December 2025

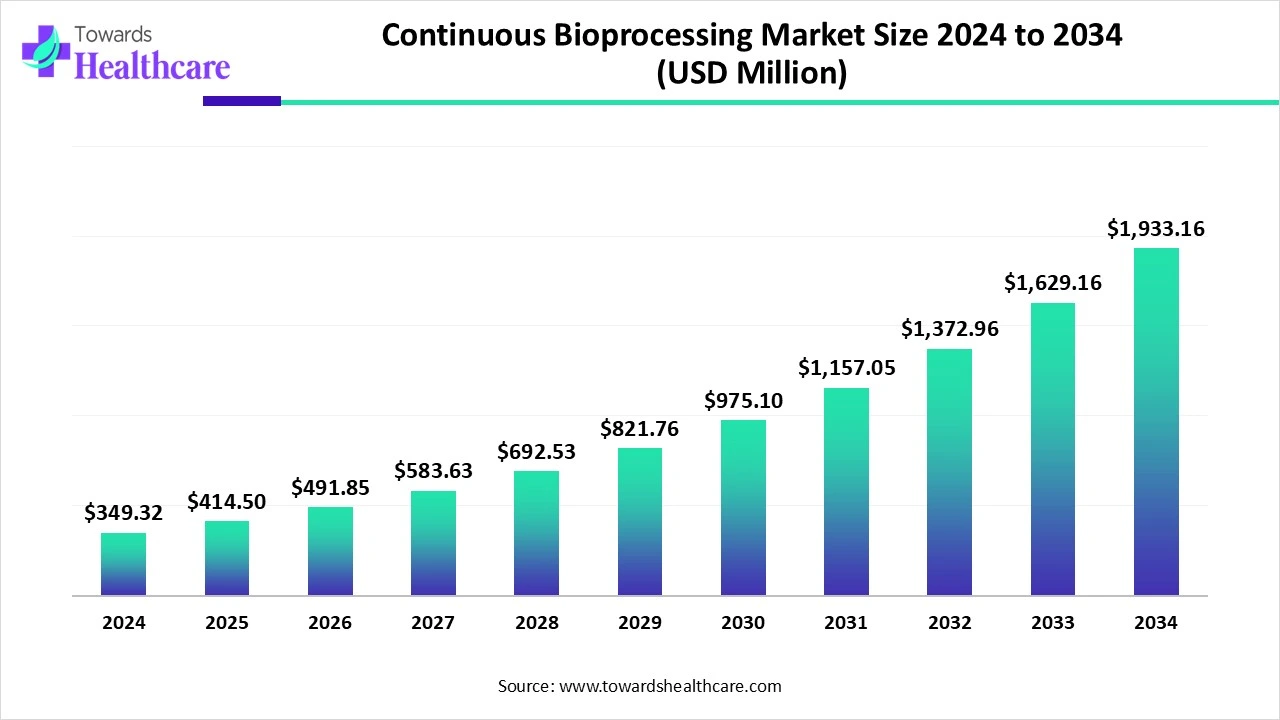

The global continuous bioprocessing market size is calculated at USD 349.32 in 2024, grew to USD 414.5 million in 2025, and is projected to reach around USD 1933.16 million by 2034. The market is expanding at a CAGR of 18.66% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 414.5 Million |

| Projected Market Size in 2034 | USD 1933.16 Million |

| CAGR (2025 - 2034) | 18.66% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By End Use, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Danaher, WuXi Biologics, Sartorius AG, Asahi Kasei Bioprocess America, Inc., Ginkgo Bioworks, GE Healthcare, Repligen Corporation, Merck KGaA |

The biological drugs are often faced with production or quality-related problems. Hence, to overcome these problems, various industries are focusing on the continuous production of biopharmaceuticals and process intensification. This, in turn, increases the adoption of continuous bioprocess techniques. It decreases production costs, shortages, variability, facility footprints, and capital costs. Similarly, it enhances the manufacturing flexibility, product yield, and simplifies scale-up methodologies. Furthermore, with the help of a real-time monitoring and control system, the product life cycle can be monitored. Thus, continuous bioprocessing enhances the product stability, availability, as well as reduces its cost.

The use of artificial intelligence (AI), machine learning (ML), process automation, etc., is contributing to the digital transformation of continuous bioprocesses. The data obtained during the continuous bioprocess is systematically analyzed and forecasted with the help of AI. This, in turn, improves the control and synchronization of the process, which in turn enhances its performance and efficiency. Furthermore, the AI helps to address challenges during the continuous bioprocessing, such as nonlinearity, resource availability, complex metabolisms, parameter dimensionality, and risk mitigation.

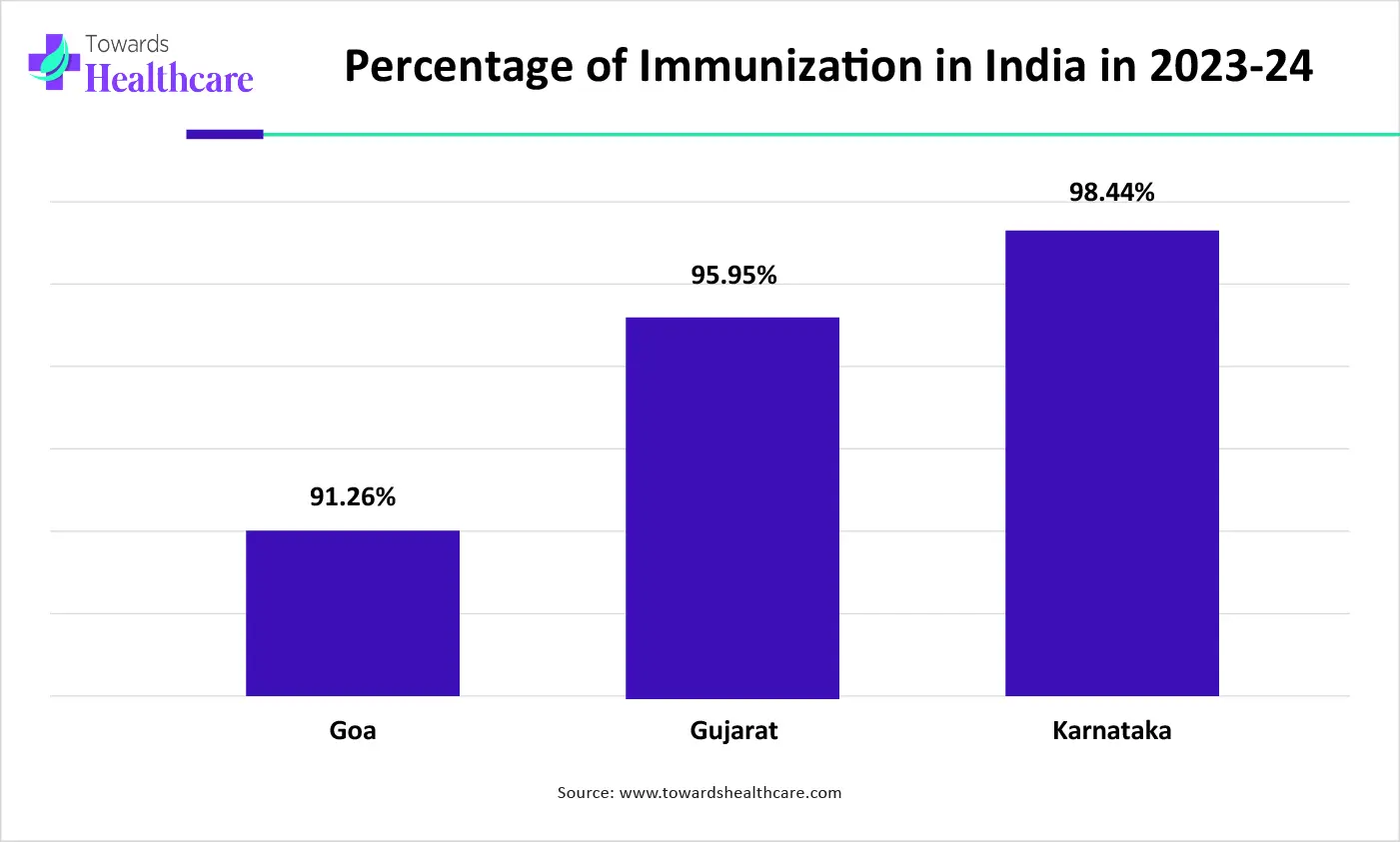

Rising Awareness About Vaccination

The increasing awareness about the importance of vaccination is increasing their demand in the market. Furthermore, various programs are also being conducted by the government, as well as the private sector. Thus, with the help of continuous bioprocessing, the vaccine can be produced at a faster rate. At the same time, large-scale production is also possible, which is a reliable method of production. This, in turn, provides more flexible and efficient production. Thus, rising awareness drives the continuous bioprocessing market growth.

The graph represents the percentage of immunization coverage in India in FY 2023-2024. It indicates that there is a rise in immunizations conducted, which increases the demand for vaccination for the effective management of rising diseases. Thus, this in turn will ultimately promote the market growth. (Source - Ministry of Health and Family Welfare)

High Cost

Continuous bioprocessing requires sophisticated equipment, which may be costly. At the same time, their maintenance as well as monitoring requires a skilled or an expert person. Moreover, continuous bioprocessing is a complex process, which further makes it a time-consuming method. Thus, all these factors add up to the cost, which in turn can impose a restraint on the market growth.

Rising Gene and Cell Therapies

Gene and cell therapies are being used in various diseases, which is increasing their demand in the market. This, in turn, increases the production process within the companies. Hence, the use of continuous processing for rapid and effective gene and cell therapies increases. It helps in the production without altering the quality, as well as the environmental conditions required for the production. It also reduced the risk of cross-contamination within the products. Furthermore, it can also be used for personalized therapy production. This promotes the continuous bioprocessing market growth.

For instance,

By product type, the consumables & reagents segment dominated the market in 2024. This segment dominated because the consumables & reagents were used repeatedly in the continuous bioprocessing. Furthermore, they provided stable conditions and environment in the production process, which contributed to the continuous bioprocessing market growth.

By product type, the instruments segment is estimated to grow significantly at a notable CAGR during the forecast period. The instruments help in maintaining the stability as well as the product quality. They also minimize the errors, which enhances the safety of the product being developed.

By application type, the monoclonal antibodies segment dominated the market in 2024. The segmental growth is attributed to the increasing use of monoclonal antibodies in chronic disorders, such as cancer, autoimmune disorders, and infectious diseases, as well as its potential for large-scale production. The monoclonal antibodies were used in various treatment approaches. Its quality as well as the production was enhanced with the use of continuous bioprocessing, which enhanced the market growth.

By application type, the vaccine segment is anticipated to be the fastest growing during the forecast period. The increasing demand, as well as rising awareness, are increasing the use of vaccines. Thus, this is increasing the adoption of continuous bioprocessing.

By end use, the pharmaceutical and biotechnology segment dominated the global continuous bioprocessing market in 2024. The growing demand for the use of biologics, gene therapies, etc., has increased the use of continuous bioprocessing as well as their adoption for the same in the industries. This promoted the market growth.

By end use, the CMOs & CROs segment is predicted to grow at the fastest rate during the forecast period. The CMOs & CROs are utilizing the continuous bioprocessing method in the development of various new treatment options during clinical trials.

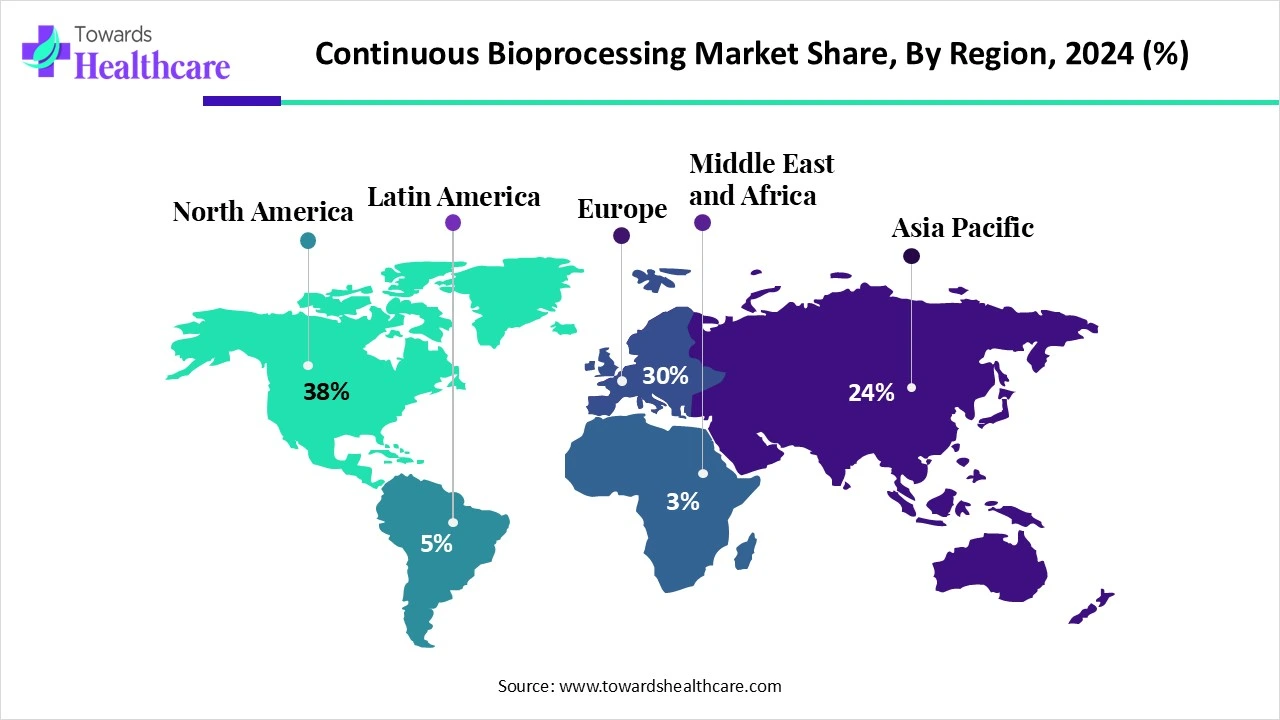

North America dominated the continuous bioprocessing market in 2024. North America consisted of well-developed research and development sectors, which increased the use of continuous bioprocess to enhance the production rates. This contributed to the market growth.

The industries in the U.S. are using different advanced technologies as well as continuous bioprocessing methods to improve the production of various biologics. At the same time, the availability of specialized equipment enhances the workflow.

The increasing research in the industries as well as institutes is increasing the use of continuous bioprocessing for various products. This, in turn, is also growing the number of collaborations within the industries and institutions, along with the funding provided by the government.

Asia Pacific is estimated to host the fastest-growing continuous bioprocessing market during the forecast period. Asia Pacific is experiencing a rise in the growth of various industries. This is increasing the adoption of various new advanced technologies, as well as methods such as continuous bioprocessing. This is also supported by the government investments.

For instance,

The industries in China are utilizing various new methods and technologies, along with sophisticated infrastructure, to enhance the production of various products. This is also driven by the increasing demand for the use of gene therapies.

The industries in India are growing, as well as the rising demand, and diseases are also increasing the demand for the use of continuous bioprocess technology, to increase the manufacturing of different formulations. To make them affordable, the government is also providing its support.

Europe is expected to grow significantly in the continuous bioprocessing market during the forecast period. The increasing awareness about the use of biologics, gene or cell therapies, and vaccination in Europe is increasing the demand in the market, which in turn increases the use of continuous bioprocessing. Thus, this promotes the market growth.

Germany is increasing the use of continuous bioprocess in various industries to meet the rising demands for various effective treatment options. At the same time, to make the production process more reliable, it is with compliance of regulatory guidelines.

The rising awareness in the UK is increasing the demand for various medications. This, in turn, increases the production rates within the companies with the help of continuous bioprocessing.

Latin America is expected to grow at a notable CAGR in the continuous bioprocessing market in the foreseeable future. The growing demand for biologics and the rising prevalence of chronic disorders boost the market. Latin American countries have suitable manufacturing infrastructure for biologics. Government organizations emphasize the importance of immunization, thereby increasing the demand for vaccines. They also support local manufacturing of biologics. The growing need for cost-effective biosimilars also drives market growth.

COFEPRIS regulates the approval of biosimilars and biologics in Mexico. The Mexican government has partnered with Gavi to support the objectives of the development policy to fight the global pandemic and improve maternal and infant health by increasing access to vaccination.

In July 2024, Bio-Manguinhos/Fiocruz, the largest vaccine manufacturer of Latin America, announced its partnership with CEPI to support faster and more equitable responses to future emerging infectious disease threats. The $17.9 million investment from CEPI enables the company to expand its existing vaccine manufacturing capabilities by developing new rapid-response mRNA and viral vector vaccine technology platforms.

The Middle East & Africa are expected to grow at a considerable CAGR in the continuous bioprocessing market in the upcoming period. The presence of a suitable manufacturing infrastructure and the growing need for personalized medicines bolster market growth. Government organizations support the development of biologics through funding and initiatives. The rising adoption of advanced technologies and increasing collaborations with contract research organizations favor market growth.

In April 2025, Burjeel Holdings announced a collaboration with Caring Cross to manufacture CAR T-cell therapies in the UAE at affordable rates. Burjeel aims to establish a GMP manufacturing facility in Abu Dhabi. The Department of Health, Abu Dhabi, also collaborates with private companies to enhance clinical research and development and manufacturing.

Companies like Eppendorf, Sartorius, and Cytiva Lifesciences provide continuous bioprocessing systems in South Africa. As of August 2025, a total of 203 and 105 clinical trials are registered on the clinicaltrials.gov website related to vaccines and monoclonal antibodies, respectively.

By Product

By Application

By End Use

By Region

December 2025

November 2025

November 2025

October 2025