February 2026

The sustainable bioprocessing materials market is poised for significant growth from 2024 to 2034, driven by the rising demand for eco-friendly alternatives in biopharmaceutical manufacturing. Increasing regulatory support for green technologies and a growing shift toward circular bioeconomy practices are fueling adoption. Innovations in biodegradable polymers and renewable raw materials are enhancing process efficiency while reducing environmental impact. As bioprocessing industries aim for carbon neutrality, sustainable materials are becoming integral to next-generation production platforms.

Through the use of green technology and practices, bioprocessing for sustainable manufacturing is transforming the industrial landscape. Utilizing biological processes, including bacteria and enzymes, this novel method produces products in an eco-friendly way. Conventional manufacturing techniques generate significant waste and pollution, and often rely on fossil fuels. By employing renewable resources and generating fewer emissions, bioprocessing, on the other hand, reduces its negative environmental consequences. Businesses may accomplish sustainable manufacturing by developing bioprocessing technologies, which will both meet the rising demand for eco-friendly products and drastically minimize their environmental impact.

The sustainable bioprocessing materials market comprises environmentally friendly, biodegradable, recyclable, or bio-based materials used in biopharmaceutical manufacturing processes. These materials aim to reduce environmental impact while maintaining the quality and safety required in upstream and downstream processing, single-use systems, and drug formulation. As environmental responsibility obtains greater attention globally, the bioprocessing industry is adjusting its approach to reduce its environmental impact without compromising quality or safety. Bioprocessing companies are using strategies such as process intensification, which optimizes processes to utilize less water, energy, and materials.

The application of artificial intelligence (AI) in bioprocessing aids in the transition to more sustainable and environmentally friendly production methods. Through waste reduction and resource optimization, artificial intelligence may contribute to the development of bioprocesses that are more economically and environmentally sustainable. The use of AI in bioprocessing offers several opportunities to enhance process performance.

Waste management

Bioprocessing, the mainstay of the manufacturing of biopharmaceuticals, has previously relied on resource-intensive methods and generated a large quantity of waste. Sustainable bioprocessing seeks to reduce the industry's ecological footprint, save resources, and lower its environmental impact while maintaining high-quality pharmaceutical manufacture. Alternatively, bioprocessing using renewable resources combined with a multi-product approach that encourages creative integration boosts resource efficiency and promotes the "green economy."

High initial cost

Sometimes, creating and deploying sustainable bioprocessing technologies requires a significant upfront financial investment for specialized machinery, including automation technologies, bioreactors, and chromatography systems. The widespread adoption of sustainable practices may be hindered by making it harder for smaller companies or those with less capital to enter the market.

What is the future of the sustainable bioprocessing material market?

Growing consumer awareness of eco-friendly products across several industries is driving demand. As multinational corporations seek to shift away from processes that rely on fossil fuels, industrial bioprocessing is anticipated to play a pivotal role in shaping the future of manufacturing. An inventive, robust, and low-carbon industrial environment will be the outcome. Because of market demand and regulatory pressure, biomanufacturing will continue to adopt more ecologically friendly techniques worldwide.

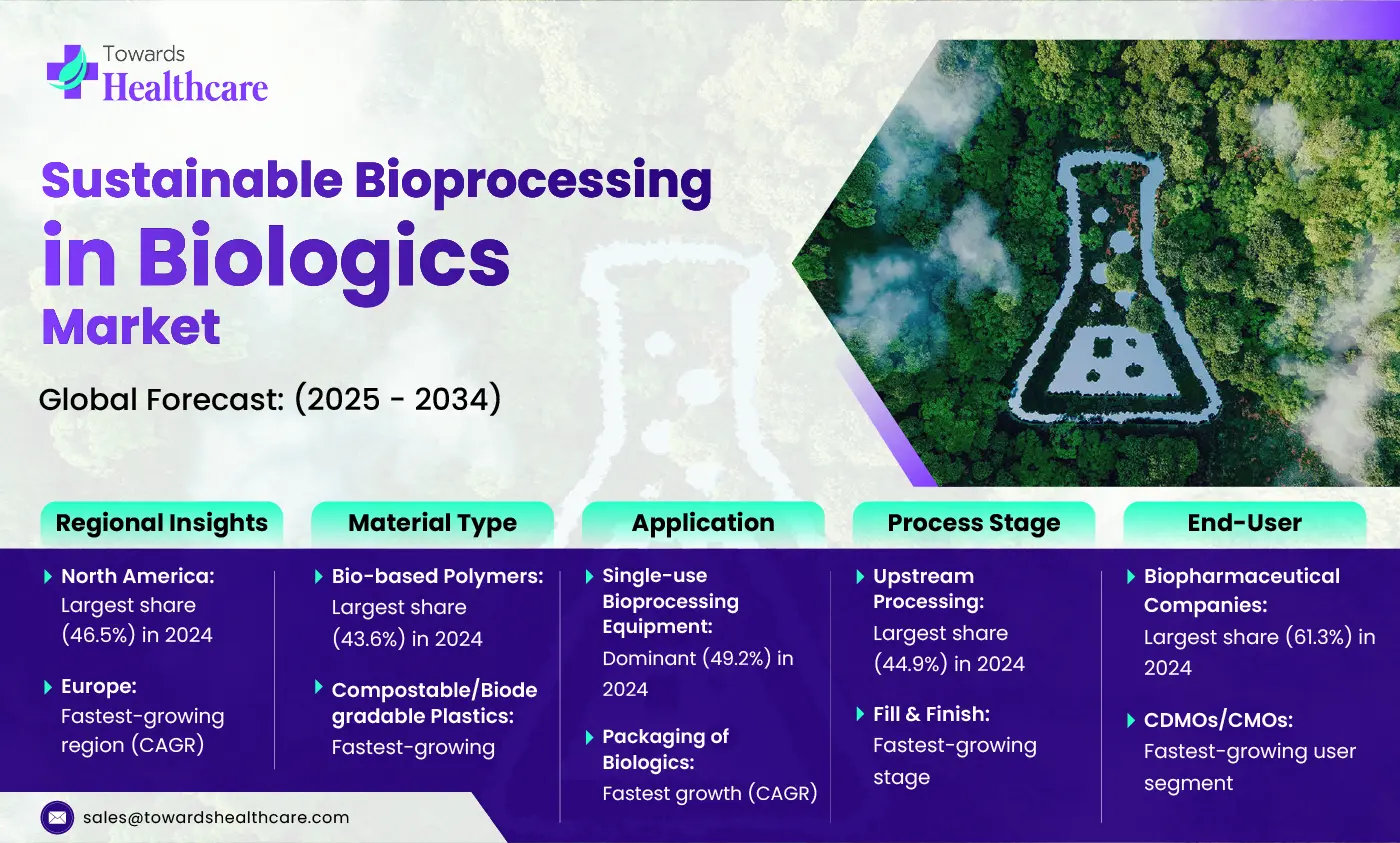

By material type, the bio-based polymers segment captured the largest share of 43.6% of the sustainable bioprocessing materials market in 2024. Biopolymers have started to gradually replace conventional materials due to their unique properties. The drive for environmental sustainability has led to a discernible shift away from the extensive use of synthetic polymers in various industries, including the pharmaceutical sector, toward natural biopolymers. In recent decades, researchers and manufacturers have shown a significant interest in biodegradable polymer-based drug delivery methods compared to synthetic, non-biodegradable polymers and their analogs.

By material type, the compostable/biodegradable plastics segment is expected to be the fastest-growing in the sustainable bioprocessing materials market during the forecast period. Eco-friendly pharmaceutical packaging solutions are provided to healthcare sector members by pharmaceutical corporations in response to the growing customer demand for eco-friendly products. To lessen the harm they cause to the environment, big pharmaceutical corporations are starting to cooperate more. The need for bioresorbable polymers will only increase as the world's population ages and medical demands rise.

By application, the single-use bioprocessing equipment segment was dominant in the market with a sustainable bioprocessing materials market share of 49.2% in 2024. An industry that has traditionally relied on petroleum-based plastics for single-use systems is shifting as companies adopt plant-based, biodegradable alternatives that meet stringent safety standards and environmental goals. Eliminating plastic waste without compromising quality or compliance is one of the most pressing sustainability concerns. As pressure on the biopharmaceutical and healthcare industries to reduce their environmental impact grows, innovative solutions are emerging to address this challenge.

By application, the packaging of biologics segment is expected to grow at the fastest CAGR in the sustainable bioprocessing materials market during the forecast period. Biologics are the pharmaceutical market segment that is expanding at the fastest rate; thus, it is important to fully explain how the production of these drugs affects the environment. In response to global concerns over resource conservation, waste reduction, and environmental impact, pharmaceutical companies are aggressively reevaluating their packaging strategies. One significant development in this area is the study of bioplastics, which are produced from renewable resources like sugarcane, maize starch, or other plant-based materials.

By process stage, the upstream processing segment captured the dominant revenue share of 44.9% of the sustainable bioprocessing materials market in 2024. Aside from lessening the environmental effects of research and manufacturing processes, upstream bioprocessing can benefit greatly from implementing a sustainability-by-design strategy. Upstream bioprocessing places a lot of emphasis on techniques including utilizing less energy and water, minimizing waste and dangerous chemicals, and employing more ecologically friendly materials.

By process stage, the fill & finish segment is expected to grow at the highest CAGR in the sustainable bioprocessing materials market during the forecast period. One of the developments in the fill and finish bioprocess is the increased focus on sustainability and environmental stewardship. Pharmaceutical companies are looking at eco-friendly packaging solutions, reducing waste output, and increasing the energy efficiency of fill-finish processes. Finding a balance between sustainability objectives, operational effectiveness, and regulatory compliance is still challenging; this necessitates innovative approaches and supply chain-wide strategic partnerships.

By end-user, the biopharmaceutical companies segment dominated the sustainable bioprocessing materials market with a revenue share of 61.3% in 2024. There is a call for the biopharmaceutical industry to progress its sustainability efforts. Many biopharma companies are thinking of recycling spent organic solvents via solvent incineration in order to recover stored energy. Similar to this, many biopharma companies are switching from standard stainless steel equipment to single-use systems because of their many benefits, which include the fact that they need significantly less time, energy, labor, and capital to set up.

By end-user, the CDMOs/CMOs segment is expected to be the fastest-growing in the sustainable bioprocessing materials market during the forecast period. In the biotech and pharmaceutical industries, CDMOs and CMOs are increasingly focusing on sustainable materials and procedures. Using green chemistry, using more eco-friendly packaging and materials, and simplifying processes to generate less waste are some examples of this. Along with researching renewable energy sources, they are also taking measures to reduce their carbon footprint.

North America dominated the sustainable bioprocessing materials market with a market revenue share of 46.5% in 2024. In a big market like the U.S., market expansion is being supported by both the government's supportive policies and the growing investments made by the markets. Furthermore, increased healthcare expenditure, a heightened understanding of the sustainability of biopharmaceuticals, and heightened attention to key players in reducing carbon footprints all contribute to North America's supremacy in international markets.

The biopharma sector remains unclear due to the U.S. government's 2025 policy directives. It has been determined that a third of the $3.5 trillion U.S. healthcare system is ineffective or underutilized. Moreover, over 10% of the nation's greenhouse gas emissions, or 614 million metric tons of carbon dioxide, are produced by the US health sector each year. These emissions have increased by more than 30% in the last decade. The Yale Program on Health Care Environmental Sustainability (Y-PHES), located within the Center on Climate Change and Health, is dedicated to enhancing the environmental performance of healthcare itself through basic and applied research, public policy and advocacy, and education.

Pharmacies across Canada deliver prescription drugs, manage out-of-date medications, and dispose of packaging waste, all of which have a significant negative influence on the environment. The pharmaceutical industry in Canada is focusing on waste and environmental impact reduction in order to become more sustainable. Canadian pharmacies are rapidly using sustainable methods to lessen their adverse environmental impacts and to promote world health. Programs like Canada's National Medication Return Program collect and appropriately dispose of old or expired medications to prevent environmental contamination.

Europe is estimated to host the fastest-growing sustainable bioprocessing materials market during the forecast period. More sustainable materials are now available thanks to enhanced innovation pipelines brought about by strategic alliances between government organizations and pharmaceutical corporations. Additionally, the advent of biosimilars has increased patient access to biologic medicines, particularly in Europe's cost-sensitive markets. This is maintaining market growth and increasing demand for sustainable bioprocessing materials. The development of novel manufacturing platforms, such as continuous bioprocessing and single-use technologies, has also improved production efficiency and scalability.

Through a combination of government assistance, corporate initiatives, and technological advancements, Germany is quickly pursuing sustainable pharmaceutical manufacturing. Even though the German pharmaceutical industry's environmental impact is minimal compared to other industries, efforts are being made to further reduce it, especially with regard to energy and water use. Promoting environmentally friendly production methods, sustainable packaging, and investigating digital solutions for more effective and ecologically responsible production are a few of the initiatives.

Over £14 million will be invested in 29 innovative projects by Innovate UK to help make the pharmaceutical manufacturing sector in the UK more sustainable. The projects are being implemented in partnership with the Department of Health and Social Care as part of the Sustainable Medicines Manufacturing Innovation Programme (SMMIP). SMMIP aims to transform the pharmaceutical manufacturing sector in the UK by encouraging innovation, adoption, investment, and collaboration. The program will focus on developing disruptive technologies to increase production efficiency, reduce waste, and lower emissions in accordance with global sustainability goals.

Asia Pacific is expected to grow significantly in the sustainable bioprocessing materials market during the forecast period. Driven by the expansion of sustainable healthcare, better waste management, and government support for biopharmaceutical research. In countries such as China, India, and Japan, the use of single-use technology is increasing, regulatory frameworks are being strengthened, and local biologic sustainable manufacturing is being expanded. Vaccines, peptide-based biologics, and monoclonal antibodies are especially needed in the treatment of infectious diseases, cancer, and metabolic disorders. As a result, companies in the region are striving to make their products as environmentally friendly as possible.

China Pharma is committed to becoming a model corporate citizen and accepting full responsibility for its actions. China's medication supply chain has been restored as a result of the adoption of drug reform laws, and notable advancements have been made in resolving various challenges.

Government support is a major factor in the Indian pharmaceutical industry's adoption of sustainable practices. Policies that provide tax incentives, grants, or subsidies can reduce the financial burden on firms and speed up the adoption of environmentally friendly industrial processes. The Economic Survey 2022–2023 highlighted the importance of these measures and demonstrated the commitment of the Indian government to fostering business research and innovation.

In September 2024, Chris Qualters, CEO of TekniPlex Healthcare, says the biologics market is one of the fastest-growing segments of the pharmaceutical industry. This is a result of the growing and constantly changing need for vendors of premium components and materials who can act as genuine solution partners. We will be in a strong position to meet the demands of this industry by providing value-added solutions that aid in the introduction of potentially life-saving treatments to the market as we further enhance our concept-to-commercialization skills and capacity potential. (Source: Pharmaceutical Manufacturing)

By Material Type

By Application

By Process Stage

By End User

By Region

February 2026

January 2026

December 2025

November 2025