February 2026

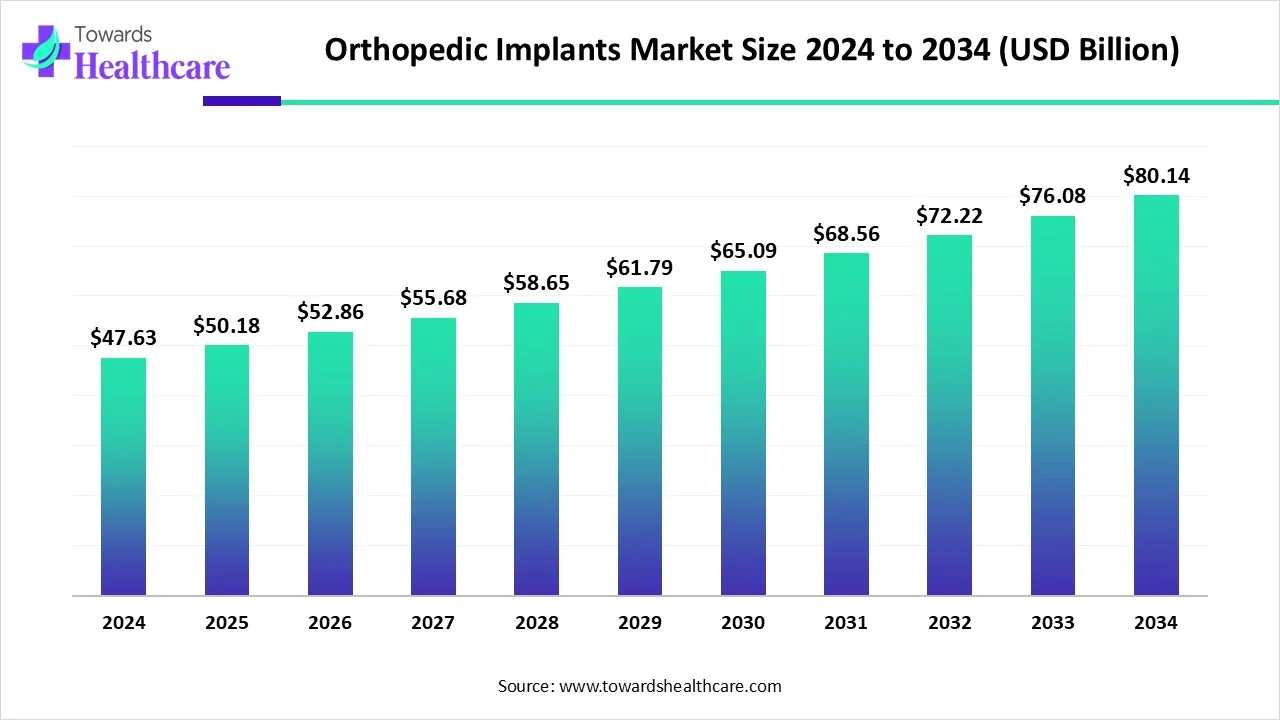

The global orthopedic implants market size is calculated at USD 47.63 billion in 2024, grow to USD 50.18 billion in 2025, and is projected to reach around USD 80.14 billion by 2034. The market is rising at a CAGR of 5.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 47.63 Billion |

| Projected Market Size in 2034 | USD 80.14 Billion |

| CAGR (2025 - 2034) | 5.34% |

| Leading Region | North America |

| Market Segmentation | By Product, By End-user, By Region |

| Top Key Players | Biomet Holdings, Inc., Stryker Corporation, Medtronic plc, BioTek Instruments, Inc, Arthrocare Corporation, Orthopedic Implant Company, Smith and Nephew plc, Integra Life Sciences Holdings Corporation, NuVasive, Inc, Aesculap Implant Systems |

Orthopedic implants are medical devices surgically placed in the body to replace, support, or stabilize bones and joints affected by injury, disease, or deformity. They are typically made from biocompatible materials such as titanium, stainless steel, or medical-grade polymers. Common types include plates, screws, rods, and joint prostheses. The market is growing due to the aging population and the increasing prevalence of bone and joint disorders such as arthritis and osteoporosis. The rising number of road accidents is also driving demand. Technological advances, such as 3D printing, robotic-assisted surgeries, and improved biomaterials, are enhancing treatment outcomes. Additionally, growing healthcare infrastructure, better patient awareness, and increasing access to medical care in developing regions are further contributing to the orthopedic implants market expansion.

For Instance,

AI is poised to revolutionize the market by enhancing various aspects, from design to patient care. AI-driven tools like machine learning and 3D modeling enable more precise, customized implant designs tailored to individual patient anatomy. Additionally, AI applications in surgical planning and navigation can improve the accuracy of implant placement, reducing errors and complications. AI-powered predictive analytics can also monitor patient recovery, offering real-time insights for proactive care. These technological advancements will not only improve clinical outcomes but also drive innovation and growth in the orthopedic implants market, benefiting both healthcare providers and patients.

Aging Population

The aging population is driving the orthopedic implants market due to the increased prevalence of age-related musculoskeletal conditions, such as arthritis, osteoporosis, and tears in joints and bones becoming more significant, leading to a higher need for treatment like joint replacement and spinal surgeries. Older individuals are also more prone to fractures and injuries, further increasing the demand for orthopedic implants. According to the World Health Organization, the global geriatric population is expected to increase from 1 billion to 1.4 billion by 2030, with one in every six people projected to be 60 years or older. This significant growth highlights the rising proportion of elderly individuals worldwide. This demographic shift contributes to a growing market for implants designed to restore mobility and improve the quality of life for elderly patients.

High-Cost Orthopedic Implants

The high cost of orthopedic implants is are major restraint to market growth because it limits access to these essential medical devices, particularly in developing regions or for lower-income patients. Expensive implants can lead to increased healthcare costs, making it difficult for many individuals to afford necessary surgeries. Additionally, the high prices put pressure on the healthcare system and insurance providers, who may limit coverage or reimbursement for advanced implants. This financial barrier slows the adoption of new technologies and treatments, hindering market expansion.

For Instance,

Government Initiatives

Government initiatives are a good opportunity to increase funding and support for healthcare infrastructure, especially in developing regions. Programs aimed at improving access to healthcare and reducing the cost of medical treatments can make orthopedic surgeries more affordable, thus expanding the market. Additionally, the government may implement policies that encourage innovation in medical technologies, offer subsidies, or provide reimbursement for surgeries involving orthopedic implants. These initiatives can drive demand for advanced, important solutions, fostering market growth and improving patient access to care.

For Instance,

By product, the joint reconstruction segment held a dominant presence in the market in 2024, primarily driven by the increasing prevalence of degenerative joint diseases like osteoarthritis and rheumatoid arthritis, which often require joint replacement procedures. Advances in implant material, surgical techniques, and prosthetic design have led to improved outcomes and longer-lasting implants, encouraging more patients to opt for these surgeries. Additionally, the integration of cutting-edge technologies, such as robotic-assisted surgery and 3D printing, has enhanced the precision and customization of joint implants. These factors have collectively contributed to the strong growth and dominance of the orthopedic implants market.

By product, the spinal implant segment is anticipated to grow at a significant rate in the market during the studied years, due to increasing cases of spinal injuries and trauma caused by accidents, falls, and physically demanding lifestyles. Rising adoption of sedentary behavior and poor posture, especially among younger populations, is contributing to early spinal issues, prompting demand for corrective procedures. Moreover, growing investments in R&D and the launch of innovative, motion-preserving spinal devices are offering better treatment alternatives, making spinal implants a preferred choice in modern spinal care.

For Instance,

By end-user, the hospitals and ambulatory surgery segment was dominant in the market in 2024, due to their advanced infrastructure and skilled surgical teams capable of handling complex procedures. These facilities are early adopters of cutting-edge technologies like robotic-assisted systems and image-guided navigation, which enhance surgical precision and improve outcomes. Additionally, they offer comprehensive care from pre-surgery evaluation to post-operative rehabilitation, making them the preferred choice for both patients and healthcare providers, thereby driving the orthopedic implant market expansion.

By end-user, the orthopedic clinics and others segment is expected to grow at the highest CAGR in the market during the forecast period due to increasing preference for outpatient care. These clinics offer cost-effective, efficient services with shorter recovery times, attracting a larger patient base. The adoption of minimally invasive techniques and advanced technologies like robotic-assisted procedures and 3D printing enhances treatment precision and patient outcomes. This shift towards specialized, technology-driven care is fueling the rapid growth of the orthopedic implant market.

North America dominated the orthopedic implants market in 2024, due to its advanced healthcare infrastructure, high prevalence of orthopedic disorders, and a large aging population. The presence of leading implant manufacturers such as Stryker, Zimmer Biomet, and Johnson & Johnson ensures rapid product innovation and availability. Additionally, favorable reimbursement policies, including Medicare and Medicaid, along with high healthcare spending, facilitate access to orthopedic surgeries. These factors combined have significantly boosted the demand for orthopedic implants, reinforcing North America's market leadership.

The U.S. market is growing due to an aging population, which increases demand for joint replacements and treatments for age-related conditions like osteoarthritis. Technological advancements, such as robotic-assisted surgeries and smart implants, are improving surgical precision and patient outcomes. Additionally, higher rates of sports injuries, obesity, and lifestyle factors contribute to the rise in orthopedic issues. The presence of major medical device companies and strong healthcare infrastructure further supports the market's expansion.

Canada's market is expanding due to an aging population, leading to a higher demand for joint replacements and treatments for age-related conditions like osteoarthritis. Technological advancements, such as minimally invasive and robotic-assisted surgeries, are improving surgical precision and reducing recovery times. Additionally, increasing healthcare investments are making high-quality implants more accessible. These factors combined are driving the continued growth of Canada's orthopedic implants market.

For Instance,

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The region's aging population, especially in countries like Japan, China, and South Korea, is leading to a higher prevalence of joint disorders such as osteoarthritis, which drives demand for orthopedic procedures, particularly joint replacements. Additionally, Asia-Pacific has become a hub for medical tourism, attracting patients seeking affordable and high-quality treatments. Investments in modernizing healthcare infrastructure in countries like India and China, coupled with technological advancements in AI, robotics, and IoT, are enhancing surgical precision and patient outcomes, further propelling the market's growth.

China's market is growing rapidly due to its aging population, which is driving demand for treatments for conditions like osteoarthritis and osteoporosis. Technological advancements, including robotic-assisted and minimally invasive surgeries, are improving outcomes and accessibility. Significant investments in healthcare infrastructure are expanding access to advanced orthopedic care across the country. Additionally, supportive government initiatives, such as approvals for surgical robots, are enhancing procedural efficiency. These combined factors are fueling the steady growth of the market in China.

India’s market is expanding due to increased awareness about orthopedic health and rising demand for quality healthcare in both urban and rural areas. Growing incidences of road accidents and sports injuries are also fueling the need for trauma-related implants. Furthermore, local manufacturing capabilities have improved, making implants more affordable and accessible. Government initiatives promoting “Make in India” in the medical device sector are also encouraging domestic production and reducing reliance on imports, driving market growth.

Europe is anticipated to grow at a significant rate in the orthopedic implants market during the forecast period, due to the region's focus on early diagnosis and preventive orthopedic care. Public health campaigns and initiatives promoting active lifestyles have led to a higher number of sports-related injuries, especially among middle-aged adults. Moreover, strong regulatory standards and supportive reimbursement systems encourage the adoption of high-quality implants. Collaborative research among universities, hospitals, and medical device companies also fosters innovation and strengthens Europe’s position in this market.

The UK market is growing due to a rising aging population, leading to increased cases of musculoskeletal disorders and joint issues. Advances in implant materials, such as 3D-printed and biocompatible devices, are enhancing outcomes and durability. There is also a growing demand for minimally invasive procedures, which offer faster recovery. Additionally, improvements in healthcare infrastructure and wider access to surgical treatments are supporting the market’s steady expansion.

Germany's market is expanding due to its aging population, which increases demand for joint replacements, particularly hip and knee procedures. Technological advancements such as minimally invasive surgeries and robotic-assisted procedures improve surgical outcomes. Additionally, Germany's advanced healthcare infrastructure and high rates of surgeries contribute to the growing need for orthopedic implants, driving market growth.

For Instance,

Latin America is expected to grow at a notable CAGR in the orthopedic implants market in the foreseeable future. The rising prevalence of orthopedic disorders and the increasing adoption of advanced technologies are the major growth factors for the market in Latin America. Government organizations launch initiatives to create awareness among the general public for screening and early diagnosis of orthopedic disorders. The presence of key players and increasing investments also contribute to market growth.

The prevalence and incidence of rheumatoid arthritis in Mexico are estimated to reach 465.5 and 27.9 by 2030, as well as 518.9 and 30.2 per 100,000 inhabitants, respectively. The favorable geographical location and affordable treatment costs encourage foreigners, especially U.S. citizens, to visit Mexico for orthopedic surgeries.

The Agência Nacional de Vigilância Sanitária (ANVISA) regulates the approval of orthopedic implants and other medical devices in Brazil. The Brazilian government announced an investment of $480 million to purchase more than 10,000 pieces of medical equipment to be used in basic care and surgical procedures.

In May 2025, Restor3d, a Durham-based company specializing in 3D-printed orthopedic implants, secured $38 million in venture capital. Kurt Jacobus, CEO and co-founder of restor3d, stated, “This funding allows us to scale our technology further, expand access to truly personalized care, and continue setting new standards in orthopedic treatment. We are redefining what’s possible in orthopedics to better serve our surgeons and patients.”

By Product

By End-user

By Region

February 2026

February 2026

February 2026

February 2026