapies are available to help them adapt to a new way of life.

On the other hand, the gene therapy segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as scientists have found that an OPA1-targeted gene therapy treats dominant optic atrophy in pre-clinical trials. Gene therapy is intended to change gene mutations in disorders affecting the optic nerve, as well as to alter genes responsible for suppressing or activating pathways of optic nerve growth and regeneration. This therapy solves an unmet need and provides an effective neuroprotective procedure for the management of optic neuropathy. This technology offers advanced therapeutic targets and a novel RGC-specific promoter for use in gene therapy.

By disease type, the glaucomatous optic neuropathy segment dominated in the optic nerve atrophy treatment market in 2024 with a 36% share, as it is considered as progressive loss of retinal ganglion cells (RGCs) and their axons and cause to measureable functional and structural damage to the optic nerve, blindness, and visual impairment. Current treatment modalities for glaucomatous optic neuropathy involve lowering IOP using topical ocular drugs, combination drug products, and medical interventions.

On the other hand, the hereditary peripheral neuropathies segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as it is a genetically hereditary disease that causes vision loss. Many people who inherit the condition develop blurred vision that gets progressively worse over six months. Idebenone, which is a synthetic form of Coenzyme Q10, is the only FDA-approved medication for treating this disease. Treatment options are limited, but include the use of antioxidant supplements.

By drug type, the neuroprotective agents segment dominated the market in 2024, as neuroprotective strategies beneficial for optic neuropathies in the early stages of disease and for situations with slow degeneration, end-stage optic neuropathies necessitate cell replacement-based strategies. Neuroprotective agents avoid apoptosis by moderating molecules that play a role in apoptosis. Furthermore, they enhance impaired brain functions by supporting neurogenesis and neuroplasticity.

On the other hand, the investigational gene therapies segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as investigational gene therapies provide a hopeful approach for managing optic nerve atrophy by potentially slowing disease progression, re-establishing lost vision, and addressing underlying genetic sources.

By route of administration, the oral segment dominated in the optic nerve atrophy treatment market in 2024 with a 48% share, as oral administration of medication is a cost-effective, convenient, and most generally used medication administration route. The primary site of medicine absorption is typically the small intestine, and the bioavailability of the medicine is influenced by the amount of drug absorbed in the intestinal epithelium. These benefits include good patient compliance, safety, ease of ingestion, pain avoidance, and versatility to accommodate different types of drugs.

On the other hand, the intravitreal segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as it provides advantages such as an immediate and increased therapeutic effect in the intended retinal tissue. The precision, accuracy, and reproducibility of the delivered volume are based on the size of the syringe and the doctor's manual experience. They significantly work by preventing further damage and do not restore the lost vision.

By end user, the hospitals & eye care clinics segment dominated in the optic nerve atrophy treatment market in 2024 with a 54% share, as it allows early detection, and blindness is avoided in over 75% of cases when a person gets hospitalized early. Hospitals & eye care clinics play a crucial role in taking care of eyes by having regular checkups. Sometimes eye symptoms and diseases are very complex to treat, or can’t be treated after they’ve reached a certain point. Therefore, it’s significant to check the optic nerves and lens systematically.

On the other hand, the academic & research institutions segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as these institutions support to contribute to advancement and innovation in eye care and will expand and optimize care options. Clinical research plays a significant role in advancing eye care and enhancing patient outcomes. From understanding the complex mechanisms of eye diseases to evolving innovative treatments and diagnostic devices, eye care research creates a novel way for a future where vision loss is prevented.

North America dominated the market in 2024, with a 46% share, as this region offers high-quality medical care that is culturally and linguistically sensitive, patient-centered, timely, cost-effective, well-coordinated, and safe, with access to state-of-the-art diagnostic tools and treatment facilities. The presence of specialized ophthalmology and neurology centers in North America, such as the Neuro-Ophthalmology Society's is dedicated to achieving wide-ranging excellence in the care of patients with neuro-ophthalmic diseases, causes growth of the market.

In January 2025, Oculis Holding AG, a global biopharmaceutical company purposefully driven to save sight and improve eye care, announced positive topline results with OCS-05 in the Phase 2 ACUITY trial, which met the primary endpoint of safety and achieved statistical significance on several key efficacy-based secondary endpoints. The trial evaluated the safety, tolerability, and efficacy of OCS-05, a neuroprotective candidate, in patients with acute optic neuritis. (Source - Oculis)

The U.S. invests a larger amount in medical care than other high-income countries, which allows greater access adoption of advanced technology for optic nerve atrophy treatment. The US is a leader of major biotech companies because of noteworthy government support for biomedical and healthcare research, which is extensively driving the growth of the market. The US is a hub for the majority of the top biotechnology firms, including Amgen, Gilead Sciences, Thermo Fisher Scientific, Vertex Pharmaceuticals, and Regeneron Pharmaceuticals. These factors all drive the growth of the market.

Increasing clinical trials in Canada, as it captures 4% of worldwide clinical trials, is fourth in the number of clinical trial sites, and is the G7 leader in clinical trial efficiency. Some recent clinical trials have significantly focused on neurodegenerative optic diseases and optic nerve regeneration, which drives the growth of the market.

Europe is expected to grow at the fastest rate in the market during the forecast period, as Europe has strong healthcare regulatory frameworks, such as MedTech Europe’s, which inspire the advancement of treatments for rare diseases like ONA. This also raises access to innovation and confirms the timely availability of harmless and performing healthcare technologies for patients and health systems in Europe. Medical technology incessantly expands through innovation to meet the requirements of patients and society, which drives the growth of the optic nerve atrophy treatment market.

Increasing healthcare research and technology in Germany, as it is the global leader in clinical trials and its approach is likely to attract huge spending in clinical trials, promoting the whole European research ecosystem, and also clinical trials increases substantial economic advantages, which allows the increasing adoption of advance technology include optic nerve atrophy treatment. Germany is a developer of personalized and biotechnology medicine. Active progress in genome research and stem cell therapy, led by companies like MorphoSys, allows advanced treatments that are renovating patient care.

In the UK, the major cause of blindness in old age is age-related macular degeneration. Also, increasing cases of AMD, which is a condition where the cells in the central part of the retina (macula) become damaged, so expanding the patient population for ONA treatments. Biotechgate stated that the UK is home to 1385 biotechnology organizations in 2023. It is predicted that by 2050, the number of people with sight loss in the UK will twice to over four million, which it increase the need for optic nerve atrophy treatment market.

Asia Pacific is estimated to host a significantly growing market during the forecast period, as the increasing incidence of diabetes, which is a major risk factor for vision loss, is driving the rise in APAC, increasing awareness of eye care for treating eye conditions, and lowering vision impairment. The emergence and advancements in eye disease treatment modalities have extended the options offered to clinicians, which drives the growth of the market.

China’s role in the worldwide healthcare sector has grown significantly in recent years. Biotech in China is focused on the two main hubs of Shanghai and Beijing. High investment in healthcare technology, mainly artificial intelligence (AI), which is having an extensive impact on the biotech and healthcare field, including research of optic nerve atrophy, drives the market growth.

India is becoming a significant country in biotech, due to increased focus on R&D, rising digitalisation, and government investment. The government played a significant role in the expansion of India’s biotech and medical sector. The government committed Rs 197,000 crore ($26,578.3 million) to its pharmaceutical Production Linked Incentive (PLI) scheme. The presence of large biotech organizations in India, such as Bharat Biotech and Shantha Biotechnics, supports to drive the growth of the market.

In January 2025, Riad Sherif, MD, Chief Executive Officer of Oculis, Stated, “Oculis Announced Positive OCS-05 Phase 2 ACUITY Trial in Acute Optic Neuritis. These positive efficacy and safety results from ACUITY represent a significant milestone in bringing the first potential neuroprotective treatment in ophthalmology to patients. The advancement in vision is especially encouraging, and the consistent improvement in retinal structure highlights the therapeutic potential of OCS-05 across multiple ophthalmic and neurological conditions.” (Source - Oculis)

By Therapy Type

By Disease Type

By Drug Type

By Route of Administration

By End User

By Region

February 2026

January 2026

January 2026

January 2026