February 2026

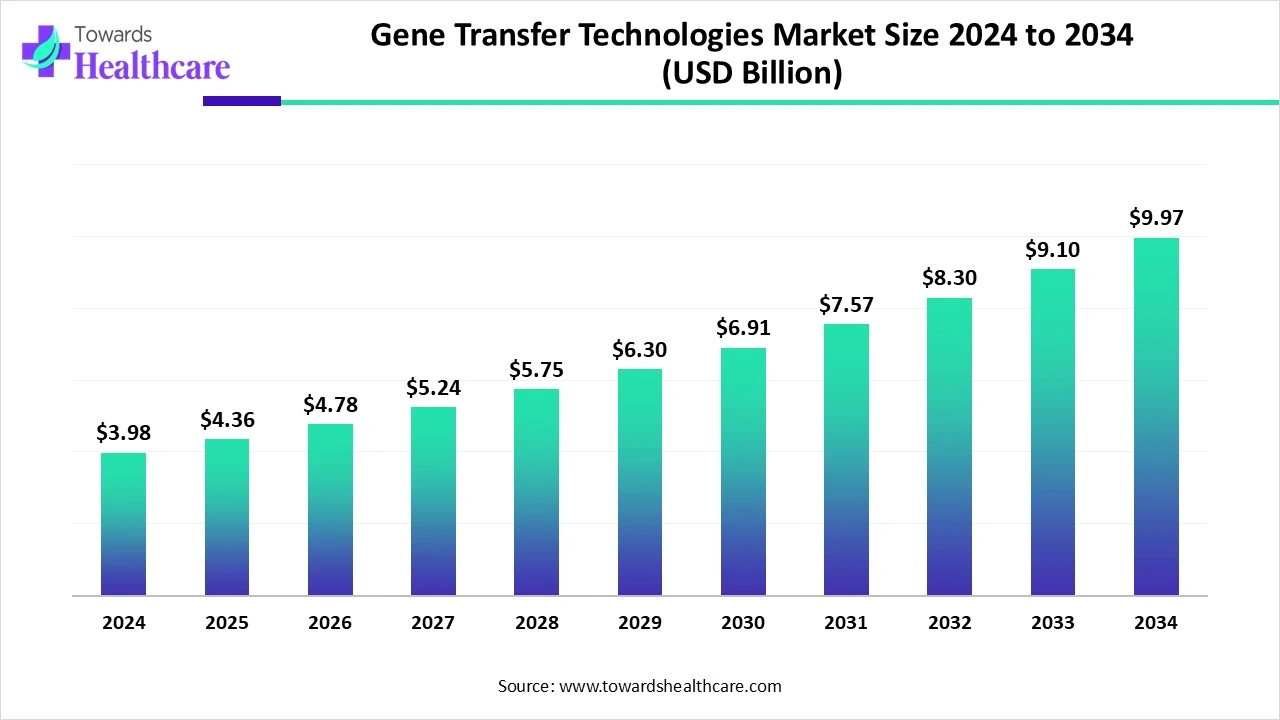

The global gene transfer technologies market size in 2024 was US$ 3.98 billion, expected to grow to US$ 4.36 billion in 2025 and further to US$ 9.97 billion by 2034, backed by a robust CAGR of 9.62% between 2025 and 2034.

The global gene transfer technologies market is expanding rapidly, driven by advancements in molecular biology, growing demand for precision medicine, and the rising prevalence of genetic disorders. From viral vectors to non-viral delivery systems, the innovation pipeline continues to diversify, catering to various therapeutic and research applications.

| Metric | Details |

| Market Size in 2025 | USD 4.36 Billion |

| Projected Market Size in 2034 | USD 9.97 Billion |

| CAGR (2025 - 2034) | 9.62% |

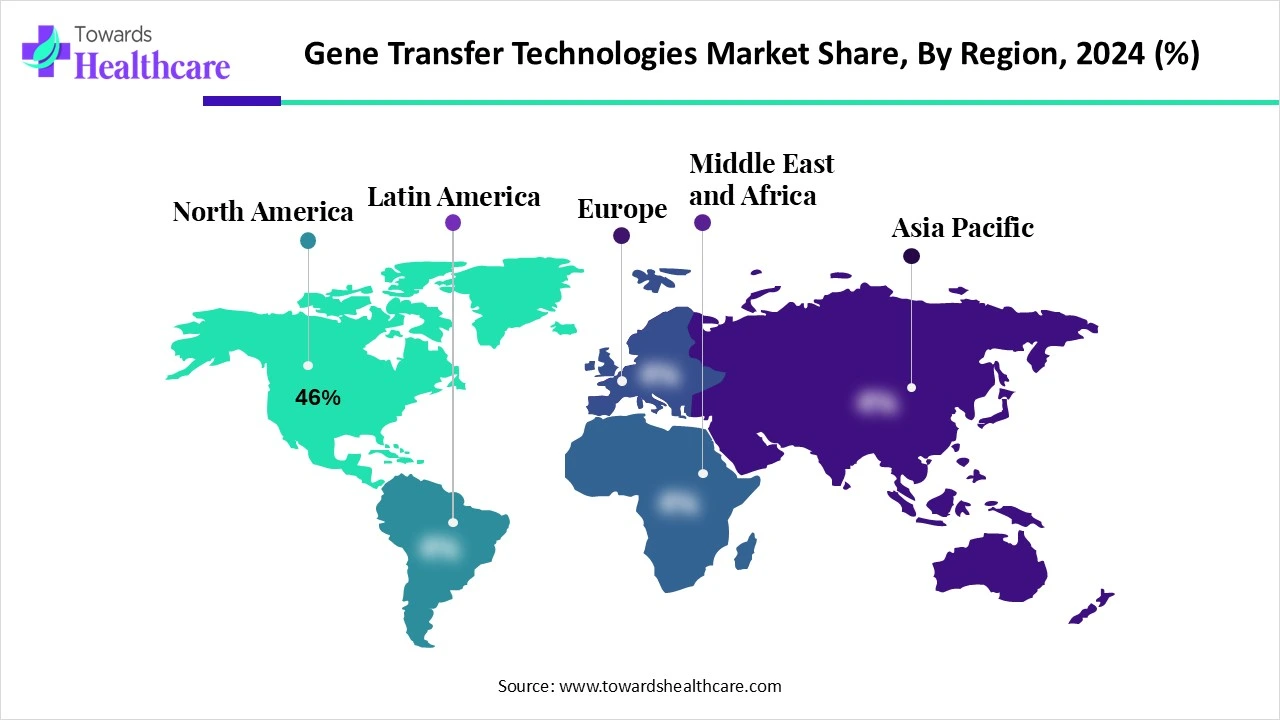

| Leading Region | North America Share 46% |

| Market Segmentation | By Delivery Method, By Vector Type, By Mode of Delivery, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Lonza Group AG, Merck KGaA, Sartorius AG, Takara Bio Inc., Charles River Laboratories, Bio-Techne Corporation, Polyplus-transfection SA, Synthego Corporation, Addgene, Aldevron, OriGene Technologies, Inc., Precision NanoSystems, Acuitas Therapeutics, Vigene Biosciences, 4D Molecular Therapeutics, Regenxbio, Inc., CureVac AG, Evonik Industries, Transposagen Biopharmaceuticals |

The gene transfer technologies market includes tools, platforms, and systems used to deliver exogenous genetic material such as DNA, RNA, or gene-editing constructs into target cells. This is a fundamental process in gene therapy, vaccine development, regenerative medicine, functional genomics, and transgenic research. Technologies range from viral vectors (AAV, lentivirus, retrovirus) to non-viral methods like electroporation, lipid nanoparticles (LNPs), and physical/mechanical delivery systems. The market is rapidly growing due to the surge in gene therapy pipelines, expansion of mRNA vaccine platforms, and increased use in cell engineering and biomanufacturing.

Gene transfer technology has transitioned from experimental research to real-world therapeutic applications. Its influence spans from treating inherited diseases to enabling immunotherapies and cell-based interventions. The market is witnessing a surge in collaborations between biotech firms and research institutions to innovate safer and more efficient delivery systems. Increasing government support for genomic initiatives is fueling R&D, especially in rare diseases and oncology. With expanding clinical pipelines and regulatory encouragement, market growth is poised to accelerate. Technological convergence is making gene transfer not only a therapeutic tool but also a strategic asset in personalized medicine.

Artificial Intelligence is redefining the landscape of gene transfer technologies. It enables predictive modelling for gene vector design, drastically reducing R&D timelines. AI tools analyze vast datasets from clinical trials, helping optimize gene delivery efficiency and safety profiles. With machine learning algorithms, researchers can simulate and assess multiple transfer strategies before wet-lab testing. AI also enhances automation in gene-editing workflows, improving precision and reducing manual error. As a result, AI not only accelerates development but also improves the scalability of these technologies. The synergy between AI and gene transfer platforms is poised to deliver more targeted, effective, and economically viable therapies.

Rising Genetic Disease Burden Fueling Market Momentum

The increasing incidence of genetic disorders is a primary force behind the growth of gene transfer technologies. With over 10,000 known genetic conditions, the need for advanced therapeutic options is more critical than ever. Gene transfer holds the promise to correct or replace faulty genes, offering potential cures instead of symptomatic treatments. Moreover, advancements in gene editing tools make it easier to target specific genes with minimal off-target effects. The growing awareness of gene therapy options among patients and physicians is driving clinical adoption. Regulatory bodies are also streamlining approval processes, further boosting market penetration. Together, these factors are propelling the demand for innovative gene transfer platforms.

High Costs and Regulatory Complexities Tempering Growth

Despite immense promise, the market faces key challenges. High development and manufacturing costs hinder widespread adoption, especially in low- and middle-income regions. The complexity of regulatory approval processes adds delays and expenses. Ethical concerns surrounding gene modification continue to evoke public skepticism, especially in reproductive and embryonic applications. Moreover, inconsistent global standards make international commercialization difficult. Limited access to skilled professionals and high-end infrastructure is another barrier in developing countries. These constraints, if not addressed, could slow the pace of innovation and limit the accessibility of these technologies.

Expanding Application Horizons Beyond Human Therapeutics

The potential of gene transfer technologies extends well beyond human health. Opportunities are burgeoning in veterinary gene therapy, crop genetic engineering, and synthetic biology. The agriculture sector is exploring gene transfer for drought-resistant and pest-resistant crop development. In animal health, gene therapy is emerging as a solution for inherited diseases in livestock and pets. The increasing focus on sustainable biotechnology solutions opens new markets for gene transfer innovations. Moreover, with the rise of biomanufacturing, gene transfer methods are vital in producing biologics and enzymes. These emerging avenues provide significant untapped market potential for developers and investors alike.

The viral vectors segment was dominant, with the biggest share of the gene transfer technologies market in 2024, owing to their high efficiency in delivering genetic material into host cells. Adeno-associated viruses and lentiviruses are particularly favored due to their proven safety profiles and ability to target both dividing and non-dividing cells. These vectors mimic natural viral infection mechanisms, making them highly effective tools in gene therapy. Their role is especially critical in treating genetic disorders, cancers, and some neurological diseases. Regulatory agencies have already approved several viral vector-based therapies, which have further cemented their credibility. The scalability of viral vector manufacturing is also improving, reducing previous production bottlenecks.

The segment dominance is also linked to their integration into clinical pipelines by major pharma players. Research institutions and biotech firms heavily rely on viral vectors for developing personalized and rare disease therapies. Moreover, public-private partnerships are accelerating innovation in viral delivery systems. Despite their complex development cycle and biosafety considerations, viral vectors remain the backbone of modern gene therapy. Their continued dominance reflects the clinical confidence and infrastructure already built around them. As more commercial applications emerge, their relevance will only grow stronger.

The non-viral segment is expected to have the fastest growth in the market during the forecast period, challenging the traditional dominance of viral vectors. These methods, including electroporation, lipid nanoparticles, and CRISPR-based direct editing, offer lower immunogenicity and a cleaner safety profile. Their rise is supported by innovations in nanotechnology and biocompatible delivery systems. Unlike viral systems, non-viral approaches do not carry risks of insertional mutagenesis, making them suitable for repeated dosing. Additionally, they are easier and more cost-effective to produce at scale. Their flexibility allows customization for a wide range of therapeutic applications.

What makes them truly revolutionary is their compatibility with DNA-based vaccines, which gained global validation during the COVID-19 era. Biotech startups and academic labs are increasingly shifting toward non-viral tools for regenerative medicine and in vivo gene editing. As regulatory pathways evolve to accommodate these newer techniques, their market share is expected to expand rapidly. Their non-integrative nature makes them ideal for transient expression therapies. With growing interest in non-invasive and re-doable gene therapies, non-viral methods are carving a distinct space in the market landscape.

The AVV vectors segment was dominant, with the biggest share of the gene transfer technologies market in 2024, due to the non-pathogenic nature and ability to achieve long-term gene expression, which has made them the vector of choice for many FDA- and EMA-approved therapies. It offers tissue-specific targeting, enabling precise delivery to organs like the liver, muscles, and retina. Their proven track record in treating hemophilia, spinal muscular atrophy (SMA), and retinal dystrophies has earned them a leadership position. Furthermore, advancements in capsid engineering are improving their specificity and reducing immunogenicity.

The dominance of AAV vectors is supported by robust manufacturing capabilities and regulatory acceptance. Startups and big pharma alike are pouring resources into enhancing AAV delivery platforms. With scalable production and a favorable clinical history, AAVs continue to anchor the vector landscape. Their versatility supports both in vivo and ex vivo applications.

The herpes simplex virus segment is expected to grow at the fastest CAGR in the market during the forecast period, as large genome size enables them to carry bigger therapeutic payloads, which is a key advantage over other vectors. HSV vectors also have a natural affinity for neural tissues, making them ideal for gene therapies targeting the central nervous system. Researchers are particularly interested in their potential for treating glioblastomas, chronic pain, and neurodegenerative diseases. Modified HSVs offer reduced pathogenicity while maintaining efficient transduction. Clinical trials using HSV-based vectors are expanding globally.

The fast growth of the herpes simplex virus segment is being driven by unmet needs in neurology and oncology. They offer an excellent platform for combination gene therapies and oncolytic virus-based treatments. As new vector engineering techniques improve their safety, the confidence in HSV systems is rising. Partnerships between academia and biotech firms are accelerating development in this space.

The ex vivo gene transfer segment was dominant, with the biggest share of the gene transfer technologies market in 2024, due to its precision and controlled environment. In this method, cells are extracted from the patient, genetically modified in the lab, and reintroduced. It allows for in-depth quality checks, safety verification, and targeted alterations before reinfusion. This approach is widely used in CAR-T therapy, hematopoietic stem cell modification, and inherited blood disorders. The clinical success of ex vivo therapies has made it the gold standard for many high-risk diseases. It minimizes off-target effects, increasing both safety and efficacy.

Leading companies prefer ex vivo delivery for its consistent results and compatibility with GMP protocols. It’s also ideal for autologous therapies, reducing the chances of immune rejection. While resource-intensive, its predictability outweighs the cost concerns. Hospitals and specialized centers are setting up dedicated facilities for ex vivo cell processing. Its proven track record and regulatory support ensure continued dominance. As automation and AI integration improve lab workflows, ex vivo delivery will remain central to advanced gene therapies.

The in vivo gene transfer segment is expected to grow at the fastest CAGR in the market during the forecast period, as it eliminates the need for complex ex vivo procedures, making it more scalable and patient-friendly. It is especially useful for diseases requiring systemic gene distribution, such as muscular dystrophies or metabolic disorders. In vivo methods typically use viral or non-viral vectors to deliver therapeutic genes directly to target tissues. The appeal lies in faster treatment timelines and broader access, especially in decentralized settings. It’s gaining momentum in both diagnostic and therapeutic areas.

Advances in targeting mechanisms and vector engineering are boosting confidence in in vivo approaches. Their simplicity allows for outpatient administration in some cases, reducing hospital burden. Biotech firms are heavily investing in this space due to its commercial scalability. The approach also aligns well with next-gen technologies.

The biopharmaceutical & gene therapy companies segment was dominant, holding the largest share of the gene transfer technologies market in 2024, driven by developing and commercializing gene-based treatments across a broad disease spectrum. With deep R&D pipelines and clinical expertise, they have the infrastructure needed to take gene transfer products from lab to patient. Major players are investing in manufacturing capabilities and collaborating with academic institutions. Their dominance is also due to their role in navigating complex regulatory pathways. They are setting benchmarks in safety, efficacy, and scalability.

Biopharmaceutical & gene therapy companies have pioneered the shift toward curative treatments. Their strong financial backing enables them to absorb the high costs of development and trials. Many have also formed strategic alliances with vector suppliers and CROs. Their integrated capabilities across discovery, clinical development, and commercialization keep them at the forefront. As gene therapy expands globally, these companies are poised to lead in market access and affordability. Their ongoing dominance highlights their indispensable role in transforming genetic science into life-saving medicine.

The contract development & manufacturing organization segment is expected to grow at the fastest CAGR in the market during the forecast period, as biotech and pharma companies increasingly outsource development and production, CDMOs play a vital role in scalability and compliance. They offer specialized capabilities in viral vector production, quality control, and regulatory documentation. Their agility allows smaller firms to navigate the complex manufacturing demands of gene therapy. With the growing demand for personalized medicine, CDMOs are expanding their footprint globally. They are investing in advanced bioreactors and single-use technologies to meet rising demand.

The biopharmaceutical & gene therapy companies segment was dominant, holding the largest share of the gene transfer technologies market in 2024, as applications are being deployed to treat inherited disorders, cancers, and certain autoimmune diseases with increasing clinical success. They harness the power of precise gene manipulation to either replace defective genes or silence harmful mutations. This approach has moved from bench to bedside, with multiple therapies now approved across the US, Europe, and Asia. Large-scale clinical trials and long-term patient outcomes have built strong confidence in these applications. Continued funding from governments and venture capitalists has reinforced their growth trajectory.

The regenerative medicine segment is expected to grow at the fastest CAGR in the market during the forecast period, due to gene editing and cell reprogramming to repair or replace damaged tissues and organs. It holds transformative potential for conditions like spinal cord injuries, cardiovascular diseases, and neurodegenerative disorders. Advances in induced pluripotent stem cells (iPSCs) and gene-modified stem cell therapies are accelerating market momentum. Researchers are now focusing on combining gene editing with 3D tissue scaffolding and bioprinting. This synergy enhances tissue regeneration with superior functional outcomes.

North America dominated the gene transfer technologies market share by 46% in 2024. The region benefits from strong government support for genomic research and a robust ecosystem of biotech firms and academic institutions. The U.S. is home to several FDA-approved gene therapies and ongoing clinical trials. Venture capital investments in gene-editing start-ups continue to rise, reflecting confidence in long-term returns. Moreover, the presence of global biotech giants and advanced manufacturing infrastructure accelerates product development. Patient demand for precision medicine further fuels adoption across oncology, neurology, and rare disease treatments.

The U.S. hosts multiple FDA-approved gene therapies and numerous ongoing clinical trials. Venture capital investments in gene-editing start-ups keep increasing, indicating strong confidence in their long-term profitability.

In Canada, government-backed health innovation programs and partnerships with universities are catalyzing gene therapy research. Canadian biotech firms are increasingly focusing on rare diseases and neuromuscular disorders using viral vector platforms. The country’s regulatory framework is gradually adapting to accommodate novel therapies, making it a favorable landscape.

Asia Pacific is expected to grow at a considerable CAGR in the biological inactivated vaccine market in the upcoming period. Propelled by improving healthcare infrastructure and increasing government investments in biotechnology. Countries like China, India, Japan, and South Korea are making major strides in gene therapy research. The region's large patient population presents opportunities for clinical trial diversity and scalability. Startups and multinational firms are expanding their footprints through local collaborations.

India is investing significantly in genomics through public-private initiatives and academic collaborations. Indigenous biotech companies are developing gene delivery systems for oncology and rare diseases.

In China, the gene landscape is rapidly evolving with increasing government approvals and industrial funding.

Dr. Rebecca Ahrens-Nicklas, a senior team physician, noted that the recent discovery in gene editing therapy resulted from years of advancements in the field. Although KJ is only one patient, she expressed hope that he will be the first of many to receive benefits.

By Delivery Method

By Vector Type

By Mode of Delivery

By Application

By End User

By Region

February 2026

February 2026

January 2026

January 2026