February 2026

The global next-gen CAR-T therapy market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The next-gen CAR-T therapy market is witnessing strong growth due to advancements in gene editing, improved safety profiles, and efforts to overcome relapse and resistance. Innovations like allogeneic (off-the-shelf) CAR T therapies are enhancing accessibility and reducing treatment timelines. Additionally, expanding clinical trials, rising approvals for solid tumors, and integration with other immunotherapies are boosting its therapeutic potential. These developments are shaping a more effective and scalable approach to personalized cancer treatment across various indications.

The In Vivo CAR-T Platform Market refers to the emerging field of in vivo chimeric antigen receptor T-cell (CAR-T) therapy, where T cells are genetically modified directly inside the patient’s body, rather than being extracted, engineered ex vivo, and reinfused as in traditional CAR-T therapies. These platforms use nanoparticles, viral vectors, lipid-based delivery systems, or gene-editing payloads (e.g., mRNA, DNA, CRISPR) to deliver CAR constructs to T cells in situ. This next-generation approach promises faster treatment timelines, lower costs, off-the-shelf scalability, and reduced manufacturing complexities, making CAR-T more accessible for both hematologic and solid tumors. The growth of the next-gen CAR-T therapy market is driven by advances in gene editing, improved cell engineering techniques, rising cancer prevalence, and increasing demand for personalized treatments. Innovations like off-the-shelf allogenic therapies, enhanced safety mechanisms, and expanding clinical applications beyond blood cancers are accelerating market expansion and therapeutic adoption.

For Instance,

AI is significantly enhancing the next-gen CAR-T therapy market by streamlining drug discovery, optimizing cell design, and accelerating clinical trial processes. It helps identify ideal target antigens, predict patient responses, and minimize toxicities through data-driven modeling. Additionally, AI supports personalized treatment strategies and efficient manufacturing workflows, ultimately reducing development time and improving therapy outcomes in precision oncology.

Advancements in Gene Editing and Synthetic Biology

The progress in gene editing and synthetic biology is revolutionizing next-gen CAR-T therapies by enabling more refined and customizable treatment approaches. These innovations allow scientists to enhance T-cell specificity, durability, and resistance to tumor-induced suppression. Additionally, engineered safety switches and multi-targeting constructs are becoming more feasible, helping reduce relapse rates and broadening CAR-Ts' application across different types of cancers, including those previously difficult to treat.

For Instance,

High Cost and Complex Manufacturing Processes

The complexity and high expense of producing next-gen CAR-T therapies present significant barriers to broader next-gen CAR-T therapy market adoption. These therapies often rely on personalized manufacturing, which involves highly specialized techniques and stricter quality controls. This not only drives up operational costs but also creates logistical hurdles in timely delivery. Such challenges make it difficult for healthcare providers to implement CAR-T treatments widely, especially in regions lacking advanced facilities or funding, thus slowing the market’s growth potential.

Expansion into Solid Tumor Treatment

The move toward treating solid tumors with next-gen CAR-T therapy offers a significant growth avenue. Unlike hematologic cancers, solid tumors present barriers like antigen heterogeneity and a suppressive microenvironment. However, emerging innovations such as armored CAR-T cells, dual-antigen targeting, and improved cell trafficking are helping overcome these issues. As these technologies advance, they may unlock effective CAR-T treatment for a wider range of cancers, making this a key opportunity for future market expansion.

For Instance,

The dual/multitargeted CAR-Ts segment dominated the next-gen CAR-T therapy market in 2024. The segment is gaining traction due to its ability to address treatment resistance and relapse. By engaging more than one tumor antigen, these therapies offer broader cancer cell recognition and minimize the risk of tumor cells escaping detection. The improved therapeutic potential makes them a preferred approach in both hematologic malignancies and emerging solid tumor applications, leading to their strong adoption throughout the forecast period.

The armored CAR-Ts segment is expected to be the fastest-growing during the forecast period. It is gaining momentum as it offers improved persistence and functionality of CAR-T cells. These advanced versions are engineered to release stimulatory molecules or resist suppression by the tumor environment. This innovation enhances their ability to target difficult cancers, especially solid tumors. As a result, growing interest in more durable and effective treatment options is fueling the rapid growth of the market during the forecast period.

The autologous (patient-derived) CAR-Ts segment led the next-gen CAR-T therapy market in 2024, largely because of its proven clinical efficacy and lower likelihood of severe immune reactions. This method uses the patient's immune cells, which are engineered to target cancer, allowing for precise and personalized treatment. Its growing adoption in replacing or refractory blood cancers and established manufacturing workflows have also made it the preferred option in clinical settings.

The allogeneic (off-the-shelf) CAR-Ts segment is estimated to witness the fastest growth because it offers a ready-to-use treatment option that significantly reduces wait times for critically ill patients. Unlike autologous approaches, which require custom manufacturing off-the-shelf product can be produced in bulk, ensuring consistency and quicker access. Innovation in cell engineering is also enhancing safety and compatibility, making allogenic therapies a promising solution for expanding patient reach and improving treatment timelines in the next-gen CAR-T space.

The dominance of the hematologic malignancies segment in the 2024 next-gen CAR-T therapy market stems from the proven effectiveness of CAR-T treatments in targeting blood-related cancers. These cancers present well-defined antigens and are more responsive to immune cell therapies. Furthermore, streamlined clinical trial outcomes, regulatory approvals, and broader physician familiarity with these therapies in hematologic indications have accelerated their clinical adoption.

The solid tumors segment is projected to expand rapidly in the next-gen CAR-T therapy market during the forecast period as scientists develop more advanced engineering approaches to overcome barriers like poor T-cell infiltration and immune evasion. Innovation such as armored CAR-Ts, enhanced co-stimulatory domains, and localized delivery methods is increasingly efficacy against solid tumors. With growing clinical success and research investment, these developments are positioning CAR-T therapies as a promising option beyond blood cancers.

The third generation CAR-Ts segment led the market in 2024 due to its enhanced efficacy and safety profile. These CAR-T cells incorporate two co-stimulatory domains, such as C028 and 4-1BB, improving T-cell activation, persistence, and tumor-killing ability. This dual signaling enhances anti-tumor responses while reducing relapse rates. Their improved design over earlier generations has made third-generation CAR-T therapies more appealing for treating both hematologic and solid tumors, contributing to their widespread clinical adoption and market dominance.

The fourth generation/armored CARs segment is projected to expand rapidly in the next-gen CAR-T therapy market during the forecast period. The fourth generation/armored CARs segment, also called TRUCKs (T cells Redirected for Universal Cytokine Killing), is gaining traction due to its ability to deliver therapeutic payloads directly into the tumor site. This enhances immune activation and improves efficacy, particularly in difficult-to-treat cancers. Their design allows better control over immune responses and durability of treatment effects, making them a strong contender for future growth in the during the forecast period.

In 2024, the clinical-stage therapies segment led the next-gen CAR-T therapy market as a result of increased research efforts and trial enrollments across diverse cancer types. The active pipeline of experimental CAR-T products, especially those targeting novel antigens and enhanced immune responses, has accelerated development timelines. This momentum, coupled with growing regulatory engagement and early clinical success, has positioned clinical-stage therapies at the forefront of innovation and investment in the CAR-T field.

The commercialized next-gen CAR-Ts segment is anticipated to witness notable growth during the forecast period due to increasing physician trust, broader treatment guidelines, and improved real-world outcomes. As therapists gained of refractory cases, demand surged. Streamlines regulatory pathways and post-approvals data supporting durability of response, further encouraged adoption, while industrial partnership enhanced market reach and availability, accelerating the market expansion across multiple care settings.

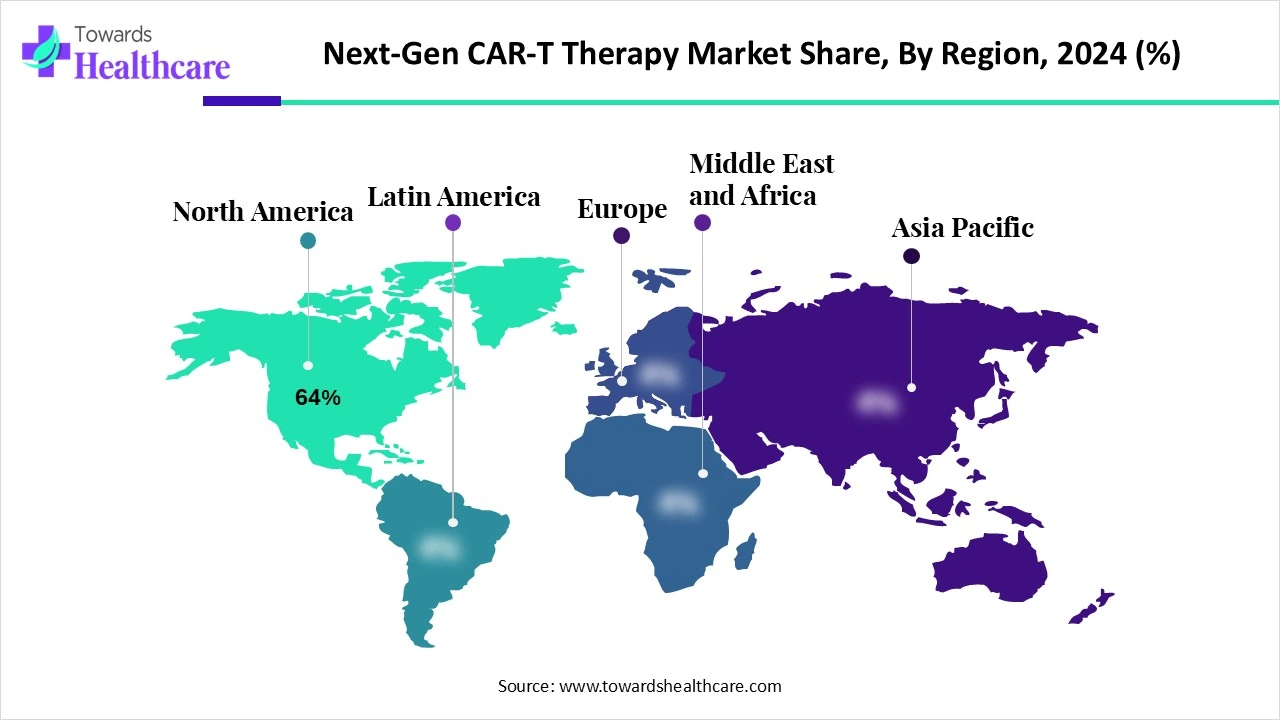

North America dominated the next-gen CAR-T therapy market share by 64% in 2024, owing to its advanced healthcare infrastructure, early adoption of innovative therapies, and supportive regulatory environment. The region also benefits from a high number of ongoing clinical trials, significant investments in biotechnology, and strong collaboration between research institutions and pharmaceutical companies. Additionally, the presence of key market players and a growing patient population seeking personalized cancer treatments further contributed to the region’s leading position in the CAR-T space.

The growth of the U.S. market is driven by the urgent need for more effective cancer therapies, especially for patients with relapsed or refractory conditions. Continued R&D, increasing clinical success rates, and support from academic and research institutions are encouraging innovation. Moreover, faster FDA approvals and investments from major pharmaceutical companies are accelerating market expansion across both hematologic and emerging solid tumor indications.

Canada's therapy market is expanding due to a combination of rising cancer incidence, increased clinical trial activity, and supportive government initiatives. The federal government is actively investing in cell and gene therapy infrastructure, including vector production and biomanufacturing. Collaborations between academic institutions and biotech firms are also accelerating innovation, helping Canada enhance local development, streamline regulatory approvals, and improve patient access to advanced CAR-T treatments.

During the forecast period, the Asia-Pacific region is expected to rapidly advance the market due to supportive regulatory frameworks, increased clinical trial activity, and growing biotech investments. Countries like China, Japan, and India are streamlining approval processes and investing in local manufacturing to accelerate therapy development. Additionally, the region benefits from lower production costs and expanding partnerships between academia and industry. These factors collectively position Asia-Pacific as a significant growth hub for CAR-T innovations during the forecast period.

China’s market is expanding due to strong regulatory support, a rise in clinical trials, and growing domestic biotech capabilities. The Chinese government has streamlined approval processes, encouraging rapid innovation. Additionally, the presence of advanced research centers and collaborations between local and global firms have boosted development. These factors are accelerating the clinical adoption and production of next-gen CAR-T therapies across the country.

India’s market is advancing due to rising local innovations, supportive government initiatives, and increased demand for advanced cancer treatments. The approval and launch of NexCAR19, India’s first indigenously developed CAR-T therapy, have accelerated market momentum by offering a cost-effective alternative to imported therapies. Backed by institutions like IIT Bombay and Tata Memorial Centre, India is making CAR-T therapies more accessible and affordable for a broader patient base.

During 2025-2034, Europe is expected to grow at a significant rate. Europe accelerated adoption through enhanced regulatory frameworks, academic–industry collaboration, and clinical innovation. The EMA’s PRIME scheme, hospital exemption pathways, and faster marketing approvals have supported more therapy candidates reaching patients across multiple countries. Europe also hosted major conferences like ESGCT and EBMTEHA, spotlighting advances in allogeneic CARs, armored constructs, and solid-tumor applications. Simultaneously, initiatives such as FAST’s development guidebook and the GoCART Coalition helped standardize training, safety protocols, and multi-center trial readiness, ensuring readiness for wider therapeutic access.

The UK market is witnessing steady growth due to strong regulatory support, rapid clinical adoption, and the expansion of advanced therapy centers. The NHS has been actively integrating CAR-T treatments into standard care, especially for blood cancers. Recent regulatory changes by the MHRA allowing on-site CAR-T production in hospitals are reducing delays and making therapies more accessible, which further strengthens the country’s position in this field.

Germany’s market is expanding due to a combination of robust healthcare infrastructure, increasing domestic R&D investments, and a strong presence of global biotech firms collaborating with local players. Regulatory support and infrastructure buildouts, such as investments in cell therapy manufacturing, are facilitating pipeline growth. Companies like Novartis, Gilead, and Bristol Myers Squibb are advancing clinic-ready CART candidates in Germany alongside German innovators, strengthening innovation and market momentum in this region.

A new next-gen “armored” CAR T cell therapy developed at the University of Pennsylvania showed promising results in patients with B-cell lymphoma resistant to multiple treatments, including existing CAR T therapies. In a small clinical study, 81% of patients responded, and 52% achieved complete remission, some lasting over two years. Dr. Jakub Svoboda, who led the trial, highlighted the therapy’s strong effectiveness and manageable toxicity, noting it offers hope for patients with limited options after standard CAR T failure.

By Target Antigen / Mechanism

By Cell Source

By Indication

By Generation of CAR Design

By Therapy Status

By Region

February 2026

February 2026

February 2026

February 2026