February 2026

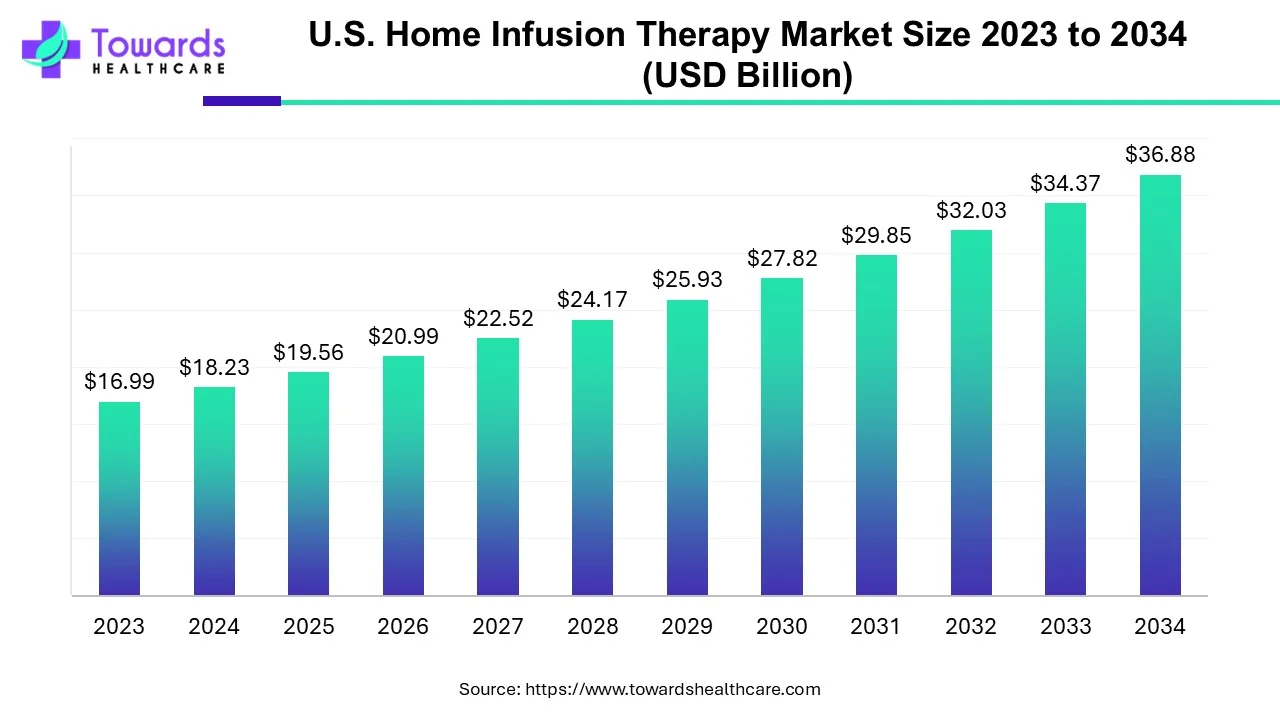

The U.S. home infusion therapy market is predicted to expand from USD 19.56 billion in 2025 to USD 39.57 billion by 2035, growing at a CAGR of 7.3% during the forecast period from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 20.99 Billion |

| Projected Market Size in 2035 | USD 39.57 Billion |

| CAGR (2026 - 2035) | 7.3% |

| Market Segmentation | By Product, By Application |

| Top Key Players | Option Care Health, Inc., B. Braun Medical, Inc., Baxter International Inc., Fresenius Kabi USA, Amedisys, Inc., CareCentrix, Inc., ICU Medical, Smiths Medical, Inc., CareFusion, Caesarea Medical Electronics Ltd. |

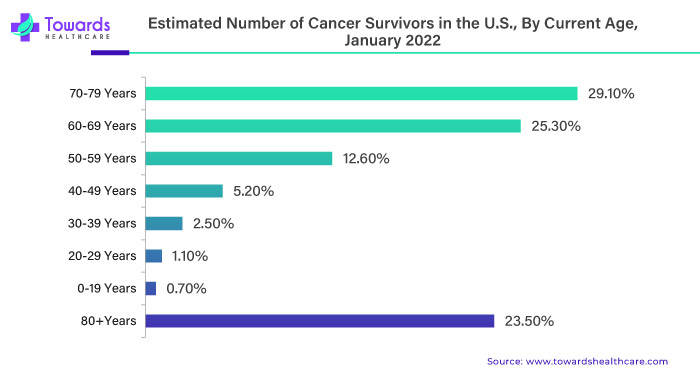

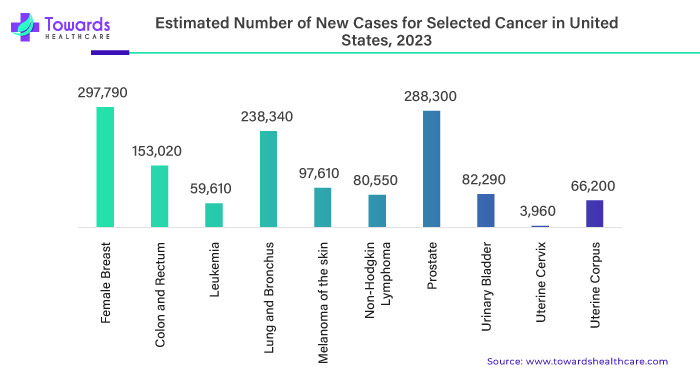

According to the American Cancer Society, approximately 1.8 million people were diagnosed with cancer, with over 600,000 people expected to die as a result of this challenging disease. Home infusion allows patients to manage cancer treatment actively, giving them greater control.

The COVID-19 pandemic hit a pause on elective surgeries, causing a dip in the need for follow-up home care. Thanks to cost-cutting by slashing inpatient stays and a buffet of infusion device options. Home infusion therapy (HIT) takes the healthcare party directly to a patient's doorstep at home, nursing home, hospital or outpatient clinic. But, also, a knowledge gap looms between the home infusion experts and the clinicians, potentially leading to less-than-stellar outcomes. Let's bridge that gap for optimal therapeutic adventures.

U.S. Home infusion therapy is like bringing the hospital to your home! It's a specialized healthcare service where patients receive medications through a needle or catheter at home instead of going to a medical facility. This method is often used for conditions requiring ongoing treatments, like infections, chronic illnesses or pain management. A trained healthcare professional usually administers the infusions, ensuring patients can comfortably manage their treatment in the familiar environment of their own homes. It offers convenience and personalized care, making the healing process a bit easier.

U.S. home infusion therapy has become increasingly popular, especially in cancer treatment, as it involves delivering medications directly into a patient's bloodstream through intravenous (IV) infusion within the comfort of their home. Several key factors drive this shift. The patients appreciate the comfort and convenience of receiving treatment at home, bypassing the need for frequent hospital or clinic visits. This enhances the overall quality of life for individuals undergoing prolonged or regular therapies and allows for a more personalized care approach. Healthcare professionals can better tailor the schedule and dosage of medications to suit each patient’s needs and lifestyle.

Additionally, regarding comfort and personalization, U.S. home infusion therapy reduces healthcare costs in the long run. Although there may be initial setup expenses, the overall financial burden is alleviated by fewer hospital visits, leading to decreased transportation costs, less strain on healthcare facilities and potentially lower insurance expenses. Technological advances are crucial, making administering complex therapies at home easier. Portable infusion pumps and remote monitoring capabilities enable healthcare providers to closely track a patient's progress without constant in-person visits.

Furthermore, U.S. home Infusion therapy empowers patients to manage their treatment actively, fostering an increased sense of control. This empowerment can have positive effects on the psychological and emotional well-being of individuals grappling with cancer. Moreover, avoiding infections is a significant benefit, considering hospitals can be breeding grounds for pathogens. Home infusion minimizes the risk of exposure to harmful infections, which is particularly crucial for patients with compromised immune systems, such as those undergoing cancer treatment. While the prevalence of cancer has fueled the growth of the home infusion therapy market, its appeal extends beyond oncology to encompass other chronic conditions requiring ongoing intravenous treatments. This trend underscores a broader shift towards patient-centric healthcare, aiming to enhance medical interventions' effectiveness and overall experience.

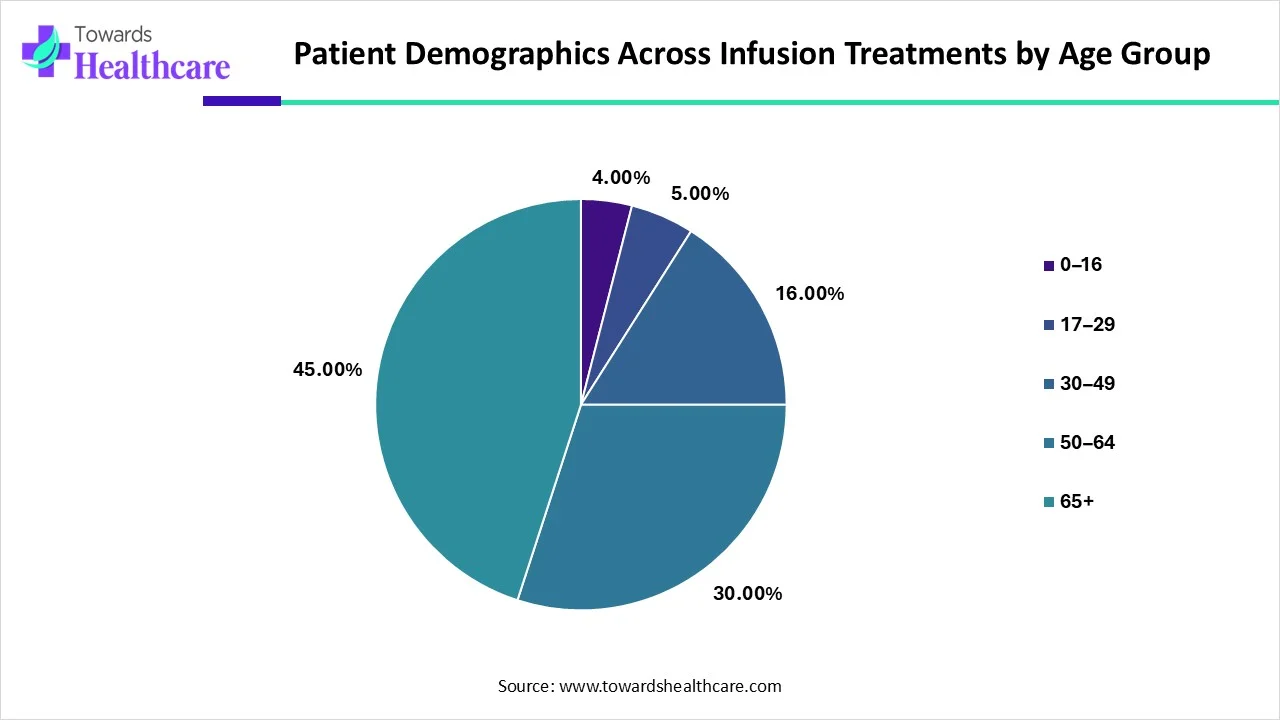

| Age Group | Share of Patients (%) |

| 0–16 | 4.00% |

| 17–29 | 5.00% |

| 30–49 | 16.00% |

| 50–64 | 30.00% |

| 65+ | 45.00% |

Imagine a world where receiving medical treatments becomes more comfortable and efficient. Elastomeric devices, essentially flexible and stretchy gadgets, are being innovated to make home infusion therapies easier to adopt. These devices use intelligent materials that can adapt to the body's movements, providing a user-friendly experience for patients undergoing infusion therapies. The goal is to enhance comfort and convenience and encourage more people to embrace these important medical treatments.

The Elastomeric Pump Device, offered by Balmers Pump, serves diverse purposes in drug delivery, catering to needs such as administering antibiotics, chemotherapeutic drugs, analgesics and local anesthetics. Its applications span various medical fields, including postoperative analgesia, ambulatory chemotherapy and outpatient parenteral antibiotic therapy (OPAT). Post-surgery, these pumps effectively manage acute pain and improve the patient's quality of life by maintaining optimal drug plasma levels. Ambulatory chemotherapy enables patients to receive infusions comfortably at home, ensuring adherence to treatment regimens without disrupting daily routines. Additionally, Elastomeric Pumps contribute to the growth of outpatient parenteral antibiotic therapy (OPAT) services, offering cost-effective, user-friendly solutions that enhance patient mobility and streamline the overall care process. As a result, these applications contribute to the global expansion of the market for Elastomeric Pump Devices.

The U.S. home infusion therapy market faces a friendly challenge with healthcare policies. Currently, these policies mainly support treatments in hospitals or clinics, making it a bit tricky for home infusion to become more widespread. The rules and how insurance pays for things favor treatments in healthcare buildings. These policies might only partially show how excellent home infusion therapy is. We need our healthcare rules to be more open and friendly towards this convenient way of getting treatment at home. Our healthcare guidelines need an update to fully embrace the great possibilities of home infusion therapy.

| Site of Care | Share of Infusion Therapy Treatments (%) |

| Hospital | 55% |

| OIC (Office Infusion Center) | 27% |

| AIC (Ambulatory Infusion Center) | 6% |

| Home | 12% |

By product, the infusion pumps segment held a dominant presence in the market in 2024. This segment dominated because infusion pumps are an essential component of infusion therapy to deliver medications or other fluids. The availability of ambulatory infusion pumps boosts the segment’s growth. They are portable and wearable pumps and can be used by patients anywhere. Technological advancements have led to the development of smart pumps with safety features, including user alerts. The pump can alert the user about any adverse reaction or dose maintenance.

By product, the needleless connectors segment is expected to grow at the fastest CAGR in the market during the forecast period. The increasing risk of needlestick infections necessitates healthcare professionals to use needleless connectors. Needleless connectors are devices that allow quick access to the infusion line, ensuring a secure connection. The medications and fluids are directly administered to the patient through catheters. They are widely used as they are safer with reduced complications.

By application, the anti-infective segment held the largest share of the market in 2024. This is due to the rising prevalence of infectious diseases and the need for targeted delivery. They are used in different types of diseases, such as pneumonia, meningitis, sepsis, herpes, cytomegalovirus, candidiasis, etc. At-home anti-infective infusion therapy allows patients to avoid hospitalizations for severe infections. This approach delivers medications directly into the bloodstream, supporting the body’s healing process.

By application, the endocrinology segment is expected to grow with the highest CAGR in the market during the studied years. The rising cases of diabetes and other endocrine disorders facilitate the need for home infusion therapy. The most common therapies include hormone therapy, such as testosterone, estrogen, and insulin. This therapy works by lowering the amount of hormones in the body or by blocking their action. According to the International Diabetes Federation, approximately 589 million people were living with diabetes in 2024. (Source: https://idf.org/about-diabetes/diabetes-facts-figures/)

The geographical landscape for the U.S. home infusion therapy market varies, with growth observed in both developed and developing regions. In developed countries like the United States and Western European nations, an aging population and a preference for home-based healthcare contribute to market expansion. Developing regions, driven by improving healthcare infrastructure and rising awareness, also show increasing adoption of home infusion services. Regulatory frameworks, reimbursement policies and each region's healthcare landscape may influence market dynamics. The National Home Infusion Association (NHIA) estimated that approximately 3.2 million people receive home infusion services in the U.S. annually. (Source: NHIF)

By Product

By Application

February 2026

February 2026

February 2026

February 2026