December 2025

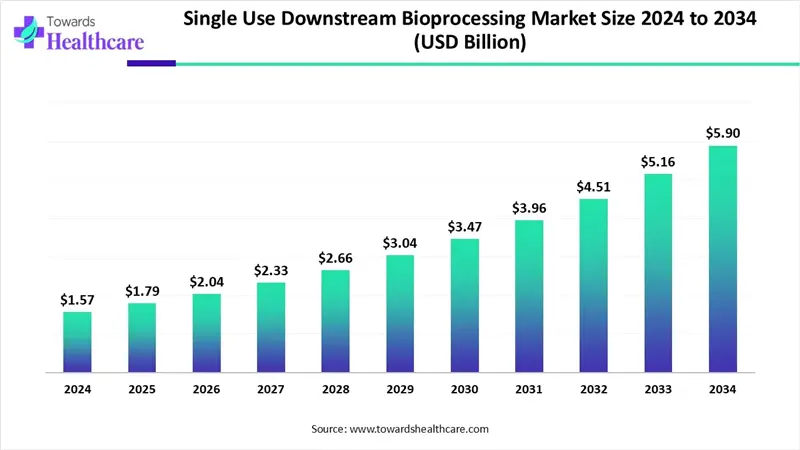

The global single-use downstream bioprocessing market size is calculated at USD 1.57 in 2024, grew to USD 1.79 billion in 2025, and is projected to reach around USD 5.9 billion by 2034. The market is expanding at a CAGR of 14.24% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 1.79 Billion |

| Projected Market Size in 2034 | USD 5.9 Billion |

| CAGR (2025 - 2034) | 14.24% |

| Leading Region | North America |

| Market Segmentation | By Product, By Operation, By End-user, By Region |

| Top Key Players | Sartorius AG, 3M Purification, Danaher (Cytiva), Repligen Corporation, Merck Millipore, Sepragen Corporation, Thermo Fisher Scientific, Inc., Meissner Filtration Products, INC., Dr. Mueller AG, Parker Hannifin Corp, Agilitech, Foxx Life Sciences |

The main advantages of single-use systems are reduced environmental impact, elimination of clean-in-place and sterilize-in-place techniques, reduced water usage, increased overall productivity and throughput, flexibility and speed in a multiproduct operational facility, and more. Single-use has lately become more common in downstream process flows for applications such as fill and finish, separation, and purification. Presentations at bioprocessing conferences that highlight the range of product categories and biopharmaceutical R&D and production applications that single-use technologies target offer a clear picture of the development of this sector.

Robots, AI, machine learning, and big data analytics are some of the intelligent automation technologies that Bioprocessing 4.0 incorporates to improve bioprocesses in the pharmaceutical industry. Because predictive analytics and AI-driven modeling reduce the risks, costs, and time associated with experiment-based procedures, they aid in the improvement of biopharmaceutical operations. It may be possible to monitor and control bioprocesses with artificial intelligence. AI-based systems enable efforts to monitor processes at different stages of the bioprocess, including downstream processes that include product purification.

Rising Demand for Biologics

When biologics were introduced, the pharmaceutical industry experienced a significant paradigm shift that prompted a reevaluation of traditional approaches to medication development and manufacturing. Pharmaceutical firms are increasing their investment in biotechnology research and development in order to capitalize on the growing demand for biologic medications. The growth of biologics has also spurred the development of manufacturing technologies, such as cell culture systems and bioreactors, enabling the large-scale production of complex biological molecules.

Environmental Concerns

Single-use bioprocessing processes produce a large amount of plastic as a byproduct. However, certain areas have implemented strict environmental rules due to concerns about the environmental effects of using disposables, which might slow down the paradigm in particular businesses.

Will Demand for Personalized Medicine Promote the Market’s Growth?

Innovation in the manufacturing of tailored medications is probably going to benefit the industry as a whole. Protein biomanufacturing may benefit from the adoption of single-use methods designed for lower-scale production, especially in downstream processes. Single-use bioprocessing will become increasingly automated and widespread in the coming years, with closed systems enabling continuous production for both upstream and downstream operations. The shift is well under way, propelled by the growing need for monoclonal antibodies and low-volume batches of gene and cell treatments in customized medicine.

By product, the single-use chromatography segment was dominant in the single-use downstream bioprocessing market in 2024. Single-use chromatography is particularly appealing to manufacturers that wish to facilitate variable facility designs, reduce contamination issues, decrease clean-area classification, and expedite time to market for closed-processing applications. This includes several different types of drug developers. Biologics companies that specialize in mAbs, recombinant proteins, and vaccines can use SU systems.

By product, the single-use filtration segment is expected to be the fastest-growing in the single-use downstream bioprocessing market during the forecast period. Single-use has gained popularity in the pharmaceutical sector as a whole over time due to the emergence of the previously stated tailored medicines, as well as other novel medical techniques. The pharmaceutical sector now relies heavily on single-use filtering systems that employ disposable parts like bags and filters, which were once only used in laboratories.

By operation, the preclinical/clinical segment led the single-use downstream bioprocessing market in 2024. A medicine typically takes 10 to 12 years to get from design to clinical testing. Pre-commercial, preclinical, and clinical bioprocessing now use disposable or single-use equipment. For example, in the preclinical and clinical stages, producers might only need one 2,000 L bioprocess to generate the necessary cell cultures.

By operation, the commercial/industrial segment is expected to be the fastest-growing in the single-use downstream bioprocessing market during the forecast period. The introduction of single-use systems (SUS) has revolutionized the biopharmaceutical sector. Compared to traditional systems, single-use solutions offer more efficiency. These innovations have revolutionized industrial processes and increased flexibility, cost-effectiveness, efficiency, and contamination control.

By end-use, the biopharmaceutical manufacturers segment held the largest share of the market in 2024. The biopharmaceutical industry began using single-use technology more than a decade ago to reduce operating costs while maintaining product quality and safety. Disposable technology can also reduce the cost and effort of change-control documentation, as well as the lead periods for commissioning and qualification. Additionally, there has been a trend toward larger disposable modules to accommodate larger production sizes. Since more process intensification is needed in DSP, alternative manufacturing approaches are employed.

By end-use, the CMOs segment is estimated to grow at the fastest rate in the single-use downstream bioprocessing market during the forecast period. Contract manufacturing organizations (CMOs) are always looking for better single-use systems for their clients. CMOs have embraced novel single-use solutions very early on in comparison to pharmaceutical researchers (innovators). This is due to the fact that CMOs are able to stay competitive by manufacturing biologics more efficiently and affordably, particularly for research and development and clinical trials.

North America dominated the single-use downstream bioprocessing market in 2024 because of a very advantageous regulatory environment, robust research and development, and the concentration of major biopharmaceutical companies. The United States has the highest proportion thanks to its extensive clinical trials and significant biologics production capabilities. The early adoption of advanced bioprocessing technologies and investments in flexible and modular facilities have cemented North America's leadership position.

The U.S. is one of the largest markets for biopharmaceuticals and leads the world in biopharmaceutical research and development. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), biopharmaceutical businesses in the U.S. invested around $96 billion in research and development in 2023. R&D carried out by U.S. biopharmaceutical businesses accounted for over 20 percent of total sales in 2023. Foreign direct investment in medicines and medications was $503.4 billion in 2023. (Source - Trade)

The Canadian government has made significant investments to increase the capacity of the country's biomanufacturing, vaccine, and pharmaceutical industries as part of the federal Biomanufacturing and Life Sciences Strategy (the Strategy). Canada's academic and scientific expertise is complemented by its capabilities in clinical development and intellectual property production, as demonstrated by the high number of biopharmaceutical medicines in the pipeline and its position as the G7 leader in clinical trial productivity. (Source - Government of Canada)

Asia Pacific is estimated to host the fastest-growing single-use downstream bioprocessing market during the forecast period. The single-use bioprocessing sector in Asia-Pacific is expanding quickly. The cost-effectiveness and scalability of single-use technologies are driving a boom in biomanufacturing operations in nations like China, India, Japan, and South Korea. These developments are in line with the area's focus on affordability and efficiency.

Over the past 10 years, China has emerged as a significant player in the global biopharma ecosystem. Due to investments in cutting-edge technology like gene and cell therapy and regulatory improvements that accelerated drug approvals, the nation has rapidly surged in the rankings. In addition to spearheading a number of advancements in precision medicine, biologics, and synthetic biology, China now produces 23% of the world's cutting-edge drug pipeline. The expansion of the National Reimbursement Drug List (NRDL) is a crucial part of China's strategy to improve access to healthcare and encourage biopharma innovation.

By 2030, the Indian bioeconomy, which is home to over 5,000 businesses and is among the world's largest suppliers of reasonably priced drugs and vaccines, is predicted to reach a valuation of $300 billion. In the Asia-Pacific region, India ranks third in terms of biotechnology travel destinations and is among the top 12 biotechnology hubs worldwide. Biotechnology in India includes biopharma, bioservices, bioagriculture, bioindustry, and bioinformatics.

Europe is expected to grow significantly in the single-use downstream bioprocessing market during the forecast period. Set apart by a well-established biopharmaceutical sector and a sophisticated regulatory environment. European biopharmaceutical firms are increasingly integrating single-use bioprocessing technologies into their manufacturing facilities to benefit from benefits including short turnaround times, lower capital costs, and greater flexibility in scaling output volumes. The region's reputation as a world hub for biopharmaceutical research and manufacturing is further strengthened by collaborative initiatives between academic institutions and industrial players that foster technical advancement and bioprocess innovation.

Germany is the world leader in medical biotechnology, second only to the United States. The strength of the industry is influenced by the presence of both new and established companies. Industry, government, and the research community are collaborating to reinforce the already strong commercial foundations of the thriving sector. Thanks to its excellent research infrastructure, globally renowned expertise, and the largest number of biotech companies in Europe, Germany has cemented its status as a worldwide hub for medical biotechnology.

A top-tier talent pool, long-term vision, and collaboration with the government support the UK's booming, international biopharmaceutical business. With a global market value of $1.5 trillion, the biopharmaceuticals sector is one with strong development prospects. This expansion and potential have been facilitated by AI applications in R&D and healthcare, data and empirical evidence, advanced medicines, drug discovery, bioprocessing and bioengineering, and research and development (R&D) services. The innovative biotech and life sciences sector in the UK has already attracted £1.98 billion in investment in Q1 and Q2 2024, up from £1.80 billion the previous year.

In October 2024, according to Shakthi Nagappan, Director of Lifesciences and Pharma for the Government of Telangana, this partnership with Thermo Fisher is a significant step in our efforts to build a first-of-its-kind bioprocessing facility for biologics manufacture in India. The center will help the biopharma sector by offering pay-per-use infrastructure, technological expertise, and cutting-edge research solutions that will help companies reduce their time to market through its single-use bioreactors. In addition to boosting Telangana's biopharma manufacturing industry, it will improve India's reputation abroad. (Source - Express Healthcare)

By Product

By Operation

By End-user

By Region

December 2025

November 2025

November 2025

January 2026