According to WHO, collaboration and digitalization have played critical roles in bringing COVID vaccines and therapies to market at an unprecedented rate, saving an estimated 750,000 lives in the United States and Europe alone, and raising demand in the global life sciences tools market.

Life sciences tools refer to various instruments, equipment, reagents, and software used in biological research, diagnostics, and drug discovery. These tools are essential for studying and manipulating biological systems at the molecular, cellular, and organism levels. Examples include DNA sequences, mass spectrometers, microscopes, gene editing tools, and various analytical instruments. Life sciences tools are crucial in advancing and understanding biology, enabling medical discoveries, and facilitating the development of new therapies and diagnostic methods.

The life sciences tools market has experienced growth due to advancements in technology, increased research activities, and rising demand for personalized medicine. Emerging fields like genomics, proteomics, and synthetic biology have driven the demand for sophisticated tools like next-generation sequencing and gene editing technologies. Additionally, the collaboration between academia and industry and government initiatives have fueled innovation, expanding the market for life sciences tools. Overall, the growing biological mechanisms and development of targeted therapies have contributed to the expansion of this market.

Life sciences tools encompass various technologies used to study living organisms. Critical applications include Genomics, Proteomics, Cell Biology, Bioinformatics, and Diagnostic Tools. The continuous advancement of life sciences tools enhances understanding of living systems and contributes to breakthroughs in medicine, agriculture, and environmental science.

Several key life science technologies contribute significantly to the market's growth. These technologies drive innovation, enhance research capabilities, and play a pivotal role in advancing our understanding of biological processes. Next-generation sequencing (NGS) technologies have revolutionized genomics research by enabling rapid and cost-effective DNA sequencing. This has led to breakthroughs in understanding genetic variations, identifying disease markers, and advancing personalized medicine. CRISPR-Cas9 has transformed molecular biology, allowing precise and targeted editing of genes. This technology has immense potential for understanding gene functions, developing therapeutic interventions, and creating genetically modified organisms for various applications.

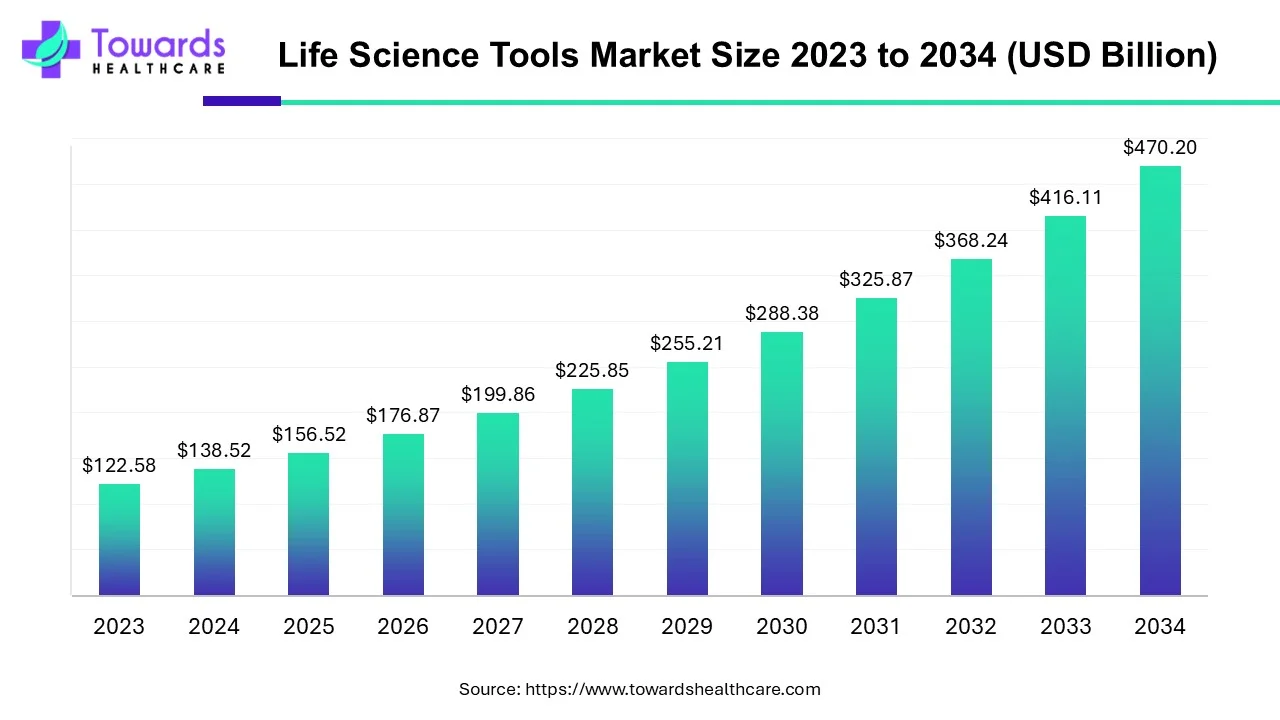

The global life science tools market size is forecast to grow at a CAGR of 13%, from USD 156.52 billion in 2025 to USD 470.20 billion by 2034, over the forecast period from 2025 to 2034, as a result of the growing R&D and technology advancements.

Digital Transformation in Life Sciences

Life sciences companies are increasingly integrating digital tools into their operations, yet they still trail behind other industries in digital maturity. Despite advancements, they struggle with fully leveraging digital capabilities due to misalignment of incentives and the need for agility.

Advancements in Research and Development Tools

The application of digital and analytics tools in research and development (R&D) is yielding significant benefits. These tools are helping to de-risk drug discovery, accelerate clinical trials, and enhance interactions with healthcare providers and patients. However, the full potential of these tools is still being realized.

Growth in Patents and Publications

In 2023, 3.55 million patent applications were filed globally, accounting for a 2.7% increase from 2022. Publications in digital and analytics tools for life sciences have also increased, indicating a growing focus on advancing research capabilities.

Venture Funding and Investments

Venture funding in digital health, which includes investments in life science tools, peaked during the COVID-19 pandemic and remains high. Investments have focused on tools and solutions for commercial applications, research, early development, and regulatory and safety processes. This influx of funding is driving innovation and development in life science tools.

The availability of state-of-the-art research and development facilities and increasing investments boost the market. The number of life science researchers in the U.S. is more than 545,000. The National Institute of Health invested around $26.4 billion as of August 2024 into the life science and healthcare sector.

Canada comprises more than 2,000 life sciences firms, employing more than 220,000 people. In 2023, approximately $82.1 billion was contributed by pharmaceuticals and medical manufacturing to Canada’s GDP. In February 2025, the Government of Canada announced an investment of $6 million for AdMare Bioinnovations to support the establishment of a new life sciences Innovation Center in Vancouver.

Lionel Matthys, Chief Product Officer, Overture Life, commented that Parallel Fluidics’ microfluidic systems such as MV-2 provide advanced care in fertility treatments by precise fluid control and manage sensitive biological samples without wastage. This enables faster, more reliable processes to enhance patient outcomes and drive innovation in reproductive medicine.

Partner with our experts to explore the Life Science Tools Market at sales@towardshealthcare.com