December 2025

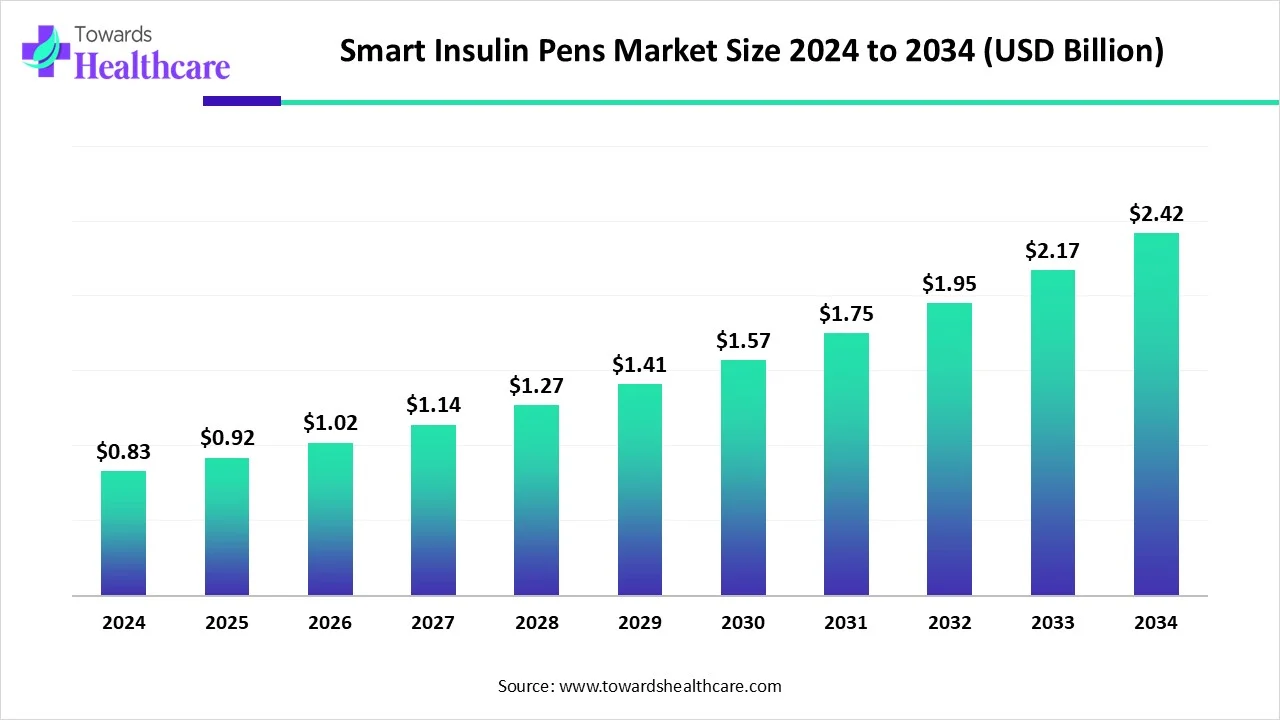

The global smart insulin pens market size is calculated at USD 0.83 in 2024, grew to USD 0.92 billion in 2025, and is projected to reach around USD 2.42 billion by 2034. The market is expanding at a CAGR of 11.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 0.83 Billon |

| Projected Market Size in 2034 | USD 2.42 Billion |

| CAGR (2025 - 2034) | 11.34% |

| Leading Region | North America |

| Market Segmentation | By Connectivity, By Indication, By Distribution Channel, By Region |

| Top Key Players | Novo Nordisk A/S, Ypsomed AG, Diabnext, Medtronic, Cambridge Consultants Ltd., Pendiq, Emperra GmbH, Jiangsu Deflu Medical Device Co. |

The use of smart insulin pens, which are insulin delivery devices, is contributing to the digital age. It can enhance the connection between diabetes patients, healthcare systems, and healthcare providers. It consists of wireless connectivity, integration with personalized dosing decision support, and digital dose capture. The digital dose capture reviews the insulin dose data along with the paired glucose data. Furthermore, it also helps the healthcare providers and the patients to make data-driven decisions during the scheduled visits to the hospital. Thus, SIP offers a modernizing diabetes care for the population suffering from diabetes.

The AI integration with the smart insulin pens helps in transforming diabetes management as it offers improved glycaemic control, real-time personalisation, and better patient outcomes. The advancements in AI algorithms can be used in the systems to adapt complex dynamic factors and individual variability, which includes rates of insulin absorption and glucose response patterns. Furthermore, new advancements to replicate these complex dynamic factors, as well as individual variability, as also being considered, as they can be used in the development of new personalized treatment options.

Increasing Occurrence of Diabetes

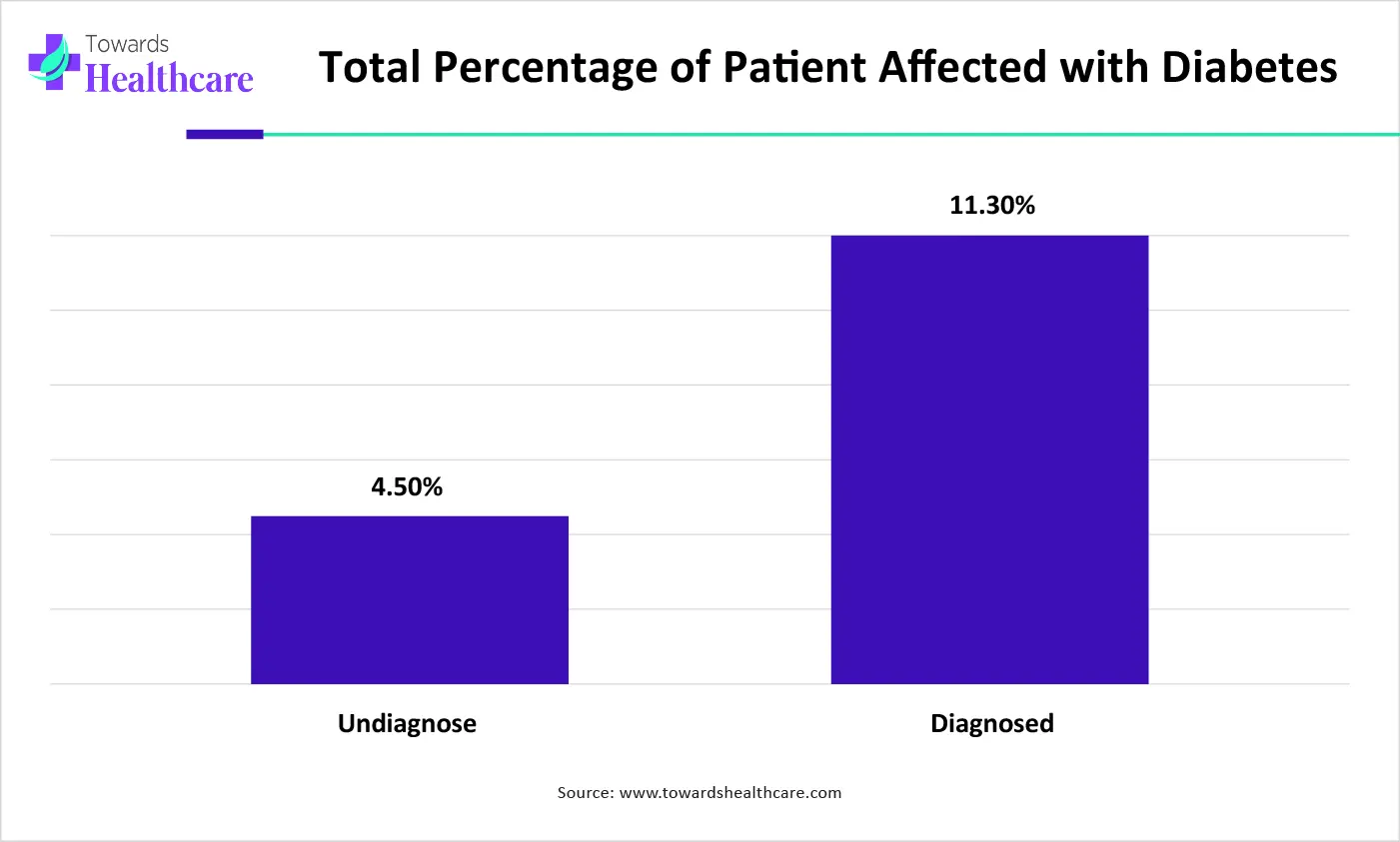

Due to the rising population, there is an increasing incidence of diabetes. At the same time, the changes in the life lifestyle are also causing a rise in diabetes patients. This, in turn, raises the demand for early diagnosis as well as effective treatment options. Thus, the use of smart insulin pens also increases. It helps in monitoring as well as managing the diabetic condition in patients effectively. Furthermore, the accurate dosing also helps in minimizing errors. Thus, it enhances patient satisfaction, outcomes, as well as the use of insulin pens. This, in turn, drives the smart insulin pens market growth.

The graph represents the percentage of patients undiagnosed and diagnosed with diabetes. It indicates that the prevalence of diabetes is increasing. Hence, it increases the demand for new diagnostic and treatment options for its effective management, as well as the use of smart insulin pens. Thus, this in turn will ultimately promote the market growth.

High Cost

The smart insulin pens are expensive. Due to this, many patients are unable to afford it. At the same time, various healthcare systems use traditional methods for diabetes management. Similarly, low-income countries also cannot afford the use of smart insulin pens. Thus, all these factors lead patients to choose other methods rather than the use of the smart insulin pens. This, in turn, may affect the market growth.

Remote Patient Monitoring

The geriatric population suffering from diabetes is increasing, which enhances the use of smart insulin pens. This helps the patient in reducing the hospital visits as well as improves the self-monitoring, which in turn increases comfort. Furthermore, the data stored can help in providing personalized treatment plans. This, in turn, increases their demand in the market, increasing the production rates. Thus, all these factors enhance the patient outcomes and adherence to the treatment. This eventually promotes the smart insulin pens market growth.

For instance,

R&D in smart insulin pens focuses on developing and improving technologies that enhance insulin delivery and the management of diabetes patients, such as automatic dose delivery and wireless connectivity.

Key Players: Novo Nordisk, Eli Lilly & Company, and Ypsomed Holding

Clinical trials are conducted to assess the safety and efficacy of smart insulin pens. Novel devices are approved by regulatory agencies of various countries to expand their accessibility.

Key Players: Medtronic plc, G2e Co. Ltd., and DexCom, Inc.

Smart insulin pens support patients in managing their insulin therapy with greater ease and precision, providing bolus calculation, automated dose tracking, and patient education.

Key Players: Medtronic, Novo Nordisk, F-Hoffman La Roche

By connectivity type, the Bluetooth segment dominated the market in 2024. Bluetooth helped in effective data sharing through mobile apps. Furthermore, it also provided notifications or alerts that helped in insulin dosing. All these factors increased the smart insulin pens market growth.

By connectivity type, the near field communication (NFC) segment is estimated to grow significantly at a notable CAGR during the forecast period. The NFC offers user-friendly insulin dosing. At the same time, due to less energy consumption, the long-term use is possible.

By indication type, the type 1 diabetes segment dominated the market in 2024. Type 1 diabetes requires frequent dosing as well as proper monitoring of the glucose levels. Thus, the use of SIPs improved the insulin dosing as well as monitoring, increasing its use among the patients.

By indication type, the type 2 diabetes segment is anticipated to grow significantly during the forecast period. The increased occurrences of type 2 diabetes are increasing the use of SIPs. This helps in remote monitoring, increasing patient satisfaction, and adherence to the treatment.

By distribution channel, the hospital pharmacies segment dominated the global smart insulin pens market in 2024. The hospital pharmacies consisted of a large volume of smart insulin pens. This provided easy access to the patient in need. Furthermore, it also provided guidance to the parties about its use and working.

By distribution channel, the retail & online pharmacies segment is predicted to be the fastest growing during the forecast period. The retail & online pharmacies offer the SIPs at reasonable prices. Moreover, they also provide different SIPs and their review, which help in the selection of a suitable SIP as per the patient's demand.

North America dominated the smart insulin pens market in 2024. North America consisted of a well-developed healthcare system as well as infrastructure. Furthermore, the technological advancements have also increased the production of smart insulin pens with the rising demand. This contributed to the market growth.

The healthcare infrastructure and the systems are well developed in the U.S. This has increased the use of the smart insulin pens in the management of diabetes. At the same time, technological advancements also expand its use.

The industries in Canada contain various technological advancements along with skilled personnel. This improves the quality as well as the production of smart insulin pens. Moreover, this also increases the collaborations, which enhances the manufacturing process to meet the public's demands.

Asia Pacific is expected to grow at the fastest CAGR in the smart insulin pens market during the forecast period. Asia Pacific is experiencing a rise in the prevalence of diabetes within the population. Thus, the government is supporting the healthcare sector by enhancing the manufacturing process as well as making the SIPs affordable, which promotes the market growth.

A large portion of the population is affected by diabetes, which increases the use of SIPs. At the same time, the use of advanced technologies along with government support improves the production process, increasing patient outcomes.

The use of SIPs in India is rising as it helps in the effective management of diabetes in the growing population. Moreover, the developing healthcare sector is also increasing its efforts to minimize diabetes incidences, along with government support, by making it affordable.

For instance,

Europe is estimated to host the significantly growing smart insulin pens market during the forecast period. The increasing awareness, as well as incidences of diabetes, are increasing the demand for effective diagnosis and treatment options in Europe. Thus, the use as well as adoption of smart insulin pens is enhancing the market growth.

Due to the increasing demand for the treatment and early diagnosis of diabetes, the use of SIPs is rising. Furthermore, the technologies used enhance the production along with compliance with regulatory guidelines. This increases their use in the market.

The growing awareness about diabetes and its complications has increased the use of SIPs in the UK. At the same time, the industries are supported by the government to increase the manufacturing rates.

The Middle East & Africa are considered to be a significantly growing area, owing to the increasing diabetes prevalence and growing awareness of advanced treatment. According to the International Diabetes Federation (IDF), approximately 25 million people were estimated to live with diabetes in Africa in 2024. The rising disposable income and the adoption of advanced technologies also propel the market. The growing research and development activities favor the development of novel and innovative insulin pens. Government organizations also support early diagnosis and treatment of type 1 and type 2 diabetes.

Diabetes is a rising concern among people in the UAE. According to a recent study, the annual cost of dealing with type 2 diabetes in the country is projected to reach $3.4 billion by 2031. Some researchers have also anticipated that 1.6 million people in the UAE will suffer from diabetes in the early part of the next decade. This potentiates the need for smart insulin pens. (Source: The National News)

Diabetes affects around 19% of the total adult population in Saudi Arabia. In February 2025, Sanofi, Sudair Pharma Company, and NUPCO collaborated to launch Saudi Arabia’s first local insulin manufacturing facility. The facility was launched under the initiative of “Vision 2030” with an aim to improve access to life-saving insulin for millions living with diabetes. (Source: WAM Saudi)

By Connectivity

By Indication

By Distribution Channel

By Region

December 2025

December 2025

November 2025

January 2026